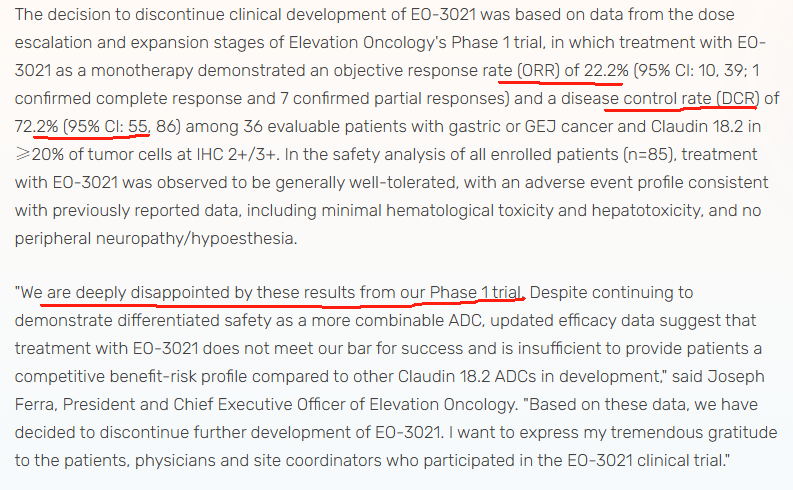

This March, the American biotechnology company Elevation Oncology announced the termination of the development pipeline for EO-3021 (Claudin 18.2 ADC) licensed from Shiyao Group, redirecting resources to EO-1022 (HER-3 ADC). In July 2022, Shiyao Group licensed EO-3021 to Elevation, which paid a $27 million upfront fee along with potential milestone payments of up to $1.148 billion and royalties on net sales for the development rights outside Greater China.According to an announcement on Elevation’s official website, the primary reason for this return was the unsatisfactory results from the Phase I clinical trial conducted in the U.S. The Overall Response Rate (ORR) was 22.2% (compared to 47.1% in domestic clinical data), and the Disease Control Rate (DCR) was 72.2% (compared to 64.7% domestically). Although the safety profile was acceptable, it lacked competitiveness compared to competing products, leading to this return.

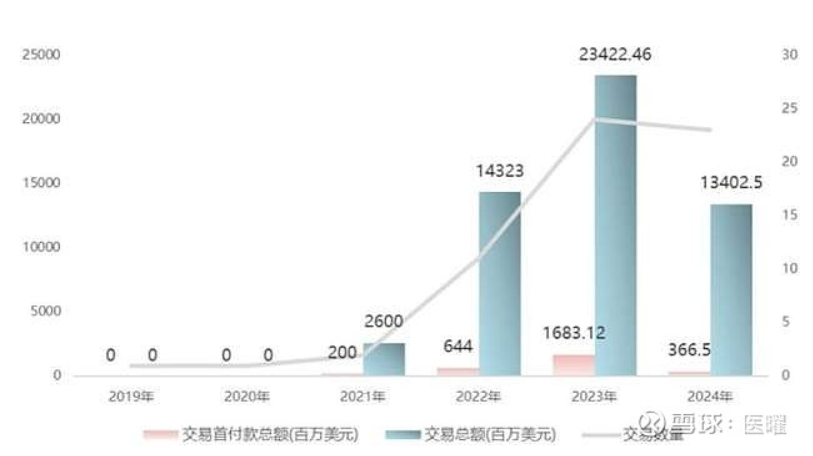

In July 2022, Shiyao Group licensed EO-3021 to Elevation, which paid a $27 million upfront fee along with potential milestone payments of up to $1.148 billion and royalties on net sales for the development rights outside Greater China.According to an announcement on Elevation’s official website, the primary reason for this return was the unsatisfactory results from the Phase I clinical trial conducted in the U.S. The Overall Response Rate (ORR) was 22.2% (compared to 47.1% in domestic clinical data), and the Disease Control Rate (DCR) was 72.2% (compared to 64.7% domestically). Although the safety profile was acceptable, it lacked competitiveness compared to competing products, leading to this return. In addition to EO-3021, earlier this year, Rongchang Bio’s Vidicimab was also written down by Pfizer for 200 million yuan in intangible assets; in August 2024, Merck announced the return of rights for Kelun Biotech’s SKB315 (Claudin 18.2), and in October, Lixin Pharmaceutical’s LM-302 (also Claudin 18.2) was returned. These pipelines had all reached Phase II clinical trials, not early-stage pipelines.Domestic ADC projects are also facing issues. Baiyoutai’s BAT8001 (HER2 ADC) did not meet endpoints in a Phase III clinical trial for breast cancer, leading to an unfortunate termination with nearly 200 million yuan in R&D costs. Dongyao Pharmaceutical’s TAA013 (HER2 ADC) also terminated its Phase III trial due to changes in market dynamics. Yilian Bio’s YL202 (HER3 ADC) was halted by the FDA due to safety concerns; Innovent Biologics’ CEACAM5 ADC, introduced from Sanofi, was also cut due to unmet endpoints in Phase III clinical trials.From the data, China’s ADC exports peaked in 2023 before experiencing a significant decline in 2024. Structurally, while the number of transactions remained stable, the transaction value dropped by 43%.

