(Report Produced By: Ping An Securities)

1. Geely Holding Group: A Leading Comprehensive Automotive Electronics Service Provider

1.1 Company Overview

Geely Holding Group was established in 2003, focusing on providing electronic products, R&D services, and high-level intelligent driving solutions for customers in the automotive and unmanned transport sectors. In its early years, the company primarily engaged in R&D services and solution provision, taking on the Dongfeng Motor Engine Simulation Testing Project in 2004. In 2006, the company established an automotive electronics product division and began R&D work on intelligent driving electronic products in 2010. In 2015, the company entered the high-level intelligent driving business and formed a complete port MaaS solution. In 2022, the company successfully listed on the Shanghai Stock Exchange’s Sci-Tech Innovation Board. In 2021, the company achieved total revenue of 3.26 billion yuan, with a net profit attributable to shareholders of 150 million yuan. The company is headquartered in Beijing, with modern production bases in Tianjin and Nantong. R&D centers are located in Beijing, Shanghai, Tianjin, Chengdu, Shenzhen, and Wuhan, covering sales regions nationwide, with branches in the United States and Germany.

1.2 Focused on Automotive Electronics Business, Forming a “Trinity” Business Layout

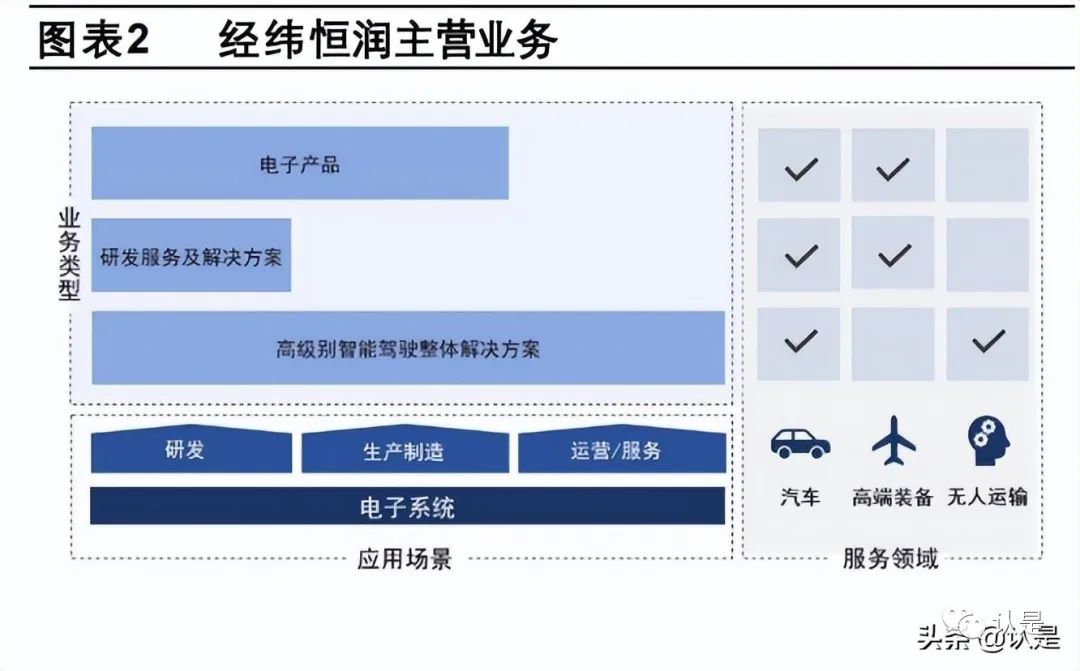

The company’s main business revolves around automotive electronic systems, focusing on automotive, high-end equipment, and unmanned transport sectors. It provides electronic products, R&D services, solutions, and high-level intelligent driving solutions to customers in these fields, covering all stages from R&D, manufacturing to operational services. The “Trinity” business layout enables the three major businesses to develop synergistically. After long-term development, the company’s electronic products, R&D services, and solutions, and high-level intelligent driving solutions have formed a “trinity” business layout, mutually supporting and developing in core technologies, application scenarios, and industry customer groups. The company can provide R&D services and solutions covering R&D tools, development, and testing processes for customer R&D activities, while also developing electronic products for vehicles based on customer needs. With years of deep engagement in the intelligent driving business, the company has developed a complete port MaaS solution, contributing potential profit growth points and accelerating rapid development in areas such as SOA architecture, in-vehicle high-performance computing platforms (HPC), 5G T-BOX, Ethernet communication, intelligent driving, and OTA. The three types of businesses support each other and develop synergistically, serving customers in multiple dimensions and establishing long-term business relationships, forming a higher customer stickiness compared to simple electronic product support or technical services.

The company’s main product business includes three parts: electronic products, R&D services, and high-level intelligent driving solutions. In 2021, the revenue from the three major businesses was 2.50/0.71/0.04 billion yuan, with the automotive electronics business being the company’s core product and revenue pillar. The revenue from electronic products is in a rapid growth stage, accounting for over 75% of total revenue. The company’s electronic products mainly focus on automotive electronics, supporting domestic OEMs and Tier 1 suppliers, along with a small number of high-end equipment electronic products. The revenue from electronic products increased from 910 million yuan in 2018 to 2.50 billion yuan in 2021, with an annualized average growth rate of about 40%, where intelligent driving, body and comfort domain, and intelligent connected electronic products contributed significantly to the company’s electronic product business. The revenue from R&D services is relatively stable. R&D services are the earliest business the company started, mainly including automotive electronic system R&D services and high-end equipment electronic system R&D services, providing various technical solutions, tool development, and process support services for customers’ electronic system R&D processes. From 2018 to 2021, this business segment’s revenue remained around 600-700 million yuan, with stable operating income and relatively low growth rate, accounting for about 21.7% of the company’s total revenue in 2021. The high-level intelligent driving solution business is a new business initiated in 2015. The company’s high-level intelligent driving business has cooperated with several vehicle manufacturers, covering multiple scenarios, including intelligent port logistics, intelligent sanitation vehicles, intelligent park logistics vehicles, and intelligent shuttle buses.

1.3 Gross Margin Leading Industry Peers, Significant R&D Investment

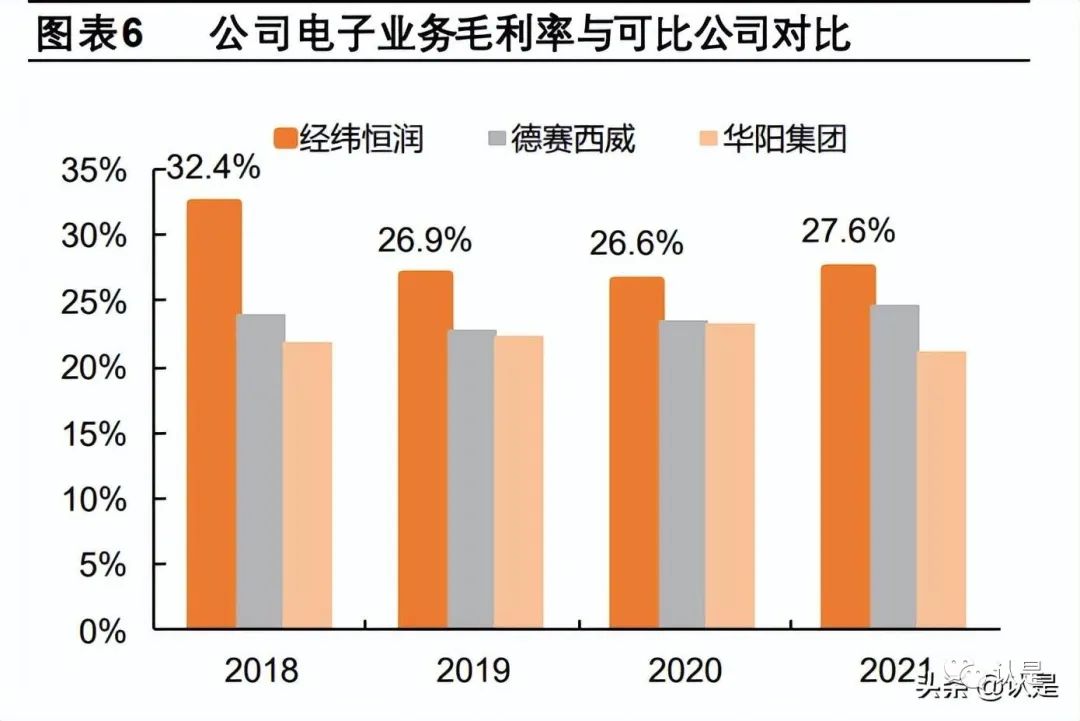

The gross margin level is higher than domestic peers but is gradually declining, mainly due to the increasing proportion of electronic product business. The company’s main business gross margin level is relatively high, leading domestic peers, with electronic business gross margins around 27% in recent years, and R&D service business gross margins generally maintained between 40% and 50%. The company’s overall gross margin has declined in recent years (from 39.3% in 2018 to 30.9% in 2021), mainly due to the increasing revenue share of electronic business. As the revenue share of the company’s electronic business increases, the company’s gross margin level will gradually approach the gross margin level of the electronic business.

