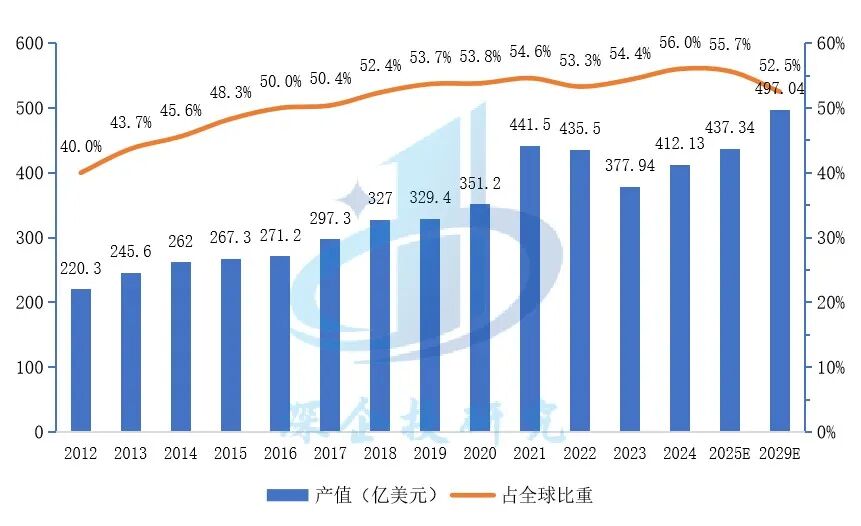

Driven by applications in artificial intelligence, servers and data storage, network communication, and automotive electronics, the global PCB industry has entered a new growth cycle, with the market size expected to reach $100 billion by 2030. Open-source large models like DeepSeek have significantly reduced deployment costs and barriers across various industries, leading to a rapid increase in demand for intelligent computing centers and servers, making the PCB market in the server sector grow faster than in other application areas. Mainland China is a major production area for the global PCB industry, with its output value expected to account for 56% of the global total by 2024. Since 2020, due to rising geopolitical tensions, the PCB industry has begun its fifth capacity migration, with Southeast Asia, particularly Thailand, being the main beneficiary. However, the new round of trade wars has generally impacted Southeast Asia, weakening its potential as a backup production base under the “China +1” strategy.

Overview of PCB Products

A printed circuit board (PCB), also known as a printed wiring board, is called a “printed” circuit board because it is made using electronic printing technology. As a printed board that forms connections between points and prints components on a general substrate according to a predetermined design, its main functions are: 1) to provide mechanical support for various components in the circuit; 2) to create electrical connections for various electronic components to form a predetermined circuit, acting as a relay for transmission; 3) to mark the installed components with symbols for easy insertion, inspection, and debugging.

As a key electronic interconnect component in electronic products, PCBs are used in almost all electronic products and are indispensable electronic components in modern electronic information products, often referred to as the “mother of electronic products.” The manufacturing quality of PCBs not only directly affects the stability and lifespan of electronic products but also impacts the integrity of signal transmission between various chips. Therefore, the development level of the PCB industry reflects, to some extent, the technological level of a country’s or region’s IT industry.

PCB products can be classified in various ways, with the most commonly used classification methods in the industry being based on the number of conductive pattern layers, the material of the board, and the product structure.

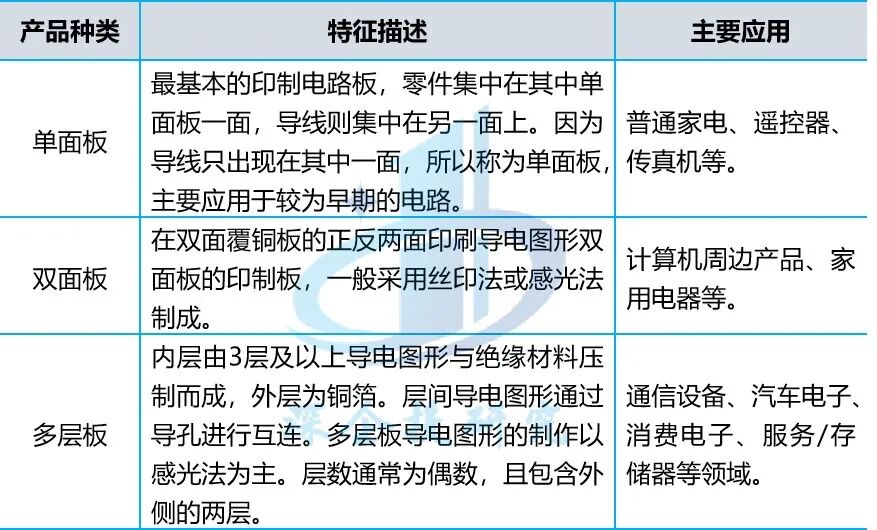

Based on the number of conductive pattern layers, PCBs can be divided into single-sided boards, double-sided boards, and multi-layer boards. As shown in the table below, common multi-layer boards are generally 4-layer or 6-layer boards, while complex multi-layer boards can reach dozens of layers.

Table 1 PCB Categories (by Number of Conductive Pattern Layers)

Source: Organized by DeepSeek Industry Research Institute.

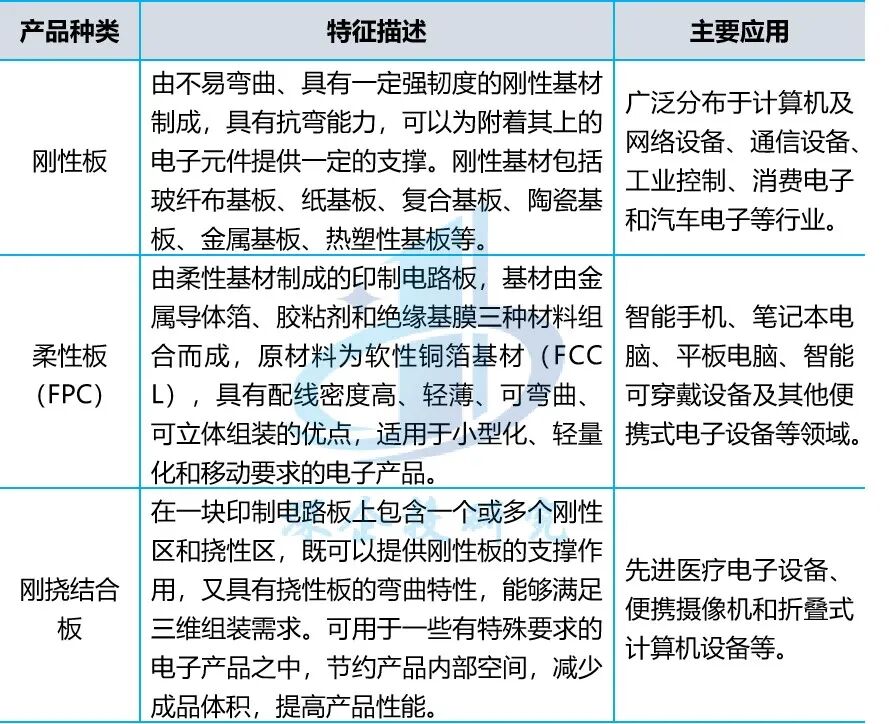

Based on the material of the board, PCBs can be divided into rigid boards, flexible boards (also known as FPC), and rigid-flex boards.

Table 2 PCB Categories (by Material)

Source: Organized by DeepSeek Industry Research Institute.

