Yi Gongzi’s Sword – A Business Review Worth Reading

Xie Xide and Zhang Zhongmou left the MIT campus almost at the same time, but with two completely different feelings.

After transferring to the Massachusetts Institute of Technology (MIT), Xie Xide studied hard for two years and successfully obtained her PhD. The news of the founding of New China excited her, but the outbreak of the Korean War hindered the return of scientific talents to China. It was not until the famous scholar Joseph Needham intervened that Xie Xide, later known as the “Mother of China’s Semiconductors,” managed to return to her homeland after a long journey.

In contrast, Zhang Zhongmou’s academic journey was not as smooth. Born in Ningbo, Zhejiang, he was rejected when applying for a PhD at MIT after completing his master’s degree there. The young man viewed this as the biggest blow of his life, standing in front of a list without his name, his accumulated self-esteem and confidence suddenly vanished, and his years of study came to an abrupt end, leaving him unsure of his next steps and how to face his parents and newlywed wife.

One was filled with hope, while the other was lost in confusion. From the same campus, both dedicated their lives to the semiconductor industry, and their vastly different life experiences together tell the story of China’s semiconductor journey.

The rejection from MIT remained a shadow in Zhang Zhongmou’s heart, a painful memory. However, years later, he surprisingly had a complete turnaround in his perspective, viewing that rejection as the luckiest event of his life.

Forced to find a job after being rejected, Zhang Zhongmou found the job offer from Ford Motor Company particularly appealing. At that time, Ford was thriving, ranking among the top ten companies globally. As a master’s graduate in mechanical engineering from MIT, working at Ford would have been a perfect match for his skills. However, due to another offer that paid him one dollar more per month, the young Zhang Zhongmou naively hoped Ford would raise his salary. After being met with bureaucratic indifference, he chose to go to that other company, Sylvnia, which was then researching a new product – transistors made from semiconductor materials.

Zhang Zhongmou studied mechanical engineering, and in terms of relevance to the company’s main business, he was far less aligned than two other young Chinese talents at Sylvnia – Huang Chang, a physics PhD from Harvard, and Lin Lanying, a physics PhD from the University of Pennsylvania. However, the latter two chose the same path as Xie Xide, leaving their high-paying jobs to return to China.

The famous Wilson cruise ship was subjected to strict searches by the CIA, with even textbooks and student notes confiscated. Lin Lanying, the first female PhD in the history of the University of Pennsylvania, secretly brought back germanium and silicon single crystals in a medicine box as a gift for the new China.

Before this, Huang Kun had already boarded a ship from England. Once, at Southwest Associated University, he was known as one of the “Three Musketeers” of the physics department alongside Yang Zhenning; now, co-authoring the “Theory of Lattice Dynamics” with quantum mechanics pioneer and later Nobel laureate Max Born had already made him famous in the global physics community.

While Zhang Zhongmou was still burning the midnight oil to transition from mechanical engineering to the semiconductor profession, across the Pacific, Huang Kun, Xie Xide, Lin Lanying, Huang Chang, and Wang Shouwu had already formed a young and talented team in the new China.

Using Bell Labs’ invention of the transistor as a milestone, China’s semiconductor industry started just 3-5 years behind the United States.

Based on conductivity, materials are divided into conductors (like iron) and insulators (like wood). Semiconductors, as the name suggests, are materials that fall between the two, with their conductivity controlled by the number of electrons in the conduction band. The scientific community recognized the existence of semiconductors long ago but did not know how to utilize them. It wasn’t until 1948 when William Shockley at Bell Labs invented the transistor using semiconductor materials, with its advantages of being small, light, short, and economical, that it perfectly replaced the previous generation of technology in the electronics industry (vacuum tubes), marking the official start of an ongoing industrial revolution.

Shockley’s call attracted countless young talents to join his commercial company. However, apart from the incompatibility of business philosophies, Shockley’s paternalistic style was off-putting. For instance, Gordon Moore (the creator of Moore’s Law) recalled that when a minor accident occurred in the lab, employees had to take lie detector tests to determine who was lying and who was at fault. Eventually, a group of eight, led by Noyce, left to establish Fairchild Semiconductor, famously known as the “Traitorous Eight.”

The Traitorous Eight

Although Fairchild experienced a brief period of glory, the members soon scattered again. However, whether in industry, research, or investment, they achieved significant accomplishments, leading to the saying that more than half of Silicon Valley companies have direct genes from Fairchild, hence the phrase “First came Fairchild, then came Silicon Valley.” Among them, Noyce and Moore’s newly founded company, Intel, dominated the integrated circuit industry, witnessing nearly all technological rivalries in human history, standing tall as a peak to this day.

In 1956, New China issued a call to “march towards science,” and under the care of the Premier, the Ministry of Education gathered 300 people from Peking University, Fudan University, Jilin University, Nanjing University, and Xiamen University, led by Huang Kun and Xie Xide, to establish a specialized training class for semiconductors at Peking University. Among these 300 people were future leaders like Wang Yangyuan, chairman of SMIC, Xu Juyuan, chief engineer of Huajing Group, and Yu Zhongyu, chief engineer of the Ministry of Electronics Industry. In this spring-like atmosphere, China’s semiconductor industry set sail.

During this period, China independently refined germanium crystals and developed integrated circuits, achieving milestones that were only 5-7 years behind the United States and almost synchronized with Japan, leading Korea by a full decade.

In addition to the top-tier semiconductor class at Peking University, Huang Kun and Xie Xide published “Semiconductor Physics,” with Huang Kun in the north and Xie Xide in the south at Fudan University, promoting solid-state energy spectrum research, forming teams, acquiring equipment, and organizing experiments. China’s semiconductor industry steadily advanced from talent cultivation to industrial exploration.

Unfortunately, during the same period when “Fairchild sowed the seeds, Silicon Valley blossomed,” movements swept across China. Xie Xide and her Cambridge PhD husband were soon labeled as “spies.” This “reactionary academic authority” was assigned to pull weeds in a field behind the physics building at Fudan University, not allowed to stop or look up. Under the scorching sun, her low-temperature laboratory at Fudan was transformed into a barn for holding scientists, and the liquid helium equipment was sent to factories as waste. With multiple “hats” placed on her, she was forbidden from engaging in research, attending academic conferences outside the institution, or subscribing to publications. The closest she got to science was being assigned to grind silicon wafers at the school-run factory.

That “decade of being unable to draw a bow to shoot the sun” coincided with the decade when the semiconductor industry in the Western world soared.

