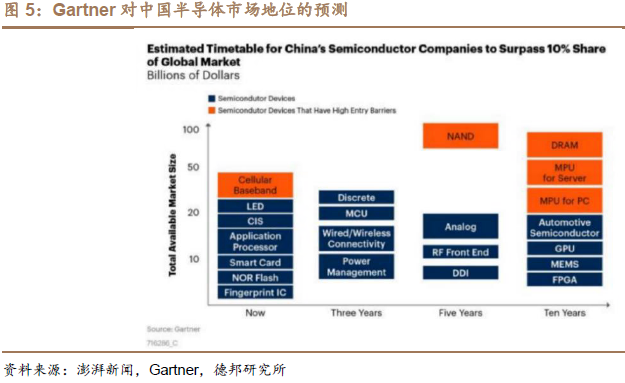

CIS: The Soul and Value Core of CMOS Camera Modules, Domestic Substitution Enters Deep Waters. Functionally, CIS is currently the most mainstream image sensor that can capture photons and convert them into electrical signals, serving as the core component for imaging in CMOS camera modules; in terms of value, CIS accounts for approximately 52% of the value of CMOS camera modules, making it the core of their value. The degree of localization of CIS in the semiconductor field is relatively high. According to Gartner’s predictions, CIS is among the first categories where domestic manufacturers have a global market share exceeding 10%, which has brought the development of domestic CIS into deep waters, with high-end models urgently needing breakthroughs.

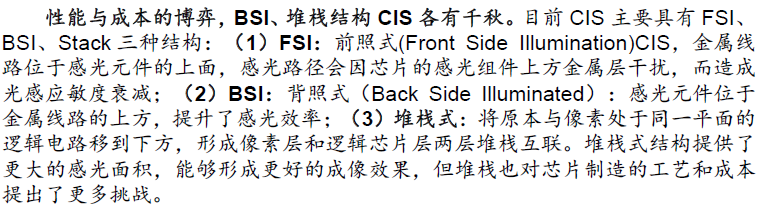

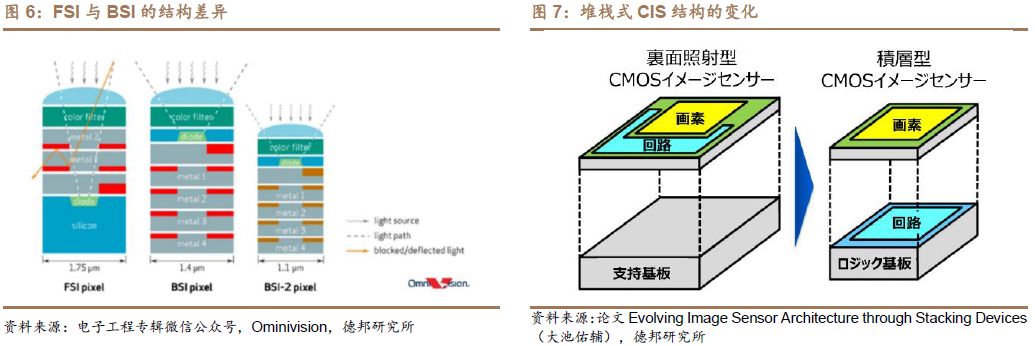

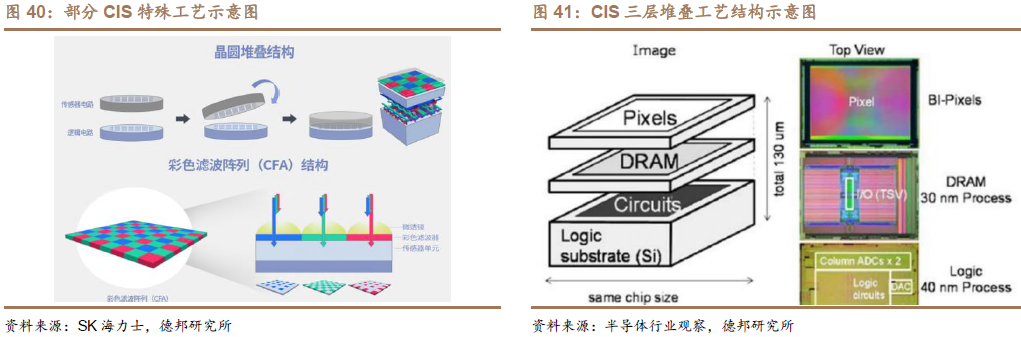

Currently, technological breakthroughs in CIS are mainly focused on the pursuit of extreme performance within a certain price range. How to achieve a larger optical size (determined by pixel size and pixel count) within limited space and budget to realize high-quality light-sensitive performance has become the focal point of technological breakthroughs. This has led to the emergence of more complex CIS products such as Stack.

To obtain the full PDF report, click on the blue text “Smart Car Expert” above and reply with “CIS2 “ to receive it.