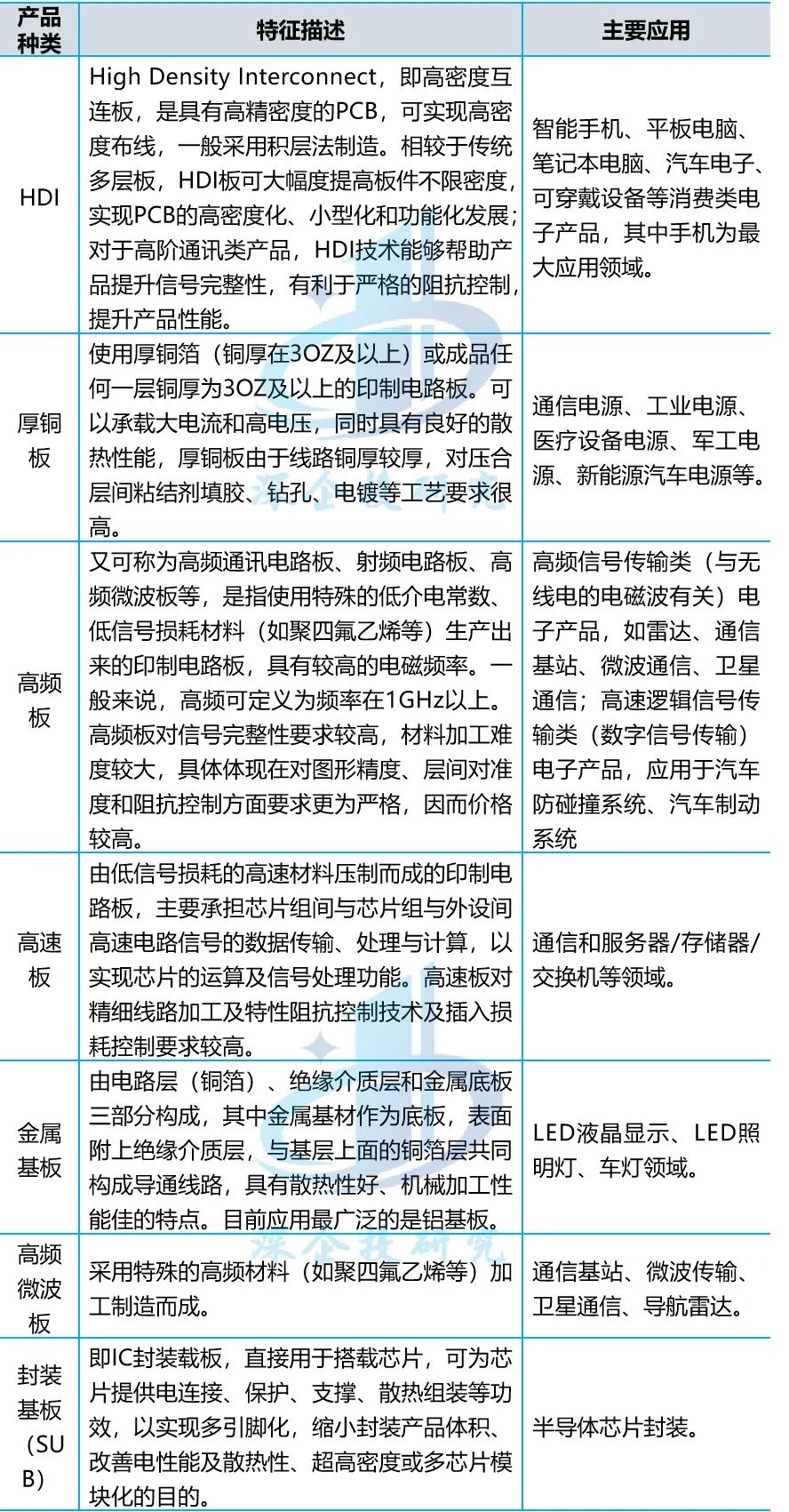

Based on product structure, PCBs can be divided into HDI boards, thick copper boards, high-frequency boards, high-speed boards, metal base boards, and packaging boards, as shown in the table below.

Table 3 PCB Categories (by Product Structure)

Source: Organized by DeepSeek Industry Research Institute.

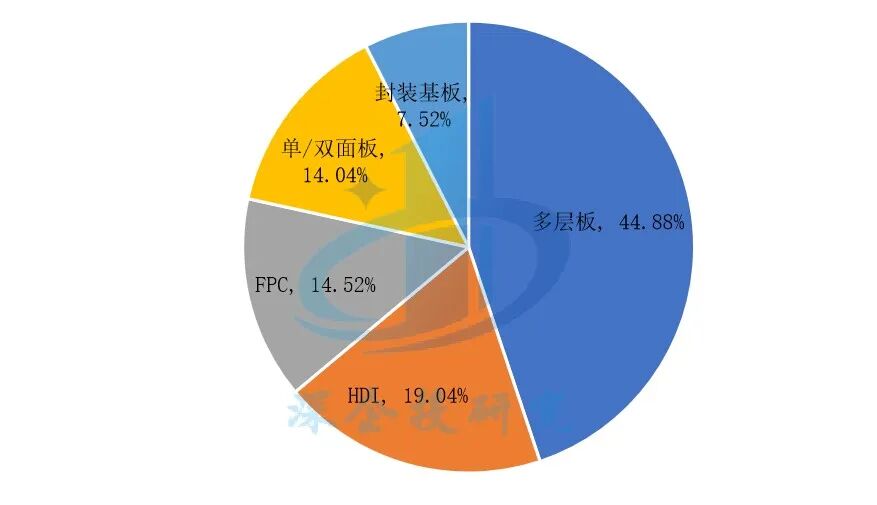

Although there are many angles for classifying PCB products, in practice, they are often mixed classified based on the output value of each sub-industry into single/double-sided boards, multi-layer boards, flexible boards (soft boards), HDI boards, and packaging boards.

Upstream Raw Materials and Cost Structure

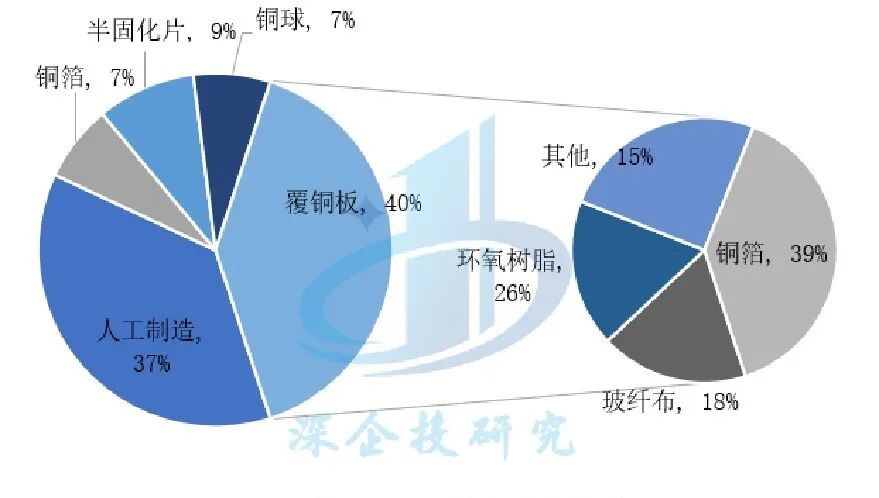

The upstream raw materials in the printed circuit board industry chain include copper foil, copper balls/copper oxide powder, prepreg (bonding sheets), fiberglass cloth, wood pulp, ink, resin, dry film, etching solution, etc. Among these, electrolytic copper foil, resin, and fiberglass cloth are the three main materials, with the conductivity, insulation, and support of PCBs primarily relying on these three raw materials. The midstream substrate is mainly copper-clad laminate (CCL), made from copper foil, epoxy resin, fiberglass yarn, and other raw materials. The downstream application industries involve consumer electronics, automotive, communications, aerospace, and military sectors.

The production cost of PCBs is mainly divided into material costs and labor manufacturing costs, with material costs primarily including copper-clad laminates, copper foil, phosphor copper balls, ink, etc. Copper-clad laminate (CCL) is the core material for making PCBs, while electrolytic copper foil is the main raw material for producing copper-clad laminates, accounting for about 40% of the production cost of copper-clad laminates. The cost structure of PCB production is shown in the figure below.

