The global sensor industry is experiencing explosive growth amidst the wave of IoT and smart manufacturing. As the core component for data collection,the global market size reached $192.97 billion in 2023, with China contributing nearly one-third of this at 364.47 billion yuan. The growth rate of smart sensors is particularly remarkable, with a domestic compound annual growth rate of 17.9% over the past three years. The industry competition presents a “dual-track” pattern: international giants like Sony, Samsung, Sensata, and Honeywell dominate the high-end market, with the top five manufacturers holding over 37.8% of the global market share; domestic companies such as Will Semiconductor, SmartSens, Hanwei Technology, and Keli Sensor have achieved domestic substitution through technological breakthroughs, gaining market share in CMOS, gas, and weighing sensors, and accelerating their layout in cutting-edge fields like six-dimensional force sensors for robots.

The future development trends focus on three major directions: on the technical level,MEMS technology drives miniaturization and integration, AI empowers self-diagnostic functions, and nanomaterials and quantum sensing technologies initiate a precision revolution; application scenarios extend to smart vehicles (LiDAR sensors), humanoid robots (mechanical quantity sensors), and new energy fields, with the Chinese market expected to exceed 500 billion yuan by 2030, and the self-sufficiency rate of domestic sensor chips anticipated to rise from 10% to 40%. This sensing revolution is reshaping the global manufacturing landscape and driving the Internet of Everything into a new era.

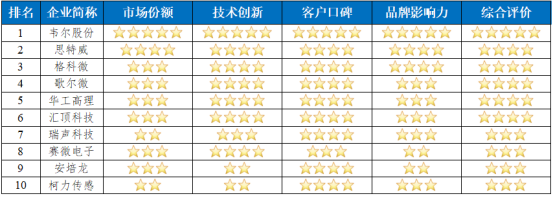

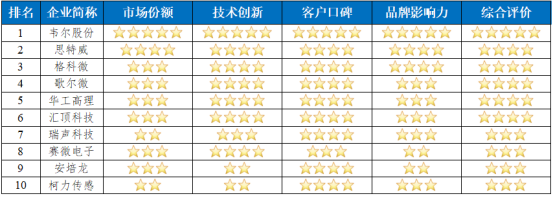

We evaluated the comprehensive competitiveness of Chinese IoT sensor companies through multiple indicators, and the results are as follows:

2025 ChinaIoT SensorCompanyComprehensiveCompetitiveness RankingsTOP10

1. Will Semiconductor

The development history of Will Semiconductor can be described as a “Transformers origin story” in the semiconductor industry—starting from electronic component distribution in 2007, to going public in 2017 and embarking on a “snake swallowing elephant” acquisition strategy, spending 15.3 billion yuan to acquire OmniVision Technologies, transforming into one of the top three global CMOS image sensor manufacturers, showcasing a stunning turnaround from “chip mover” to “technology leader.” Today, this “sensor magician” holds three major trump cards: the OV50H chip in mobile phone cameras allows domestic flagship phones to capture the moon without becoming “blurry,” the automotive-grade OX series sensors equip every smart vehicle with eight “keen eyes,” and the LCOS panels in AR/VR devices bring the virtual world into sharp focus.

With these hardcore products, Will has secured the third position in the global mobile phone CIS market, and its automotive sensor share has soared to 33%, making it the champion. In 2024, revenue is expected to exceed 25.7 billion yuan, setting a new historical high. The founder, Yu Renrong, a Tsinghua University graduate, wields the “merger + R&D” dual weapon, maintaining a relaxed demeanor of a tech geek while embodying the aggressive spirit of the Ningbo business community, writing the legend of “Chinese chips” in the semiconductor world.

2. SmartSens

SmartSens’s comeback story is akin to the “legend of the monk sweeping the floor” in the semiconductor industry—this “technology fanatic” born in 2011, relying on selling cars to pay salaries, fought through the siege of Sony and Samsung. Starting from security monitoring, the SC1035 chip, known as the “out-of-stock king,” swept the market, and in less than ten years, it became the global champion in security sensor shipments, resembling a hidden master in a martial arts novel. Now, this “imaging magician” wields three swords: the SC550XS for mobile devices allows the Huawei Mate60 to capture the moon without being “hazy”; the automotive-grade SC533AT equips smart vehicles with “X-ray vision”; and a mysterious weapon sweeping the drone obstacle avoidance market boasts a global market share of 90%. With this “triple sword” technique, revenue is expected to soar by 108% in 2024, exceeding 5.9 billion yuan, with net profit increasing 26 times, shocking the industry, as it sits in the mobile sensor market with a view of the top three.