The net profit margin has gradually increased, with a relatively high R&D expense ratio. In 2021, the company’s net profit attributable to shareholders reached 150 million yuan, nearly doubling compared to 2020, with a net profit margin of 9.5% in 2021. Due to the increase in revenue scale, various expense ratios have continuously decreased, while the company’s R&D expenses have grown continuously, with all R&D expenditures being expensed. R&D expenses mainly consist of employee compensation and material consumption, reaching 460 million yuan in 2021, with an R&D expense ratio of 14%, exceeding 20% in the first quarter of 2022. In the first quarter of 2022, the company’s revenue reached 710 million yuan, a year-on-year decrease of 2.7%, with a net loss of 31.73 million yuan, a year-on-year decline of 198%. The company’s profit decline in the first quarter of 2022 was mainly affected by the sluggish domestic commercial vehicle business, chip shortages, and the outbreak of the pandemic, along with the increase in R&D personnel leading to a significant rise in R&D expenses, which was also a significant reason for the company’s losses.

1.4 Rich Customer Resources, Deepening Cooperation with OEMs

Through long-term business accumulation, the company has formed a core customer group in the automotive field, including domestic and foreign vehicle manufacturers such as FAW Group, China National Automotive, SAIC Group, GAC Group, and Navistar, as well as internationally renowned Tier 1 suppliers like Infineon, Aptiv, and BorgWarner, along with high-end equipment customers such as COMAC and CRRC and unmanned transport customers like Rizhao Port.

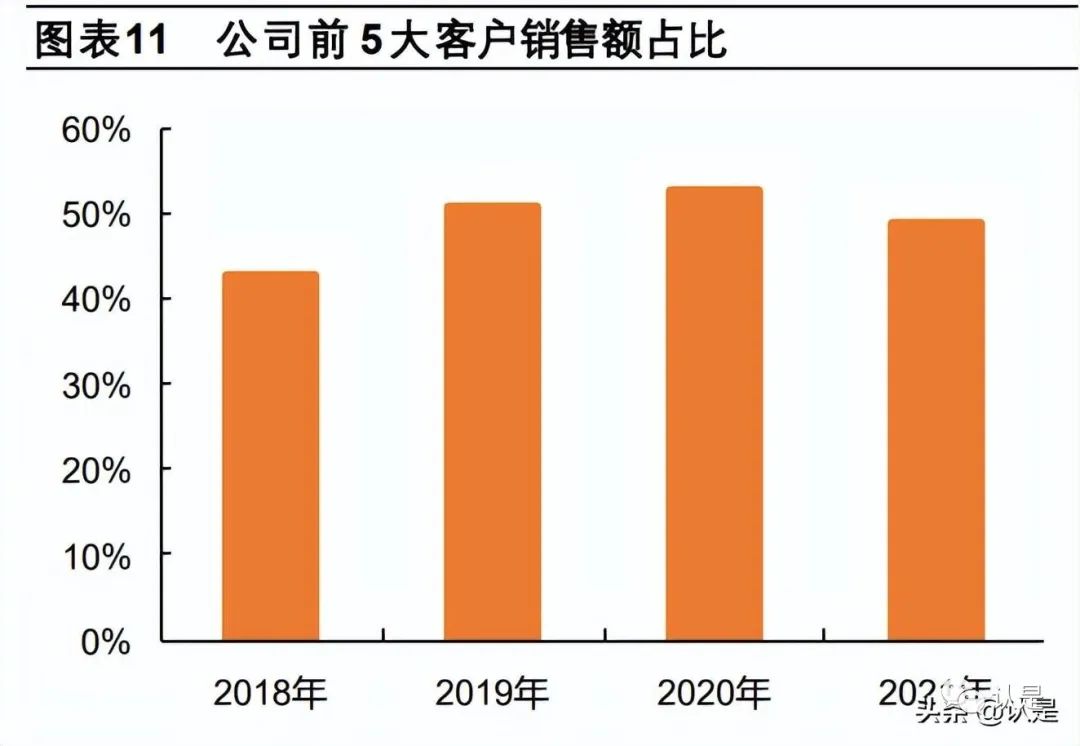

The company’s main customer concentration is relatively high, and with the increase in new customers, revenue distribution is expected to become more balanced. From 2018 to 2021, the sales amount from the top five customers accounted for 42.62%, 50.48%, 52.56%, and 48.63% of total revenue, indicating a high customer concentration. Among them, FAW Group is currently the company’s largest customer, with revenue from FAW Group reaching 850 million yuan in 2021, accounting for 26% of total revenue. Apart from FAW Group, revenue from SAIC Group, BAIC Group, and Geely also accounted for around 5%-6% of the company’s revenue in 2021. We believe that as the company increases its new customer base, its revenue distribution will become more balanced in the future.

2. Electronic Business: Focused on Automotive Electronics, Benefiting from the Trend of Automotive Intelligence

The automotive electronics business is comprehensively laid out, with intelligent driving, intelligent networking, and body electronics being the company’s core electronic products. The company established an automotive electronics product division in 2006, began R&D on intelligent driving electronic products in 2010, and achieved electronic business revenue of 2.5 billion yuan in 2021, accounting for about 77% of the company’s revenue during that period. The company’s electronic business revolves around automotive electronics, covering intelligent driving electronic products, intelligent networking electronic products, body and comfort domain electronic products, chassis control electronic products, new energy and power system electronic products, and automotive electronic product development services. Among these, intelligent driving, intelligent networking, and body electronics account for the largest proportion of the company’s electronic business. In 2021, the revenue from these three segments was 570 million, 450 million, and 1.10 billion yuan, accounting for 22.9%, 18.0%, and 43.8% of the company’s electronic business revenue, respectively.

2.1 Intelligent Driving Electronic Products: ADAS Products Backed by Mobileye, Comprehensive Layout of Autonomous Driving Solutions

The company’s autonomous driving solutions cover a wide range. The company’s intelligent driving electronic products include perception, decision-making, execution, and solutions, with major products including Advanced Driver Assistance Systems (ADAS), Intelligent Driving Domain Controllers (ADCU), On-board High-Performance Computing Platforms (HPC), Millimeter Wave Radar (RADAR), On-board Cameras (CAM), High-Precision Positioning Modules (LMU), Driver Monitoring Systems (DMS), and Automatic Parking Assist System Controllers (APA).