Application Trends: Emerging Fields like Automotive Benefit

1.1. Automotive: The Intelligent Eye, Accompanying the Iteration of Autonomous Driving with Rising Volume and Price

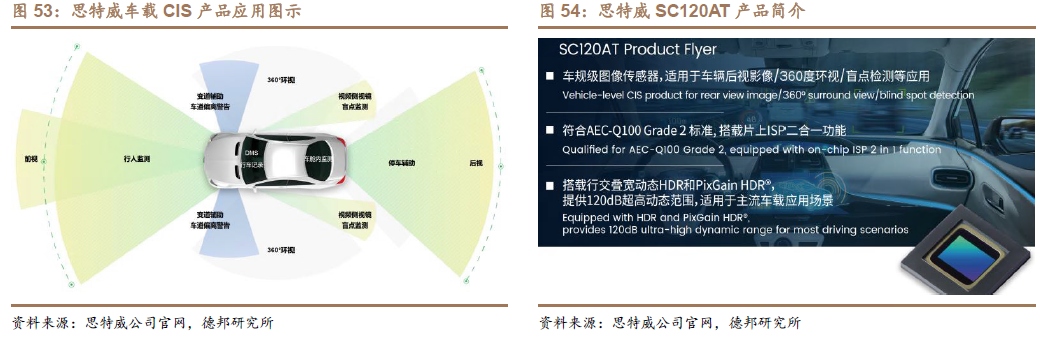

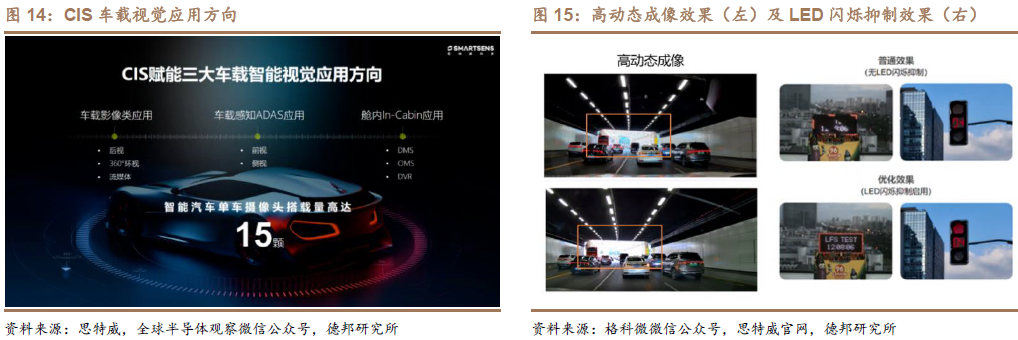

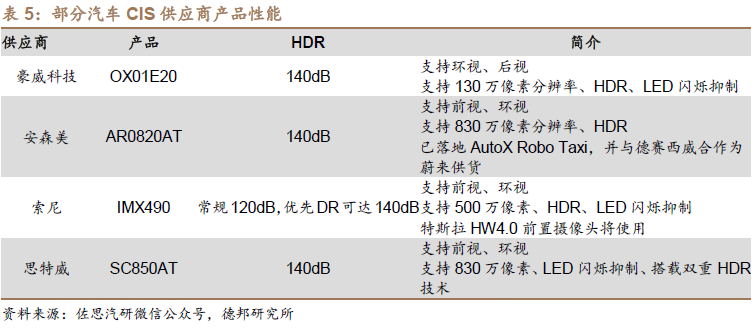

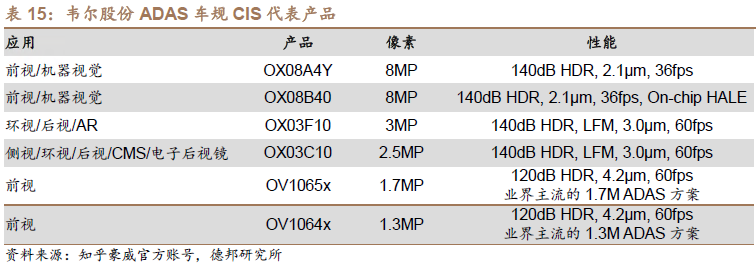

Automotive CIS: The camera is the intelligent eye of the car, and automotive-grade CIS has higher requirements for light sensitivity, high HDR, and LED flicker suppression.CIS has wide applications in front view, rear view, testing, surround view, and cabin monitoring scenarios. Currently, mainstream automotive CIS products mainly have the following performance requirements: (1) Automotive certification: Automotive CIS requires higher stability and lifespan than consumer products and must pass stringent automotive-grade certifications (such as AEC-Q100, ISO26262). (2) High light sensitivity: Automotive CIS must have stronger light sensitivity to ensure that in-car cameras can operate normally at night and in tunnels. (3) High dynamic range (HDR): According to 52 Smart Driving, the dynamic range of automotive CIS is generally required to be between 120~140dB, ensuring that in-car cameras can adapt to drastic changes in light and capture high-quality images. The dynamic range of smartphone CIS is generally between 60~70dB. (4) LED flicker suppression (LFM): Automotive CIS manufacturers are required to use suppression technology to avoid misjudgments caused by the asynchronous frequency of CIS and LED signal lights.

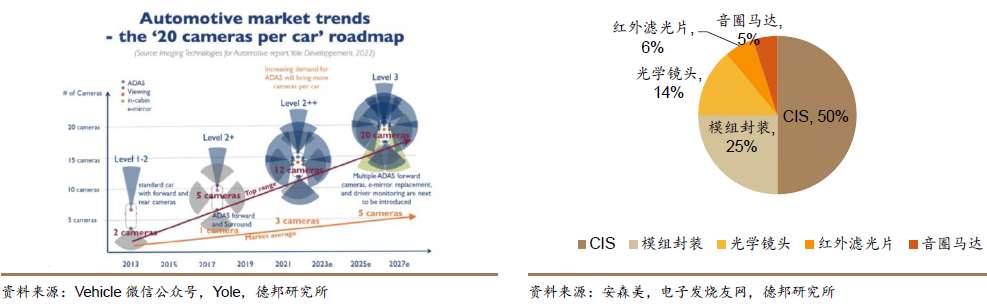

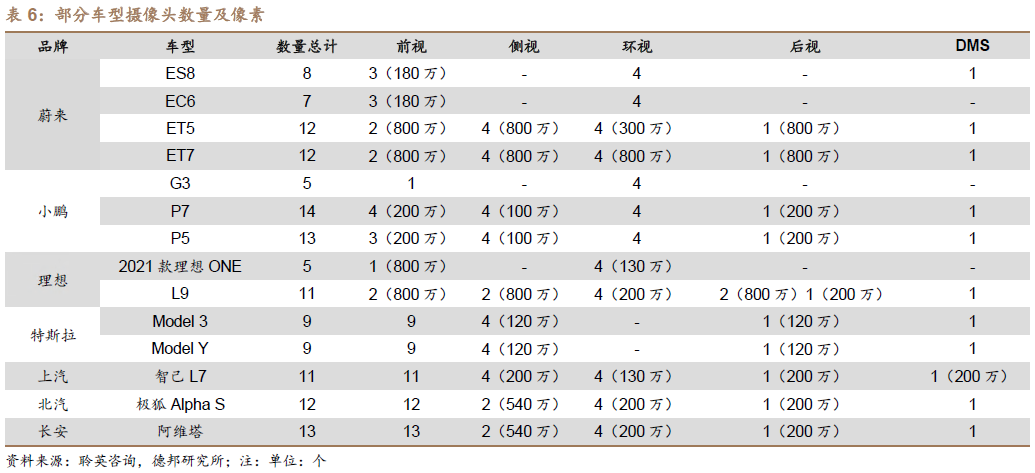

ADAS, Urban NOA, and Other Intelligent Driving Functions Penetrate, Automotive CIS Volume and Price Rise Together. (1) Volume increase: The number of CIS used closely follows the increase in the number of automotive cameras. Automotive cameras are the intelligent eyes of the car, and the continuous iteration of ADAS, NOA, and high-level autonomous driving drives the number of cameras to increase. According to Yole, by 2027, the maximum number of cameras per vehicle is expected to reach 20. (2) Price increase: CIS is the core of the value of automotive camera modules. According to Onsemi, CIS accounts for 50% of the total cost of automotive camera modules. The increasing demand for autonomous driving requires the use of higher resolution CIS, and the resolution is closely related to the detection distance of the camera. For example, an 8-megapixel CIS can detect distances up to three times that of a 1.2-megapixel camera. Currently, the NIO ET 7 is equipped with 11 cameras of 8 megapixels, while the Ideal L9 is equipped with 6 cameras of 8 megapixels.

1.2. Mobile Phones: Benefiting from the Increase in Camera Quantity and Specifications, Cost-Effectiveness is Key Under Cost Pressure

