Author | Yan Xi

Author | Yan Xi

In Q1 2025, when Rockchip’s net profit surged by 209.65% year-on-year, the atmosphere in Allwinner Technology’s financial report meeting was filled with anxiety.

These two chip companies, both born in the Pearl River Delta, have staged the most remarkable comeback in the history of China’s semiconductor industry over the past decade. In 2015, Allwinner led Rockchip by 35% with a revenue of 1.2 billion yuan, while in 2024, Rockchip surpassed its rival with a revenue of 3.48 billion yuan, a 70% increase.

More critically, the gross margin difference—Rockchip’s 40.95% gross margin is 12 percentage points higher than Allwinner’s, indicating a technological gap has formed. The core driving force behind this turnaround is the precise timing of the explosive growth in edge computing.

The Changing of the Guard in Chip Dominance Amidst the Wave of Edge Computing.

In the intelligent cockpit of the Geely Galaxy L7, the Rockchip RK3588M chip is driving four-screen interaction with a computing power of 6 TOPS. This processor, manufactured using TSMC’s 8nm process, has rewritten industry rules with three major breakthroughs:

4*A76 + 4*A55 architecture, with a 40% reduction in power consumption compared to the previous generation, and a thermal design power of only 5W. The built-in NPU supports INT8 quantization, achieving inference speeds three times that of Allwinner’s H618. It fully supports Android Auto and HarmonyOS, reducing the adaptation cycle by 60%.

This “flagship product” has allowed Rockchip to make significant inroads in the automotive electronics sector. In 2024, its automotive-grade chip shipments surged by 300%, capturing 32% of the domestic intelligent cockpit market, with a single chip premium reaching 150% of the industry average.

From Survival Struggles to Cash Cows.

In 2024, operating cash flow reached 1.379 billion, an 18-fold increase from the low point in 2021.

This is attributed to three major transformations:

1. Accelerated inventory turnover: The turnover rate of smart home chips increased from 0.8 to 1.03 times.

2. Optimized customer structure: The proportion of prepayments from automotive Tier 1 customers increased to 45%.

3. Reconstructed payment terms: Implemented cash on delivery (0 payment term) for companies like NIO and Li Auto.

Net profit margin soared from -2.1% in Q4 2022 to 23.67% in Q1 2025, driven by a qualitative change in product structure: the proportion of high-end chips (unit price > $15) increased from 18% to 52%. The gross margin for AIoT chips exceeded 45%, 20 percentage points higher than consumer electronics chips. Patent licensing revenue surged (reaching 210 million in 2024).

Ecological Competition Across All Scenarios.

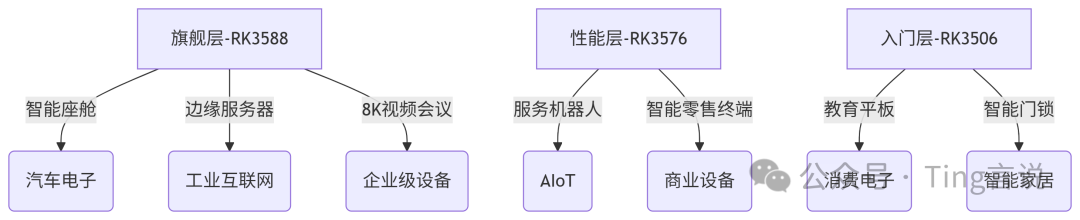

Rockchip’s “pyramid” product matrix is building an ecological barrier that is hard to replicate:

The impact of this layout is evident in customer stickiness: the proportion of customers using a dual-chip solution (RK3588 + RK3506) reached 68%, an increase of 45 percentage points compared to 2020.

The Ultimate Game in a Trillion Market.

Rockchip’s cash reserves of 2.072 billion are precisely directed towards three future battlefields:

1. Spatial Computing Revolution: The AR glasses chip RK2608, developed in collaboration with Thunderbird Innovation, supports SLAM spatial positioning with a latency of <10ms and power consumption controlled at 300mW, and has received orders for Meta’s second-generation Ray-Ban smart glasses.

2. Large Models on the Edge: An upgraded version of RK3588 will integrate a Transformer acceleration engine, capable of running a 7 billion parameter model on the edge, with inference speeds 5 times faster than cloud solutions.

3. Robot “Nervous System”: A SoC platform adapted for humanoid robots, with a computing power density of 20 TOPS/W, meeting real-time motion control requirements, with Ninebot already starting tests.

Survival Rules Across Cycles.

Despite the accelerated turnover, the 2.23 billion inventory still hangs like the sword of Damocles. Learning from the lesson of a 120 million inventory impairment during the 2023 consumer electronics winter, the company is building a dynamic early warning mechanism: establishing an AI-driven demand forecasting system (accuracy rate 92%). Signing JIT (Just-In-Time) supply agreements with automotive companies like BYD. Developing multi-scenario compatible chips (universal automotive/industrial chips).

Under the U.S. upgrade of semiconductor equipment controls, its 8nm process faces risks. Rockchip’s response strategy is textbook-worthy:

a. Co-building a 28nm BCD process production line with SMIC (yield rate 98.2%).

b. Pre-stocking key raw materials for 2 years.

c. Initiating RISC-V architecture chip development (tape-out in 2025).

From Follower to Rule Maker.

When the RK3588M won the Automotive Electronics Science and Technology Award, Rockchip’s journey had transcended mere commercial success.

From starting with MP3 chips to leading the edge computing revolution, its comeback trajectory validates the evolutionary logic of China’s semiconductor industry—achieving excellence in niche areas can reconstruct the rules of the game.

As its chief engineer remarked upon successful tape-out: “All bottleneck lists will eventually become innovation roadmaps.” In this unfolding blueprint, Rockchip is transforming from a technology follower to a standard setter.

The trillion-dollar market of edge computing may have just sounded the charge.

Note:(Disclaimer: The content and data in this article are for reference only and do not constitute investment advice. Investors act at their own risk based on this.)

– End – Hope to resonate with you! @Following and sharing is the greatest support@To avoid losing contact, please add the author’s WeChat:zbyzby_233 (Please state your identity and purpose)

@Following and sharing is the greatest support@To avoid losing contact, please add the author’s WeChat:zbyzby_233 (Please state your identity and purpose)