The founder, Xu Chen, a Tsinghua University graduate, maintains a “technical cleanliness” of a scientist while possessing the keen sense of the Ningbo business community, using a combination of “cost-performance opening + high-end breakthrough” to carve out a coordinate for “Chinese chips” in the CMOS landscape. From the embarrassment of selling his car to the current bravado of arm-wrestling with Sony and Samsung, SmartSens’s story is the most passionate footnote of China’s intelligent manufacturing comeback.

3. Geke Micro

Geke Micro, founded in 2003 in Zhangjiang, Shanghai, started as a small garage factory and carved out a path in the mid-to-low-end market besieged by Sony and Samsung using “pixel magic.” The founder, Zhao Lixin, returned to China with Silicon Valley experience and developed China’s first mass-produced image sensor in an aluminum alloy boardroom, using a “four-transistor” process to enable counterfeit phones to take clear photos, thus initiating a “rural encirclement of cities” comeback story. This “pixel wizard” holds three major treasures: the single-chip 32-megapixel GC32E2 allows the OPPO Reno12 overseas version to capture movie-level night scenes, the 50-megapixel GC50B2 achieves “night vision” ultra-sensitive shooting on Transsion phones, and the mysterious weapon SC1035 sweeping the global security market ensures that one in every four CMOS chips shipped bears the mark of “Geke Micro manufacturing.” From initially shipping 80 million chips per month to now exceeding 2.5 billion annually, this former “savior of counterfeit phones” has ascended to the throne of global CMOS shipment champion.

After completing a glamorous transformation to the Fab-Lite model in 2023, Geke Micro’s self-built 12-inch wafer factory is like a “pixel alchemy furnace,” not only achieving independent mass production of 8 million to 50 million pixel products but also sending automotive pre-installed sensors to the testing platform of car manufacturers, laying down a “heavenly eye matrix” in smart cockpits. From starting from scratch to becoming a semiconductor giant with a 25% global market share, Geke Micro has proven over twenty years that “Chinese chips” can not only illuminate the spring of counterfeit phones but also light up the starry sea of the intelligent world.

4. Goertek

Goertek, as the flagship platform for MEMS sensors under Goertek Co., Ltd., has built full industry chain competitiveness through a “chip + device + module” vertical integration model since its independent operation in 2017, becoming a leading player in the global smart sensing field. The company evolved from the MEMS R&D center of Goertek Co., Ltd. established in 2004, undergoing business restructuring and capital operations (completing asset integration in 2019 and planning to list on the Hong Kong Stock Exchange in 2024), achieving a leap from acoustic device OEM to independent chip design. In its core product matrix, acoustic sensors maintain the first position with a 32% global market share, with their ultra-small size and anti-interference technology empowering top terminals like Apple and Xiaomi; pressure sensors and inertial sensors have made breakthroughs in smart vehicles and AR/VR fields, being equipped in models like NIO ET9 to achieve innovative piezoelectric touch interaction. The simultaneously laid-out SiP system-level packaging technology has contributed 17.9% to revenue through products like TWS earphone modules, driving the miniaturization revolution in consumer electronics.

As the fourth largest sensor supplier globally, Goertek achieved a revenue of 3 billion yuan in 2023, serving the top 9 mobile phone manufacturers and the Apple supply chain (accounting for over 50%), with over 1,800 patents reserved, and was selected as a champion enterprise in the manufacturing industry by the Ministry of Industry and Information Technology in 2024. In the wave of AI-driven sensor upgrades, its unicorn with a valuation of 28 billion yuan is reshaping the ecological landscape of smart terminals with its full-stack capabilities of “perception-interaction-decision-making.”

5. Huagong Gaoli

Huagong Gaoli Electronics Co., Ltd. has transformed from a university-run enterprise to a global sensor giant since its establishment in 1988 at Huazhong University of Science and Technology. After relocating to Xiaogan in 2009, its production capacity increased twentyfold, establishing the world’s largest multifunctional sensor supply base. The company, with a gene of “breaking through technology,” was the first to break Japan’s monopoly on temperature sensors, reducing the price of NTC temperature sensors for home appliances by 80% and capturing 70% of the global market share, becoming a “champion enterprise” certified by the Ministry of Industry and Information Technology.