The early semiconductor materials for transistors were germanium, but the scientific community had recognized that silicon was a better material, only limited by technology, as it could not produce silicon of suitable cost and purity.

Texas, located in the southwestern United States, is known for its cowboys and rugged character, often viewed as a backwater by mainstream Americans. When the relatively obscure Texas Instruments announced the extraction of silicon suitable for industrial production, it was indeed surprising.

Zhang Zhongmou also became acquainted with Texas Instruments due to the silicon material revolution. After completing his transformation from a mechanical student to a semiconductor expert at Sylvnia, he jumped to Texas Instruments. Fortunately, the silicon material innovation was just the beginning for Texas Instruments, and Zhang Zhongmou witnessed another groundbreaking invention.

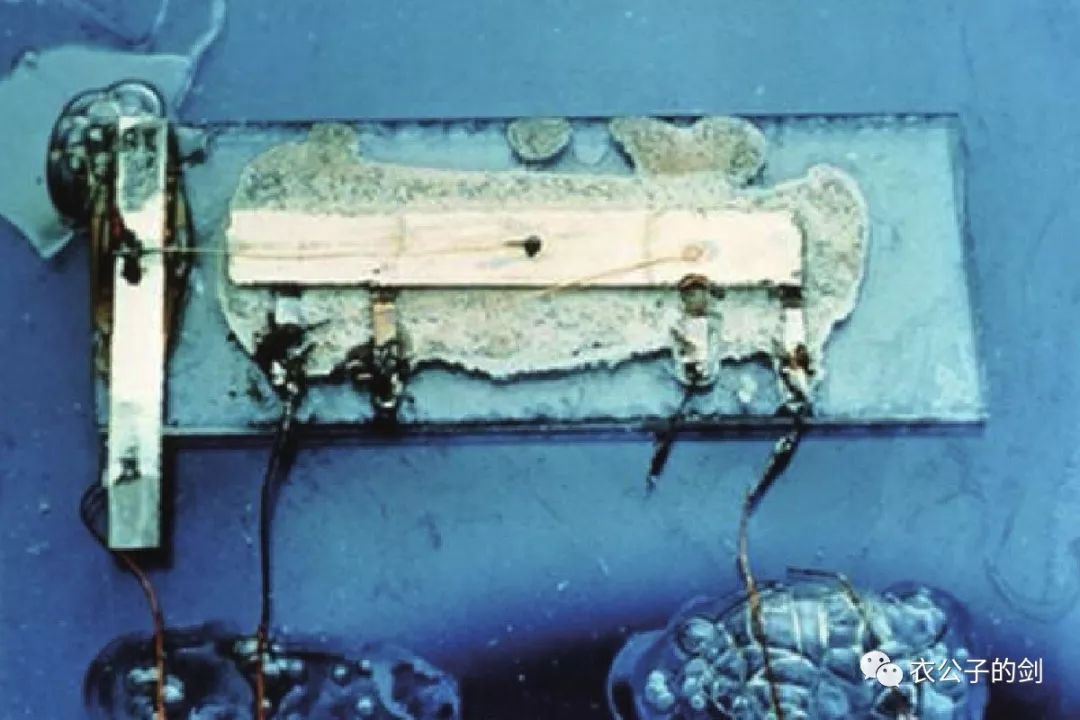

Jack Kilby, who stood 2 meters tall, had a slender build but a large head, and despite being in his thirties, he looked unusually old, yet that striking hairline proclaimed the strength of an exceptional engineer. He joined the company at the same time as Zhang Zhongmou, and they quickly became good friends, sharing coffee daily. Kilby combined transistors, diodes, and resistors into a single circuit on the same silicon chip, naming it the “Integrated Circuit.”

The First Integrated Circuit

Kilby not only won the Nobel Prize in Physics for this invention but also revolutionized the industry. The semiconductor industry was booming, and Texas Instruments had a sharp weapon, cutting through obstacles and soaring to new heights. Zhang Zhongmou worked there for 30 years, traversing the country and fulfilling the king’s business, earning fame both in life and posthumously. As the third key figure at Texas Instruments, Zhang Zhongmou was already the leading Chinese figure in the global electronics industry. However, that was still not the peak of his personal achievements; even greater glory awaited him.

For a long time, the inspiring story of Texas Instruments rising from nothing to dominance was widely discussed. The phrases “small bets against big” and “latecomers surpassing earlycomers” served as both motivational business mantras for future generations and as curses that led to the industry’s numerous failures.

The future of the electronics industry is vast and boundless, and the arms race between major powers has immediately begun. Just a few years after the invention of the integrated circuit, Japan and China rushed to catch up.

Japan, led by the Ministry of International Trade and Industry, with Fujitsu, Hitachi, Mitsubishi, NEC, and Toshiba as the core, united various research institutes and launched the Very Large Scale Integration (VLSI) plan. Three years later, they entered Intel’s main battlefield with their self-developed 64K random access memory, employing a simple yet effective competitive strategy: always being 10% cheaper than Intel.

Leveraging their inherent advantages and price wars, the Japanese quickly carved out a path in the market invented by the United States. In the 1980s, Japan’s semiconductor output surpassed that of the United States. The industry pioneer Intel announced its withdrawal from the memory market, unable to afford the competition. In hindsight, Intel’s decision to focus on microprocessors led to even greater success. However, at that moment, the news of the industry star losing $180 million and laying off 8,000 employees shocked and worried the entire nation.

The United States organized a multi-faceted counterattack against Japan from legislative, industrial policy, direct intervention, and trade war perspectives. In addition to the “Information Superhighway” promoted by Clinton, the U.S. government initiated the establishment of the Semiconductor Manufacturing Technology Consortium (SEMATECH), led by Noyce, the founder of Fairchild and Intel, along with business and technology leaders. The federal government funded half, and companies contributed the other half, sharing research results. Of course, the more famous aspect was the trade negotiations with Japan, threatening 100% tariffs and various conditions. Ultimately, Japan promised to self-regulate semiconductor products, reducing output and raising prices.

Japanese business leaders, including Sony founder Akio Morita and right-wing politician Shintaro Ishihara, wrote a book titled “Japan Can Say No,” with pride evident in their expressions. However, Japan soon fell into a “lost decade,” even two decades. Although electronic products continued to shine, the trend of descending from the altar was already predetermined.

