This is the 267th content shared by the platform.

After World War I, the old imperial system in Europe collapsed, with the German Empire, Austro-Hungarian Empire, and Ottoman Empire weakened and disintegrated.France suffered severe destruction, while Britain lost its hegemony, and the United States emerged as a first-class world power..

The victorious countries adjusted their relationships based on the new balance of power through struggle and compromise, forming a new international relations system.

In 1919, the Paris Peace Conference signed the “Covenant of the League of Nations,” the “Treaty of Versailles,” and other treaties, legally adjusting the interests of the powers in Europe, North Africa, and West Asia, establishing a new system of international relations in post-war Europe——the Versailles system. The failure of Chinese diplomacy at the Paris Peace Conference directly led to the outbreak of the May Fourth Movement, marking the beginning of the new democratic revolution in China. Two years later, in 1921, the Communist Party of China was founded.

The Paris Peace Conference saw a shift in the power structure in the Asia-Pacific region, with the competition for dominance in the Far East concentrated among the United States, Britain, and Japan.

The Paris Peace Conference saw a shift in the power structure in the Asia-Pacific region, with the competition for dominance in the Far East concentrated among the United States, Britain, and Japan.

In 1922, the Washington Conference signed the “Treaty on Pacific Islands and Territories” (also known as the “Four-Power Treaty”), the “Naval Limitation Treaty” (also known as the “Five-Power Treaty”), and the “Nine-Power Treaty on Principles and Policies Applicable to Events in China” (also known as the “Nine-Power Treaty”), adjusting and redefining the relationships of the powers in the Far East and Pacific region, establishing a temporary balance based on the new power dynamics, forming the Washington system.

After the war, major capitalist countries were committed to healing the wounds of war, domestic politics began to stabilize, and the economy started to recover, leading to a prosperous economic development in the 1920s. Under the guidance of liberal economic theory, the so-called “Coolidge Prosperity” emerged in the United States.

Coolidge Prosperity

Coolidge Prosperity

U.S. industrial production increased significantly, and by 1929, the total industrial output value in the U.S. had doubled compared to 1914. The automobile, construction, and electrical industries experienced the fastest growth. The total national consumption value increased from $74.2 billion in 1919 to $103.1 billion in 1929, while per capita national consumption value rose from $1,315 to $1,671. During the Coolidge Prosperity period, the U.S. actively expanded domestic and foreign markets, seizing a large number of overseas markets through capital and commodity exports. To stimulate consumption, advertising rapidly flourished, leading to the emergence of installment payment methods to encourage premature consumption.

However, this prosperity concealed significant crises, such as widening wealth gaps, agricultural overproduction, and excessive speculation in the stock market.

In the 1920s, U.S. industrial productivity surged by 55%, but workers’ wages only increased by 2%, exacerbating the wealth disparity. In 1929, 5% of the wealthy held one-third of the nation’s wealth, while 60% of households had an annual income of about $2,000, and 21% earned less than $1,000, severely limiting their consumption capacity. At the same time, international grain prices plummeted, causing farmers’ incomes to drop to one-third of urban residents, leading to a decline in rural purchasing power. During this period, the stock market fell into “irrational exuberance”: the Dow Jones index soared from 63 points in 1921 to 381 points in 1929, with a market value reaching 82% of GDP. Many people speculated through “margin trading” (10% down payment with leverage). Installment shopping became prevalent (e.g., 70% of automobiles), and the ratio of consumer debt to income rose from 15% in 1920 to 35% in 1929, significantly increasing the risk of default. The Federal Reserve’s low interest rates (the discount rate dropped from 6% to 3.5%) stimulated banks to over-lend, flooding the stock market with funds. Blind expansion by banks, high-risk bond packaging, and lack of deposit insurance exacerbated systemic risks.

Ultimately, on October 24, 1929 (“Black Thursday”), U.S. stocks plummeted by 11%, and on October 29 (“Black Tuesday”), they fell another 12.8%, with the Dow Jones index dropping to 41 points in 1932, and the market value evaporating by 90%.

Dow Jones index in 1929From 1930 to 1933, the economic crisis fully erupted.Over 9,000 banks in the U.S. went bankrupt, with depositors losing about $14 billion (equivalent to $250 billion today), and the money supply shrank by 30%.In 1932, U.S. industrial output fell by 46% compared to 1929, with steel production dropping from 31 million tons to 6 million tons, and automobile production falling from 5.3 million to 1.9 million.From 1930 to 1933, over 80,000 businesses went bankrupt, and the unemployment rate soared from 3.2% in 1929 to 25% in 1933 (about 15 million unemployed), with millions surviving on relief funds.

