This is the worst of times, yet also the most hopeful of times.

Source | Yuan Chuan Technology Review (ID: kechuangych)Author | Liu Rui, Deng YuImage Source | IC PhotoThe lithography machines are monopolized by the Dutch, polishing machines and ion implantation equipment are dominated by the Americans, and even in the semiconductor testing and packaging, where China excels, upstream equipment is also monopolized by the Germans.For twenty years, the mindset of “buying is better than making, and renting is better than buying” continued until we were caught off guard by supply chain disruptions, leading us to reflect: Is achieving independence in China’s semiconductor equipment really harder than building an atomic bomb?At least in the field of etching machines, this is not the case.Comparing it simply with the lithography machines: making chips involves carving the chip circuits from the mask onto the silicon wafer. Among them, the lithography machine is the pen that sketches the pattern, while the etching machine is the knife that carves on the wafer.Among various semiconductor equipment, the lithography machine is the most precise and the most expensive per unit; while the etching machine has become the main contributor to pushing Moore’s Law forward after the lithography machine encountered bottlenecks, and in recent years, it has become the largest market among all semiconductor equipment.

Since the 1970s and 1980s, this market has been monopolized by American Applied Materials, Lam Research, and Japan’s Tokyo Electron, controlling 80% of the market. Among them, high-end plasma etching machines have been under export control to China until 2015.The lifting of the blockade is mainly attributed to a company called Zhongwei Semiconductor, founded in 2004 by the 60-year-old Yin Zhiyao upon his return to China. In 2007, the first CCP etching equipment was successfully developed, and by 2015, the blockade on plasma etching machines was broken. The success of Zhongwei is actually based on a methodology for breaking through the semiconductor barriers that has been validated multiple times in China. Memories of Chip HardshipsMaking chips and equipment is a technology-driven industry, but it is also an experience-driven industry. A thousand Tsinghua graduates may not be as valuable as a craftsman with twenty years of experience working in Silicon Valley. Yin Zhiyao, who returned to China in 2004 to establish Zhongwei Semiconductor, is a typical representative.“I am a cancer patient, with only half a life left. Even if I risk this half, I want to produce lithography machines and plasma etching machines for the country. Let’s work together!”The speaker was Jiang Shangzhou, then Deputy Director of the Shanghai Economic Commission and head of the National Medium and Long-term Science and Technology Major Projects Group, who was also Yin Zhiyao’s junior at Beijing No. 4 High School. Around the time of the 2004 Shanghai World Semiconductor Equipment Exhibition, he used all his efforts to persuade his senior to return to China.

Memories of Chip HardshipsMaking chips and equipment is a technology-driven industry, but it is also an experience-driven industry. A thousand Tsinghua graduates may not be as valuable as a craftsman with twenty years of experience working in Silicon Valley. Yin Zhiyao, who returned to China in 2004 to establish Zhongwei Semiconductor, is a typical representative.“I am a cancer patient, with only half a life left. Even if I risk this half, I want to produce lithography machines and plasma etching machines for the country. Let’s work together!”The speaker was Jiang Shangzhou, then Deputy Director of the Shanghai Economic Commission and head of the National Medium and Long-term Science and Technology Major Projects Group, who was also Yin Zhiyao’s junior at Beijing No. 4 High School. Around the time of the 2004 Shanghai World Semiconductor Equipment Exhibition, he used all his efforts to persuade his senior to return to China.

