The core components of the robot body include servo, reducer, and controller. Taking a six-axis joint robot as an example, each robot is equipped with six servos, six reducers, and one controller. The motor and reducer are inside the robot, while the controller, which is the control cabinet, is connected to the robot body via cables.

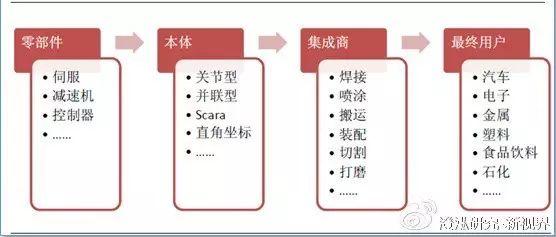

Robot Industry Chain Diagram

【Components: The Core is Control】

The core components of the robot body include servo, reducer, and controller. Taking a six-axis joint robot as an example, each robot is equipped with six servos, six reducers, and one controller. The motor and reducer are inside the robot, while the controller, which is the control cabinet, is connected to the robot body via cables.

The control process of the robot is driven by the controller issuing commands to the servo drives, which in turn drive the servo motors to rotate and execute actions via the reducer. Among these, the highest technical barrier is the reducer, followed by the servo motor and drive, and then the controller. However, the barriers mentioned here refer to functional barriers, which are the thresholds for achieving these functions.

The costs of the three core components, the reducer, servo, and control cabinet, account for 30% to 50% , 20% to 30% , and 10% to 20% of the robot’s total cost, respectively.

(1) Reducer

The working principle of the reducer is to reduce the speed of the motor, thereby obtaining a large torque. This is similar to the need for a car to slow down when going uphill.

The cost of the reducer averages 30% of the robot body cost. Due to the limited number of reducer suppliers, which leads to near-monopoly, the procurement price of reducers for domestic robot bodies is higher, with the reducer accounting for up to 40% to 50% of the body cost.

Reducers are divided into harmonic reducers and RV reducers.

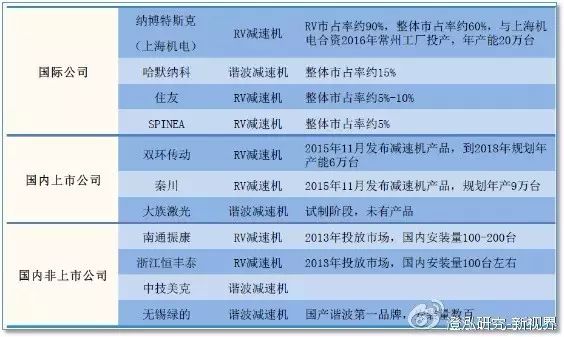

The harmonic reducer is used for small robots or for several axes at the end of large robots, characterized by being small in size, light in weight, having a large load capacity, high motion precision, and a large single-stage transmission ratio. Internationally, HarmonicDrive company almost monopolizes the entire industrial robot harmonic reducer field, currently holding a global market share of up to 80%. In the domestic harmonic reducer industry development, Green has developed the fastest and has begun supplying some domestic and even foreign robot manufacturers for trial use, with a forecast of breaking through 30,000 units this year, capturing over 50% of the domestic harmonic reducer market share.

Harmonic Reducer Structure

RV reducers are suitable for heavy-load robots. They are generally applied to the legs, waist, and elbow joints of heavy-load robots. Compared to harmonic reducers, RV reducers have higher fatigue strength, rigidity, and lifespan, and do not significantly lose motion precision over time like harmonic drives. Their disadvantage is that they are heavier and larger in size. The key to RV reducers lies in the processing and assembly technology.

Japan’s Nabtesco (Teijin) holds a global market share of 60% in the RV reducer market. Domestic manufacturers Nantong Zhenkang and Hengfeng Tai have spent 6 to 8 years in development and are currently among the top brands in the domestic RV reducer market. For a detailed comparison of reducer market shares, see the table below.

