According to Nikkei Asia, Japanese semiconductor giant Renesas Electronics has officially abandoned its mass production plan for silicon carbide (SiC) power semiconductors. The construction of the production line, which was scheduled to start in early 2025 at the Takasaki plant in Gunma Prefecture, has been completely terminated, and the related production team was disbanded earlier this year..

$2 Billion Supply Chain Agreement Collapses

Wolfspeed Bankruptcy Crisis Triggers the Collapse

Renesas’s SiC strategy heavily relied on wafer supply from the American supplier Wolfspeed. In July 2023, the two parties signed a ten-year agreement worth $2 billion, with Renesas prepaying to secure the supply of 150mm and 200mm silicon carbide wafers, planning to achieve mass production starting in 2025. However, Wolfspeed is on the brink of bankruptcy due to a debt crisis, and the construction of its 8-inch wafer plant in North Carolina has stalled due to the lack of subsidies from the U.S. CHIPS Act, failing to fulfill its promise to supply Renesas with 200mm wafers. As of June 2025, Wolfspeed’s stock price had fallen to $1.21, with a market value of less than $200 million and debts reaching $6.5 billion, preparing for bankruptcy restructuring.

This sudden change directly threatens Renesas’s financial security. If Wolfspeed enters bankruptcy proceedings, the $2 billion deposit prepaid by Renesas may not be recoverable, resulting in potential impairment losses. More seriously, Renesas’s original plan to optimize costs through Wolfspeed’s technology has been cut off—the expansion of 200mm wafer capacity has stalled, preventing it from reducing chip prices through economies of scale, putting it at a disadvantage in competition with Chinese manufacturers.

Price Wars with Chinese Manufacturers and

Dual Pressure from Shrinking Market Demand

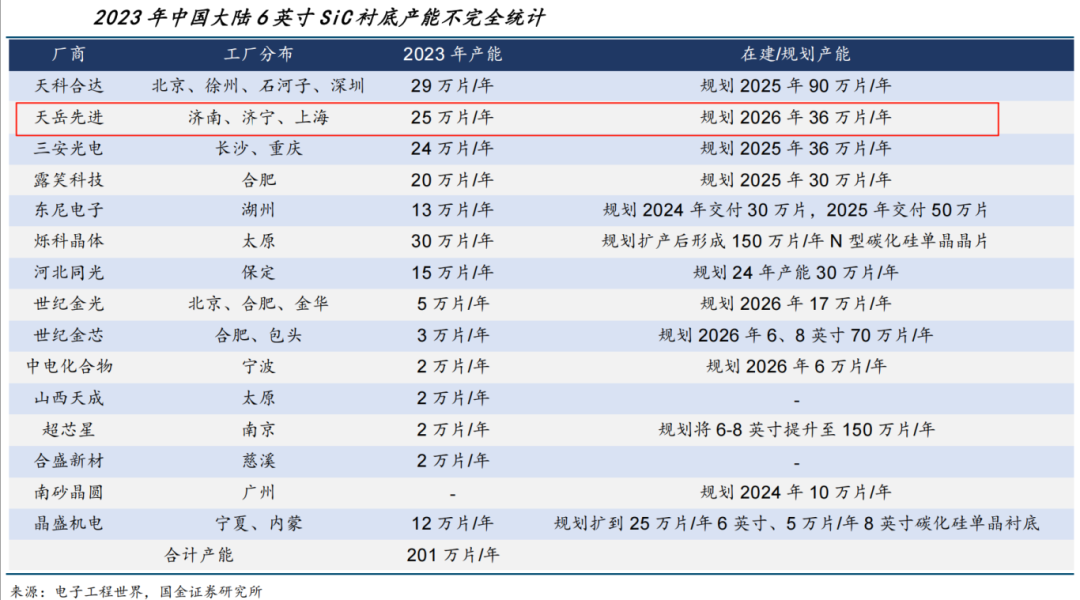

In addition to the supply chain crisis, the deterioration of the global SiC market environment has become the last straw for Renesas.In 2024, Chinese SiC substrate manufacturers such as Tianjiao and Tianyue Advanced will leverage cost advantages to reduce the price of 6-inch wafers from $1,500 to $500. Chinese manufacturers hold 35% of the global SiC substrate market share, with Tianjiao ranking second with a 17.3% market share, closely followed by Tianyue Advanced at 17.1%. Meanwhile, Chinese automakers are accelerating domestic substitution, with companies like BYD achieving cost control through self-produced SiC wafers, while Renesas’s ability to withstand risks is approaching zero due to reliance on external supply chains.