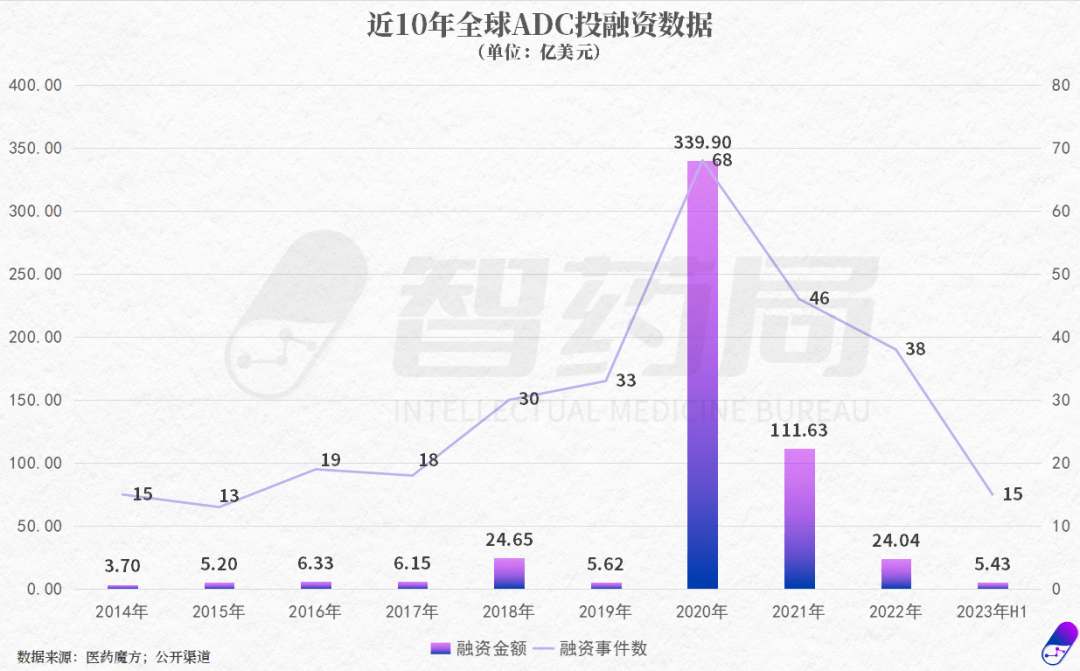

In addition to EO-3021, earlier this year, Rongchang Bio’s Vidicimab was also written down by Pfizer for 200 million yuan in intangible assets; in August 2024, Merck announced the return of rights for Kelun Biotech’s SKB315 (Claudin 18.2), and in October, Lixin Pharmaceutical’s LM-302 (also Claudin 18.2) was returned. These pipelines had all reached Phase II clinical trials, not early-stage pipelines.Domestic ADC projects are also facing issues. Baiyoutai’s BAT8001 (HER2 ADC) did not meet endpoints in a Phase III clinical trial for breast cancer, leading to an unfortunate termination with nearly 200 million yuan in R&D costs. Dongyao Pharmaceutical’s TAA013 (HER2 ADC) also terminated its Phase III trial due to changes in market dynamics. Yilian Bio’s YL202 (HER3 ADC) was halted by the FDA due to safety concerns; Innovent Biologics’ CEACAM5 ADC, introduced from Sanofi, was also cut due to unmet endpoints in Phase III clinical trials.From the data, China’s ADC exports peaked in 2023 before experiencing a significant decline in 2024. Structurally, while the number of transactions remained stable, the transaction value dropped by 43%. Looking back to 2019, the ADC sector was thriving. Following the approval of Enhertu, co-developed by Daiichi Sankyo and AstraZeneca, numerous pharmaceutical companies entered the field. Pfizer acquired Seagen for $43 billion, Gilead purchased Immunomedics for $21 billion, AbbVie invested $10.1 billion to acquire ImmunoGen, and Merck reached a $10 billion collaboration with Kelun Biotech and Daiichi Sankyo.In this context, Chinese pharmaceutical companies also began to follow suit. In 2020, ADC financing exceeded 36 billion yuan, and some innovative companies like Rongchang Bio and Kelun Biotech saw their ADC pipelines gain more certainty in their prospects.

