Click on the aboveFocus on Economy and follow us! Learn forex easily!

Focus on Economy

Deeply original financial media in the forex market

This is a common topic. Since everyone wants to make money in forex, the security of funds and the legitimacy of the platform is paramount. Without this premise, showing off your profit statements and agent income in your social circles is meaningless. There will always come a day when you can’t recover your funds, and when that day comes, asking me how to get your money back will leave me powerless. After years in forex, especially with many people recently asking me how to recover funds from fraudulent platforms, I truly feel helpless. Once a platform runs away, it is really difficult to recover funds, so choosing a legitimate platform is very important!

The risks in forex mainly come from two aspects: one is the risk from the platform, which is the security of funds, and the other is the risk from trading strategies. Today, we will analyze how to choose a legitimate forex company that ensures fund security!

I have to say, this is a topic that has been discussed countless times. Currently, forex trading is neither legal nor illegal in China, as there is no legislation. So for Chinese citizens, the regulation of forex companies is your last line of defense!

Let’s analyze the regulatory bodies in the forex industry!

Regulatory types can generally be divided into offshore regulation, international regulation, and national regulation!

Offshore Regulation

Regulatory Strength: Lenient

Investment Risk: Huge

Offshore regulatory bodies include Belize, Seychelles, and the newly added Vanuatu.

The regulatory environment is relatively lenient; as long as you have money, you can buy it. This is why many forex funds favor such regulations, as the costs are low! This is also a pitfall for many novices. Investing is simple for Chinese people, mostly speculative. In forex, as long as you have regulation and can make money, it doesn’t matter where the regulation is from, I will do it! However, this situation is now rare, as many people have suffered losses under these regulations, so there are few investors participating in these regulations now. Those who still invest under these regulations either have a fluke mentality or know nothing about forex!

If everyone knew that Vanuatu’s regulation could be obtained for tens of thousands, would they still invest millions?

International Regulation

Regulatory Strength: Strict

Investment Risk: Relatively Low

Compared to offshore regulation, international regulation is much stricter. For example, minimum capital requirements for licensed institutions are much higher, and regulatory fees are also higher than offshore regulation. Common examples include the UK’s FCA, the US’s NFA, and Australia’s ASIC.

It is worth mentioning that under the UK’s FCA regulation, so far only one company has gone bankrupt, IronFX, which returned some funds to clients after liquidation, but the vast majority of clients did not get their money back! So just because a platform is FCA regulated does not mean it is safe. Everyone should be fully aware of this. FCA is the strictest regulatory body, and the risk to clients is relatively low! There is no such thing as 100% safety in the world; all investments carry risks! Regulatory inquiry series: FCA inquiry process and precautions!

Furthermore, many NFA licensed brokers operate beyond their limits, meaning they do not have the qualifications for forex trading and cannot participate in retail forex business. Therefore, NFA is also favored by many white label brokers, becoming a new pitfall for many novices! Everyone participating under NFA regulation should pay attention to the qualifications of the regulation! Do not participate if you do not have forex retail business!

National Regulation

Regulatory Strength: Severe

Investment Risk: Extremely Low

Asian countries often adopt national regulation for forex, such as Japan’s Financial Services Agency (FSA), Indonesia’s Commodity Futures Trading Regulatory Agency (BAPPEBTI), and China’s State Administration of Foreign Exchange (SAFE).

For example, Japan’s Financial Services Agency (FSA) regulates forex margin trading, which mainly includes regular inspections (semi-annually or at year-end settlements), on-the-spot inspections, and monthly trading reports provided by traders. The monthly reports provided by forex traders mainly cover the following aspects!

1. Capital adequacy ratio status

2. Business development status

3. Client fund segregation custody (equivalent to domestic third-party custody), segregated accounts

4. Market risk

5. Counterparty risk

6. Trading risk

7. Liquidity risk

Asian regulations are the strictest in all forex regulations. However, due to traditional perceptions domestically, many who enter the domestic forex market tend to focus on the UK, US, and Australia, with few participating in Asian forex markets. This is partly due to national regulation, and brokers must undergo regular inspections by national regulatory authorities or random checks, raising the entry barrier and crime costs significantly!

To date, there have been no reports of problems with platforms under national regulation, as the cost of crime is extremely high, directly linked to national regulation. If an issue arises, it would mean a problem with the national financial system!

