The trend of smart appliances in the home appliance industry began several years ago and has become more pronounced and rapid in recent years. Whether it is traditional black appliances, white appliances, or the rapidly developing kitchen appliances and smart small home appliances, they have all incorporated smart elements to varying degrees. Currently, the smart features added to smart home appliances include smart control, remote monitoring, automatic alarms, voice interaction, cameras, and more.

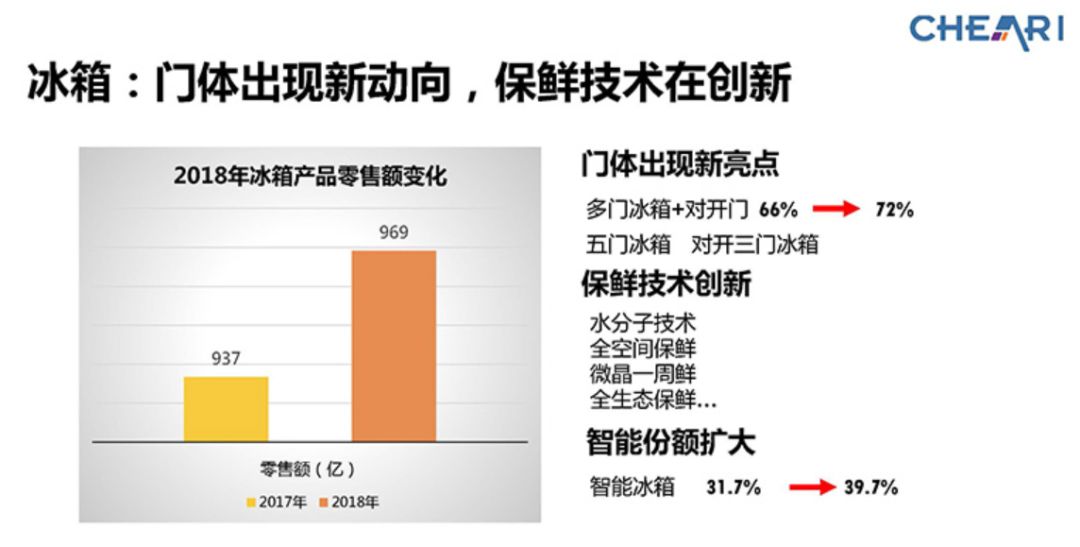

With advancements in technology and increased levels of information, as well as the growing demand for smart home appliance products, the smartization of home appliances will become the main form of future home appliance products. Data from the National Home Appliance Industry Information Center shows that in 2018, the market share of smart refrigerators increased from 31.7% to 39.7%; the market penetration rate of smart air conditioners has exceeded 30%, becoming a new trend for consumers; the retail share of smart washing machines (models with WiFi or automatic dispensing features) also rose from 36.6% to 39.8%.

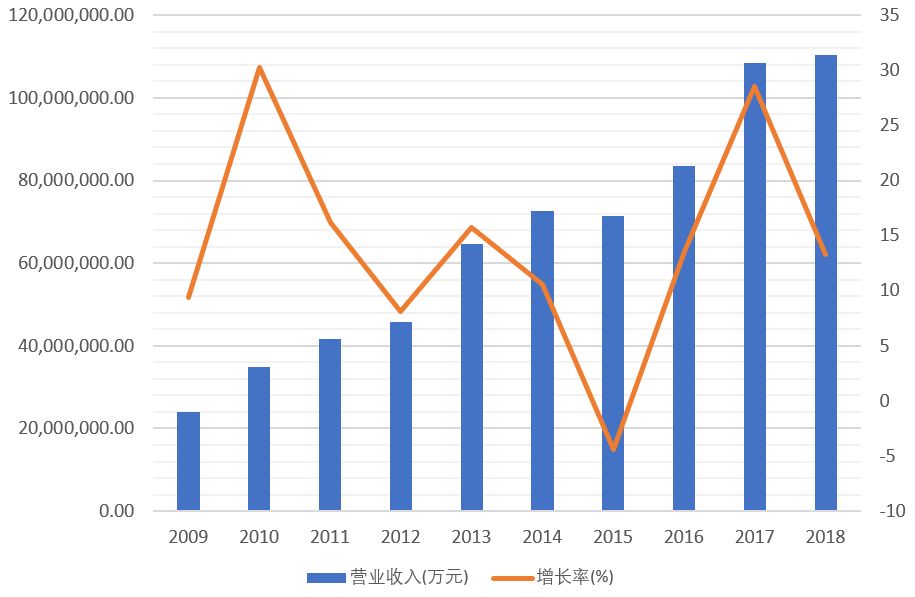

Figure 1: Revenue and growth rate of home appliances from 2009 to 2018.(Data source: Wind)

Smartization of home appliances promotes MCU market growth

At the China Household Appliances and Consumer Electronics Expo (AWE) held in Shanghai this March, we saw many well-known home appliance, consumer electronics, and cross-industry companies showcasing a large number of smart home appliance products, such as air conditioners with body-sensing radar, refrigerators with touch screens, washing machines that can identify fabric types, range hoods that can automatically adjust fan speed based on oil fume concentration, and vacuum robots with cameras and path planning capabilities.

