18 years ago, Zhang Rujing led a group of returning engineers to establish “Semiconductor Manufacturing International Corporation (SMIC)” in Shanghai, marking the beginning of a century-long chapter for China’s semiconductor industry.

18 years later, a new generation of chip manufacturers led by Canaan Creative, Ebang International, and Bitmain has completed a curve overtaking in the fast lane of blockchain, capturing a significant portion of global ASIC chip demand.

The ongoing Sino-US trade war has put the chip industry in the spotlight. Under the high-tech blockade from developed Western countries, China’s semiconductor industry, which is undergoing industrial upgrades, is striving for multiple breakthroughs.

In this issue, TokenData will analyze the chip industry from multiple dimensions, exploring the opportunities and future that the blockchain industry brings to China’s “chip”.

Analysts | Hong Fuchuan, Lin Yanming

Guidance | Meng Jiangdong

/1/

The Three Steps of Blockchain Chips

In 1946, the world’s first electronic digital computer, ENIAC, was invented by Americans Mauchly and Eckert. At that time, this machine weighed 30 tons, occupied 170 square meters, and was assembled with 18,000 vacuum tubes, making it bulky and inefficient.

Now, highly integrated chips have achieved miniaturization, with a wide variety of processors ranging from single-purpose to multi-purpose. In the development of chips in the blockchain industry, the evolution from CPU to GPU and finally to the current ASIC chips represents a process of specialization in computing, simplifying complexity and excelling in one direction. The semiconductor is the most important foundational component of chips, which can be used to manufacture large integrated circuits or assembled into chips through special architectural designs.

In other words, if semiconductors are cotton, transistors are threads, then integrated circuits are like fabric, ultimately sewn into clothing, which is the finalized chip.

One of Intel’s founders, Gordon Moore, once proposed that, under constant prices, the number of transistors that can fit on an integrated circuit would double every 18-24 months, and performance would also double. Thus, the improvement of semiconductor technology is crucial for chip development. The commonly used term “nm” (nanometer) describes the distance (line width) between circuits on an integrated circuit. Reducing line width means more circuits can fit in the same area, allowing for more complex chips. At the same complexity level, chips can be made smaller and denser, effectively lowering costs.

The speed of electrons is relatively fixed (modern transistors operate at a relatively constant speed). With advancements in technology leading to smaller transistors, the distance electrons travel is shortened, reducing the time they spend moving through transistors, thereby improving efficiency.

The first step of blockchain chips initially adopted CPUs, also known as central processing units, which are the core of computation and control in computers. Currently, the main commercial products come from Intel and AMD. The manufacturing process of CPUs to some extent determines their performance.

The main feature of CPUs is comprehensive processing capability, which can meet various complex computational needs. However, blockchain requires more single computations, so CPUs quickly became obsolete in the history of blockchain chips.

The main feature of CPUs is comprehensive processing capability, which can meet various complex computational needs. However, blockchain requires more single computations, so CPUs quickly became obsolete in the history of blockchain chips.

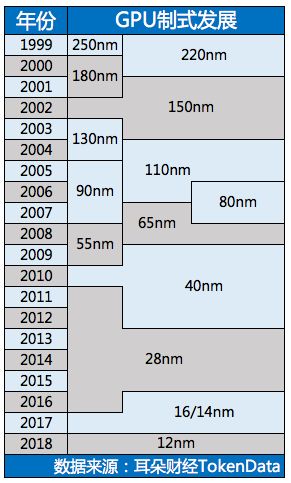

Quickly, the second step of the industry focused on GPU chips, which are also known as graphics processing units, the main computation chip mounted on graphics cards. The concept of graphics cards was proposed by NVIDIA in 1999. Prior to this, the tasks of GPUs were integrated into CPUs. By separating tasks like graphics rendering and redeveloping new external devices, this is also why GPUs have lagged behind CPUs in standardization (GPUs merely share the workload of CPUs).

Currently, commercial GPUs are mainly produced by NVIDIA and AMD, with NVIDIA outperforming AMD in technical specifications. The development of GPUs is no longer limited to graphics processing; their advancements in floating-point calculations and parallel computing are dozens or even hundreds of times stronger than CPUs. Due to this unique computational capability that aligns well with blockchain algorithms, the demand for GPU chips has surged, leading to skyrocketing prices last year.

The high prices have caused a sharp increase in the cost of industry chips, and efficiency has reached a bottleneck. At this point, the industry developed a chip called ASIC, which combines high performance and low power consumption, representing the farthest step taken so far, with efficiency increasing geometrically.

