(Report produced by: Shenwan Hongyuan Research)

1. Controllers: The “Brain & Cerebellum” of Humanoid Robots

1.1 Controllers: The Core Foundation of Humanoid Robots

The framework of humanoid robot controllers typically includes perception, voice interaction, motion control, and other layers. 1) Visual perception layer: Composed of hardware sensors and algorithm software, it achieves functions such as recognition, 3D modeling, and positioning navigation; 2) Motion control layer: Composed of tactile sensors, motion controllers, and complex motion control algorithms, it performs real-time control of the robot’s gait and operational behavior; 3) Interaction algorithm layer: Includes speech recognition, emotion recognition, natural language, and text output.

Taking UCLA’s humanoid robot platform ARTEMIS as an example, its control architecture includes hardware interfaces, simulation interfaces, controller interfaces, and safety interfaces, with a central processing unit (CPU) to share and store data and information. Since humanoid robot technology solutions have not yet been finalized and are rapidly iterating, controllers are suitable for a modular structure, making it easier to replace components and simplifying the creation of different controller combinations. ① Hardware interface: Includes actuators, inertial navigation (IMU), sensors, etc., which provide feedback on joint position, speed, torque, and other data information; ② Simulation interface: Mimics the functions of hardware interfaces for simulation environment testing; ③ Controller interface: After reading internal and external environmental information, sends commands to motion controllers; ④ Safety interface: Shuts down the machine upon detecting any erroneous behavior.

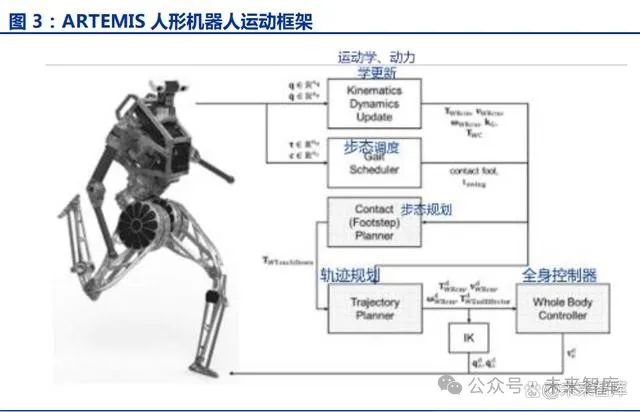

The motion controller is one of the most important and complex modules in the humanoid robot control architecture. For humans, we can combine different senses, such as vision, touch, and hearing, to respond to uncertainties in the environment. After long-term walking training, motion control has long been internalized into “subconscious” actions. For robots, if a robot performs dynamic movement on uneven ground and in uncertain external environments, the motion controller needs to adjust its plans and trajectories in real-time and coordinate the status of bipedal and whole-body limbs. Taking ARTEMIS as an example, its motion framework is very complex, consisting of a motion controller, gait scheduling, gait planning, trajectory planner, and full-body controller. The motion controller receives current generalized coordinates (q, q’), torque (τ), and contact status (c), and calculates the required feedforward torque (τ) and joint feedback. Gait scheduling determines when to move the end effector, gait planning determines where to move the end effector, and the trajectory planner and full-body controller determine how to move the end effector, center of mass, and body.

1.2 Key Technical Breakthroughs Supported by National Policies

The “brain” and “cerebellum” are key to the industrialization of humanoid robots and are also the technical challenges. They are not only the critical points of competition among various humanoid robot manufacturers but also the focus of current policy support. In this year’s significant policies released by the two ministries regarding humanoid robots, “motion control” is placed in a key position. In September 2023, the Ministry of Industry and Information Technology released the “List of Tasks for Humanoid Robots”, with the core foundational technology being the whole-body dynamics control algorithm. The task is to address the full-body control problem for high-dynamic walking of humanoid robots, breaking through key technologies such as real-time models of humanoid robot multi-body dynamics, model predictive control based on whole-body torque, long-distance offline body posture and foot placement planning, online gait planning and real-time posture tracking, and high-explosion joint servo impedance control for humanoid robots. The goal is to establish a humanoid robot high-dynamic walking control method and conduct experimental verification on a humanoid robot physical platform by 2025, establishing high-dynamic walking control algorithms that can support humanoid bionic mechanisms with not less than 28 degrees of freedom, including bipedal, dual-arm, waist, hip, knee, and ankle, enabling humanoid robots to achieve high-dynamic walking in various environments such as flat ground, slopes, steps, uneven surfaces, and soft ground, with a maximum walking speed of ≥4 km/h and a maximum running speed of ≥9 km/h.

In November 2023, the Ministry of Industry and Information Technology, in conjunction with multiple departments, released the “Guiding Opinions on the Innovative Development of Humanoid Robots”, with controllers as a key breakthrough product. The policy goal is to establish a preliminary humanoid robot innovation system by 2025, achieving breakthroughs in a number of key technologies such as the “brain, cerebellum, limbs”. Among them, the “brain” is based on large artificial intelligence models to enhance environmental perception, behavioral control, and human-robot interaction capabilities; the “cerebellum” is used to control humanoid robot movement, build a motion control algorithm library, and establish a network control system architecture. The development goal for controller products is to develop dedicated chips with high dynamic motion drive and high-speed communication functions to meet the needs for high real-time coordinated motion control, and to develop intelligent chips with capabilities for multi-modal spatial perception, behavior planning modeling, and autonomous learning to enhance the coordinated control capabilities of humanoid robots.

1.3 Horizontal Comparison with Mature Industries: Different Paths Leading to the Same Principles

1.3.1 Industrial Robots vs. Humanoids: Higher Requirements for Control Precision and Process Understanding

Industrial robot controllers, as the “brain” of the robot, have functions such as controlling the working state, motion trajectory, spatial position, and operation sequence of the mechanical arm. The basic requirements for industrial robots include: ① Controlling the position, speed, and acceleration of industrial robots, and for robots with continuous trajectory motion, trajectory planning and interpolation functions are also required; ② Human-machine interaction: Workers use teach pendants or operation panels to program the robots; ③ External perception: Some scenarios require industrial robots to measure and perceive information related to vision, force, touch, etc., and sometimes need to exchange information and coordinate work with other devices.

Industrial robot controllers are usually PC-based, composed of hardware and software: ① Hardware: The hardware consists of industrial computers and teach pendants (used for teaching programming)/computer panels (used for offline programming). The industrial computer includes PCB circuit boards (connecting electronic components and electricity), IC chips (integrated circuits formed by microelectronic components such as transistors, resistors, capacitors), transistors (controlling output current based on input voltage), and resistors and capacitors (obstructing current, serving as voltage dividers, current dividers, limiters in circuits). The industrial computer also includes operation panels, communication interfaces, network interfaces, sensor interfaces, and driver interfaces. ② Software: The software consists of control algorithms and secondary development (custom development by customers). Some industrial robots use teaching programming, where workers control the industrial computer through the teach pendant; some require workers to conduct offline programming to generate the robot’s operating trajectory.