His junior’s enthusiastic invitation left Yin Zhiyao in a dilemma: should he return to start a business as an elderly Chinese or retire honorably as a senior executive of an American giant? In his own words, “Starting a business is a one-way street; for someone like me who was already sixty when starting, I might die at my post.”But “not returning after studying abroad is like walking in the night without a light.”After more than twenty years of reform and opening up, China needed a thorough upgrade of its high-end manufacturing industry.Experienced overseas Chinese engineers and executives were the leaders in this wave.In the historical article “The Bitter Memories of Chinese Chips,” we have summarized: SMIC was established in 2000; Spreadtrum was established in 2001; Goodix Technology was established in 2002; Huawei HiSilicon was established in 2004; Montage Technology was established in 2004; GigaDevice was established in 2004; Zhongwei Semiconductor was established in 2004…Among them, SMIC’s founder Zhang Rujing worked for Texas Instruments for 20 years; GigaDevice’s founder Zhu Yiming was a senior engineer at iPolicyNetworks Inc; and Zhongwei Semiconductor’s founder Yin Zhiyao was also the vice president of the world’s largest semiconductor etching machine giant, Applied Materials.The reasons behind this are twofold: first, the first batch of talents cultivated by China’s reform and opening up studied abroad in the 1980s and returned in 2000, at the peak of their technology, connections, and experience; second, semiconductor entrepreneurship not only has high technical difficulty but also involves a know-how experience black box.Having worked in the U.S. for twenty years, Yin Zhiyao rose to the position of vice president at Applied Materials and general manager of the plasma etching business group. He made contributions in two of the three oligarchs in the chip etching machine industry and holds 86 U.S. patents. When he led 15 senior Chinese scientists from Silicon Valley back to China, even USA Today devoted considerable coverage to Zhongwei Semiconductor.Although etching machines are not as complex as lithography machines, they are also precision instruments that require the integration of at least over 50 disciplines and areas of expertise.From R&D to product launch, even for giants like Applied Materials and Lam Research, it generally takes three to five years.However, Zhongwei, which started with only a team of 15, successfully developed its first CCP etching equipment product within three years and shipped it to domestic customers, rapidly advancing in plasma etching at 45nm, 22nm, 14nm, and 7nm, and within less than fifteen years, it has basically caught up with the thirty years of accumulation of its competitors in technology.

The Hardships of Early Semiconductor EntrepreneurshipChoosing the right location in Shanghai was the second step in Zhongwei’s successful methodology. Shanghai provided Zhongwei and SMIC with both support and an industrial ecosystem where 1+1 is greater than 2.In 2004, after Zhongwei settled in Shanghai, it faced considerable skepticism. With only $1.5 million raised by Yin Zhiyao’s team, Zhongwei might have to shut down before it even opened. But after government subsidies, was it a state-owned or private enterprise? As a company registered by a Chinese in overseas, was Zhongwei a foreign company or a Chinese company?With the lessons from Hanxin, no one could afford the blame of losing state assets.Moreover, in the early stages of semiconductor entrepreneurship, it is common knowledge that capital only flows in and not out.At that time, Applied Materials and Lam Research invested hundreds of millions to over a billion dollars annually just to maintain their leading positions.Still, with only $1.5 million raised by Yin Zhiyao’s team, Zhongwei might have to shut down before it even opened.Once the government decided to support, it would become a bottomless pit of burning money.However, Shanghai has always been one of the most accommodating places for high-tech in the country.In 2000, when Zhang Rujing established SMIC, he initially chose Hong Kong, but unfortunately, even with the chief executive’s agreement, SMIC was driven out by real estate developers.Returning to Shanghai, Zhang Rujing was immediately received by the then mayor of Shanghai, who pointed to the planned Zhangjiang area and waved his hand, saying that SMIC could build a factory “wherever they wanted!”Money, people, land, only SMIC did not dare to ask, and Shanghai at that time was willing to cooperate.The treatment that SMIC enjoyed back then was also extended to Zhongwei.With funding, personnel, and land, under the protection of Jiang Shangzhou and others, Zhongwei received 50 million yuan in startup funds from the Shanghai municipal government in its early days.Later, Jiang Shangzhou also introduced Yin Zhiyao to Chen Yuan, the president of the National Development Bank, securing a $50 million interest-free loan.With the support of the 02 Special Project and the Shanghai government, Zhongwei survived the most difficult early stage of entrepreneurship in an era when everyone regarded semiconductors as a scam.But were Zhongwei and SMIC really just isolated bright spots in Zhangjiang? 1+1 being greater than 2 is the true purpose of Zhangjiang Hi-Tech.Although semiconductor equipment is located upstream of the semiconductor industry, it also requires cooperation from downstream foundries and upstream component manufacturers.Take lithography machines as an example; an EUV lithography machine composed of hundreds of thousands of parts has 90% of its components sourced from external suppliers. To ensure R&D progress, ASML also actively brings in foundries like TSMC and Samsung as shareholders.While etching machines are not as complex as lithography machines, it is important to note:High-end lithography machines are similar, while etching machines vary greatly even in their basic models.The specific reason is that etching the semiconductor substrate requires ICP equipment, while etching the upper layer circuits requires CCP equipment.Even for the same substrate etching, different types of etching machines need to be matched according to the chip’s storage, computing, and automotive types.In summary, the types of etching machines vary greatly based on processes and semiconductor types.Naturally, this requires cooperation across the entire industry chain.In addition to introducing Yin Zhiyao and Zhang Rujing back to China, Jiang Shangzhou was also one of the planners of the Zhangjiang Hi-Tech Industrial Park.Before Zhongwei settled in, advanced integrated circuits had already been introduced, including Huahong, Hongli, Shanghai TSMC, and Shanghai Beiling;afterward, Unisoc, GigaDevice, Weir Semiconductor, and Alibaba successively settled in, covering everything from upstream equipment to downstream packaging and testing. For SMIC, whenever Zhongwei’s latest equipment is released, SMIC is often one of the first downstream customers to “taste” and “test” it.Up until 2016, SMIC was still Zhongwei’s largest customer, accounting for 39% of its revenue.While the rise of Zhongwei and SMIC is certainly due to the efforts of the companies themselves, it must be acknowledged that all technological innovations are inseparable from a government willing to invest and spend money.