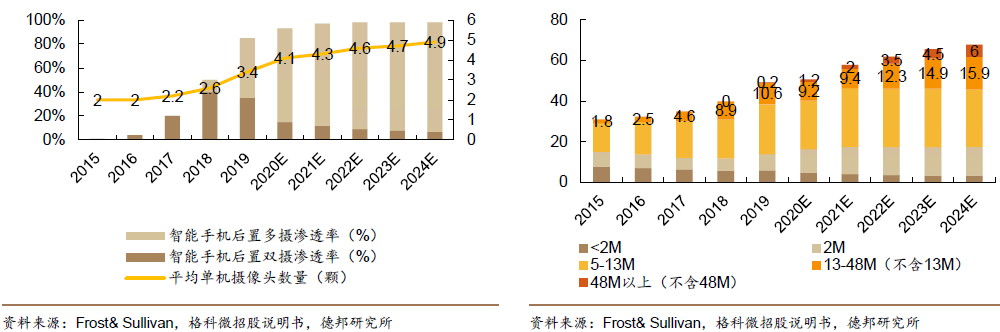

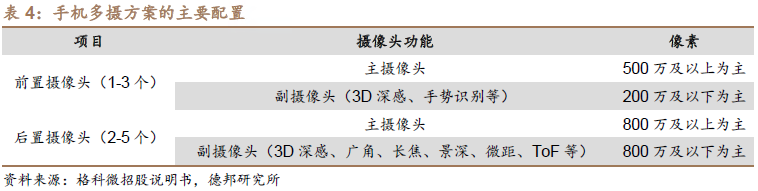

Mobile Phone CIS: The penetration of multi-camera solutions boosts the usage of mobile phone CIS, with high pixel and multi-function main camera demands for high-end, high-performance CIS. (1) Usage increase – multi-camera: According to Frost & Sullivan, by 2024, the penetration rate of multi-camera in mobile phones is expected to rise to 91%, with an average of 4.9 cameras per phone. As the smartphone market enters a phase of stock competition, the increase in the number of smartphone cameras will directly drive the demand for CMOS image sensors. (2) High-value volume – high-pixel main camera: Users’ pursuit of photographic performance drives the improvement of CIS technology levels and value volume. Additionally, how to balance the increase in the light-sensitive area of CIS with the size of the camera module, as well as meet the diverse functional requirements of the camera, poses challenges for the performance iteration and development of CIS. It is worth noting that the light-sensitive area is influenced by both pixel size and quantity, and the increase in pixel quantity is not limitless; performance and cost remain important considerations.

Facing declining shipment volumes, mobile phone manufacturers are seeking more cost-effective CIS products, posing higher product cost control challenges to upstream CIS manufacturers. It is noteworthy that the prices of high-pixel CIS products are still significantly higher than those of low-pixel CIS products, thus low-pixel CIS manufacturers seeking breakthroughs in high-end products are also expected to bring growth opportunities for these suppliers.

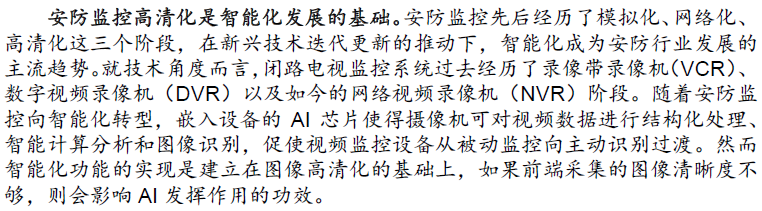

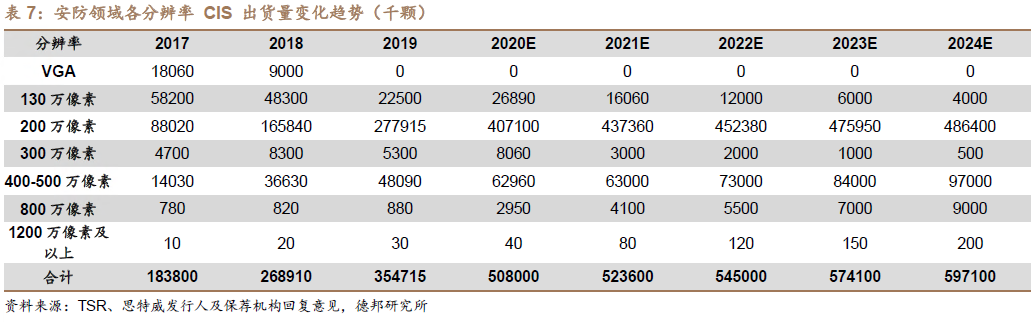

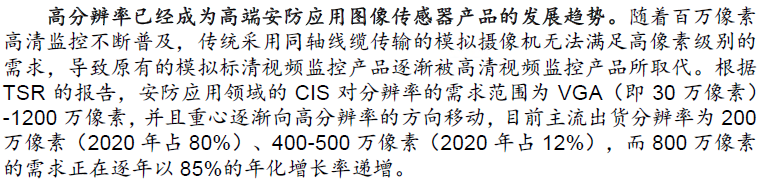

1.3. Security: CIS Performance as the Foundation for Innovation, Transitioning from High Definition to Intelligence

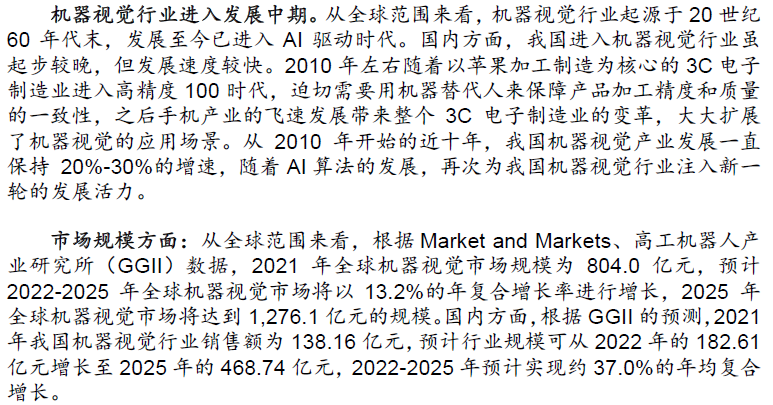

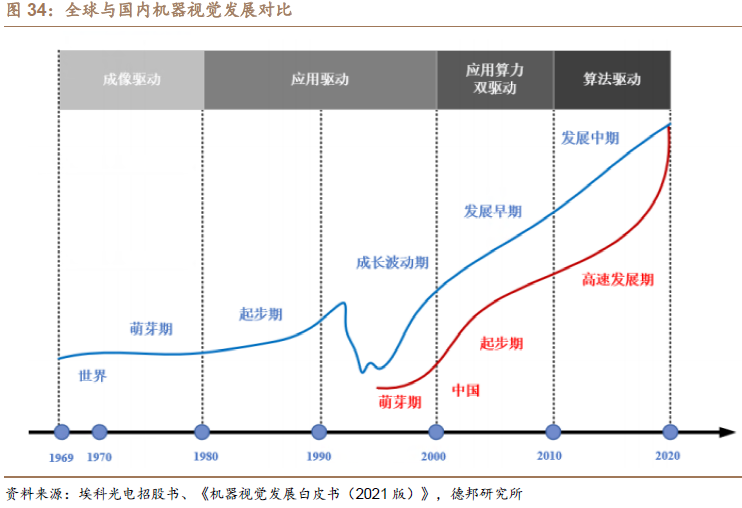

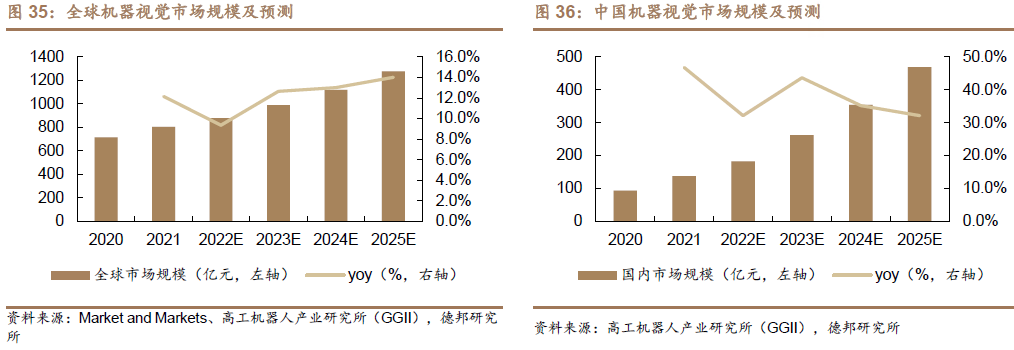

1.4. Machine Vision: Rapid Development of Emerging Machine Vision, Global Shutter CIS Plays an Important Role

CIS: The Soul and Value Core of Camera Modules, Domestic Substitution Enters Deep Waters