Figure 1 PCB Production Cost Composition

Source: CPCA China Electronic Circuit Industry Association, organized by DeepSeek Industry Research Institute.

Current Status and Trends of the Global PCB Industry

(1) Global Output Value Scale

The global PCB industry has entered a new growth cycle. Since the outbreak of the COVID-19 pandemic, the global PCB industry has experienced a cycle of peak-fall-rebound. In 2021, the general prosperity of global electronic products drove PCB output value to grow by 24.1% year-on-year, reaching $80.92 billion. In 2022, global inflation rose and end demand weakened, but driven by the packaging substrate market, the output value still increased by 1.0% year-on-year, reaching $81.74 billion, a historical peak. In 2023, high inflation in Europe and the United States and the Federal Reserve’s interest rate hikes suppressed consumer purchasing power, leading to an extended replacement cycle for global consumer electronics, resulting in a reduction in the PCB market size, with the global PCB output value decreasing by 15% year-on-year to $69.517 billion. However, as market inventory adjustments and weak consumer electronics demand issues come to an end, and with the accelerated evolution of AI applications, the PCB industry will enter a new growth cycle. In 2024, the total global PCB output value is expected to reach $73.565 billion, a year-on-year increase of 5.8%. In the medium to long term, the global PCB industry is expected to revive, with the output value projected to reach $94.661 billion by 2029, and a compound annual growth rate of 5.2% from 2024 to 2029, showing a stable growth trend.

Figure 2 Global PCB Output Value and Growth Rate from 2012 to 2025

Source: Based on historical data from Prismark, organized by DeepSeek Industry Research Institute.

(2) Global Product Structure

In 2024, the global PCB industry will show a development trend of “structural differentiation and technological upgrading in parallel.” On one hand, there is an oversupply of mid-to-low-end electronic circuit capacity, with fierce price competition for traditional multi-layer and double-sided boards; on the other hand, the explosive growth in smartphones, new energy vehicles, AI servers, 5G/6G communications, and high-end industrial control fields is driving a surge in demand for high-end products such as HDI (High-Density Interconnect), FPC (Flexible Printed Circuit), and IC substrates, with leading companies continuously expanding their market share through technological barriers and capacity advantages.

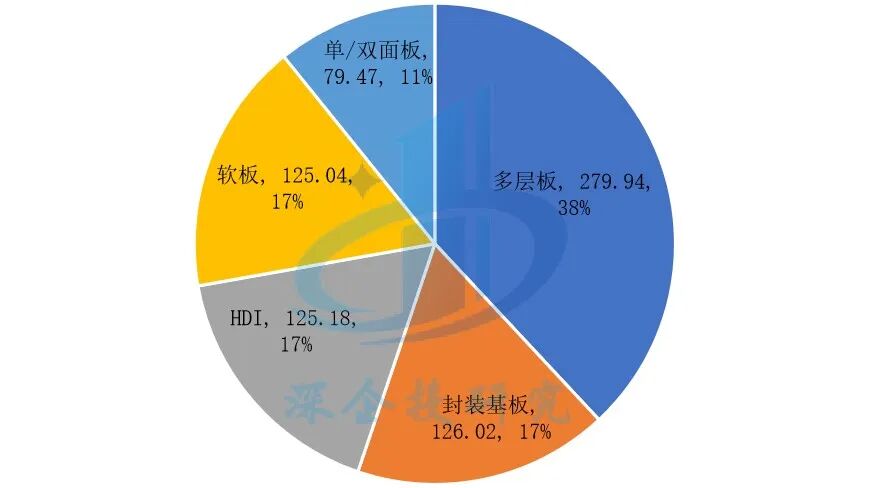

According to a report released by Prismark in March 2025, in the output value of global PCB sub-products in 2024, multi-layer boards will have the highest output value, reaching $27.994 billion, accounting for 38%; packaging substrates, HDI, and flexible boards will have similar output values of $12.602 billion, $12.518 billion, and $12.504 billion, respectively, each accounting for 17%; single/double-sided boards will have the lowest output value of $7.947 billion, accounting for 11%, as shown in the figure below.

Figure 3 Global PCB Sub-Product Output Value in 2024 (in billions)

Source: Prismark, organized by DeepSeek Industry Research Institute.

In the next five years, driven by the growth in downstream industries such as high-speed networks, artificial intelligence, servers/data storage, automotive electronics (EV and ADAS), and satellite communications, the demand for high multi-layer boards, HDI boards, and packaging substrates will continue to grow. Among them, PCBs with 18 layers and above, HDI boards, and packaging substrates are expected to outperform the overall industry, with market sizes projected to reach $5.020 billion, $17.037 billion, and $17.985 billion, respectively, by 2029, with compound annual growth rates of 15.7%, 6.4%, and 7.4% from 2024 to 2029.

Table 4 Global PCB Industry Product Structure from 2024 to 2029

Source: Prismark, Shenghong Technology targeted issuance fundraising prospectus.

(3) Market Development Drivers

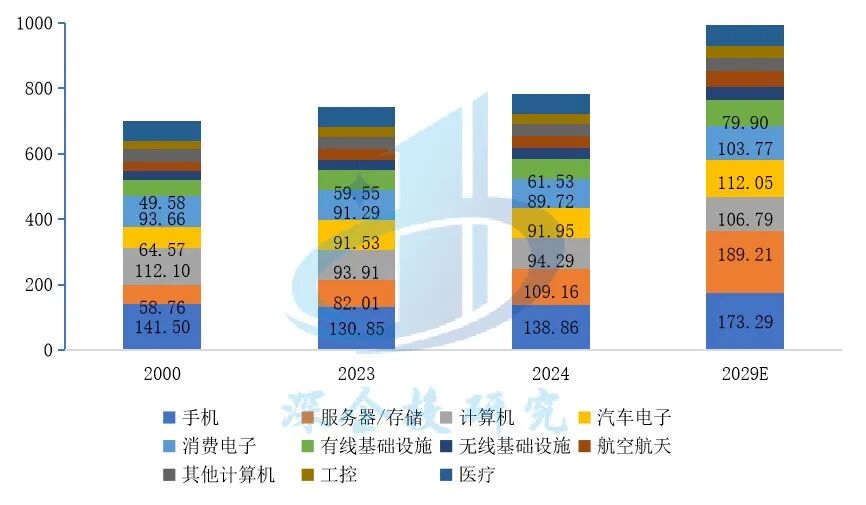

Smartphones, servers and storage, personal computers, automotive electronics, and consumer electronics constitute the main application fields for PCBs downstream. According to Prismark data, in 2024, the output value of PCBs for mobile phones will be $13.886 billion, accounting for 18.9%, and is expected to grow to $17.329 billion by 2029, with a compound annual growth rate of 4.5%; the output value of PCBs for servers/storage will be $10.916 billion, a year-on-year increase of 33.1%, accounting for 14.8%, and is expected to grow to $18.921 billion by 2029, with the most significant growth rate of 11.6%; the output value of PCBs for computers will be $9.429 billion, accounting for 12.8%, and is expected to grow to $10.679 billion by 2029, with a compound annual growth rate of 2.5%; the output value of PCBs for automotive electronics will be $9.195 billion, accounting for 12.5%, and is expected to grow to $11.205 billion by 2029, with a compound annual growth rate of 4.0%; the output value of PCBs for consumer electronics will be $8.972 billion, accounting for 12.2%, and is expected to grow to $10.377 billion by 2029, with a compound annual growth rate of 3.0%.

Figure 4 Global PCB Output Value by Application from 2024 to 2029 (in billions)

Source: Prismark, organized by DeepSeek Industry Research Institute.

