Recently, the WeChat update has disrupted the publication schedule, causing many readers to miss article updates. Please set “Fengkou Research” as a star ⭐ so we can continue to move forward together and meet every day!

In the field of AIoT (Artificial Intelligence of Things) chips, Allwinner Technology and Rockchip are two prominent companies. With the financial reports for 2024 and the first quarter of 2025 being released, let us delve into a comparative analysis of their development trends.

1.Differences in Main Business

Rockchip focuses on the platformization of AIoT SoC chip layouts, with products like the RK3588 involved in smart cockpits, RK356X used for machine vision, and the RV11 series, covering various fields such as automotive electronics, machine vision, and industrial robotics.

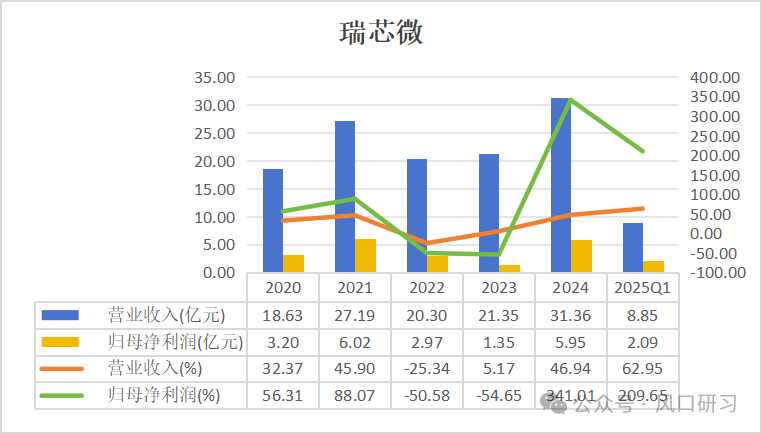

In 2024, revenue reached 3.136 billion yuan, a year-on-year increase of 46.94%, with a net profit of 595 million yuan, a staggering year-on-year increase of 341.01%, and a gross profit margin rising to 40.95%. Its product structure is relatively high-end, which also keeps the gross profit margin at a high level.

Allwinner Technology, on the other hand, centers around intelligent application processors, focusing on AR-HUD chips in automotive electronics, the MR series for robotic vacuum cleaners, and smart projection scenarios.

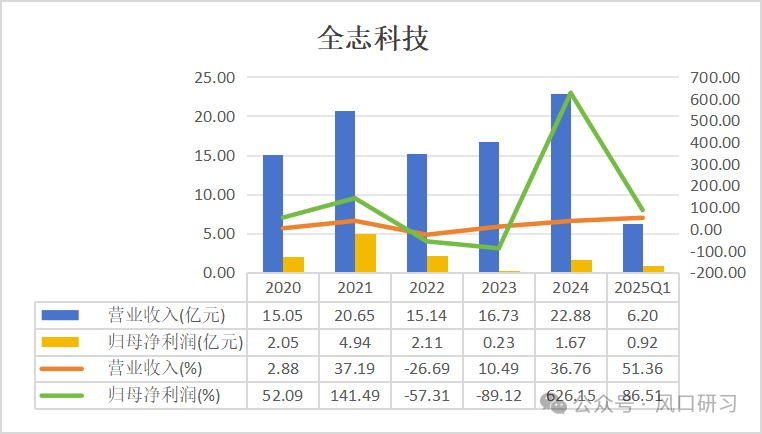

In 2024, revenue reached 2.288 billion yuan, a year-on-year increase of 36.76%, with a net profit of 167 million yuan, a year-on-year surge of 626.15%, although the gross profit margin is about 32.68%.

It can be seen that Allwinner Technology is experiencing rapid growth in emerging sectors like consumer electronics, such as robotic vacuum cleaners, but the overall business base is relatively low.

2.Growth Capability

Rockchip has seen a continuous increase in gross profit margin for five consecutive quarters, with revenue in the first quarter of 2025 reaching 885 million yuan, a year-on-year increase of 62.95%, and a net profit of 209 million yuan, a year-on-year surge of 209.65%. Moreover, new products like RK3576 and RK2118 are well-stocked, indicating strong long-term growth certainty and a steady growth pace.

In contrast, Allwinner Technology achieved a record high single-quarter revenue of 653 million yuan in the second quarter of 2024, with a net profit of 91.55 million yuan in the first quarter of 2025, a year-on-year increase of 86.51%. However, its fourth-quarter net profit fluctuated significantly, ranging from -93.71% to +22.19%, indicating that Allwinner Technology’s growth is heavily reliant on emerging sectors, leading to high volatility in the short term.