2.1. CIS: The Soul and Value Core of CMOS Camera Modules

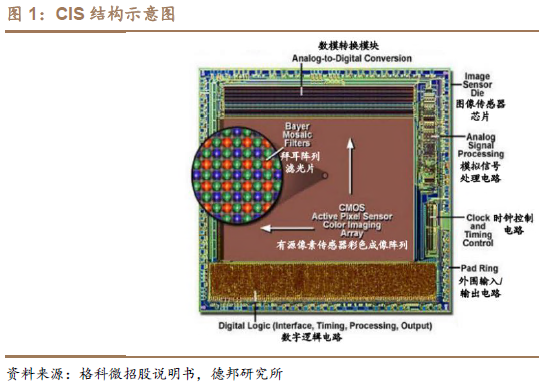

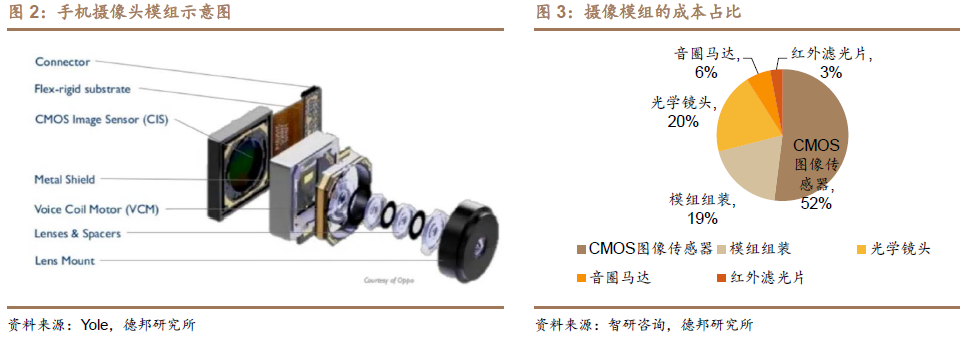

CIS: The soul of CMOS camera modules that realize functionality, converting light into electricity. The image sensor, or Image Sensor, is the core component for imaging in camera modules. CMOS (Complementary Metal-Oxide-Semiconductor) image sensors (CIS) can convert photons into electrons, transforming image signals into digital signals. CIS has a high level of integration, with its structure mainly including a photosensitive area array (pixel array), timing control, analog signal processing, and analog-to-digital conversion modules. The light-capturing unit of CIS can pick up various wavelengths of photons when the lens is focused and convert them into electrons. The CMOS unit is surrounded by transistors, which amplify the electronic charge and transmit the electronic signal to the analog-to-digital converter, which reads the electrons and converts them into pixels of various colors.

CIS: Also the Core of the Value of CMOS Camera Modules, Accounting for Over 50% of the Total BOM Cost. The hardware of camera modules mainly consists of CIS, optical lenses, voice coil motors, and infrared filters, and the production of camera modules also requires assembly. According to Zhiyan Consulting, CIS accounts for 52% of the total cost of camera modules, occupying an absolute core value position, while optical lenses, module assembly, voice coil motors, and infrared filters account for 20%, 19%, 6%, and 3% of the camera module cost, respectively.

2.2. Application Fields: Rooted in the Mobile Phone Battlefield, Penetrating Multiple Fields

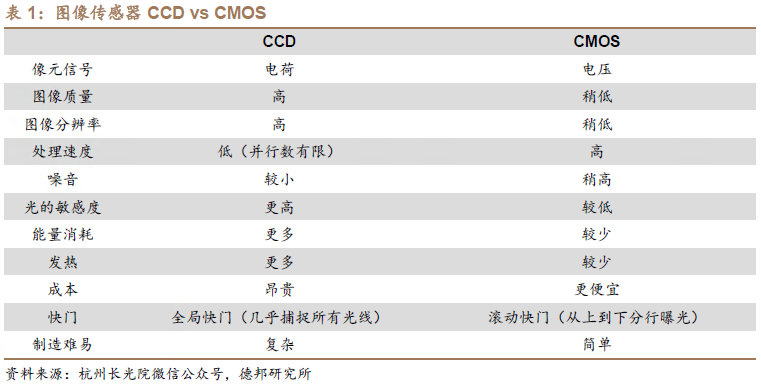

CIS vs CCD: CIS is Cost-Effective and the Most Mainstream Image Sensor. Image sensors mainly include CCD and CMOS. Although CMOS is slightly inferior to CCD in image quality and resolution, its advantages in processing speed and cost have made it gradually the most mainstream image sensor in the market. According to Frost & Sullivan, by 2024, the market share of CIS is expected to rise to 89.3%. Despite the past lower image quality and resolution of CMOS image sensors compared to CCD, rapid improvements have brought it closer to CCD’s technical level.

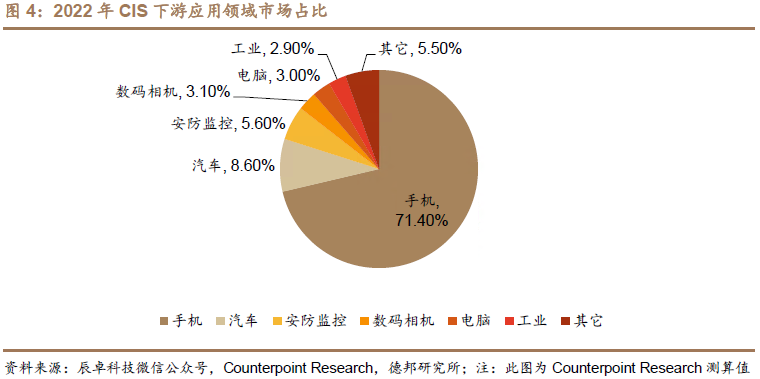

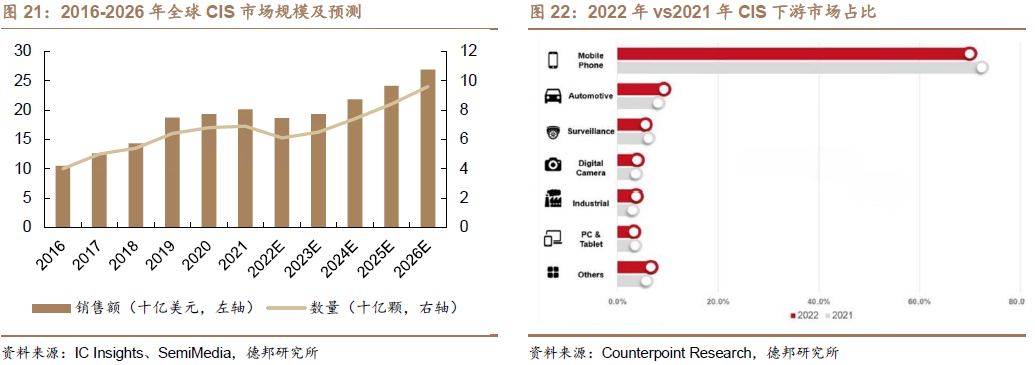

Mobile Phones as the Traditional Battlefield for CIS, Emerging Fields like Automotive Blooming. Currently, mobile phones are the most widely used downstream application field for CIS. According to Counterpoint Research’s TAM market space estimation, in 2022, mobile phones accounted for approximately 71.40% of the downstream field of CIS. Additionally, automotive and security monitoring fields accounted for approximately 8.60% and 5.60% of the downstream field of CIS, respectively. Different downstream application fields also pose different requirements for CIS: due to consumer market demand for high-definition cameras in mobile phones, smartphone pixels can reach up to 100M, with lower requirements for light sensitivity and frame rate; while security, automotive, and machine vision fields require higher light sensitivity and dynamic range due to the need to work in dark environments or when the subject is moving at high speeds.