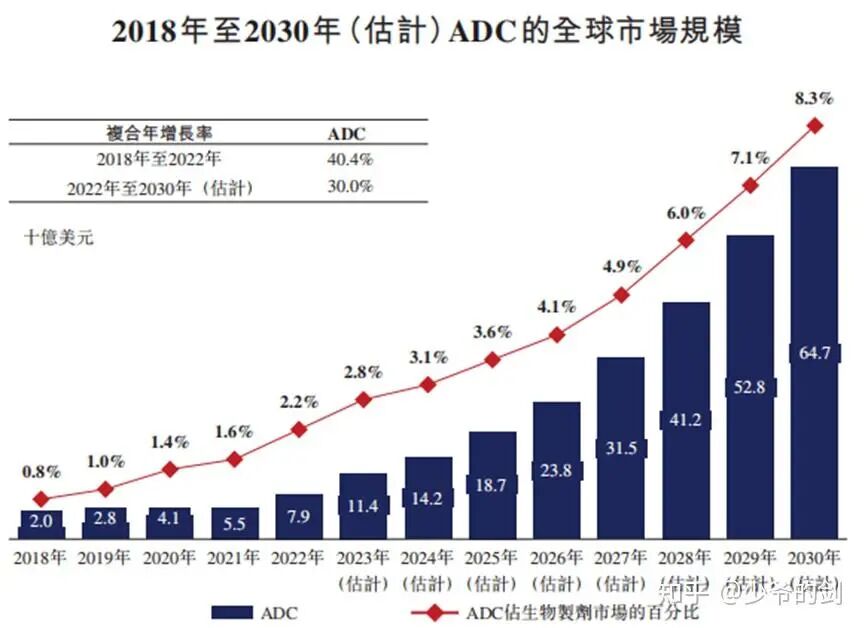

Looking back to 2019, the ADC sector was thriving. Following the approval of Enhertu, co-developed by Daiichi Sankyo and AstraZeneca, numerous pharmaceutical companies entered the field. Pfizer acquired Seagen for $43 billion, Gilead purchased Immunomedics for $21 billion, AbbVie invested $10.1 billion to acquire ImmunoGen, and Merck reached a $10 billion collaboration with Kelun Biotech and Daiichi Sankyo.In this context, Chinese pharmaceutical companies also began to follow suit. In 2020, ADC financing exceeded 36 billion yuan, and some innovative companies like Rongchang Bio and Kelun Biotech saw their ADC pipelines gain more certainty in their prospects. Meanwhile, market expectations for ADCs have been high. According to a market survey in 2022, the global ADC market is projected to reach $64.7 billion by 2030, with a CAGR of 30% from 2022 to 2030.

Meanwhile, market expectations for ADCs have been high. According to a market survey in 2022, the global ADC market is projected to reach $64.7 billion by 2030, with a CAGR of 30% from 2022 to 2030. Under the strong pursuit of capital, China’s ADC industry has experienced a facade of false prosperity. Over 50% of domestic pipelines are concentrated on five major targets: HER2, TROP2, and Claudin 18.2, which account for 64%, 77%, and 86% of global pipelines, respectively. Moreover, the intensification of similar experiments has led to competition for patient resources, forcing clinical trials to lower enrollment standards or extend timelines, resulting in increased R&D costs. The increase in similar products has also led to a decline in the market value of individual products, significantly reducing their value post-commercialization.In reality, the technical threshold for ADCs is very high, requiring a delicate balance between antibodies, linkers, and toxins. For instance, Daiichi Sankyo’s DXd platform achieved precise and controllable drug release after 20 years of iteration, which is incomparable to the “micro-innovation” and externally sourced technologies adopted by some Chinese pharmaceutical companies. This is also one of the significant reasons for the current ADC bubble burst.China’s ADC exports also face a challenge, namely the widespread adoption of a high-risk model of “low upfront, high total” payments, where the upfront payment is minimal (for example, Shiyao’s Claudin 18.2 ADC had an upfront payment ratio of only 2.3%), and subsequent milestone payments depend on high-risk clinical progress. For large overseas pharmaceutical companies, a small upfront payment allows them to secure pipelines in bulk and adjust or terminate R&D at any time, while Chinese companies bear the primary risk.How to Break the DeadlockThe answer is quite simple: return to the essence of innovation. For example, Yilian Bio’s development of the TMALIN tripeptide linker technology not only targets differentiated targets like NaPi2b and DLL3 but also breaks through traditional ADC internalization limitations, establishing a technical barrier. Transitioning from me-too to FIC/BIC and precisely addressing unmet clinical needs is the ultimate answer for innovative drug development.Additionally, pharmaceutical companies can innovate their models to better advance pipeline exports. For instance, Hengrui Medicine established a joint venture with large overseas pharmaceutical companies using the “NewCo model,” binding equity to share resources and explore symbiotic cooperation. Alternatively, companies like BeiGene can independently promote Zebrutinib, continuously enhancing international recognition and achieving a transition from “selling technology” to “selling products.”ConclusionLooking back, the current capital withdrawal in the ADC industry has shifted the focus from me-too to a competition based on “platform innovation + clinical insights + global commercialization” hard power. Pharmaceutical companies with core technology platforms, differentiated pipeline layouts, and independent commercialization capabilities have the potential to navigate through cycles and reshape the industry landscape.

