1.Overview of the NOR Flash Industry

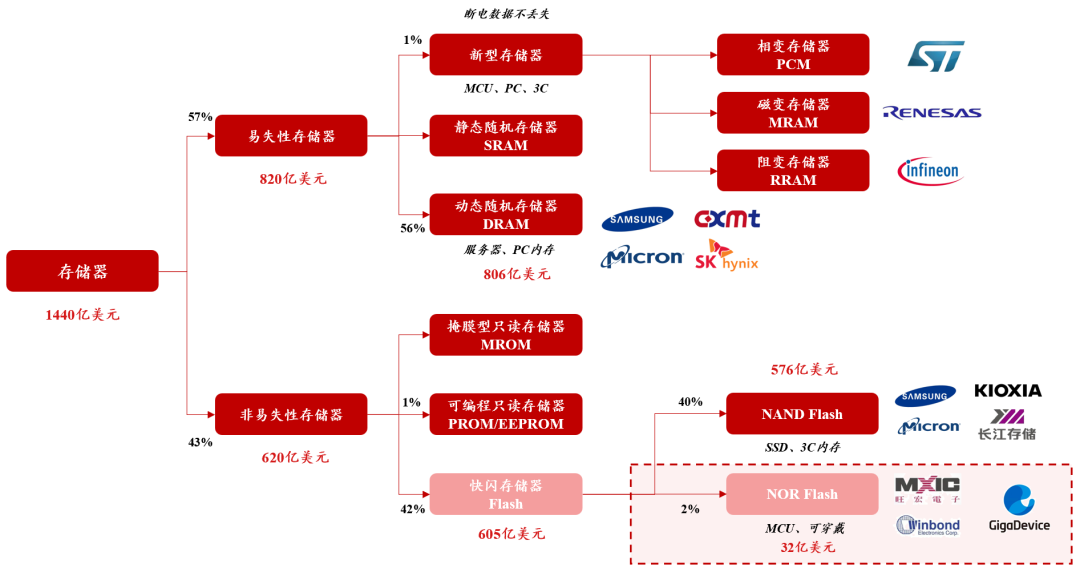

(1) Overview of the Memory IndustryThe memory industry is divided into volatile memory (RAM) and non-volatile memory (NVM). RAM is typically used as temporary working memory, which is fast but loses data when power is off (volatile); NVM is used for permanent storage of data and programs, retaining data even when power is off (non-volatile).Among them, RAM mainly includes Dynamic Random Access Memory (DRAM) and Static Random Access Memory (SRAM); at the same time, new types of volatile memory are continuously being developed, with companies like ST, Renesas, and Infineon introducing innovative processes such as PCM, mRAM, and rRAM. NVM is primarily based on Flash memory, which is further divided into NAND Flash and NOR Flash.

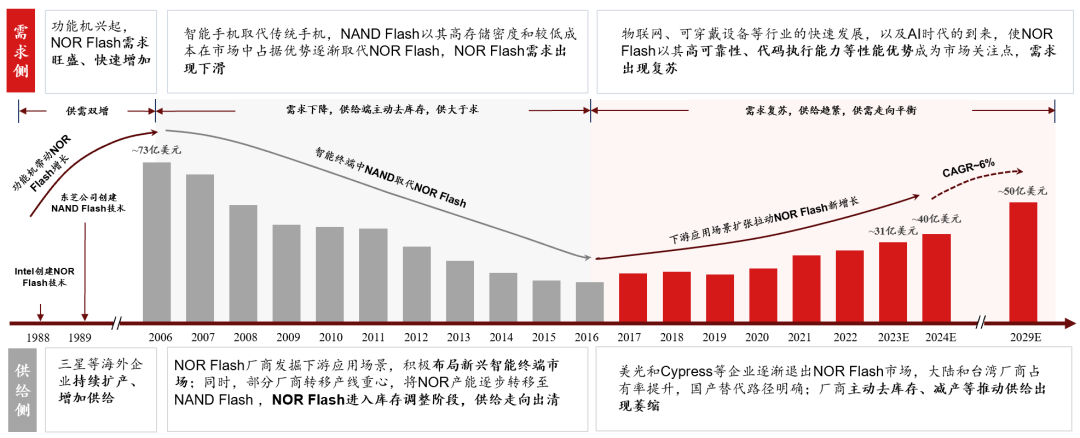

(2)Historical Review of NOR Flash: A Cycle of Adjustment and the Arrival of a New Upward Cycle

NOR and NAND Flash are the two main technological paths for current non-volatile Flash memory, which were developed to overcome the limitations of EEPROM/EPROM in terms of cost and performance.