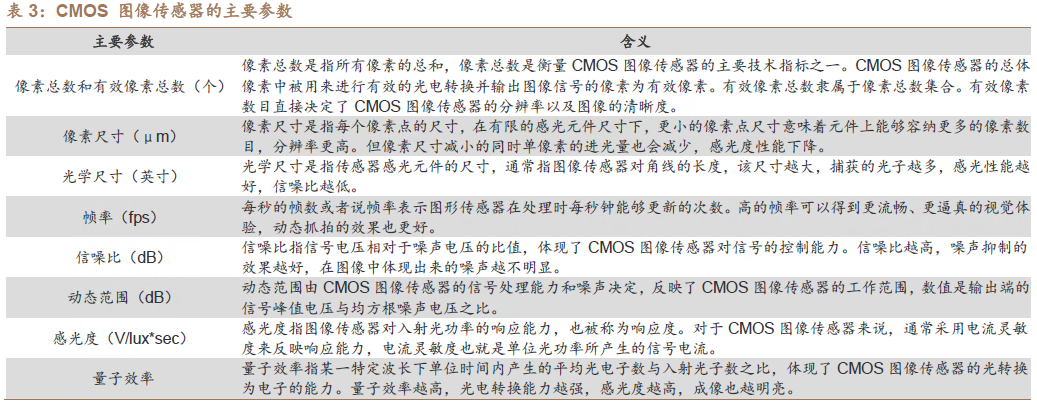

2.3. Technical Route: Optical Size Determines Imaging Effect, Performance and Cost Trade-off

CIS Market: Encountering a Phase of Cooling in 2022, Emerging Automotive Downstream Grows Against the Trend

3.1 Automotive: Benefiting from Autonomous Driving Visual Perception, Onsemi and OmniVision Compete in the Front-Mount Market

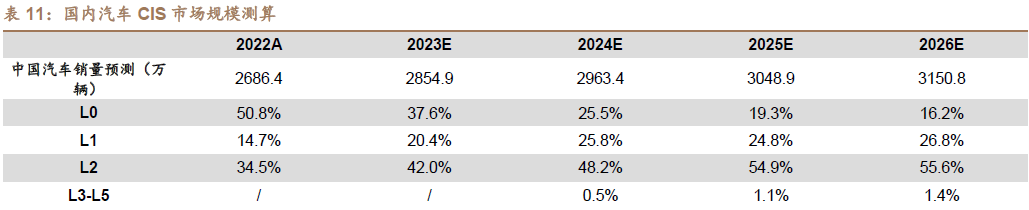

We predict that by 2026, the domestic automotive CIS market size is expected to reach $1.32 billion. In terms of domestic automotive sales, according to Yiou Think Tank’s predictions, by 2025, domestic automotive sales are expected to reach 30.489 million vehicles. In terms of ADAS penetration rates, according to iCV Tank’s predictions, by 2026, the penetration rates for L0, L1, L2, and L3 (and above) are expected to be 16.2%, 26.8%, 55.6%, and 1.4%, respectively. In terms of camera configuration, based on information collected by Lingying Consulting, L0 generally uses one front-facing camera, L1 uses one front-facing + one side-facing + one surround view scheme, L2 uses two front-facing + one rear-facing + two side-facing + two surround view schemes. Since L3 level autonomous driving has not yet been officially opened in China, we assume that L3 and above will use a scheme of three front-facing + two rear-facing + three side-facing + two surround view cameras. In summary, we predict that by 2026, the domestic automotive CIS market size is expected to reach $1.32 billion.

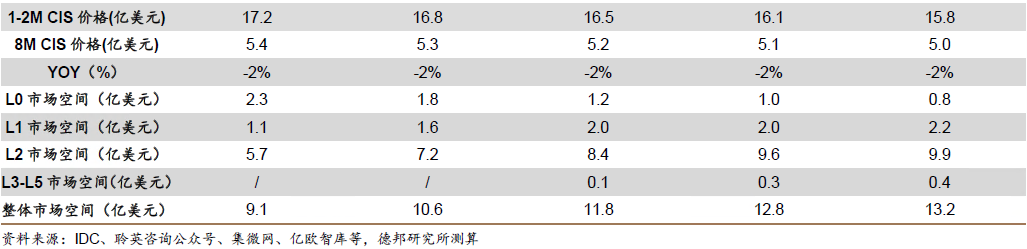

The Front-Mount Market Has Vast Potential, Onsemi and OmniVision Are the Largest Automotive CIS Suppliers Globally. In 2022, the global automotive CIS market continued to grow, with the front-mount market size reaching $2.174 billion, an increase of 8.21% compared to 2021; the rear-mount market size was $0.421 billion, a decrease of 2.55% compared to 2021. With the iteration and penetration of autonomous driving functions, the front-mount market will become the main driving force for the growth of automotive CIS. According to ICV Tank’s predictions, by 2027, the automotive front-mount CIS market is expected to grow to $5.131 billion. Currently, Onsemi is the largest automotive CIS supplier globally. In 2022, Onsemi held a 44.05% share of the global automotive CIS market, while domestic supplier OmniVision held a 30% share. Additionally, traditional CIS giants like Samsung and Sony have also entered the automotive CIS market.

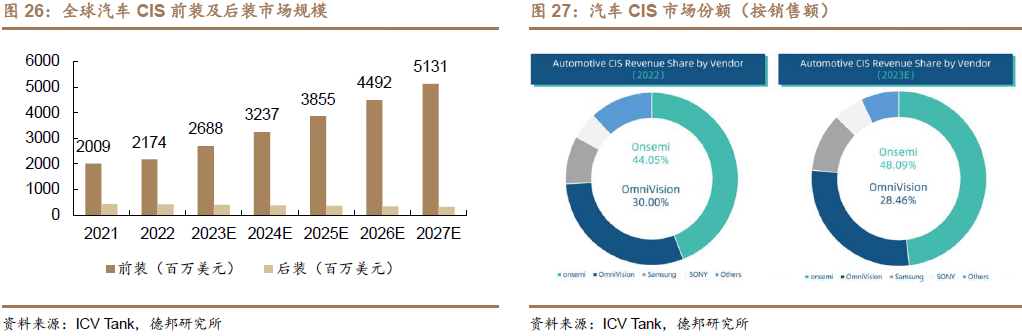

According to IC Insights, the CIS market size is expected to be $18.6 billion in 2022, a decrease of 7.46% compared to the $21 billion market size in 2021. According to Counterpoint Research statistics, in 2022, the largest downstream segment market for CIS, mobile phones, saw a year-on-year decline in its share of the overall CIS market, while the security market also faced phase pressure. In contrast, the automotive sector showed growth in its share of the downstream market. Although the mobile phone market is under short-term pressure, its share in the downstream CIS market remains high, and it continues to be the main battlefield for CIS applications in the short term.