(2) Servo

The term “servo” originates from the Greek word for “slave.” A “servo mechanism” is a tool that obeys the control signal’s requirements to act. Before the signal arrives, the rotor remains stationary; when the signal arrives, the rotor immediately rotates; when the signal disappears, the rotor can stop instantly.

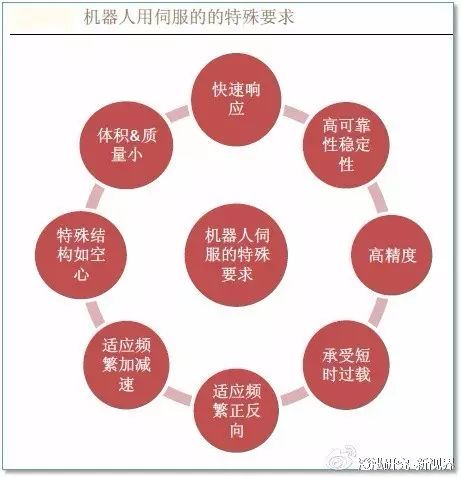

Robotic servo motors require fast bus communication speed between the controller and the servo; high precision of the servo; and certain processing requirements for the base materials. Especially for the robot’s end effector (gripper), a motor with the smallest possible size and weight is required, particularly when fast response is needed. The servo motor must have high reliability and stability, able to withstand harsh operating conditions, frequently performing forward and reverse operations and acceleration/deceleration, and can endure overloads in a short time.

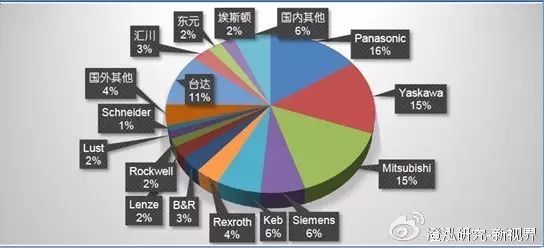

The three main components of a servo are: motor, driver, and encoder. Currently, there have been breakthroughs in the manufacturing of motors and drivers domestically, while the production level of encoders still lags behind international standards. Servos have the potential to achieve localized replacement of components. For the domestic servo motor market share, see the figure below.

(3) Controller

The robot control system is an important component of the robot, used to control the robot to complete specific work tasks. It is the brain of the robot, centered on algorithms. Its main basic functions are as follows:

Position servo — multi-axis linkage, motion control, speed and acceleration control, dynamic compensation, etc.

Teaching — Teaching refers to the process of instructing the robot on the actions and specific tasks it should perform when replacing humans. This process is called teaching the robot or programming the robot.

Various interfaces — such as connections with peripheral devices (input and output interfaces, communication interfaces, network interfaces, synchronization interfaces). Human-machine interfaces (teaching boxes, control panels, displays). Sensor interfaces (position detection, vision, touch, force sensing, etc.).

Coordinate settings — setting up the coordinate system for the robot’s movement.

Storage — storing work sequences, motion paths, motion modes, motion speeds, and information related to production processes.

Fault diagnosis and safety protection — monitoring system status during operation, safety protection under fault conditions, and self-diagnosis of faults.

The hardware part of the controller accounts for 10% to 20% of the robot body cost, but the software part is responsible for the brain functions of the robot. It can be said that the hardware components used by foreign robots are similar, and the procurement costs are also similar. However, the precision and speed advantages vary among different brands of robots, fundamentally due to the differences in design and control algorithms of the components. This is the core competitiveness of different brands of robots at the technical level.

Looking at the four major global robot manufacturers, it is evident that the controller is uniformly self-produced. This underscores the importance of the controller.

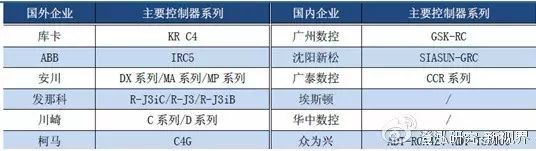

For domestic robot manufacturers, the difficulty in breaking through the core of reducers and servos currently lies in basic industries, such as materials, heat treatment processes, precision machining processes, etc. These are not easily achieved by automation manufacturers alone but require an overall improvement in basic industrial and processing levels. This requires a dual accumulation of time and experience. The current situation of the domestic controller market is illustrated in the figure below.