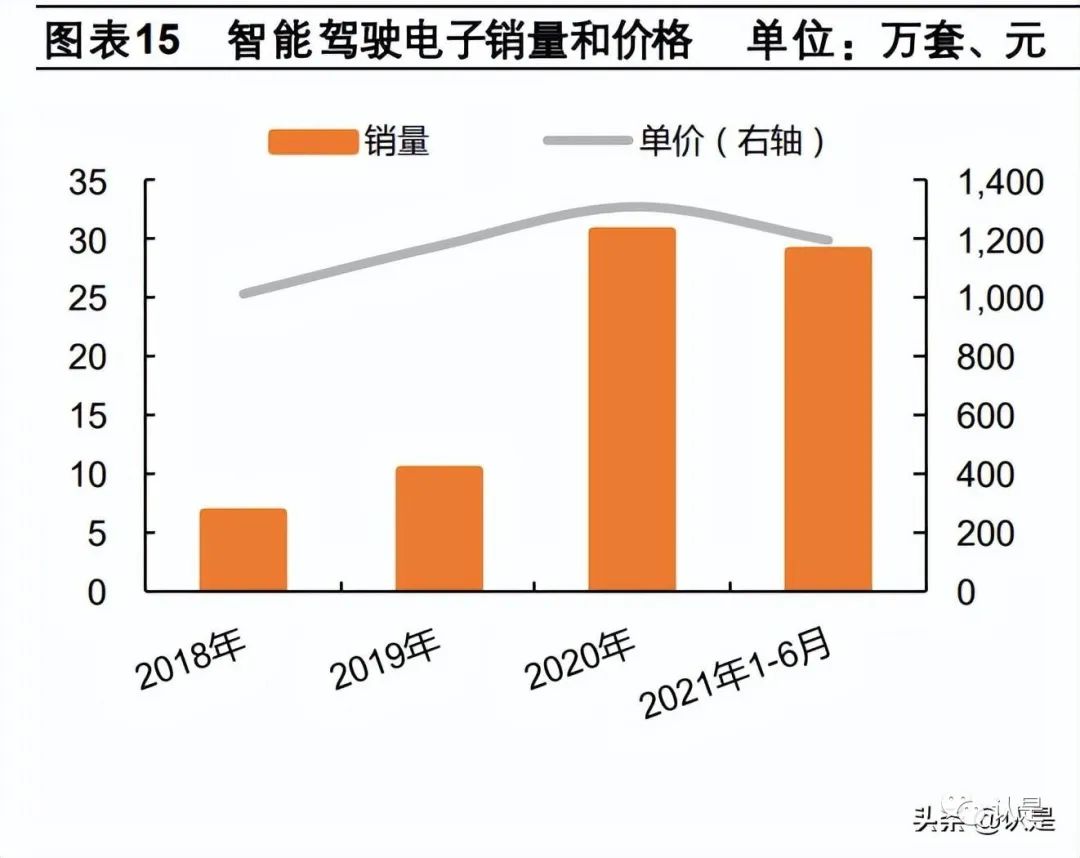

The intelligent driving electronic business is growing rapidly, becoming an important growth point for the company’s revenue. From 2018 to 2021, the revenue from the company’s intelligent driving solutions increased from 70 million to 570 million yuan, with its share of the company’s electronic business revenue increasing from 7.5% in 2018 to 22.9% in 2021, making it the second-largest automotive electronic business after body electronics. From 2018 to the first half of 2021, the sales volume of the company’s intelligent driving electronic products was 67,000, 102,000, 308,000, and 290,000 units, with the price per unit of intelligent driving electronic products being approximately 1200-1300 yuan.

The company’s ADAS products have broken the monopoly of foreign component companies in this field, supporting multiple domestic OEMs. The company’s ADAS products primarily focus on forward active safety cameras (Forward Active Camera, FAS-Cam), catering to the needs of L2 and below driving assistance functions. In 2016, the company’s ADAS products were equipped in the Roewe RX5, breaking the monopoly of foreign companies in this field, and since 2016, the company has completed four generations of ADAS iterations. Currently, the company’s ADAS products are equipped in models such as SAIC Roewe RX5, FAW Hongqi H5/H7/H9/HS5/HS7/E-HS3/E-HS9, Geely Boyue Pro/New BinYue/Dihao, and FAW Liberation J6/J7, and Heavy Truck HOWO T7, among others. From 2018 to the first half of 2021, the sales volume of the company’s ADAS products was 67,000, 102,000, 307,000, and 272,000 units.

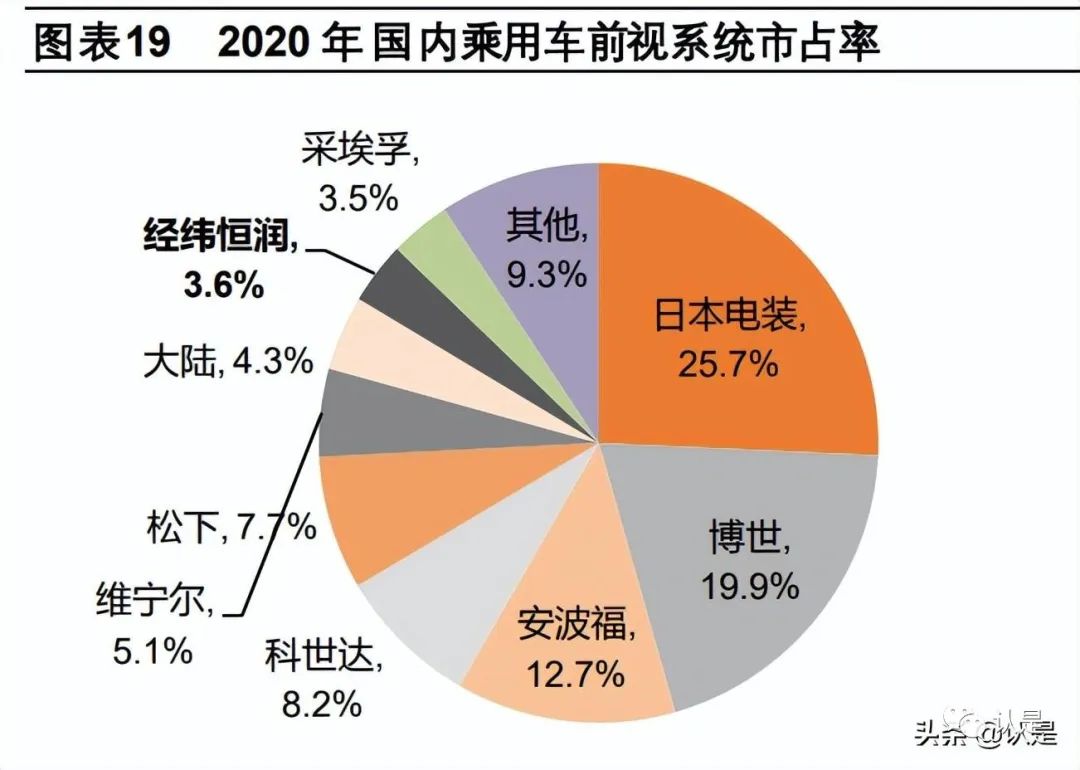

From a competitive landscape perspective, the company ranks among the top domestic suppliers in terms of ADAS market share, with significant room for domestic substitution. According to statistics from Zosi Automotive Research, in 2020, Geely Holding Group’s passenger car new ADAS product assembly volume was 178,000 units, with a market share of 3.6%, making it the only domestic enterprise among the top ten suppliers of new passenger car forward systems in China. In the autonomous brand passenger car market, the company’s ADAS product market share was 16.7% in 2020, ranking second, only behind Bosch. In terms of competition, domestic ADAS products are mainly dominated by foreign manufacturers, including Denso, Bosch, Aptiv, and Continental. We believe that domestic ADAS manufacturers, represented by Geely Holding Group, have certain advantages over foreign manufacturers in terms of compliance with Chinese regulations, understanding unique Chinese scenarios, service responsiveness, and cost, providing customized and differentiated development. Additionally, considering supply chain security, geopolitical factors, and the rise of domestic brands will provide more development opportunities for domestic ADAS manufacturers.

From an industry perspective, the market space for the company’s ADAS products is expected to continue to grow rapidly in the coming years, with an estimated 16 million passenger cars in China expected to be equipped with forward ADAS systems by 2025. According to Zosi Automotive Research data, in 2020, the assembly volume of new passenger car forward systems (i.e., the company’s ADAS products) was 4.986 million units, a year-on-year increase of 62.1%; the assembly rate for forward systems was 26.4%, an increase of 10.9 percentage points compared to 2019. Among them, domestic brands accounted for 16.1%, a year-on-year increase of 6.5 percentage points; joint ventures accounted for 32%, a year-on-year increase of 13.7 percentage points. It is expected that by 2025, the assembly volume of forward systems for passenger cars in China will reach 16.305 million units, with an assembly rate of 65%.