During this process, it is important to be careful when checking regulations, as many fraudulent platforms may be using the names of legitimate regulatory platforms. If you are dealing with a shell company, then encountering problems is inevitable!

Today, let’s share the ASIC inquiry process and precautions:

Key steps to teach you how to check the current forex platforms that are easily confused and frequently run away: ASS

The Australian Securities and Investments Commission (ASIC) was established in 2001 under the Australian Securities and Investments Commission Act. It regulates Australian consumer credit activities (including banks, credit unions, financial institutions, etc.), financial markets (stocks, derivatives, and domestic futures), and financial services (pension insurance, funds, stocks, securities, derivatives, and insurance). The Australian Securities and Investments Commission is the regulator of the Australian retail forex industry.

★ Any company regulated by ASIC must also hold an Australian Financial Services License (AFSL) and an Australian Company Number (ACN) to qualify for trading financial derivatives.

Please note:

Just because a trader claims to be regulated in Australia does not necessarily mean they are; they could just be a regular company registered in Australia or a shell company;

Being able to find them on ASIC does not mean they are regulated; they may only have a financial advisory license;

Having an AFSL does not necessarily mean they are a “regulated forex trader”; you need to check whether their regulated business scope includes retail forex business.

Focus on Economy teaches you how to check Australian ASIC regulation

01

Step 1: Before starting the inquiry, first understand the differences between AFSL, ABN, and ACN.

We have noticed that many shell companies use ACN or ABN numbers to mislead investors who do not understand English, claiming they are Australian regulatory numbers. Investors can usually distinguish these three based on the number of digits.

ACN stands for Australian Company Number, a 9-digit number. All businesses in Australia must register for an ACN, which is equivalent to domestic business registration.

ABN stands for Australian Business Number, an 11-digit number (two-digit tax number + 9-digit ACN number). Having an ACN does not necessarily mean having an ABN; some dormant companies do not have an ABN, while any company with an ABN must have an ACN.

AFSL stands for Australian Financial Services License, usually 6 digits, and only businesses engaged in financial services have an AFSL. The number most commonly referred to as the Australian regulatory number is the AFSL license number.

Therefore, ACN and ABN are just ordinary registrations; companies with only ACN or ABN do not have the qualifications to trade financial derivatives.

Fraud Prevention Tips:

If a forex trader claims to be regulated in Australia and provides a 9-digit or 11-digit regulatory number, then that company definitely has issues because a 9-digit number is an ACN, and an 11-digit number is an ABN; ACN or ABN is not a regulatory number at all.

02

Step 2: Check whether the trader holds an AFSL license and whether the license’s scope includes retail forex business.

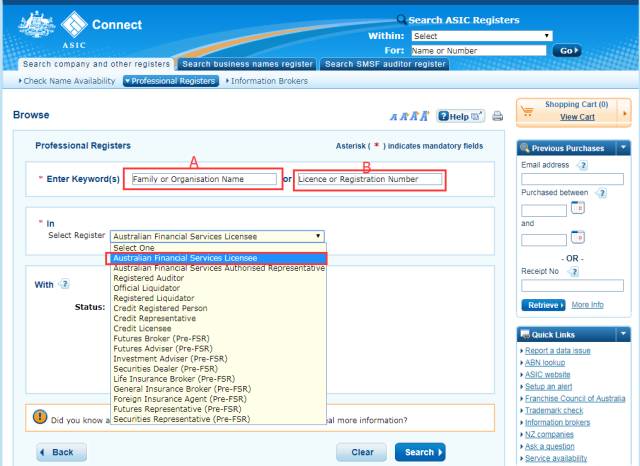

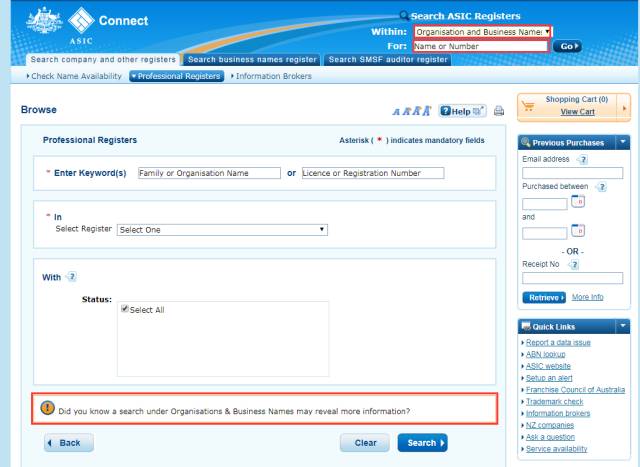

1.Log into a VPN, and open the ASIC website

www.asic.gov.au, selectProfessional Registers

2.In section A, enter the name of the company you want to check or in section B, enter the AFSL license number, then selectAustralian Financial Services Licensee from the drop-down menu and clickSearch to inquire.