NOR Flash has gone through a cycle since the feature phone era, and with the rise of downstream applications such as IoT, wearable devices, and AI, it is facing a new development cycle.

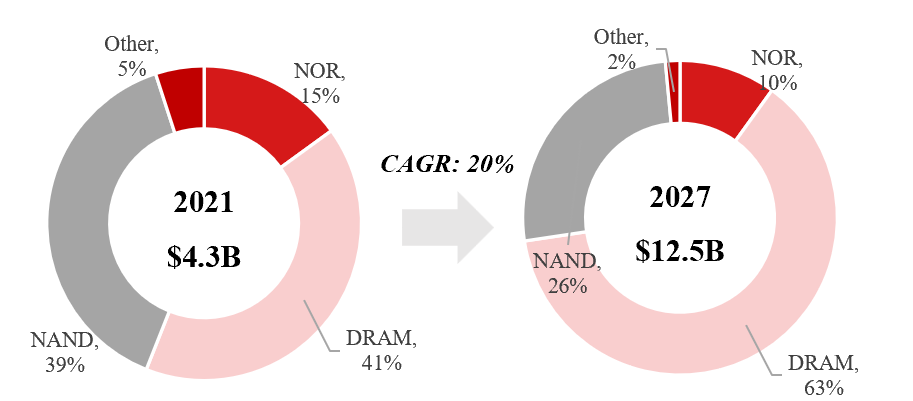

In the semiconductor memory market, NOR Flash accounts for only about 2% (with NAND Flash accounting for about 40%), making its market size relatively small and positioning it as a niche memory market.

