Core Insights

◾ ‘U-shaped bottom’ is rising, and market conditions are gradually improving

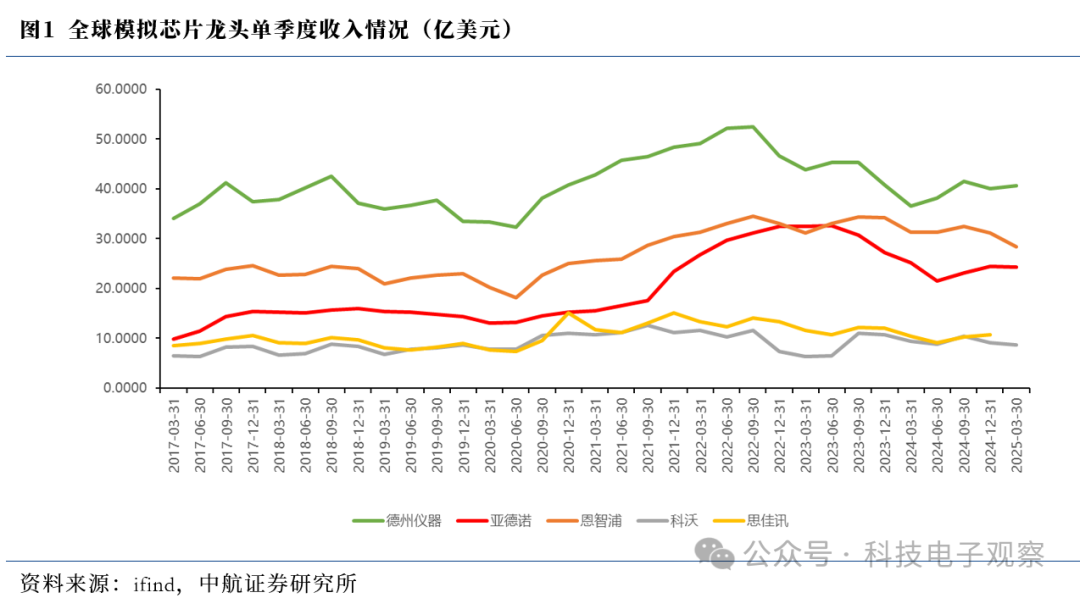

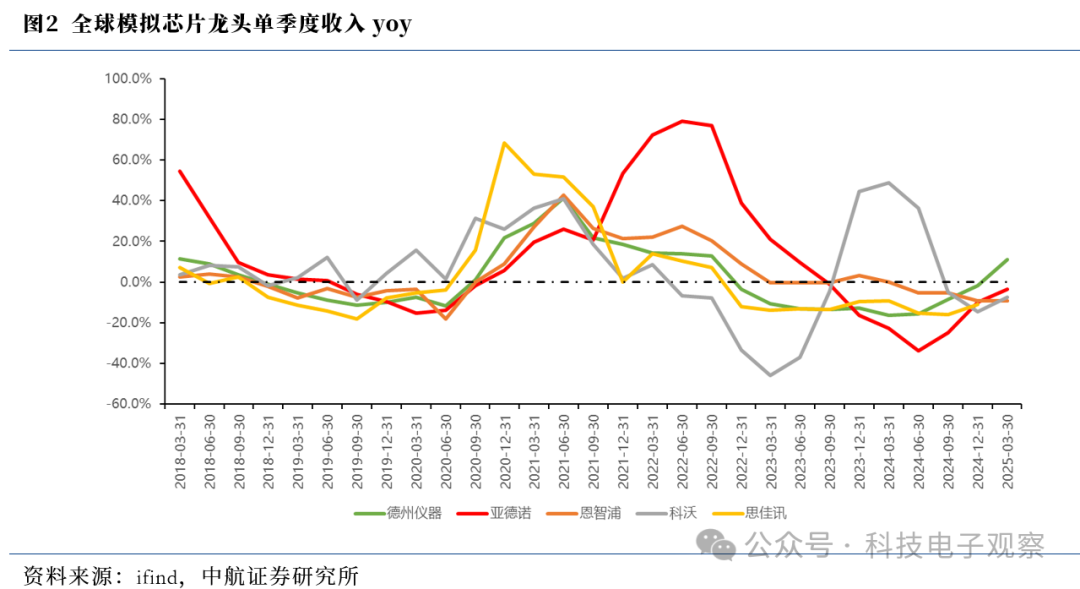

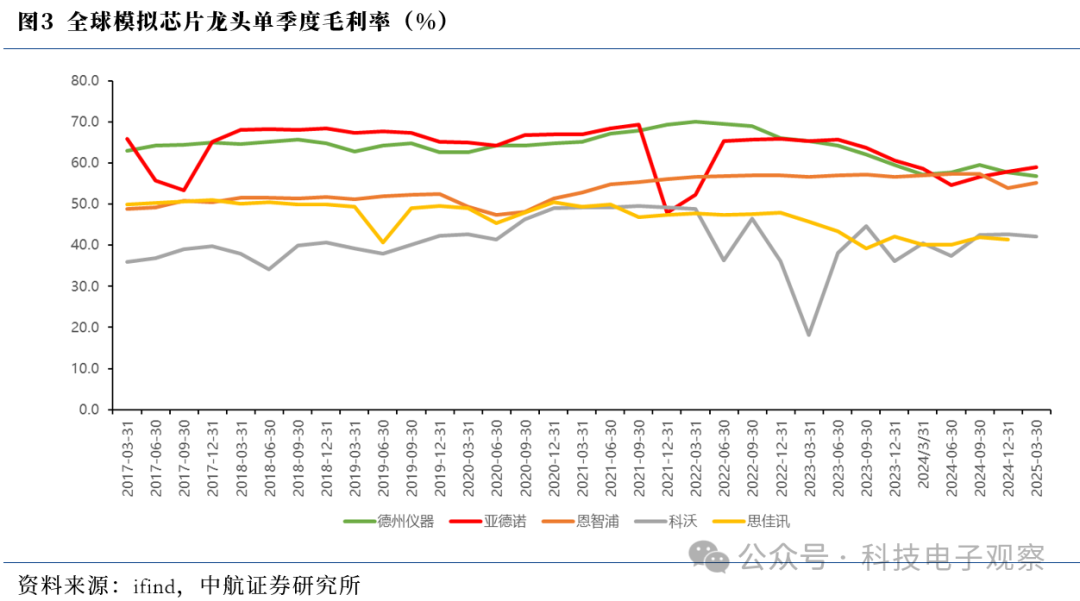

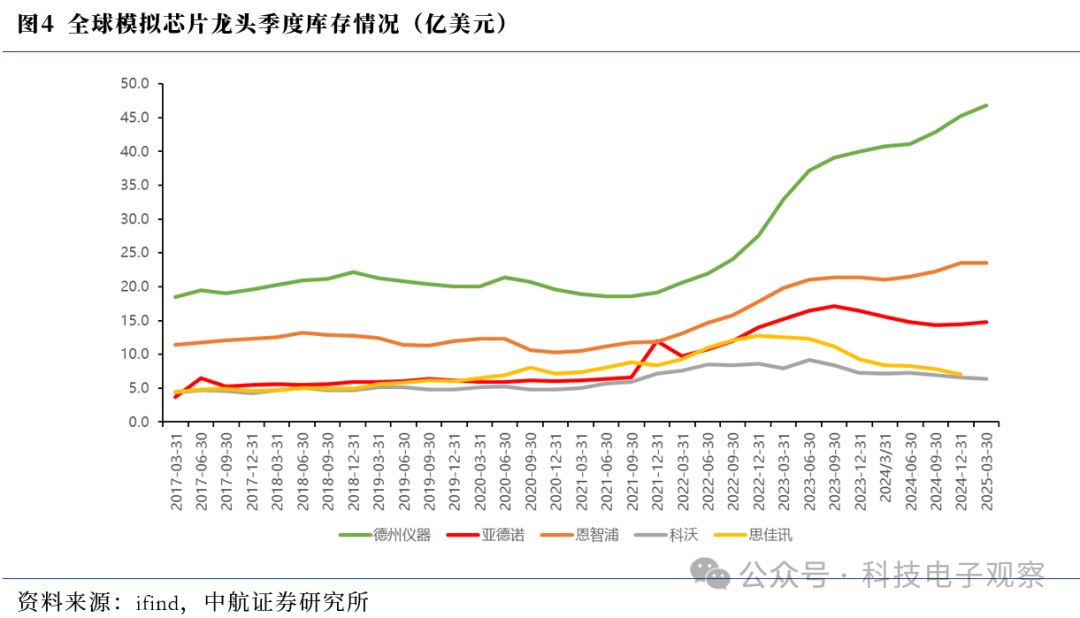

Leading global analog companies TI and ADI reported a year-on-year revenue increase in Q1 2025, emerging from a U-shaped bottom, primarily driven by high-growth sectors such as automotive, industrial, and communication equipment, offsetting the seasonal weakness in the personal electronics market. Companies’ gross margins are beginning to stabilize, but they still face challenges from high inventory levels. Regarding tariff impacts, companies stated that the situation remains unclear.