The architecture of robot controllers can be classified into three types: centralized control, master-slave control, and distributed control. 1) Centralized control is where a single robot implements all control functions, with a simple structure and low cost; however, it has poor real-time performance, is difficult to expand, and has low reliability, which was common in early robots; 2) Master-slave control uses a two-level processor system to implement control functions, with the master CPU managing, transforming coordinates, generating trajectories, and conducting system self-diagnosis, while the slave CPU controls all joint movements, providing good real-time performance, suitable for high-precision and high-speed scenarios; but it has poor system scalability and is difficult to maintain; 3) Distributed control adopts a “decentralized control, centralized management” approach, where the system comprehensively coordinates and allocates overall goals and tasks, and subsystems coordinate to complete control tasks; its characteristics include good flexibility, improved reliability, facilitating parallel execution of system functions, improving efficiency, and ease of expansion, but the control performance may deteriorate when the number of degrees of freedom and algorithms becomes complex.

Compared to humanoid robot controllers, the differences mainly lie in: 1) Industrial robots have precision requirements: Currently, the motion control precision of industrial robots reaches 0.1mm, which differs from the micrometer-level precision of machine tools but is far higher than the requirements for humanoid robots; 2) The controller algorithms determine motion precision, closely related to process understanding: Industrial robots are applied in factory scenarios such as automotive and photovoltaic, where controllers require secondary programming, and programmers need to deeply understand process know-how and customer needs to continuously optimize algorithms and improve the motion precision of the controller; humanoid robots are not used for precision processing, so the requirements for process understanding and precision are low. 3) The complexity of control differs: The industrial robot controller controls fewer degrees of freedom and fewer sensors; the humanoid robot controller is mainly used to control more complex full-body degrees of freedom, dexterous hand degrees of freedom, gait control, and whole-body coordinated control, requiring more external sensors (vision, force, touch, hearing, etc.), with more complex and diverse application scenarios, necessitating the introduction of large artificial intelligence models, with high algorithm and computing power requirements.

1.3.2 Robotic Vacuums vs. Humanoids: Simplified Mobile Robot Framework

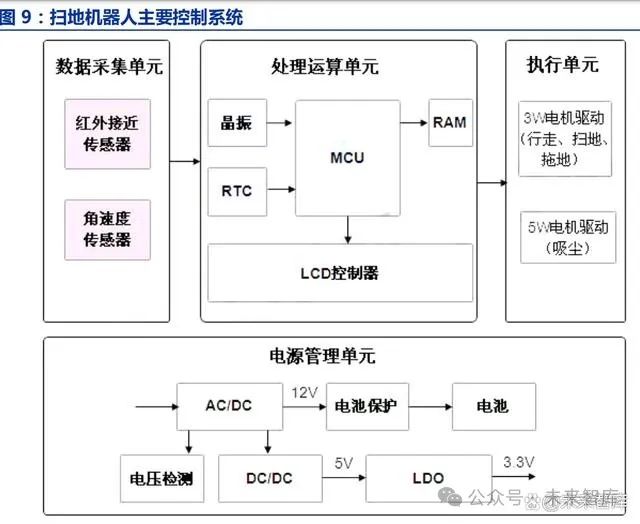

The robotic vacuum system can be divided into several subsystems: sensors, controllers, drive motors, batteries, and power management. First, the robotic vacuum constructs a “perception layer” through LIDAR, cameras, and various sensors, transmitting environmental information to the “brain” of the robotic vacuum. The navigation system uses data from these sensors and SLAM algorithms to plan paths, ensuring the robot accurately locates itself in space and builds an environmental map. Once the map is established, the navigation system passes it to the MCU chip. The MCU chip is mainly responsible for motion control, accurately guiding the robotic vacuum to perform cleaning tasks based on map information and path planning.

As an intelligent small household appliance, the controller is one of the core components of robotic vacuums. Currently, common robotic vacuums mainly use MCU controllers. It accomplishes the following tasks: ① Data collection function: The MCU controller sends selection signals to various sensors, communicating sequentially with each sensor to collect information data in real-time. ② Obstacle recognition and planning: The MCU calculates and determines the relative position and size of obstacles based on received data. Combined with preset rules, it determines corresponding avoidance measures, such as moving forward, turning left, right, backing up, or turning around. ③ Motor control: After determining avoidance measures, the MCU outputs corresponding control pulses to the stepper motor, ensuring the robot executes avoidance actions precisely and moves flexibly. ④ Remote control and status adjustment: The MCU receives instructions from the remote control, allowing users to adjust the robot’s working status. At the same time, it monitors the remaining battery power, directing the smart vacuum to automatically return to the charging station for charging management.

The control principle of humanoid robots is similar to that of robotic vacuums: 1) The robotic vacuum controller mainly plans paths, avoids obstacles, and interacts with humans. For example, humans set the cleaning range and provide voice instructions for the robotic vacuum to clean, controlled by digital signal processors and microcontrollers for the execution layer (motors) and feedback from external information. Companies like Xiaomi and TCL utilize STMicroelectronics’ M3 microcontroller chip as the control chip for path planning. 2) The humanoid robot controller encompasses motion planning and human-machine interaction. The motion controller receives current generalized coordinates, torque, and contact status, calculates the required feedforward torque and joint feedback, and subsequently controls the state of the actuators.

The difference lies in: the humanoid robot controller requires higher real-time performance, and its processing capability far exceeds that of robotic vacuums. Humanoid robots have more actuators and sensors, and require perception, decision planning, motion control, and feedback to be completed in the shortest time possible, demanding a high level of response and coordination between hardware and software. Furthermore, the development and modeling of software algorithms and operations require significant computational power.

1.3.3 Automotive Controllers vs. Humanoids: More Complex Involved Links, Automotive-grade Requirements

With the continuous penetration of electrification and intelligence in the automotive industry, automotive controllers are constantly being updated and iterated, evolving from distributed to domain control and centralized control trends. ① Distributed architecture: Divided into modular (each function of the vehicle has an independent ECU) and integrated (integration of functions from the design stage), traditional distributed architecture has drawbacks such as dispersed computing power that cannot be efficiently utilized, cost and weight disadvantages of wiring harnesses, inability to support high-bandwidth in-vehicle communication, and difficulties in upgrading and maintaining later on. ② Domain controller architecture: Includes centralization (domain central controller) and domain fusion (cross-domain central controller, such as Tesla Model 3). The advantages of centralized architecture include cost savings, reduced assembly difficulty; improved communication efficiency, decoupling software and hardware, facilitating OTA upgrades for the whole vehicle; centralized computing power, reducing redundancy, etc. ③ Vehicle centralized architecture: Divided into onboard computers and vehicle-cloud computing, also a future direction of automotive development.