Under the strong pursuit of capital, China’s ADC industry has experienced a facade of false prosperity. Over 50% of domestic pipelines are concentrated on five major targets: HER2, TROP2, and Claudin 18.2, which account for 64%, 77%, and 86% of global pipelines, respectively. Moreover, the intensification of similar experiments has led to competition for patient resources, forcing clinical trials to lower enrollment standards or extend timelines, resulting in increased R&D costs. The increase in similar products has also led to a decline in the market value of individual products, significantly reducing their value post-commercialization.In reality, the technical threshold for ADCs is very high, requiring a delicate balance between antibodies, linkers, and toxins. For instance, Daiichi Sankyo’s DXd platform achieved precise and controllable drug release after 20 years of iteration, which is incomparable to the “micro-innovation” and externally sourced technologies adopted by some Chinese pharmaceutical companies. This is also one of the significant reasons for the current ADC bubble burst.China’s ADC exports also face a challenge, namely the widespread adoption of a high-risk model of “low upfront, high total” payments, where the upfront payment is minimal (for example, Shiyao’s Claudin 18.2 ADC had an upfront payment ratio of only 2.3%), and subsequent milestone payments depend on high-risk clinical progress. For large overseas pharmaceutical companies, a small upfront payment allows them to secure pipelines in bulk and adjust or terminate R&D at any time, while Chinese companies bear the primary risk.How to Break the DeadlockThe answer is quite simple: return to the essence of innovation. For example, Yilian Bio’s development of the TMALIN tripeptide linker technology not only targets differentiated targets like NaPi2b and DLL3 but also breaks through traditional ADC internalization limitations, establishing a technical barrier. Transitioning from me-too to FIC/BIC and precisely addressing unmet clinical needs is the ultimate answer for innovative drug development.Additionally, pharmaceutical companies can innovate their models to better advance pipeline exports. For instance, Hengrui Medicine established a joint venture with large overseas pharmaceutical companies using the “NewCo model,” binding equity to share resources and explore symbiotic cooperation. Alternatively, companies like BeiGene can independently promote Zebrutinib, continuously enhancing international recognition and achieving a transition from “selling technology” to “selling products.”ConclusionLooking back, the current capital withdrawal in the ADC industry has shifted the focus from me-too to a competition based on “platform innovation + clinical insights + global commercialization” hard power. Pharmaceutical companies with core technology platforms, differentiated pipeline layouts, and independent commercialization capabilities have the potential to navigate through cycles and reshape the industry landscape.

Pharmaceutical and Biological Investment Notes

What is the future of small molecule drugs?

Discussing the opioid analgesic market

A beginner’s guide to viral learning notes

Overview of induced pluripotent stem cells

Mechanisms and clinical progress of CAR-NK

What is biomolecular phase separation?

Bioprinting technology – the future puzzle of regenerative medicine

Overview of synthetic biology research frameworks

Brain-computer interfaces – the revolution has arrived

Innovative drug pipeline overview

Understanding the current innovative drug development pipeline for breast cancer

Overview of innovative drug pipelines for multiple myeloma

Overview of innovative drug pipelines for non-small cell lung cancer

Overview of innovative drug pipelines for urothelial carcinoma

Overview of innovative drug pipelines for pancreatic cancer

Overview of innovative drug pipelines for gastric cancer