◾ Domestic revenue saw widespread year-on-year growth in Q1

Domestic analog chip suppliers achieved sustained revenue growth in Q4 2024 and Q1 2025, with most companies reporting year-on-year revenue increases by Q1 2025.

With the recovery in revenue, most companies in the industry have stable inventory changes without significant fluctuations.

Due to market competition and weakened demand, domestic analog chip companies have seen their gross margins decline significantly since Q3 2021. As competition in the consumer electronics sector intensifies, the upward substitution of high-end products will take time. We anticipate that industry gross margins will gradually rise with the cyclical recovery and slow domestic substitution.

◾ Recommendations:

Based on data from domestic and international analog chip suppliers, we believe the industry has entered a recovery phase, with downstream demand improving first in the industrial and automotive sectors. Domestic suppliers are shifting their narrative towards high-end industrial and automotive product substitutions. We recommend paying attention to companies with a rich variety of products or those with low valuations, such as NXP Semiconductors, Hittite Microwave, and SiTime.

◾ Risk Warning:

Risks include the continued weakening of consumer electronics demand, intensified market competition, and a lack of industry innovation.

Report Body

1. ‘U-shaped bottom’ is rising, and market conditions are gradually improving

Leading global analog companies TI and ADI reported a year-on-year revenue increase in Q1 2025, emerging from a U-shaped bottom, primarily driven by high-growth sectors such as automotive, industrial, and communication equipment, offsetting the seasonal weakness in the personal electronics market. Companies’ gross margins are beginning to stabilize, but they still face challenges from high inventory levels. Regarding tariffs, companies stated that the situation remains unclear, and they are cautious about the potential impacts of tariffs.

Texas Instruments:Revenue growth is attributed to its diversified product portfolio and market positioning. The analog chip business benefits from strong demand in automotive electrification, industrial automation, and 5G infrastructure. The automotive market achieved low single-digit growth quarter-on-quarter; personal electronics sales declined by about 15%; enterprise systems grew by about 5%; and communication equipment grew by approximately 10%.

Analog Devices:Believes the company has entered a recovery phase and is prepared for continued recovery. Industrial business grew by 1% quarter-on-quarter. Customer inventory improved; automotive business grew by 2% quarter-on-quarter, with the company’s leading connectivity and functional safety power solutions again achieving double-digit year-on-year growth; communication business grew by 6% quarter-on-quarter, with wired business accounting for about two-thirds of the company’s overall communication business, driven by demand for data center infrastructure construction propelled by artificial intelligence, achieving double-digit growth both quarter-on-quarter and year-on-year, but the company’s wireless business revenue continues to face demand challenges; finally, consumer business declined by 15% quarter-on-quarter, reflecting the impact of seasonal delays.

NXP Semiconductors:Business is under comprehensive pressure. The company’s automotive business declined by 7% quarter-on-quarter; industrial and IoT declined by 11%; mobile business declined by 3%; communication business declined by 21%. The company stated that automotive and industrial business fell below expectations. The company believes that the industrial IoT sector will be driven by artificial intelligence, with customers needing efficient, secure, low-power processors deployed locally, hence plans to acquire the AI NPU supplier Kinara.

Coherent:The company’s defense and aerospace business achieved record quarterly revenue. In the SoC business, the company is focusing on low-power Bluetooth and ultra-wideband, both of which are growing at rates far exceeding the company’s average. Over the past 12 months, the company’s ultra-wideband sales channels for automotive have grown by over $500 million, now exceeding $2 billion.