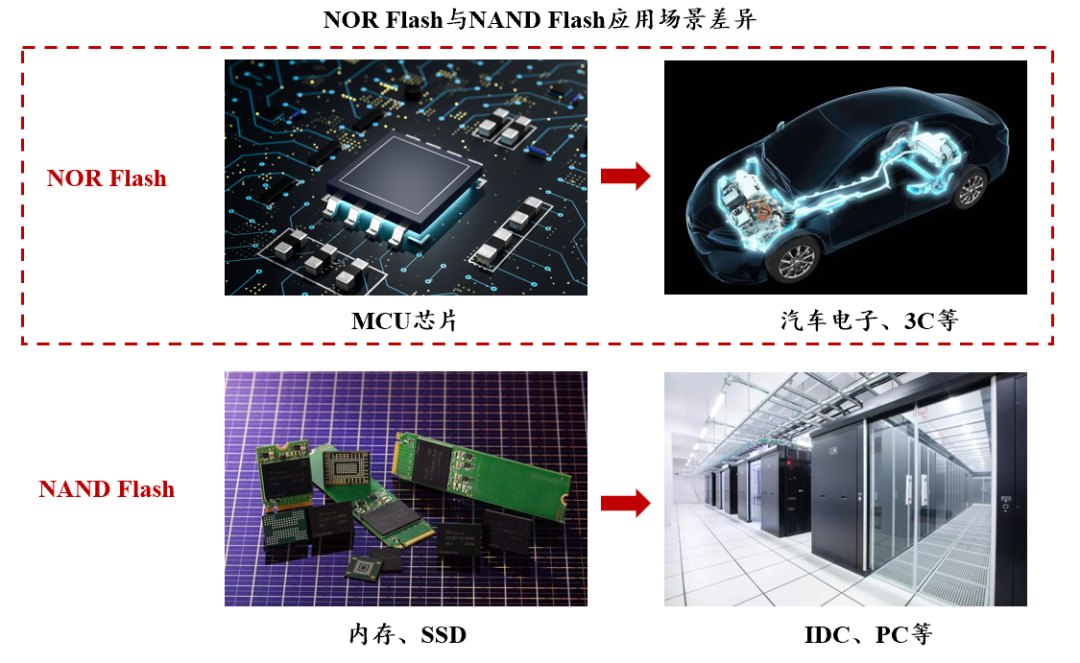

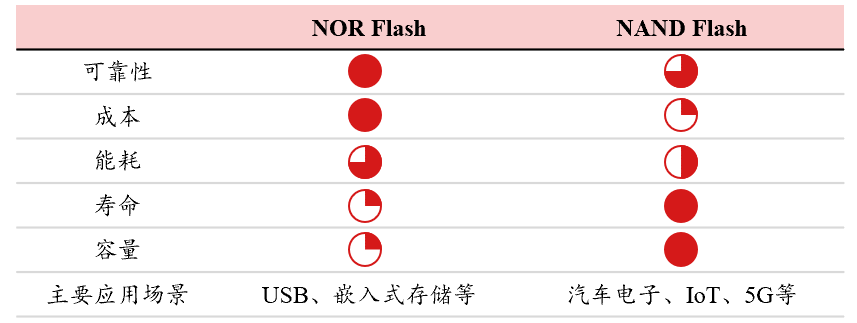

(3)Comparative Analysis of NAND and NOR

Flash can be divided into NOR Flash and NAND Flash based on its architecture. The eFlash used in MCUs requires the random access characteristics of NOR Flash, thus NOR architecture Flash eFlash, which is embedded Flash technology, is integrated within microcontroller units (MCUs) or other integrated circuits. This technology has the following characteristics:Highly Integrated: eFlash is typically used as data cache or instruction storage within the MCU, and compared to traditional external storage, the integration of eFlash within the chip improves data processing speed and system efficiency.Fast Access: eFlash uses random access technology, allowing for fast read and write speeds, suitable for high-speed computing needs.Data Persistence: eFlash can maintain data for a long time (e.g., 10 years) even after system power loss, even in high-temperature environments (e.g., 125 degrees).

