On June 17, 2025, chip company Marvell held an online investor summit focused on AI infrastructure. Although Marvell has generally maintained a low profile in the public eye, this summit sent a strong signal—it’s fully betting on “custom AI chips,” attempting to seize a core position in the data center chip market amid the upcoming AI wave.

As the development of large AI models deepens, traditional general-purpose chips are gradually unable to meet the high energy efficiency demands of cloud training and inference. In contrast, chips customized for specific customers and tasks offer greater flexibility and performance optimization, making them the preferred choice for large tech companies. Marvell is a key player in this trend, providing underlying computing power support for Amazon AWS, Microsoft Azure, Meta, and xAI. Notably, the CEO of AWS publicly stated at the summit that the collaboration with Marvell has enhanced the performance and scalability of its AI cloud platform, highlighting its strategic position.

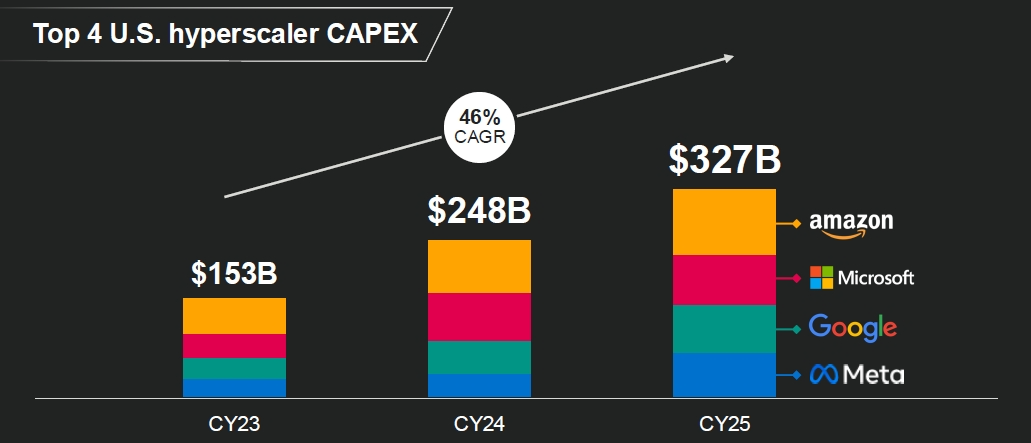

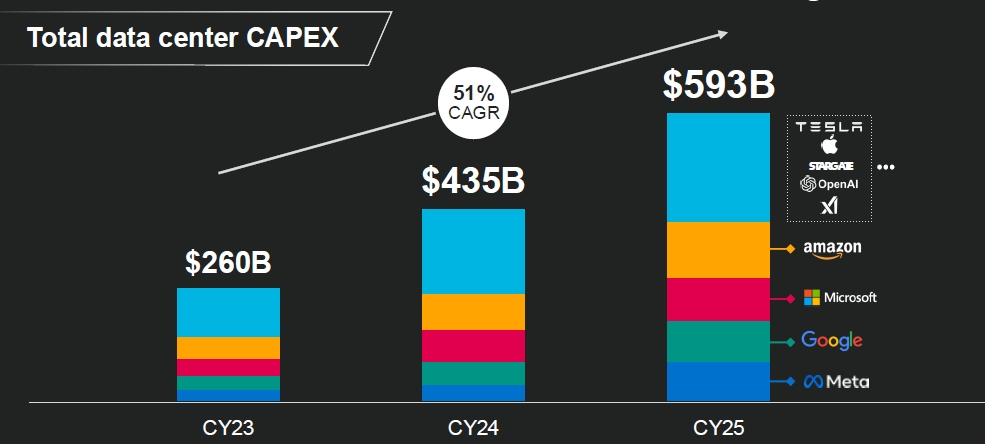

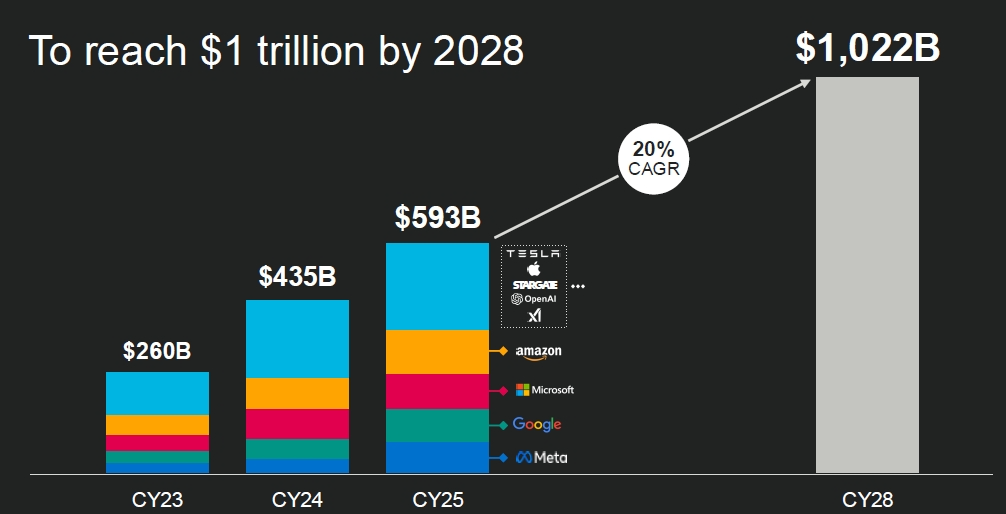

From a market size perspective, investment in AI infrastructure is expanding exponentially. According to data cited by Marvell, global capital expenditure for data centers in 2023 is $260 billion, and it is expected to exceed $1 trillion by 2028, with a compound annual growth rate of 20%. Among these, the market for “accelerated computing” chips specifically for AI services is projected to reach $349 billion by 2028, including main control chips and peripheral collaborative chips. The market size for custom main chips is estimated at $146 billion, with an average annual growth rate of 47%; while the growth of custom supporting chips (such as memory managers, network interfaces, co-processors, etc.) is even more astonishing, with a compound annual growth rate of 90%, and the market size is expected to reach $408 billion.

Currently, Marvell is still a “dark horse” in this market, with a market share of less than 5% in 2023, but its goal is to achieve a 20% market share by 2028, occupying a core position in the “accelerated computing custom chip” field. According to its internal forecasts, each custom main chip project is expected to generate billions of dollars in revenue over the next five years, while each supporting chip project can contribute hundreds of millions of dollars, with a lifecycle of 2 to 4 years. Currently, Marvell has won 18 related chip projects, including 12 collaborations with the top 4 U.S. cloud service providers, with over 10 customers and more than 50 potential project opportunities, totaling expected revenue of over $75 billion.