2. Domestic revenue saw widespread year-on-year growth in Q1

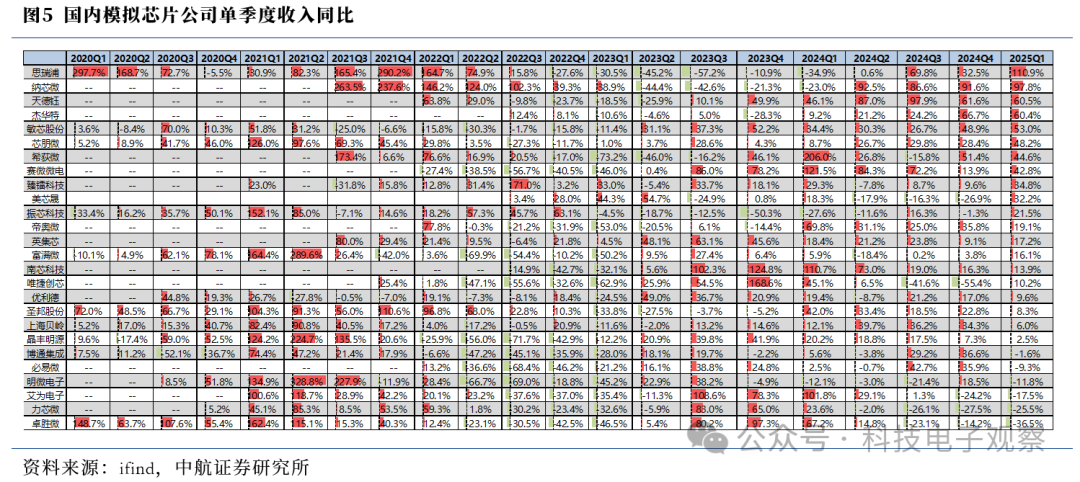

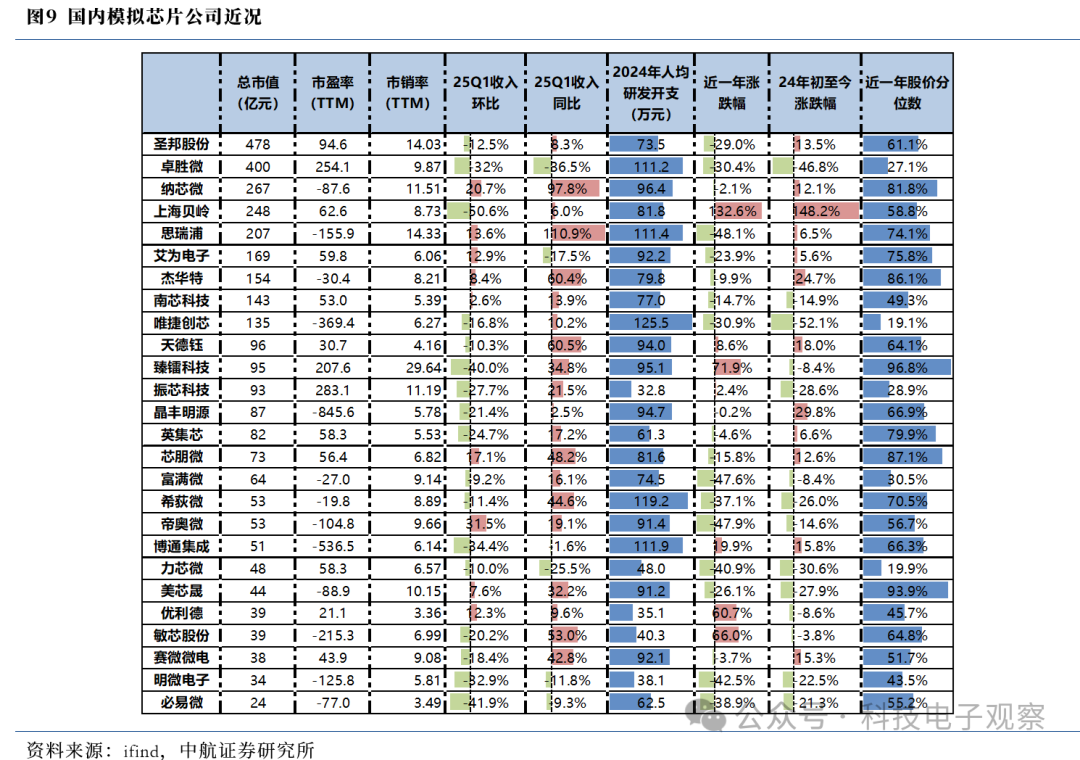

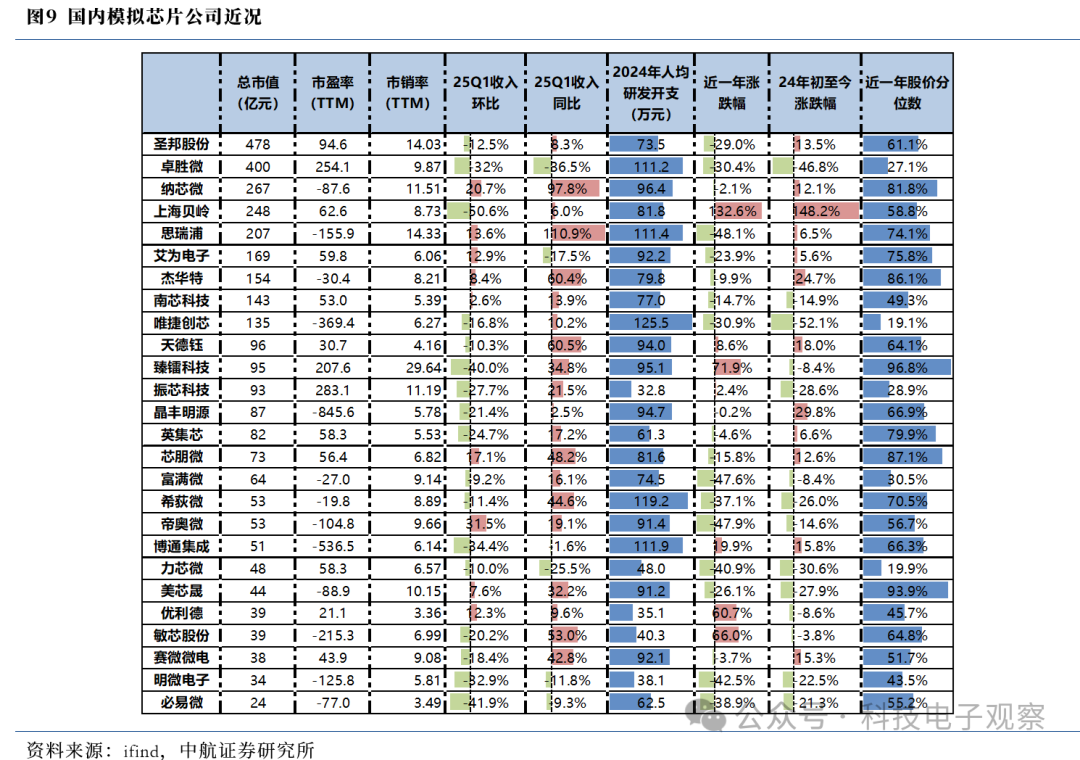

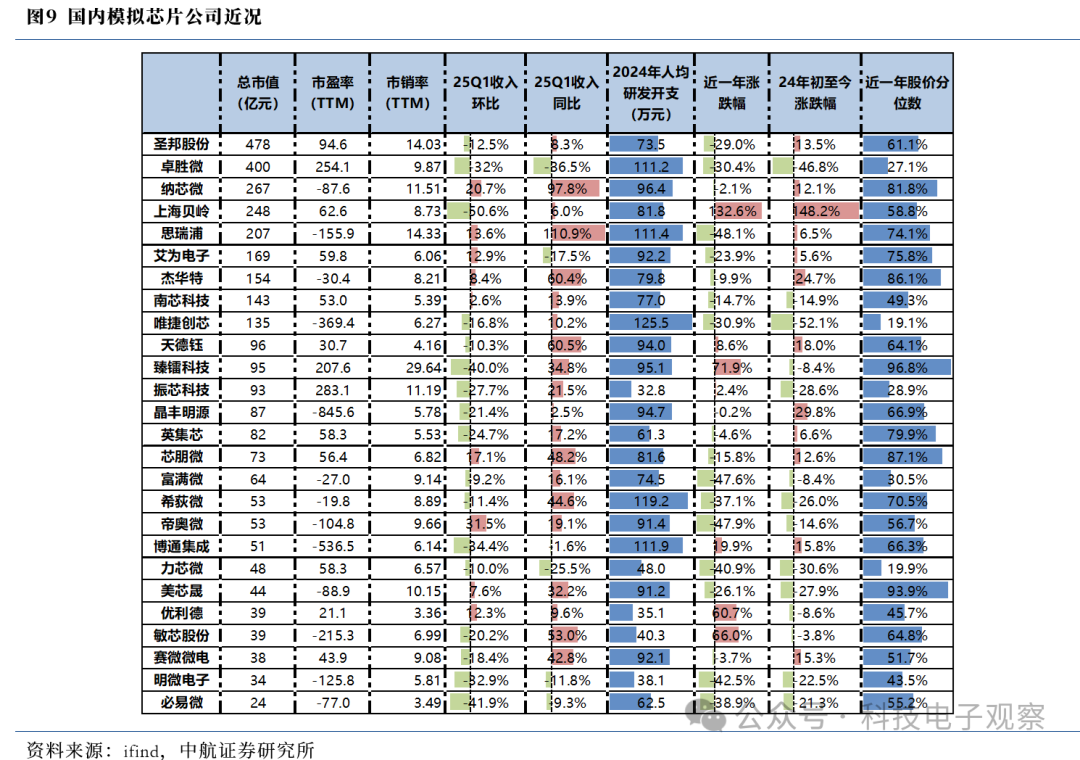

Domestic analog chip suppliers achieved sustained revenue growth in Q4 2024 and Q1 2025, with most companies reporting year-on-year revenue increases by Q1 2025. The top three companies in terms of year-on-year revenue growth are SiTime, NXP Semiconductors, and Tianda Yu (110.9%, 97.8%, 60.5%), while the bottom three are Zhaoxin Micro, Lichip Micro, and Aiwai Electronics (-36.5%, -25.5%, -17.5%).