2.Main Application Scenarios and Competitive Landscape of NOR Flash

(1) Downstream Application Landscape of NOR Flash

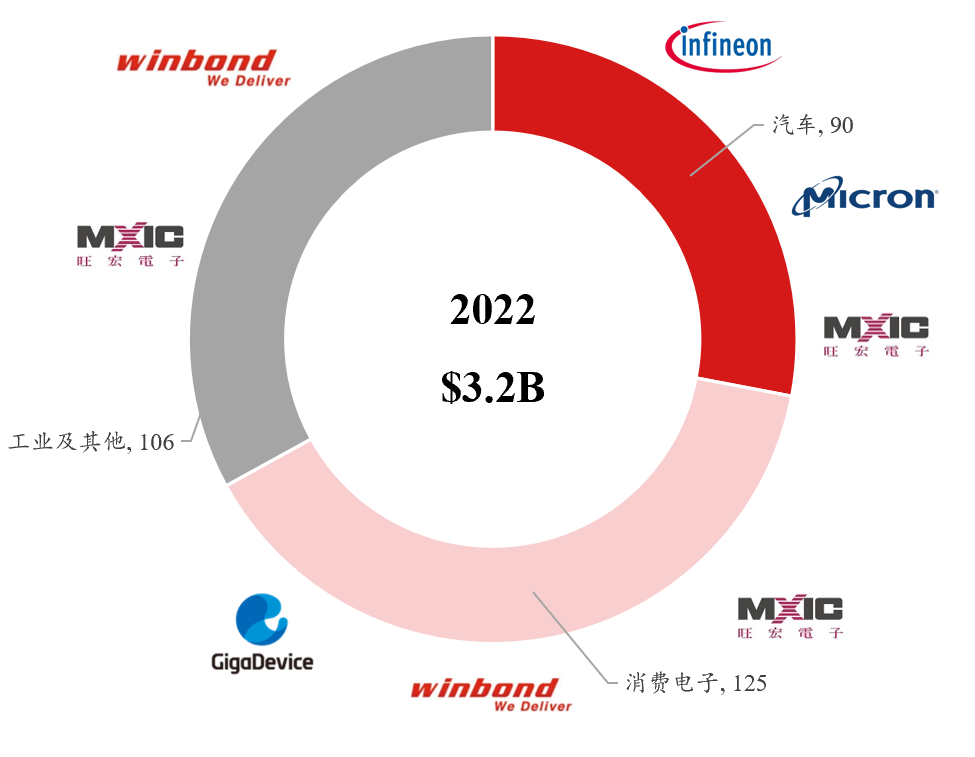

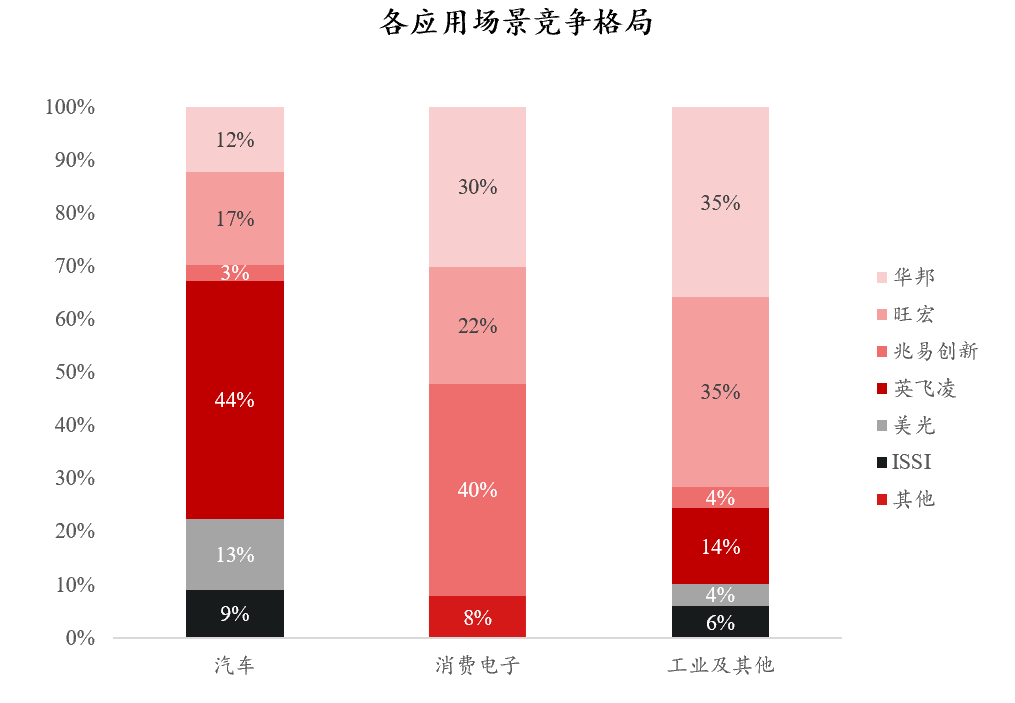

NOR Flash allows the CPU to read and execute instructions directly from it (XIP), enabling fast startup speeds, stable read speeds, and reliable data retention (non-volatile). The write endurance (durability) is usually higher than that of NAND Flash used for large-capacity storage, making it particularly suitable for storing critical code and small data that must load and execute quickly without errors. Therefore, NOR Flash is mainly used in embedded systems, consumer electronics, and industrial devices that require storage and direct execution of critical boot code, operating systems, applications, and small capacity critical configuration data.Among them, consumer electronics is the largest downstream application for NOR Flash, with companies like Gigadevice, Winbond, and Macronix being the market leaders; the mid-to-high-end automotive market is dominated by Infineon (Cypress) and Micron. (2) Incremental Support 1: The Growth of Automotive Electronics in the Intelligent Era Drives Continuous Growth of NORThe rapid development of digital cockpits, autonomous driving, and other fields is driving the rapid growth of automotive electronics, leading to a sharp increase in demand for in-vehicle memory. Due to the high reliability requirements for ECU memory, the in-vehicle NOR market is expected to exceed $1 billion by 2027.