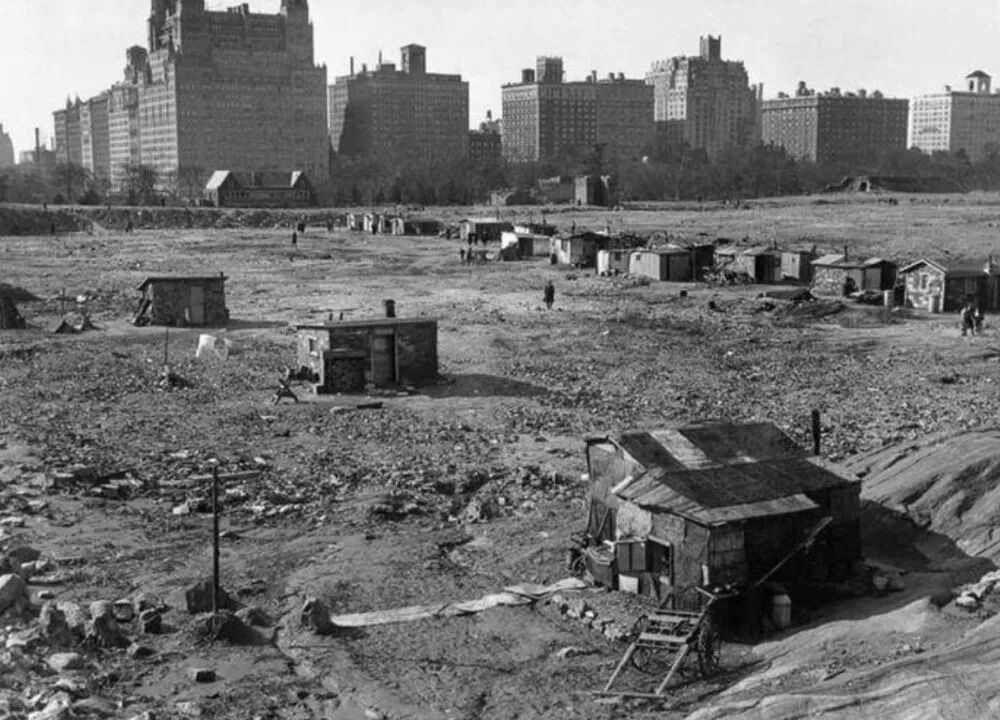

Dow Jones index in 1929From 1930 to 1933, the economic crisis fully erupted.Over 9,000 banks in the U.S. went bankrupt, with depositors losing about $14 billion (equivalent to $250 billion today), and the money supply shrank by 30%.In 1932, U.S. industrial output fell by 46% compared to 1929, with steel production dropping from 31 million tons to 6 million tons, and automobile production falling from 5.3 million to 1.9 million.From 1930 to 1933, over 80,000 businesses went bankrupt, and the unemployment rate soared from 3.2% in 1929 to 25% in 1933 (about 15 million unemployed), with millions surviving on relief funds. People queue for relief aidSociety was also extremely unstable, with dairy farmers pouring milk into the Mississippi River and burning milk trucks to protest against capital monopoly and market collapse, coexisting with overproduction and poverty. Universities closed or went bankrupt, and the malnutrition rate reached 20%. Over 15,000 homeless people gathered in New York’s Central Park, and unemployed people in Chicago built shantytowns with boards and tin, known as “Hoovervilles,” which even had self-governing committees.

People queue for relief aidSociety was also extremely unstable, with dairy farmers pouring milk into the Mississippi River and burning milk trucks to protest against capital monopoly and market collapse, coexisting with overproduction and poverty. Universities closed or went bankrupt, and the malnutrition rate reached 20%. Over 15,000 homeless people gathered in New York’s Central Park, and unemployed people in Chicago built shantytowns with boards and tin, known as “Hoovervilles,” which even had self-governing committees. Milk poured into the Mississippi River

Milk poured into the Mississippi River Hooverville in New York’s Central Park

Hooverville in New York’s Central Park I want a job

I want a job

In 1930, the U.S. was deeply mired in the Great Depression, and the oil industry was also severely impacted. Two young men, John Karcher and Eugene McDermott, were also laid off from their oil company, possibly due to optimization or voluntary resignation.

