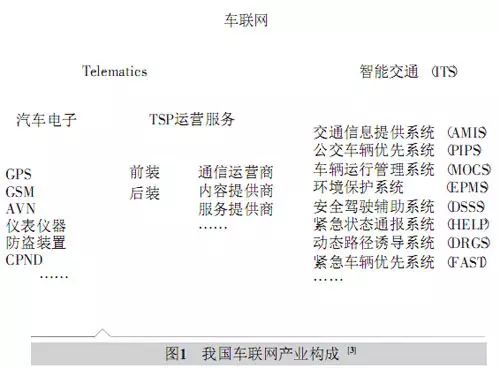

The Internet of Vehicles refers to a large system network based on in-vehicle networks, inter-vehicle networks, and vehicle-mounted mobile internet, which conducts wireless communication and information exchange between vehicles, roads, pedestrians, and the internet according to agreed communication protocols and data exchange standards. It enables intelligent traffic management, intelligent dynamic information services, and intelligent vehicle control, representing a typical application of Internet of Things technology in the transportation system.

Telematics, or vehicle-mounted information service systems, refers to a service system that integrates users with various service resources through the vehicle’s front-end system, representing a narrower definition of the Internet of Vehicles. The Internet of Vehicles not only includes Telematics but also encompasses intelligent transportation systems.

2009 marked the inaugural year of the Internet of Vehicles in China, with domestic companies such as Haobangshou and Chengjitong successively launching Internet of Vehicles products. Foreign brands like G-Book and Onstar were also introduced to China. Prior to 2009, only isolated Telematics services existed in China, such as in-vehicle navigation and roadside assistance, which were the precursors to Telematics services.

In March 2009, the imported Lexus RX350 equipped with the G-Book system was launched in the Chinese market, marking the official introduction of Telematics systems in China. In November of the same year, General Motors launched OnStar in the Cadillac SLS, ending G-Book’s monopoly in China. The domestic brand SAIC Roewe also launched the Roewe 350 equipped with Inkanet in April 2010. Besides these three pioneering Chinese Internet of Vehicles brands, other automotive companies also began to offer Internet of Vehicles services.

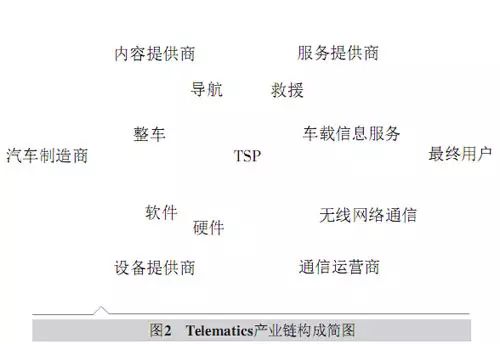

Automakers

As the carriers of Telematics, automakers hold the most significant power in the industry chain, possessing considerable influence and authority, allowing them to effectively integrate many resources and have a substantial advantage in developing Telematics. However, due to competition among manufacturers, the Telematics services provided are limited to their own brands, making them incompatible with each other. Additionally, the Telematics offered by various automakers is generally priced high and can only be bundled with their own brand vehicles, limiting the customer base and affecting promotion in the aftermarket.

TSP

TSP, or Telematics Service Provider, directly serves users in the industry chain, providing navigation, remote diagnostics and control, entertainment information, dealer activities, and other services. TSP occupies a core position in the entire industry chain, integrating and regulating service content upstream, while providing services in two ways downstream: as a “white-label” service provider determined by the automaker, or under TSP’s own brand. Besides integrating resources and providing services, TSP also undertakes the tasks of collecting fees and distributing profits.

Telecommunications Operators

The three major telecommunications operators in China—China Mobile, China Unicom, and China Telecom—have all participated in the Internet of Vehicles as network channel providers since its inception. The role of telecommunications operators in the industry chain is to relay user requests through the network to TSPs and call centers, and then feedback the results to users, thus becoming the channel for transmitting information between the vehicle-mounted terminal and TSP. Therefore, it is evident that telecommunications operators are naturally participants in the Telematics industry chain.

Content and Service Providers

Content providers supply TSPs with news, weather, real-time traffic information, etc., providing content support. The content provided by China’s content providers tends to be homogeneous, with little differentiation in user experience, and there are still very few services targeted at private users. Service providers refer to those companies that offer navigation, emergency rescue, insurance, booking services, etc., providing service support to TSPs. Currently, the Telematics services available in China cover security, navigation, and entertainment information, similar to those provided abroad.

Device Providers

Device providers supply the equipment necessary for the implementation of the entire Telematics service, primarily categorized into hardware and software. Hardware mainly refers to vehicle-mounted terminal devices, while software includes positioning software and system software, among others. Front-end terminal equipment providers must integrate and install relevant system software, positioning software, sensing chips, GPS modules, and other electronic components according to the design plans provided by automakers to produce dedicated vehicle-mounted terminals.

