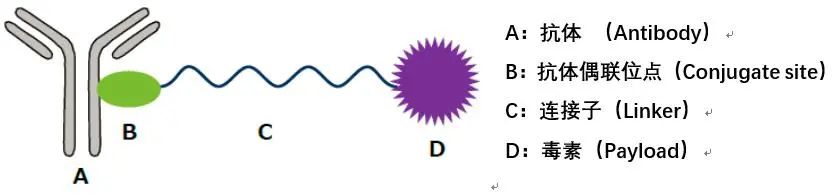

Antibody-drug conjugates (ADC) are also known as “biological missiles”. They connect cytotoxic drugs similar to chemotherapy with monoclonal antibodies, consisting of three parts: antibodies, linkers, and payloads (small molecule cytotoxic drugs). This combination achieves the dual advantages of small molecules and antibody drugs, enabling targeted killing of tumors and other diseases.

Antibody-drug conjugates (ADC) are also known as “biological missiles”. They connect cytotoxic drugs similar to chemotherapy with monoclonal antibodies, consisting of three parts: antibodies, linkers, and payloads (small molecule cytotoxic drugs). This combination achieves the dual advantages of small molecules and antibody drugs, enabling targeted killing of tumors and other diseases.

In recent years, global ADC drug research and investment have been rapidly increasing. With advancements in technology, ADCs have not only achieved structural breakthroughs from the classic antibody + linker + small molecule toxin model but have also expanded their therapeutic areas from tumors to other innovative fields such as autoimmune diseases. In March 2023, Pfizer announced plans to acquire ADC industry leader Seagen for $43 billion, marking a new landscape for the global ADC drug market.

Approved ADC Drugs

As of March 2023, a total of 15 ADC drugs have been approved globally (Table 1), with 8 ADC products approved in China. Among them, products launched after 2019 account for two-thirds of the total. The diseases targeted are primarily tumors, involving lymphoma, leukemia, breast cancer, multiple myeloma, head and neck cancer, cervical cancer, and urothelial carcinoma. In terms of targets, HER2 is the most common (3 products), along with BCMA, CD19, CD22, CD30, CD79B, EGFR, FRα, Nectin-4, Tissue Factor (TF), and Trop-2. The most common effective payloads are microtubule inhibitor derivatives MMAE (Monomethyl auristatin E) and MMAF (Monomethyl auristatin F), with 6 ADC products (40% of the total), followed by 2 ADC products involving DM1 and DM4 derivatives and DNA cleaving agent calicheamicin.

Table 1: Details of Approved ADC Drugs Worldwide

Note: Dxd: Deruxtecan; PBD: Pyrrolobenzodiazepine; mDOR: Median Duration of Response; mOS: Median Overall Survival; PFS: Progression-Free Survival; IDFS: Invasive Disease-Free Survival; ORR: Objective Response Rate; CR: Complete Response; PR: Partial Response

*: Procedures have been initiated to revoke the US marketing authorization for Blenrep.

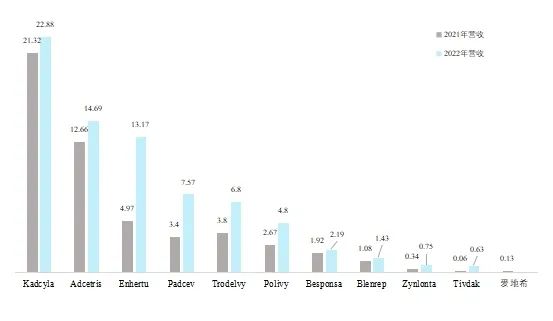

ADC Drug Market

The ADC drug market has significant growth potential. Most approved ADC drugs are for later-line therapies, and many have been approved for a short time, indicating that the market is still in the cultivation stage. As shown in Figure 1, the combined sales of the 11 ADC drugs on the market reached $5.25 billion in 2021, while the sales of 10 ADC drugs reported in 2022 reached $7.49 billion, showing significant growth. Roche’s Kadcyla leads the market with revenue of $2.288 billion in 2022, up 7% year-on-year, a decrease from the 16% growth of the previous year. Adcetris ranks second with total revenue of $1.469 billion, up 16% year-on-year. Enhertu’s revenue in 2022 was $1.317 billion, a 165% increase.