Among these smart home appliance products, white appliances such as air conditioners, refrigerators, washing machines, and vacuum cleaners are the main growth drivers. The smartization of all these products relies on a key core component—the microcontroller (MCU).

Figure 2: The share of smart refrigerators in China rose to 39.7% in 2018.(Source: China Household Electrical Appliances Research Institute)

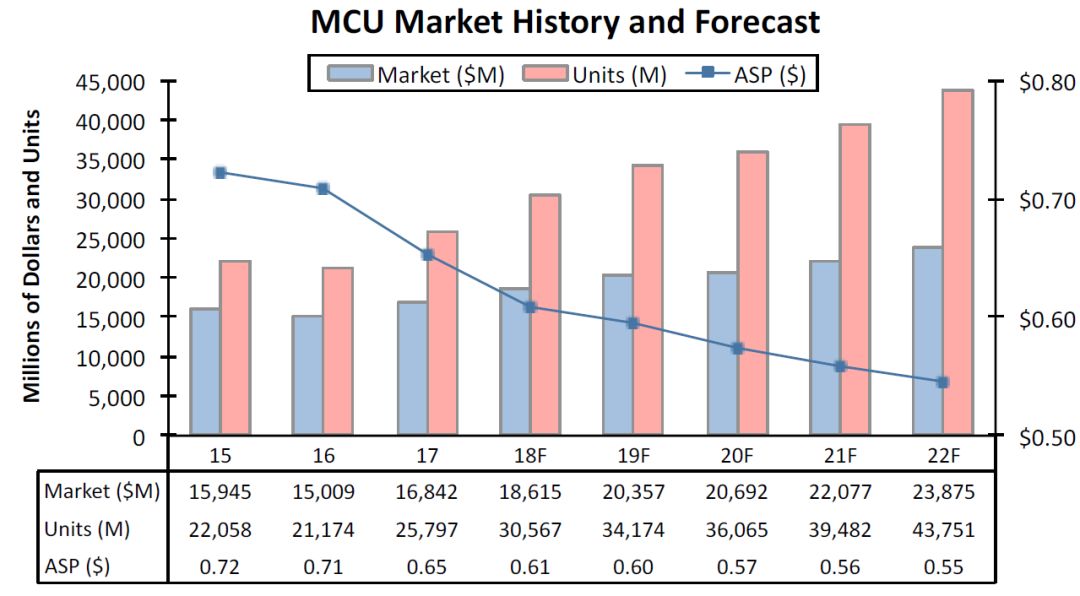

According to a report on MCUs published by IC Insights, the global sales of MCUs reached $18.6 billion in 2018, with a shipment volume of 30.6 billion units. It is expected that revenue will maintain a growth rate of 9% in 2019, increasing to $20.357 billion, and is projected to reach a historical high of $23.875 billion in 2022.

Figure 3: Global MCU market size and shipment forecast from 2019 to 2022.(Source: IC Insights)

The shipment volume of MCU manufacturers in China also reflects this trend. Taking the industry leader, GigaDevice, as an example, its annual report for 2018 shows that the cumulative shipment volume of its MCU products exceeded 200 million units, with over 10,000 customers. Its GD32 MCU is also very suitable for the development of products for smart living experiences, including smart homes, smart appliances, robots, drones, handheld gimbals, and balance scooters. From the market perspective, the GD32 MCU is currently the largest Arm® Cortex®-M series MCU product family in China. The GD32 MCU excels in maximum clock frequency, code execution efficiency, on-chip Flash and SRAM capacity, integrated peripheral resources, and power efficiency.

GD32 adds momentum to smart vacuum cleaners

According to the “2018 Annual Report on China’s Home Appliances” by the China Household Electrical Appliances Research Institute, vacuum cleaners continued to lead the growth category in the small appliance industry in 2018, with a market size reaching retail sales of 19.5 billion yuan, a year-on-year growth rate of 45.6%.

Although vacuum cleaners have been developing in China for nearly 20 years, they have only begun to gain popularity in recent years. The penetration rate of vacuum cleaners in countries like the United States and Japan is close to saturation, while in China, the penetration rate is currently only 11%, and the market has yet to be fully opened.