3.2. Samsung and Sony Dominate the Market, Domestic Manufacturers Compete for High-End Models

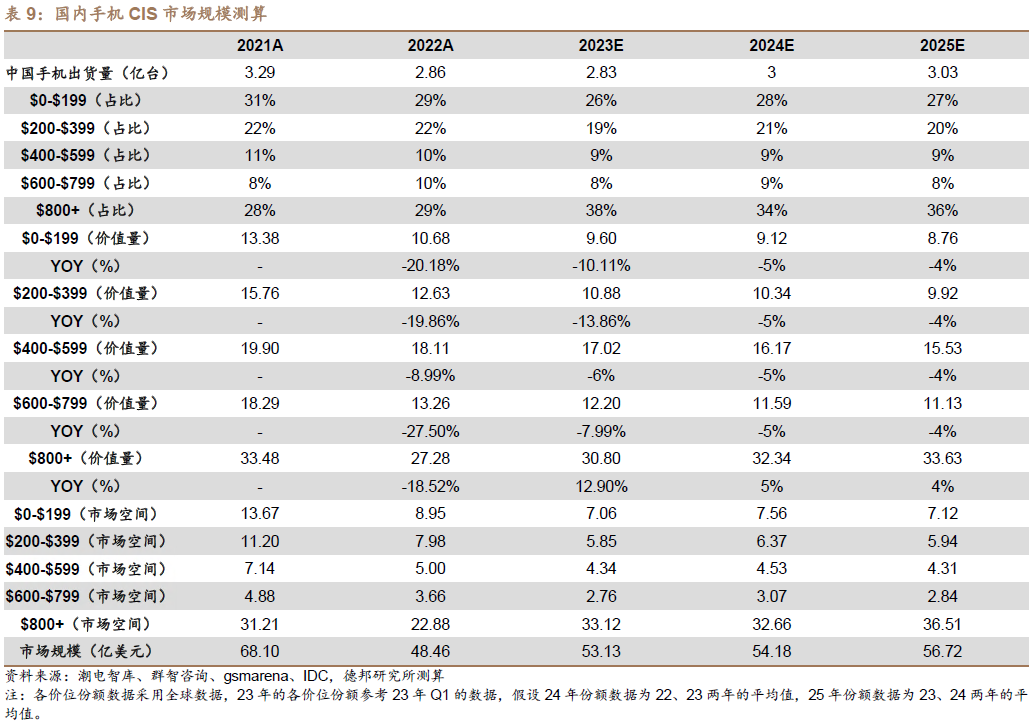

We predict that by 2025, the domestic smartphone CIS market size will be approximately $5.67 billion. In terms of smartphone shipment volume, according to IDC’s predictions, the domestic smartphone shipment volume is expected to be approximately 283 million units in 2023, and is expected to reach approximately 303 million units by 2025. In terms of estimation methods, we refer to the classification method of ChaoDian Think Tank, categorizing smartphones into five price segments based on a $200 range. In terms of smartphone CIS configuration, we refer to Samsung’s smartphone camera configuration standards and the price situation of different pixel smartphone CIS disclosed by Qunzhi Consulting to calculate the value of smartphone CIS at each price level. In summary, we predict that by 2025, the domestic smartphone CIS market size will be approximately $5.67 billion.

3.3. Security: Entering Recovery in the Post-Pandemic Era, Domestic Manufacturers Urgently Need to Move Towards High-End

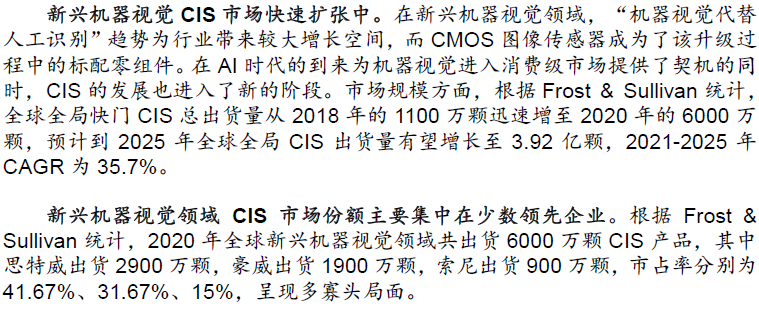

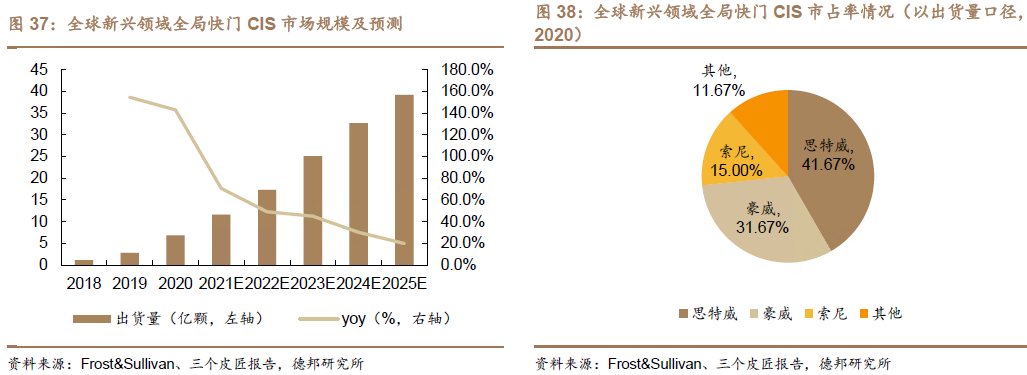

3.4. Machine Vision: AI Opens a New Growth Cycle, SmartSens Global Shutter Leads the Way

04

Industry Overview: Integrated Production and Research, Collaborative Progress in Upstream and Downstream, Promoting Breakthroughs in Domestic Models

4.1. Industry Chain: Design + Manufacturing + Packaging, Three Key Links Combine Production and Research to Promote Domestic Substitution of High-End Models