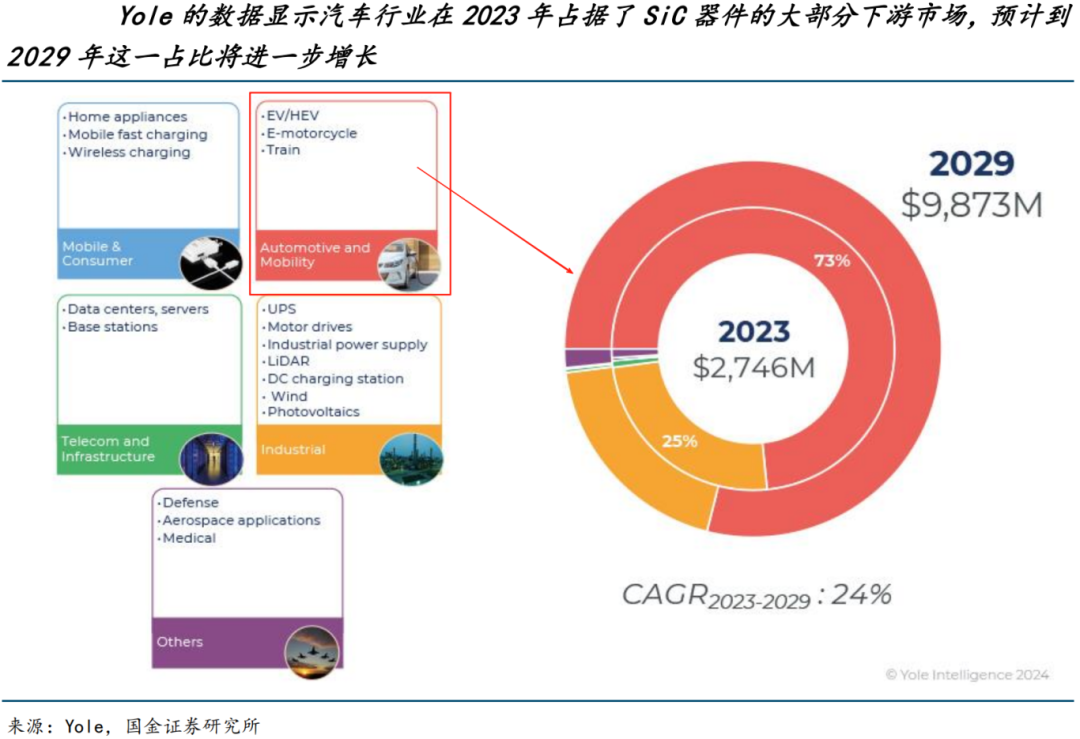

Market demand is also weak. Due to the decline in European electric vehicle subsidies, the global SiC power semiconductor market is expected to grow only 18% to 391 billion yen (approximately $2.69 billion) in 2024, far below the initial forecast of 27% growth. Germany, the largest automotive market in Europe, ended subsidies early at the end of 2023, directly leading to a slowdown in electric vehicle sales in the region, while the low-price strategy of Chinese manufacturers further squeezed Renesas’s market space.

Strategic Contraction and Industry Chain Reaction

Renesas’s exit is not an isolated case but a microcosm of the global SiC industry reshuffle. Japanese peer Rohm has reported its first net loss in 12 years for the fiscal year ending March 2024 due to increased SiC investments; Swiss STMicroelectronics has seen its stock price plummet over 50% since 2024; and American Wolfspeed is facing bankruptcy restructuring. Meanwhile, Chinese manufacturers are accelerating their market capture, with companies like Tianjiao and Tianyue Advanced achieving small batch shipments of 8-inch silicon carbide wafers, with yield rates exceeding 97%, and passing automotive-grade certification.

Renesas’s strategic adjustment also reflects its financial pressure. In the first quarter of 2025, the company’s sales fell 12.2% year-on-year to 308.8 billion yen, and operating profit decreased by 26.2% to 83.8 billion yen, with the capacity utilization rate of the Takasaki plant plummeting to 30%. Against this backdrop, Renesas announced it would concentrate resources on silicon-based power devices, such as IGBTs and other traditional advantageous areas, to cope with market uncertainties.

Vertical Integration and Technological BreakthroughsAre Key to Survival

The current SiC market presents a “stronger gets stronger” pattern. Companies with vertical integration capabilities (IDM model) and binding relationships with leading automotive companies are more competitive. For example, BYD achieves cost control through self-produced wafers, while Chinese manufacturer Changfei Advanced’s 6-inch silicon carbide wafers have entered the main supply chain for new energy vehicles. In contrast, companies like Renesas, which rely on external supply chains, are gradually losing their advantages in price wars and technological iterations.

In the future, competition in the SiC market will revolve around the mass production of 8-inch wafers and breakthroughs in automotive-grade technology. Chinese manufacturers’ advantages in cost and capacity may further expand, while European and American companies need to reshape their competitiveness through technological innovation and policy support. Renesas’s exit is not just a case but a footnote to the global semiconductor industry’s power shift.

Some materials sourced from: relevant online media, Guojin Securities

Integration: Optoelectronic Link. If the integrated content involves copyright issues, please contact us, and we will take appropriate measures in a timely manner.

Recommended Reading

· The largest domestic silicon carbide wafer factory officially starts production in Wuhan

· Foreign media: The U.S. has effectively cut off some semiconductor technology exports to China

· U.S. think tank: 25% chip tariffs could cost the U.S. $1.4 trillion in GDP loss over the next decade

· AMD’s new move in AI! Acquires silicon photonics startup Enosemi

· Germany achieves ultra-fast single-photon control for the first time, marking a significant breakthrough in quantum information processing