Author: Luo Yiqi

Editor: Zhu Yimin

Image Source: Tuchong

After experiencing multiple quarters of losses, leading global storage manufacturers have finally begun to turn a profit.

According to a comprehensive report by the 21st Century Business Herald, major international storage manufacturers began to report losses in their storage-related businesses starting in the fourth quarter of 2022. By the first quarter of 2023, SK Hynix was the first to return to profitability, followed by Micron, Samsung, and others.

This turnaround is related to the characteristics of the current storage cycle.

Several industry insiders have told reporters that the turning point in this storage cycle is not solely due to a recovery in the downstream market, but more so driven by upstream storage suppliers (represented by the aforementioned leading manufacturers) who have aggressively reduced production, accelerating the market’s transition to a phase of improved supply-demand relationships. Subsequently, this has led to price increases, gradually improving profitability. This is significantly different from previous storage cycle fluctuations.

Historically, Samsung has consistently adopted a “counter-cyclical” investment strategy, expanding production during downturns, which has allowed it to stand out in competitive environments and achieve its current dominant position in the storage market. However, with Samsung now initiating production cuts, it has truly begun to stem the losses in the storage industry, pushing it back towards a positive growth trajectory.

While generative AI has driven increased demand for storage products beyond HBM, the current global demand for smartphones and PCs is recovering at a relatively moderate pace, making it difficult for this factor alone to significantly boost storage demand. Leading manufacturers are more focused on embracing AI server-related demand.

The next concern is the rapid increase in storage prices. Tai Wei, General Manager of Shenzhen Flash Market Information Co., believes that the storage industry has seen a comprehensive rebound in prices since the third quarter of last year. Coupled with another significant increase in the first quarter of this year, prices are expected to maintain a steady upward trend in the next three quarters. “Of course, we also call for caution, as excessive and rapid price increases will severely impact the planning of end product lines, dampen the enthusiasm for capacity expansion, and be detrimental to the overall healthy and stable development of the industry.”

Gradual Turnaround

SK Hynix, which was the first to achieve profitability, benefited from its rapid expansion in the HBM market.

Financial reports show that in the third quarter of 2023, SK Hynix’s DRAM business began to turn profitable after two quarters of losses, with HBM and DDR5 being significant contributors to its performance. In the first quarter of 2024, the NAND Flash business also entered a profitable state, primarily due to contributions from eSSD (enterprise solid-state drives).