ASIC refers to an integrated circuit designed for a specific purpose. For example, the first SHA256 algorithm was designed solely for the computation of this algorithm, unable to perform tasks outside of this algorithm. By discarding the functionalities designed for other purposes in CPUs and GPUs, it can achieve lower power consumption, smaller size, and higher performance at the same computational capability.

/2/

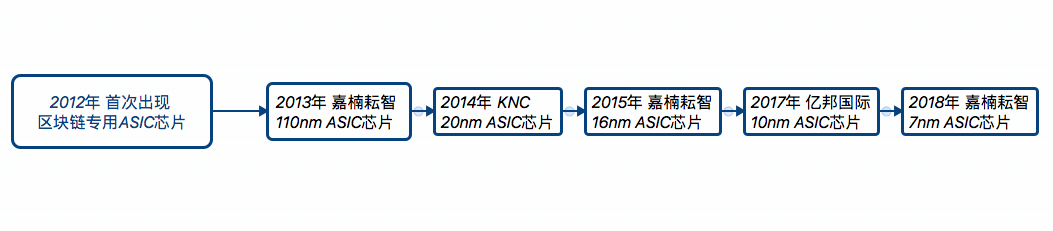

Upgrades and Iterations of ASIC Chips

The technological development of chips in the blockchain industry is faster, and competition is fiercer.

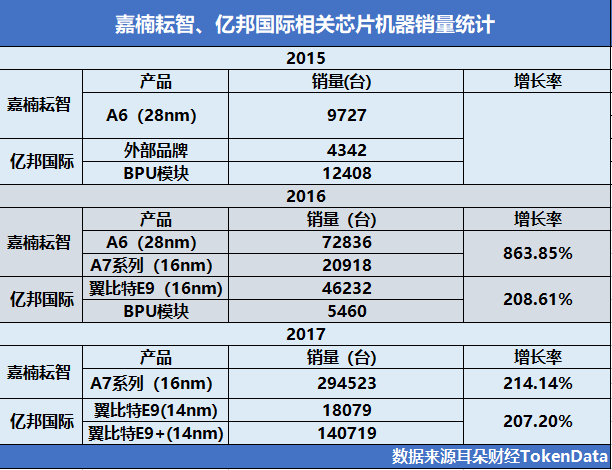

In August 2018, Canaan Creative announced the mass production of 7nm chips, while Japan’s GMO also joined the ranks of 7nm chips. From the first mass production of 110nm chips in 2013, experiencing 28nm, 16nm, to now 7nm, it seems that they have completed in five years what international giants like Intel, AMD, and NVIDIA took over a decade to achieve. However, this is not the case.

Although both are chips, the design difficulty of ASICs and GPUs is not on the same level. ASICs serve a relatively single purpose, while GPUs have complex applications, making their architecture complex and their design difficulty geometrically increasing. This is the main reason why domestic manufacturers can design 7nm ASIC chips but cannot design 14nm GPUs.

From 110nm chips in 2013 to 7nm chips in 2018, the compressed technology upgrade cycle is closely related to the presence of capital, or the booming development of the blockchain industry.

From 110nm chips in 2013 to 7nm chips in 2018, the compressed technology upgrade cycle is closely related to the presence of capital, or the booming development of the blockchain industry.

Just yesterday, on the 31st, Huawei released the new generation Kirin 980 mobile phone chip, becoming the second company to mass-produce 7nm chips after Canaan Creative. The driving force behind this is the fierce competition in the mobile phone industry and Huawei’s substantial investment in independent research and development. The difficulty of developing 7nm chips has led many manufacturers to shift their product development focus—from performance to power consumption.

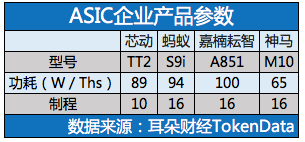

Shenma is an example of a manufacturer that has emerged by reducing power consumption.

Shenma chips can significantly reduce user costs while still outperforming higher-process chips in performance despite being behind in process technology.

This may be the future trend of ASIC chip development, focusing less on advanced processes and more on reducing user costs, catering to the diverse needs of customers.

/3/

Foundries that only focus on processing are not necessarily losing out

According to IC Insights, the top ten chip suppliers in 2016 were Intel, Samsung, TSMC, Qualcomm, Broadcom, SK Hynix, Micron Technology, Texas Instruments, Toshiba Semiconductor, and NXP Semiconductors. According to 2016 data, Intel had the highest revenue at $56.3 billion, followed by Samsung, with TSMC firmly in third place.