The core product matrix covers two strategic fields: smart home and new energy vehicles: home appliance temperature sensors empower global top brands like Samsung and Gree; new energy vehicle PTC heaters, with 1800V high-voltage chip technology, break through industry bottlenecks, achieving stable operation at -40°C and four times faster charging efficiency, with a domestic market share of 60%, covering mainstream automakers like Tesla and BYD. The pressure sensors laid out simultaneously break the monopoly of American and German companies, with an annual production capacity exceeding 10 million units, and refrigerant gas monitoring sensors have passed international certification and entered the North American market.

As a core supplier in the global perception layer, Huagong Gaoli achieved revenue exceeding 3 billion yuan in 2023, with PTC heater sales increasing by 233% year-on-year. Relying on seven national-level R&D platforms and a 30% master’s and doctoral R&D team, the company continues to deepen its “sensor +” strategy, building a technological moat with over 1,800 patents, aiming for a scale of 5 billion yuan in five years, and reshaping the global smart sensing ecology.

6. Goodix Technology

Goodix Technology’s growth story can be described as a “geek’s comeback” in the semiconductor industry—starting in 2002 with fixed-line phone chips, but during the mobile touch era, it performed a “masterful maneuver,” using a capacitive touch chip to pry open the door to the Android world, transforming from a “telephone chip small factory” to a “fingerprint recognition wizard.” This “Transformers of semiconductors” broke the foreign monopoly with the “sapphire fingerprint technique” in 2014, and then introduced the under-display optical fingerprint technology, allowing full-screen phones to unlock in a “finger ballet” style, and now has mastered ultrasonic fingerprint technology, enabling unlocking even with oily or wet fingers.

Having delved into the sensor industry for twenty years, Goodix holds three major trump cards: its ultrasonic fingerprint sensor for mobile devices has enabled the vivo X200 Pro to achieve “oily hand unlocking freedom,” automotive-grade touch chips equip smart cockpits with “golden fingers,” and health sensors play with heart rate and blood oxygen “life codes” in smartwatches. With this “perception family bucket,” its fingerprint solutions have a global market share exceeding 33%, and in 2024, revenue is expected to break through 4.37 billion yuan against the trend, with net profit surging by 265%, igniting a “technological bonfire” in the semiconductor winter. From chasing counterfeit phones to arm-wrestling with Apple and Samsung, this “fingerprint recognition king” has built a moat with over 7,300 patents, allowing Android flagships to achieve “fingerprint freedom” collectively, and laying down a “perception network” in the automotive electronics field. As the founder Zhang Fan’s “bamboo theory” suggests—rooted in the ground, it seems slow, but once it breaks through the soil, it will surely grow into a towering tree.

7. AAC Technologies

AAC Technologies, as a disruptor, embarked on its journey in Shenzhen in 1993, using a buzzer to knock on the door of global precision manufacturing, and thirty years of hard work has forged a benchmark for “Chinese intelligent manufacturing.” From breaking through Motorola’s acoustic devices to listing on the Hong Kong Stock Exchange in 2005 and building a global footprint, to launching the world’s first WLG glass-plastic hybrid lens in 2020, this company, with “technical standards” as its faith, has reached the pinnacle in three battlefields: micro-acoustics, precision optics, and MEMS sensors, winning three manufacturing industry champion awards from the Ministry of Industry and Information Technology.

Its sensor business is known as the “perception nerve center,” with cumulative shipments of MEMS microphones exceeding 3 billion units, and high signal-to-noise ratio products achieving full domestic production breakthroughs. The automotive array modules have received international certification from car manufacturers, and the SOPRANO ultra-miniature speaker has rewritten the TWS sound quality rules.

In its core product matrix, the super-linear SLS acoustic platform redefines mobile audio standards, the X-axis linear motor defines a new paradigm for touch interaction, and the WLG wafer-level glass lens technology reshapes the imaging landscape of smartphones. Today, AAC has established R&D centers in 18 countries, holding over 14,000 patents to build a technological Great Wall, serving 90% of flagship mobile phone acoustic systems, with annual revenue exceeding 27.3 billion yuan. From consumer electronics to smart vehicles, from AR/VR to IoT, this “creator of perception experiences” is constructing an intelligent ecological empire of the Internet of Everything with multi-dimensional perception technologies of sound, light, and touch.

8. Saimo Electronics

Beijing Saimo Electronics Co., Ltd. has undergone a strategic transformation from navigation business to the core semiconductor track since its establishment in 2008, and has become a leading enterprise in the global MEMS (Micro-Electro-Mechanical Systems) wafer foundry field. After landing on the Growth Enterprise Market in 2015, the company achieved a technological leap through the full acquisition of Sweden’s Silex (a top global MEMS foundry), establishing an 8-inch production line layout with bases in Beijing and Sweden, where the Beijing FAB3 is planned to have a capacity of 30,000 wafers per month, and the Swedish production line has ranked first in the global MEMS pure foundry for five consecutive years (2019-2023).