It must be said that the timing of the Koreans was just right. Samsung’s Lee Byung-chul sought to restrain Japan by enticing high-paid talent from Japan, particularly the key recruitment of Toshiba’s semiconductor division head, Kawanishi. The 1990s was a booming period for the computer industry, and Japan’s production limits and pricing provided significant advantages for Korea’s semiconductor development.

Samsung not only took advantage of the situation but also brought greater turmoil to the industry. The semiconductor industry is typically cyclical; when prices rise, everyone invests heavily and works overtime; when prices fall, layoffs and factory closures occur to survive. However, Samsung stood out by expanding production during downturns, further driving down prices and forcing competitors out of the market, creating a monopoly. This “counter-cyclical investment strategy” invented by Intel was played out with style and skill by the Koreans.

However, Samsung’s willingness to gamble and drag the entire industry off a cliff was backed by the support of the South Korean government. In Korea, the semiconductor industry is referred to as “industrial food” and “filial industry”; the government instructs major conglomerates to lend to enterprises. After nearly 20 years of continuous losses, they repeatedly fought back, and the students finally defeated the teacher.

With the collapse of Japan’s Elpida, Samsung now leads the DRAM memory market, followed closely by Hynix (a spin-off of the Korean Hyundai Group) and Micron from the United States, with no competitors in sight globally.

From the historical context of Japan’s defeat and Korea’s rise, the essence of the semiconductor industry can be summarized as: firm national will, introduction of advanced technology, capture of leading talents, and enduring long-term losses.

Unfortunately, China, mired in movements, had no conditions to know this, and it took a long detour to return to the world. Today, China has both clear recognition and accumulated strength, but the industry’s challenges are different from the past. Due to the peculiar nature of the semiconductor industry, the long-standing chasm that has developed will likely test China severely.

Looking back at the achievements of the 60s and 70s, one must mention “the two bombs and one satellite.” This achievement, born under the backdrop of international blockade and domestic chaos, gives rise to a contemporary question for China: If the Chinese can produce “the two bombs and one satellite,” why can’t they produce chips? Why can’t they produce cars? Why can’t they produce the beauty products that Chinese girls love? …

Qian Xuesen’s words are thought-provoking: In the 1960s, we invested all our efforts into “the two bombs and one satellite” and gained a lot; In the 1970s, we did not focus on semiconductors, and as a result, we lost a lot.

Among the four essences of the semiconductor industry we summarized, the easiest to imitate is “introducing advanced technology.” In the 1970s, China normalized diplomatic relations with the U.S. and Japan. As the saying goes, strike while the iron is hot; in the early 1970s, China introduced seven production lines from Japan, but while the equipment was acquired, the technology and software capabilities did not keep up, resulting in poor outcomes. By the late 1970s, as the U.S. upgraded its industry, China introduced second-hand equipment that had been eliminated, forming 24 production lines, but again, due to a lack of technology and software capabilities, expectations were not met, resulting in half-baked results.

Why can the same mistake be repeated? In the 60s and 70s, the nationwide blockade often had reasons behind the introduction of Western technology, but despite this, whenever movements arose, they were still labeled as “foreign slave philosophy” and “crawlingism,” leading to criticism and downfall. In such turbulent times, how can one think and summarize?

The two bombs and one satellite and the semiconductor industry are entirely different endeavors; the former relies on cost-agnostic, movement-style investment for breakthroughs in cutting-edge technology, while the latter depends on the maturity and efficiency of the entire social industrial chain, matching costs and benefits.

“Where the new swallows peck at spring mud, several early orioles compete for warm trees,” the global semiconductor industry is changing rapidly, with one side singing while the other takes the stage, yet Chinese newspapers remain obsessed with such typical propaganda: In a certain alley, an old lady managed to make semiconductors using a diffusion furnace.

When we closed the door, China’s semiconductor industry was only 5 years behind the world; when China returned to the world, it was already 20-30 years behind.

In 1977, Wang Shouwu stated: There were over 600 semiconductor production factories nationwide, and the total annual output of integrated circuits was only one-tenth of what a large factory in Japan produced in a month. The heartbroken Deng Xiaoping asked him: Can you get large-scale integrated circuits up and running in a year?

How to boost China’s semiconductor industry? Allowing talents like Xie Xide to return to the podium and laboratories to immediately resume the talent cultivation interrupted for ten years is undoubtedly essential; indeed, it is the 77th and 78th batch of semiconductor students who are currently supporting half of the industry. However, beyond talent cultivation, the exploration of the era theme is precisely the starting point of the detour.

At the beginning of the reform and opening up, the entire country believed that as long as competition was introduced and the market was opened, all problems could be solved. Therefore, the national governance approach was to reduce direct investment and encourage everyone to find their way through economic laws. After the separation of government and enterprise, financial allocations disappeared, but bank loans were available. Given the significant gap between China and the West, and to achieve short-term results, semiconductor factories across the country hastily abandoned independent research and development in favor of introducing foreign production lines.

The same fate also befell China’s large aircraft project.

However, simple laissez-faire is not a cure-all. The semiconductor process evolves rapidly, and the independent introductions lack professionalism and negotiation leverage. They could neither obtain the latest processes nor achieve digestion and absorption. The slogan of “introducing, digesting, absorbing, and innovating” was not realized, but instead formed a vicious cycle of “introducing, digesting, falling behind, and reintroducing.” Soon, continuous losses coupled with bank interest led enterprises into difficulties.

Realizing the error, the ruling authorities shifted direction, and national projects 531 and 908 followed one after another.

Unfortunately, the goal of “popularizing 5 microns, developing 3 microns, and tackling 1 micron” in project 531 ultimately resulted in “introducing equipment but failing to digest technology and management.” This repetition of mistakes was not merely a matter of insufficient understanding; a more significant reason was that after a decade of movements, China’s semiconductor talent was in a state of disarray. Even if they understood that software and management were more important, it was difficult to make bricks without straw.

The failure of project 908 was another typical case. The goal was to join the ranks of world-class projects, but after two years of approval, three years of verification, and two years of factory construction, seven years later, the Huajing factory was already lagging behind. Not only was it 4-5 generations behind advanced processes, but its monthly production capacity was also a meager 800 wafers, less than 10% of the target capacity of 12,000 wafers, rendering it commercially worthless. Faced with heavy bank interest, Huajing’s later choices were quite passive. After numerous twists and turns, it was eventually acquired by the state-owned enterprise China Resources in the new century, becoming what is now China Resources Microelectronics.