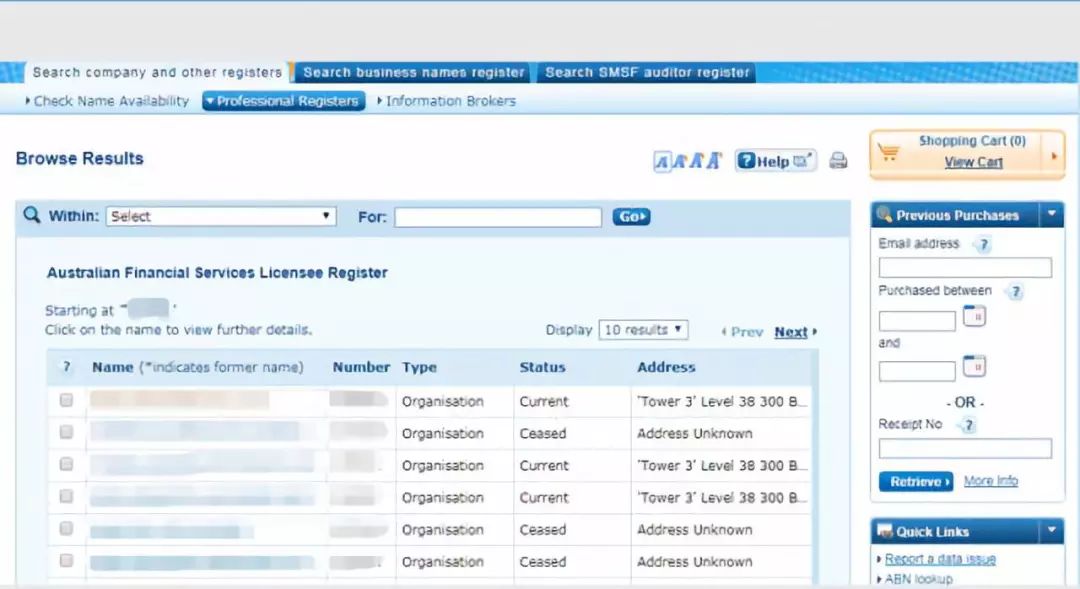

3. If you search directly for the regulatory status by entering the company name, multiple similar names may appear in the search results, so pay attention to compare the consistency of the company name. The two common regulatory statuses arecurrent (currently regulated) andceased (regulation has been canceled).

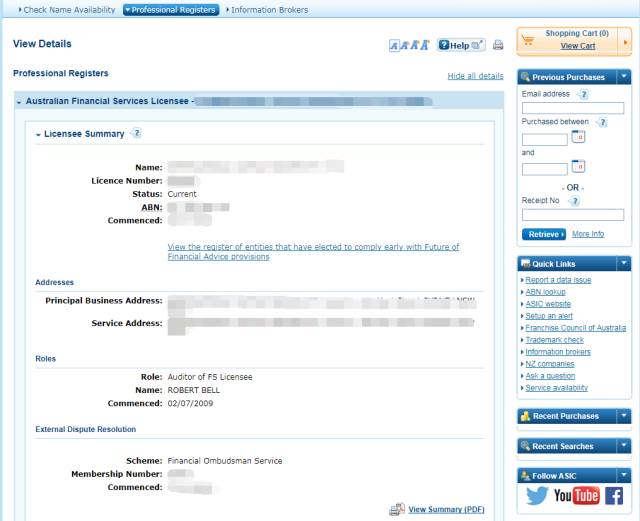

4. If you know the trader’s AFSL regulatory number, searching is very convenient; you won’t worry about finding other companies because entering the regulatory number and clicking search directly takes you to the results page. If the status showscurrent, it means this company is currently regulated. If there’s anExternal Dispute Resolution (EDR), it indicates that this company can provide services to retail clients, and you can find the basic contact information for regulated companies throughEDR.

