Non-ferrous

——

Understanding New Varieties in Advance

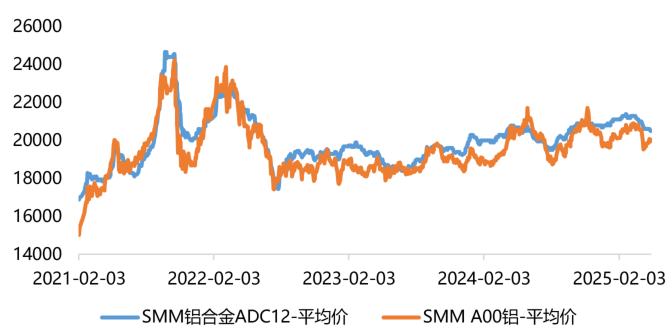

In April 2025, the average monthly spot price of SMM aluminum alloy ADC12 was 20,675 yuan/ton, an increase of 0.34% compared to the average price of 20,605 yuan/ton in April 2024, indicating that the price of ADC12 aluminum alloy is gradually finding upward support.

Data Source: SMM Guangzhou Futures Research Center

Data Source: SMM Guangzhou Futures Research Center

As the world’s largest recycled casting aluminum alloy variety, the price fluctuations of ADC12 are in line with the trends of electrolytic aluminum prices. By conducting a price correlation analysis between the average prices of SMM A00 aluminum and aluminum alloy ADC12, the following conclusions can be drawn:

1. ADC12 aluminum alloy shows a positive correlation with the Shanghai aluminum price, with a good degree of linear fitting;

2. The price trends of ADC12 aluminum alloy and Shanghai aluminum prices are similar, with similar trends in increases and decreases;

In summary: The spot price of Shanghai aluminum is positively correlated with the spot price of ADC12, and the synchronized trends can serve as a reference for price trends.

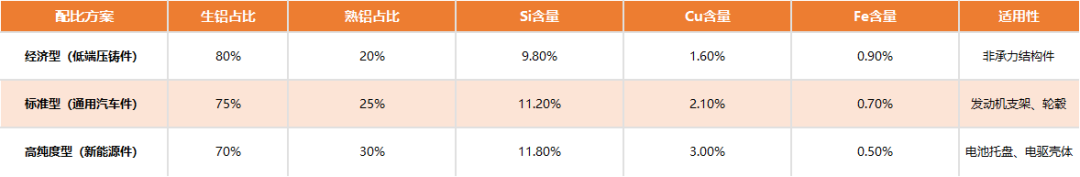

From the production process and cost structure of ADC12, we can see that, according to SMM data, scrap aluminum is the core of ADC12’s cost, accounting for about 90% of raw material cost expenditure. In actual production applications of ADC12, the ratio of primary aluminum (scrap) to secondary aluminum (raw aluminum) will be slightly adjusted based on downstream personalized demands. Excluding the content of other alloying elements such as silicon and copper, it is estimated that the aluminum content in ADC12 is about 85%-90%.

Data Source: Market Public Data Compilation Guangzhou Futures Research Center

Data Source: SMM Guangzhou Futures Research Center

The main factors affecting the price of ADC12 aluminum alloy are:

1) Domestic and foreign policy shocks reconstructing costs

From the perspective of national trade, the EU’s CBAM imposes taxes based on carbon price differences, forcing companies to transition to low-carbon operations, with green electricity procurement and certification costs becoming rigid expenditures; the US 232 tariffs raise entry barriers under the guise of trade protection, forcing companies to turn to high-risk transshipment trade, with countries like the US, Vietnam, and Thailand strengthening origin inspections, adding compliance and logistics costs that squeeze profit margins. From January to April 2025, China’s exports of aluminum alloy products to the US decreased by 28% year-on-year, while the proportion of transshipment to Southeast Asia rose to 17%, but the overall export costs increased by 15%-20%.

China’s “dual carbon” goals are driving the upgrade of the recycled aluminum industry. The 2025 “High-Quality Development Plan for the Aluminum Industry” requires the elimination of production capacity below the energy efficiency benchmark level. Non-energy-efficient standard production capacity in the industry is forced to be transformed, requiring adjustments in production while investing in technological upgrades. According to market industry research, the cost of energy efficiency upgrades for electrolytic aluminum (such as replacing electrolytic cells) is about 15%-20% (calculated per ton of production capacity), while the cost of upgrading recycled aluminum smelting furnaces is about 10%-15%.