Taking Tesla’s automotive controller as an example, it has undergone three major developments: 1) Model S divided by function into domains, with the ADAS module spanning power and chassis domains; 2) Model X achieved in-depth modularization across domains, using cross-domain central controllers to control the entire vehicle; 3) Model 3 broke the limitations of domains, achieving full vehicle modularization. The mainstream development direction in the automotive industry is that each of the five domains has a central brain that performs central calculations, with all operational logic in that domain completed by the domain controller, which is connected to various sensors and actuators via CAN or LIN bus. The design concept of Model 3 is different; it adopts the concept of large integration, integrating all controllers visible within a certain area into one super controller, significantly reducing the cost per vehicle.

Since HW2.0, Tesla has begun using self-developed smart driving domain controllers, with FSD (Full Self-Driving) being Tesla’s product aimed at achieving fully autonomous driving. It consists of a computing platform made up of multiple NVIDIA chips, with 8 1.2MP cameras connected to the domain control and fused with millimeter-wave radar information. The currently deployed HW3.0 has seen a significant upgrade in domain control computing power, shifting from NVIDIA’s computing platform to self-developed FSD chips and NPU, with GPU computing power increasing by 12 times and the number of video frames processed per second increasing by nearly 21 times.

Based on functional centralized partitioning, the intelligent driving automotive electronic control system is divided into five domains: power domain, chassis domain, cockpit domain, autonomous driving domain, and body domain. Among them, the autonomous driving domain is key to delivering personalized intelligent experiences for the entire vehicle at this stage and is also the focal point of competition and layout for automotive companies. Its functional development and realization currently require a large amount of AI computation, thus placing high demands on the computing power provided by chips and the underlying algorithms of the operating system; while other domain controllers involve many components related to vehicle safety, thus requiring higher functional safety levels, with relatively lower demands for chip computing power and functional intelligence.

The structure and control principles of autonomous driving vehicle domain controllers are similar to those of humanoid robot controllers. 1) The autonomous driving domain enables vehicles to possess capabilities for multi-sensor fusion, positioning, path planning, decision control, image recognition, high-speed communication, and data processing. The autonomous driving domain typically requires multiple external cameras, millimeter-wave radar, LIDAR, and other vehicle-mounted sensors to perceive the surrounding environment, developing corresponding strategies through sensor data processing and multi-sensor information fusion, and appropriate working models for decision-making and planning. The inputs to the domain controller are data from various sensors, and the algorithm processing covers perception, decision, and control at three levels, ultimately transmitting outputs to actuators for longitudinal and lateral vehicle control. 2) The robot motion controller acts as both the brain and cerebellum, controlling the limb behavior of the robot. For instance, the action of robot walking requires planning a target path based on perceived environments, generating reference projections through the locomotion planner, producing a gait movement scheme, and then converting it into torque and speed outputs for each actuator on the robot, allowing the robot to advance according to the planned gait scheme. However, the requirements for control precision, algorithm demands, and interface complexity differ between vehicles and humanoid robots: 1) Autonomous driving requires higher operational precision and safety: Typically, the driving speed of vehicles is much higher than the walking or running speed of humanoid robots. 2) Humanoid robots operate in more complex external environments, necessitating higher algorithm demands and greater reliance on neural networks to solve path planning and execution issues, while vehicles mainly face road environments. 3) The number of components that vehicles need to control far exceeds those of robots, thus adopting a domain control structure for centralized management to improve efficiency; however, humanoid robots have fewer components, and they are relatively densely distributed.

1.3.4 Tesla FSD vs. Optimus

On November 25, 2023, Tesla has launched the fully autonomous driving (FSD) V12 version to its employees. This version will implement a new “end-to-end autonomous driving” technology, for the first time using neural networks for vehicle control, including steering, acceleration, and braking, discarding the previous 300,000 lines of code, relying more on neural networks, and reducing dependence on hard-coded programming. FSD V12 allows the neural network to directly output vehicle control instructions such as steering, acceleration, and braking by inputting image data captured by cameras. This method is more similar to how the human brain works, where 99% of decisions are made by the neural network, eliminating the need for high-precision maps or LIDAR. The system can analyze and think solely based on visual inputs from the vehicle’s cameras, outputting corresponding control strategies.

The two technical foundations of FSD are: the BEV+Transformer perception algorithm architecture and the Dojo supercomputer system. The former provides FSD with perception and positioning capabilities that do not rely on high-precision maps, while the latter supports rapid algorithm iteration in response to user feedback, achieving an efficient data closed loop.

1) BEV+Transformer

In Tesla’s 2021 Tech Day, it was proposed to use BEV (Battery Electric Vehicle) in conjunction with Transformer technology for feature-level fusion. This technology constructs a three-dimensional image from the scenes captured by the vehicle’s cameras, extracting common features through Transformers. It enables real-time mapping of the surrounding environment without relying on high-precision maps, accurately judging the positions and outlines of objects around the vehicle, as well as traffic facilities such as lane markings, road bumps, and traffic lights.

2) Dojo Supercomputer System

Tesla introduced the Dojo supercomputer system at the 2021 AI Day, which is an innovative non-Von Neumann design supporting parallel computing. The Dojo system is equipped with a rich network structure and interfaces, balancing resource expansion and power consumption while providing corresponding storage and scheduling structures. The company believes that the supercomputer center is crucial for supporting the evolution of FSD (Full Self-Driving) large data models. By fully utilizing the high stability, high scalability, and high parallel computing characteristics of the Dojo system, the company has built more efficient data labeling, algorithm iteration, and simulation verification capabilities, continuously expanding its algorithmic lead in FSD. Tesla intends to apply the FSD technology to humanoid robots. Tesla’s engineering team stated that from the concept of the robot to design, production, and verification, they used vehicle design as the foundation. The two share many similarities, and most design experience can be transferred from vehicles to robots. Musk once said, “A car is a robot with four wheels, while Optimus can be seen as a robot with limbs.” 1) The external environment for humanoid robots is more complex, requiring greater reliance on neural networks to solve path planning and execution issues; if the FSD system is integrated into the humanoid robot system, the end-to-end solution is expected to significantly enhance the humanoid robot’s visual perception level and motion planning and control capabilities; 2) The computing power requirements for humanoid robots are high, and the Dojo supercomputer system can provide support.

Since Optimus’s debut at the 2022 AI Day, its visual perception capabilities have significantly improved, and its motion control capabilities have continuously evolved and iterated. According to videos released at the 2022 AI Day, in April 2022, Optimus took its first step; in July 2022, Optimus unlocked pelvic applications for balance; in August 2022, the arms began to function; in September 2022, the toes began to sense, and motion speed increased. As more joints joined the training, the motion speed improved. Additionally, Optimus employs motion center of gravity control algorithms to determine its state based on height information and center of mass, maintaining balance while walking or when subjected to external forces. According to subsequent videos released by Tesla, Optimus’s motion control capabilities have progressed rapidly. By May 2023, it achieved jumping in place on one leg, with improved integrity and stability, and smoother robot gait and dexterous hand grasping (previously slow gait and hand shaking). By September 2023, Optimus can self-calibrate its hands, arms, and legs based on pure vision and joint position encoders, accurately locating its limbs in space; the robot demonstrated advanced actions like stretching, extending its body, and balancing on one leg, with enhanced posture control and self-balancing abilities. It can be seen that Tesla has bridged the underlying models of FSD and robots, continuously optimizing FSD algorithms relying on neural network models and visual technology, performing well in perceiving the environment and making autonomous analysis for motion.