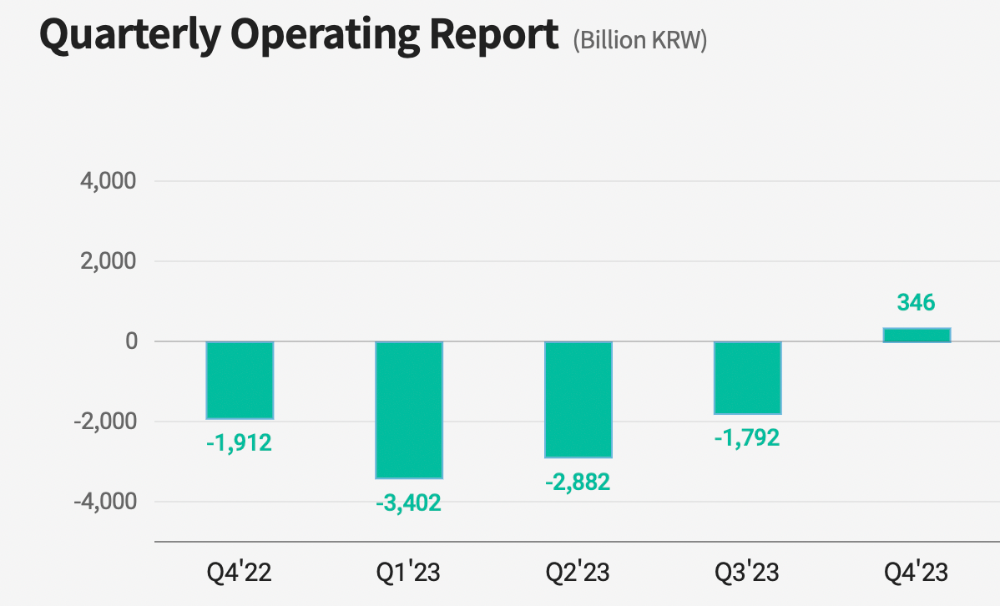

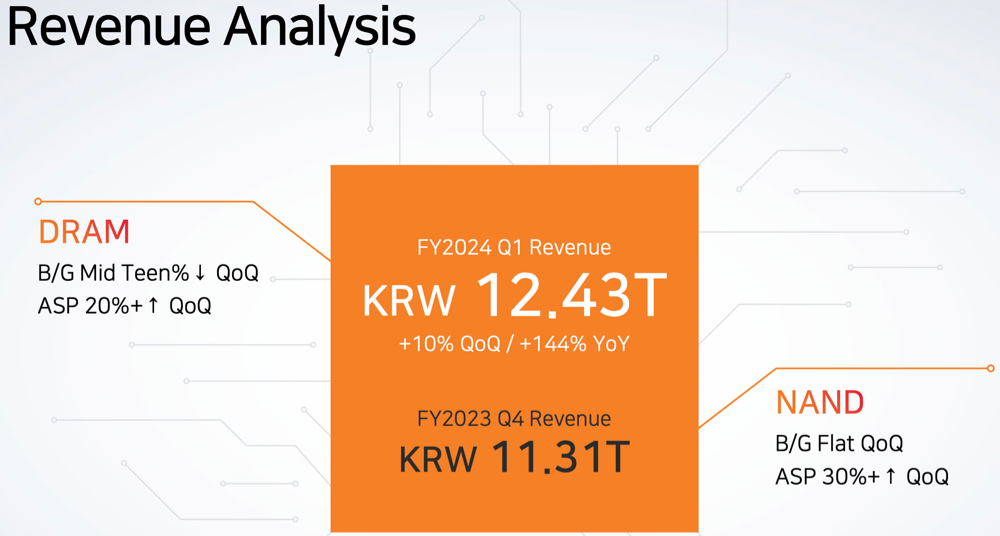

In the first quarter, SK Hynix achieved revenues of 12.43 trillion KRW, a year-on-year increase of 144% and a quarter-on-quarter increase of 10%; operating profit was 2.89 trillion KRW, a staggering quarter-on-quarter increase of 734%, compared to a loss of 3.4 trillion KRW in the first quarter of 2023.

(SK Hynix began to turn profitable overall in the fourth quarter of 2023, image source: company website)

It is noteworthy that the price trend is also significant. Financial reports indicate that in the first quarter alone, the ASP (average selling price) of SK Hynix’s DRAM products increased by over 20% quarter-on-quarter; the ASP of NAND Flash products increased by over 30% quarter-on-quarter. Similar high increases were observed in the previous quarter as well.

Specifically, in the major terminal markets, the PC segment is expected to be relatively weak in the first half of 2024, but will benefit from enterprise-level demand in the second half, with AI PCs and Windows 10-related products driving replacement demand and storage capacity expansion. The smartphone market, aside from some flagship models with AI capabilities, is experiencing relatively moderate demand. The upcoming release of new smartphones equipped with AI features and software is expected to drive new demand for corresponding storage capacity and replacements in the second half of the year.

(Both product types of SK Hynix are experiencing rapid quarter-on-quarter increases in ASP)

The server market, with the development of AI technology, is shifting its focus from training to inference, and will continue to benefit from strong support for AI servers. Additionally, the substantial investments made in cloud computing data center servers during 2017-2018 will gradually enter the replacement phase.

