By Zhang Cheng

Editor: Jiang Miao

The night is dark as ink, and the rain pours heavily, covering the car windows, making the road conditions difficult to discern.

The driver, unable to see the road, turns the wipers to the highest setting and looks at the car’s display screen. With the help of laser radar, the road conditions ahead appear clearly on the screen.

At a busy intersection, the driver casually turns on the indicator, and the screen clearly shows the scenes on the side and rear of the car, with flashing red circles appearing around pedestrians and electric bikes, reminding the driver to pay attention to traffic safety.

In blind spots that human vision cannot reach, artificial intelligence can help you see. A brand new traffic scene, completely transformed by intelligent technology, is emerging before people’s eyes.

The realization of this scene is supported by countless chips.

A smartphone requires hundreds of chips to operate, while a smart car needs hundreds of chips, involving various aspects such as mobile communication, computing storage, power management, and power control.

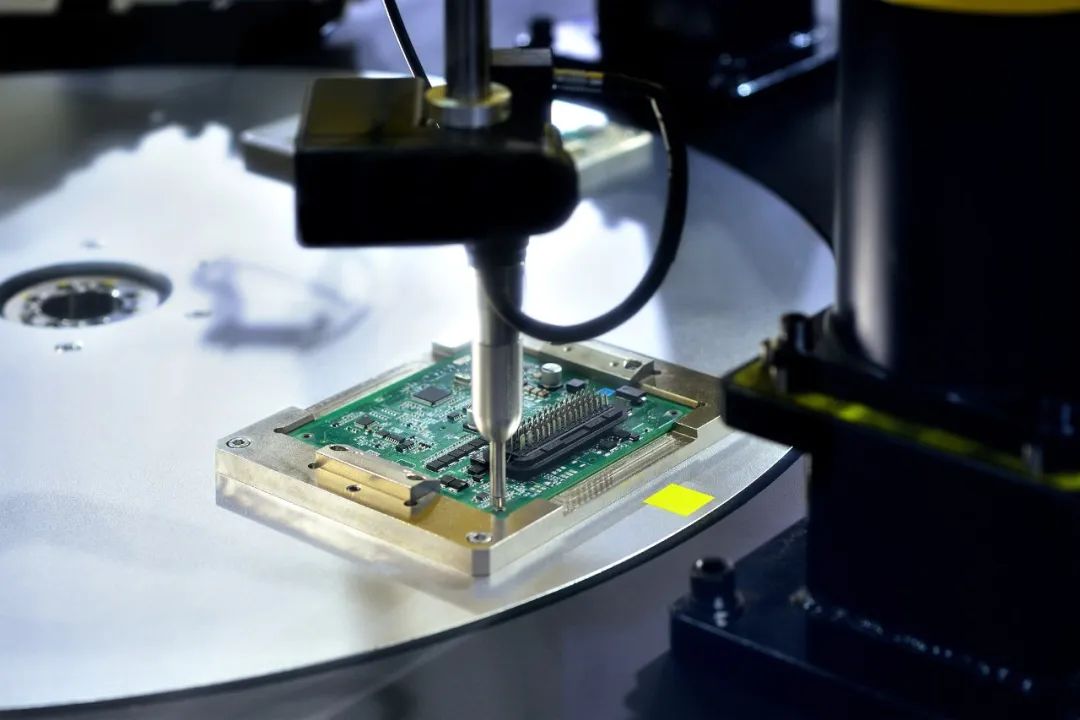

Like many electronic products, chips iterate rapidly under Moore’s Law. With the increasing data volume in the era of artificial intelligence, the demand for computation and storage is soaring, leading to higher requirements for chips in terms of performance, miniaturization, and energy efficiency.

This poses a challenge to the lifecycle of enterprises. Despite the rapid development of the entire industry, fluctuations in production line capacity, technical strength, energy support, intellectual property, and geopolitical influences can affect the fate of technology companies.

Statistics show that in 2023, China registered 65,700 new chip companies while 10,900 chip companies were deregistered.

The 2022 Central Economic Work Conference proposed to achieve a virtuous cycle of “technology-industry-finance.” The 2023 Central Economic Work Conference further required promoting industrial innovation through technological innovation and developing new productive forces. It encourages the development of venture capital and equity investment.

On the road to developing new productive forces, it is necessary to continue supporting the lifecycle of technology enterprises, allowing chemical reactions to form between industries while reducing the risks brought by fluctuations in the development process.

In response to the above tasks, some Chinese enterprises have already made explorations.