According to relevant reports, the global ADC drug market is expected to reach $10.4 billion and $20.7 billion in 2024 and 2030, respectively, with a compound annual growth rate of 30.6% from 2019 to 2024, and 12.0% from 2024 to 2030; the ADC drug market in China only emerged in 2020, but with continuous breakthroughs in ADC technology and expansion of research pipelines targeting a wider range of indications, the Chinese ADC treatment market is growing rapidly, with total market values expected to reach 7.4 billion and 29.2 billion RMB in 2024 and 2030, respectively, and a compound annual growth rate of 25.8% from 2024 to 2030.

Figure 1: Revenue of ADC Products in 2022 (in billions)

Data Source: Pharmaceutical Affairs, company-released financial reports

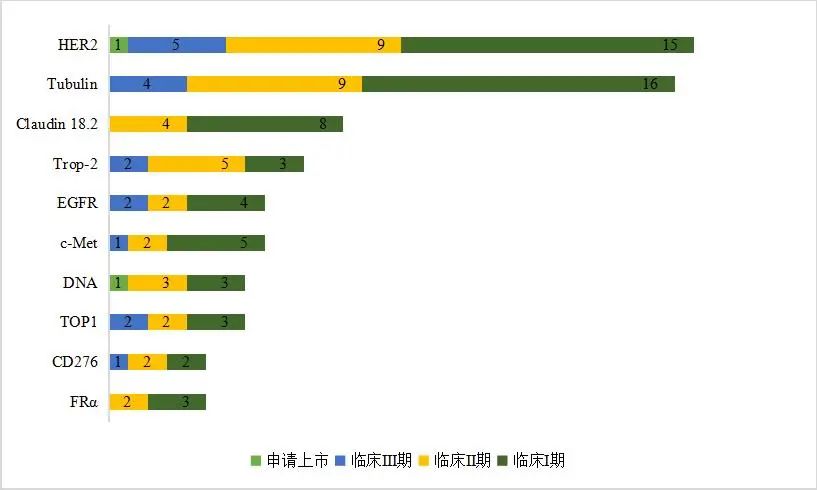

Clinical ADC Products Under Research

Currently, there are 179 products in clinical research, including 1 product applying for marketing authorization, 15 in clinical phase III, and 68 and 95 in clinical phases II and I, respectively. The disease areas with the highest research intensity remain tumors, including solid tumors and hematological malignancies, with other indications such as rheumatoid arthritis, musculoskeletal disorders, myopathies, muscular dystrophies, and COVID-19 also having products in clinical research.

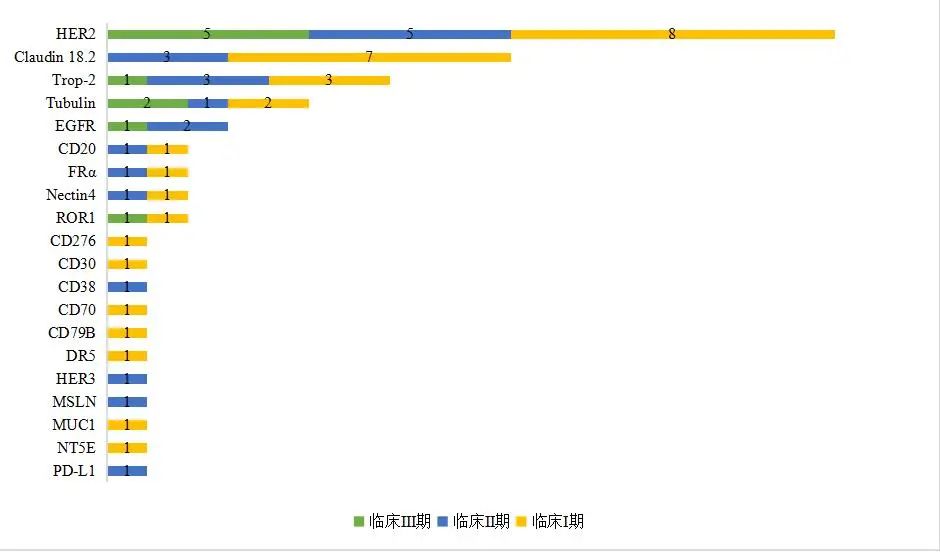

In terms of targets, some target tracks are becoming crowded, such as HER2 and Tubulin, and products entering the market will face fierce competition (Figure 2). In response, some ADC research companies have begun to pursue differentiated innovation, exploring novel targets. While many drugs are in research for these targets, none have successfully entered the market, such as Claudin 18.2 and c-Met.