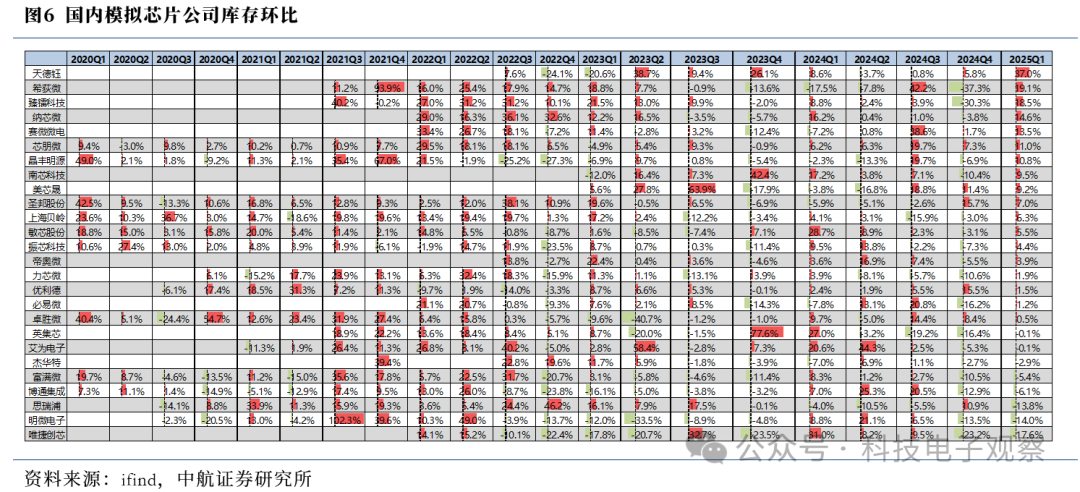

With the recovery in revenue, most companies in the industry have stable inventory changes without significant fluctuations. The top three companies with the largest quarter-on-quarter inventory reductions are Weijie Chuangxin, Mingwei Electronics, and SiTime (-17.6%, -14.0%, -13.8%), while the top three with quarter-on-quarter inventory growth are Tianda Yu, Hittite Microwave, and Zhenlei Technology (37.0%, 19.1%, 18.5%).

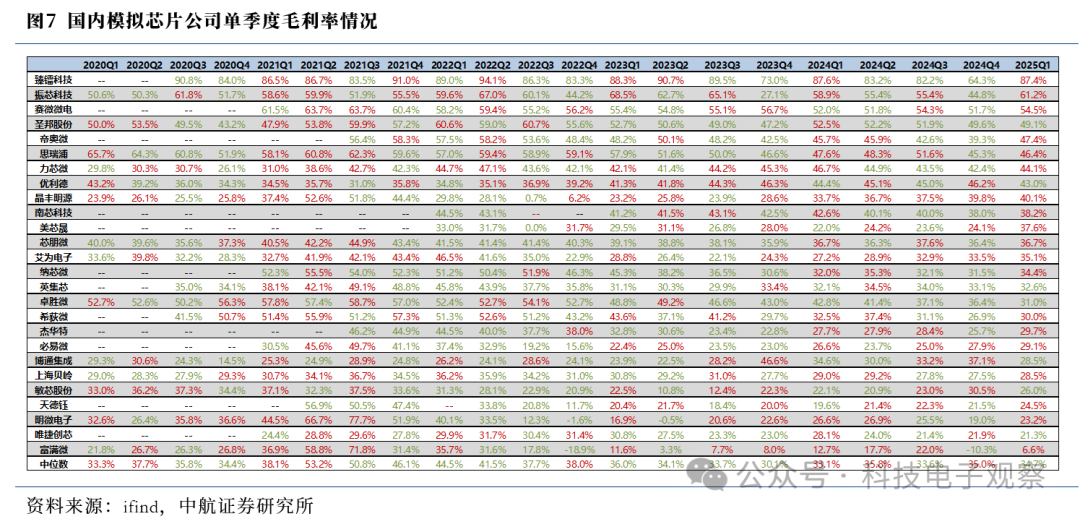

Due to market competition and weakened demand, domestic analog chip companies have seen their gross margins decline significantly since Q3 2021. As competition in the consumer electronics sector intensifies, the upward substitution of high-end products will take time. We anticipate that industry gross margins will gradually rise with the cyclical recovery and slow domestic substitution. The top three companies in terms of gross margin in Q1 2025 are Zhenlei Technology, Zhenxin Technology, and Saiwei Microelectronics (87.4%, 61.2%, 54.5%), while the bottom three are Fuman Micro, Weijie Chuangxin, and Mingwei Electronics (6.6%, 21.3%, 23.2%).