From 0 to 1,

China’s chips look forward to “from 1 to 100”

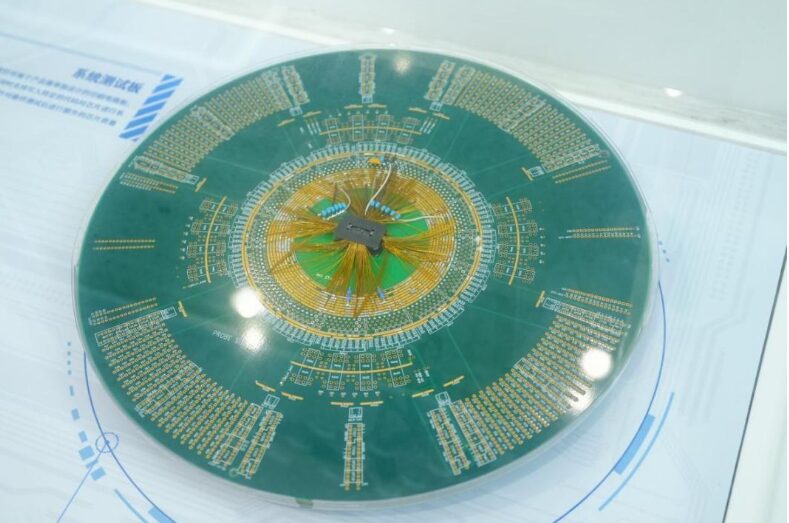

Inside the Shanghai Integrated Circuit Technology Museum, a unique map of Shanghai hangs.

It does not mark the beautiful scenery and food of The Bund, Chenghuangmiao, and Nanjing Road, but the integrated circuit industry enterprises distributed in various industrial parks across the city.

From the western industrial parks of Songjiang and Qingpu to the eastern Zhangjiang Science City, Waigaoqiao Free Trade Zone, and Lingang New Area, the production of silicon wafers, micro-processing, chip manufacturing, and inspection testing in various subsectors together form the landscape of the integrated circuit industry.

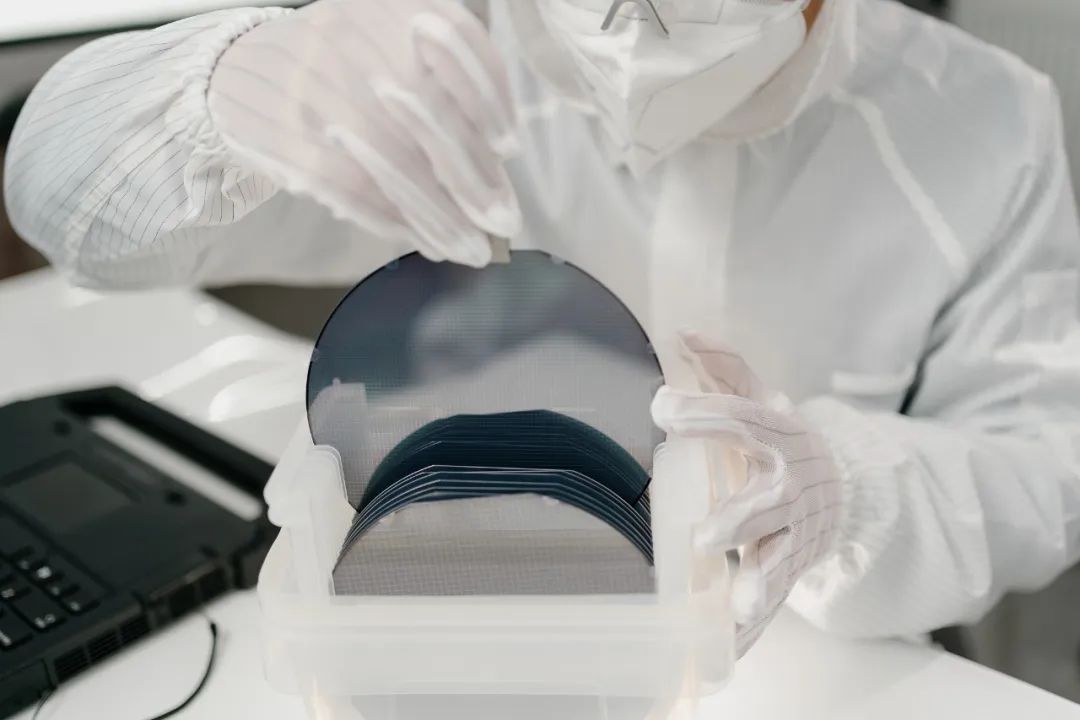

In the silicon wafer production workshop of the Songjiang Industrial Park, from the first floor to the third floor, each overhead crane carries 25 pieces of 12-inch integrated circuit silicon wafers.