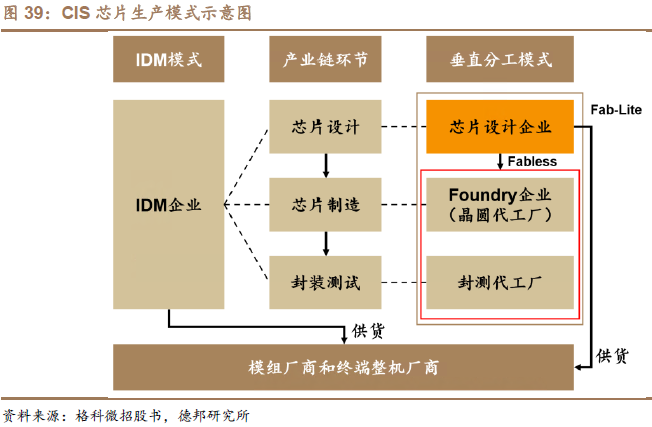

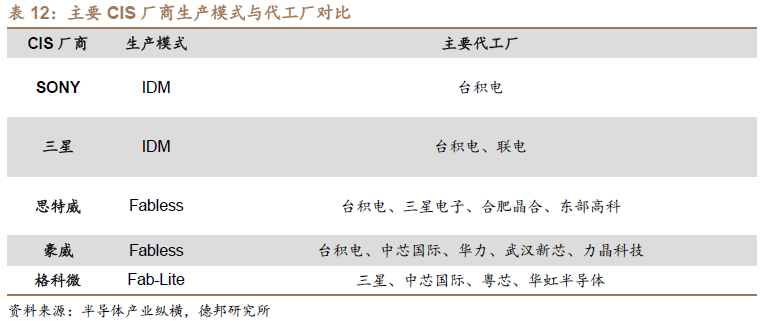

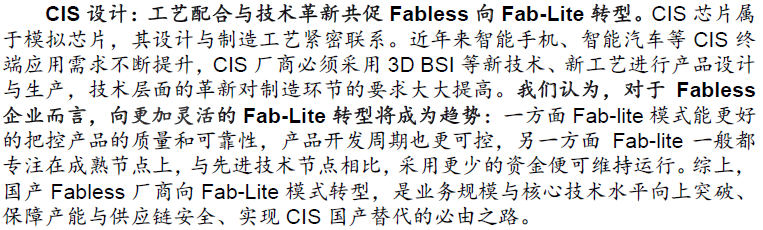

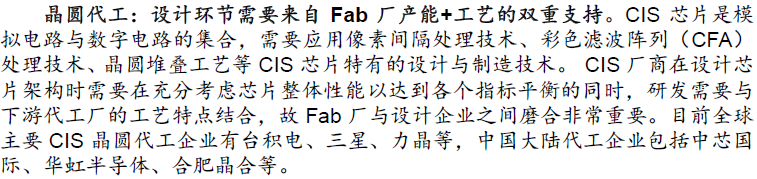

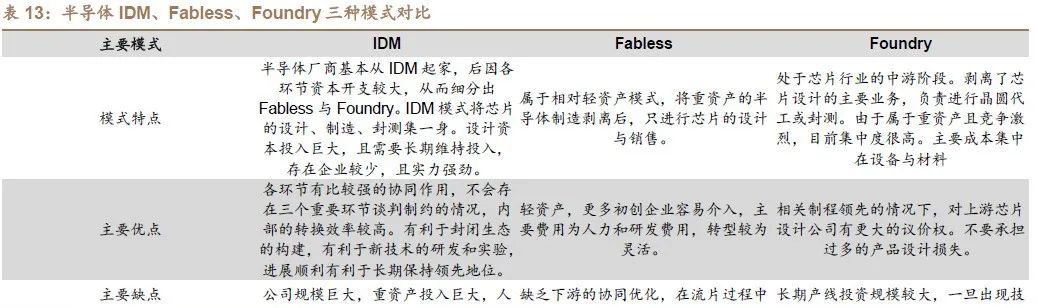

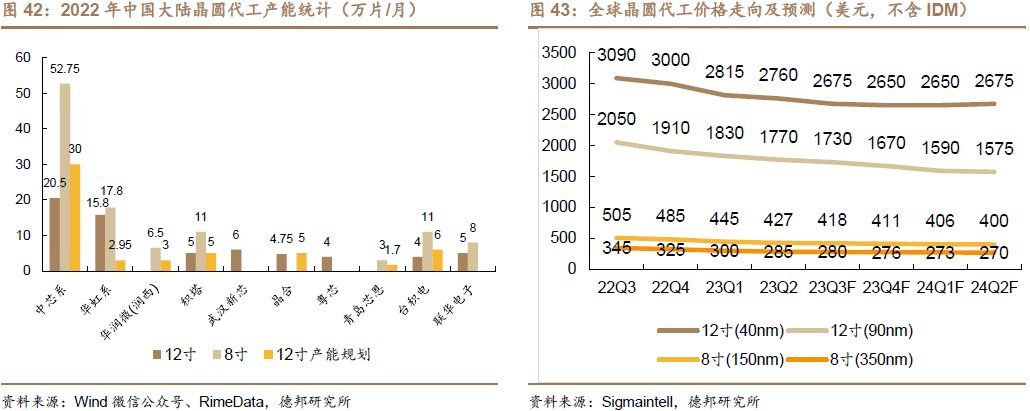

CIS manufacturers generally adopt three mainstream production models: Fabless, IDM, and emerging Fab-Lite. (1) Fabless: A fabless model where all processes except design are outsourced. Representative companies include Will Semiconductor, SmartSens, etc. (2) Fab-Lite: A light fab model where IDM companies outsource part of their manufacturing business while retaining some manufacturing capabilities. This model is between IDM and Fabless, with Geke Micro being a typical representative in the CIS field, having made remarkable progress in transitioning from Fabless to Fab-Lite. (3) IDM: A vertically integrated manufacturing model where the company completes most or all of the wafer manufacturing and packaging processes in-house. Representative companies include SONY, Samsung, Intel, and other international semiconductor leaders.

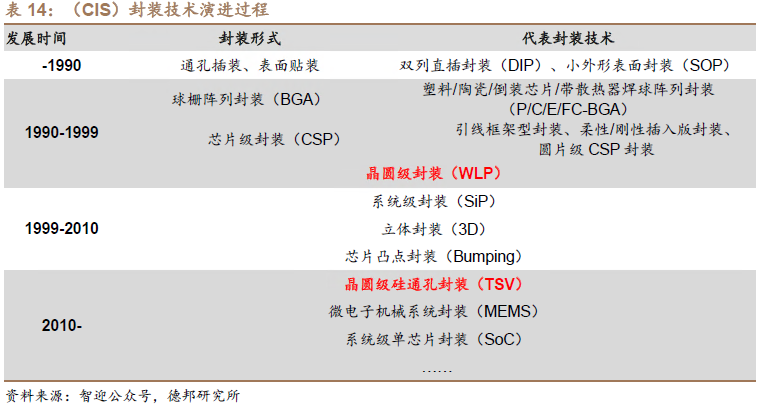

CIS Packaging: Domestic Manufacturers Lead the Industry with Cutting-Edge Packaging Technology, Huge Growth Potential.

The packaging technology of CIS chips has gone through stages of through-silicon vias (TSV), surface mount, wafer-level packaging (WLP), and chip-scale packaging (CSP). Currently, the most advanced packaging technology is wafer-level chip size packaging (WLCSP) technology represented by TSV. As of 2021, only four packaging manufacturers globally, including Jingsai Technology, Huada Semiconductor, Jingfang Technology, and Keyang Optoelectronics, provide WLP packaging solutions for CIS, among which Jingfang Technology and Huada Semiconductor both possess TSV technology and 12-inch (300mm) packaging lines. Currently, global CIS packaging capacity is mainly concentrated in Taiwanese manufacturers such as Jingsai, Shengli, and Tongxin, but as mainland Chinese manufacturers continue to make progress in CIS packaging technology, their scale is expected to grow rapidly.