2. Industrial Control Field: Mature Development of Controllers, Huge Potential for Domestic Substitution

2.1 Controllers Have Developed Over a Century, with Multiple Technical Routes Coexisting

The motion control system is the core component of mechanical equipment, responsible for real-time control of the motion trajectory, position, speed, and acceleration of mechanical moving parts to ensure they move according to predetermined requirements. A complete motion control system includes: motion controllers, drivers, motors, sensors, etc. Among them, the controller uses the kinematic and dynamic models of the controlled mechanical system for motion planning and control prediction. At the same time, it achieves closed-loop control through feedback from information provided by various sensors. Motion controllers integrate algorithms for logical control, precise positioning, and trajectory control, thereby completing specific motion trajectories, positions, speeds, and accelerations, and outputting precise commands that meet control objectives, such as temperature, flow, pressure, displacement, etc.

The motion control system has evolved alongside the industrial electrification, automation, and intelligence process, continuously absorbing advanced technologies and giving rise to numerous branches. Early motion control systems were composed of digital logic circuits, and with the development of microelectronics and computer technology, computer software has replaced hardware circuits, allowing for the implementation of complex control algorithms that can be upgraded during use to enhance performance or change applications. Depending on the usage scenario, motion control systems can be categorized into CNC systems (Computer Numerical Control), General Motion Controllers (GMC), and Programmable Logic Controllers (PLC).

① CNC Systems (Computer Numerical Control System)

CNC systems are motion control systems specifically developed for CNC machine tools, capable of controlling machine tools to complete work movements and process parts according to numerical information commands of parts processing programs. Depending on the number of controlled motion axes and their linkage relationships, CNC systems are defined as M-axis N-linkage CNC systems. The motion control of machine tools is not fundamentally different from that of other devices, so CNC systems are often seen in other automation devices, such as automatic assembly lines.

② Programmable Logic Controllers (PLC)

The initially invented PLC could only perform logical control, hence the name Programmable Logic Controller. With the development of computers, it has also added many new functions. The PLC’s characteristics are that it primarily focuses on logical control, with control objects being IO (Digital or Analog), and its type is broader, with motion control being only one part of it, making motion control relatively simple.

③ General Motion Controllers (GMC)

General motion controllers are not designed for specific devices. Their main task is to perform necessary logical and mathematical operations according to motion control requirements and signals from sensors to provide correct control signals for motors or other power and execution devices. PC-Based controllers refer to control systems or controllers based on personal computers (PCs). These controllers typically use personal computer hardware and software to perform various automation, monitoring, and control tasks.

④ Specialized Controllers

Specialized motion controllers are a specific type of controller designed to achieve highly customized and specific application motion control tasks. Compared to other general controllers, specialized motion controllers focus more on executing specific mechanical movements or motion control tasks. Specialized motion controllers are widely used in many fields, such as CNC machine tools, laser cutting control systems, laser marking control systems, glue dispensing control systems, and other areas requiring highly precise and customizable motion control, with application software developed by controller manufacturers based on industry application process requirements, allowing equipment manufacturers to use them directly without secondary development. Different types of motion control systems continuously iterate, and there are also overlaps, so the boundaries are often unclear. For example, ① Originally, PLCs were used to control devices with lower automation levels, but as the automation demands of fields such as textile machinery, printing machinery, and packaging machinery have continuously increased, PLC motion control functions have become increasingly powerful; ② With continuous innovation in equipment, there is a lack of strict demarcation standards between CNC machines and automation devices; some devices adopt GMC-structured CNC systems, while others are equipped with general motion controllers that absorb CNC functions.

2.2 General Controllers: Strong Flexibility and Versatility for Complex Control

Motion controllers consist of hardware, firmware, software, etc. The hardware part includes microprocessors, memory, interface circuits, communication interfaces, power supplies, etc.; firmware refers to software that is fixed in microprocessors, memory, programmable logic devices, etc.; the software part consists of real-time operating systems, motion control instruction compilers, preprocessing and optimization of motion control parameters, motion control functions, communication management, and other modules. PC-Based controllers refer to control systems or controllers based on personal computers (PCs). These controllers typically use personal computer hardware and software to perform various automation, monitoring, and control tasks.

PC-Based controllers can be classified into three types based on specific models: plug-in controllers, embedded controllers, and network-based controllers. ① Plug-in controllers need to be inserted into industrial computers to operate, existing in the form of “cards”, usually using high-performance DSP and FPGA as core processors, with strong versatility and expandability; suitable for applications in 3C electronics, semiconductors, industrial robots, packaging, etc. ② Embedded controllers integrate industrial computers and plug-in controllers, making specially designed motion controllers more suitable for applications requiring high-speed computing and microsecond-level response times. These dedicated processors can ensure very fast control cycles, especially suitable for high-end manufacturing fields with extremely high speed and precision requirements, applicable to knitting machinery, laser cutting, glue dispensing machines, etc. ③ Network-based controllers connect with servo drive systems using various industrial bus forms, such as Ethercat. Application scenarios include semiconductor processing, laser processing equipment, PCB drilling and milling equipment, robots, CNC machine tools, woodworking machinery, printing machinery, electronic processing equipment, and automated production lines.

According to data from Ruida Industrial MIR, the scale of China’s PC-based motion controller industry was approximately 3.264 billion yuan in 2022, and it is expected to reach approximately 4.02 billion yuan by 2025. PC-Based motion controllers are mainly applied in 3C, semiconductors, industrial robots, and machine tools. As of 2022, in the main application fields of PC-Based motion controllers, the 3C industry, semiconductor manufacturing, and industrial robots accounted for the top three positions, with shares of 16%, 15%, and 11% respectively.

The PC-based controller market is dominated by mature foreign manufacturers, but the penetration rate of domestic brands is quite high. According to data from Ruida Industrial MIR, in 2022, among the top five in the market, aside from the foreign enterprise Beckhoff accounting for 21%, the rest are all domestic brands, with domestic companies represented by Advantech, GSK, Leadshine, and Weihong Electronics occupying 35% of the market, gradually becoming an important force in the PC-based motion controller field. Therefore, in the PC-based motion controller market, the low-end market is mainly dominated by domestic manufacturers, but the overall technical level still has a certain gap compared to foreign-funded manufacturers, and the high-end market is still controlled by foreign enterprises.