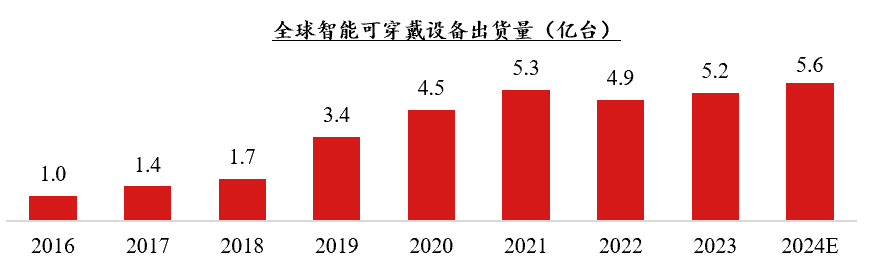

(2) Incremental Support 1: The Growth of Automotive Electronics in the Intelligent Era Drives Continuous Growth of NORThe rapid development of digital cockpits, autonomous driving, and other fields is driving the rapid growth of automotive electronics, leading to a sharp increase in demand for in-vehicle memory. Due to the high reliability requirements for ECU memory, the in-vehicle NOR market is expected to exceed $1 billion by 2027. (3) Incremental Support 2: NOR has become a Necessity for Devices like TWS EarbudsThe market for wearable devices such as TWS earbuds (which contain one NOR to store system code), smartwatches/bands (with one NOR either built-in or external), and AR/VR (typically equipped with one NOR) is rapidly developing, with expected shipments of approximately 560 million units by 2024, corresponding to a large potential demand for NOR.