After packaging and testing, these silicon wafers are sent to various chip manufacturing enterprises, becoming raw materials for chip manufacturing.

On the other hand, various types of chips are sent from Zhangjiang Science City, integrated into numerous devices such as smartphones, bicycles, and glasses, becoming part of people’s smart lives.

In 2021, the Shanghai Municipal Government released the “14th Five-Year Plan for Advanced Manufacturing Development in Shanghai,” establishing integrated circuits, biomedicine, and artificial intelligence as the three leading industries.

Technological progress and industrial iteration unfold here every day.

Many practitioners agree that the integrated circuit industry has never experienced a decline since its inception, but has undergone significant fluctuations. From electronic watches and PCs to smartphones and smart wearable devices, each update of electronic products also brings iteration and innovation to the chip and integrated circuit industry.

At the same time, the construction of new production lines, large-scale production of new products, performance testing, and operational testing all require time accumulation.

Song Hongwei, Vice President of Shanghai Super Silicon, told Phoenix Weekly: “From silicon wafers to chips, almost everything is highly customized. From samples to mass production, time accumulation is also required. Generally speaking, product certification, if it undergoes two rounds of testing, takes about six months.”

For the integrated circuit industry to achieve long-term healthy development, it requires each enterprise to scientifically grasp the industrial development and iteration cycle, comprehensively understand the development trends of the industry, and also requires all parties to work together to help relevant enterprises smoothly navigate the cycle.

If the construction of various industrial parks and corresponding support has helped the Shanghai integrated circuit industry successfully achieve a breakthrough from 0 to 1, then next, it requires the efforts of all parties to help the industry achieve growth from 1 to 10, and then to 100.

The importance of investment relay is highlighted here.

In 2023, China Life established the “China Life – Huifa No. 1 Equity Investment Plan,” acquiring shares in the Shanghai Integrated Circuit Industry Investment Fund Co., Ltd. held by state-owned enterprises in Shanghai through S-share investment, with an investment scale of about 11.8 billion yuan, supporting the development of China’s integrated circuit industry and the construction of the Shanghai International Science and Technology Innovation Center.

Liu Fan, Vice President of the Asset Company under China Life Group, stated that the project explores the relay cooperation model of insurance funds and government funds in regional development and industrial support through S-share investment, that is: government planning and guiding industrial development, realizing the incubation and cultivation of key areas from zero to one, while insurance funds and other socialized capital provide support when the industry achieves phased results, helping the government “replace old with new” and improve the efficiency of financial fund utilization, breaking down barriers between industrial guidance and market-oriented development.

Zhuang Siliang, Senior Vice President of the Innovative Investment Division of China Life Asset Company, stated that in the use of insurance funds, correctly understanding, accurately grasping, and laying out key areas of China’s economic development in advance, finding the resonance points with the engine of economic growth is not only an important source of investment returns but also the best embodiment of grasping and supporting new productive forces. This project is based on this idea, finding the resonance points between the use of insurance funds and technological innovation, regional development, effectively supporting the development of China’s integrated circuit industry while achieving reasonable financial returns, and promoting the construction of the Shanghai International Science and Technology Innovation Center.

Prior to this, from 2022 to 2023, the two phases of the “China Life – Changcun Phase II Project Debt Investment Plan” initiated by China Life successfully completed fundraising and issuance, with a total scale of 6 billion yuan. This is the first insurance fund debt investment plan project by China Life in the central region serving advanced manufacturing, supporting high-level technological self-reliance, and addressing “bottleneck” projects, assisting invested enterprises in tackling major projects in the storage chip field.

New Productive Forces,

Expecting a “Chemical Reaction” of Bidirectional Configuration

The rapid advancement of high-tech industries such as integrated circuits and artificial intelligence represents the vigorous development of China’s new productive forces.

Driven by these industries, new opportunities and challenges arise every day.

At the same time, the various subjects of new productive forces are not in a state of fighting alone, but rather in collaboration within the upstream and downstream industrial chains.