3.Profitability

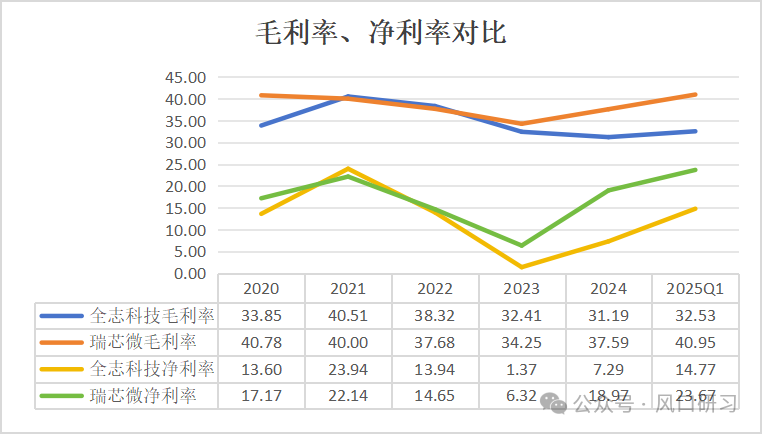

In 2024, Rockchip’s gross profit margin was 37.59%, an increase of 3.34 percentage points year-on-year, reaching 40.95% in the first quarter of 2025. The net profit margin for the entire year of 2024 was 19.0%, mainly benefiting from the increasing proportion of high-end products (such as RK3588), showcasing excellent profitability.

On the Allwinner Technology side, the gross profit margin in 2024 was about 32.68%, with a net profit margin of 7.3%. Although the R&D expense ratio was 23.28%, a year-on-year decrease of 5.86 percentage points, showing some scale effects, there is still a significant gap in profitability compared to Rockchip. Future product upgrades are needed to optimize the gross profit margin.

4.Operational Capability

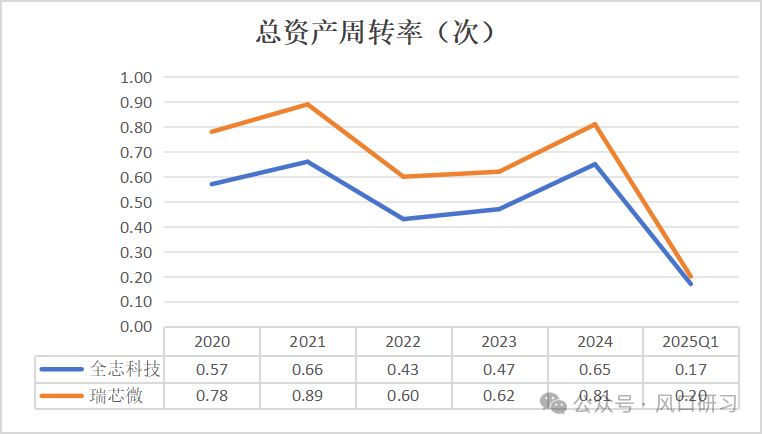

In terms of asset efficiency,Rockchip’s total asset turnover rate is 0.807 times, higher than Allwinner Technology’s 0.6465 times, indicating better asset utilization efficiency.

In terms of cash flow quality,Rockchip’s net cash flow from operating activities is 1.379 billion yuan, seven times that of Allwinner Technology, and the cash flow/debt ratio (1.916) is significantly higher than that of Allwinner Technology (0.3556), indicating superior earnings quality.

5.Debt Repayment Pressure

In 2024, Rockchip’s asset-liability ratio was 24.7%, with ample operating cash flow, indicating almost no short-term debt repayment pressure.

Allwinner Technology’s asset-liability ratio is 31.5%, with significant capital expenditure on R&D, but there is no major debt risk. Overall, Rockchip has a more stable financial structure.

Conclusion

Currently, the demand in the AIoT market is continuously expanding, and both Allwinner Technology and Rockchip are actively seizing opportunities, although their development paths have shown a clear divergence.

In summary, Rockchip, with its platformization advantage in AIoT flagship chips, holds the upper hand in profitability, operational efficiency, and long-term growth certainty; while Allwinner Technology seeks breakthroughs through high R&D investment and layouts in emerging fields (such as robotics and industrial control), but must address the issue of profitability volatility.

Disclaimer: The above content is for reference only and should not be considered as investment advice.

Recent Hot Articles:

Yili Co., Ltd., is it still going strong?Proya, the “dark horse” and “windfall” in the beauty trackGree Electric Appliances, valuation reshaping