On the technical side, Marvell has demonstrated strong independent R&D capabilities. Its team has achieved the world’s first batch of 2-nanometer process chips and continues to make breakthroughs in ultra-high-density memory, high-speed signal transmission, silicon photonics technology, and advanced packaging. The latest self-developed SRAM technology announced at the summit boasts a bandwidth density 17 times higher than existing solutions, with half the area and a 66% reduction in standby power consumption; while the new generation of SerDes (high-speed signal interface) maintains an extremely low error rate and clear signal even at 50dB signal attenuation, leading the world in performance. Additionally, Marvell has been active in the advanced packaging field, proposing multi-dimensional packaging solutions from 2.5D, 3.5D to 4.5D, integrating silicon photonic modules and chiplet interconnect technology to achieve higher performance and lower power consumption in system integration.

Marvell’s data center business is already showing results. In fiscal year 2025, the revenue from this business reached $4.2 billion, with over 25% coming from custom chips, and this proportion is expected to exceed 50% in the future. As more projects are implemented, the company’s overall growth path is becoming clearer. Notably, compared to NVIDIA’s GPU and general-purpose chip solutions, the custom chip market that Marvell focuses on is more vertical and has higher barriers to entry, which also gives it strong customer stickiness and technical barriers.

The AI chip market is rapidly evolving towards “highly customized” solutions, and Marvell is undoubtedly one of the key drivers in this technological evolution. It may not be the leading actor, but it holds the “control” of the underlying AI computing power. In the coming years, amid the large-scale deployment and upgrading of AI infrastructure, Marvell is likely to become a true “behind-the-scenes winner” thanks to its strong design capabilities, advanced processes, and customer collaboration foundation.

Swipe left and right to see more