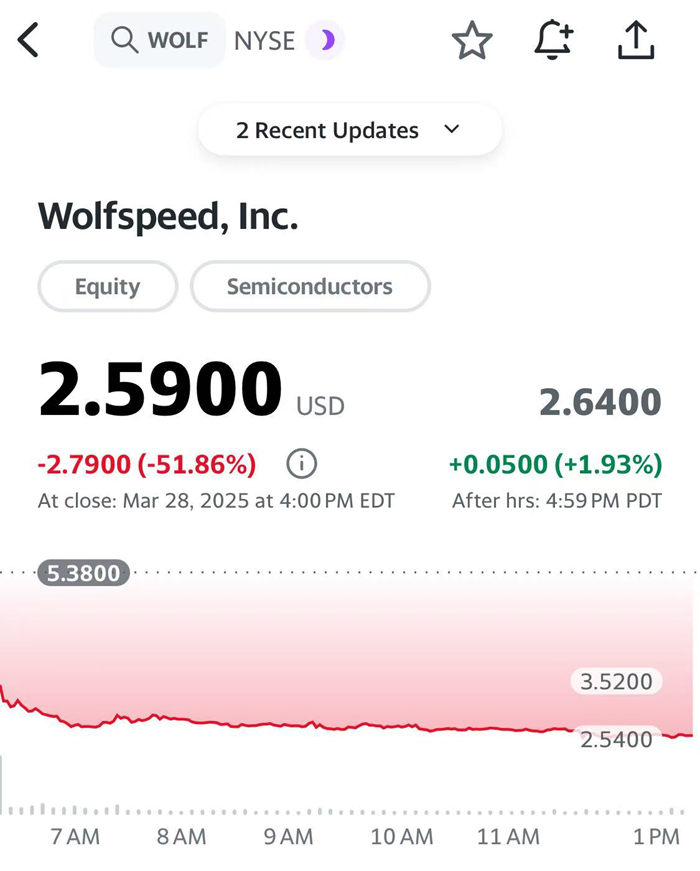

In recent years, Wolfspeed, a leader in global silicon carbide (SiC) technology, saw its stock price plummet by 50% on Friday, announcing measures to improve its capital structure amid growing concerns about its balance sheet and financing prospects.

The company has undergone a dramatic shift from industry peak to deep trouble. Once highly regarded for its leadership in the silicon carbide field, Wolfspeed now faces unprecedented challenges due to recent performance losses, management turmoil, and a sharp decline in stock price.

01

Continuous Losses and Financial Woes

According to U.S. stock investment website, Wolfspeed’s financial situation has deteriorated in recent years. In the first quarter of fiscal year 2025, the company’s revenue fell by 1.37% year-on-year to $195 million, with a net loss of $282 million. To address performance pressures, Wolfspeed initiated a $450 million facility closure and consolidation plan, planning to shut down its 150mm silicon carbide plant in Durham, North Carolina, and lay off about 20% of its workforce, affecting approximately 1,000 jobs. As of March 29, 2025, Wolfspeed’s stock price had plummeted by 50% to $2.50 per share, a staggering 99% drop from its peak of $142.33 per share in 2021.

02

Management Turmoil and New CEO Appointment

Amid performance pressures and investor dissatisfaction, significant changes occurred in Wolfspeed’s management. On November 18, 2024, CEO Gregg Lowe resigned, and Board Chairman Thomas Werner took over as Executive Chairman. Lowe had served as CEO since 2017, during which he transformed the company from an LED lighting business to one focused on silicon carbide chips. However, recent poor performance and a sharp decline in stock price led the board to decide on a leadership change.

Subsequently, on March 27, 2025, Wolfspeed announced that veteran chip industry executive Robert Feurle would take over as CEO starting May 1. Feurle, who holds dual citizenship in Germany and the U.S., previously held executive positions at German chip manufacturer ams-OSRAM and U.S. chip maker Micron Technology, bringing extensive factory operations and management experience. The company hopes to leverage Feurle’s expertise to optimize factory operations, enhance production efficiency, and turn around its current predicament.

03

Pending U.S. Government Funding and Imminent Debt Pressure

Wolfspeed has been counting on receiving $750 million in federal funding from the U.S. CHIPS Act for new factory projects in North Carolina and New York. However, recent political shifts have raised doubts about support for the act, with former President Trump calling for its repeal, leading to concerns about whether Wolfspeed will secure the funding. Analysts indicate that without this funding, Wolfspeed may need to undergo significant restructuring to preserve cash.

According to U.S. stock data site StockWe.com, Wolfspeed is also facing pressure to repay $575 million in convertible bonds maturing next year. With the current stock price far below the bond conversion price, conversion to equity seems nearly impossible. The company is working with JPMorgan to advance restructuring efforts, hoping to reach an agreement with investors to address its debt crisis.

04

Future Outlook: Challenges and Opportunities

Facing both internal and external challenges, Wolfspeed needs to develop a feasible strategy under the new CEO’s leadership to improve operational efficiency and stabilize its financial situation. Additionally, the company must actively communicate with the government and investors to secure necessary support and funding. As a leading player in the silicon carbide sector, Wolfspeed still possesses technological advantages and market potential, but to return to its peak, it must find new development opportunities amid turmoil, though it may already be too late.

Free use ofAI Quantitative U.S. Stock Analysis Tool U.S. Stock Big Data

Open the official website in your browser

https://stockwe.com/StockData

U.S. Stock Investment Networkis a financial technology company specializing in U.S. stock research, founded in Silicon Valley by former New York Stock Exchange analyst Ken, in collaboration with several Morgan Stanley analysts and Google Meta engineers, utilizing AI and big data, combined with over a decade of practical experience in U.S. stocks and industry quantitative models, to establish a stock market database https://StockWe.com/to track Wall Street institutional options movements, dark pool major orders, and daily breaking news, uncovering potential high-growth stocks, sending real-time U.S. stock market data, investment strategies, trading skills, company research reports, and quantitative trading.

U.S. Stock Investment Networkis a financial technology company specializing in U.S. stock research, founded in Silicon Valley by former New York Stock Exchange analyst Ken, in collaboration with several Morgan Stanley analysts and Google Meta engineers, utilizing AI and big data, combined with over a decade of practical experience in U.S. stocks and industry quantitative models, to establish a stock market database https://StockWe.com/to track Wall Street institutional options movements, dark pool major orders, and daily breaking news, uncovering potential high-growth stocks, sending real-time U.S. stock market data, investment strategies, trading skills, company research reports, and quantitative trading.

Contact Information

Customer Service Telegram: meiguM

Public Account: TradesMax

Email: [email protected]

U.S. Stock Investment Network: TradesMax.com

U.S. Stock Big Data: StockWe.com