The “yesterday” of ZhiHuiJun seems to be the “today” of humanoid robot entrepreneurs.

While ZhiYuan Robotics has gone through six rounds of Series A funding and recently advanced to Series B, more humanoid robot startups are still stuck in Series A funding.

At the forefront is Songyan Power, which was recently thrust into the spotlight by Zhu Xiaohu.

Zhu Xiaohu stated in an interview that he is “gradually exiting humanoid robot companies” and questioned “who would spend over a hundred thousand to buy a robot to work”. One of the companies exiting is Songyan Power.

Songyan Power is currently the most frequently funded humanoid robot company in the Series A stage. According to Qichacha, since entering Series A in March last year, Songyan Power has completed four rounds of Series A financing, running for 13 months in this stage. Founded in September 2023, the company has completed five rounds of financing but has yet to enter Series B.

Image source: Qichacha

Jiang Zheyuan, the founder of Songyan Power, stated in a March interview with Sohu Technology that “in terms of competition among enterprises, the main focus is currently on financing; if financing cannot keep up, companies will quickly be eliminated, and some are already feeling pessimistic.” For the currently popular humanoid robot sector, aside from Yushu Technology and ZhiYuan Robotics, which have successfully navigated the Series A funding challenges, Songyan Power may represent a small snapshot of the new wave of robot startups.

According to statistics from Face AI (ID: faceaibang), 13 star robot companies established since 2022 generally exhibit a “stagnation in a single round” funding characteristic. Data shows that these 13 companies have undergone multiple rounds of financing before entering Series B; aside from ZhiYuan Robotics, which has raised funds six times in Series A to advance to Series B, six others are still stuck in Series A, and another six have completed at least three rounds of financing but remain in earlier angel and Pre-A rounds.

Yunxiu Capital has provided FA services for robot companies like Yushu Technology, and its partner and head of the smart manufacturing group, Fu Zhilong, pointed out that when a company’s valuation has peaked but production progress does not meet expectations, the company will often resort to multiple rounds of “+ rounds” financing to make up for funding gaps.

“The first angel round financing at the end of last year was not ideal, this year the interest is high, many investors are looking, but few are actually investing; this year we plan to raise pre-A funds in 2-3 small batches.” A founder of a robot company told Face AI that robot startups have reached a stage where they can burn through 100 million yuan in less than a year, but facing cautious investors, they do not seek large single-round financing; multiple small rounds of funding can still yield ideal results.

For companies like Songyan Power, conducting small rounds of financing also has its considerations. The R&D cycle in the robot sector is long, with high technical barriers requiring substantial capital investment. Hardware development, algorithm optimization, and supply chain management are significant cost drivers. However, market sentiment is currently cautious, making it difficult for companies to secure sufficient funds in one go, often leading them to adopt a fragmented financing approach to alleviate funding pressure.

However, being stuck in Series A is not a comfortable zone; the continuous pressure of financing awaits companies like Songyan Power, which, despite having raised funds five times, still faces tight finances. “Songyan Power remains a grassroots team, and money will always be relatively tight,” Jiang Zheyuan stated in an interview.

01

“When we first started, Songyan Power did not have as much funding as we do now,” Jiang Zheyuan stated in an interview.Financial tightness has been a constant theme throughout Songyan Power’s entrepreneurial journey.

Jiang Zheyuan, who studied electronics at Tsinghua University, gave up his PhD at Tsinghua to start a business at the age of 25. At that time, Jiang’s father sought out an old friend to persuade his son not to start a business, but the friend ended up investing 1 million yuan in Songyan Power.

However, starting a robot business is not as simple as it seems; this industry requires significant investment, and financial constraints have trapped most robot companies. Even ZhiHuiJun (Peng Zhihui), who carries the title of “Huawei Genius Youth”, took six rounds of financing in Series A before ZhiYuan Robotics could advance to Series B.

In November 2023, just two months after its establishment, Songyan Power secured angel round financing. From March 2024 to February 2025, Songyan Power completed four rounds of Series A financing. The company has not disclosed the financing amounts, with only the most recent round revealing over 100 million yuan, which remains vague.

Even after completing the fourth round of Series A financing, Jiang Zheyuan stated in an interview, “Songyan Power remains a grassroots team, and money will always be relatively tight; we cannot pursue technical ideals as freely as DeepSeek; we must commercialize quickly.”