Fraud Prevention Tips:

According to ASIC regulations, if a trader wants to provide financial products and services to retail clients, they must join an external dispute resolution agency to protect the rights of retail clients. If an Australian forex trader does not have EDR, they cannot serve retail clients (which we refer to as retail investors). It is understood that institutional clients in Australia are those with over 500,000 AUD. This tip can help filter out many fraudulent companies, as many domestic websites are using the names of Australian financial service providers that only serve institutional clients.

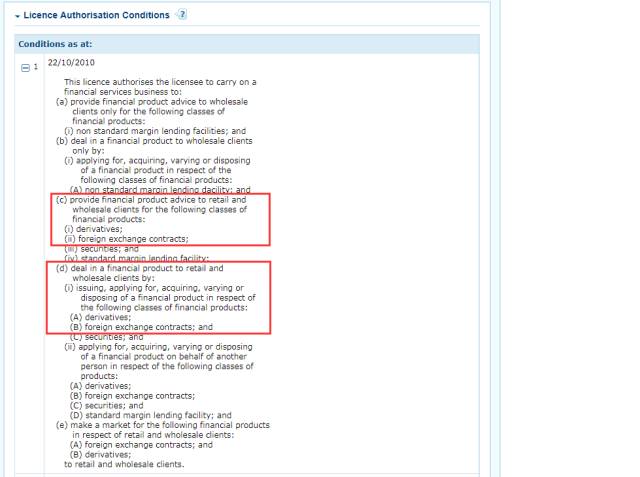

5. Check the scope of regulated business, which usually includes these two major categories:provide financial product advice (financial product advice) anddeal in financial products (financial product trading), and both categories should typically includederivatives (financial derivatives) andforeign exchange contracts targeting retail clients, as the vast majority of investors are retail clients.

★★★ Now let’s summarize the key points for a forex trader regulated by ASIC:

1

First, check the regulatory statuscurrent.

2

Second, checkEDR, indicating acceptance of retail clients.

3

Third, checkderivatives (financial derivatives) andforeign exchange contracts.

4

Fourth, confirm the website of the truly regulated company (key point!), throughEDR inquiry.

In the previous text, we mentioned that many shell companies use ACN or ABN to falsely claim to be regulated in Australia. Next, I will teach you how to check ACN and ABN↓

Focus on Economy teaches you how to check AustralianACN andABN

1. Log into a VPN and click the link below to enter the inquiry page

https://connectonline.asic.gov.au

In thewithin drop-down menu, selectorganisation and business names, and in theName or number field, enter the company name, the 9-digit ACN number, or the 11-digit ABN number to click and query.

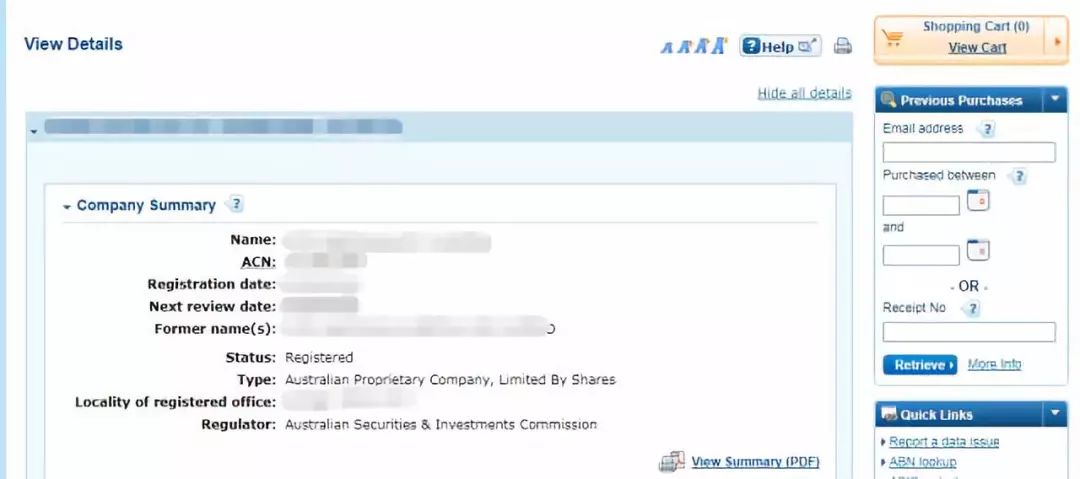

2. The inquiry results page will show the company’s registration time, address, former names, and other basic information. You can also pay to obtain more information about the company.

