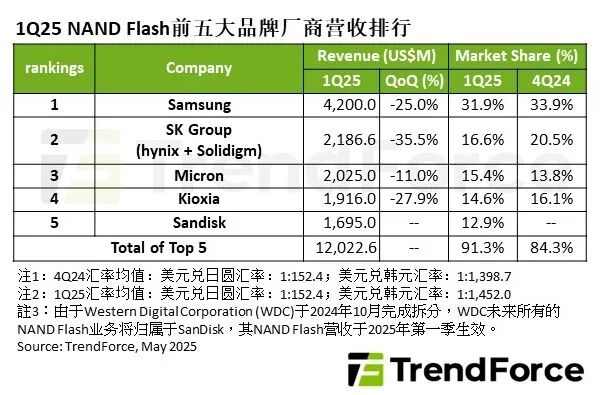

According to the latest research by TrendForce, in the first quarter of 2025, NAND Flash suppliers faced inventory pressure and a decline in end-user demand, resulting in an average selling price (ASP) decrease of 15% quarter-over-quarter and a 7% drop in shipment volume. Even though some product prices rebounded towards the end of the quarter, driving demand, the total revenue of the top five NAND Flash brands amounted to $12.02 billion, a nearly 24% decrease from the previous quarter.

Looking ahead to the revenue performance in the second quarter, as end buyers’ inventory gradually decreases to a healthy level, NAND Flash prices are expected to rebound. Additionally, changes in the international situation are prompting some manufacturers to actively increase orders, with an estimated revenue growth of 10% for the second quarter.

The revenue performance of major NAND Flash suppliers in the first quarter is as follows:

Samsung remains in first place, with revenue declining by about 25% to $4.2 billion due to reduced demand for Enterprise SSDs. However, the rebound in NAND Flash wafer prices in March is helping Samsung improve profitability, and with NVIDIA’s new products gradually being shipped, revenue is expected to recover quarter by quarter.

In second place, SK Group [including SK hynix and Solidigm] is the main supplier of high-capacity products for 2024, facing the seasonal effects of the first quarter of 2025 and challenges from customers’ 30TB SSD inventory that needs to be depleted, leading to declines in both shipment bits and ASP, with revenue falling to $2.19 billion.

Micron benefited from an increase in shipment bits in the first quarter, and despite a decrease in ASP, revenue still reached $2.03 billion, with a relatively small decline of about 11%, marking its first time ranking third in quarterly revenue.

Kioxia fell to fourth place, with revenue declining due to weak seasonal demand, resulting in decreases in both shipment bits and ASP, with first-quarter revenue at $1.92 billion.

SanDisk, after completing its spin-off from WDC, saw a slight decline in both shipment bits and ASP in the first quarter, with revenue reaching $1.7 billion. SanDisk plans to increase QLC product shipments and optimize profitability to support capital investments needed for future process upgrades, thereby strengthening long-term competitiveness.