In 2017, Broadcom attempted to acquire Qualcomm for $105 billion, with the highest bid reaching $117 billion. If the acquisition had succeeded, these two chip companies would have become the third-largest chip enterprise, potentially reshaping the entire industry landscape. Meanwhile, Qualcomm also attempted to acquire NXP Semiconductors, which was spun off from Philips’ semiconductor business, but ultimately failed.

In 2017, Broadcom attempted to acquire Qualcomm for $105 billion, with the highest bid reaching $117 billion. If the acquisition had succeeded, these two chip companies would have become the third-largest chip enterprise, potentially reshaping the entire industry landscape. Meanwhile, Qualcomm also attempted to acquire NXP Semiconductors, which was spun off from Philips’ semiconductor business, but ultimately failed.

The reason for the failure was that the US government vetoed Broadcom’s acquisition of Qualcomm on the grounds of “potential harm to national security,” and the acquisition was voted down by China after receiving approvals from eight other countries (a total of nine countries were needed).

The importance of chip companies to the nation is self-evident.

In the chip foundry industry, China (including Taiwan) accounts for 74.4% of the entire industry’s share. This is also a development trend for semiconductor manufacturers.

In the chip foundry industry, China (including Taiwan) accounts for 74.4% of the entire industry’s share. This is also a development trend for semiconductor manufacturers.

Semiconductor manufacturers can currently be classified into three categories based on their primary functions:

1. Responsible for designing and selling their chips, outsourcing manufacturing.

2. Only produce chips.

3. Responsible for designing and manufacturing their chips = 1 + 2.

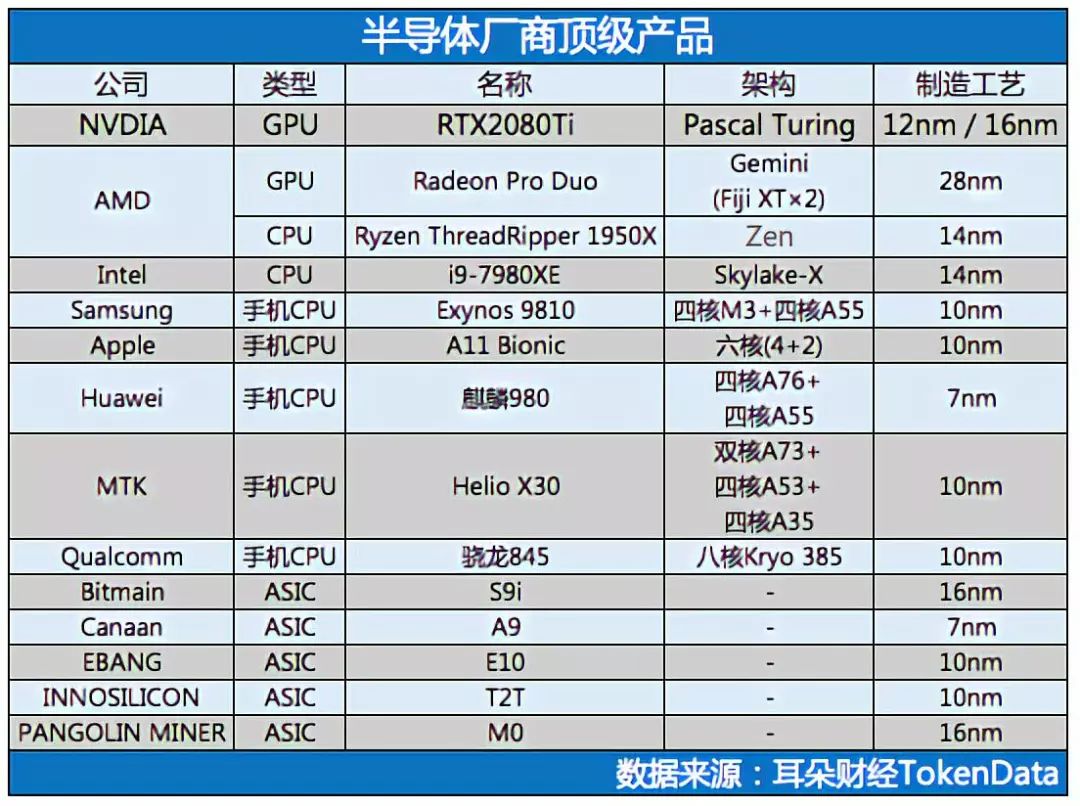

TokenData has compiled a list of common semiconductor products on the market:

From the perspective of chip manufacturing processes, 7nm has nearly reached the physical limit of silicon material chip manufacturing, which is why Canaan’s mass production of 7nm chips is so exciting.