—— The PCB growth rate in the server sector leads other application areas. In the next five years, AI systems and servers will be the main drivers of PCB demand growth. Servers require various specifications of PCBs internally, typically including PCBs for server motherboards, CPU boards, hard disk backplanes, power backplanes, memory, network cards, and other components. Driven by technologies such as artificial intelligence and high-performance computing, especially with open-source large models like Deepseek significantly reducing the computing power required to run large models, enabling rapid deployment across various industries, the demand for intelligent computing centers and servers will continue to grow rapidly.

According to Prismark data, in 2024, the market size for servers/data storage is expected to be approximately $291 billion, a year-on-year increase of 45.5%, with a projected growth of 36.1% in 2025. The average annual compound growth rate from 2024 to 2029 is expected to reach 11.2%, leading other segments of the electronic market. The upgrade of AI servers is driving PCBs towards higher layer counts, higher density, and higher transmission speeds, significantly increasing the value of PCBs per unit, such as the GPU board group of NVIDIA’s DGX A100 AI server, which has a unit PCB value exceeding 12,000 yuan, reaching six times that of general servers. With the surge in computing power demand, large-size, high-speed, high-multi-layer PCBs will become the core support for server performance upgrades.

The strong demand in the server market will drive the growth of high multi-layer boards (PCBs with 18 layers and above), high-end HDI, and other high-end PCB products. According to Prismark data, in 2023, the PCB market size for global AI/HPC server systems (excluding packaging substrates) is close to $800 million, expected to reach $1.9 billion in 2024, a year-on-year increase of nearly 150%; by 2028, the PCB market size for AI/HPC server systems (excluding packaging substrates) will catch up with general servers, reaching $3.17 billion, with an average annual compound growth rate of 32.5% from 2023 to 2028.

—— The electrification and intelligence of automobiles drive the doubling of the value of automotive PCBs. The electric control system in electric motors mainly consists of three major power control systems: the vehicle control unit (VCU), motor control unit (MCU), and battery management system (BMS). The value increment of PCBs mainly comes from these three power control systems, especially the BMS, which has a complex architecture and requires a large number of PCBs, with high technical requirements for PCBs, averaging around 3-5 square meters in usage, with a high unit value. In terms of usage area, traditional fuel vehicles use 0.6-1 square meters of PCBs per vehicle, high-end models use 2-3 square meters, while new energy vehicles reach 5-8 square meters.

According to data from Zosi Automotive Research, the total value of PCBs in Tesla Model 3 is between 3,000-4,000 yuan, about 5-6 times that of ordinary fuel vehicles. In the Chinese market, the penetration rate of new energy vehicles continues to rise, while the transition from L2 to L3 level of assisted driving is underway, with high-level intelligent assisted driving expected to be popularized in models priced above 100,000 yuan by 2025, leading to upgrades in PCB usage and specifications for automotive sensors, ADAS controllers, intelligent cockpits, and 800V high-voltage three-electric systems.

—— The PCB market for communication devices is steadily developing. Communication devices mainly refer to communication infrastructure used for wired or wireless network transmission, including communication base stations, routers, switches, base station antennas, RF devices, and backbone network transmission equipment. Currently, the demand for PCBs in communication devices is mainly for multi-layer boards, with 5G communication devices requiring higher standards for high-frequency and high-speed PCB processes and materials. In terms of power supply, low power consumption and high power density are required, while the increase in data transmission volume necessitates high-speed chips paired with high multi-layer board products, significantly increasing the demand for high-frequency and high-speed boards that facilitate high-speed signal transmission. For example, with the continuous improvement in chip performance and data throughput requirements, 800G switches are accelerating penetration, and to meet the data transmission needs of 800G switches, multi-layer PCBs are required to ensure high-speed and stable signal transmission, thus driving both the quantity and price of PCBs in the switch field.

According to Prismark data, in 2024, the output value of PCBs in the global communication equipment sector is expected to be approximately $9.33 billion, a year-on-year increase of 2.8%; by 2029, the output value of PCBs in the global communication equipment sector will reach $11.963 billion, maintaining a compound growth rate of 3.9% from 2024 to 2029.

—— The iteration of consumer electronics drives the development of the PCB market. PCB products for consumer electronics typically feature characteristics such as large volume, lightweight, and miniaturization, mainly consisting of single-sided/double-sided boards, four-layer boards, six-layer boards, HDI boards, and FPC boards. Consumer electronics products have a wide coverage, fast-changing downstream demand, short product iteration cycles, and the emergence of new categories, with each new consumer hotspot leading to a round of consumer electronics product iteration and driving demand growth in the PCB industry. The rapid development of AI applications is pushing terminal devices towards lightweight, thin, and small designs, while HDI and FPC can better meet the requirements for lightweight and compact terminal devices, also having advantages in high-frequency and high-speed signal transmission, with usage expected to further increase.

According to market analysis agency Canalys, the global shipment of AI smartphones is expected to account for 16% of total smartphone shipments in 2024, surging to 54% by 2028, with a compound annual growth rate of 63%. AI PCs are expected to exceed 100 million units in shipments by 2025, accounting for 40% of total PC shipments, reaching 205 million units by 2028, with a compound annual growth rate of 44% from 2024 to 2028. According to Wellsenn XR forecasts, global AI glasses sales are expected to grow to 3.5 million units in 2025, a 230% increase from 2024, and reach 90 million units by 2030, equivalent to 60 times that of 2024, corresponding to a rapid growth in the HDI and FPC board markets.

(4) Industry Development Trends

1. PCB is moving towards higher density and higher performance.

As a key supporting component of the electronic information industry, the technological development of PCBs is closely linked to the demand for downstream electronic terminal products. As the next generation of electronic products evolves towards lightweight, compact, high-speed, and high-frequency designs, downstream applications are raising higher standards for the precision and stability of PCBs, driving the development of PCB products towards higher density and higher performance.

High density is an important direction for future PCB technology development, with strict requirements for aspects such as hole diameter, wiring width, layer count, and stacked hole structures. High-Density Interconnect (HDI) technology is an advanced technology representative of PCB high density, which reduces the number of through holes by precisely setting blind and buried holes, saving routable area and significantly increasing component density. The high density of IC packaging substrates is even more pronounced compared to HDI boards. Embedded or buried component technology, which embeds passive and active devices within the PCB, can achieve higher circuit density and smaller product sizes, representing an important new technology for achieving high density in electronic products.

High performance focuses on enhancing the functionality of PCBs, such as impedance and heat dissipation, to improve product functionality and reliability. Modern electronic products have a large amount of information transmission and fast transmission rates, prompting digital signal technology to develop towards high frequency. Only PCBs with good impedance can ensure effective information transmission, reduce losses, and ensure stable product performance while achieving complex functions. Additionally, high-performance products generate significant heat, requiring PCBs with excellent heat dissipation performance to assist in cooling. In this context, metal substrates, thick copper boards, and other PCBs with good heat dissipation performance are widely used, highlighting the trend of high performance in PCB products.

2. The industry market concentration is increasing.

Due to the rising technical standards in downstream application fields and the accelerated iteration of terminal products, PCB manufacturers face higher technical barriers and capital requirements. Large-scale manufacturers with technological advantages and brand reputation have significant competitive advantages. At the same time, global oversupply and intensified price competition have led to decreased capacity utilization and increased losses for companies, causing many small and medium-sized manufacturers to exit the market due to the industry’s downturn. Large-scale manufacturers, with stronger risk resistance, are seizing expansion opportunities through industry consolidation, driving continuous increases in market concentration. According to Prismark data, the market share of the top five PCB manufacturers globally has increased from 10.80% in 2006 to 23.55% in 2024. According to the “2024 Revenue of Major Enterprises in China’s Electronic Circuit Industry” list by the China Electronic Circuit Industry Association, the total revenue of the top 10 enterprises in the top 100 comprehensive PCB companies in China is expected to reach 161 billion yuan in 2024, a 15.3% increase from the top 10 enterprises in 2023, accounting for 46.3% of the revenue of the top 100 enterprises.