This also poses new requirements for the financial industry. In April 2024, the State Council issued the “Several Opinions of the State Council on Strengthening Regulation, Preventing Risks, and Promoting High-Quality Development of the Capital Market” (referred to as “National No. 9”), which clearly mentioned “vigorously promoting the entry of medium- and long-term funds into the market, continuously expanding the strength of long-term investments,” while emphasizing the need to “enhance inclusiveness towards new industries, new business formats, and new technologies, and better serve technological innovation.”

As the most scarce patient capital and high-energy capital in the market, insurance funds play a catalytic role in the “chemical reaction” of the upstream and downstream industrial chains. They can effectively meet the financing needs of technology innovation enterprises, providing full-cycle financial services for them.

By the end of 2023, the total investment scale of China Life Group supporting technological self-reliance has exceeded 330 billion yuan; the loan balance for technology enterprises at Guangfa Bank, a member unit, is nearly 189 billion yuan. As the main platform for the operation of insurance funds under the entire group, China Life Asset Company supports strategic emerging industries with an investment scale of 203.4 billion yuan, advanced manufacturing with 87.9 billion yuan, green investments with 394.8 billion yuan, and “two new and one heavy” with 382.5 billion yuan by the end of the first quarter of 2024.

In 2022, China Life established the “China Life – Electronic Mixed Reform No. 1 Equity Investment Plan,” increasing capital for China Electronics Co., Ltd. by 1.99 billion yuan, supporting the construction of the PKS system for core pillars such as domestic CPUs and operating systems, accelerating breakthroughs in key core technologies in the field of cybersecurity.

Zhuang Siliang introduced that the prudent use of insurance funds and the characteristics of long-term value investment have gradually established a good market reputation and influence in investors’ minds. The investment by insurance institutions often has potential impacts such as stable valuation on the invested enterprises, which can create a better external environment for technology enterprises. At the same time, insurance institutions can leverage their expertise to assist invested enterprises in corporate governance, market value management, internal control construction, etc. Moreover, the extensive investment map of insurance institutions often involves the upstream and downstream of various industrial chains, providing additional links for business collaboration among invested enterprises.

Liu Fan stated that moving forward, China Life will continue to enhance its investment research capabilities in the forefront of technology fields that serve national strategic needs, promoting a series of quality research results to accelerate conversion and landing. Strengthening investment support for technological innovation fields, continuously exploring investment opportunities in strategic emerging industries such as biomedicine, computing, electronics, communication, new energy, and energy conservation and environmental protection to achieve positive growth in related investment stock scale.

The financial industry has also felt the high efficiency brought by technology. Currently, China Life Asset Company has established a unified data, unified process, unified interface, and integrated investment management platform covering the entire process of investment management—CLIMB platform, managing assets exceeding 5 trillion yuan.

Liu Fan stated that data is productivity. China Life hopes to leverage technological power to achieve standardized sharing of regulated digital resources, and on this basis, in conjunction with the development of artificial intelligence technology, to empower more in the future. Ultimately, it hopes to achieve the sedimentation of research results and the reengineering of business processes.

