Recently, Japan’s semiconductor giant #Renesas Electronics announced the dissolution of its silicon carbide (SiC) team and the cancellation of its planned mass production of SiC power semiconductors originally scheduled for early 2025. This news has stirred significant waves in the semiconductor industry.

According to various sources, Renesas is currently preparing to sell its new SiC equipment located at its Takasaki factory in Gunma Prefecture, which may revert to traditional silicon-based markets, maintain some small-scale SiC design lines, and prepare for the research and production of future gallium nitride (GaN) devices.

This move by Renesas is not just an internal adjustment but also a reflection of the current changes in the global electric vehicle market, intensified competition in the SiC industry, and the rise of Chinese semiconductor companies.

01

Multiple Impacts on the SiC Market: Weak Demand, Price Collapse, and Supply Chain Dilemmas

Renesas had high hopes for SiC; as early as July 2023, it signed a 10-year SiC wafer supply agreement with global SiC wafer leader Wolfspeed, paying a $2 billion advance to secure a long-term, stable, and high-quality supply of SiC wafers starting in 2025, aiming to advance its SiC power semiconductor roadmap and expand applications in automotive, industrial, and energy sectors. However, just over a year later, Renesas announced the abandonment of its SiC production plans and the dissolution of the related team, which is attributed to various reasons.

Weak Market Demand and Slowing Growth

Weak Market Demand and Slowing Growth

Firstly, the slowdown in the global electric vehicle (EV) market directly impacts the demand for SiC. SiC power semiconductors are core components of electric vehicle drive systems, and their market performance is closely tied to EV sales. According to the latest research from TrendForce, the shipment growth of SiC substrates has significantly slowed due to weakened demand in the automotive and industrial sectors in 2024. Looking ahead to 2025, the SiC substrate market still faces severe challenges from weak demand.Additionally, market reports indicate that one significant reason for this weakness is the end of EV subsidy funds in Europe. Many European countries previously provided purchase subsidies to stimulate EV consumption, which are now gradually being canceled or reduced, directly leading to lower-than-expected sales growth for electric vehicles, which in turn affects the upstream SiC supply chain, resulting in reduced orders.

Intense Competition Leading to Price Collapse

Intense Competition Leading to Price Collapse

Secondly, the competition in the SiC market is exceptionally fierce, with product prices experiencing a “collapse.” As numerous manufacturers enter the SiC field, production capacity is gradually released, but demand growth has not kept pace, leading to an oversupply in the market. According to supply chain reports, focusing on the Chinese market, the price of 6-inch SiC substrate wafers has dropped below $400, nearing the production cost line.

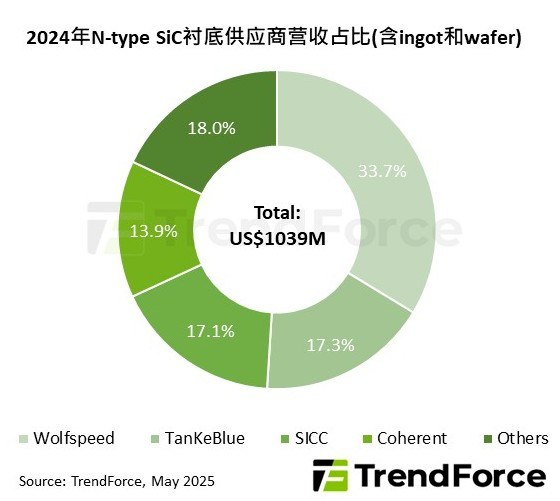

Overall, the combined effects of weak demand and price wars have directly impacted the revenue of the SiC industry. According to TrendForce data, due to intensified market competition and significant price declines, the global revenue of N-type (conductive type) SiC substrate industry is expected to decline by 9% year-on-year in 2024, dropping to $1.04 billion.

Concerns Heightened by Partners and Peers’ DilemmasMoreover, the plight of several peers and partners has intensified Renesas Electronics’ concerns about the SiC market. Recently, Wolfspeed, Renesas’ strategic partner with whom it signed a 10-year SiC wafer supply agreement, has been reported to consider filing for Chapter 11 bankruptcy protection in the U.S. In a document submitted to the U.S. Securities and Exchange Commission (SEC) in early May 2025, Wolfspeed acknowledged “significant doubts” about its ability to continue as a going concern. As a core upstream supplier, Wolfspeed’s uncertainty undoubtedly poses a significant supply chain risk to Renesas’ SiC production plans, and its $2 billion advance payment is also at risk of potential loss.