From the perspective of chip manufacturing processes, 7nm has nearly reached the physical limit of silicon material chip manufacturing, which is why Canaan’s mass production of 7nm chips is so exciting.

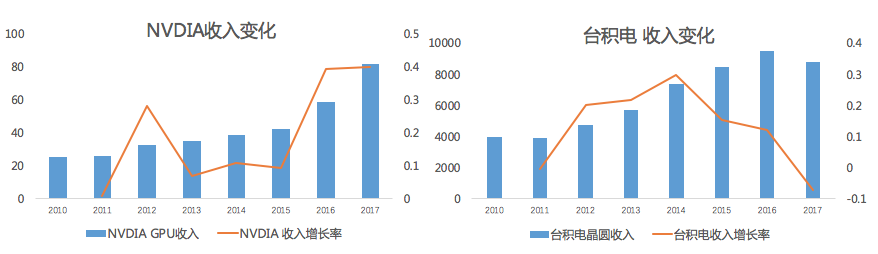

In the rapidly developing years of blockchain, the revenue of GPU manufacturers has also risen sharply.

(NVIDIA and TSMC stock charts)

(NVIDIA and TSMC stock charts)

NVIDIA can be considered one of the companies most affected by blockchain, as the 2017 explosion and the shortage of GPU chips led to a surge in stock prices. In contrast, TSMC, limited by production capacity, did not gain significant benefits, which also indicates that, as an upstream industry, compared to pure blockchain chip manufacturers, NVIDIA has three major advantages:

1. Broader audience with high demand from individual PC users.

2. More complex chips, leading to higher industry barriers. Pure blockchain chips find it difficult to enter the GPU chip industry.

3. Long time for technological accumulation, currently the leading company in the GPU market.

/4/

The Balance of the Chip Market Has Been Disrupted

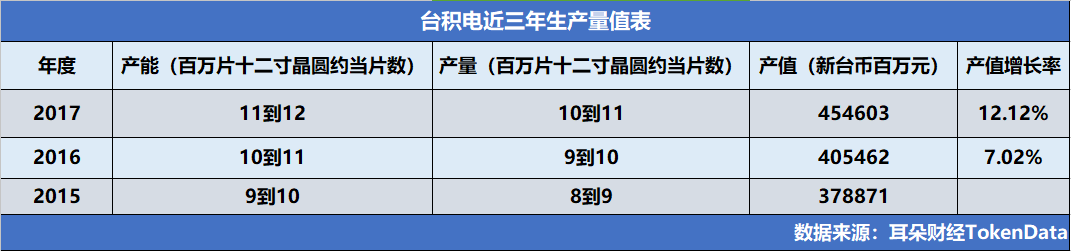

After obtaining 7nm chip foundry technology, TSMC secured numerous orders, including Apple’s A11 processor and AMD’s Vega chip, and claimed that the market share for orders below the 7nm process would be “100%”. It can be said that the balance of supply and demand in the market has been disrupted.

According to TSMC’s financial data, it can increase production capacity by about one million 12-inch wafer equivalent pieces each year. Based on this estimation, TSMC’s production capacity in 2018 was between 12 to 13 million 12-inch wafer equivalent pieces. In terms of growth rate, the growth rate in 2017 increased by 5.1 percentage points year-on-year, with stable production capacity growth.

According to TSMC’s financial data, it can increase production capacity by about one million 12-inch wafer equivalent pieces each year. Based on this estimation, TSMC’s production capacity in 2018 was between 12 to 13 million 12-inch wafer equivalent pieces. In terms of growth rate, the growth rate in 2017 increased by 5.1 percentage points year-on-year, with stable production capacity growth.

However, the demand for chips in the blockchain industry has been experiencing explosive growth, with industry giants Canaan Creative and Ebang International increasing their machine sales annually. According to statistics from TokenData, in 2017, Canaan Creative and Ebang International alone sold over 500,000 machines, with growth rates exceeding 200%, not including the chip demands from companies like Bitmain and Innosilicon.

In summary, under the condition that it does not affect other businesses, TSMC’s production capacity allocated to blockchain may not be sufficient to meet market demand, which will lead to a surplus of chip orders.