From Technological Assistance to Risk Mitigation

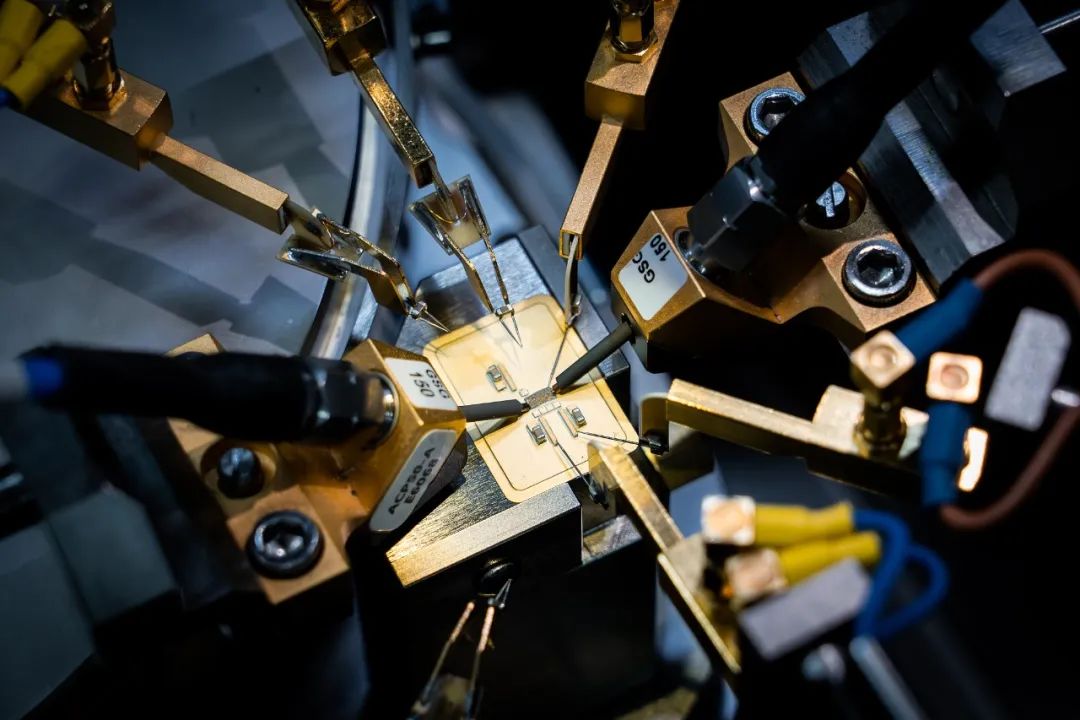

In the Shanghai Lingang Industrial Zone, a semiconductor equipment factory covering over 100,000 square meters is meticulously engraving nano-level traces on raw materials.

This is a necessary step in chip production, and whether the production process goes smoothly not only relates to the fate of the enterprise itself but also affects the fate of the upstream and downstream industries.

“The testing of automotive intelligence heavily relies on stable chip quality and timely supply. If there are issues with chip supply or quality, the testing progress may be forced to extend by more than six months,” an automotive engineer told Phoenix Weekly.

As technology penetrates people’s daily lives, the importance of technology security is being mentioned more and more, and the forms of protection are becoming increasingly diverse.

Liu Zhe, Deputy General Manager of China Life Property & Casualty Insurance Shanghai Branch, told Phoenix Weekly: “The insurance of modern technological products will have targeted insurance specific to each industry, providing protection based on the characteristics and risk points of the corresponding industry.”

The various industries of new productive forces often face different stages such as R&D, product landing, and market promotion. Each stage is interconnected but may also generate specific risks within a stage.

In response, China Life Property & Casualty Insurance Company has set up a comprehensive insurance plan for new productive force enterprises such as artificial intelligence and biomedicine, covering the entire lifecycle of enterprises.

“For example, when a company is established, it needs to conduct R&D first. If the R&D fails, we have set up a compensation mechanism for R&D expenses. From successful R&D to landing, if product issues cause losses to the purchaser or user, we will also provide protection. In the mature stage, if there are intellectual property disputes or legal disputes in different markets, we can also assist enterprises in bearing corresponding losses or help enterprises maintain their legal rights in overseas markets,” Liu Zhe said.

The other meaning of technology insurance lies in risk prevention; preventive measures are often more important than post-compensation.

For various industries of new productive forces, the role of electricity is becoming increasingly important.

For instance, in the chip industry, even if a chip company worth billions of dollars loses power for just one second, all equipment functions will instantly disappear, causing thousands of wafers to be scrapped, which not only affects delivery schedules but may also incur compensation liabilities, thus impacting the company’s performance.

For such enterprises, insurance companies need to understand the backup situation of the enterprise’s circuits in advance while underwriting, including how many circuits there are, what remedial measures are in place in case of power outages, etc.

This is also thanks to the advancement of technology. China Life has co-established the “China Life-Tsinghua Industrial Safety Big Data Joint Research Center” platform and, based on this, created the safety responsibility insurance accident prevention service project for China Life’s insurance business, while independently developing the “Safety Production Intelligent Prevention System” (CIRS). This system focuses on actively implementing the main responsibility within the enterprise and engaging all personnel effectively, aiming to help enterprises reduce risks, improve safety management efficiency, and minimize the occurrence of safety accidents.

Currently, China Life has developed eight major categories of exclusive main insurance products, including those for “three firsts” (referring to major technological equipment, new software, and new materials that have major technological breakthroughs but have not yet achieved market performance), intellectual property, cybersecurity, life sciences, aerospace, and high-tech enterprises, totaling over 40 products. In 2022, it also innovatively developed specialized technology insurance products such as automotive chip quality safety liability insurance, which has basically formed a rich, comprehensive, and market-relevant technology insurance product supply system.In 2023, the total risk protection amount of technology insurance of China Life Group reached 870 trillion yuan, a year-on-year increase of 133%.

From technological advancement to industrial growth, and to the financial investment relay, new productive forces are forming a virtuous growth cycle, which further brings new imagination to various industries, including finance and technology enterprises, and even the entire Chinese economy.