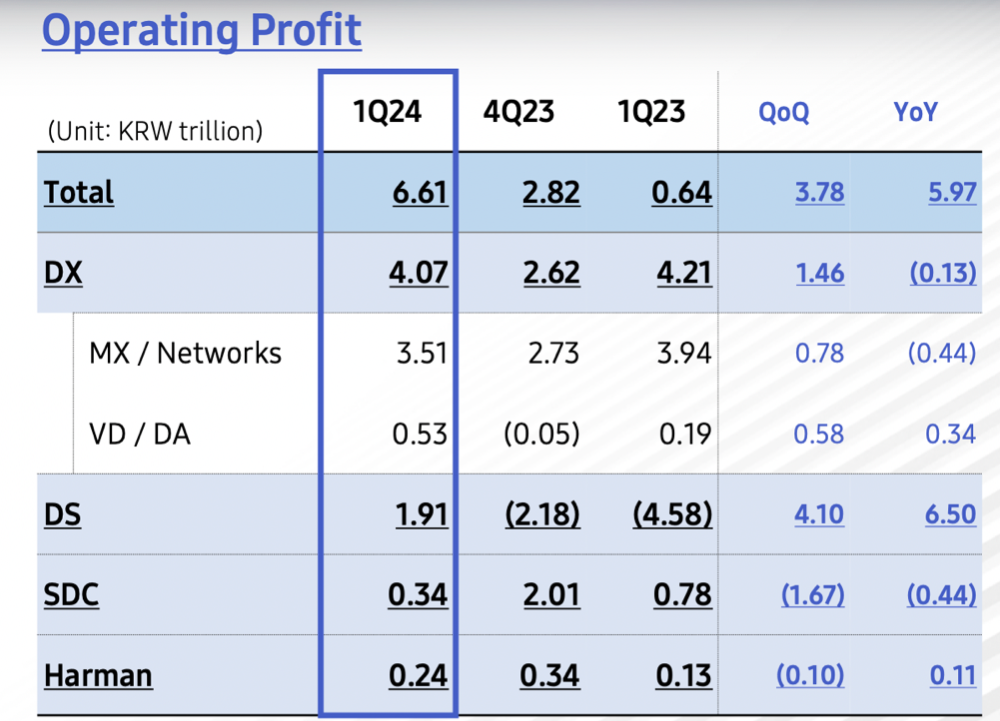

Samsung, with its numerous business lines, has also seen its DS semiconductor division return to profitability in the first quarter of this year after four consecutive quarters of losses, achieving an operating profit of 1.91 trillion KRW. The company noted that strong demand for DDR5 and generative AI’s support for corresponding storage products have led to continuous price increases and robust demand.

Looking ahead to the second quarter, Samsung expects AI to drive continued growth in related storage demand, including traditional servers and flash products. Thanks to sustained shipments from major mobile clients, demand for mobile storage products is expected to remain stable. However, in terms of product mix, Samsung will tend to allocate more capacity to server-related storage rather than to PC and mobile terminal products. It is expected to achieve mass production of HBM3E 12H DRAM and 1bnm 32Gb DDR5 in the second quarter.

For the entire year of 2024, considering that more generative AI functions will be applied in terminals, strong demand for related storage in PCs and smartphones is anticipated.

Since May, midstream storage controller chip manufacturers have begun to report performance, indicating that they are entering a rapid growth phase.

Silicon Motion Technology achieved revenues of $189 million in the first fiscal quarter of 2024, a quarter-on-quarter decrease of 6% but a year-on-year increase of 53%. The first quarter gross margin was 45%. Revenue from SSD controller chips grew by 5% quarter-on-quarter and 35%-40% year-on-year; revenue from eMMC/UFS controller chips decreased by 10%-15% quarter-on-quarter but increased significantly by 235%-240% year-on-year.

Silicon Motion’s General Manager, Gou Jiazhuang, stated that revenue from Client SSD controller chips has grown for four consecutive quarters, driven by stable demand in the terminal market and increased collaboration with major NAND manufacturers. Considering the strong performance at the beginning of the year and the continuously increasing backlog of unshipped orders, the company has decided to raise its full-year revenue forecast. It is estimated that revenue for the second quarter of 2024 will be between $199 million and $280 million, a quarter-on-quarter growth of 5%-10% and a year-on-year increase of 42%-48%. The total revenue for 2024 is expected to be between $800 million and $830 million, a year-on-year growth of 25%-30%.

Phison Electronics reported on May 10 that its consolidated operating revenue for the first quarter of 2024 was NT$16.526 billion, a quarter-on-quarter increase of 4.9% and a year-on-year increase of 64.0%; net profit was NT$2.42 billion.

In April, consolidated revenue reached NT$5.156 billion, a year-on-year increase of 53%, marking the second-highest for the same period in history; cumulative revenue from January to April reached NT$21.682 billion, a year-on-year increase of 61%, also setting a historical record for the same period; the total shipment volume of storage bits from January to April increased by 63% year-on-year, setting a new historical high.