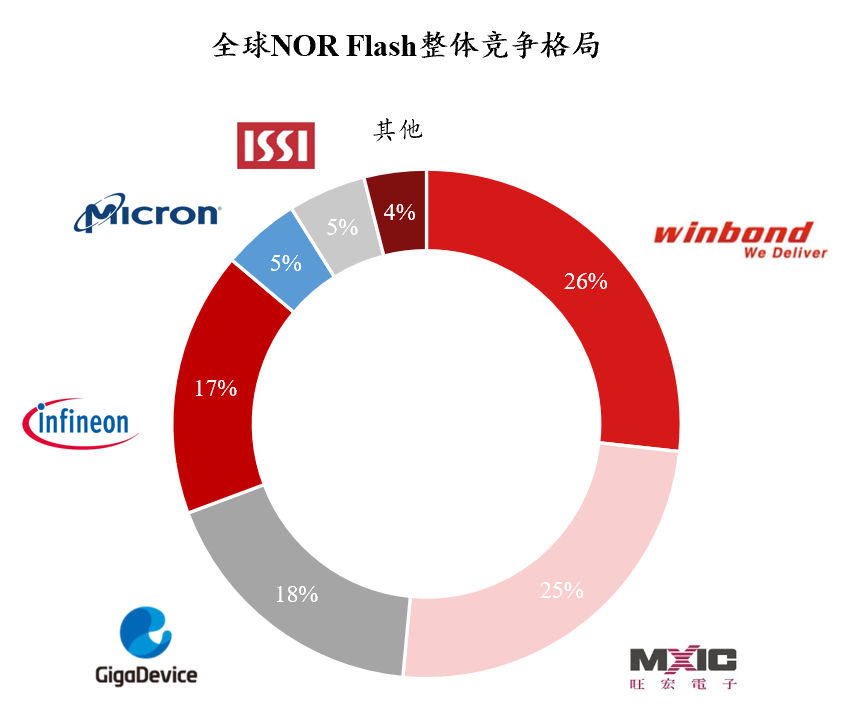

(3) Incremental Support 2: NOR has become a Necessity for Devices like TWS EarbudsThe market for wearable devices such as TWS earbuds (which contain one NOR to store system code), smartwatches/bands (with one NOR either built-in or external), and AR/VR (typically equipped with one NOR) is rapidly developing, with expected shipments of approximately 560 million units by 2024, corresponding to a large potential demand for NOR. (4) Global Competitive Landscape of the NOR Flash MarketThe top two global NOR Flash suppliers are both Taiwanese players (Winbond and Macronix), together accounting for over half of the market share. Winbond and Macronix have been deeply involved in the NOR Flash field for over 40 years, with a full product matrix covering all market segments including consumer electronics, industrial, and automotive. Among them, Macronix is continuously investing in 3D NOR process development, aiming to expand its product line to include large-capacity products of 1Gb and above.Since 2021, Gigadevice has consistently maintained its position as the top three global NOR Flash supplier, with its main products targeting the consumer electronics market for wearable devices.Infineon acquired Cypress in 2019, mainly providing high-density NOR Flash products for the automotive electronics market; Micron, similar to Infineon, mainly covers the high-density NOR automotive electronics market, but has been continuously reducing its NOR product line in recent years, focusing more on NAND and DRAM businesses.

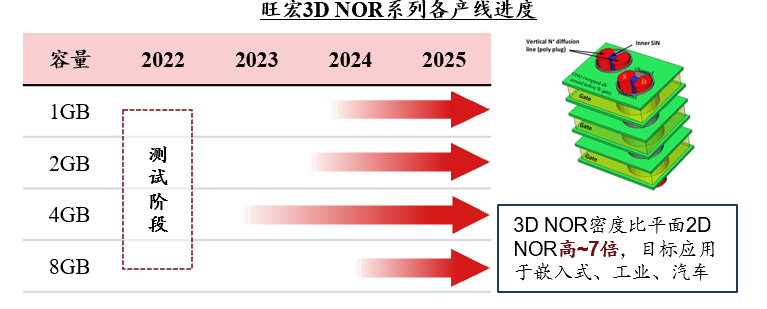

(4) Global Competitive Landscape of the NOR Flash MarketThe top two global NOR Flash suppliers are both Taiwanese players (Winbond and Macronix), together accounting for over half of the market share. Winbond and Macronix have been deeply involved in the NOR Flash field for over 40 years, with a full product matrix covering all market segments including consumer electronics, industrial, and automotive. Among them, Macronix is continuously investing in 3D NOR process development, aiming to expand its product line to include large-capacity products of 1Gb and above.Since 2021, Gigadevice has consistently maintained its position as the top three global NOR Flash supplier, with its main products targeting the consumer electronics market for wearable devices.Infineon acquired Cypress in 2019, mainly providing high-density NOR Flash products for the automotive electronics market; Micron, similar to Infineon, mainly covers the high-density NOR automotive electronics market, but has been continuously reducing its NOR product line in recent years, focusing more on NAND and DRAM businesses.