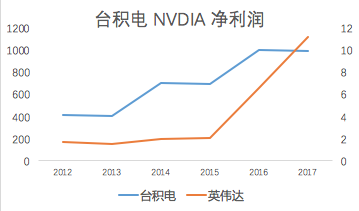

The reality is that, facing the technological pursuit of other companies, TSMC’s financial annual report shows that its dominance is waning and its growth potential is declining.

The 2017 financial report indicates that TSMC’s revenue from semiconductor manufacturing services reached NT$ 53 billion, with a growth rate of 7%, which was a decline of 1% compared to 2016.

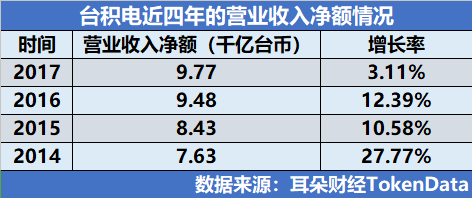

Although net operating income has increased year by year, compared to the high growth rates of previous years, TSMC’s growth rate in 2017 has slowed to 3.11%.In 2018, TSMC announced its first-quarter financial report, showing a net profit of NT$ 89.785 billion (approximately US$ 3.06 billion), a year-on-year growth of 2.5%, which was below market expectations.

Although net operating income has increased year by year, compared to the high growth rates of previous years, TSMC’s growth rate in 2017 has slowed to 3.11%.In 2018, TSMC announced its first-quarter financial report, showing a net profit of NT$ 89.785 billion (approximately US$ 3.06 billion), a year-on-year growth of 2.5%, which was below market expectations.

It is evident that the growth rate has slowed, showing signs of fatigue.

According to estimates, global market demand is expected to increase by 5% in 2018. However, TSMC is likely unable to dominate this market share due to technical and capacity constraints, creating conditions for the rise of many small and medium-sized semiconductor chip companies.

/5/

Opportunities for China’s “Chip”

In recent years, Chinese companies like SMIC and Huawei HiSilicon have developed rapidly and have begun to gain a foothold in the semiconductor chip market. However, due to the blockade of high-end chip technologies, they have not found a breakthrough opportunity. As the blockchain industry gradually returns to a rational phase, ASIC chips appear much smaller compared to the star products of many big-name manufacturers, which requires seeking new avenues, presenting a rare opportunity for many domestic chip companies.

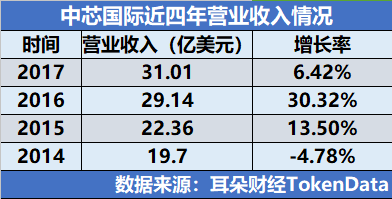

From 2014 to 2017, SMIC’s annual revenue grew from $1.97 billion to $3.101 billion. From negative growth to a maximum growth rate of 30.32%, SMIC achieved this in just two years. However, in 2017, SMIC’s revenue growth rate fell to 6.42%, indicating that SMIC also faces challenges in growth potential.

Figure 5-1 Recent Revenue Changes of SMIC

Figure 5-1 Recent Revenue Changes of SMIC

Entering 2018, with state-owned investments, SMIC’s revenue in the first half of the year reached $1.722 billion, a year-on-year growth of 11.49%. It is expected that SMIC’s revenue in the second half of the year will show stronger growth than in the first half, and it is likely that the annual growth rate will exceed that of 2017.

The chip industry is characterized by long R&D cycles, high capital investment, and low returns. China has spent half a century catching up, but the core issue remains the need for high-end talent. Returning high-end engineers are essential for chip development. The continuous growth of the blockchain industry has brought new directions to the chip industry. Although the logical architecture is not complex, the processes are at the leading level.

In the field of ASIC chips, Chinese companies have completed in five years what other companies took nearly 15 years to achieve. This is something to be proud of, but it does not mean that Chinese companies dominate the entire chip field.

The ZTE chip incident further illustrates that R&D in the chip industry is still not refined or strong enough. For advanced 28nm CPUs and GPUs, we can only look on from a distance. In complex chips, we are at least two generations behind overseas technology. However, there are still individuals like Zhang Rujing and companies like Canaan dedicated to building the competitiveness of domestic chips.

In the foreseeable future, we can vaguely see that many companies striving for this will carve out a path for China’s “chip” among the strong competitors.

[Previous Recommendations]

(Click the image to browse previous exciting content)

Add Ear to the Community (ID: shqzhy1)

Play with Blockchain and receive mysterious rewards

Leave a message below; the most liked comment

Can privately message Ear to receive a mysterious gift