Concerns Heightened by Partners and Peers’ DilemmasMoreover, the plight of several peers and partners has intensified Renesas Electronics’ concerns about the SiC market. Recently, Wolfspeed, Renesas’ strategic partner with whom it signed a 10-year SiC wafer supply agreement, has been reported to consider filing for Chapter 11 bankruptcy protection in the U.S. In a document submitted to the U.S. Securities and Exchange Commission (SEC) in early May 2025, Wolfspeed acknowledged “significant doubts” about its ability to continue as a going concern. As a core upstream supplier, Wolfspeed’s uncertainty undoubtedly poses a significant supply chain risk to Renesas’ SiC production plans, and its $2 billion advance payment is also at risk of potential loss.

Furthermore, other major competitors are also under pressure. For instance, Japan’s ROHM has faced its first net loss in 12 years due to increased investments in SiC semiconductors, while STMicroelectronics’ stock price has been affected by fluctuations in the SiC market, and its revenue is expected to decline by 22.4% in the fourth quarter of 2024; Infineon’s revenue is expected to drop by 15% in the fourth quarter of 2024, although it shows some resilience in its outlook for the first quarter of 2025, the overall market demand (especially in the automotive sector) remains a pressure on its performance. Infineon has also postponed its expansion plans for its SiC factory in Kulim, Malaysia, due to uncertainties in market demand.

02

Renesas’ Strategic Choice: Potential Exit from Production, but Not the Market

The competition in the SiC market is exceptionally fierce. According to TrendForce research, from the current SiC power semiconductor market landscape, while companies like STMicroelectronics, Infineon, ON Semiconductor, Wolfspeed, ROHM, and Bosch remain in leading positions, Chinese manufacturers have been catching up rapidly, with companies like Chipone and Sanan Optoelectronics now in the top ten market share.

It is reported that while Renesas has abandoned internal production of SiC chips, it does not intend to completely exit the SiC market. On the contrary, it may continue to develop its own SiC designs and outsource manufacturing to foundries, then sell the finished products under its own brand (Compound Semiconductor News, TrendForce). This strategy of “exiting production but not exiting the market” is more complex than a simple abandonment and aligns with the flexible strategies that large semiconductor companies typically adopt when facing market challenges.Although Renesas has not yet issued an official statement regarding the dissolution of the SiC team, the views of its executives on market prospects, the dilemmas of supply chain partners, and the severe competition and demand slowdown in the current SiC market all constitute sufficient signs and reasons for this strategic adjustment.

03

Renesas Electronics Shifts to Gallium Nitride (GaN), Seeking New Growth Points?

Meanwhile, Renesas Electronics is actively laying out in the gallium nitride (GaN) field, which may signal its search for new growth points in the power semiconductor sector and a rebalancing of its technology roadmap. On April 16, Renesas reached a strategic agreement with Polar Semiconductor to obtain authorization for its D-MODE silicon-based GaN (GaN-on-Si) technology. According to the agreement, Polar will produce 650V high-voltage silicon-based GaN devices for Renesas and other customers at its automotive-grade production facility in Minnesota. Both parties will jointly promote the commercialization of GaN devices, focusing on key areas such as automotive electronics, data centers, industrial energy, consumer electronics, and aerospace and defense.

Image Source: Screenshot from Polar Semiconductor’s official website

It is reported that Polar Semiconductor is the only commercial foundry in the U.S. specializing in sensors, power supplies, and high-voltage semiconductors. Its expansion plan (monthly capacity will increase from 20,000 wafers to nearly 40,000 wafers) and funding support from the U.S. CHIPS and Science Act will provide Renesas with reliable GaN foundry capabilities.

Notably, Renesas fully acquired the globally leading GaN device manufacturer Transphorm for 2.4 billion RMB at the beginning of 2024. Through this acquisition, Renesas obtained the technical assets of Transphorm’s AFSW wafer fab located in Aizuwakamatsu, Japan, which means Renesas will have internal production capabilities for GaN chips, with its GaN products primarily produced at this facility.

TrendForce Compound Semiconductor Overview

About TrendForce

TrendForce is a global high-tech industry research organization, with research areas covering memory, AI servers, integrated circuits and semiconductors, wafer foundries, display panels, LEDs, AR/VR, new energy (including solar photovoltaics, energy storage, and batteries), AI robotics, and automotive technology. With years of in-depth research, TrendForce is committed to providing forward-looking industry research reports, industry analysis, project planning assessments, corporate strategy consulting, and brand integration marketing services, making it a trusted decision-making partner in the high-tech field.