Among vacuum cleaner products, popular items include robotic vacuum cleaners and handheld vacuum cleaners represented by Dyson.

Currently, in the robotic vacuum cleaner field, market participants include manufacturers focused on vacuum cleaners such as Ecovacs, Dyson, iRobot, Neato, and Fmart, as well as traditional home appliance manufacturers like Philips, Haier, Panasonic, and Midea. Additionally, some smart hardware manufacturers, including Xiaomi, are also getting a share of the market. According to industry insiders, most of the robotic vacuum cleaners on the market currently use GD32 MCUs. The reason is that GD32 MCUs provide excellent motor drive and control capabilities, enabling the machines to have strong power, ultra-quiet operation, energy efficiency, and further enhance their intelligence while reducing production costs.

GD32 becomes the core of motor control for smart appliances

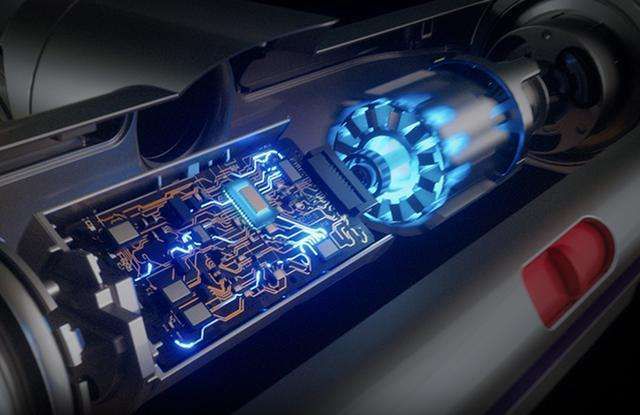

Dyson’s handheld vacuum cleaner has become a hot-selling product in the market in recent years, with its most notable feature being its ultra-high speed. The latest Cyclone V11 cordless vacuum cleaner uses a digital motor with a speed of up to 125,000 RPM and an output power of 525W.

Figure 4: Dyson V11 digital motor reaches a speed of 125,000 RPM.(Source: Dyson official website)

In recent years, domestic brands have also launched some vacuum cleaner products similar to Dyson. Although their appearance is similar, their suction power is not on the same level. The reasons for this are the design issues of high-speed motors and deficiencies in hardware drive control circuit design.

For domestic brands to achieve breakthroughs, they need not only high-speed motors but also to choose MOSFET devices with high-speed switching and low-loss characteristics, as well as support from MCUs with high code execution efficiency. Although domestic low-loss MOSFET devices have not yet broken through foreign technical barriers, some domestic MCU devices have already surpassed foreign brands in specifications and performance. For example, GigaDevice’s GD32F350 and GD32E230 products have specifications and performance that are very suitable for the design of control boards for handheld vacuum cleaners. The GD32E230 series products use the latest ARMv8 architecture Cortex-M23 core, with a maximum frequency of up to 72MHz and large-capacity embedded memory. Coupled with built-in hardware multipliers, dividers, and high-speed hardware comparators, the working performance can reach up to 55 DMIPS. In terms of code execution efficiency at the same clock frequency, it is more than 30% higher than similar Cortex-M0+ products on the market. Additionally, with the on-chip integrated 12-bit 2.6M SPS high-speed sampling rate ADC for closed-loop detection, it can easily drive brushless DC motors to over 100,000 RPM. Furthermore, the GD32E230 series products can enter low-power sleep mode, significantly reducing the static power consumption of handheld vacuum cleaner products during standby, ensuring standby time when the vacuum cleaner is not in use.

New trends in the smartization of traditional white appliances

Similar to the small appliance market, white appliances are also undergoing upgrades and iterations. As variable frequency has become mainstream, the use of brushless DC motors is growing rapidly year by year. It is expected that the variable frequency rate of white appliances will reach 40% in 2019 and 70% by 2022!

MCUs are also beginning to embark on the path of AIoT technology integration, moving from professional core “control” to the goal of “intelligent interconnection.” In the AIoT era, MCUs will no longer just be responsible for core control; reasoning and computing capabilities will become standard for MCUs, and various artificial intelligence algorithms, such as image analysis and biometric recognition, will be introduced into the home appliance field, making traditional appliances smarter.