Four Major Business Models of the Internet of Vehicles

From the previous analysis, it is clear that TSP occupies a dominant position in the entire industry chain. Therefore, based on the operators, the business models of the Internet of Vehicles can be divided into four categories, combining existing business models in both domestic and international fields.

1. Automaker-Led

In the automaker-led model, automakers actively become or control TSPs to provide Telematics services for their own brands. The revenue along the entire industry chain comes not only from the fees paid by users for purchasing terminal devices and subscribing to service packages but also from the profits shared through cooperation with third parties; advertising revenue from new media platforms targeting the preferences and needs of vehicle owners regarding dining, entertainment, and leisure; and income from life service hotspots based on vehicle owner interaction and interest point sharing/ranking, along with the introduction of hotspot CP/SP resources. In this business model, the revenue is distributed by TSP, which is the automaker, who incurs substantial initial investment and holds the highest share of revenue.

Based on the current situation in China’s Internet of Vehicles market, the automaker-led business model can be specifically divided into three types: control outsourcing model, equity joint venture model, and self-operated model.

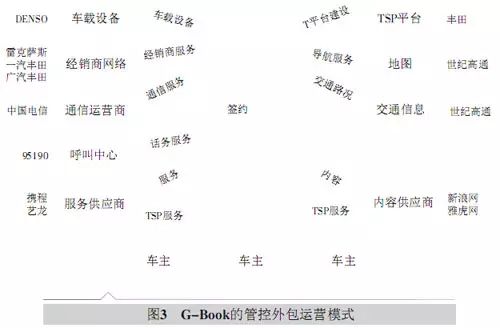

1. Control Outsourcing

The control outsourcing model is the primary model currently adopted by domestic automakers, who choose and control important resources and partners. G-Book is a representative brand under the control outsourcing model.

The advantage of this model is that automakers primarily manage and control TSPs, allowing them to direct business directions; third-party TSPs possess professional teams, operational management experience, and complete operational qualifications and sound management processes, enabling them to quickly understand, digest, and execute the automakers’ requirements, allowing automakers to enter the Internet of Vehicles industry swiftly. Moreover, TSPs can customize personalized solutions for automakers, and the operational model is flexible and easily changeable, introducing competition mechanisms that can enhance operational efficiency.

However, as third-party operators, automakers are reluctant to rely heavily on TSPs, making deep cooperation challenging in the early stages. Furthermore, once automakers wish to operate Internet of Vehicles businesses independently, the replacement costs are relatively high.

2. Equity Joint Venture

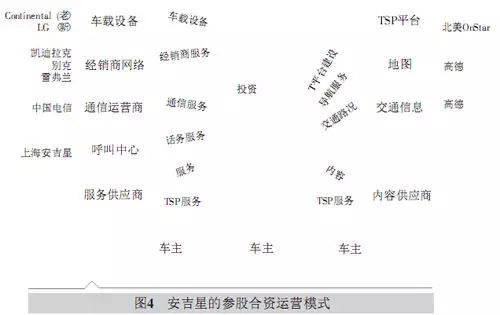

The most representative example of this model is Onstar. In the joint venture model, TSP is often a subsidiary controlled by the automaker, with considerable operational independence, but the joint venture company often does not align strategically with the automaker, focusing more on renewal and profitability, while the automaker emphasizes customer service.

The advantage of this model is that automakers can share investments and risks with the joint venture company, drawing on each other’s operational resources, experience, and management talent, thus sharing resources. Moreover, automakers bear limited operational risks, can obtain operational profits, and can create an independent Telematics service brand.

However, establishing a joint venture company requires lengthy negotiations, leading to extended timelines for the implementation of Telematics services. Once the operational model is determined, it is not easily changeable, and it lacks flexibility. Additionally, management is complex, and there are risks of conflicting interests and disagreements.

3. Self-Operated by Automakers

The Telematics brand CARWINGS provided by Dongfeng Nissan represents the self-operated model. The advantages of this model are evident, as TSP can fully execute the automaker’s strategy, allowing the automaker to have complete control over TSP’s operations, ensuring smooth internal communication and coordination, enabling timely problem resolution, and allowing for prompt responses to customer personalization needs.

However, the disadvantages of this model are also apparent. First, automakers lack experience in building and subsequently operating Telematics services, needing to communicate with multiple partners, leading to high management costs. Second, the initial investment scale is enormous, requiring the establishment of T service platforms, call centers, and new dedicated departments, which takes a long time to set up, and substantial cost inputs are required during the operational period. Finally, as TSP is managed as an internal department, independent innovation is relatively difficult, and changes to the business model cannot be made in the short term.

