Texas Instruments is one of the earliest chip manufacturers to release its financial report after the U.S. announced reciprocal tariffs, and the company recently provided positive signals for the chip industry in its first-quarter financial report!As a major semiconductor manufacturer with the broadest product line and the largest customer base in the industry,Texas Instruments’ financial performance is also a barometer for measuring demand across various products.

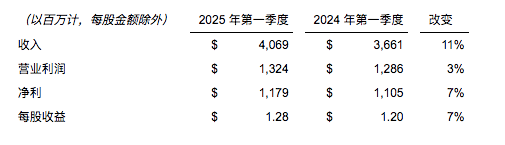

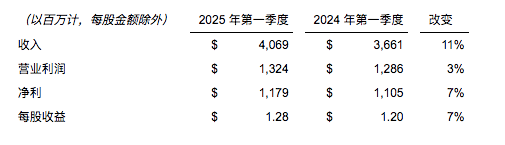

Texas Instruments recently announced that its first-quarter revenue was$4.07 billion, an increase of

Haviv Ilan, President and CEO of Texas Instruments, stated that the cycle has hit bottom, as more and more customers indicate that their inventories are really very, very short.

When asked if customers are eager to place orders in advance,Haviv Ilan replied, “Based on what we saw in the first quarter, I believe this is a real recovery, not just due to customers worrying about future tariffs leading to price increases and thus pulling demand forward.” He also warned that, “ it is difficult to determine the motivations of buyers in the second quarter.“

In an article released yesterday titled “STMicroelectronics: Net Profit Plummets by 90%! Q2 Financial Outlook Improves“, it was mentioned that another major semiconductor manufacturer, STMicroelectronics, expects that the first quarter has already hit bottom,“We view the first quarter of 2025 as the bottom, but in the current uncertain environment, we are more focused on the parts we can control.” STMicroelectronics expects second-quarter revenue to achieve a quarterly growth of over7%, exceeding market expectations.

The signals released by these two semiconductor giants indicate the latest signs of recovery in automotive and industrial chip sales after a prolonged slump. However, caution is still needed regarding the impact of U.S. tariff policy uncertainties!

Previous HighlightsTexas Instruments Layoffs, Details ReleasedSTMicroelectronics: Net Profit Plummets by 90%! Q2 Financial Outlook ImprovesStrong AI Demand, Customers Stockpiling! SK Hynix Revenue and Profits SurgeAIoT Chip Design Companies: Net Profit Soars by 341.01%!Ongoing Controversies and Challenges! ST Announces Restructuring Plan Details, Initiates Voluntary Employee Departures!Price Increases Exceeding 25%! Yageo Bids for Japanese Sensor CompanyFailed Negotiations! ON Semiconductor Cancels $6.9 Billion Acquisition of AllegroDomestic Power Chip Company: One Business Unit Grows by 1402% Year-on-Year!Failed Negotiations! ON Semiconductor Cancels $6.9 Billion Acquisition of Allegro Scan to Follow Chip InformationChip Information at Your Fingertips

Scan to Follow Chip InformationChip Information at Your Fingertips