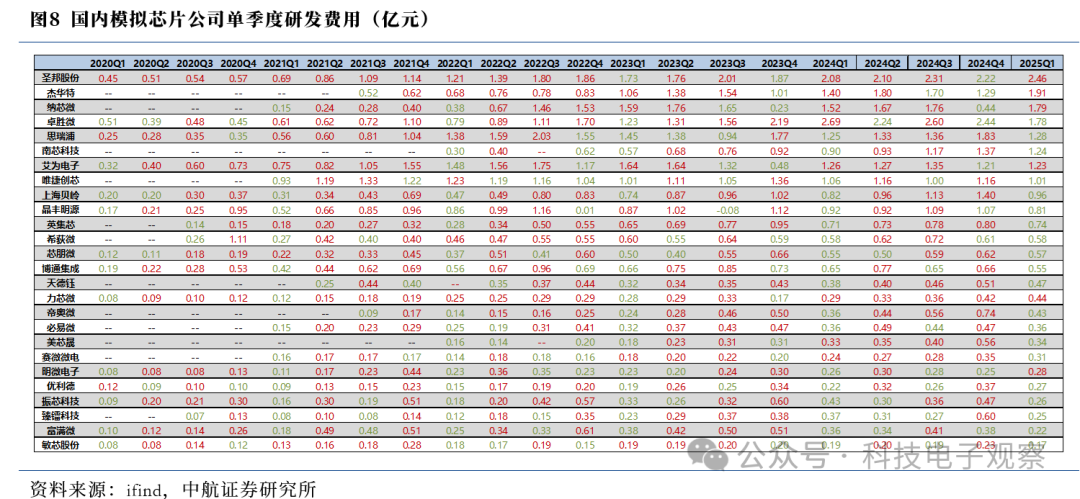

Most companies reduced their R&D investment quarter-on-quarter in Q1 2025, which may be a seasonal fluctuation based on historical Q1 observations. The companies with the highest R&D investments are Shengbang Co., Jiewater, and Zhaoxin Micro (246 million yuan, 191 million yuan, 179 million yuan), while the companies with the lowest investments are Minxin Co., Fuman Micro, and Zhenlei Technology (17 million yuan, 22 million yuan, 25 million yuan).

Based on data from domestic and international analog chip suppliers, we believe the industry has entered a recovery phase, with downstream demand improving first in the industrial and automotive sectors. Domestic suppliers are shifting their narrative towards high-end industrial and automotive product substitutions. We recommend paying attention to companies with a rich variety of products or those with low valuations, such as NXP Semiconductors, Hittite Microwave, and SiTime.

Based on data from domestic and international analog chip suppliers, we believe the industry has entered a recovery phase, with downstream demand improving first in the industrial and automotive sectors. Domestic suppliers are shifting their narrative towards high-end industrial and automotive product substitutions. We recommend paying attention to companies with a rich variety of products or those with low valuations, such as NXP Semiconductors, Hittite Microwave, and SiTime.

Based on data from domestic and international analog chip suppliers, we believe the industry has entered a recovery phase, with downstream demand improving first in the industrial and automotive sectors. Domestic suppliers are shifting their narrative towards high-end industrial and automotive product substitutions. We recommend paying attention to companies with a rich variety of products or those with low valuations, such as NXP Semiconductors, Hittite Microwave, and SiTime.Most companies reduced their R&D investment quarter-on-quarter in Q1 2025, which may be a seasonal fluctuation based on historical Q1 observations. The companies with the highest R&D investments are Shengbang Co., Jiewater, and Zhaoxin Micro (246 million yuan, 191 million yuan, 179 million yuan), while the companies with the lowest investments are Minxin Co., Fuman Micro, and Zhenlei Technology (17 million yuan, 22 million yuan, 25 million yuan).