This was destined to be the darkest period for China’s semiconductor industry. In terms of national investment, the achievements of reform and opening up were limited, with finances stretched thin, and the ability to attract top international talent was lacking. The talent gap caused by a decade of educational stagnation brought continuous pain, leaving people heartbroken and helpless.

Looking back at projects 531 and 908, the only seemingly comforting evaluation is that they were indeed the “Huangpu Military Academy” of China’s semiconductor industry. In fact, the term “Huangpu Military Academy” is a genuine lament, often referring to something that was once glorious but ultimately declined, with a bleak outlook, leading to a scattering of talent.

Stumbling along, China’s integrated circuit production finally crossed the threshold of 100 million pieces, entering what is known in the industry as the large-scale production phase. By this standard, it was 25 years behind the United States and 23 years behind Japan.

Amidst the tumultuous waves of integrated circuits, industry pioneers and DRAM memory veterans – Intel, Texas Instruments, and IBM withdrew from the field in 1986, 1998, and 1999, respectively. Among them, due to Texas Instruments shutting down its DRAM business, 49-year-old Zhang Ruijing retired early and took over as general manager of Taiwan’s United Microelectronics Corporation (UMC).

The old system had been shattered, and the new system had yet to be established. After Samsung’s tumultuous rise, the industry was about to welcome its next reshaper. Earlier, Taiwan established the Electronics Research Institute, with government funding to purchase technology from RCA in the U.S. and transfer it free of charge to the newly established UMC and Taiwan Semiconductor Manufacturing Company (TSMC). Taiwan’s “technology father” Lee Kuo-ding made several trips to the U.S., visiting over 2,000 Chinese scientists and engineers in Silicon Valley in a month, with the most significant achievement being inviting the 54-year-old Zhang Zhongmou back to Taiwan. Previously, during Samsung’s famous century gamble, Lee Byung-chul had reserved a key position for Zhang Zhongmou in his golden team, but several invitations had failed to succeed.

Soon, with the support of the Taiwanese authorities, Zhang Zhongmou took over TSMC. After nearly 30 years at Texas Instruments, the once-rejected student from MIT had become the leading Chinese figure in the semiconductor industry. As he stated at the beginning of his tenure, he had already “climbed to the high tower, gazing at the endless road ahead.”

What a “gazing at the endless road ahead.” Among the four essences of the semiconductor industry we summarized, “introducing advanced technology” is the easiest to imitate, while “capturing leading talents” is the most serendipitous.

The semiconductor ties between Taiwan and the mainland are profound; at its inception, TSMC had no remarkable advantages. Its major shareholder was the Dutch company Philips. At that time, Philips was just entering its prime, having laid out two joint semiconductor companies in its Asian strategy. In addition to TSMC in Taiwan, Philips also partnered with Shanghai Radio Factory to establish Shanghai Philips Semiconductor, which later became Shanghai Advanced. The English abbreviation for Shanghai Advanced is ASMC, and TSMC’s is so similar for this reason.

If Xie Xide and Zhang Zhongmou’s fates diverged based on life choices – one dedicated to the education of the new China, enduring hardships, and becoming a pioneering master; the other immersed in cutting-edge industry, encountering continuous opportunities, ultimately becoming a godfather. However, the similarly rooted TSMC and Shanghai Advanced have also taken vastly different developmental trajectories, which is truly lamentable: It is easy to find a thousand troops, but hard to find a general.

Zhang Zhongmou designed the path for TSMC as: focusing on foundry.

The term “foundry” may seem unremarkable at first glance, but upon closer inspection, it carries a sense of lowliness. Can it also create miracles?

In November 1995, a Chinese leader visited South Korea and, after touring Samsung’s semiconductor factory, the elder, who had once served as the Minister of China’s Ministry of Electronics Industry, adjusted his black-framed glasses and summarized his feelings as “shocking to the eye.”

It was truly unexpected that after rounds of market incentives and national projects, China’s integrated circuit production and sales accounted for only about 0.3% of the global share, a figure so low it could be ignored, and the production level remained at 4-5 inch wafers and 2-3 micron processes, lagging 15-20 years behind the first tier.

Even more astonishing was that the 908 project proposed five years earlier was still dragging in the verification stage. Without further ado, the 909 project was immediately launched. This time, lessons were learned, and everything from approval to funding was simplified and expedited, with the Minister of Electronics Industry personally serving as the chairman of the project (Huahong Microelectronics), handling special matters with unmatched specifications.

The partner was Japanese electronics giant NEC, which was at a critical moment of being strangled by Korean semiconductors. Over the years, even though China and Japan have historical issues, whenever another neighboring country is mentioned, both sides can often reconcile for mutual benefit.

To demonstrate friendship, NEC not only took on greater obligations in the joint venture contract, providing more benefits to the Chinese side, but also repeatedly shortened the originally planned construction period, achieving production at a miraculous speed.

Huahong NEC not only reached world-class standards in technology but also achieved a monthly production scale of 20,000 wafers in 2000, generating profits in the first year. Unfortunately, as fate would have it, in the fourth quarter of 2000, the internet bubble burst, and the computer industry transitioned from summer to winter overnight. Larry Page spent an entire year promoting Google, yet few paid attention. In the first eight months of 2001, Huahong NEC suffered a massive loss of 700 million, and just as it seemed that holding on a little longer would bring a turnaround, the 9/11 terrorist attacks occurred.

Semiconductor professionals watched helplessly as a giant hand reached down from the sky, plunging the semiconductor industry, which was about to rise, back into the icy waters.

The only certainty was that Samsung once again unleashed its counter-cyclical investment, dragging the entire industry off a cliff. Within a year, the partner NEC underwent drastic changes, its once formal attire transformed into tattered clothing, suffering massive losses and divesting its semiconductor business. In the midst of its own turmoil, how could it care for Huahong NEC?

Originally, Huahong NEC’s strategy was to “start with memory and transition to logic products,” but now it was forced to pivot to foundry. However, the secret to foundry manufacturing lies in investing more as losses mount. First, during industry downturns, equipment can be purchased at the lowest prices; second, the construction cycle of factories is about 18 months, which aligns with the industry cycle, so when the new factory is put into production, the added capacity can catch up with the industry’s prosperity, reaping significant profits. Unfortunately, after suffering heavy losses, Huahong’s ambitions could not be realized, and it did not become the leader to lead China’s semiconductor industry out of the predicament.