Similar trends are observed among major storage manufacturers in mainland China. Reports indicate that major storage manufacturers such as Jiangbo Long and Deming Li achieved profitability in the fourth quarter of 2023, while Baiwei Storage turned profitable in the first quarter of 2024. With the industry chain entering a positive development cycle and driven by AI demand, the stock prices of related companies have also performed well recently.

Mixed Blessings

As we enter 2024, with the market generally expecting a “moderate recovery” across various terminal types, the storage industry is entering a new development cycle, with the largest momentum coming from the proliferation of AI large models.

However, at the same time, due to the price increases in storage exceeding some industry insiders’ expectations, new concerns are emerging in the industry, namely that if prices rise too quickly, it may suppress demand in the terminal market to some extent.

Phison Electronics’ CEO, Pan Jiancheng, pointed out during the earnings report that NAND manufacturers have returned to normal profitability since the first quarter of 2024, so if NAND market prices stabilize, the overall supply-demand situation in the NAND industry will be relatively healthy; conversely, if NAND market prices rise sharply in the short term, it may suppress the NAND storage capacity of end system users, leading to a bubble.

He further analyzed that while NAND manufacturers’ short-term price increases do impact consumer NAND storage demand, Phison has broadly laid out NAND storage applications in areas such as industrial control systems, gaming hosts, automotive applications, and enterprise SSDs, and has recently expanded the promotion of its exclusive patented AI solutions, effectively increasing its market share and contribution in various “non-consumer” applications.

Third-party organizations in the flash market believe that as profits recover, storage manufacturers’ desire to increase market share will gradually rise, leading to a certain differentiation in market pricing strategies from the second quarter of 2024 onwards.

(Samsung’s DS semiconductor business returned to profitability in the first quarter of this year)

According to the organization, under the expectation of rising storage prices, some terminal manufacturers have already begun to lower their shipment expectations and adopt downgrading strategies for certain models; the spot market is increasingly experiencing backwardation in the second quarter, ultimately due to demand not yet recovering. In the server sector, strong demand from major North American clients has begun to lead to order grabbing, but the domestic market is facing a very different situation, with cautious procurement for the second quarter due to existing inventory. Therefore, the market still faces a situation of firm price increases from manufacturers and slowing demand from consumer terminals, leading to a divergence in supply-demand expectations.

Of course, this does not mean that storage prices should stagnate, as manufacturers in the storage industry had previously aggressively lowered prices to clear inventory during high inventory phases. Industry insiders have analyzed that current memory prices are not at the peak levels of the previous cycle; rather, the current rate of increase is simply a bit fast.

Certainly, exploring the growth potential of storage demand for AI large models is a direction that manufacturers are striving for.

Typically, running large models on the terminal side relies more on DRAM, which seems unrelated to NAND Flash, but more and more flash manufacturers are indicating that they are seeking new opportunities in this area.

This is partly because DRAM and NAND Flash are inherently interdependent product types, which will naturally drive some demand for flash; on the other hand, it also raises more technical requirements.

Duang Xiting, Senior Vice President of Client and Automotive Storage (CAS) at Silicon Motion, analyzed that “LLM (Large Language Model) initially runs in the cloud, but to land on the terminal side, it must first be streamlined and lightweight. Currently, many lightweight models use DRAM storage, but this approach is costly. Silicon Motion is considering how to strengthen the role of SSDs (a type of NAND flash).”

He continued, stating that how to promote NAND from passive storage to active storage, making flash a part of the disruptive innovation in AI cost architecture, is the key focus for NAND manufacturers. “Strengthening the AI ecosystem and optimizing flash capabilities to transfer the costs that DRAM has to bear to SSDs, thereby reducing overall BOM costs, is essential for the widespread adoption of AI large models; otherwise, this process will be slow. Silicon Motion already has plans in place for this.”

This indicates that in the face of the generative AI wave, the technological and ecological competition within the storage industry chain is also gradually commencing.

SFC

Edited by Liu Xueying, Jin Shan, Intern Su Jinyi

Recommended Reads

The turning point of the storage industry’s cycle is clear!

Giants are raising prices, and the storage chip market is warming up.

How to break the “shortage” of automotive chips?