The sensor business constitutes its core segment, covering various categories of MEMS sensor manufacturing, including inertial, pressure, and acoustic sensors, with products applied in cutting-edge fields such as lithography lens systems, DNA sequencers, smart vehicles, and humanoid robots. In its core product matrix, MEMS wafer manufacturing contributes over 54% of revenue, with process development accounting for nearly 29%, and key products include BAW filters, micro-mirrors, and temperature and humidity sensors, among which high-end devices like MEMS-OCS wafers and LiDAR mirrors have achieved large-scale mass production.

As the fourth largest MEMS supplier globally, Saimo Electronics is expected to achieve revenue of 1.205 billion yuan in 2024, serving 90% of global lithography machine manufacturers and leading AI computing companies, having completed over 500 process development projects and holding 147 international patents. Its Swedish subsidiary Silex has ranked first in the global foundry rankings for five consecutive years, and in 2022, it ranked 26th globally, demonstrating its technological dominance in high-precision markets such as biomedicine and industrial automotive.

9. Amperelong

Shenzhen Amperelong Technology Co., Ltd. (stock code: 301413) was founded in 1999, with a gene of “breaking through technology,” undergoing three strategic leaps from the development of thermistor components to breakthroughs in temperature and pressure sensors, growing into a leading domestic intelligent sensor enterprise. The company relies on sensitive ceramic materials and MEMS technology dual platforms to build a vertical industry chain of “materials-chips-modules,” with its core product matrix covering thermistors, temperature sensors (49% of 2023 revenue), pressure sensors (47%), and oxygen sensors, among which ceramic capacitive pressure sensors have broken international monopolies, with annual production and sales exceeding 10 million units.

In terms of industry position, Amperelong has been recognized as a “little giant” by the Ministry of Industry and Information Technology for its specialization and innovation, and as a key product demonstration enterprise for industrial strengthening, with a global market share of 6.8% for temperature sensors and ranking in the first tier for domestic pressure sensors. The company has deeply bonded with leading automakers like BYD and SAIC Group, achieving domestic substitution for automotive-grade sensors, with revenue from the automotive sector exceeding 50% in 2023. Its forward-looking layout of glass micro-melting technology and six-dimensional force sensor development has collaborated with Tianji Intelligent to promote the application of robotic joint modules, constructing a second growth curve. Through a three-dimensional layout of “home appliance fundamentals + automotive main battlefield + robotics new blue ocean,” Amperelong is accelerating its entry into the top tier of global intelligent sensor companies with over 1,800 patents to build a technological moat.

10. Keli Sensor

Since its establishment in 1995, Keli Sensor has undergone three strategic leaps, evolving from a domestic leader in weighing sensors to a global builder of intelligent sensing ecosystems. The company started with strain gauge weighing sensors, maintaining the first position in domestic market share for 14 consecutive years (with over 25% market share in 2022), and since 2011, it has transformed through IoT to connect the entire chain of “sensors-instruments-system integration,” and after 2017, it has built a “sensor forest” covering over 20 types of sensors through a model of “industrial investment + park construction + ecological platform.”

The sensor business layout spans multiple physical quantities, including mechanics, optics, gas, and temperature, with core products including: strain gauge weighing sensors used in industrial scales and automation control, leading the global production capacity of steel sensors; robotic sensors: six-dimensional force/moment sensors have achieved product development for key parts of humanoid robot wrists and ankles, mastering core technologies such as structural decoupling and high-speed sampling, and advancing sample testing with Huawei and collaborative robot clients; industrial IoT systems: covering eight major scenarios such as smart logistics and unattended operations, forming a closed-loop ecosystem of “hardware + software + data.”

In terms of industry position, Keli Sensor is not only a national-level manufacturing champion and a “double innovation” platform certified by the Ministry of Industry and Information Technology, but also integrates data from 50,000 upstream and downstream enterprises with its “industrial brain,” leading the construction of the first intelligent sensor industry ecological platform in Zhejiang Province. In 2024, through acquisitions, it is accelerating its layout, with 36 subsidiaries under its control, forming three industrial bases in Ningbo, Zhengzhou, and Shenzhen, with annual revenue exceeding 1.2 billion yuan, and the robotic sensor business revenue approaching the hundred million scale, aiming to become a core sensor supplier for global humanoid robots.

[Weico Network Business Cooperation]

Alice: 13122434666 (same WeChat)Email: [email protected]