In 2022, the recurring COVID-19 pandemic and sluggish market demand kept the entire Chinese home appliance industry in a prolonged downturn, but the pace of upgrading to smart home appliances did not stop.From information perception and transmission to data processing and computation, every “task” performed by smart home appliances in the home environment relies on chips.Chips not only support the functionality of smart home appliances but also provide technical support for meeting consumers’ personalized needs.

MCU: The “Brain” of Smart Home Appliances

Smart home appliances are products formed by integrating microprocessors, sensors, and network communication technologies into home appliances, enabling them to automatically perceive the state of the residential space, the appliance itself, and the service status of the appliance. They can also automatically control and receive user commands issued from within the home or remotely. Analyzing these keywords related to smart home appliances, the reporter from Electrical Appliances found that the intelligence of home appliances cannot be achieved without the support of chips.

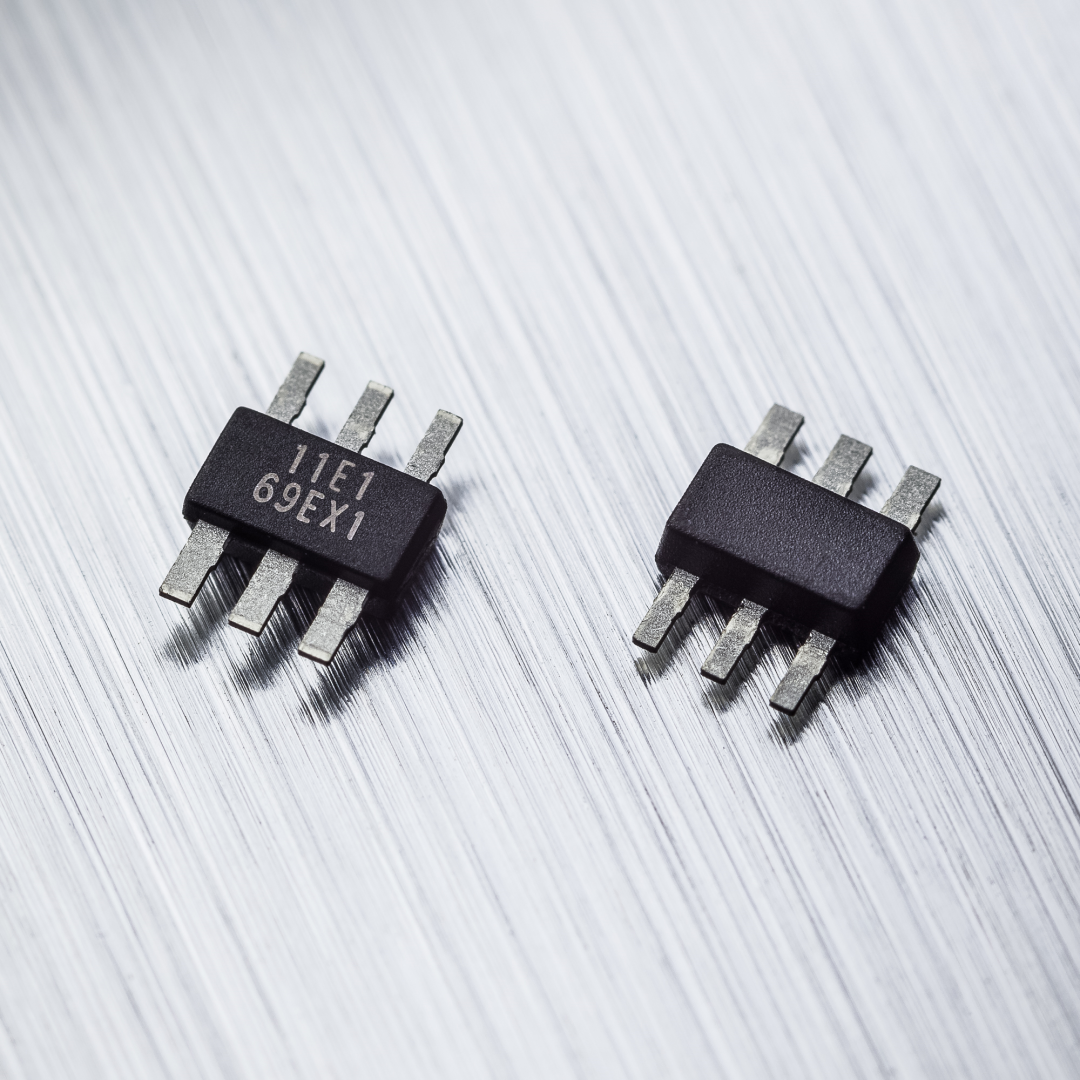

So, what types of chips are needed for a product to be considered a smart home appliance? Feng Bo, Deputy General Manager of Meiren Chips, summarized three types. He said: “The first type is the main controller, commonly known as the MCU. It is the ‘brain’ of smart home appliances, capable of processing various external information inputs simultaneously and directing each functional unit to operate intelligently and efficiently. Additionally, touch MCUs and variable frequency MCUs can assist the main control MCU in completing system functions. The touch MCU is mainly used to perform touch button functions, working with the main control MCU to interact with users, such as the icon buttons on the control panels of refrigerators and washing machines, which can be activated with a simple touch; the variable frequency MCU is primarily used to intelligently and efficiently control motor operation based on the characteristics and operating status of the motor, such as washing machine motors and air conditioning fans. The second type is wireless communication IoT chips, which are used for data communication and the sending and receiving of various control commands, such as the Wi-Fi chip in smart air conditioners. The article from Electrical Appliances described: “In the MCU field, the foreign MCU brands participating in the competition in the home appliance sub-market mainly include NXP, Microchip, Renesas Electronics, STMicroelectronics, Infineon, Toshiba, Texas Instruments, etc. These brands provide MCUs that can meet the needs of mid-to-high-end home appliance products, while domestic brands such as GigaDevice, Nuvoton Technology, and Holtek Semiconductor are competitive in the mid-to-low-end home appliance market.”

In the realm of home appliance intelligence, some MCU companies possess comprehensive “software + hardware” R&D capabilities, allowing them to independently upgrade MCUs to be smarter. Others collaborate with software companies to provide ideas for the intelligent upgrade of home appliances.