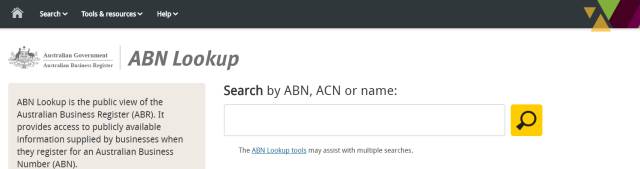

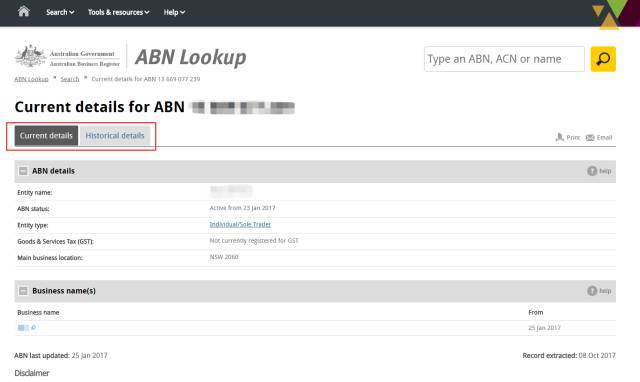

3. Companies with ABN numbers can also directly use ABN Look UP to check basic information about the company.

Inquiry address:

http://www.abr.business.gov.au

Enter the ABN number (you can also enter the ACN number for companies with ABN numbers) or the company name to check.

4. You can find the current basic information and historical basic information about this company.

Fraud Prevention Tips:

Please note that some companies may not show any results in the ABN inquiry. There are two possibilities: the first is that the company name or regulatory number is fictitious, and the second is that it may be a dormant company that has not registered for tax. You can directly check the company information using the method of checking organisation and business names.

The forex market is such a place that once you understand it, you never want to leave. China is about to enter a booming development era, which is good news for investors and financial professionals!

2019 is the explosion period for forex investment, and the Chinese forex market will enter a 20-year financial blue ocean.

《Focus on Economy》

Basic Knowledge

What is forex! ∣What is the forex market∣ Nine basic knowledge of forex, a must-read for beginners∣ Must-read forex basics∣ Forex trading leverage introduction∣ In-depth trading leverage∣ Basic concepts of forex trading∣ Forex margin trading deposit methods∣ Differences between forex and stocks/futures∣ How to develop stop-loss strategies in forex trading∣ Factors affecting forex trends∣ Skills and psychological qualities for forex trading∣ Introduction and calculation of forex margin

Forex Essentials Four Parts

Essential knowledge one∣ Essential knowledge two∣ Essential knowledge three∣ Essential knowledge four

Forex Macroeconomic Policies

CCTV reports on national attitudes∣ Haier’s strong entry into forex∣ Actions of industry leaders in forex∣ Large enterprises transforming into forex∣ Current situation of the domestic forex market∣ CCTV reports that domestic forex is just beginning∣ The forex wave begins for Chinese people∣ The country’s prosperity is inseparable from forex∣ Modern history of forex trading in China∣ The prospects and legality of forex∣ The three giants enter the forex market∣ Japan’s全民炒外汇∣ Why do forex∣ The largest investment and wealth management market in China in the future

Forex Security

Types of forex platforms and security∣ Forex AB channel∣ Types of forex platform regulation∣ Reasons for trading losses and solutions∣ How to identify the authenticity of MT4∣ Forex liquidity∣ Profit models of forex platforms∣ Who controls China’s financial system∣ No liquidity means no forex∣ How forex trading makes money

Forex Scams

IGO Scam∣ Inside forex funding scams∣ Chongqing forex scams∣ Shenzhen forex scams∣ Bank scams

Forex Hot Articles

Jacky Cheung’s wife trades forex∣ Forex is the next investment hotspot∣ Must-do forex investment∣ New opportunities in forex∣ The fourth wave of wealth opportunities in China∣ Fan Shengmei trades forex to change fate∣ The low ground of the domestic forex industry is in second- and third-tier cities∣ The forex industry is a hundred flowers blooming