Abnormal expression of Claudin 18.2 can lead to structural damage and functional impairment of epithelial and endothelial cells, playing a significant pathogenic role in the invasion and metastasis of various epithelial-derived tumors. About 70%–80% of gastric cancer patients and 60% of pancreatic cancer patients have positive expression of Claudin 18.2 in their tumor cells. This target is becoming a star target for solid tumors, following PD-1/PD-L1, with many pharmaceutical companies vying to develop it. Currently, ADC products targeting this marker are still in early clinical stages, with 8 in clinical phase I and 4 in phase II.

c-Met is a receptor tyrosine kinase that is abnormally expressed in various solid tumors. The fastest progress for this target is by AbbVie with Telisotuzumab vedotin, which is in phase III clinical trials for non-small cell lung cancer. Regeneron Pharmaceuticals’ REGN-5093-M114 and domestic company Rongchang Bio’s RC-108 are both in phase II clinical research.

Figure 2: Top 10 Targets of ADC Products Under Clinical Research Worldwide

Currently, there are 91 drugs in clinical research and marketing applications in China, with 66 of them being class 1 biological drugs submitted by domestic companies. There are 8 products in phase III, 21 in phase II, and 37 in phase I. The indications are primarily focused on tumors, with few other indications and high homogeneity.

Domestic companies’ R&D products mainly focus on HER2 and Claudin 18.2 (Figure 3), with more than 10 products in clinical research. Additionally, targets such as Trop-2, EGFR, CD20, Folr1, and Nectin4 are also being explored by companies.

Figure 3: Targets Involved in Clinical ADC Products Under Research by Domestic Enterprises

Future Development Trends

With continuous iteration and updates in technology, ADC drugs have entered a rapid development phase. Looking ahead, the ADC market is expected to maintain rapid growth, and the competitive landscape will become more intense. ADC drug development should start from clinical needs, focusing on differentiation, and seek breakthroughs in targets, antibodies, linkers, payloads, and conjugation methods to stand out in a crowded field.

Exploring new targets and expanding indications has become an important trend. Currently, the drugs approved globally and in China, as well as the research pipelines, are primarily concentrated on mature targets such as HER2 and B-cell-related receptors, leading to significant target homogenization competition. The launch of the blockbuster drug Enhertu has put immense pressure on the development of other HER2-targeted drugs globally, making the search for new targets a key focus for pharmaceutical companies. Although there are currently no ADC products on the market targeting Claudin 18.2 and c-Met, several products are undergoing clinical research, and breakthrough progress may be seen in the coming years. Furthermore, emerging target pipelines such as HER3 and SEZ6 already have products in clinical trials, such as the HER3-targeting Patritumab deruxtecan by Daiichi Sankyo, which has entered phase III for non-small cell lung cancer, and Sichuan BaiLi Pharmaceutical’s BL-B01D1 targeting solid tumors and urinary tract tumors currently in phase II research; AbbVie’s SC-011 targeting SEZ6 has entered phase I.

Bispecific ADC drugs are becoming a new exploration direction. Bispecific antibodies can more specifically target tumor cells, overcome resistance, and reduce side effects; they can also promote the synergistic endocytosis of two targets through cross-linking, improving the efficiency of toxin entry into tumor cells, and further inhibit tumor cell growth signals by reducing the expression of receptor proteins on the cell membrane for better therapeutic effects. The rapid development of bispecific antibody technology provides new directions for ADC drug development. Emd Serono Research & Development Institute’s M1231, BeiGene’s Zanidatamab zovodotin, Regeneron Pharmaceuticals’ REGN-5093-M114, Sichuan BaiLi Pharmaceutical’s BL-B01D1, and CanSino Biologics’ JSKN003 have all entered clinical research.

New ADC drugs have vast development potential. With the rise of PROTAC technology, degradation-antibody conjugates (DAC) have become a new research strategy. Although DAC is still in its infancy, many such entities have been created, demonstrating certain biological activity in vitro and/or in vivo. Various E3 ligase-binding PROTACs have been used in the generation of these conjugates, effectively degrading several well-differentiated target proteins. Additionally, many different novel linkers and monoclonal antibody conjugation methods have been employed to construct the described DAC.

[References]

1. Fu Z, Li S, Han S, et al. Antibody drug conjugate: the “biological missile” for targeted cancer therapy. Signal Transduct Target Ther, 2022, 7(1): 93.

2. Drug Database, Retrieval Date: March 23, 2023.

3. Pharmaceutical Research Network, Pharmaceutical Affairs, Pharmaceutical Chain Circle, Medical Magic Cube, Tong Xie Yi and other publicly available online resources.