3. The industry is becoming increasingly intelligent.

As downstream customers’ demand for PCB products becomes more refined and personalized, the intelligent transformation of the PCB manufacturing industry is accelerating. Intelligent production equipment significantly improves production efficiency, maintaining processing precision at a very high level, and significantly reduces the defect rate caused by human factors. For example, in the drilling process, intelligent drilling equipment can operate precisely according to preset programs, controlling hole position deviations within a very small range, while traditional manual operations have relatively larger deviations. Additionally, intelligent production lines built on internet technology can respond quickly to customer orders, using intelligent algorithms to formulate optimal production plans, flexibly adjusting production processes to meet the production needs of different batches and specifications. Furthermore, intelligent factories achieve automated management of equipment and data, automatic switching of process parameters, real-time collection of production data associated with product batches, enabling fine traceability and quality control throughout the entire process, ensuring product quality.

4. Production emphasizes green and environmental protection.

The PCB industry has complex production processes, and the production materials contain heavy metals such as copper, nickel, gold, and silver, which can easily cause environmental pollution during production, with significant challenges in pollutant treatment. For example, the copper-containing wastewater generated during the etching process, if discharged without proper treatment, can cause severe damage to aquatic ecosystems. With increasingly stringent environmental protection requirements globally, the PCB industry is actively responding by establishing a series of strict environmental protection standards. From a sustainable development perspective, seeking to use new environmentally friendly materials (such as biodegradable, low-pollution new substrate materials) and improving environmental protection processes (such as new cyanide-free electroplating processes) have become important trends in the industry’s development.

(5) Global Regional Distribution

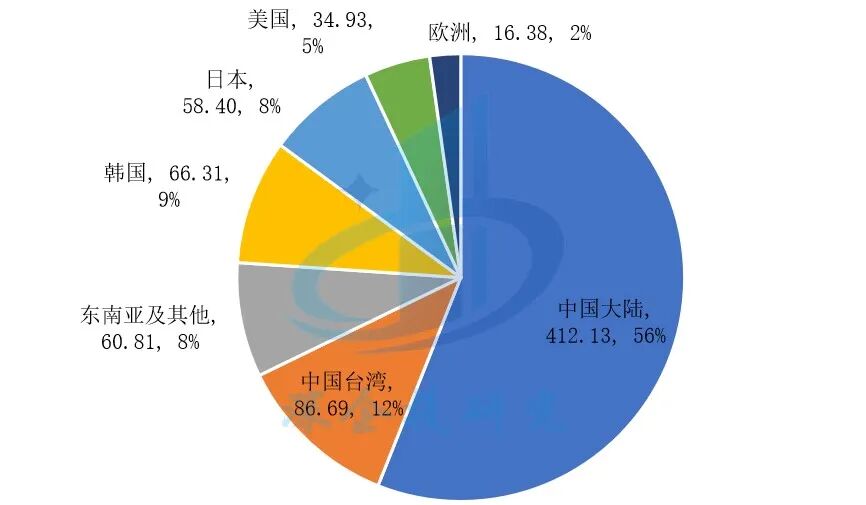

The global PCB production capacity has undergone multiple migrations, with mainland China currently being the main base. The PCB industry is widely distributed globally, initially dominated by developed countries and regions such as the United States, Europe, and Japan, which accounted for over 70% of the total global PCB output value in the early 2000s. Since the 21st century, Asia, particularly mainland China, has attracted the global electronics manufacturing industry due to advantages in labor, raw materials, policies, and industrial clusters, leading to rapid growth in PCB manufacturing scale. Mainland China surpassed Japan in 2006 to become the world’s largest PCB manufacturing base, with its output value rising from 8% of the global total in 2000 to 56% in 2024.

From a regional perspective, in 2024, among the major PCB production areas globally, PCB output values in Europe, Japan, and South Korea are expected to decline year-on-year, with Europe experiencing the largest decline. Under the combined effects of technological iteration, policy support, and recovery in downstream demand, the PCB output value in mainland China is expected to grow by 9.0% year-on-year to $41.213 billion; the PCB output value in the United States is expected to grow by 9.0% year-on-year to $3.493 billion; the PCB output value in Southeast Asia and other regions is expected to grow by 8.4% year-on-year to $6.081 billion; and the PCB output value in Taiwan is expected to grow by 3.1% year-on-year to $8.669 billion. The output values of the United States, Europe, and Japan continue to decline, with their respective shares dropping from 26.1%, 16.1%, and 28.7% in 2000 to 4.7%, 2.2%, and 7.9% in 2024.

Figure 5 Global PCB Output Value Regional Distribution in 2024 (in billions)

Figure 6 Changes in Global Major PCB Production Regions’ Output Value from 2020 to 2029 (in billions)

Source: Prismark, organized by DeepSeek Industry Research Institute.

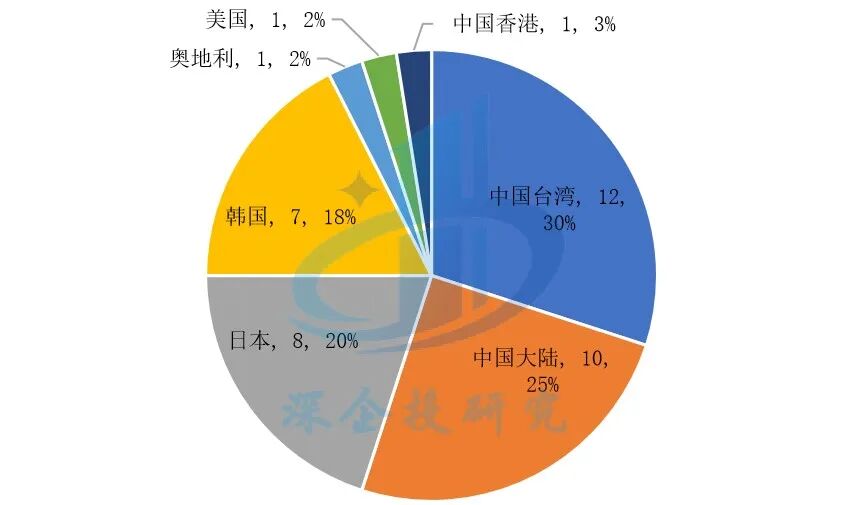

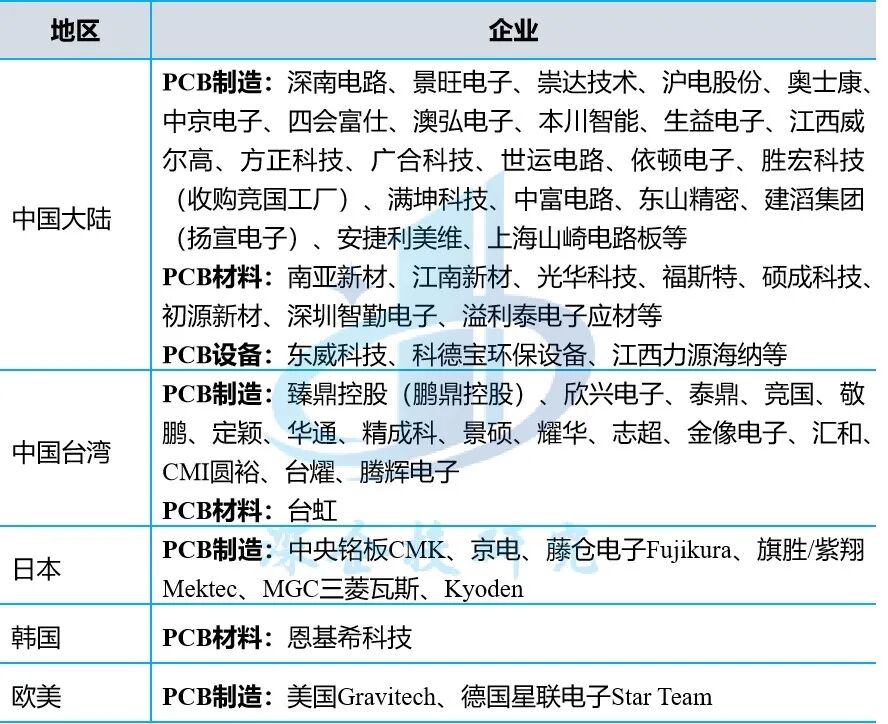

(6) Global Competitive Landscape

From the perspective of the global competitive landscape of industry enterprises, in 2024, among the top 10 PCB companies ranked by output value globally, half are from Taiwan, three from mainland China, and one each from the United States and Japan. Among the top 40 global companies by output value in 2024, there are 12 companies from Taiwan, followed by 10 from mainland China, 8 from Japan, 7 from South Korea, and one each from Austria, the United States, and Hong Kong, as shown in the figure below.