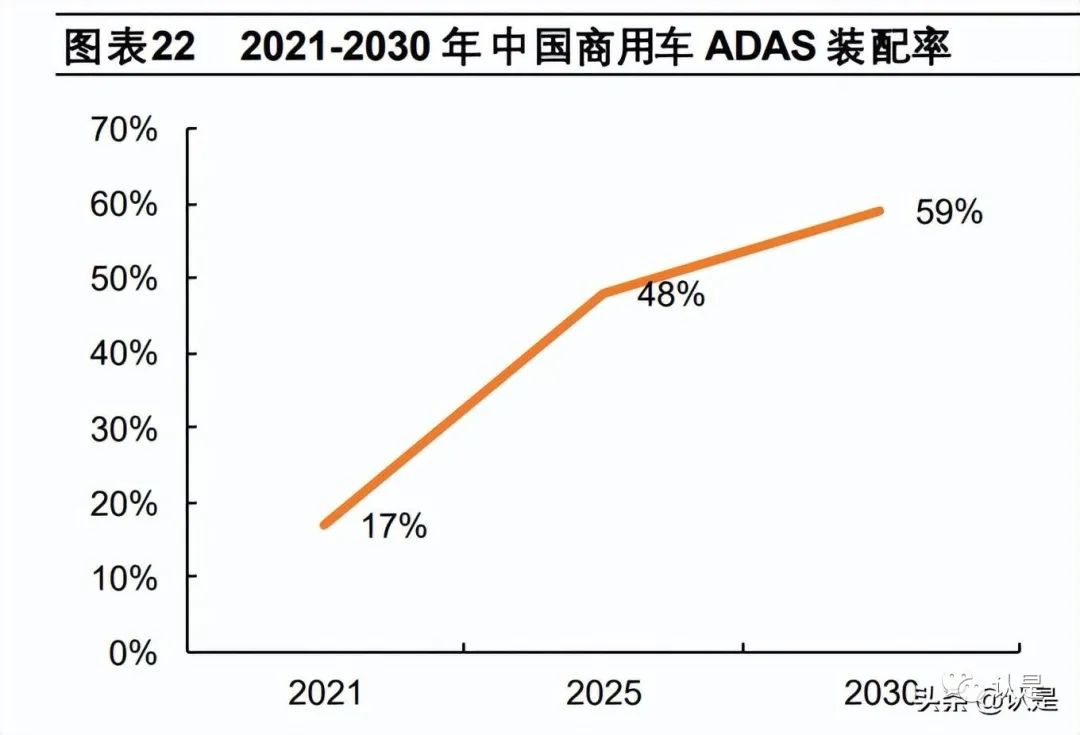

Due to policy influences, the assembly rate of ADAS in commercial vehicles will also rapidly increase. 1) Buses: In 2017, China required that operational buses longer than 9 meters must be equipped with “LDW (Lane Departure Warning)” and “FCW (Forward Collision Warning)” (dual warning systems); from April 2019, new operational vehicles over 9 meters must be equipped with LDW and AEB. 2) Trucks: From September 1, 2020, tractors and trucks with a total mass of ≥18,000 kg must be equipped with FCW and LDW (dual warning). From May 1, 2021, tractors with a maximum speed greater than 90 km/h, and trucks with a total mass greater than or equal to 12,000 kg and a maximum speed greater than 90 km/h must be equipped with AEB. Driven by policy regulations and market demand upgrades, L1-L2 functional implementation in commercial vehicles will become the primary trend in the short term. According to Zosi Automotive Research forecasts, the assembly rate of ADAS in commercial vehicles in China is expected to reach 48% and 59% in 2025 and 2030, respectively.

The company’s dual-warning system for commercial vehicles and Neusoft Ruichi is currently in the top tier of the industry, with the heavy-duty tractor ADAS market share ranking first. The competition in the heavy-duty dual-warning (LDW, FCW) market is fierce. Currently, the company and Neusoft Ruichi are in the top tier in the dual-warning field. According to statistics from the Gaogong Intelligent Automotive Research Institute, from September to December 2020, following the implementation of new regulations, the number of new heavy-duty tractors (operational) equipped with ADAS warning products was 367,900 units, with Geely Holding Group’s ADAS assembly volume at 112,000 units, capturing a market share of 30.44%, ranking first in the market.

Backed by Mobileye, the company’s ADAS products will benefit from the popularization of L2-level autonomous driving. Mobileye is a global leader in ADAS chips, with over 28 million Mobileye EyeQ chips shipped in 2021, a year-on-year increase of 45.6%. By the end of 2021, the total shipment of Mobileye EyeQ series chips had exceeded 100 million units. In 2021, Mobileye secured 41 new ADAS projects across more than 30 automakers globally. According to data from Gaogong Intelligent Automotive Research Institute, Mobileye ranked first in the Chinese market for pre-installed ADAS visual perception chips/algorithm solutions with a market share of 36.29% in 2021. We believe that although Mobileye’s market share in the high-level auxiliary driving field is gradually being encroached upon by manufacturers such as NVIDIA, Qualcomm, Huawei, and Horizon, from the perspective of the installation rate of models in the price range, new cars priced at 200,000 yuan and below have relatively low installation rates for both ADAS and L2 level. Moreover, as OEMs focus on cost-performance ratio in this price range, they have higher requirements for scheme costs and development efficiency. The ADAS products developed by Geely Holding Group based on Mobileye are mature and competitively priced, and are expected to continue benefiting from the popularization of L2-level auxiliary driving functions.

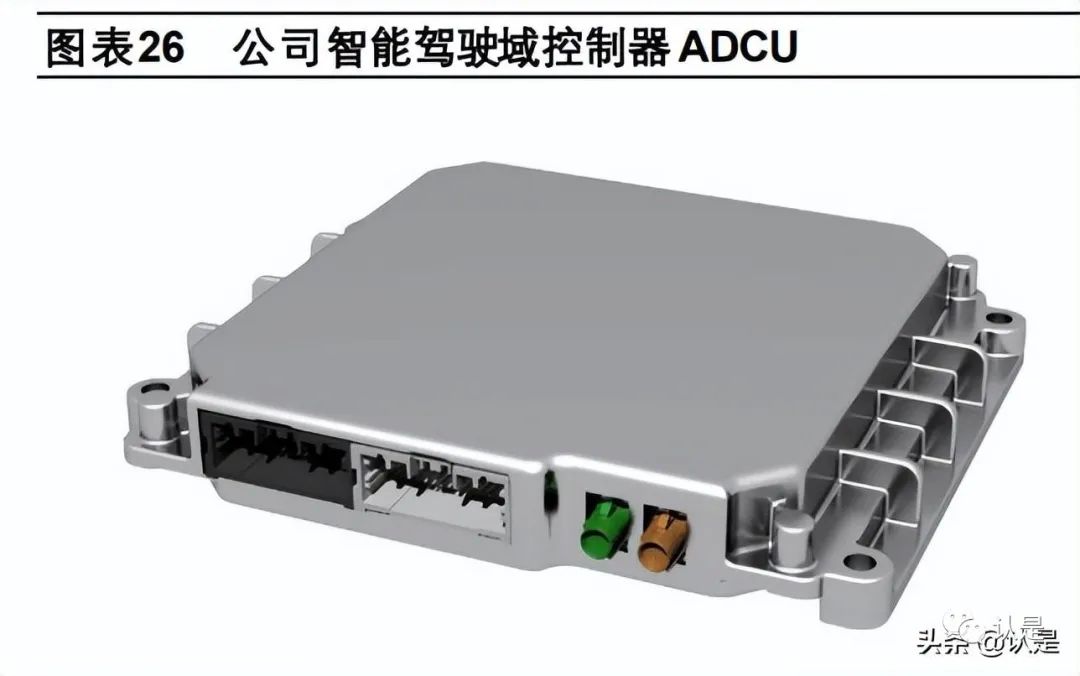

Intelligent auxiliary driving chip partners are not limited to Mobileye. Mobileye is a deep partner of the company but not the only chip supplier. In addition to Mobileye, the company’s next-generation on-board high-performance computing platform HPC uses TI’s TDA4 and Infineon’s TC397 chips. The company signed a strategic cooperation agreement with Black Sesame Technology in 2021, and both parties will conduct comprehensive technical and business cooperation on autonomous driving (including domain controllers, parking, etc.), intelligent cockpit products, and related applications. Additionally, the company plans to launch its intelligent driving solutions based on NVIDIA’s Orin chip in the future. For L2+/L3 auxiliary driving scenarios, the company’s intelligent driving domain controller (ADCU) is mass-produced for the Hongqi E-HS9: the company’s intelligent driving domain controller is based on Mobileye EyeQ4, designed for L2 and L3 level autonomous driving needs, supporting the integration of information from cameras, millimeter-wave radar, lidar, high-precision maps, and driver monitoring, enabling not only ADAS functionalities but also advanced autonomous driving functions such as driver confirmation for lane changes, high-speed driving assistance, traffic jam autonomous driving, and highway autonomous driving. The company’s self-developed intelligent driving domain controller (ADCU) was mass-produced for the Hongqi E-HS9 model in 2020.

For higher-level auxiliary driving, the company’s on-board high-performance computing platform (HPC) has achieved mass production. The company started the R&D of its HPC products in 2019 and has since launched two generations of products. The new generation HPC products use TI TDA4 and Infineon TC397 high-performance chips, supporting the integration of information from cameras, millimeter-wave radar, lidar, high-precision maps, and driver monitoring, providing customized system-level high-level intelligent driving solutions for users. It can achieve advanced autonomous driving functions such as automatic lane changes and automated assisted navigation driving. Currently, the company’s HPC products have been successfully integrated into models from Wintech Technology and Baoneng Automotive.