2.3 PLC: Focused on Logical Control, High Ease of Programming

The hardware structure of PLCs is similar to that of microcomputers, consisting of power supplies, CPUs, memories, I/O, functional modules, communication modules, etc. Depending on the number of I/O points, PLCs can be divided into micro, small, medium, and large categories. Small PLCs have fewer than 256 I/O points, are smaller in size, lower in price, but have single functions and can only realize simple control systems. Medium and large PLCs have more than 256 I/O points and often possess more powerful control functions, suitable for complex logical production systems or automation control of large production equipment, but their prices are high, and the technical barriers are significant.

There are differences between PLCs and PC-Based controllers in terms of project precision and real-time performance, making them suitable for different downstream application scenarios. 1) PC-Based controllers and specialized motion controllers focus on controlling complex motion algorithms, possessing stronger data transmission and management capabilities, suitable for continuous control and high-precision process industries. Therefore, these controllers are often used in fields requiring high precision and real-time performance, such as industrial robots, semiconductor manufacturing, and medical devices. These controllers have strong computing capabilities and fast control cycles to ensure high precision and speed of movement and operation. 2) PLCs focus more on localized logical control, making them more suitable for discrete operations with lower precision and real-time requirements. Therefore, in applications where precision and real-time requirements are lower, such as household appliances and traditional manufacturing, simpler PLC controllers can usually be used.

According to data from Ruida Industrial MIR, the scale of the PLC market in 2022 was approximately 17 billion yuan. Specifically, the scale of the large PLC market was approximately 8.58 billion yuan, with a year-on-year growth of 8.8%; the scale of the small PLC market was approximately 8.41 billion yuan, with a year-on-year growth of 5.6%. Additionally, according to MIR’s predictions, by 2025, the PLC market scale is expected to increase to approximately 18 billion yuan, with the small PLC market scale expected to reach 8.65 billion yuan, and the medium and large PLC market scale expected to reach 9.36 billion yuan.

As the core controller of industrial control, PLCs are the brain of the entire industrial control system and a core component for maintaining the safety of the industrial control industry chain. Currently, the market share of PLC manufacturers in mainland China is still relatively low. In the global market competition landscape, European and American manufacturers have a strong voice in the medium and large PLC markets, while Japanese and Taiwanese manufacturers mainly focus on the small and medium PLC markets. With the improvement of autonomous controllability, domestic manufacturers are rapidly occupying the market share of small and medium PLCs, challenging the positions of Japanese and Taiwanese manufacturers due to their advantages in product cost performance, short delivery times, and rapid response to customer needs.

① Small PLC: The entry threshold for the small PLC market is relatively low, mainly applied in the OEM market. Due to downstream customers’ sensitivity to price, the small PLC market faces severe homogenization issues and intense competition. The OEM market mainly involves traditional industry upgrades and automation of emerging industries. The industry types are relatively scattered, with batteries, textiles, packaging, and electronics manufacturing accounting for 7%, 7%, 6%, and 5% respectively in 2022. The competition pattern in the small PLC market is relatively scattered, showing a market model of one strong leader and many competitors. In 2022, the competition in China’s small PLC market was relatively scattered, with the top two accounting for about 53% of the market. Siemens’ small PLCs perform competitively, with Huichuan, Mitsubishi, and Omron ranking second, third, and fourth respectively. Domestic brands led by Huichuan and Newjoy are continuously enhancing their market competitiveness.

② Medium and Large PLCs: The technical difficulty of medium and large PLC markets is higher, mainly applied in project-based markets. Due to the complexity of medium and large PLC processes, they are mainly applied in project-based markets, where users have high demands for product safety and anti-interference. The project-based market refers to independent single projects, usually requiring strong targeting to meet specific industry needs. In the project-based PLC market, customers have a low tolerance for industrial accidents, so strong stability between PLC devices and platforms is required. The industry types are relatively concentrated, with batteries, metallurgy, petrochemicals, and logistics accounting for 13%, 10%, 9%, and 7% respectively in 2022. Medium and large PLCs face barriers such as “technology + customers + networking/exclusivity”, with foreign brands occupying monopoly market positions due to their leading technological advantages and well-established sales and service networks. Long-term technological accumulation has made stability between devices and platforms the core competitiveness of PLC enterprises. Factors such as customer trust costs, upfront investment, PLC ecology, after-sales service, and usage habits collectively increase the migration costs for PLC customers, strengthening customer stickiness and creating significant barriers to customer migration. In 2022, the competition in the medium and large PLC market was relatively concentrated, with Siemens, Omron, and Mitsubishi dominating, collectively accounting for over 85%. Rockwell, Keyence, and Schneider each accounted for over 4%. Siemens’ medium and large PLCs performed strongest in the market, with Omron and Mitsubishi’s market shares being 14% and 9% respectively. Rockwell, Schneider, and Keyence each held 7%, 4%, and 6% of the medium and large PLC market, with Chinese enterprises lacking competitiveness in this segment.

2.4 CNC Systems (Computer Numerical Control): Developed for CNC Machine Tools, High Precision Requirements

CNC systems are the “brain” of CNC machine tools, a core component with high technical content, accounting for about 20% of the cost of CNC machine tools, generally composed of control systems, servo systems, and detection systems: 1) The hardware of the control system (CNC device) is a dedicated computer system with input and output functions, issuing control commands to the servo system; 2) The detection system can detect the motion position and speed of machine tool components and feedback to the control system and servo system to correct control commands; 3) The servo system compares and controls the control commands from the control system with feedback information from the detection system, driving machine tool components to move as required. CNC systems are specially developed motion control systems for CNC machine tools, capable of controlling machine tools to complete work movements and process parts according to numerical information commands of parts processing programs. Depending on the number of controlled motion axes and their linkage relationships, CNC systems are defined as M-axis N-linkage CNC systems. Depending on the type of machine tools controlled, CNC systems can be divided into: lathe systems, milling systems, machining center systems, engraving and milling machine systems, cutting machine systems, etc. The mechanical parts processed by lathes are more standardized, and the motion control functions are relatively simple. Machining centers, engraving, and milling CNC systems are aimed at complex spatial surface processing, some of which integrate functions such as automatic tool changing, networking, and machine vision, making the systems more complex.

The economic-type systems have basically achieved domestic production, and domestic enterprises are focusing on importing substitutes for mid to high-end CNC systems. The China Machine Tool Industry Association classifies CNC systems into three categories based on functionality and level: economic CNC systems, standard CNC systems, and high-end CNC systems. Among them, standard and high-end CNC systems have a high degree of technical difficulty, with high demands for functionality, performance, and reliability, and there are relatively few domestic production enterprises. The market share is mainly concentrated in international enterprises such as Japan’s Fanuc and Germany’s Siemens, while domestic companies like Huazhong CNC focus on importing substitutes for mid to high-end CNC systems. Economic CNC systems have relatively mature technology, with domestic brands occupying the market share.