Figure 7 Distribution of the Top 40 Global PCB Companies by Region in 2024

Source: Prismark, organized by DeepSeek Industry Research Institute.

In 2024, the total revenue of the top 40 global PCB companies is expected to reach $56.947 billion, a year-on-year increase of 6.5%. It should be noted that most of the top 40 companies have their main production bases in mainland China, with only six Korean and Japanese companies having exited mainland China in recent years (either transferring or ceasing operations at their mainland bases).

Table 5 Top 40 Global PCB Companies by Output Value in 2024

Source: Prismark, organized by DeepSeek Industry Research Institute.

Status of the PCB Industry in China

(1) Output Value Scale in China

Mainland China is a major production area for the global PCB industry. After decades of global electronic information manufacturing industry transfer and globalization, as global assembly manufacturing capacity has shifted to mainland China, it has developed into a major base for PCBs. Almost all multinational PCB companies have established their main production bases in mainland China. In the medium to long term, Asia will continue to dominate the PCB industry, with mainland China remaining the primary player. Prismark predicts that by 2029, the output value of the PCB industry in mainland China will reach $49.704 billion, accounting for 53% of the global total, with a compound annual growth rate of 3.8% from 2024 to 2029.

Figure 8 Output Value of PCBs in Mainland China and Its Share of the Global Total

Source: Prismark, organized by DeepSeek Industry Research Institute.

In terms of import and export, from 2021 to 2023, both the import and export scales of PCBs in China showed a downward trend, with imports decreasing from $12.28 billion to $7.96 billion and exports decreasing from $20.84 billion to $17.51 billion. In 2024, the export scale of PCBs in China is expected to rebound, while the import scale is expected to shrink further. Among them, imports are expected to be $7.66 billion, a year-on-year decrease of 3.8%; exports are expected to be $20.18 billion, a year-on-year increase of 15.3%; the total import and export volume is expected to reach $27.84 billion, a year-on-year increase of 9.3%; and the trade surplus is expected to be $12.52 billion, a year-on-year increase of 31.2%.

Figure 9 Import and Export Scale of PCBs in China from 2018 to 2024

Source: PCB Network City WeChat Official Account.

(2) Product Structure in China

According to Prismark data, in 2024, the market scale of rigid boards in China will be the largest, with multi-layer boards accounting for 44.88%, single/double-sided boards accounting for 14.04%; followed by HDI boards, accounting for 19.04%; FPC and packaging substrates accounting for 14.52% and 7.52%, respectively. In the medium to long term, strong demand for artificial intelligence servers, high-speed networks, and automotive systems will continue to support the growth of high-end HDI, high multi-layer boards, and packaging substrates. Prismark predicts that from 2024 to 2029, the annual compound growth rates for PCBs with 18 layers and above, HDI boards, and FPC boards in mainland China will be 21.1%, 6.3%, and 4.5%, respectively, outperforming the overall industry growth rate of 4.3%.

Figure 10 Product Structure of PCBs in Mainland China in 2024

Source: Prismark, organized by DeepSeek Industry Research Institute.

(3) Competitive Landscape in China

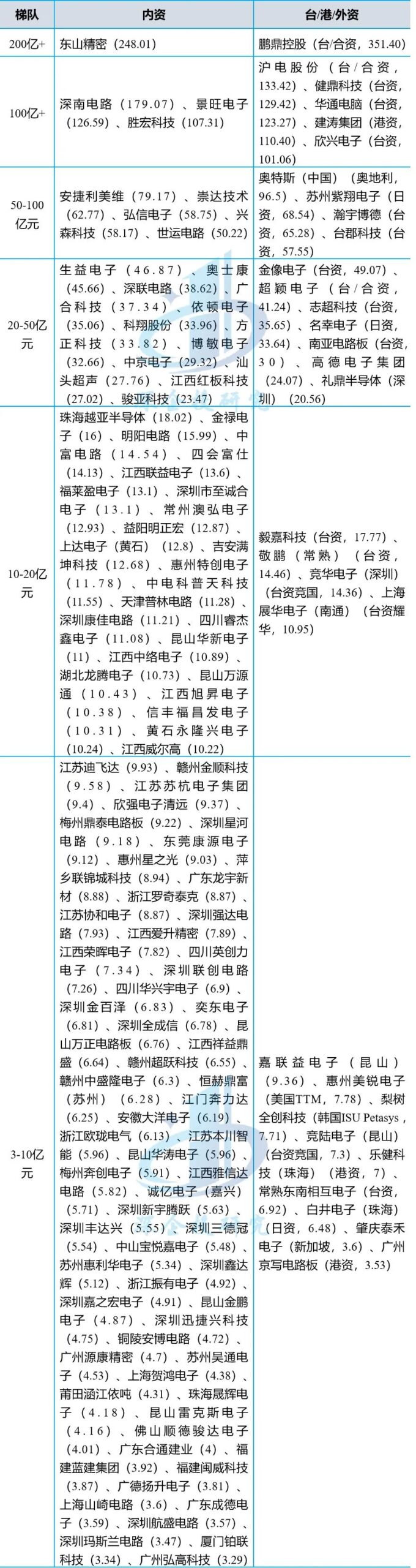

There are thousands of PCB production enterprises in mainland China. Approximately 55% of PCB manufacturers globally are located in mainland China, including about 150 foreign-funded factories, around 100 Taiwanese-funded manufacturers (some of which only have headquarters in Taiwan without factories), about 20 Japanese manufacturers, and three American manufacturers.

The industry shows a significant head effect, with the revenue share of domestic enterprises increasing. According to the “2024 Revenue of Major Enterprises in China’s Electronic Circuit Industry” list by the China Electronic Circuit Industry Association (CPCA), the total revenue of the top 100 comprehensive PCB companies (including domestic and foreign) in China is expected to reach 347.987 billion yuan in 2024, a year-on-year increase of 12.38%; domestic enterprises are particularly outstanding, with the top 100 domestic PCB companies collectively expected to generate 196.82 billion yuan, a significant year-on-year increase of 16.24%. In 2024, the number of enterprises in the top 100 comprehensive PCB companies with revenues exceeding 1 billion yuan is expected to increase to 67 (an increase of 8 from 2023), with total revenue accounting for 92.6% of the top 100. Among them, four domestic enterprises, including Dongshan Precision, Shenzhen South Circuit, Jingwang Electronics, and Shenghong Technology, have entered the 10 billion yuan revenue club. In the top 100 comprehensive PCB companies, the revenue share of domestic enterprises is expected to reach 52.08% (an increase of 1.99 percentage points year-on-year), with listed companies becoming the main growth force.