2.2 Intelligent Networking Electronic Products: Rapid Growth of T-BOX and Gateway

Intelligent networking electronic products are an important component of the company’s electronic business. From 2018 to 2021, the company’s intelligent networking electronic business revenue was 100 million, 250 million, 350 million, and 450 million yuan, with the revenue from intelligent networking electronic products accounting for about 18% of the company’s electronic business revenue in 2021. The company’s intelligent networking electronic products mainly include Remote Communication Controllers (T-BOX) and Gateways (GW). (1) Remote Communication Controllers (T-BOX): The company’s 4G-TBOX products provide a variety of Internet of Vehicles services for vehicle customers, including driving data collection, high-precision location information, vehicle fault monitoring, remote vehicle querying and control (locking/unlocking, air conditioning control, engine start/stop, etc.), intelligent driving warnings, driving behavior analysis, 4G wireless hotspot sharing, and OTA, supporting models including FAW Liberation J6, FAW Hongqi HS5/HS7, GAC Aion S/V/LX, and Jiangling Ford Lingjie, among others. (2) Gateways (GW): The company’s CAN(FD) gateway has already achieved mass production, and the 100Mbps Ethernet gateway has completed R&D and mass production, while the Gigabit Ethernet gateway has completed design and reliability testing. The models supported by the company’s gateways mainly include Buick GL8, Chery Tiggo 8, Geely BinYue/Dihao/Yuanjing/Yuanjing X3/Geometry A, GAC Trumpchi GS4/GS8/GM8, XPeng P7, FAW Liberation J6/J7, and Heavy Truck HOWO T7, among others.

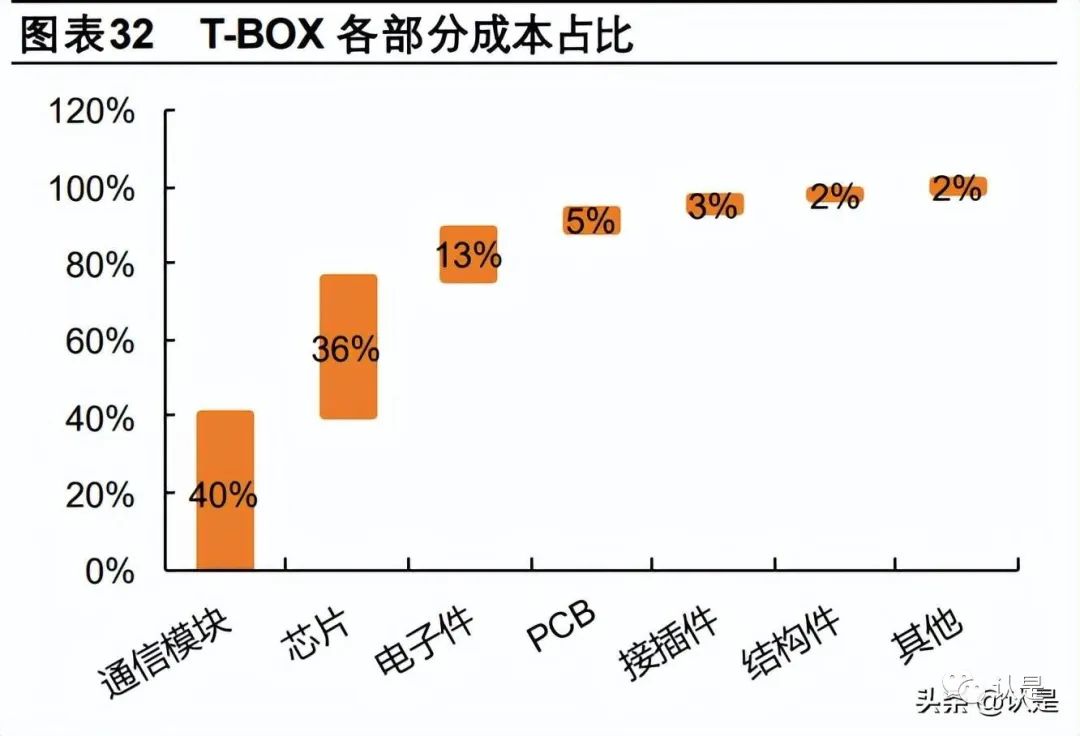

In 2021, the assembly volume of T-BOX in China’s passenger cars approached 13 million units, and it is expected to exceed 20 million units by 2025. According to Zosi Automotive Research data, the assembly volume of pre-installed T-BOX in China’s passenger cars in 2021 was 12.94 million units, a year-on-year increase of 31%, with an assembly rate of 60%, an increase of approximately 10 percentage points compared to 2020. In the future, the Internet of Vehicles in passenger cars will further popularize, and the assembly volume and assembly rate of T-Box will continue to rise. Zosi Automotive Research predicts that by 2025, the pre-installed assembly rate of T-Box in China’s passenger cars will reach 83.5%, with an assembly volume exceeding 20 million units. The number of participants in the T-BOX market is gradually increasing, leading to fierce competition. From the cost perspective, the most significant costs in T-BOX are the communication module and chip, which together account for 76% of the total cost. The company’s T-BOX products ranked 10th in the industry in 2020, and 5th among domestic manufacturers. In 2021, the top 10 T-Box suppliers in China accounted for 64% of the market share, and the company’s T-Box assembly volume ranking has declined, with leading domestic suppliers including Lianyou Technology, Neusoft, and Huifan Microelectronics.

The company’s T-BOX will benefit from the development of 5G T-BOX. With the advancement of 5G network construction and the application of 5G communication modules, domestic T-BOX products will gradually transition from 4G to 5G in the next 3-5 years. In 2021, approximately 40,000 units of 5G vehicles were insured, accounting for 0.3% of the total T-BOX assembly volume. The company is one of the few suppliers of 5G T-BOX in the industry, with other suppliers mainly including Lianyou Technology, Neusoft, and Huifan.Geely Holding Group’s 5G T-Box adopts an AP+NAD+MCU architecture, providing support for multiple platforms including Qualcomm and MTK, presenting various forms such as standalone, smart antenna, and multi-communication module integration. Functional interfaces include 5G SA/NSA, C-V2X, CAN/CAN FD, Gigabit Ethernet, dual-frequency GNSS, WiFi6, Bluetooth 5.2, USB, etc. It has been mass-produced in models such as Dongfeng Lantu and can also integrate TPMS, ETC, battery swap control, Bluetooth keys (expandable to UWB), and other specialized industry services, while providing centimeter-level high-precision positioning, AVP for site/vehicle, and high-speed channels for 10G Ethernet for intelligent driving domains. In the future, with the advancement of autonomous driving technology and mass production, the low latency and high speed characteristics of 5G will provide more efficient networking services for autonomous driving. Simultaneously, as communication technology and industry environmental conditions mature further, 5G T-Box will usher in new growth opportunities.