The key to high-end CNC systems lies in technological levels, with extremely high product added value, and the market is mainly occupied by German Siemens and Heidenhain. The key to standard CNC systems lies in product reliability, with relatively high added value and stability, and the market is mainly occupied by Japanese Fanuc and Mitsubishi (Japanese manufacturers generally do not export high-end CNC systems to China). Economic CNC systems mainly depend on product price, with a lower entry threshold, primarily dominated by domestic brands, making market competition intense.

CNC system products have high technical barriers, and the market is still dominated by overseas brands, with vast potential for domestic substitution in mid to high-end systems. According to statistics from the CNC Systems Branch of the China Machine Tool Industry Association, there are significant differences in market shares of domestic and foreign brands in different levels of CNC systems in China. According to data from Ruida Industrial MIR, based on system sales, in 2022, foreign brands such as Fanuc, Mitsubishi, and Siemens accounted for approximately 45% of market share, while based on sales value, these three manufacturers collectively accounted for 67% of the CNC system market in China. Taking domestic CNC machine tool manufacturer Nuwei CNC as an example, from 2018 to 2020, the proportion of CNC systems imported or sourced from foreign brands accounted for 99.81%, 99.53%, and 99.88%, respectively, with the proportion of purchases from Fanuc being 82.97%, 82.13%, and 79.85%.

2.5 Hardware and Software Integration as Bottleneck Breakthroughs, Huge Potential for Domestic Substitution

Motion controllers include hardware, software, custom design, and integration, which are the reasons for the gap in controller products. 1) Hardware: Hardware includes processors, control chips, sensors, motor drivers, and connectors. High-performance processors and specialized control chips are usually expensive, while high-precision sensors and motor drivers also increase costs. 2) Software: Controllers need to develop corresponding control algorithms and motion planning software to achieve precise motion control and positioning. The development and debugging of software require professional developers and tool support. 3) Engineering design and integration: For specialized motion controllers’ specific application needs, customized engineering design and integration processes may be required to ensure the controller’s adaptability and reliability.

(1) The hardware gap mainly lies in chips

Chips are the key components affecting the performance and future development of industrial control systems. Currently, key MCU chips, industrial bus chips, high-precision sensors, and industrial-grade analog chips used in DCS, SIS, and PLC are mainly imported. The proportion of domestic chips in conventional systems is less than 30%. In recent years, the US has taken a series of continuously escalating restrictive measures against China using chips as weapons. Since the chips used in industrial control systems mainly adopt mature processes and rarely use advanced processes, the current impact on the stability of the industrial control system supply chain does not seem significant, but the potential risks of supply interruptions are very high. Moreover, restrictions on advanced processes will limit future technological progress in industrial control systems. Currently, there are several issues with using domestic chips in industrial control systems: the variety of products is limited, and some key categories are missing; domestic manufacturers have relatively weak design and process capabilities, lack application experience targeting industrial control industry customers, have a small customer base, and poor matching with industry application scenarios, and deficiencies in derating design, material application testing, etc., will affect product detail parameters; after passing initial device verification, the quality consistency of subsequent batch products is poor. In terms of chips, Siemens, Schneider, and Rockwell’s PLCs all use customized SoC chips to replace general CPU chips for the main control module and I/O modules. Under conditions of sufficient product quantity, the BOM cost of customized SoC chip solutions has a significant decrease compared to discrete chip solutions, and they are smaller in size, consume less power, have strong anti-interference capabilities, and high performance. Domestic PLCs are unable to customize SoC chips due to low production volumes and limited development investments.

(2) The software gap is substantial: mainly in precision and versatility

The performance of motion controller software includes the control algorithms of the controller and the ease of use of secondary development platforms. 1) The algorithm level of the controller directly affects motion precision. The level of the algorithm is influenced by the understanding of customer processes, requiring time and project experience accumulation to form a closed loop of application-feedback-iteration. Foreign-funded enterprises have a first-mover advantage, making it relatively difficult to shake their advantages in controller algorithms. 2) Controllers usually adopt closed structures, leading to deficiencies in openness, software independence, fault tolerance, extensibility, and networking capabilities, making it difficult to meet the demands for intelligence and flexibility. Different industrial robot companies usually have their independent software development environments and dedicated robot programming languages, such as ABB’s RAPID, KUKA’s KRL, Yaskawa’s INFORM, Kawasaki’s AS, and Fanuc’s Karel. Due to different manufacturers adopting different software systems, along with the lack of significant advantages of domestic manufacturers in robot controller software technology, domestic industrial robot controllers have not yet been widely applied in the market. 3) Ease of use: Most foreign PLC giants adopt real-time multitasking operating systems and real-time control software, enabling various PLC operating modes such as single run, periodic run, continuous run, interruption, etc., and configuration software provides integrated design capabilities and tools with SCADA, MES, etc., allowing for once programming to be used everywhere, reducing the workload of implementing intelligent factory projects. Domestic PLCs mostly use general embedded operating systems, with poor multitasking performance, unstable task execution cycles, unable to meet the complex machine control requirements of high-speed multi-axis coordination control and high-speed production lines, and the integration workload with third-party systems is relatively large, with complicated operation methods and poor ease of use.

(3) The network protocols used by domestic manufacturers are insufficient to enter the high-end market

In terms of network protocols, foreign products mostly independently develop industrial real-time Ethernet protocols, and generally only form IEC international standards or open-source parts of code for the conventional protocol sections, while the protocol sections and codes for complex control applications are not disclosed. Due to insufficient network development capabilities, domestic manufacturers mostly directly use IEC standards and open-source codes, often finding them inadequate for complex control applications, making it difficult to enter the high-end market. The general controller market has significant potential for domestic substitution. Foreign brands usually position themselves in the high-end market, but with the continuous development of domestic brands in recent years, they have also achieved certain breakthroughs. 1) In the PLC controller market, domestic enterprises such as Huichuan are gradually expanding their sales scale. 2) In the PC-Based controller market, domestic brands such as GSK, Leadshine, Chengdu Lechuang, and ZW have occupied over 70% of the market share. The “14th Five-Year Plan for Intelligent Manufacturing Development” clearly states that by 2025, China’s supply capacity will be significantly enhanced, and the level of intelligent manufacturing equipment and industrial software technology and market competitiveness will be significantly improved, with domestic market satisfaction rates expected to exceed 70% and 50% respectively, and the motion control market is expected to maintain high growth in the future.

3. Key Links and Company Overview

3.1 Industrial Controllers

3.1.1 General Controllers

(1) GSK Technology: Comprehensive Product System Covering Core Components, Systems, and Complete Machines for Motion Control

The company focuses on motion control technology, forming a product system covering core components, systems, and complete machines for motion control. Among them, core components are the business foundation and main source of income since the company’s establishment; system and complete machine products are part of the vertical integration strategy focusing on specific application scenarios and addressing specific industry pain points, which will be a key area for future layout. The company has long focused on independent research and development of core technologies for motion control and intelligent manufacturing, and its technology, products, and system solutions are widely used in high-end equipment manufacturing fields such as semiconductor equipment, industrial robots, CNC machine tools, 3C automation and testing equipment, printing and packaging equipment, and textile equipment. The company’s clients include high-end equipment manufacturing companies such as Han’s Laser, Bozhong Precision, Xinyi Chang, Lianying Laser, Ada Intelligent, Nantong Zhenkang, Guangdong Kejie, Yawen Co., Ltd., and Cixing Co., Ltd.