Compared to foreign-funded enterprises, domestic enterprises exhibit a characteristic of being numerous with low industry concentration. In terms of product structure, domestic PCB enterprises currently have an uneven product distribution, mainly concentrated in mid-to-low-end products such as rigid boards, while high-end PCBs still account for a low proportion, especially in high-value-added products such as packaging substrates, high-end HDI boards, and FPCs. However, in recent years, domestic PCB enterprises have been transitioning from “winning by volume” to “breaking through by quality,” with high-end, specialized, green, and intelligent development being the main transformation directions. According to CPCA statistics, as of the end of 2024, there are 167 PCB industry enterprises that have been awarded the national-level “specialized, refined, distinctive, and innovative” small giant enterprise title, including 67 PCB companies, 54 material companies, 39 equipment companies, and 7 others. More than 60% of specialized and innovative enterprises are mainly distributed in Guangdong Province, Jiangsu Province, Shenzhen City, and Jiangxi Province.

The major enterprises in China’s PCB industry and their revenues are shown in the table below.

Table 6 Revenue of Major PCB Enterprises in China in 2024

Source: China Electronic Circuit Industry Association (CPCA), organized by DeepSeek Industry Research Institute. Only mainland factories of Taiwanese/Hong Kong/foreign-funded enterprises are counted. Some enterprise data may differ from those of the Guangdong Province Circuit Board Industry Association.

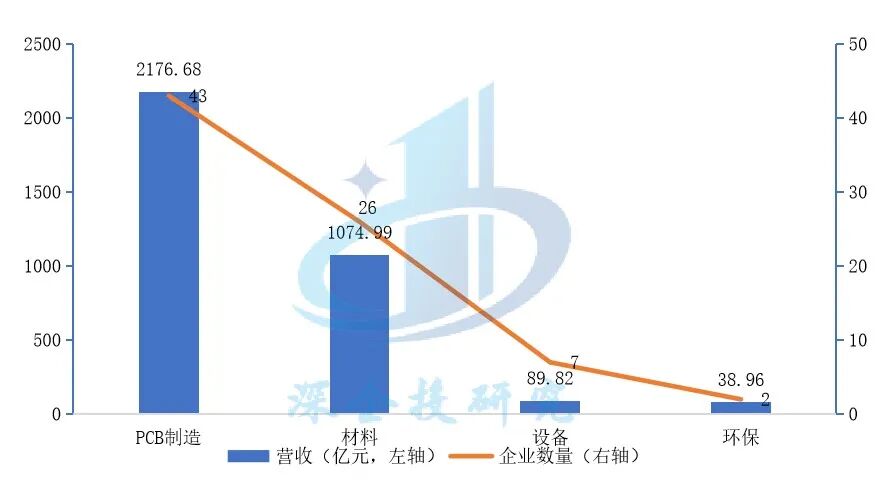

(4) Status of Listed Enterprises

Listed companies account for the main revenue of the industry. The PCB sector is one of the most densely populated segments of listed companies in China’s electronic information industry. According to data from the China Electronic Circuit Industry Association, as of the end of April 2025, there are 78 A-share listed companies in China’s electronic circuit industry, 2 listed companies in Hong Kong, and 19 listed companies in Taiwan. In terms of detailed categories, among A-share listed companies, there are 43 PCB manufacturing companies, 26 material companies, 7 equipment companies, and 2 environmental protection companies. In 2024, the total revenue of the 78 A-share listed companies is expected to reach 338.044 billion yuan, a year-on-year increase of 14%, with PCB manufacturing companies generating 217.668 billion yuan, a year-on-year increase of 16.08%, material companies generating 107.499 billion yuan, a year-on-year increase of 10.49%, and equipment companies generating 8.982 billion yuan, a year-on-year increase of 25.13%, as shown in the figure below.

Figure 11 Revenue and Distribution of A-Share Listed Companies in China’s PCB Industry in 2024

Source: China Electronic Circuit Industry Association (CPCA), organized by DeepSeek Industry Research Institute.

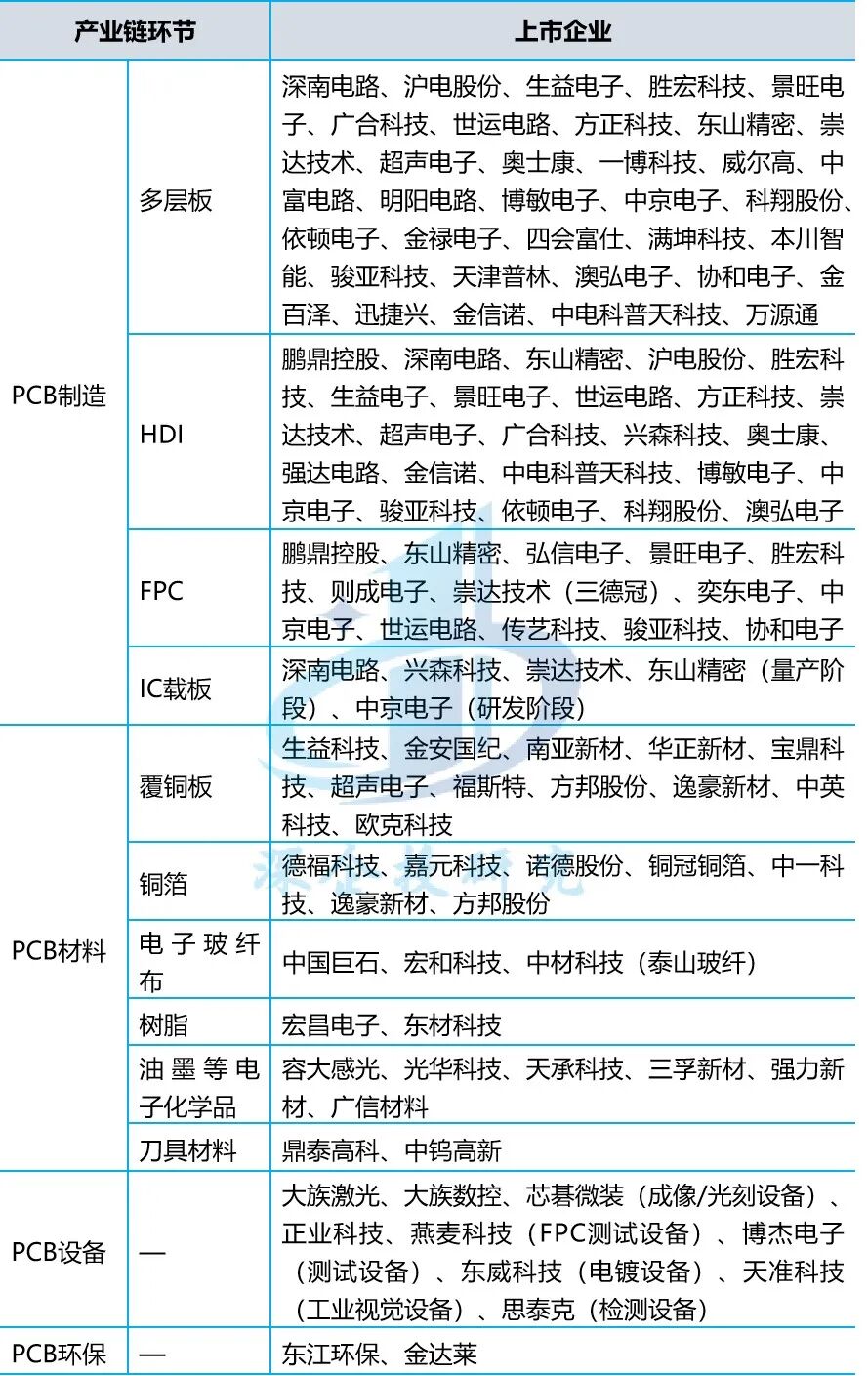

The distribution of the industrial chain of A-share listed companies in the domestic PCB industry is shown in the table below.

Table 7 Distribution of A-Share Listed Companies in China’s PCB Industry

Source: Organized by DeepSeek Industry Research Institute.