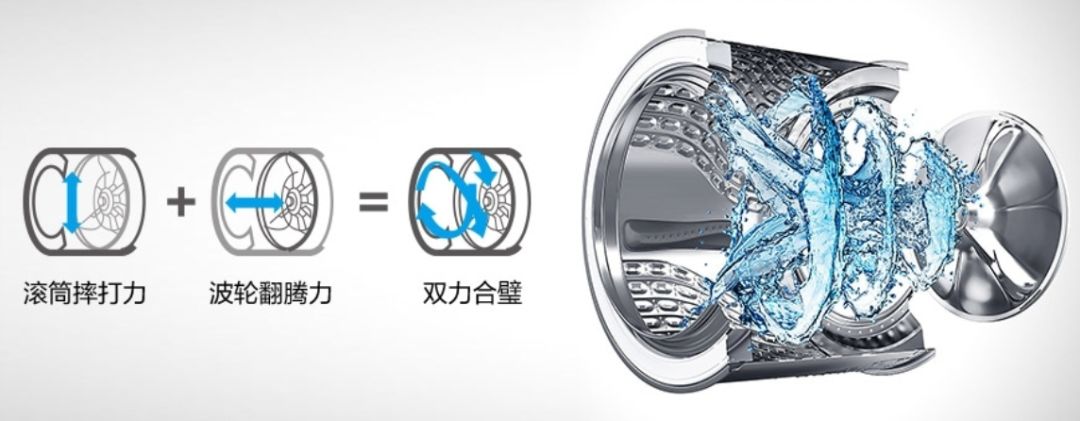

Leading companies in the South Korean white appliance industry, Samsung and LG, have promoted dual-drive dual-variable frequency washing machines in their home country for many years and have gradually begun to penetrate the domestic market. This dual-drive inner drum design cleverly combines two washing methods, drum and pulsator, greatly enhancing cleaning ability and making dehydration more efficient, significantly reducing washing time.

Figure 5: Samsung Quick Drive multi-dimensional dual-drive washing machine principle.(Source: Samsung official website)

The biggest difference between dual-drive dual-variable frequency washing machines and traditional washing machines is that the MCU needs to control the rotation of two motors simultaneously, which will continuously increase the demand for the MCU’s core computing power, analog peripheral precision, and on-chip memory space. Therefore, future washing machine products will have more stringent specifications and performance requirements for MCUs. Currently, the only Arm core MCU products that can control two BLDC motors at any speed and in any direction with a single MCU, besides the STM32 series MCUs from foreign semiconductor supplier STMicroelectronics, are the GD32F3/F4 series MCUs launched by GigaDevice. GD32 MCUs have become the largest Arm Cortex MCU family in China, offering 22 product series, over 320 product models, and 11 different packaging types, providing engineers with flexible design options.

In addition, it is worth mentioning the currently popular massage chairs (including both home-use and shared massage chairs). Taking the LeMoBa shared massage chair as an example, this brand’s massage chair uses multiple control boards and various sensors for pressure, angle, etc., synchronized detection, thereby achieving personalized control of massage techniques, intensity, duration, etc., and also features artificial intelligence adjustments. It serves about 700,000 users daily in shopping malls, cinemas, train stations, airports, and other consumer venues. Compared to existing 32-bit MCUs, GD32 MCUs have differentiated advantages in high performance, low cost, and ease of use, and are therefore widely adopted by many solution providers.

Safety is key in smart appliance applications

As the variety of smart home appliance products increases and their functions become richer, some products connect with each other through wireless or wired networks, while others need to connect to the cloud. For example, smart TVs, TV boxes, washing machines, rice cookers, etc., need to connect to the external internet. Therefore, security issues have been elevated to a new level, and creating safe and reliable smart home appliance products must start from the hardware level. For MCU systems, security mainly includes development security, code execution security, and application security.

In terms of MCU security, different MCU manufacturers have different approaches. Some use customized embedded flash memory modules to ensure code security; some incorporate hardware-level AES-128/192/256 encryption circuits for data encryption; others consider software aspects such as user authentication, identity management, and secure network access… GigaDevice’s GD32 MCU not only integrates widely used AES, DES, MD5 hardware encryption and decryption functions but also enhances memory protection units (MPU) and frequency security systems (CSS) in accordance with industry security standards, and features bottom-layer encryption to prevent tampering, fully ensuring the security of code data and users’ intellectual property rights.

To further strengthen the security mechanisms of MCUs, GigaDevice plans to launch a new generation of GD32 series security processors based on Arm TrustZone technology, featuring Arm Cortex-M23 and Arm Cortex-M33 cores.

As people’s demands for smart home appliances continue to rise, the evolution of smart home appliance products requires higher demands for diverse application development, whether it is mobility (motors), visibility (HMI interfaces), remote control (wireless), or safety performance. As the largest and most complete Arm® Cortex-M series MCU product family in China, GD32 MCUs provide a controllable and comprehensive product portfolio and development ecosystem, fully promoting the intelligent upgrade of home appliance products, and have become an important driving force in accelerating the development and implementation of the smart home appliance industry.