Introduction:

As technology companies venture into the Internet of Vehicles (IoV), this field is undergoing a revolution. How will traditional automakers and tech companies compete?

Although the concept of IoV is no longer new, numerous business opportunities continue to emerge. With many industry giants outside the traditional automotive sector entering this field, the development of IoV is indeed revolutionary. Automakers urgently need to identify their business positioning, clarify the value of emerging technologies, and fully commit to creating new operational models to seek new development capabilities. Otherwise, various tech companies will take the initiative and seize opportunities in the IoV market.

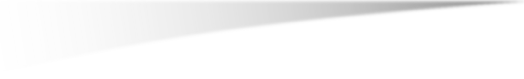

The number of vehicles equipped with IoV capabilities is steadily increasing.

The development of IoV is in full swing. In fact, by 2025, all new passenger cars sold will be connected vehicles.

However, as many automakers gradually delve into this field, they will face a series of challenges. First, research by Accenture shows that while consumers want their vehicles to have connectivity capabilities, they are unwilling to pay extra for it. At the same time, they expect to seamlessly use smartphones, tablets, and other devices inside the vehicle.

Faced with increasingly discerning consumers, automakers must compete with handheld device manufacturers by offering increasingly complex configurations. Relying solely on internal development resources, as is currently the case, will not achieve this goal.

Complicating matters further is the rapid R&D pace of tech companies, where new products and services often take only months from development to market, compared to the years required in traditional industries. This forces automakers to accelerate their pace.

For automakers, going it alone is clearly not feasible; the future depends on whether they can integrate to form a strong IoV ecosystem, collaborating with automakers, tech giants, telecommunications companies, startups, and aftermarket service providers to offer comprehensive solutions to customers.

In this environment, automakers should focus on vehicle-related functions, such as rescue, remote access, or navigation services, to effectively provide excellent solutions. They should leverage the strategic advantage of deep vehicle integration and combine it with handheld device-based vehicle extension services.

These two types of services are primarily based on different connectivity models: the former adopts a fully embedded solution, while the latter generally requires information exchange with handheld devices. Regardless of the method, seamless integration of vehicle human-machine interface input and output must be achieved through optimizing the use of large embedded central control systems, touch/press control devices, and vehicle audio systems.

The value of the Internet of Vehicles

Connecting vehicles requires significant upfront investment from automakers. But how can they derive value from it?

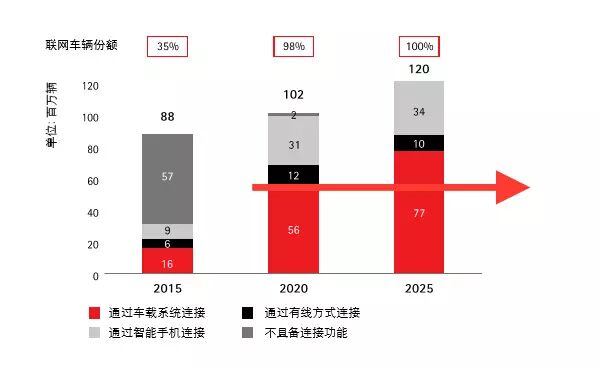

The development prospects are indeed promising. Accenture predicts that by 2020, the market size for IoV services will reach $100 billion, and by 2025, it will grow to $500 billion. For the vehicles themselves, a fully connected car, if utilized to its full potential, can generate over $5,000 in additional value over its entire lifecycle. In this new ecosystem, how to meet customers’ potential needs is key to whether automakers can dominate the market.

First, automakers need to identify and assess potential sources of value.

▲ Potential value analysis in the IoV environment (based on a single vehicle lifecycle)

Hardware

As the most important vehicle hardware facility, the vehicle central control system is crucial for vehicle connectivity. Currently, this device still has a certain premium price. However, due to competition from handheld devices, price pressure is increasingly evident, and a downward trend is inevitable. To maintain the competitiveness of the vehicle central control system, manufacturers are striving to add various functions to it. However, as handheld devices become increasingly intelligent, the vehicle central control system is becoming more like a simple display system, merely serving as a medium for information output from handheld devices inside the vehicle. The effectiveness of this strategy will also be increasingly impacted.

Conversely, automakers should gradually lower the price of their onboard central control systems, making it easier for customers to select various connected extension services. Although this may seem like a loss, over time, it will bring more sources of value to the company.

Service Fees

As automakers further enhance existing service products to attract more customers, their revenue will significantly increase. At the same time, this will help automakers break free from retail intermediaries and establish direct connections with end customers, gaining valuable business insights by understanding customer usage habits, which will help companies formulate marketing strategies.

Third-Party Collaboration

The increasingly integrated IoV ecosystem will create new business models and revenue sources. Providing relevant customer data to external business partners for a fee will be a highly valuable business. For example, based on the automaker’s remote information processing platform, insurance companies can continuously monitor real-time driving data of customers, analyzing and assessing their driving styles to offer personalized insurance products based on this pricing standard.