3.Current Status and Future Trends of the NOR Flash Market

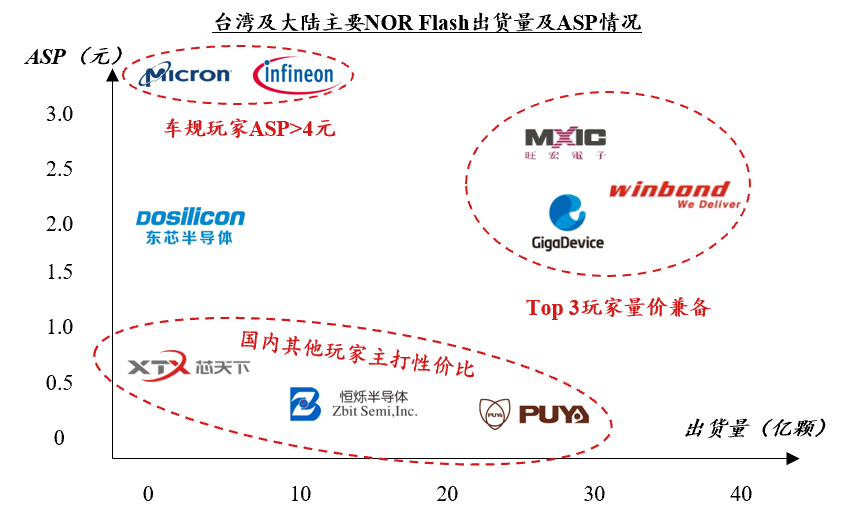

(1) Market Status: Top 3 Suppliers Each Have Their Advantages, Large Capacity Becomes the Next Competitive PointThe top three suppliers of NOR Flash are at a similar level of development, with a clear trend towards large capacity development.Gigadevice adopts a Fabless model, focusing on R&D and design with a lighter asset load; Winbond and Macronix adopt an IDM model, allowing for process synergy optimization and better capacity control during this upward cycle.

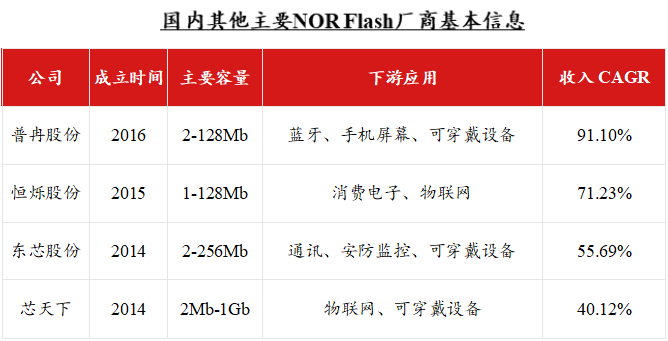

(2) Market Status: Domestic Enterprises are Pursuing Domestic Substitution from the Bottom Up, Focusing on Medium and Small Capacity Products

Domestic NOR Flash companies are adopting a “bottom-up” domestic substitution approach, prioritizing the medium and small capacity (e.g., 128Mb and below) NOR Flash product market, which has relatively low technical barriers and high demand. They are gradually achieving import substitution and increasing market share in these niche areas through localized services, cost-performance advantages, and continuous technological accumulation, using this as a springboard to move towards higher capacity/performance products.

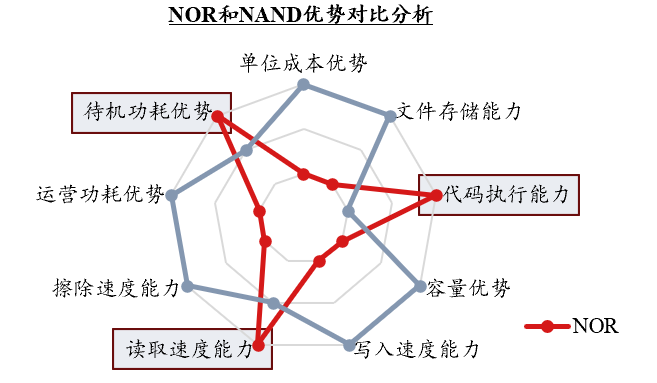

(3) Future Trends: Complementary Advantages of NOR and NAND, High Irreplaceability

NOR and NAND complement each other, with NOR having irreplaceable advantages: there are multiple technical differences between the two, and their technological development advantages complement each other; NOR has fast read speeds, strong code execution (XIP) capabilities, and can be used to store system code, making it irreplaceable.NOR has high reliability, but due to its higher cost, larger storage energy consumption, and shorter lifespan, it is mainly applied in medium and small capacity scenarios to leverage its advantages in executing code.

(4) Future Trends: Capacity, Process Technology, and Business Capability Will Become Key Competitive Points

In the short term, the industry concentration is expected to remain stable, maintaining a tripartite situation, with the leading positions of Macronix, Winbond, and Gigadevice being relatively stable, but facing competition from many small and medium-sized manufacturers.In the long term, companies that can enhance NOR capacity/process technology, possess strong marketing capabilities, and have sufficient production capacity will stand out.