For SMIC, whenever Zhongwei’s latest equipment is released, SMIC is often one of the first downstream customers to “taste” and “test” it.Up until 2016, SMIC was still Zhongwei’s largest customer, accounting for 39% of its revenue.While the rise of Zhongwei and SMIC is certainly due to the efforts of the companies themselves, it must be acknowledged that all technological innovations are inseparable from a government willing to invest and spend money.

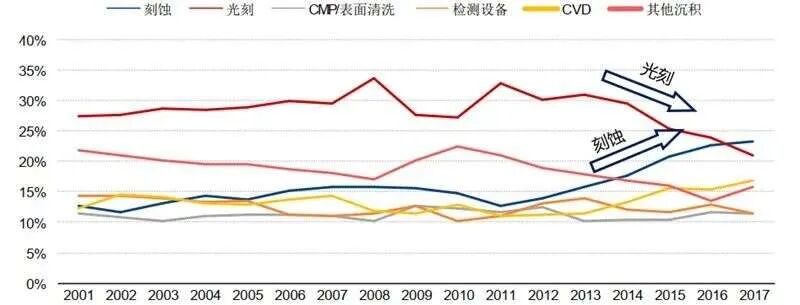

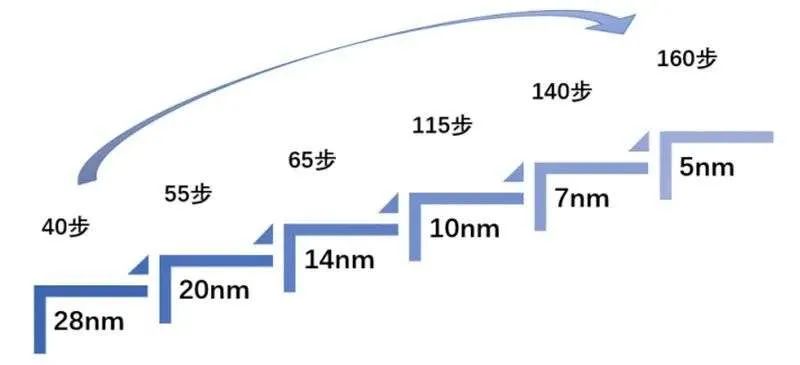

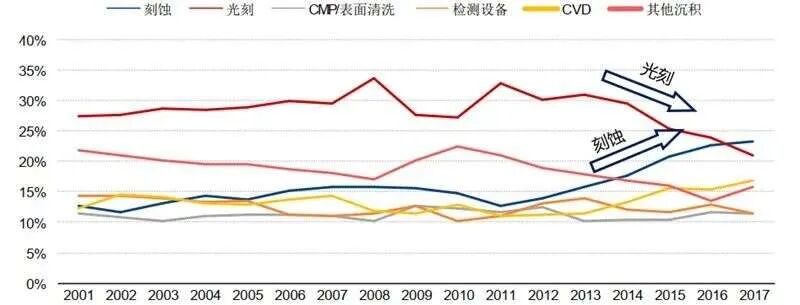

The Comprehensive Rise of EquipmentIf the past decade of lurking was the starting point for the domestic semiconductor equipment industry from zero to one, then the three years of catalysis starting in 2018 was the final push for the comprehensive rise of domestic semiconductor equipment.There are three main reasons:1. The supply chain disruption that began in 2018 turned semiconductor independence from an industry concern into a national wound; the consensus became that without semiconductor independence, there could be no technological independence.2. The etching machine market itself has rapidly developed with the continuous advancement of chip processes.3. The emergence of the Sci-Tech Innovation Board and the National Big Fund has made Chinese semiconductors no longer just an island surviving on sentiment; entrepreneurs have a future, investors can exit, and companies can collaborate, creating a healthy business ecosystem that is thriving.The first point will not be elaborated further; here, the second point regarding the importance of etching machines needs explanation.In the chip field, there is an industry norm known as Moore’s Law:The number of components that can be accommodated on an integrated circuit doubles every 18 to 24 months (and the corresponding chip process continues to shrink).But how is the process improved?While companies like Intel, Qualcomm, and HiSilicon are well-known, they are merely the downstream players picking the fruit.The real decision-makers are actually the material and equipment companies.As mentioned earlier, lithography machines play a decisive role, but improving the process is not solely dependent on lithography machines.To put it simply, the process of turning a silicon wafer into a chip can be imagined as the process of carving a window flower from a piece of paper.The lithography machine is the pen that draws the pattern;while the etching machine is the knife that carves according to the pattern using physical or chemical methods.For advanced processes, the pen must first be fine;but the knife cannot be neglected either.Moreover, as the number of transistors per unit volume increases, trying to process all patterns at once naturally affects product yield.This is when multi-step etching technology comes into play.The principle can be simply understood as:first, outline the first carving, then process the details with secondary and tertiary carvings.This leads to an increase in the number of etching steps with each advancement in chip processes.