Data Monetization

Data obtained from connected vehicles helps understand consumers’ driving habits, which in turn provides valuable insights for automotive product development or various marketing strategies, effectively supplementing or even replacing specialized market research to some extent. Additionally, statistical data can be referenced by external partners to help them formulate strategies in some business operations related to traffic or driving habits. For example, retailers can determine the best locations for new stores based on customer traffic patterns.

Cross-Selling

Automakers have recognized that there is great potential in the IoV data for providing various extension services, especially after-sales services. In fact, many of the latest models can predict vehicle maintenance needs and send relevant information to the user’s preferred maintenance shop for appointment scheduling, resulting in significant after-sales benefits. However, using this data requires prior consent from customers. Currently, automakers are striving to implement various incentives to encourage customers to allow manufacturers to utilize this data.

Upselling Vehicles

Emphasizing the independence of certain IoV functions is a rather innovative concept. Advanced connected navigation functions are a good example. This function should be separated from the IoV system to avoid confusion with the free features provided by the vehicle central control system. Instead, separate positioning and pricing will help realize its true value.

Remote Upgrades

Historically, automakers have been reluctant to fully utilize IoV for updating or upgrading sold vehicles. We believe this situation will change in the future, and the development prospects are very promising. Free upgrades will add new features to vehicles just like paid upgrades.

Because the aforementioned sources of value are interdependent, automakers should avoid going all out in every aspect. Instead, they should focus on the vehicles themselves, leveraging user data to ultimately create a data-driven business model. This will help prevent tech giants from indirectly obtaining users’ driving data through various handheld devices and applications.

Readjusting Operational Models

Automakers need to readjust their operational models from the perspectives of business, information technology, and the openness of the entire ecosystem to maximize the value obtained from IoV solutions.

From a structural perspective, automakers should ensure that their IoV business has a high degree of flexibility to respond to rapidly changing market trends; experiment in multiple areas to assess market potential; and collaborate with relevant third parties to design and develop new services and products. To this end, automakers can establish dedicated small departments, prioritize them strategically, and develop corresponding capabilities. From a broader perspective, actively integrate to ensure that IoV development becomes a strategic focus at the corporate level, providing various products and services that fit local markets.

In terms of specific implementation, especially in software development, companies need to possess new skills to continuously innovate and manage end-customer relationships. In the face of increasingly shortened technology innovation cycles and consumers’ deepening expectations for product innovation, companies need to introduce lean and efficient process management and invest heavily in open innovation.

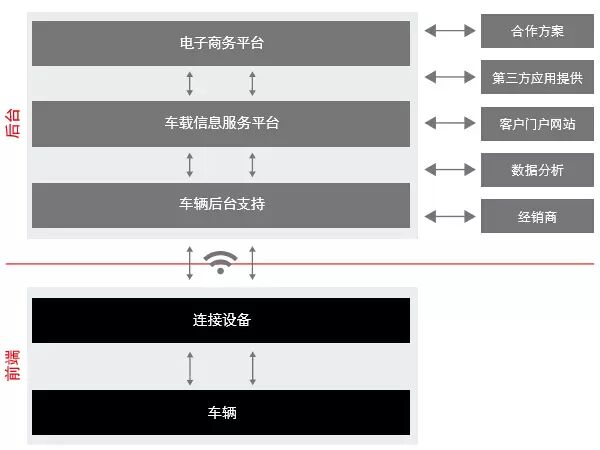

Finally, from a technical perspective, only with an open technology architecture that has standard APIs can seamless integration with third-party applications and services be achieved. Additionally, the application of big data, data analytics, and cloud technology is crucial for the formation of data-driven services.

▲ An open technology architecture is a necessary access point for the connected ecosystem

Embracing the Future

There is no doubt that IoV will fundamentally change the rules of the game in the automotive industry. As a key part of the smart living strategy, tech giants have clearly recognized this. How should automakers take effective measures to defend their existing positions?

Management needs to realize that to seize IoV opportunities and achieve corporate value, they cannot be limited to vehicle R&D alone. The new landscape requires new business models; companies must make profound changes in strategy, thinking, culture, and operations to succeed in the future IoV market.

Recommended

Recommended

【Beijing Auto Show】 Special:

Click the image or text below to read

At the Beijing Auto Show, the barbarians have finally entered the house.

What “small step” has autonomous driving taken at the Beijing Auto Show?

Why did IoV products collectively “fall silent” at the Beijing Auto Show?

Why did IoV products collectively “fall silent” at the Beijing Auto Show?

Leave your sharp comments in the comment section

Add WeChatcheyunjun2015 as a friend,

Interact with Cheyun Jun up close!

Scan the QR code below to get more exciting content from “Cheyun”