【Robot Body】

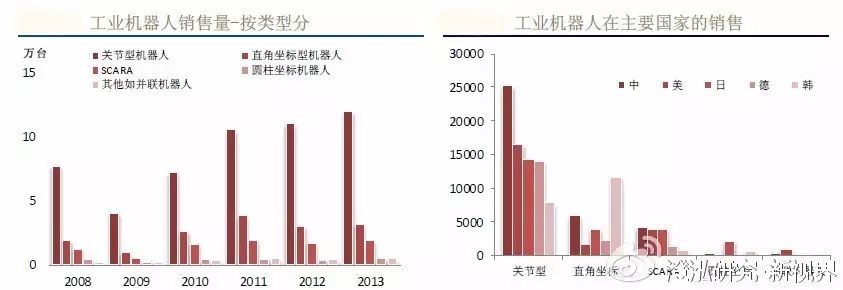

The robot body can be classified by mechanical structure into Cartesian robots, SCARA robots, joint robots, parallel robots, and others. The global industrial robot market mainly consists of joint robots.

Classification of Robot Bodies by Structure

Comparison of Robot Body Sales and Country Sales

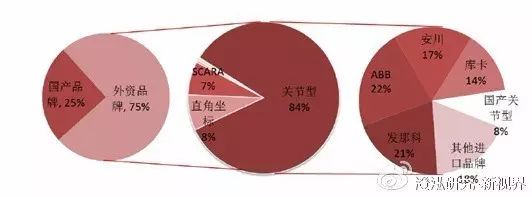

Market Share of Robot Bodies in China

【Robot Integration】

Robot integration refers to the installation of fixtures and other supporting systems on the robot body to complete specific functions. The robot body is a standard product, which can be understood as an arm.

System integration involves equipping this arm with a hand (fixture). Complex system integration may also require the installation of eyes (visual control), touch (force control), etc., to complete corresponding actions and functions. It may even provide workstations or supporting production lines.

In 2013, the global total transaction for robots and related software and systems amounted to $29 billion, with China’s transaction volume being $9.5 billion, making it the largest robot market in the world. It is expected that by 2020, China’s robot system integration market will reach 200 billion yuan.

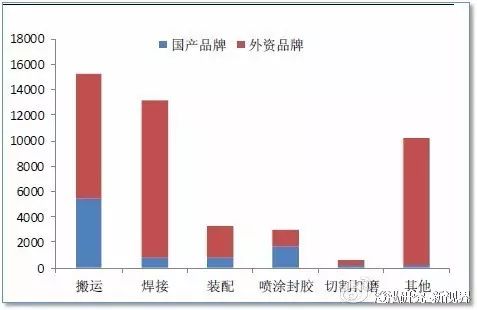

Domestic brands have penetrated fields such as handling and spraying, where precision requirements are not high. The penetration rate in welding applications has been slow due to the strong position of foreign brands. In assembly, polishing, and other areas where high process requirements exist, penetration has also been slow. For a detailed comparison of domestic and foreign brand sales, see the figure below.

Comparing the sales of domestic and foreign robots in different applications, it can be seen that domestic robots have a high market share in handling applications. This is mainly because domestic robots are primarily mid- to low-end, and mid- to low-end robots are mainly used in handling applications.

The ultimate end-users of robots can be categorized by industry: automotive industry, general industry. Within general industry, it can be further divided into food and beverage, petrochemical, metal processing, pharmaceuticals, 3C, plastics, white goods, etc. According to IFR statistics, automotive and parts account for the highest proportion of robot sales. This is followed by electronics, metals, plastics, and petrochemicals.