After leaving the oil company, the two co-founded the “Geophysical Service”, which designed and manufactured its own equipment in a laboratory located in Newark, New Jersey, but its headquarters was in Dallas, Texas (which had abundant oil).GS was the first professional company in the U.S. engaged in research on geophysical exploration using reflection seismic testing methods, essentially helping oil companies find oil and natural gas and other underground resources.

No one expected that this small company born in a basement would later become a pillar of the semiconductor industry, profoundly changing the landscape of the global electronics industry.

Due to its high technical level and good service attitude, GS quickly developed its business. As the company grew larger, it also became bolder, and GS began to have its own little ideas, secretly extracting oil while keeping it from clients.

There is no wall that does not let the wind through, and this soon caused extreme dissatisfaction among GS clients, “Goodness, we pay you to find oil, and you are also extracting oil yourself. How can I know that after you find oil with my money, you won’t keep it for yourself? Am I not a big fool?”

To quell clients’ doubts and anger, at the end of 1938 and the beginning of 1939, President Karcher decided to split the company. First, a wholly-owned subsidiary was established in Delaware, still engaged in oil exploration services, managed by Vice President McDermott. Secondly, the parent company Geophysical Service (GS) was renamed Coronado Company (which went bankrupt in 1945), managed by Karcher, focusing solely on oil extraction.

The wholly-owned subsidiary established in Delaware, GSI (Geophysical Service Inc), is the predecessor of today’s Texas Instruments.

GSI Company logo

GSI Company logo

However, the oil tycoons quickly saw through this superficial trick, “You really don’t know your place,” and they tore up contracts with GS and GSI, leading to significant losses for the company, pushing it to the brink of bankruptcy.

President Karcher was at a loss, and later, he simply thought of the simplest solution to all these problems: to sell the company for $5 million to the Indiana Mobil Oil Company.

As the new owner, the Indiana Mobil Oil Company was a good boss, believing that the management of the subsidiary GSI had the right to decide whether to join the new family or remain independent.

Thus, at the end of 1941, McDermott and three other GSI employees, H. Bates Peacock, J. Erik Jonsson, and Cecil H. Green, seized this entrepreneurial opportunity to buy GSI for $300,000, achieving a management buyout (MBO).

The early GSI team

MBO, or Management Buy-Outs, refers to the acquisition of a company by its management team using borrowed capital or equity transactions to buy out the company, making it privately owned, thus achieving control and restructuring of the company, and obtaining extraordinary returns from mergers and acquisitions. This is a special form of leveraged buyout (LBO). The acquirer is the management team, which, through the acquisition of the target company’s assets or equity, completely controls the company’s assets, turning it into a closed company controlled by the management team. The acquisition target can be the entire enterprise, a subsidiary, a branch, or even a department. Unlike general business transactions and asset restructuring, MBO emphasizes not only the right to profits but also control rights, sharing rights, and claims to residual value.

Heaven will bestow great responsibilities on a person, and they must first suffer hardships and labor… After McDermott and his partners bought GSI, they cheered for becoming company owners, winning beautiful women, and about to reach the peak of their lives, when in 1941, Japan attacked Pearl Harbor, and the Pacific War broke out.

Japan’s attack on Pearl Harbor

Most of GSI’s business was overseas, and once the war broke out, all employees were forced to return home, halting oil exploration operations, and income plummeted almost to zero. This left the four partners dumbfounded.

However, the war also brought them new opportunities, as GSI’s factory was requisitioned by the military to produce airborne radar systems and other detection equipment. Thus, GSI gradually transformed into an electronic equipment manufacturer.

Objectively speaking, starting in 1942, GSI entered the national defense electronics field for the first time with submarine detection equipment, based on the geological detection technology originally developed for the oil industry. The principles of detecting oil underground and submarines underwater theoretically seem to be consistent.

After World War II, the management of GSI, having tasted the charm of electronic technology, conceived the idea of entering the electronic vacuum tube market. However, this market was mainly monopolized by the “military-industrial eight giants” such as General Electric, Raytheon, and American Radio in the eastern U.S., making entry extremely difficult.

In 1945, a person who would have a profound impact on GSI’s future joined the company: Pat Haggerty, a PhD in electronic engineering from MIT.