(2) Leadshine Technology: Supplier of Core Components and Solutions for Motion Control

The company is a high-tech enterprise specializing in providing core components and industry motion control solutions for intelligent manufacturing equipment. The company mainly engages in the research, production, and sales of core components for motion control, including controllers, drivers, and motors, as well as research and development of related industry application systems, providing customers with complete series of motion control products and solutions. The motion control series products of the company have broad downstream applications and have been widely used in electronic manufacturing equipment, special machine tools, industrial robots, printing and packaging equipment, medical health equipment, textile and clothing equipment, logistics equipment, and other equipment manufacturing industries.

(3) Estun: Self-developed Core Component Controller for Industrial Robots

The company’s business is divided into two main parts, including industrial robots and core components. 1) Robot business: This part includes robot bodies and integrated solutions. The company’s industrial robot bodies cover a full range of products from 3-600kg, widely used in various scenarios such as bending, arc welding, handling, and palletizing. The robot body business has benefited from the rapid rise of the new energy industry, as these industries have brought a large demand for automation.

2) Core components: This part includes CNC systems, servo systems, and motion control systems. CNC systems are mainly used in metal forming machine tools, while servo systems and motion controllers are mainly applied in robotics, 3C (computers, communication, consumer electronics), lithium batteries, photovoltaics, and other industries.

(4) Xinjida: Giant in Elevator Control Systems, Actively Layouting the Entire Robot Industry Chain

The company was established in 1995, transitioning from a traditional elevator control manufacturer to the current dual-track layout of “elevators + robots”. In 2014, the company acquired ZW, a leading domestic supplier of high-performance motion control system solutions for emerging application areas. The company’s main business is divided into two segments: 1) Elevator controller business: mainly divided into elevator controllers and elevator control systems; 2) Robot business: industrial robot products mainly include articulated robots and SCARA robots, widely applied in 3C, new energy, white goods, packaging, food and beverage, pharmaceuticals, metal processing, and other industries, accumulating rich application experience in various subfields; control and drive products mainly include controllers, servo drives, and inverters. Control products cover low, medium, and high-end products from control cards to PACs, meeting different needs of different customers.

3.1.2 Laser Equipment Controllers

(1) Bichu Electronics: Main Business of Laser Cutting Control Systems, Intelligent Welding Robots Open Up Growth Space

The current core business of the company is laser cutting motion control systems. The company focuses on laser cutting motion control systems, developing three major products including follow-up control systems, board control systems, and bus control systems, among which follow-up systems and some board systems are mainly applied to medium and low-power laser cutting machines; bus systems and some board systems are applied to high-power laser cutting machines. In addition, the company’s other products include high-precision visual positioning systems, I/O expansion modules, axis expansion modules, pipe cutting software, and planar cutting software.

The intelligent welding system launched by the company for intelligent welding robots can achieve automatic, non-standard welding, replacing humans. Intelligent welding robots feature a no-teach function, focusing on welding non-standard workpieces such as steel structures. Welding robots are divided into two categories: teaching welding robots, which mainly require manual teaching to edit the welding path, and intelligent welding robots, which utilize intelligent welding offline programming software, intelligent seam tracking systems, and intelligent welding control systems to generate welding paths, achieving a no-teach function, shortening debugging cycles, and further enhancing the automation level of intelligent welding robots, making them more suitable for flexible processing of small-batch non-standard workpieces.

(2) Weihong Co., Ltd.: Deeply Cultivating the Motion Control Field, Motion Control Cards and Integrated Controllers

Weihong Co., Ltd. deeply cultivates the motion control field, with the motion controller business including motion control cards and integrated motion controllers. Specific products mainly include engraving and milling control systems, cutting control systems, and robotic arm control systems, applicable to various engraving machines, milling machines, machining centers, water jet cutting machines, laser cutting machines, plasma cutting machines, flame cutting machines, woodworking machines, glass processing machines, industrial robots, etc. Among them, 1) Motion control cards serve as the carrier for the underlying control algorithms of CNC software and hardware interfaces, requiring complete machine manufacturers to be equipped with PCs, which can flexibly use CAD/CAM and other software installed on PCs; 2) Integrated controllers integrate motion control cards, CPU motherboards, displays, and professional operation panels, making them easy to use without self-assembly; however, they are more expensive, and complete machine manufacturers cannot freely choose the models configured for industrial PCs.

3.1.3 CNC Systems

Huazhong CNC: Focusing on Mid to High-end CNC Systems, A Scarce Brain for Machine Tools

Huazhong CNC focuses on mid to high-end CNC systems. Established in 1994, the company mainly engages in the research and production of domestic mid and high-end CNC systems. The company focuses on CNC system technology, with three main business segments: CNC systems and machine tools, industrial robots and intelligent production lines, and supporting the new energy vehicle industry. 1) CNC systems and machine tools: The company specializes in mid to high-end CNC systems, mainly selling CNC systems and accessories to CNC machine tool manufacturers, supporting corresponding manufacturers’ high-speed drilling and tapping centers, machining centers, five-axis machine tools, etc. 2) Robots and intelligent production lines: The company independently produces core control and servo components for robot products, completing the assembly of robot bodies, and sells to manufacturers in the consumer electronics, home appliance industries, or educational institutions, while providing customized services. 3) Supporting new energy vehicles: The company conducts technological research and product development around automotive electrification, lightweighting, and intelligence, with specific products including servo motors for new energy vehicles, new energy vehicle drivers, new energy vehicle controllers, and lightweight vehicle bodies.

3.1.4 PLC

(1) Huichuan Technology: PLC Products are One of the Key Breakthrough Product Lines

Huichuan Technology, established in 2010, is a high-tech enterprise specializing in the R&D, production, and sales of industrial automation and new energy-related products. After more than a decade of development, the company has evolved from a single supplier of inverters to a comprehensive supplier of electromechanical hydraulic products and solutions. Currently, the company has formed five major business segments: general automation, smart elevators, new energy vehicles, rail transit, and industrial robots, providing industrial automation core components and solutions such as inverters, servo systems, PLC/HMI, high-performance motors, sensors, machine vision, and pneumatic components for automated equipment/production lines. It provides complete electrical solutions for the elevator industry, electric drive and power systems for the new energy vehicle industry, traction and control systems for the rail transit industry, and industrial robot products and solutions for automated production lines/workshops/factories.