2. Telecommunications Operator-Led

The telecommunications operator-led business model primarily appears in the aftermarket. In this model, telecommunications operators become TSPs, independently developing the entire system related to Internet of Vehicles services, including building the Telematics service operation platform, planning service functions, procuring and outsourcing content, and formulating sales strategies, pricing, and charging—all operational activities. In this business model, the sources of revenue are similar to those in the automaker-led model. All income is distributed by telecommunications operators based on costs and the profit contribution rates of the participants, with telecommunications operators making the largest investment and holding the highest share of revenue.

The advantage of telecommunications operators as TSPs lies in their substantial network platform advantages, rich operational service experience, and existing large-scale call centers, providing a solid foundation for the development of Telematics business. As TSPs, telecommunications operators can also escape the constraints of automotive brands and offer compatibility with different vehicle-mounted terminals, broadening user choices.

However, the main challenge faced by telecommunications operators is their limited understanding of the automotive industry, lacking market channels within the automotive sector, making it difficult to accurately grasp the needs of automotive consumers, which may pose challenges in market promotion. Moreover, in product design, telecommunications operators overly rely on mobile communication networks, neglecting the comprehensive features of Telematics services.

In China, the three major operators are also attempting to enter this field. China Mobile has launched products such as the He Ping tablet and He He router, while China Unicom has introduced intelligent rearview mirror products for the Internet of Vehicles. In South Korea, SK Telecom launched the NateDrive aftermarket service early in the development of the Telematics industry, dominating the market.

3. Collaboration Between Automakers and Telecommunications Operators

Both automakers and telecommunications operators have their advantages and disadvantages, giving rise to a complementary cooperation model. In this model, telecommunications operators not only provide network channels but also build the TSP platform, integrate resources, maintain the network, operate the call center, and collect fees. Automakers provide the carrier, design personalized service functions, and are responsible for marketing and business promotion. The revenue along the entire industry chain comes from users purchasing terminal devices, paying service fees and traffic fees, platform advertising revenue, and third-party application sharing. In this model, telecommunications operators invest more and contribute more, making them the core of this business model; thus, fees are collected by telecommunications operators, which are then distributed to device providers and content and service providers, followed by secondary distribution of income based on previously agreed profit-sharing terms with automakers.

The advantages of this model include that automakers have a better understanding of user needs, allowing them to design Internet of Vehicles products that meet those needs, and they possess established market channels and years of marketing experience. Telecommunications operators generally have their own call centers, significantly reducing operational costs. The downside is that TSPs are inevitably influenced by automakers, limiting the models for providing Telematics services to those of the automaker’s own brand, primarily targeting the front-end market.

In China, the three major telecommunications operators have all partnered with automakers: China Telecom has built a TSP platform, integrating various resources to provide 3G real-time intelligent services for Huatai Automobile; China Mobile has collaborated with Changan Automobile to jointly develop vehicle communication modules; while China Unicom has launched the “CUTP” architecture for the Internet of Vehicles and partnered with BMW to introduce connected driving services.

4. Third-Party Dominated Independently of Both

The third-party dominated model, independent of both automakers and telecommunications operators, is commonly seen in the aftermarket. Third-party companies independently build service platforms and call centers, select service and content providers, and create marketing plans, providing users with a complete set of Internet of Vehicles services through OBD devices and mobile apps.

Due to the open nature of the universal OBD interface, vehicles of different brands can use Internet of Vehicles services provided by independent TSPs, thus not being restricted by automotive brands and models. With independent operations, all revenue flows directly to TSPs, including income from device sales, service fees, traffic fees, advertising revenue, and third-party application sharing income. Subsequently, independent TSPs allocate profits to device providers, content and service providers, and telecommunications operators.

The advantages of this model include that independent TSPs have a high degree of autonomy and can more accurately grasp user needs based on their direct contact with users. However, the disadvantages are equally evident: independent third-party TSPs must have strong financial backing to build platforms and call centers, as well as high operational capabilities. Furthermore, they need to develop and sell Internet of Vehicles products independently, meaning this model demands a lot from companies and is not the mainstream model in the current Internet of Vehicles landscape.

Despite this, third-party companies in China are reluctant to give up on the lucrative Internet of Vehicles market, with products or services such as Seg Navigation’s Seg Car Saint, Cheyin Network’s Yujia Drivo, Siwei Tuxin’s Qujia, and 95190’s Zhijia emerging under this model.

Conclusion:

The Internet of Vehicles industry in China is still in its early stages of development, and the business models remain unclear. Collaboration among various enterprises is needed to explore sustainable development models. When choosing a business model, enterprises must conduct rational analysis and judgment based on their own circumstances to promote the development of China’s Internet of Vehicles industry.

Source: Automotive Industry Research Institute

====================================

Hosted by:Changan Automobile – Management Innovation and IT Center

Share this article:Click the button in the upper right corner of the screen to share this article with your friends!

Follow us:

Please click “Internet Innovation Research” below the article title

or click the button in the upper right corner to select “View Public Account” or “View Official Account”

or search for the WeChat public account “Internet Innovation Research”!