Taking STMicroelectronics as an example, the Regional Marketing Manager for General Microprocessors in Greater China and South Asia, Xiong Honghui, stated: “STMicroelectronics began laying the groundwork for MCU-based intelligence early on. Currently, we can provide high-performance products that support various wireless connections. Among them, STMicroelectronics’ software tool STM32CubeMX integrates AI modules, making it easy for customers to convert trained AI models into software that runs on MCUs, enabling MCUs to easily implement AI functions.”

On the other hand, taking Texas Instruments as an example, Texas Instruments is currently collaborating with CEVA, a licensor of wireless connectivity and smart sensing technologies and co-creation solutions, to combine CEVA’s WhisPro voice recognition and control software with Texas Instruments’ MCUs, quickly and easily adding wake word and voice command functionalities to IoT devices. Naomi Heller, Wi-Fi Connectivity Product Manager at Texas Instruments, stated: “From wearable devices to white goods, voice control is becoming an essential feature for many devices and applications. By collaborating with CEVA, we ensure that engineers can leverage mature and reliable MCUs to provide voice user interfaces, offering cost-effective solutions for voice-enabled IoT terminals and devices.”

Communication and Sensor Chips: The “Nerves” of Smart Home Appliances

Compared to the MCUs that act as the “brain” of smart home appliances, the rapid development of smart home appliances also relies on the support of communication and sensor technologies. In the view of the reporter from Electrical Appliances, these chips are the “nerves” that connect smart home appliances. Wireless communication IoT chips are responsible for communication functions, mainly including Wi-Fi chips, Bluetooth chips, AI chips (for voice recognition, image recognition, deep learning, etc.), and IoT chips.

Among them, Wi-Fi chips play an irreplaceable role in the development of the smart home ecosystem. On one hand, the Wi-Fi protocol continues to evolve; in terms of development speed, Wi-Fi has progressed from 802.11’s 2Mbps to Wi-Fi 6’s 9.6Gbps; in terms of channel bandwidth, Wi-Fi 7 expands the width of a single channel from Wi-Fi 6’s 160MHz to 320MHz. On the other hand, giants in the smart home industry such as Apple, Amazon, and Google have jointly initiated the Matter protocol under the CSA alliance, making efficient interconnection of smart devices possible, thereby promoting the establishment of the smart home ecosystem.

Home appliances are an important component of the smart home ecosystem. Any smart home appliance that can connect to the internet must be equipped with a Wi-Fi chip. As the penetration rate of smart home appliances increases and the entire industry accelerates the construction of the smart home ecosystem, the market size of Wi-Fi chips will grow significantly. According to Markets and Markets, the global market size for Wi-Fi chips is expected to reach $19.7 billion in 2022. In contrast, the market size of Wi-Fi chips in China was only 18 billion yuan in 2020, indicating significant growth potential in the long term. In terms of brand layout, Wi-Fi chip suppliers include both foreign brands such as Qualcomm, Broadcom, NXP, Infineon, Synaptics, and MaxLinear, as well as domestic brands like Espressif Technology.

Additionally, as the level of intelligence continues to develop, the application of sensors in the home appliance industry is increasing, further driving the demand for sensor chips.

