Click the “blue text” above to follow for more exciting content.

Hello, I am A-Cheng, and this is my 71st article. Today, we will continue discussing outstanding companies in the semiconductor field.

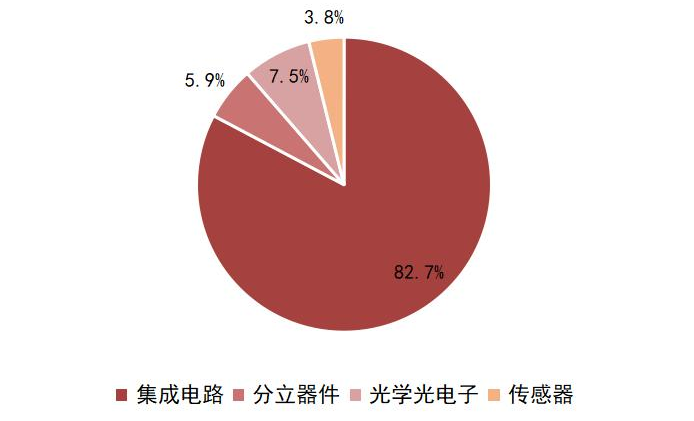

According to the World Semiconductor Trade Statistics (WSTS), semiconductor products are divided into four categories: integrated circuits, discrete devices, optoelectronic devices, and sensors. Among these, integrated circuits account for over 80% of the industry scale, with subfields including logic chips, memory, microprocessors, and analog chips. Today, we will mainly discuss integrated circuits.

According to WSTS data, the global market sizes for integrated circuits, discrete devices, optoelectronics, and sensors in 2022 were $479.988 billion, $34.098 billion, $43.777 billion, and $22.262 billion, respectively, accounting for 82.7%, 5.9%, 7.5%, and 3.8% of the global semiconductor industry. Among these semiconductor products, integrated circuits are the most technically challenging and fastest-growing sub-product, making them the most important component of the semiconductor industry.

Integrated circuits (IC) are a type of microelectronic device or component that uses specific processes to interconnect the necessary components such as transistors, resistors, capacitors, and inductors on a small piece or several pieces of semiconductor wafers or dielectric substrates, and then encapsulated in a shell to form a microstructure with the desired circuit function, also known as a chip.

From the production process perspective, semiconductor production is mainly divided into three major processes: design, manufacturing, and packaging/testing, and requires upstream semiconductor equipment and materials as support. Integrated circuits, as a representative of various products, have extensive downstream applications, and the demand growth driven by downstream innovation is the core driving force behind the rapid development of the semiconductor industry.

In terms of industry scale, the sales scale of the integrated circuit design industry in mainland China has grown from 38.3 billion yuan in 2010 to 451.9 billion yuan in 2021, with a compound annual growth rate of about 25.15%. The gradual improvement of the domestic industrial chain has also provided wafer manufacturing support for domestic startup chip design companies. Coupled with industrial funding and policy support, as well as the return of overseas talent, the number of chip design companies in China has rapidly increased. According to data from the China Semiconductor Industry Association, since 2010, the number of chip design companies in China has significantly increased from only 582 in 2010 to 3,243 in 2022, with an average annual compound growth rate of about 15.39% from 2010 to 2022. In the past decade of rapid development in the semiconductor industry, a large number of outstanding companies have emerged, becoming the backbone of domestic substitution:

1. SMIC

SMIC is the largest and most technologically advancedwafer foundry company in mainland China, established in 2000 and headquartered in Shanghai. The company provideswafer foundry services from 0.35 microns to 14 nanometers and has8-inch and 12-inch production lines covering consumer electronics, automotive chips, AI computing, and more. Recently, it has expanded into the automotive industry, collaborating with car manufacturers, with future automotive chip revenue potentially accounting for 10%.

Core Breakthrough: Despite the impact of U.S. technology restrictions, SMIC has made progress in the development of 5nm process technology, with N+1/N+2 process technology already certified by customers.

Expansion Plan: In 2025, capital expenditure is expected to be about $7.7 billion, focusing on expanding 12-inch wafers (an annual increase of 50,000 pieces).

2. Yangtze Memory Technologies

Yangtze Memory Technologies is China’sfirst 3D NAND flash memory manufacturer, established in 2016 and headquartered in Wuhan. Its products are widely used in smartphones, data centers, and other fields, with a target production capacity of300,000 pieces/month. Yangtze Memory Technologies fills the domestic storage chip gap and accelerates the process of domestic substitution.

Technical Breakthrough: In 2023, it launched the X3-9070 chip, stacking over 300 layers, with a single capacity of 1.6Tb (200GB) and an I/O rate of 3200MT/s, leading in global performance.

Capacity Planning: In 2025, the target production capacity is 300,000 pieces/month, with a global market share rising to 10%.

3. Huawei HiSilicon

Huawei HiSilicon is achip design company under Huawei, established in 2004 and headquartered in Shenzhen. ItsKirin series mobile chips andAscend AI chips have internationally leading performance, using5nm process technology, supporting Huawei’s smart terminals and AI computing. The Ascend 910B is expected to go into mass production in 2024, with a 50% increase in computing power, and is expanding into autonomous driving, robotics, and other fields, promoting the domestic chip ecosystem.

Technical Breakthrough: The Ascend chip using 5nm process technology is commercially available, covering smart cities, autonomous driving, and other fields.

High R&D Investment: Annual R&D expenses exceed 100 billion yuan, making it difficult to achieve independent profitability in the short term.

4. North Huachuang

North Huachuang is aleading semiconductor equipment company in China, established in 2001 and headquartered in Beijing. The company coversetching, thin film deposition, and cleaning equipment and other key processes, with a leading domestic localization rate for 28nm equipment. In 2024, revenue is expected to approach 30 billion yuan, and it has acquiredChipSource Micro to enhance coating and developing technology, supporting the autonomy and controllability of domestic semiconductor equipment.

Domestic Equipment Substitution: Leading market share for 28nm etching machines and PVD equipment, with breakthroughs imminent for 12-inch equipment.

Profit: 5.621 billion yuan, a year-on-year increase of 44.17%, with a compound annual growth rate of 54.57% over the past five years, making it the only company in China with a net profit growth rate exceeding 20% for ten consecutive years.Regarding the semiconductor industry, the above are some materials I have gathered today. If you know more, feel free to share in the comments!

Review of Previous Exciting Content:

1. My Chinese Chip

2. ChatGPT Continuous Upgrades, Pressure on Liang Wenfeng

3. Photoresists: Four Companies Breaking the Overseas Blockade

4. Dinglong Co., CMP Industry Leader

5. The World’s First Wafer Foundry: TSMC

6. Huahai Qingke, The Shining Star of CMP Equipment

7. Anji Technology, The Leader in CMP Polishing Liquids

8. CMP Process Parameter Control: How to Quickly Improve Yield and Efficiency

9. CMP Defect Analysis: How to Avoid Scratches, Residues, and Corrosion?

10. CMP Polishing Technology in the Glass Industry

Chinese Chips, My Heart, please give a follow to support!

Follow me for

more exciting content