Pat Haggerty

Upon joining the company, Haggerty demonstrated extraordinary foresight. In the orientation meeting, he presented the board with a research report from Bell Labs on transistors and firmly stated, “The future belongs to semiconductors, not vacuum tubes. If we do not seize this opportunity, the company will be eliminated in ten years.” Although his words sparked some controversy at the time, they prompted the company’s leadership to reassess its future direction.

In 1947, Bell Labs invented the transistor, which was like a bombshell, creating waves in the electronics industry. However, Bell Labs initially only licensed the transistor technology to large companies like Westinghouse and RCA. Haggerty understood the importance of transistors for GSI’s future development and decided to personally go to New York to negotiate with Bell Labs. At the negotiation table, Haggerty candidly stated, “Although we are a small company, we have a persistent pursuit of technology and a spirit of adventure. We are willing to bet all of the company’s cash to purchase the transistor license.” After three months of arduous negotiations, they ultimately paid $25,000 (equivalent to $300,000 today) and successfully obtained the patent license for germanium transistors. This decision was filled with risk at the time, as the company had essentially staked all its funds on the transistor business, but Haggerty firmly believed it was a key step toward the company’s future.In 1950, the Korean War broke out, leading to a surge in military orders. In 1951, under Haggerty’s leadership, the laboratory and manufacturing department (Laboratory and Manufacturing, L&M) quickly surpassed GSI’s original geographical department, and the company had effectively transformed into an electronics industry company.

At the negotiation table, Haggerty candidly stated, “Although we are a small company, we have a persistent pursuit of technology and a spirit of adventure. We are willing to bet all of the company’s cash to purchase the transistor license.” After three months of arduous negotiations, they ultimately paid $25,000 (equivalent to $300,000 today) and successfully obtained the patent license for germanium transistors. This decision was filled with risk at the time, as the company had essentially staked all its funds on the transistor business, but Haggerty firmly believed it was a key step toward the company’s future.In 1950, the Korean War broke out, leading to a surge in military orders. In 1951, under Haggerty’s leadership, the laboratory and manufacturing department (Laboratory and Manufacturing, L&M) quickly surpassed GSI’s original geographical department, and the company had effectively transformed into an electronics industry company.

Thus, to demonstrate the company’s determination and confidence in its transformation, in December 1951, GSI was renamed “Texas Instruments Incorporated (TI).”

After GSI officially changed its name to Texas Instruments, one of the founders, J. Erik Jonsson, hired a designer from an advertising company, Torger Thompson, to create a representative logo for the new company, with an agreed design fee of $500. The logo featured the shape of Texas embedded with the letters TI, and this logo has been used since 1951.

Interestingly, at the time of the final payment for the design fee, Texas Instruments was experiencing severe cash flow issues, and Jonsson had to propose paying with stock equivalent to $500, but Thompson flatly refused.

“When the guy is foolish, I want cash, cash, you know.” This guy probably regretted it later, as Texas Instruments became a super stock, with its price increasing 37 times in the following years.

Haggerty was the founder of Texas Instruments in the field of semiconductor integrated circuits. He successfully transformed Texas Instruments and later served as the company’s president and chairman. He also promoted a Chinese individual, Mr. Morris Chang, to vice president, making him the third-highest executive in the company.

“I really enjoyed my experience at Texas Instruments,” many years later, Chang described his time at Texas Instruments, “However, I actually preferred the first 23 years…”

This first 23 years coincided with Haggerty’s tenure at Texas Instruments, during which Haggerty established and cultivated the corporate culture of “innovation,” “integrity,” and “customer first” for the young giant TI. Later, this corporate culture was also transplanted by Mr. Chang to TSMC, the global semiconductor foundry king.

From its shaky beginnings during the Great Depression, through business entanglements, wartime shocks, and market struggles, Texas Instruments continuously broke through and reborn amidst the tides of the times. Pat Haggerty, with his forward-looking strategic vision, led TI to bet on transistor technology, completing a thrilling leap from an oil exploration company to a semiconductor giant. The innovative culture he nurtured not only created the company’s legendary status but also profoundly influenced the development trajectory of the global semiconductor industry through successors like Morris Chang. The story of Texas Instruments is not only a history of a company breaking through adversity but also a magnificent song of technological innovation driving industrial transformation, continuously inspiring future generations to stand at the forefront of the technological wave.