In fact, during the Series A financing stage, what has held Jiang Zheyuan back is the investors’ focus on PMF (Product-Market Fit).

Compared to ZhiHuiJun, who has already exited Series A, Jiang Zheyuan is stuck on mass production.

In December 2024, ZhiYuan Robotics will launch commercial mass production of general-purpose robots. In January of this year, the cumulative output of general-purpose robots reached 1,000 units. Its partner Yao Maoqing revealed that this year’s shipment volume is expected to be in the thousands. Just two months later, ZhiYuan Robotics completed a Series B financing led by Tencent, with a post-investment valuation of 15 billion yuan.

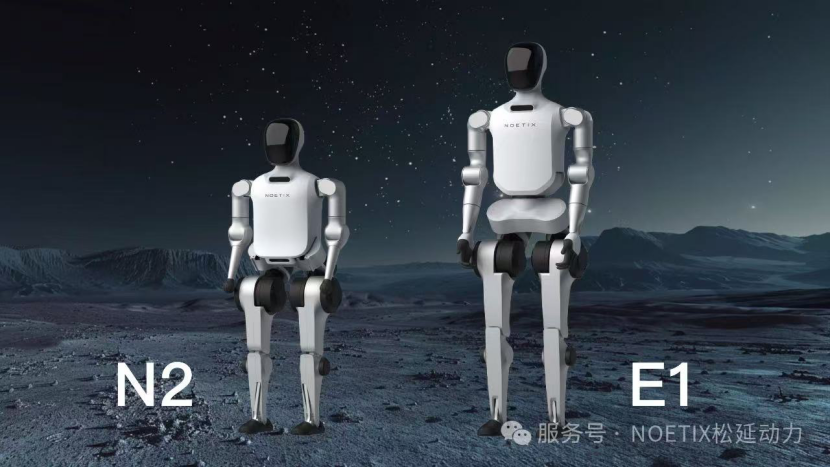

In contrast, in March of this year, Songyan Power released two robots: the humanoid robot N2 and the upgraded robot E1. Currently, Songyan Power has over 600 orders. According to Jiang Zheyuan’s plan, by the second half of this year, the production of Songyan Power’s robots is expected to exceed 150 units per month, with hopes to ship 1,000 units this year and achieve positive cash flow in the fourth quarter.

Image source: Songyan Power WeChat Official Account

Fu Zhilong stated that whether PMF can truly be achieved depends on whether the product is perceived as useful by customers and whether they are willing to pay. On one hand, it depends on whether there is the capability for large-scale production. On the other hand, whether sales can close the loop determines whether the business logic is valid.

In other words, the ability to mass-produce is a crucial factor for startups to transition from Series A to Series B.

Compared to some star robot companies, Songyan Power’s entrepreneurial team is not the most elite. Currently, there are robot startups with founders who teach at universities, such as Wang Helai, founder of Galaxy General, who is an assistant professor at Peking University’s Frontier Computing Research Center, having raised a total of 1.2 billion yuan in two rounds; and founders with backgrounds in large companies, such as ZhiYuan Robotics’ founder ZhiHuiJun, who carries the title of “Huawei Genius Youth”.

This has also led to Songyan Power not being at the forefront of capital favorability. Therefore, how to achieve the next milestone in the shortest time and match the appropriate pace of cash expenditure is a significant challenge for Jiang Zheyuan.

Jiang Zheyuan candidly stated that one of his requirements for the company is: to make money now.

The urgency for Jiang Zheyuan to accelerate commercialization is understandable; Chinese robot companies must think strictly according to PMF, so it is crucial to let the market see the capability of PMF.

Currently, Songyan Power’s humanoid robot N2, standing 1.2m tall and weighing only 30kg, is capable of performing backflips, with a price point already dropping to 39,900 yuan. Similar robots on the market, such as Yushu Technology’s Unitree G1 and ZhiYuan Lingxi X1, have mass production prices of 99,000 yuan and 108,000 yuan, respectively.

When asked, “Can we make a profit… or are we losing money on each unit sold?” Jiang Zheyuan once told “Robot Lecture Hall”, “We have strong cost control capabilities, and 39,900 yuan can definitely still be profitable.”

The amount of profit may not be the primary consideration for Songyan Power at this stage; generating cash flow and acting according to PMF is the urgent task to escape the Series A predicament.