【Current Status of the Chinese Robot Industry】

(1) China is the largest and fastest-growing industrial robot market in the world

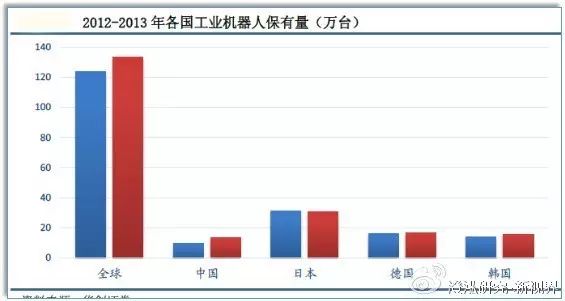

China is the largest industrial robot market in the world. In terms of sales, in 2013, the sales in the Chinese market reached 37,000 units of industrial robots, making it the largest robot market globally. In 2014, global industrial robot sales grew by 27%, while China’s industrial robot sales were about 56,000 units, with a growth rate reaching 54%. It is expected that by 2017, the sales volume of industrial robots in China will reach 100,000 units. In terms of ownership, by the end of 2014, the ownership of industrial robots in China was close to 200,000 units. According to IFR projections, it will successively surpass Germany, South Korea, the United States, and Japan, reaching over 400,000 units by 2017.

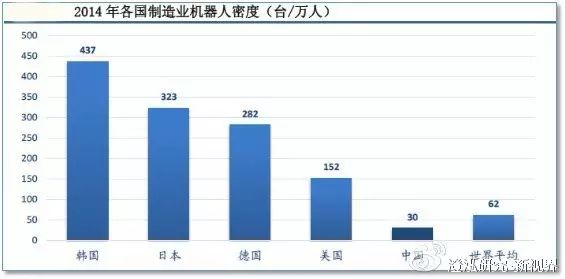

(2) There is enormous potential for increasing robot density

Robot density refers to the number of robots per 10,000 workers. China’s robot density is only 30, far below the world average of 62, while the highest in the world, South Korea, reaches 437. Wang Weiming, deputy director of the Industrial Equipment Department of the Ministry of Industry and Information Technology, has revealed that the national industrial planning aims for China to have 3 to 5 internationally competitive enterprises, 8 to 10 industrial supporting clusters, and a robot density exceeding 100 by 2020. Moving from 30 to 100 corresponds to a market scale growth of over 3 times.

(3) Domestic robots are expected to benefit from the explosive growth of the 3C industry

3C industry robots are expected to experience explosive growth. China is the world’s largest 3C manufacturing base, accounting for 70% of the global 3C production capacity. For instance, in the case of mobile phones, from 2000 to 2013, the production of mobile phones in China increased by 66 times, with the rapidly growing mobile phone industry continuously driving the automation upgrade of production equipment.

The domestic 3C industry is still labor-intensive, with a robot density of only 11 units, while Japan and South Korea have already surpassed 1200 units. For China to reach this level of robot density, industry demand may exceed one million units. This indicates that in the future, the use of robots in China’s 3C industry may experience explosive growth, surpassing the automotive industry to become the largest market.

Robots are widely used in the 3C industry. Various stages of the production line can utilize robots, such as coordinating with CNC machining centers for loading and unloading shell components, spraying the shells of mobile phones, computers, and transporting glass substrates and displays, as well as assembling various precision components. Unlike the automotive industry that mainly uses large six-axis serial robots, the robots used in the 3C industry are generally smaller, more diverse, with Cartesian robots used for gluing, coating, and soldering, small six-axis robots for sorting, assembling, and inspecting, and medium-sized robots equipped with force and vision for polishing and precision finishing.

(4) The automotive industry landscape is stable, making it difficult for domestic robots to enter

The four major processes in the automotive industry—stamping, welding, assembly, and painting—mainly use large-load six-axis industrial robots, which have high performance requirements for the robot body. Foreign automotive manufacturers generally establish long-term cooperative relationships with selected international robot brands to maintain stability and unique technical standards. Domestic automotive manufacturers also primarily choose foreign robot brands. The performance of domestic six-axis robots is currently insufficient to meet the high standards of the automotive industry. In terms of system integration, the entry barriers for automotive manufacturers are high, with domestic companies mainly concentrated in parts manufacturing or subcontracting projects, making it difficult to enter complete vehicle projects in the short term.

(Source: Investment Reference)