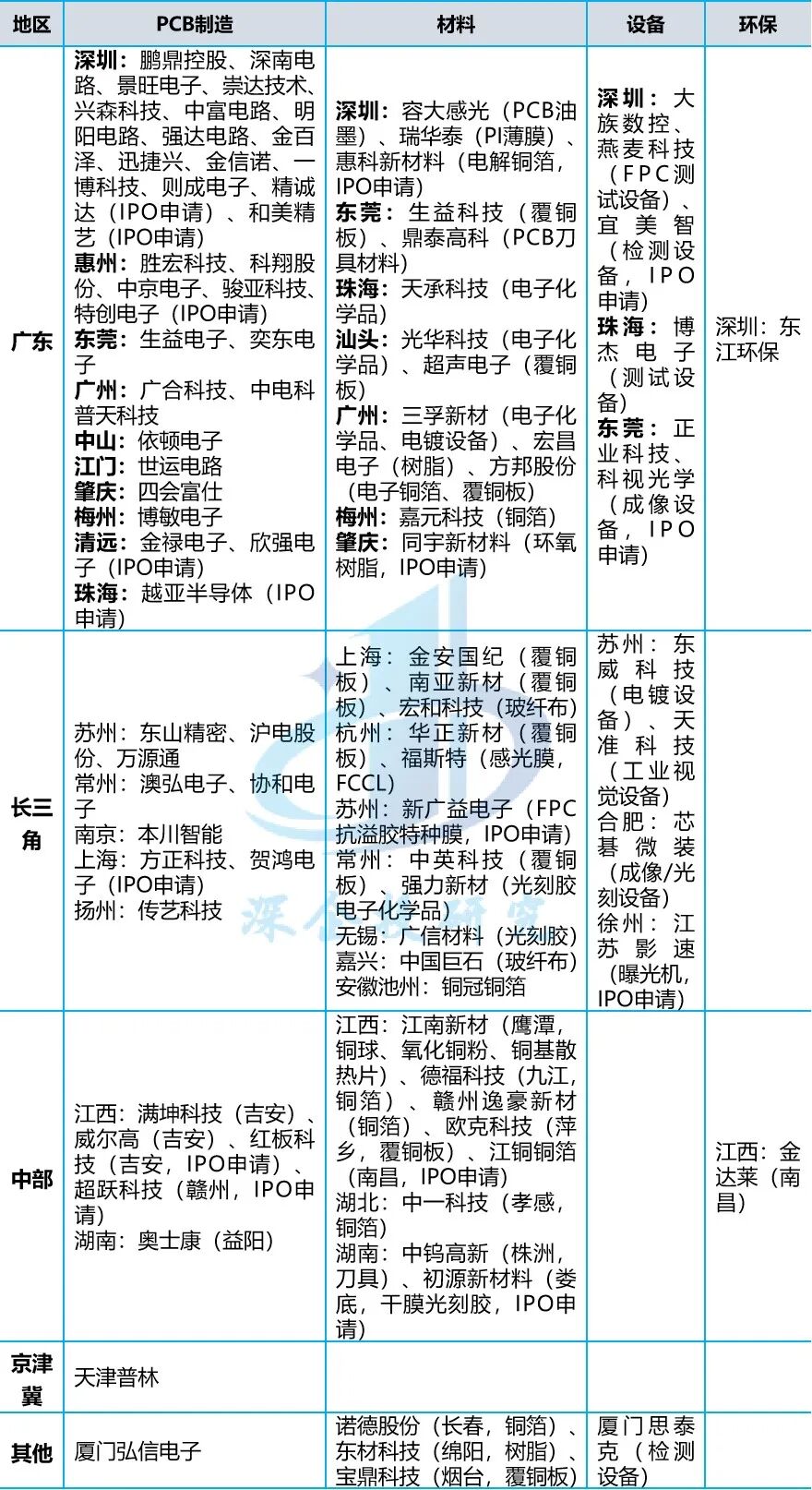

From the perspective of the headquarters location of A-share listed companies, there are over 40 listed companies in the Pearl River Delta, accounting for more than 50%, with nearly 20 listed companies in Shenzhen, leading in the country; over 20 listed companies in the Yangtze River Delta, accounting for more than 1/4; and some listed companies in Jiangxi, Hunan, Fujian, and other regions. The major enterprise regional distribution is shown in the table below.

Table 8 Distribution of A-Share Listed and Pre-Listed Companies in China’s PCB Industry

Source: Organized by DeepSeek Industry Research Institute.

Global PCB Industry Migration Direction

Since 2020, due to rising geopolitical tensions, the PCB industry has begun its fifth capacity migration, with Southeast Asia, especially Thailand, being the main beneficiary. Korean and Japanese PCB manufacturers have been early to establish operations in Vietnam and Thailand. Since 2020, influenced by multiple factors such as demand, costs, and politics, especially to address uncertainties brought by geopolitical issues and to match the capacity transfer of electronic terminal assembly to Southeast Asia and South Asia, major global PCB companies have accelerated their establishment of factories in Thailand and Vietnam. According to a Prismark report, it is expected that by 2025, more than a quarter of the top 100 PCB suppliers globally may have production bases in Vietnam or Thailand.

Thailand has become a new PCB industry cluster due to its stable political environment, abundant labor resources, and relatively complete industrial chain. Mainland Chinese manufacturers are primarily investing in Thailand, accelerating since 2022, with nearly 20 listed PCB companies having announced investment plans. Data from the Thailand Board of Investment (BOI) indicates that in 2024, the PCB industry in Thailand is expected to grow exponentially; over the past two years, there have been more than 100 PCB industry investment projects, with a total value exceeding 170 billion Thai Baht, most of which come from mainland China, Taiwan, and Japan. According to CPCA data, in 2024, the PCB industry in Thailand is expected to achieve sales of 38.1 billion Thai Baht, a year-on-year decrease of 2.44%, equivalent to $1.08 billion, a year-on-year decrease of 3.65%, with an annual output of 9.81 million square meters, a year-on-year decrease of 1.2%. Overall, the current characteristics of Thailand’s PCB base are mainly as a backup capacity for mainland China, but as key projects gradually enter mass production in recent years, the future industrial scale is expected to gradually rise. The major PCB bases in Thailand are shown in the table below.

Table 9 Major PCB Bases in Thailand

Source: Organized by DeepSeek Industry Research Institute.

Other countries in Southeast Asia, including Vietnam, Malaysia, the Philippines, and Indonesia, have the following PCB bases.

Table 10 Major PCB Bases in Other Southeast Asian Countries

Source: Organized by DeepSeek Industry Research Institute.

The transfer of the PCB industry to Southeast Asia is unlikely to shake mainland China’s status as the main production area in the short term, serving more as a backup capacity, but long-term impacts still need close attention.

About DeepSeek Industry Research Institute

The DeepSeek Industry Research Institute is a high-end think tank under the DeepSeek Group, focusing on industrial development, serving regional economies, and dedicated to providing industrial development implementation plans for local governments and parks. Its main business includes the 14th Five-Year Plan, industrial planning, industrial chain investment strategies, project planning and packaging, project evaluation, etc. The research institute has a team of industry research experts with economic backgrounds from Peking University, Renmin University, Nankai University, and Sun Yat-sen University, with a long-term focus on regional economic research and strategic emerging industries, having completed hundreds of planning consultations and industrial research projects for various regions such as the Pearl River Delta, Yangtze River Delta, Haixi, Southwest, and Northwest.

Follow Us to Get More Industry Content

Business Cooperation| Ms. Wang: 13168781866 (WeChat same number) Address| 7B1 Benyuan Building, Shennan Avenue, Futian District, Shenzhen

We Look Forward to Your Comments Below to Interact with Us!

Your “Likes” and “Views” are our important motivation for creation, thank you for your support! If you like the article, remember to “Share”!