02

“(Songyan Power) cannot pursue technical ideals as freely as DeepSeek; we must commercialize quickly,” Jiang Zheyuan’s words may represent the sentiments of most robot startups today.

Due to the lack of a clear commercialization path, Zhu Xiaohu exited Songyan Power, stating, “We prefer sustainable business models that can create value for customers.”

To some extent, investors have pressured startups to commercialize quickly.

Jiang Yi, founding partner of Hengye Capital, told Face AI that he encountered a well-known warehouse robot company with a Series A valuation of 1.8 billion that cooled off, later restructuring into A1 round at 1.2 billion (corresponding to product prototype) and A2 round at 1.5 billion (corresponding to the first customer contract), using a gradual approach to alleviate market resistance.

“The embodied intelligent robot sector is still far from maturity, and valuations lacking commercial support are hard to gain recognition,” a former investor from a leading venture capital institution told Face AI.

The difficulty in increasing valuations is also related to the market environment; the aforementioned investor stated that the entire VC market is experiencing a downturn, and the dollar funds willing to boost valuations are not as active as before. Meanwhile, state-owned capital is more prevalent, but they seek stability and tend to keep valuations lower.

Therefore, adopting a “small + round” financing model to gradually increase valuations has become a survival strategy for robot companies in the current market environment. The commercialization dilemma and financing environment make it difficult for startups to secure large amounts of funding at once, but robot R&D requires sufficient capital investment, thus elongating the financing timeline in the Series A stage.

In fact, as a new track distinct from the internet era, embodied intelligence has yet to establish a standard for how much funding is needed from development to commercial mass production.

Taking ZhiYuan Robotics’ financing as a reference, although ZhiYuan Robotics has not disclosed the amounts for each round of financing, it completed eight rounds of financing before entering Series B, with one round in December 2023 exceeding 600 million yuan. Songyan Power has not disclosed specific amounts, with the most recent round exceeding 100 million yuan. For reference, Xinghai Map, which reached Series A3, has publicly disclosed cumulative financing exceeding 800 million yuan.

Image source: Qichacha

The substantial financing of ZhiYuan Robotics can also be viewed from another angle, that to break through Series B financing, Songyan Power and Xinghai Map may need to complete a certain amount of financing.

Furthermore, for companies like Songyan Power, to escape their predicament, they must also cling to the legs of industrial capital.

Cao Wei, a partner at BlueRun Ventures, stated in an interview with the Economic Observer that ZhiYuan Robotics has numerous industrial shareholders, and demand from shareholders alone could create sales of tens of thousands of robots. The landing scenarios for ZhiYuan Robotics are also focused on industrial applications. During the Series A stage, ZhiYuan Robotics attracted a diverse range of investors, including venture capital institutions, local state-owned capital, and industrial capital from BYD and SAIC, which undoubtedly provided many landing scenarios.

This seems to be the Achilles’ heel for companies like Songyan Power. Currently, stuck in Series A, including Songyan Power, which has completed four rounds of Series A financing, and Xinghai Map, which has reached Series A3, their investor lists lack the presence of industrial capital, making it difficult for them to commercialize in various fields such as industry, services, and healthcare.

The absence of industrial investment, leading to unclear commercialization paths, may also be a reason they cannot attract more funding to move forward.

In the previous public controversy sparked by Zhu Xiaohu, the two embodied intelligence projects that Jinsha River Venture exited were Songyan Power and Xinghai Map, with the reason being the lack of a clear commercialization path. For Songyan Power, which is still stuck in Series A financing, more time may be needed to respond to Zhu Xiaohu’s doubts.

03

It is important to note that for startups, securing funding is just the beginning; how to spend the money is the real issue.

And often, the money is first spent on talent acquisition. Fu Zhilong pointed out that in the early investment stage, investors pay close attention to team capabilities, which is crucial for the supply chain capabilities in the Series A stage.

“Investors are particularly concerned about whether the core components of humanoid robots (such as joint modules and grippers) are self-developed or outsourced; if outsourced, does the team have the capability for secondary debugging to ensure product competitiveness? Additionally, investors will pay special attention to whether the team has experience in building production lines from 0 to 1 and scaling from 1 to 100, as engineering capabilities directly determine whether they can scale up later.” Fu Zhilong added.

For Songyan Power, to secure better financing amounts, the first step is to expand the team and quickly complete talent acquisition, but this part of the cost is often very high.