(2) Xinjie Electric: Early Layout in the PLC Field, Initially Perfecting the Industrial Control Product Line

The company mainly engages in industrial automation control products, with major products including: 1) Electrical control systems in industrial intelligent control systems, including programmable controllers (PLCs), drive systems (servo drives, servo motors, stepper drives, inverters), human-machine interfaces (HMIs), and intelligent equipment; 2) Electrical control integration applications, providing overall industrial control automation solutions for customers in the factory automation (FA) field. The main customers are distributed across industries such as textiles and apparel, printing and packaging, home building materials, food and beverage, automotive and new energy, machine tool tools, information technology, and warehousing logistics. The company has been in the PLC field for a long time, and has successively launched products such as the XA series, XS series, XC series, XD series (including XD3, XD5, XDM motion control type, XDC motion control bus type, XD5E Ethernet type, and XDH EtherCAT motion control type), XE series, RC series, XL series, and XG series. In 2022, PLC products achieved revenue of 511 million yuan, accounting for 56.67% of total revenue.

(3) Hechuan Technology: Early Layout in the PLC Field, Initially Perfecting the Industrial Control Product Line

Hechuan Technology is a technology-driven provider of core components and overall solutions for industrial automation control, mainly engaged in the research, production, sales, and application integration of industrial automation products. The product matrix has covered “control + drive + execution sensors + electromechanical integration” and continues to extend upstream to industrial control chips, sensors, and downstream to high-end precision CNC machine tools. Among them, the controller products are mainly PLCs, with downstream applications in photovoltaics, lithium batteries, robots, mechanical arms, 3C, LEDs, machine tools, textiles, packaging, food, dyeing, and other industries.

3.2 Consumer Field Controllers

(1) Tuobang Co., Ltd.: Core Technology of “Four Points and One Network”, Providing Intelligent Control Solutions for Five Major Fields

The company focuses on the “four electrics and one network” technology, providing various customized solutions for industries such as home appliances, tools, new energy, industrial, and intelligent solutions. ① Intelligent control products for home appliances involve controllers, motors, etc., including main control for home appliances, power control, motor drive and control, display control, etc.; these products are mainly applied in HVAC, kitchen appliances, cleaning appliances, health care, lighting, and smart home fields. ② Intelligent control for tools is used for electric tools, garden tools, and other professional tools, with customized services provided, including controllers, motors, battery pack BMS, modules, and complete machines. ③ The new energy business mainly targets two application areas: small and medium storage and new energy vehicles. ④ In the industrial control field, the company provides core components such as PLCs, motion control cards, stepper/servo drivers, and motors, along with motion control solutions tailored to industry processes for downstream automation equipment customers. ⑤ Intelligent solutions: The company’s AIoT (Artificial Intelligence of Things) technology platform and innovative capabilities for intelligent products serve as the core, targeting “medical, food, housing, and transportation” and “industrial, catering, hotels, parks” and other segmented scenarios, seizing new opportunities for intelligent upgrading, data collection and analysis, human-machine interaction, and intelligent manufacturing, actively integrating into various mainstream IoT ecosystems, including Matter, to provide customers with comprehensive intelligent solutions of “innovative products + AIoT platform + customized services”.

3.3 Connectors

(1) Weifeng Electronics: A Growing and Stable Industrial Control Connector Enterprise

Weifeng Electronics is a company providing high-end precision connector products and solutions, specializing in industrial control connectors, automotive connectors, and new energy connectors. Connectors are indispensable basic components in electronic devices, playing a crucial role in the quality and performance of electronic devices. The company’s main products have reached the same technical level as international first-class manufacturers, providing high-end precision connector products and solutions for many well-known domestic and foreign enterprises. ① In the industrial control field, the company’s products can be applied in servo motors, programmable logic controllers (PLCs), robotic arms, industrial computers, and other industrial control and automation equipment, corresponding to clients including Huichuan Technology, Delta Electronics, Tyco Electronics, and other industrial control equipment and components manufacturers. Industrial control and automation equipment operate continuously in environments of vibration and noise, with some also involving optical sensors, electromagnetic coupling, and other non-contact connections, presenting complex and diverse application scenarios where the costs of parts maintenance or replacement are high. This poses high reliability and durability requirements for industrial control connectors. ② In the automotive field, the company’s products are specifically applied in the core “three electrics” systems of new energy vehicles, including batteries, motors, and electronic control systems, as well as in-vehicle media devices and high-definition imaging systems, corresponding to clients including BYD, SAIC Group, and Aptiv, among others. Automotive connectors must focus on data transmission between the vehicle and driver during driving conditions, including feedback on changes in traffic environments and executing various driver operation commands. Therefore, the stability of connectors becomes an important indicator of safety performance. Additionally, automotive connectors must also meet the high integration, precision, and lightweight standards proposed by automotive manufacturers to reduce overall vehicle energy consumption. ③ In the new energy field, the company’s products are mainly applied in solar and wind energy inverter systems, corresponding to clients including Sungrow, Goodwe, Solaredge, and other inverter and accessory manufacturers. Inverters play a current conversion role in new energy systems, where sustained current carrying can accelerate component aging. Therefore, high electrical and mechanical performance of connectors is particularly important. Moreover, outdoor conditions such as animal strikes and weather impacts also pose challenges to the anti-interference capabilities of new energy systems. Thus, new energy connectors must effectively handle electrical signals while also considering corrosion resistance, prevention of electric leakage, and adaptability to complex and variable outdoor climate conditions.

(2) Ruikeda: Focused on Communication and Automotive Connector Layout

Ruikeda specializes in the research, production, sales, and service of connector products. After over a decade of development, the company has become one of the few enterprises capable of simultaneously developing and producing optical, electrical, and microwave connector products. The products are widely applied in data communication, new energy vehicles, industrial control, medical devices, and rail transit fields, serving global customers. ① In the application of wireless communication base station systems, the company has developed several new types of connectors, including 5G system MASSIVE MIMO board-to-board RF blind-mate connectors and integrated connectors for optical modules in wireless base stations. ② In the new energy vehicle connector market, the company has developed a full series of high-voltage, high-current connectors and components, charging and swapping series connectors, intelligent networking series connectors, and electronic integrated busbars, forming a rich product line in the new energy vehicle supporting market. ③ In industrial and other fields, the company’s coupler connectors, heavy-duty connectors, and industrial connectors are mainly applied in rail transit, locomotive air conditioning, electricity, industrial robots, and wind energy industries.

1、Accelerating AI Incubation in Automobiles: We welcome partners in AI entrepreneurship to participate together; we will rely on OEM resources to provide support in consulting, brand promotion, funding, and product integration.

2、We welcome angel round and A round enterprises across the entire automotive industry chain (including the power battery industry chain) to join the group (We will recommend to top 800 automotive investment institutions at home);There are communication groups for leaders of science and technology innovation companies andgroups for various areas such as complete vehicles, automotive semiconductors, key parts, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, and vehicle networking. Please scan the administrator’s WeChat to join the group (Please indicate your company name)