Melexis is a major supplier of sensor chips for home appliance companies. The Regional Sales Manager for the Asia-Pacific region, Zou Mingyan, stated: “Keeping pace with product upgrade rhythms, Melexis develops new technologies for home appliances, such as temperature sensors and fan drivers. For temperature sensors, we have developed the Melexis FIR array sensor for the home appliance industry, which offers good accuracy and signal-to-noise ratio, enabling intelligent control of HVAC systems, such as detecting human presence and temperature, and automatically monitoring HVAC systems for comfort. Additionally, for some home appliances that require strict temperature control, far-infrared temperature sensors are also useful. For example, the essential kitchen range hood can use our temperature array sensor to adjust the suction power based on temperature, automatically turn on and off, and provide fire alarm functions. Currently, we are one of the main suppliers of FIR array sensors in the home appliance sector.”

Domestic Chips Taking the Initiative

The market size for smart home appliances continues to expand. However, in recent years, due to factors such as Sino-U.S. trade friction and chip legislation, certain segments of the Chinese home appliance industry have experienced an embarrassing “chip shortage,” forcing home appliance companies to turn their attention to domestic chip manufacturers. In the face of opportunity, long-established domestic chip companies have rapidly expanded their market presence, significantly enhancing their supply capabilities and achieving technological breakthroughs in many high-end chip categories, thereby supporting innovation in home appliance products.

Regarding the changes in chip suppliers for Chinese home appliance companies under the “chip shortage” wave, a representative from Holtek Semiconductor told the reporter from Electrical Appliances that previously, most small appliances used domestic chips, while chips for compressors in air conditioners and refrigerators mostly came from foreign brands. In washing machines, top-loading washing machines often used domestic chips, while front-loading washing machines more frequently used foreign brand chips. “Now, some high-profit areas that were once exclusive to foreign brands are also opening up to domestic chip brands,” he said.

In terms of brands, domestic chip manufacturers entering the home appliance sector can be divided into two categories: one is domestic semiconductor manufacturers, and the other is home appliance companies.

GigaDevice is a leading supplier of NorFlash MCUs and MCUs in China. As a fabless chip design company, GigaDevice’s NOR Flash MCUs have jumped to third place globally, with a market share ranking first in China; its general-purpose 32-bit MCUs also rank first in the Chinese market. According to the reporter from Electrical Appliances, for many years before the outbreak of the “chip shortage,” STMicroelectronics had been a leading company in the MCU field. Now, GigaDevice has carved out a niche through continuous technological innovation, becoming a leading MCU brand both in the Chinese and global markets. Specifically for home appliance applications, GigaDevice’s 32-bit MCUs have a high market share and shipment volume in various fields such as variable frequency refrigerators, variable frequency air conditioners, robotic vacuum cleaners, soy milk machines, blenders, home gateways, smart locks, smart speakers, and wireless earphones.

Ingenic is an important supplier of power management chips and fast charging protocol chips in the domestic consumer electronics market. Recently, Ingenic expressed optimism about the development prospects of smart home appliances, stating that its product range now includes IoT chips, smart audio processing chips, signal chain chips, and it will continue to expand into smart audio processing, smart home appliances, IoT, and automotive electronics.

As a home appliance company, Midea has been developing IPM since 2010, achieving independent R&D of semiconductor chips for IPM modules by 2020. In 2021, Midea Group invested in the establishment of Meiren Semiconductor Technology Company. Another significant move by Midea Group is the establishment of Meiren Semiconductor under the Midea Electrical Appliances Group.

According to Feng Bo, Meiren Semiconductor was established at the end of December 2018, focusing on the design, development, and sales of mid-to-high-end semiconductor chips. In 2020, Meiren Semiconductor launched its first main control MCU, the MR88F001 series, and its first touch MCU, the MR86F001 series, which were introduced into related smart home appliances in Midea Group’s washing machine, refrigerator, and kitchen heating divisions, achieving mass shipments. In 2021, Meiren Semiconductor launched the MR88F002 series main control MCU with smaller capacity and more packaging specifications, the MR86F002 touch MCU, as well as the MR82F001 series variable frequency MCU and the first smart power module IPMMRD7110S, achieving mass production and shipment within Midea Group. In 2022, Meiren Semiconductor successively launched more models and application directions, including the MR88F005 main control MCU, MR86F005 touch MCU, MR82F003 variable frequency MCU, AC/DC power chip MRA6001H, and IoT chip MRW5601A (Wi-Fi/BLE Combo MCU). As of October 2022, the cumulative sales of the MR88F001 series main control MCU have exceeded 10 million units, with the current market failure rate reaching international first-class levels.

In addition to Midea, other home appliance manufacturers such as Gree, Hisense, Galanz, and TCL Technology have also established dedicated chip companies to provide technical support for the reliable operation of smart home appliances.

Opportunities always favor the prepared. Looking ahead, the global chip supply issues will not be completely resolved in the short term, and the pace of smart home appliance upgrades in China will not stagnate. It is foreseeable that more smart home appliances embedded with Chinese chips will enter the global market.

Serious Statement: All original articles from “Electrical Appliances Micro Newsletter” require authorization for reprinting.