2.3 Body Electronics Products: Body Domain Controller Achieving Mass Production

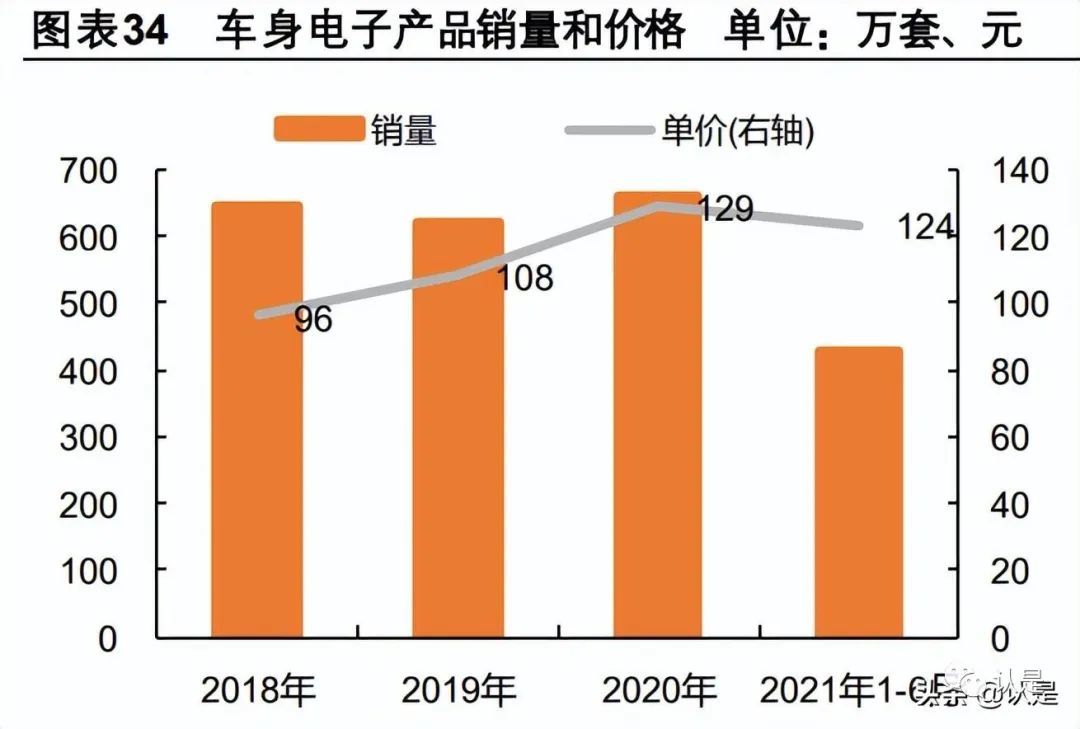

Body and comfort domain electronic products are currently the largest automotive electronic business by revenue in the company, with the revenue from body and comfort domain electronic products accounting for 43.8% of the company’s total revenue from electronic products in 2021. The company offers a wide variety of body and comfort domain electronic products. These include pinch control modules, passenger car body control systems, intelligent cockpit perception systems, keyless entry and start systems, body domain controllers, commercial vehicle door control systems, commercial vehicle body control systems, dome light controllers, electric tailgate controllers, adaptive front lighting system controllers, door domain controllers, seat controllers, ambient light controllers, and intelligent anti-glare front lighting system controllers, among others. From 2018 to the first half of 2021, the company’s body electronic product sales were 6.43 million, 6.18 million, 6.89 million, and 4.28 million units, with the average price per body electronic product being approximately 124 yuan in the first half of 2021. The company has rich experience in mass production of body and comfort domain electronic products, and based on platform algorithms and AUTOSAR software architecture, the company’s pinch control modules, electric tailgate controllers, and door domain controllers have successfully been integrated into multiple models for various OEMs, gaining high recognition. Among the company’s body electronic products, the pinch control module has the highest sales proportion, with shipments reaching 2.78 million, 2.52 million, 2.48 million, and 1.76 million units from 2018 to the first half of 2021, with major supporting customers including Infineon, Yutian Guanjia, and AXS.

The company is one of the few suppliers to achieve mass production of body domain controllers. Traditional body control modules (BCM) mainly control internal/external vehicle lights, wipers, windows, doors, etc., communicating with various nodes via CAN/LIN. As the number of various vehicle functions has increased, in recent years, additional functions such as keyless start systems, pinch protection, air conditioning control systems, and gateways have been integrated into traditional body control modules (BCM), upgrading them to body domain controllers. For example, in Huawei’s CCA architecture, aside from the intelligent cockpit and intelligent driving domain controllers, all other body control functions are integrated into the body domain controller (VDC vehicle control platform), forming a central computing + regional gateway architecture. According to data from the Gaogong Intelligent Automotive Research Institute, in 2021, the number of new passenger cars in China equipped with pre-installed body domain controllers (integrating body control + gateway) reached 500,000 units, and domestic manufacturers such as Geely Holding Group, Neusoft Ruichi, Nobow Technology, and Desay SV are expected to break the monopoly of foreign suppliers in the traditional BCM and gateway market.Geely Holding Group launched its body domain controller in 2020, integrating keyless entry and start systems (PEPS), air conditioning algorithms, door control logic, tire pressure monitoring, and other vehicle control logic based on its existing BCM functions, successfully supporting OEMs such as FAW Group and Huaren Yuntong.

2.4 Other Electronic Products: Extension of Automotive Electronics Business

In addition to autonomous driving, intelligent networking, and body electronics, the company’s automotive electronics business also extends to chassis control and new energy fields. However, the revenue share of the company’s other electronic businesses is relatively low at present. In 2021, the revenue from chassis, new energy, high-end electronics, and automotive electronic product development services was 30 million, 80 million, 120 million, and 160 million yuan, accounting for 1.2%, 3.1%, 4.7%, and 6.3% of the company’s electronic business revenue, respectively.

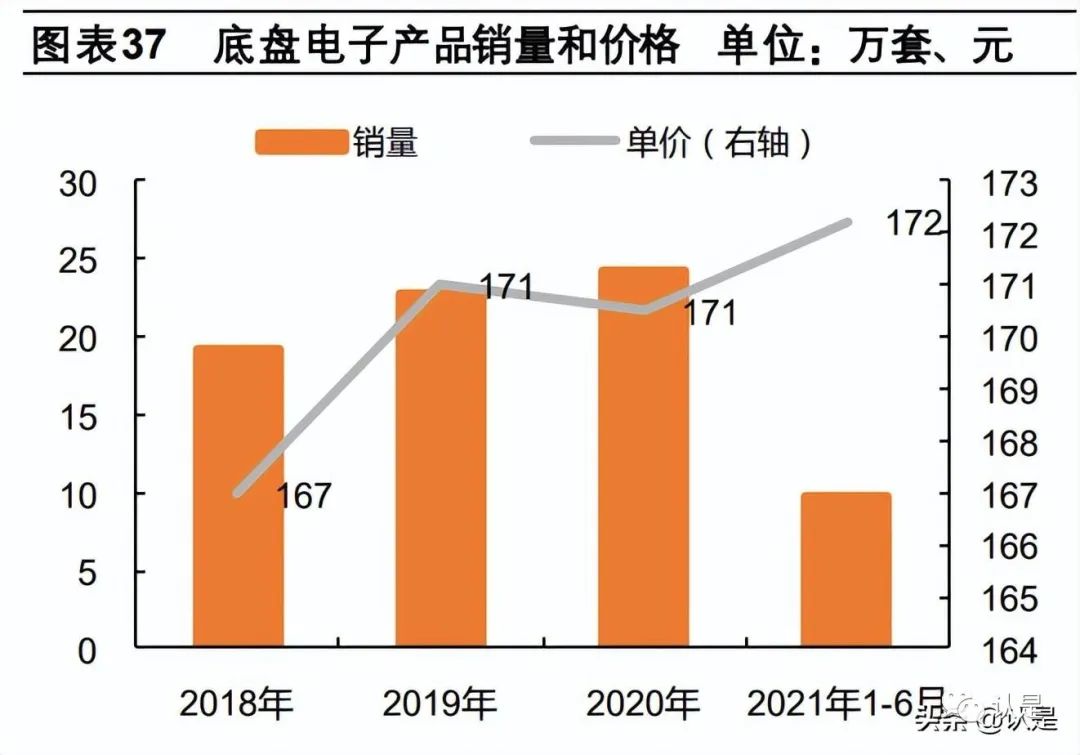

The chassis control electronics mainly focus on EPS, with the chassis domain controller fixed for NIO vehicles. The company established an electric power steering controller (EPS) team in 2006 and can currently provide EPS products that support autonomous driving. The company’s EPS products have been integrated into models such as Dongfeng Fengshen D01/D02, Changan K3, Tata Intra 1000/Intra 1300, among others. From 2018 to the first half of 2021, the company’s EPS sales were 191,100, 227,800, 242,700, and 96,500 units. Additionally, the company’s fully redundant EPS products for L3/L4 level autonomous driving have secured contracts with FAW Group for EHS9/Jiangling and contracts for DP EPS products aimed at B-class vehicles with FAW Hongqi/Jiangling/Foton. The company’s chassis domain controller has been fixed for NIO’s new platform models, meeting NIO’s full-stack self-research needs. As the NIO NT2.0 models are released, the chassis domain controller is expected to bring incremental performance to the company. In terms of new energy and power system electronics, the company launched its first generation vehicle control unit product in 2010, and after multiple platform iterations, its functionality has been continuously optimized. Currently, the company’s vehicle control units mainly include new energy vehicle controllers and commercial vehicle controllers, with major customers including FAW Liberation, Jiangling Motors, Geely, and China National Heavy Duty Truck Group. Additionally, the company’s battery management system covers battery pack types across voltage levels from 12V to 800V, accommodating both passenger and commercial vehicle usage environments, with major supporting customers including BAIC Group, Guoxuan High-Tech, and Funeng Technology.

2.5 Outlook for the Company’s Automotive Electronics Business: Huge Domestic Substitution Space, Domain Controllers Shaping Future Growth Space

The scale and cost proportion of automotive electronics are gradually increasing. With the development of the four modernization of automobiles, the proportion of automotive electronics in the overall vehicle cost is expected to reach 60% by 2025, according to data from CCID Consulting. Additionally, as the level of automotive electronics continues to improve and the cost of automotive electronics per vehicle increases, the market scale of automotive electronics is rapidly climbing. According to the China Automotive Association’s forecast, the global automotive electronics market scale is expected to reach 2.1399 trillion yuan in 2022, while China’s automotive electronics market scale is expected to reach 978.3 billion yuan.