In recent years, the share of etching machines in semiconductor equipment investments has surpassed that of lithography machines, becoming the largest segment.

With the tailwind of the market, Zhongwei has naturally surged into the billion-dollar valuation club.Of course, beyond market opportunities, Zhongwei’s valuation is also inseparable from the support of the National Big Fund and the Sci-Tech Innovation Board.Zhongwei was the first company to receive investment from the National Semiconductor Big Fund, securing 480 million yuan in one go in 2014.The emergence of the Sci-Tech Innovation Board has brought Zhongwei to the forefront, where everything can be a problem, but money is not one of them.With capital leading the way, chips have become the sure path to technological wealth and soaring corporate valuations.Figures like Jiang Shangzhou, Zhang Rujing, and Yin Zhiyao, who have emerged over the years, have been connected by an underlying thread of technological independence, and after twenty years of wandering, they have finally become the main characters in the market.Recently, we asked a well-known secondary market analyst:Do Zhongwei and SMIC really deserve their valuations (given that Zhongwei’s market valuation is close to one-third of Lam’s despite being far behind in the market)?He responded with a question:If Zhongwei’s secondary valuation cannot catch up with Applied Materials and Lam, how can we talk about our independent breakthroughs when engineers cannot afford housing and companies lack development motivation?

ConclusionReturning to the fundamental question, is the rise of China’s semiconductor industry difficult?Yes!Despite the efforts of fresh graduates and returning experts in their seventies, we have still not escaped the encirclement after seventy years of development.But is the development of China’s semiconductors really that difficult?Perhaps it is not that difficult; the key is quite simple:timing, location, and harmony.Countless officials and scholars like Jiang Shangzhou and Ni Guangnan have raised their voices, and entrepreneurs like Zhang Rujing and Yin Zhiyao have responded; countless elites have fought for technological independence, and they are the people behind China’s chips, operating systems, and precision equipment.Shanghai’s semiconductors, Beijing’s software and AI, Hefei’s displays… local support has created industrial miracles, and they are the geographical advantages of technological prosperity.With a complete foundation, pressure, funding, and national care all in place, they constitute an unprecedented opportunity for the development of China’s semiconductors over the decades:The future is full of hope for China’s semiconductors.

Tap “Read” 👇Looking forward to the rise of China’s semiconductors