The 909 project ultimately also became a “Huangpu Military Academy,” but the progress of China’s chip industry is still evident. The promotion of IC cards, public transport cards, and social security cards in Shanghai originally relied on expensive imported chips, but with the realization of 908 and 909, the prices of IC card chips plummeted by 90%. The same goes for SIM cards, which dropped from over 80 yuan to 8 yuan in one go. Later, China’s livelihood cards and second-generation ID cards also adopted domestically produced chips.

The turn of the century for Huahong’s production also marked a turning point for China’s semiconductor industry. In 2000, the former president of Fudan University, Xie Xide, passed away in Shanghai. In 2002, TSMC began litigation against SMIC. In 2004, Huawei rebranded its newly independent semiconductor business as HiSilicon…

It can be said that 909 was a bridge from the past to the future.

At the “National Science Conference” in 1977, Deng Xiaoping emphasized in Sichuan dialect that “intellectuals are part of the working class,” not only proposing that “science and technology are productive forces” but also stating that in the future, there should be “five days of work and one day of political study,” as there had been too much political study before, and now it should be reduced. The 40-year-old Xu Kuangdi and 33-year-old Ren Zhengfei sat below, sometimes shedding tears, sometimes cheering.

Xu Kuangdi later became a visiting scholar at Imperial College London, becoming an expert in steel metallurgy. During a visit, he caught the attention of Zhu Rongji and, in 1995, was elected as both an academician of the Chinese Academy of Engineering and the mayor of Shanghai. In the 909 project, he served as deputy leader, witnessing Huahong’s rapid establishment in Shanghai, where the city leaped forward like a young student, touching the ceiling of the global semiconductor industry. From then on, Shanghai became a staunch supporter of integrated circuits.

The 909 project coincided with Shanghai’s rapid progress, and during the same period, there were over a hundred billion construction projects, including General Motors and Pudong International Airport. In addition, the North-South elevated road, inner and outer ring roads, Jin Mao Tower, Shangri-La Hotel Phase II, and the Oriental Pearl TV Tower were successively under construction, with the entire Lujiazui area rising rapidly in the late 1990s.

Although TSMC and UMC had already become the semiconductor giants in Taiwan, Zhang Ruijing, who also returned to Taiwan from Texas Instruments, was still making great strides at UMC, to the extent that Zhang Zhongmou offered an obviously high and irresistible acquisition price. After leaving UMC, Zhang Ruijing continued to seek entrepreneurial opportunities in China. Initially, he hit it off with Hong Kong’s Tung Chee-hwa, but the factory plan was obstructed due to public opinion. Shanghai decisively accompanied Zhang Ruijing to select a site in Zhangjiang. In the city planning, Shanghai’s Zhangjiang Microelectronics Development Zone is three times the area of Taiwan’s Hsinchu Industrial Park.

Zhang Ruijing is indeed a world-class factory-building master, with excellent professional quality, leadership ability, and work attitude. In the early stages, he saved costs by inviting international talents, asking them to pay for their own airfare, and if they had business in Shanghai, they could “conveniently” meet. Xie Zhifeng, who had won Intel’s highest achievement award, came the day after receiving the call, and the conversation went well, but the salary offered by SMIC was even lower than what Intel had paid 12 years ago, not accounting for inflation. Seeing him hesitate, Zhang Ruijing suggested he go home and discuss it with his wife. Before leaving, he said: You are a Shanghai person, I am a Taiwanese, SMIC is a Shanghai enterprise, I, a Taiwanese, work in the fields (Zhangjiang was still farmland at that time) from 8 am to 12 pm every day, what about you?

At this point, a proud Shanghai man would not need to discuss with his wife. Xie Zhifeng immediately accepted the offer.

In April 2000, SMIC was established. In August, construction began, just 4 kilometers away from Huahong. In three years, it went from nothing to becoming one of the world’s top four. Zhang Ruijing is undoubtedly the godfather of integrated circuits in mainland China.

This damned article, whenever it writes about the good news of turning points in China’s semiconductor industry, always has to throw in a hated “but.”

It is truly lamentable how difficult and bitter it is to produce chips in China. Just as everything was looking up, “academician mayor” Xu Kuangdi was transferred from Shanghai before his term ended; subsequently, SMIC suffered significant damage in two targeted lawsuits from TSMC, and Zhang Ruijing resigned in shame; the successor Jiang Shangzhou, a graduate of Tsinghua’s radio program, was refined in governance and reform, a key promoter of China’s chips, large aircraft, and electric vehicles, but unfortunately passed away young due to cancer.

Since ancient times, the Yan and Zhao regions have produced many passionate and sorrowful figures, but this is clearly Shanghai!

Can Chinese people really produce chips? Looking back at the history of semiconductors, the contributions of Chinese are quite remarkable. Many giants in the integrated circuit industry, such as Broadcom, NVIDIA, Cadence, and Marvell, have Chinese founders.

The well-known Moore’s Law is the bible of the electronics industry – every 18 months, the number of transistors that can be accommodated in an integrated circuit doubles, and performance doubles. However, Intel announced early on that, based on physical characteristics, 20 nanometers is the limit for transistor spacing, and semiconductor processes will reach their end at 20 nanometers. Imagine if Moore’s Law fails, the fate of the semiconductor industry will be akin to textiles and steel, once exceptionally glorious, now indispensable, but the industry becomes stagnant, creativity becomes mediocre, and it gets lost in the game of existing stock and mechanical repetition.

Just as the entire industry began to feel a sense of impending doom, Berkeley University’s Hu Zhengming called out: FinFET technology. This scientist, born in Beijing’s Douya Vegetable Alley, led the global semiconductor industry to a new continent. In simple terms, the 20-nanometer limit exists in a two-dimensional plane, but FinFET expands the design of semiconductor devices from two dimensions to three dimensions. One might as well accompany this with a melody from Jay Chou’s “Nunchaku”: The limit of Moore’s Law has been kicked open by me.

It is no exaggeration to say that without FinFET, there would be no prosperity of today’s electronic products. It is hard to imagine what humanity would look like if it stagnated at 20 nanometers; for comparison, the flourishing of smartphones in 2019 was built on 7-nanometer processes, while the increasingly approaching 5-nanometer and 3-nanometer processes are the technological cornerstones of the Internet of Things and 5G.

Zhang Zhongmou’s self-assessment of “gazing at the endless road ahead” was not unfounded; TSMC promptly invited Hu Zhengming to participate as Chief Technology Officer in the layout of new production lines, seizing the rare shift period in the industry. When the 909 project and SMIC were successively established in Shanghai, TSMC and UMC were still neck and neck, but ten years later, TSMC had far outpaced UMC, entering the world’s top tier.