According to information from third-party recruitment platforms, the salaries for embedded software engineers and electronic engineers at Songyan Power are all at 13 months’ salary, with monthly salaries reaching 20,000-30,000 yuan. Among them, the salary for embodied intelligence algorithm engineers is the highest, with annual salaries reaching up to 650,000 yuan. For similar positions, the salary for a laser SLAM development engineer at Yushu Technology is 25,000-50,000 yuan/month, while the control algorithm engineer at ZhiYuan Robotics reaches 30,000-55,000 yuan/month.

ZhiYuan Robotics expanded its team through four rounds of Series A financing.

In August 2023, ZhiYuan Robotics completed its A2 round financing, at which time its R&D team had fewer than 50 people. Over the following year, ZhiYuan Robotics completed four rounds of Series A financing. By September 2024, the ZhiYuan Robotics team had exceeded 300 people.

It is foreseeable that the embodied intelligence sector is still in its early stages, representing a long chain with a complex technology stack, and companies like Songyan Power face enormous R&D investments.

For more teams, the most important thing may be to survive.

However, it is worth noting that for companies like Songyan Power, now is a good time for robot entrepreneurship.

Zhao Xing, one of the founders of Xinghai Map, stated in an interview with “Late Auto” that the popularity of large models and ChatGPT has increased confidence in embodied intelligence, leading to more resources being invested across the board.

Investors’ anxiety about missing out on potential projects has heated up the entire robot field. Xu Huazhe, co-founder of Xinghai Map, also mentioned in an interview with the Southern Metropolis Daily that last year, investors’ mindset was one of interest but needed further consideration. However, this year, investors’ mindset has shifted to FOMO (Fear of Missing Out), leaning towards quickly reaching consensus and seizing investment opportunities. Since February of this year, Xinghai Map has completed three rounds of Series A financing within three months.

At the same time, advancements in large model technology have opened up more possibilities for humanoid robots.

The American humanoid robot startup Figure AI has developed the Figure 01 humanoid robot, which can understand commands and converse with humans, seen as a significant breakthrough in the intelligence of humanoid robots. In February of this year, Figure AI abandoned OpenAI and further released its self-developed universal visual-language-action (VLA) model “Helix”, currently seeking Series C financing with a valuation of $40 billion.

Technological breakthroughs in large models have provided positive signals for the development of humanoid robots, allowing robots to not only move but also have the potential to replace humans. Currently, startups like Yushu Technology and ZhiYuan Robotics are beginning to recruit talent related to large models. The highest-paying position at Yushu Technology is for a generative AI algorithm engineer, with annual salaries exceeding 900,000 yuan.

Even though Songyan Power is still stuck in Series A, with technological advancements, both mass production and financing are expected to bring more good news.

As Figure AI’s founder Brett stated in an interview, “We are currently at the right stage for humanoid robots to enter the market and are driving this process. This is very exciting.”

In the AI era, although robot startups will go through a period of chaos, as ZhiHuiJun said, there will be various positive and negative feedback in the short-term market; for a startup, the most important thing is to stay at the table.We can still look forward to more good news from companies like Songyan Power.

References:

“Exclusive Interview with Jiang Zheyuan: Behind the 39,900 Yuan Price, We Aim to Become the Xiaomi and Apple of the Humanoid Robot Sector” – Titanium Media AGI

“27-Year-Old Tsinghua PhD Drops Out to Build Robots, How to Bring Prices Down to 39,900 Yuan?” – Sohu Technology

“Interview with Zhao Xing and Xu Huazhe of Xinghai Map: The Cambrian Explosion of Robots, Stuck at the Brain” – Late Auto

“39,900 Yuan for a Humanoid “Athlete” That Can Do Backflips?” – Robot Lecture Hall

“Star Startups Stuck in Series A After Six Rounds of Financing: What’s Next for Wolant and ZhiYuan?” – Economic Observer

“Figure Founder Interview: Why Humanoid Robot Companies Need to Vertically Integrate AI, Hardware, and Manufacturing” – Bright Company

“Embodied Intelligence Company Xinghai Map Secures 300 Million Yuan Again, Negotiating New Financing at a 5 Billion Valuation” – Southern Metropolis Daily

Feel free to leave a comment~If you need to open a white list, please add the editor on WeChat: dongfangmark