Based on data from domestic and international analog chip suppliers, we believe the industry has entered a recovery phase, with downstream demand improving first in the industrial and automotive sectors. Domestic suppliers are shifting their narrative towards high-end industrial and automotive product substitutions. We recommend paying attention to companies with a rich variety of products or those with low valuations, such as NXP Semiconductors, Hittite Microwave, and SiTime.Most companies reduced their R&D investment quarter-on-quarter in Q1 2025, which may be a seasonal fluctuation based on historical Q1 observations. The companies with the highest R&D investments are Shengbang Co., Jiewater, and Zhaoxin Micro (246 million yuan, 191 million yuan, 179 million yuan), while the companies with the lowest investments are Minxin Co., Fuman Micro, and Zhenlei Technology (17 million yuan, 22 million yuan, 25 million yuan).

3. Risk Warning

Risks include the continued weakening of consumer electronics demand, intensified market competition, and a lack of industry innovation.

Research Report Title: “2025 Q1 Analog Chip Industry Tracking: ‘U-shaped Bottom’ Rising, Gradual Improvement in Market Conditions”

Release Date: May 5, 2025

Team Introduction of AVIC Technology Electronics

Chief: Zhao Xiaokun

SAC Practicing Certificate: S0640122030028, sixteen years of experience in the consumer electronics and communications industry, having worked in several international leading brand terminal companies such as Huawei, Alibaba, Motorola, and Foxconn, responsible for R&D, engineering, supply chain procurement, and other positions. Formerly served as the Director of Semiconductor Chip Procurement at Huawei Terminal and the Director of Supply Chain Procurement at Alibaba’s Artificial Intelligence Laboratory. Long-term focus on three major areas: 1. Semiconductors and hard technology; 2. Smart vehicles and robotics; 3. The trend of new energy.

Analyst: Liu Muye

SAC Practicing Certificate: S0640522040001, Master’s degree in Mechanical Engineering from Johns Hopkins University, joined AVIC Securities in January 2022. Has investment research experience in high-end manufacturing and hard technology, engaged in research in the technology and electronics industry.

Research Assistant: Liu Yinan

SAC Practicing Certificate: S0640122080006, Master’s degree in Finance from Southwestern University of Finance and Economics, joined AVIC Securities in July 2022, covering semiconductor equipment and semiconductor materials sectors.

AVIC Research

The AVIC Securities Research Institute is led by the star analyst Zou Runfang, who has won the New Fortune Mechanical (Military Industry) first place five times, with Dr. Dong Zhongyun serving as Chief Economist, focusing on building a research system led by macro research, represented by military industry and hard technology, while also covering some major consumer sectors.

The research institute has the largest military team in the entire market, relying on the advantages of state-owned enterprise shareholders from the Aviation Industry Corporation, deeply cultivating various subdivisions of the military industry, while also involving macro strategy, advanced manufacturing, technology electronics, new energy, new materials, biomedicine, agriculture, forestry, animal husbandry, non-bank, and social services, among other research directions. The main business currently includes: investment research services (comprehensively serving primary and secondary market institutional investors), thematic index construction and related product development, assisting in the undertaking and cooperation of investment banking projects, etc.

Disclaimer

This report is not intended to be sent or to cause AVIC Securities Co., Ltd. and its affiliates to violate local laws or regulations or to subject AVIC Securities to any jurisdiction’s laws or regulations. Unless otherwise indicated, the copyright of the materials in this report belongs to AVIC Securities. Without prior written authorization from AVIC Securities, no changes or any way of sending, copying the materials, content, or copies of this report to any other person is allowed.

The materials, tools, and information contained in this report are provided for your reference only and are not to be construed as an invitation to sell or purchase or subscribe for securities or other financial instruments. AVIC Securities has not taken action to ensure that the securities referred to in this report are suitable for individual investors. The content of this report does not constitute investment advice to anyone, and AVIC Securities will not consider them as clients by accepting this report.

The sources of the information and opinions contained in this report are considered reliable by AVIC Securities, but AVIC Securities cannot guarantee their accuracy or completeness. AVIC Securities is not liable for any losses arising from the use of the materials in this report unless such losses are caused by explicit laws or regulations. Investors should not rely solely on this report to exercise independent judgment. At different times, AVIC Securities may issue other reports that are inconsistent with the information contained in this report and may have different conclusions. This report and such reports only reflect the different assumptions, views, and analytical methods of the analyst on the date of writing the report. For the avoidance of doubt, the views expressed in this report do not represent the position of AVIC Securities and its affiliates.

AVIC Securities may participate in or invest in financial transactions of the issuers mentioned in this report, provide services to such issuers or request business from them, and/or hold their securities or engage in securities transactions, as permitted by law.