Globally, there are three companies that are far ahead in integrated circuit production capacity. Among them, the veteran Intel, who says, “This road is opened by me, this tree is planted by me,” the gambler Samsung, who says, “One general’s success costs countless bones,” and TSMC, which not only does not lag behind but often leads during generational shifts.

It should be noted that the models of these three giants are not the same; Intel and Samsung design and produce their own products, known in the industry as IDM. TSMC, on the other hand, does not design or have its own products, focusing on the foundry model, known as Foundry. (Samsung and Intel also have a small amount of foundry, but it is not significant, so it will not be elaborated.)

Outsiders often look down on the term “foundry” due to its seemingly lowly connotation, and when they realize they have never purchased a TSMC-branded product, they naturally do not regard this company highly.

However, in reality, TSMC has long been embedded in everyone’s life. You must have had experiences like this – being dazzled by the launches of CEOs A, L, Y, and C, only to find that the flagship phone promised to launch in June is either delayed or out of stock. Those unaware of the inside story attribute it to “hunger marketing,” but the real reason is that 90% of the time, it lies with TSMC.

There is no way around it; Qualcomm, Apple, and Huawei are all clients, and even some products from Samsung and Intel rely on TSMC’s foundry, and with limited capacity, during peak periods, it is inevitable that everyone has to squeeze and share.

The semiconductor industry has significant economies of scale, and the innovation of production processes becomes increasingly costly in the later stages. It is precisely because of a profound understanding of the industry’s essence that Zhang Zhongmou’s TSMC focuses on foundry, building top-notch chip production capabilities. Today, apart from Intel and Samsung, if you want to produce first-class chips, then it is “the only one, and if you miss it, you won’t get another chance.” Therefore, TSMC’s valuation has long surpassed Intel, and its revenue and profits are still higher than those of another Chinese tech company, Huawei, enough to astonish newcomers.

At the end of the century, the chairman of the Beijing Association for Science and Technology and relevant leaders began to frequently visit Silicon Valley to meet with Chinese elites. In 1999, during the 50th anniversary military parade of the founding of the nation, 25 Chinese from Silicon Valley sat in the third grid to the left of Tiananmen. Almost all of these 25 later returned to China to start businesses, including Baidu’s Li Yanhong and ZTE Microelectronics’ Deng Zhonghan.

As the new century began, China continued to explore semiconductors, with Shanghai advancing hand in hand with integrated circuits, with semiconductor companies in design, packaging, testing, equipment, components, and chemicals sprouting up in Zhangjiang like mushrooms after rain. Among them, there were capital levers for large-scale acquisitions and integrations by Zhao Weiguo of Unisplendour, the super low point and shadow brought by the Hanxin fraud scandal, and the ambitious call of the National Integrated Circuit Industry Investment Fund (commonly known as the “Big Fund”).

These efforts were tested in 2018 when the U.S. sanctioned ZTE, blocking a chip the size of a fingernail, which caused this global telecom giant to go into shock. The Chinese were shocked to realize that after 40 years of reform and opening up, there was still an industry lagging 30 years behind the world?!

The semiconductor industry, also known as the integrated circuit industry, is divided into processor chips, memory and storage chips, specific function chips, discrete devices, equipment, materials, etc. From the production process, it can be divided into IP development, design, foundry, packaging, and testing, etc. Today, it has become a finely divided and complex field. We might as well simplify and follow a few questions to complete the article’s summary. First: When we talk about China’s “chip shortage,” what exactly do we mean?

In 2018, China’s chip imports exceeded $310 billion, which is twice that of oil, greater than the total imports of oil, steel, and food. The numbers do not reveal the full picture; in fact, China’s self-developed chips account for a significant share globally, second only to the U.S., South Korea, and Japan, comparable to Germany. In 2018, the global chip market was valued at $468.8 billion, with two-thirds of that coming to China. Considering that China is responsible for producing 90% of the world’s computers, 90% of mobile phones, and 90% of home appliances, according to research by Wei Shaojun, director of Tsinghua University’s Microelectronics Research Institute, 60% of imported chips are re-exported, and only 40% are genuinely consumed by China.

Therefore, “high imports” is not the issue; the more substantial problem is that in key categories, China is almost blank. Apart from the aforementioned memory (Samsung, Hynix, Micron) and lithography machines (ASML), there are also the recently popular programmable logic chips (FPGAs) that are essentially monopolized by Intel and Xilinx, as well as IGBTs, digital signal processing chips (DSPs), CPUs, GPUs, MCUs, semiconductor equipment, silicon wafers, etc., all of which rely on imports.

In simple terms, China’s “chip shortage” refers to the lack of production capacity for high-end chips.

In addition to Huahong NEC, the 909 project also made investments in upstream and downstream, including a company called Huawei. This heavy-laden private enterprise can now be considered a pillar of China’s technology industry. Looking at the top ten lists in various segments of the integrated circuit industry, there are few Chinese brands. However, in chip design, Huawei’s HiSilicon has already entered the world’s top ten, and when discussing Chinese chips today, HiSilicon is almost always mentioned.

In an era of unprecedented prosperity for electronic products, the differentiation of products must be reflected through chips. It is fortunate that China has already made achievements in chip design. Currently, there are over a hundred Chinese chip design companies with revenues exceeding 100 million, which is a commendable achievement in the entire industry. Zhang Zhongmou has played a significant role in this; it is precisely because TSMC has specialized in “chip manufacturing” that it has greatly lowered the barriers to chip design. Previously, without factories and teams of thousands, how could one talk about chip production? But now, it is common to see a PhD returning from Silicon Valley starting a chip design company with just three people.

However, amidst this scene, some issues must be pointed out. First, riding on the national “chip anxiety,” the Chinese business community generally over-packages and over-promotes. For example, so-called AI chips sound impressive, but in reality, they are chips specifically used for image or voice recognition, or only for mining. This is what is commonly referred to as application-specific integrated circuits (ASICs), whose design difficulty is far less than that of general-purpose chips (CPUs), so Intel and others still represent the pinnacle of chip capability. Using slogans like “XX company independently designed chip XX, outperforming Intel in XX environment (specific scenario)” to capitalize on the anxiety of the Chinese people regarding chips is misleading and malicious.

Second, the upstream of chip design relies on ARM’s IP licensing, the process relies on EDA tools, and the downstream relies on TSMC’s production, which is a typical case of being “controlled by others.” The gross margins of chip design companies in Europe, the U.S., and Japan generally exceed 50%, while domestic companies are usually around 20%. This is partly because the technology is not unique enough and partly because the industrial chain lacks bargaining power, often leading to “price increases without increases in quantity.”