The company’s automotive electronics business layout is comprehensive and will benefit from the major trend of domestic substitution in automotive electronics. The automotive industry is moving towards intelligence, with overall vehicle performance becoming increasingly reliant on advancements in automotive electronics. The variety of automotive electronics is increasing, and the demand for full-process automotive electronics technical services, including design development, system integration, and testing verification, is continuously increasing. International large automotive electronics companies occupy a leading position in the global automotive electronics market share due to their technological accumulation and experience. With the maturity of domestic automotive electronics industry technology, a batch of domestic automotive electronics companies with the capability to support leading automotive brands are gradually breaking through the technological barriers of international automotive electronics manufacturers and entering the supply chain system of major global automotive manufacturers. The company positions itself as a comprehensive Tier 1 supplier, covering a wide range of automotive electronics business compared to other comparable companies in China, with a positioning similar to that of international companies like Bosch, Continental, and Aptiv, and domestic companies like LianDian.

The evolution of electronic and electrical architecture brings development opportunities for domain controllers, with the company being one of the few component companies in China capable of integrating domain controllers. The intelligence of automobiles is transitioning the electronic and electrical architecture from traditional distributed systems to centralized systems. The control functions are gradually being integrated into domain controllers during the transition from distributed to centralized electronic and electrical architecture. Domain controllers and software module suppliers will experience rapid business growth. According to McKinsey’s forecast, the global domain controller market scale is expected to reach 128 billion USD by 2025 and 156 billion USD by 2030. The company is one of the few domestic companies capable of integrating domain controllers. Besides the power domain, the company’s autonomous driving domain controllers, body domain controllers, and chassis domain controllers have all achieved fixed-point or mass production support, while the cockpit domain controller is in the early stages of development. We believe that as the functions of domain controllers increase and the process of cross-domain integration progresses, the company, as a comprehensive domestic automotive electronics leader, will benefit even more.

3. Comprehensive R&D Service Solutions, High-Level Intelligent Driving as Future Growth Momentum

3.1 Comprehensive R&D Service Solutions, Entering Core Automotive Development Stages

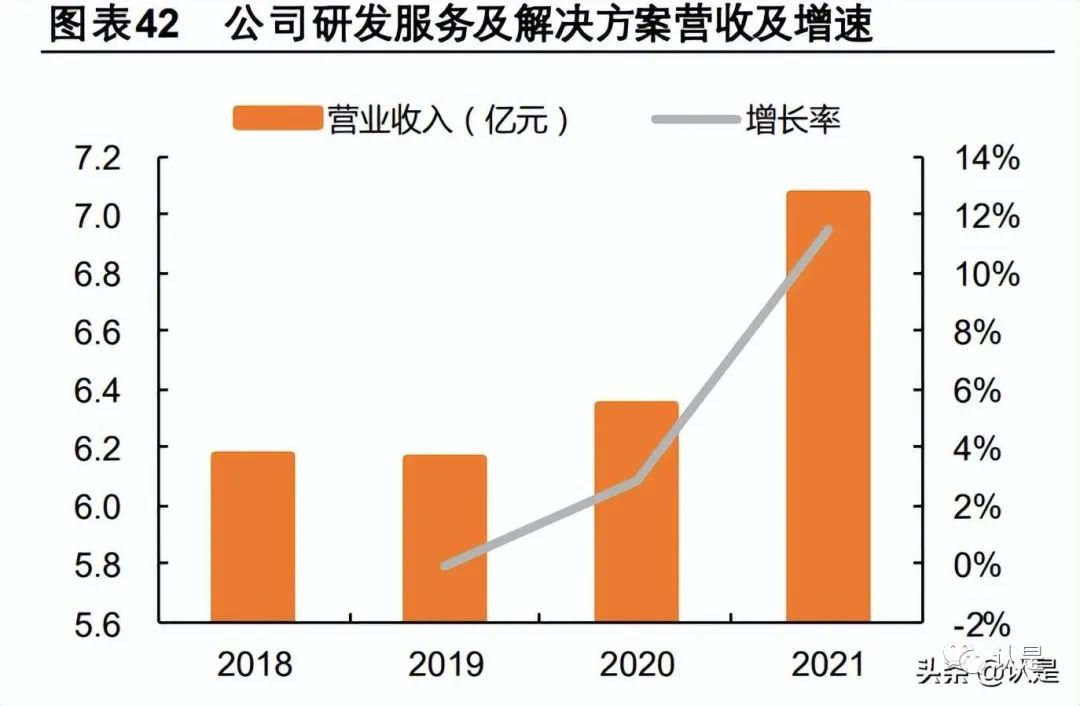

The R&D services and solutions business is the earliest layout of the company, with stable revenue. Since its establishment in 2003, the company has engaged in R&D services and solutions. From 2018 to 2020, the company’s revenue from this business was 617 million, 616 million, and 634 million yuan, with revenue increasing to 707 million yuan in 2021, a year-on-year growth of 11.55%. In terms of gross margin, the company’s gross margin for this business has shown a downward trend, with gross margins of 49.43%, 48.70%, 49.84%, and 42.01% from 2018 to 2021, remaining stable between 40% and 50%.

The company’s R&D services and solutions are comprehensive and cover a wide range. The company can provide various solutions and services throughout the development of electronic and electrical systems for customers, including automotive electronic system R&D services and high-end equipment electronic system R&D services, empowering and developing synergistically with the electronic products business to provide various technical solutions, tool development, and process support services for the electronic system R&D processes of customers in different industries. The customer base includes major OEMs such as FAW Group, SAIC Group, GAC Group, Geely, NIO, XPeng Motors, and international Tier 1 customers such as Aptiv, Bosch, Magna, and Valeo, as well as high-end equipment field customers like COMAC and CRRC and unmanned transport customers like Rizhao Port.

The company’s R&D services and solutions business includes automotive electronic system R&D services and high-end equipment electronic system R&D services:

Automotive electronic system R&D services: Based on its long-term practical experience in the electronic systems field, the company provides various solutions and services for automotive industry customers throughout the development of vehicle electronic and electrical systems, including more than ten development services, including consulting on overall vehicle electronic and electrical architecture.

High-end equipment electronic system R&D services: Mainly include aerospace system solutions, control system solutions, motor system solutions, signal processing solutions, and train electronic system solutions.

In the past few years, the revenue from the company’s R&D services has remained around 600-700 million yuan, with relatively stable revenue and low growth rates. Considering the increasing demand for R&D services due to the development of intelligent networking in automobiles, we expect the company to maintain a growth rate of around 10% in this business over the next 2-3 years.