In October 2024, the Ministry of Ecology and Environment and five other departments issued an announcement regarding the management of imports of recycled copper and copper alloy materials, recycled aluminum and aluminum alloy raw materials, requiring that scrap aluminum materials meeting the new national standard (GB/T 38472-2019) can be freely imported, while the standards for imported scrap aluminum are becoming stricter. According to SMM statistics, the proportion of Southeast Asian scrap aluminum suppliers exiting the market is about 20%, mainly due to the squeeze on participation from small and medium-sized traders, leading to an increase in raw material costs due to the rising scrap aluminum content premium.

Data Source: SMM Guangzhou Futures Research Center

2) Limited upstream raw material supply, narrowing import scrap aluminum range

Currently, the market’s scrap aluminum recycling supply can meet about 70% of market demand, with a shortage of scrap aluminum raw materials. The pricing is more controlled by market sellers, and the lack of fair pricing for scrap aluminum in the market leads to a situation where there is no supply when prices fall, and when prices rise, producers are forced to accept rising costs to ensure production.

The remaining 30% of market demand needs to be supplemented by imported scrap aluminum. After the implementation of the new national standard for imported scrap aluminum, the import quota mechanism for scrap aluminum has been abolished. According to SMM, in March 2025, 180,000 tons of imported scrap aluminum were recorded, and due to the increased standards for imported scrap aluminum requiring aluminum content ≥ 91%, the volume of imported scrap aluminum decreased by 5.26% year-on-year, but the absolute level remains high compared to previous years.

Data Source: SMM Guangzhou Futures Research Center

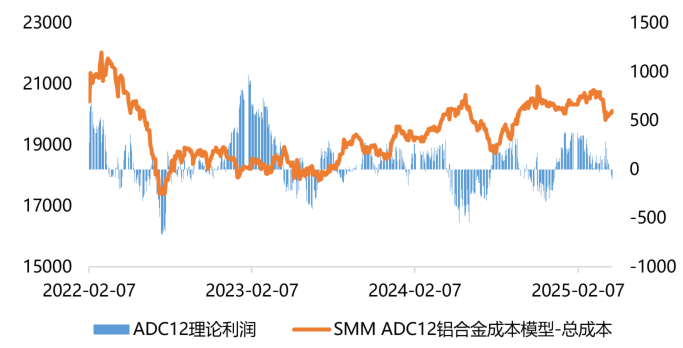

3) Overcapacity in low-end manufacturing compressing ADC12 profit margins

By 2024, domestic production capacity for recycled casting aluminum alloys reached 17.62 million tons, but actual production was only 7.52 million tons, with a utilization rate of less than 43%. Domestic ADC12 production was 4.65 million tons, with a utilization rate of 70%, and net imports were about 400,000 tons, mainly to fill the gap in high-end demand. In 2024, an additional 1.32 million tons of recycled casting aluminum alloy production capacity is expected to be added, with 560,000 tons in 2025, leading to rapid expansion of new production capacity and prominent overcapacity issues in the industry, particularly in the low-end ADC12 production sector, where market share concentration suppresses ADC12 profit margins.

Data Source: SMM Guangzhou Futures Research Center

4) Iteration of traditional and new energy consumption demands

The lightweighting of new energy vehicles drives demand growth. According to SMM research, by 2025, the amount of ADC12L aluminum alloy used per new energy vehicle is expected to reach 80-100 kg (battery tray + electric drive housing). Based on the predicted production of 16 million vehicles in 2025 by the China Association of Automobile Manufacturers, it is expected that the demand for ADC12 will increase by 120-150 thousand tons in 2025. The replacement rate of aluminum alloy photovoltaic brackets is currently relatively low due to the higher cost of aluminum alloy compared to steel, but there remains an optimistic outlook for future increases in aluminum demand for photovoltaics. Traditional demand is declining, with overall demand in the construction industry trending downward. Overall, traditional demand is dragging down while new energy demand consumption is increasing.

Guangzhou Futures Research Center

Investment Consulting Business Qualification

CSRC License [2012] 1497

Analyst: Lei Lei

Futures Practitioner Qualification: F3068041

Investment Consulting Qualification: Z0021846

Email: [email protected]

Disclaimer:All information in this report is sourced from public data. Our company does not guarantee the accuracy and completeness of this information, nor does it guarantee that the information and recommendations contained will not change. We strive for objectivity and fairness in the report’s content, but the opinions, conclusions, and recommendations in the text are for reference only. The information or opinions in the report do not constitute the basis for operations regarding the mentioned varieties, and any investment decisions made by investors based on this are unrelated to our company and the author.

Follow us for more timely research information