Let us use this as a standard to scrutinize the complex commercial truths around us – who is riding the wave, and who is doing the real work. After the ZTE incident, the entire nation was outraged, and almost everyone mentioned self-developed chips, with many entrepreneurs stepping up to take on the role of responsible persons. The initial prosperity of China’s chip design industry is a good thing and a sign of progress, but it has not fundamentally addressed the industry’s pain points. The most typical example is Dong Mingzhu, who boldly announced, “Gree will produce chips, even if it costs 50 billion, we will make chips.” Industry insiders shook their heads at this statement, as it shows a lack of understanding; 50 billion is needed for design or manufacturing? “Design” does not require that much, while “manufacturing” is far from sufficient.

In fact, for every Chinese chip design company, three critical questions can be posed: (1) Who will produce it? (2) Who will buy it? (3) Is there profit?

Currently, these critical questions often turn out to be fatal questions.

Why is chip production so difficult? Or more specifically: Why has the tried-and-true Chinese model not worked miracles in the semiconductor industry?

It must be said that with national strength, unified direction, and latecomers catching up, China can be considered a top player. For example, the high-speed rail model of exchanging technology for markets. Of course, a more comparable industry to integrated circuits is the panel industry. Just five years ago, “lack of screens” and “lack of chips” were equally painful issues, with panels being among the products with annual imports exceeding $50 billion, just like automotive parts, chips, and oil. In 2010, it was particularly disheartening when Taiwanese suppliers collectively raised prices along with Japanese and Korean brands, leaving the rapidly rising mainland electronics industry gritting its teeth and having to submit. However, after that, BOE invested a total of 300 billion, experiencing repeated losses and investments, and finally reaped rewards, not only forcing Japan and Korea to close low-generation production lines but also driving Taiwanese companies out of the market. Coincidentally, 60 years ago, the predecessor of BOE, the Beijing Electron Tube Factory, produced China’s independently drawn germanium single crystals, which was the starting point of China’s semiconductor industry. This is quite meaningful.

China’s semiconductor industry not only has the backing of large state-owned enterprises but also saw the “Big Fund” invest 140 billion over five years in 2014, which is not a small scale, yet it has not stirred up much of a wave, fundamentally due to the peculiar characteristics of the semiconductor industry.

The market share tends to concentrate at the top, which is a common economic law, and is especially pronounced in the semiconductor industry. Zhang Zhongmou said early on: When the process advances to 5 nanometers, there will only be three companies in the entire industry; Intel and Samsung will definitely be among them, and if the third is not TSMC, then there will be no one else.

Zhang’s more famous saying is: In this industry, if you are not in the top three, it is not very meaningful.

A casual glance at the market share of segmented industries shows that the top three in the image sensor market occupy 90% of the market share, which is still considered low. The top three in the DRAM memory market account for 99% of the share, which is a normal performance.

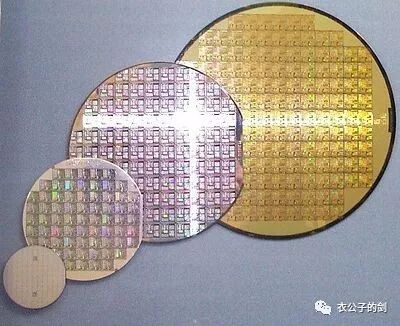

This situation of “the big eat the meat and the rest wait to starve” is due to the fact that integrated circuits are a generation of equipment, a generation of processes, and a generation of products. The industry’s top production lines evolve every year: on larger diameter (the larger, the more advanced) silicon wafers, processing intervals of how many nanometers (the smaller, the more advanced) for the width of transistors. (This is not absolute; integration is a more critical indicator.)

Silicon Wafer

Even more frightening is that the costs required for process research and development are cumulative; the R&D costs for 32/28 nanometer chip manufacturing processes are around 9 billion yuan, while the investment for a 12-inch wafer factory has reached over 20 billion yuan. Currently, the mainstream 14-nanometer or 7-nanometer chip manufacturing production lines start at an investment of 50 billion yuan.

After ZTE was sanctioned, SMIC purchased an extreme ultraviolet lithography machine from the world’s top lithography machine manufacturer ASML for an astonishing price of $120 million. Just the price of one lithography machine exceeds SMIC’s annual profit. It is important to note that this is just one piece of equipment, not an entire production line. An entire production line requires not only lithography machines but also etching machines, thin film deposition equipment, single crystal furnaces, CVD, developing machines, ion implantation machines, CMP polishing machines, etc. When calculating costs, remember to include the annual maintenance fee of 20%, or you can ignore it, because if you want to stay at the forefront, you basically have to update every year.

Zhao Weiguo of Unisplendour said that now an advanced factory casually costs over $10 billion. Looking at the peak confrontations in the industry, both Samsung and TSMC have invested over $20 billion in their 7-nanometer production plants.

The Big Fund’s investment of 140 billion over five years seems substantial, but when averaged out over a year, it actually does not match Samsung or TSMC’s annual R&D expenditure. Not to mention that it has to be spread across hundreds of integrated circuit companies in China.

Not only are the prices staggering, but the dreams are also suffocated; due to the decreasing number of players, the industry is gradually solidifying.

For example, ASML, mentioned earlier, has a market share of 75%. Due to its long-term focus on producing top-notch lithography machines, only Intel, Samsung, and TSMC will buy from them. To ensure the game can continue, they gradually built alliances.

In 2012, after a round of capital increase, Intel, Samsung, and TSMC became shareholders of ASML.

Yi Gongzi often says that all the rules are set by the older generation to control the new generation. Without elaborating, one can already imagine the difficulties faced by industry latecomers.

The integrated circuit industry is undoubtedly a “money-burning machine.” There is a joke in the industry: How to make a billionaire go bankrupt? The answer is to encourage him to engage in the integrated circuit industry.

Since the 1980s, Intel, Samsung, and TSMC have been taking all the money they earn every year, and even that is not enough; the real tough ones borrow money to keep investing. Of course, due to the industry’s large investments, long cycles, and high profits, as long as one can endure, it can also become a “money-printing machine.” As players are continuously washed away, the money earned each year and the money needed to be invested each year grow like a snowball, becoming increasingly daunting after 30 years.

12

Would you care who the second-largest integrated circuit foundry is?