3.2 High-Level Intelligent Driving Overall Solutions: Emerging Business, Expected to Become Future Growth Momentum

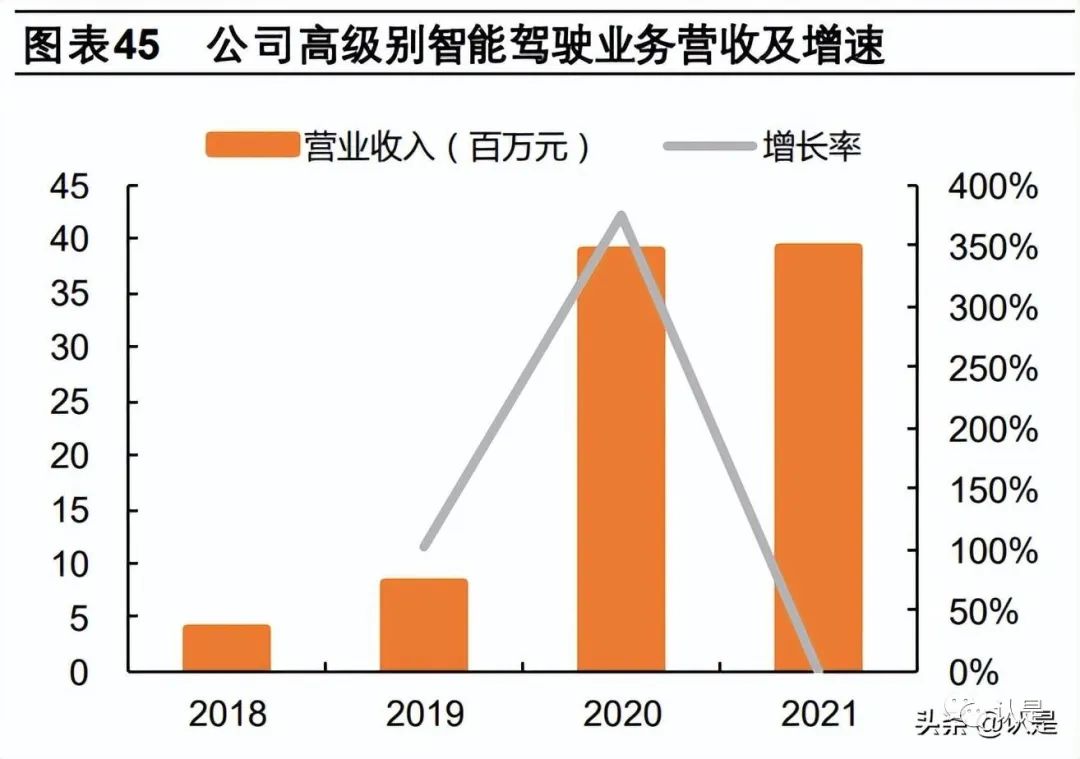

Mobility as a Service (MaaS) is the form of the company’s high-level intelligent driving solution business, providing transportation-related services through a unified information service platform. The high-level intelligent driving solution business includes single-vehicle intelligent solutions, intelligent fleet operation management solutions, and vehicle-cloud data center solutions. The company entered the high-level intelligent driving business in 2015, and currently, this business is in its early stages, with fluctuating revenue and gross margins, and a low revenue share. From 2018 to 2021, the business revenue was 0.04, 0.08, 0.4, and 0.4 billion yuan. In terms of gross margin, the gross margin for this business has shown a declining trend, decreasing from 94.5% in 2018 to 22.7% in 2021.

The company has formed a full-stack solution of “single-vehicle intelligence + intelligent fleet operation management + vehicle-cloud data center”. To commercialize the MaaS solution for high-level intelligent driving systems, the company has developed single-vehicle intelligent solutions, intelligent fleet operation management solutions, and vehicle-cloud data center solutions.

Single-vehicle intelligent solutions: Based on the SOA model, the company has designed the overall vehicle electronic and electrical system architecture, independently developed software algorithms for AI environmental perception, multi-source information fusion, high-precision positioning, intelligent decision-making, path planning, and vehicle dynamics control, as well as vehicle-grade intelligent driving domain controllers, remote communication controllers, body domain controllers, Ethernet gateways, among other hardware products, while strengthening functional safety and information security mechanisms, forming intelligent driving systems with independent intellectual property rights, providing customers with intelligent driving single-vehicle solutions for specific scenarios. Intelligent fleet operation management solutions: The intelligent fleet operation management solution independently developed by the company connects intelligent vehicles with data backends based on 4G/5G/V2X communication, establishing a fleet operation scheduling monitoring system, a fleet remote driving system, a vehicle-road collaboration system, and an on-site operation management information system, achieving full-process automated operation management from fleet departure, production operation to return to the depot. Vehicle-cloud data center solutions: The company’s vehicle-cloud data center solutions include engineering big data platforms, digital twin systems, and OTA software upgrade management systems, utilizing IoT and big data technologies to achieve scenario simulation testing, remote fault diagnosis, abnormal condition analysis, algorithm optimization, and software updates for autonomous driving vehicles, achieving rapid product iteration based on data-driven approaches.

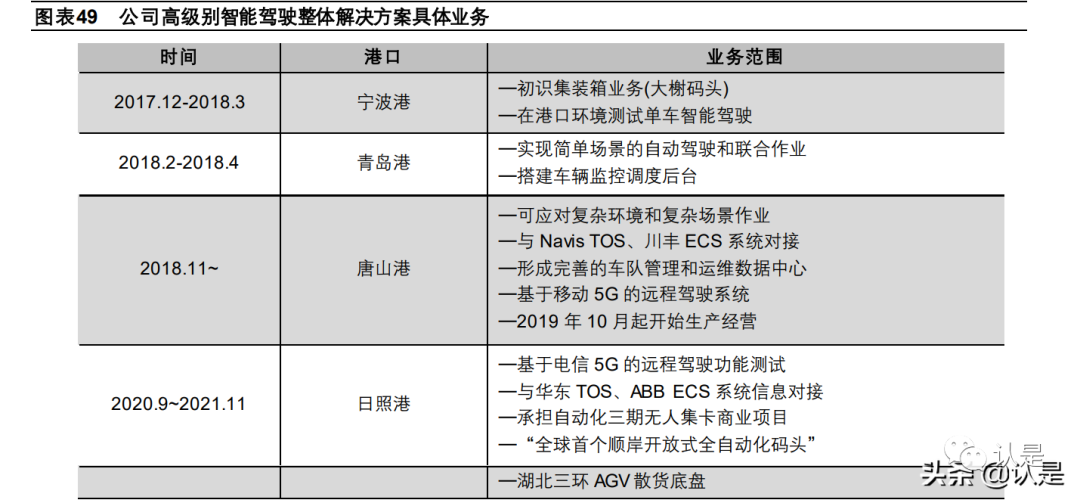

The company’s high-level intelligent driving business has cooperated with several vehicle manufacturers, covering multiple scenarios, including intelligent port logistics, intelligent sanitation vehicles, intelligent park logistics vehicles, and intelligent shuttle buses. Since 2018, the company has launched port MaaS businesses in Qingdao Port, Tangshan Port, and Rizhao Port, mainly developing single-vehicle intelligent solutions, intelligent fleet operation management solutions, and constructing vehicle-cloud data centers. In the future, the company will continue to promote the development of MaaS solutions to meet the demands of closed parks, trunk logistics, and unmanned taxi services.

4. Profit Forecast

Basic Assumptions and Company Profit Forecast

Electronic business: As the company’s main business, the automotive electronics sector is expected to enter a high growth period, likely welcoming a cycle of volume and price increases. The company’s electronic business revenue is expected to be 3.28 billion, 4.39 billion, and 5.96 billion yuan from 2022 to 2024, with corresponding gross margins of 27.6%, 27%, and 26.6%.

In terms of intelligent driving electronic products, the company’s ADAS products are backed by Mobileye, and with the increasing penetration rate of L2-level auxiliary driving, the market share of the company’s ADAS products is expected to continue to rise. Furthermore, the autonomous driving domain controller (ADCU) and on-board high-performance computing platform (HPC) for advanced auxiliary driving have already achieved mass production support. As the electronic and electrical architecture of vehicles moves towards central integration, the company’s autonomous driving domain controllers and on-board high-performance computing platforms are expected to benefit more, with the company’s intelligent driving electronic products expected to see simultaneous increases in volume and price. The revenue from intelligent driving electronic products is expected to be 950 million, 1.48 billion, and 2.24 billion yuan from 2022 to 2024, with year-on-year growth rates of 66.7%, 56.0%, and 50.6%.

In terms of intelligent networking electronic products, the company’s T-BOX products will benefit from an increase in penetration rates, with the T-BOX penetration rate expected to reach 83.5% by 2025, an increase of about 23.5 percentage points compared to 2021. The company will complete the technological upgrade from 4G to 5G for T-BOX, and with the increasing demand for 5G T-BOX in the market, the company’s intelligent networking electronic products will welcome a cycle of volume and price increases, with expected revenues of 580 million, 730 million, and 910 million yuan from 2022 to 2024, with year-on-year growth rates of 29.2%, 25%, and 25%, respectively.

In terms of body and comfort domain electronic products, the company is one of the few suppliers to achieve mass production of body domain controllers. The company launched its body domain controller in 2020 and has already supported FAW Group and Huaren Yuntong. During the transition of electronic and electrical architecture to central integration, the body domain controller will integrate more distributed ECUs, and the company’s body electronic business is expected to experience a cycle of volume and price increases. The expected revenue from body and comfort domain electronic products is 1.34 billion, 1.74 billion, and 2.34 billion yuan from 2022 to 2024, with year-on-year growth rates of 22%, 30%, and 35%, respectively.

R&D services business: The company’s revenue from R&D services has remained around 600-700 million yuan in recent years, with relatively stable revenue and low growth rates. Considering the increasing demand for R&D services due to the development of intelligent networking, we expect this business to maintain a growth rate of around 10% from 2022 to 2024. Given that the business model for this segment will not undergo significant changes, we predict that the gross margin for 2022 to 2024 will remain similar to that of 2021, around 42%.

The overall solution for high-level intelligent driving: This business is in its early stages, with revenue scale and growth rates fluctuating significantly. In the future, as high-level intelligent driving is implemented in more scenarios, the company’s overall solution for high-level intelligent driving is expected to receive more orders. We assume that this business will maintain a growth rate of around 50% from 2022 to 2024.