The second-largest is GlobalFoundries, which was spun off from AMD in 2009. AMD is Intel’s lifelong nemesis but also a lifelong challenger, known for its resilience and unwillingness to give up. In chip production, AMD has always taken good care of its “son” GlobalFoundries.

However, in the latest 7-nanometer process, the Vega 20 chip designed by AMD abandoned GlobalFoundries and was handed over to TSMC for foundry.

This is because GlobalFoundries does not have a 7-nanometer production line and announced in 2018 that it would not pursue 7-nanometer technology.

Not only GlobalFoundries, but also companies like Freescale, NXP, Infineon, and Texas Instruments have successively spun off their manufacturing businesses or announced they would no longer invest in developing new-generation manufacturing technologies.

In the past, Moore’s casual remark became the golden rule that has spanned the industry for 60 years, as well as the life-and-death spell that haunts the entire industry.

Every 18 months, the number of transistors doubles, and performance doubles, with everyone racing to achieve this goal. Those who cannot keep up will be kicked off the fast-moving train of the times, tumbling over stones and thorns, disappearing without a trace.

The protective moat of industry leaders is getting wider. TSMC currently holds over 50% of the foundry market share, which not only constitutes a monopoly in terms of numbers. The calculation of market share considers chips of all levels; if only looking at individual top processes, TSMC accounts for 100%.

After the smartphone boom, electronic products developed rapidly, and capacity was always insufficient. Except for a rare loosening in January 2019, there has always been a situation where customers surround TSMC to demand capacity, making it the undisputed “father” of the electronics industry.

Whenever there is an earthquake in Taiwan, the tech community does not care about the safety of regional leaders; they only care about whether it will affect TSMC’s production.

In 2017, the old man fell in Hawaii, and inquiries came from Shenzhen, Zhongguancun, Silicon Valley, and the 128th Highway, asking whether he was okay.

Even reporters camped at Taipei Taoyuan Airport to see whether the old man was carried off or walked off, as it directly related to the holdings of the trillion-dollar fund in major global tech companies.

Zhang Zhongmou

Where there is a lead, there is a chase.

Liang Mengsong, a key figure under Zhang Zhongmou who developed the 14-nanometer process, left TSMC in anger in 2008 and was invited to join Samsung after a long wait. At that time, TSMC had already launched the 14-nanometer process, while Samsung was still awkwardly researching the 20-nanometer process. Upon arrival, Liang Mengsong suggested that Samsung abandon the 20-nanometer process and directly tackle the 14-nanometer process, which not only led to successful production but also allowed them to snatch a large order for Apple’s A9 chip from TSMC. After a spectacular revenge drama in the industry, Liang Mengsong joined SMIC in 2017, and a year and a half later, SMIC transitioned directly from 28 nanometers to 14 nanometers.

We revisit the four essences of the semiconductor industry: firm national will, introduction of advanced technology, capture of leading talents, and enduring long-term losses. “Introducing advanced technology” is the easiest to learn, while “capturing leading talents” is serendipitous, and the remaining two are tests of national wisdom and resilience.

From the perspective of investment return periods, the integrated circuit manufacturing industry generally takes two years to build a factory, two years to ramp up, and production lines begin to generate benefits five years after investment. Considering the imbalance in China’s talent hierarchy, teams often consist of “one expert leading a group of ordinary engineers”; if the first cycle does not digest well, it often takes the second or third cycle to yield results.

Enduring long-term losses, China has tasted both the bitter fruits and the sweet rewards. In 2005, Chengdu collaborated with SMIC to establish the first 8-inch factory in western China, one of only three in the country, but it was sold to Texas Instruments amidst losses. After enduring cycles, Texas Instruments Chengdu is now very profitable. However, the Chengdu government could only learn from the experience and start from scratch.

After Chengdu, Wuhan faced a similar predicament, known as the “Wuhan Defense War.” Established in 2006, Wuhan Xinxin faced a global DRAM price collapse as soon as it was completed. In 2008, during the financial crisis, Wuhan Xinxin’s orders were nearly zero, and Micron was eager to acquire it, almost securing it.

Fortunately, with central support, Wuhan’s blood transfusion, and SMIC’s self-rescue, Wuhan Xinxin ultimately survived. Considering the “paper shredder” nature of integrated circuits, this was not an easy decision; the continuous investment in Wuhan exceeded that of the Three Gorges Dam, but it also became a spark.

Today’s Yangtze Storage, focusing on 3D NAND storage, along with Fujian Jinhua and Hefei Changxin, which focus on DRAM, is expected to fill the domestic technology gap.

After 70 years of fierce competition, the global semiconductor industry has not only remained active but has also given rise to a new wave of competition. The economic and trade game between China and the U.S. has also inspired Japan, which announced two months ago that it would sanction South Korea’s semiconductors by restricting material exports, leaving the once-glorious Samsung and Hynix in a state of panic.

In 2018, Toshiba sold its semiconductor business, and people lamented the decline of this once-great semiconductor giant. However, it has now been discovered that despite its product withdrawals, Japan has built a dominant position in semiconductor materials, controlling the industry’s throat.

Among the 19 essential materials for semiconductors, Japan holds over 50% of the market share in 14 types, including silicon wafers, synthetic semiconductor wafers, and photomasks, and contributes one-third of the manufacturing equipment globally.

The semiconductor industry will continue to be a grand arena interwoven with innovation, prosperity, competition, and dramatic ups and downs.

Returning to China, a 6% economic growth rate is a historical low, but it is not frightening. Since the transfer of low-end manufacturing to countries like Vietnam is an inevitable trend, how China bids farewell to the old model and embraces new breakthroughs is a pressing question for the elite of the era.

Carl Sagan once said that to judge whether we have progressed, we must look at our courage to ask questions, the depth of our answers, and our acceptance of the truth, rather than those things that make us feel good.

On the cruise ship returning east 70 years ago, facing the sunset over the sea, the predecessors began to ponder. After experiencing the return of elites, national projects, joint ventures, and nationwide efforts, we will continue to explore. But there is no doubt that in the semiconductor industry, there are no shortcuts to overtaking on curves; what is tested is whether there is still the calmness and persistence to sharpen a sword for ten years in this country that has become accustomed to heat and impatience.

Thank you for reading. Please give me a thumbs up if you enjoyed it.

PublicSon WeChat: yi_gongzi Recommended Reading: Youth Borrowing, Then China is Strong | Yi Gongzi The Story of Chinese Car Manufacturing | Yi Gongzi