4.2. Industry Chain

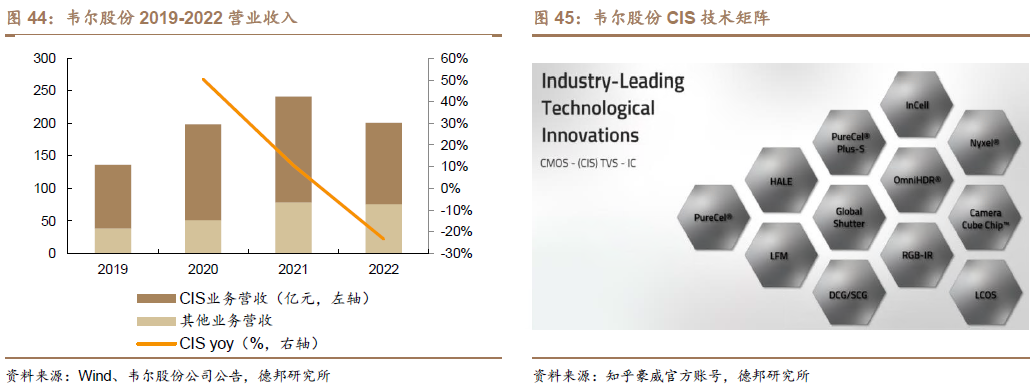

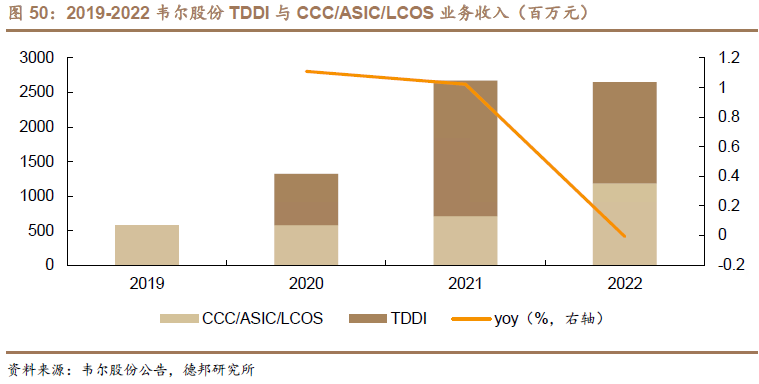

4.2.1. Will Semiconductor: Leading CIS Design Company, Rich Product Layout to Build a Platform Giant

Acquired OmniVision Technology, Strongly Entering the CIS Image Sensor Field, Strong Technical Strength, and Rich Product Coverage. Will Semiconductor was established in 2007 and has been engaged in semiconductor product design and distribution since its inception. In 2019, the company acquired OmniVision Technology, one of the top three CIS suppliers globally, becoming a leading CIS design company both domestically and internationally, forming a core semiconductor product design business system covering image sensors, touch and display, and analog. Among them, the CIS business has accounted for over 60% of the company’s revenue since 2019, making it the company’s main business area. The company’s CIS chip product models cover a wide range from 80,000 to 64 million pixels, with a complete product line layout in consumer electronics, automotive, medical, drones, security monitoring, and AR/VR fields. According to Yole’s estimates, in 2022, Will Semiconductor’s global CIS market share was approximately 11%, ranking third.

Global Smartphone CIS Leader, Deep Cooperation with TSMC, Continuous Growth in Terminal Application Scale. In the smartphone field, Will Semiconductor is one of the first companies in the industry to commercialize BSI (Backside Illumination) technology, possessing core technologies such as Pure Cel (Plus) and RGB-Ir that meet the needs of the smartphone CIS market. According to Counterpoint Research statistics, the company held nearly 7% of the global smartphone CIS market share in 2022, ranking third in the industry. The company has deep cooperation with smartphone manufacturers such as Xiaomi, Oppo, and Honor, with continuous volume growth across various specifications, competing with Sony for market share in all price segments.

With the mass production and delivery of the company’s new image sensors with over 50 million pixels in the third quarter of 2023, the company expects steady growth in product revenue from the smartphone market. At the same time, the company has close cooperation with TSMC, with deep integration of processes and technologies, achieving revolutionary breakthroughs in advanced stacking technology in 2023, with related products expected to enter the flagship smartphone market by the end of this year or early next year. The company will continue to lead the market in technology, product matrix, customers, and supply chain, further consolidating its leading position in smartphone CIS.

Leading Automotive CIS Company, Empowering Automotive Intelligence with Advanced Automotive Technology. The company began self-developing automotive-grade CIS products as early as 2005 and is the only domestic manufacturer capable of mass-producing products that pass both ASIL and AEC-Q100 dual certifications. It has now formed a complete CIS product portfolio and solutions covering VGA to 8 million pixels, suitable for various automotive applications. According to ICV Tank statistics, in 2021, Will Semiconductor held a 29% share of the global automotive CIS market, ranking second. The company’s upstream wafer foundry closely cooperates with TSMC, while its downstream collaborates with top domestic packaging companies like Jingfang Technology, with end customers including mainstream automakers such as Mercedes-Benz, BMW, Audi, and General Motors, forming significant advantages in industrial chain collaboration and high-quality customer base.

Actively Reserving New Products in Multiple Fields, Building a New Growth Curve for the Company. The company aims to grow into a platform semiconductor design enterprise, actively expanding into business areas beyond CIS, with many new products starting to gain traction, which may become a new growth driver for the company’s revenue in the coming years.

4.2.2. SmartSens: Global Leader in Security CIS, Deeply Involved in High-End Domestic Substitution in Automotive and Consumer Electronics

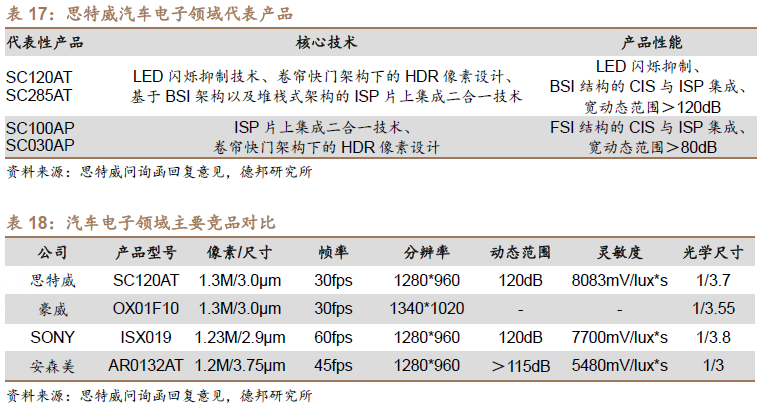

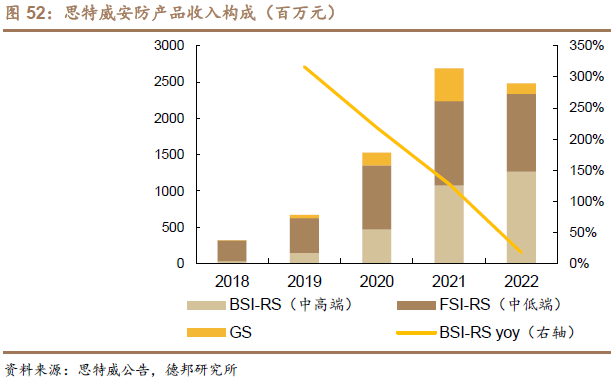

Rapidly Rising New Star in the CIS Industry, Technological Innovation Empowers Full-Field Layout. SmartSens Technology Co., Ltd. was established in 2017 and has focused on visual imaging technology and CIS product development in the security monitoring field since its inception, maintaining a leading market share in the security field. With technological innovation and experience in security business, the company has rapidly expanded its CIS business across multiple fields, entering the machine vision application field primarily focused on industrial automation in 2018; in 2020, the company began to expand into the automotive electronics field, achieving revenue contributions from low-end smartphone CIS business for the first time due to prior technological accumulation. Currently, the company’s technology and business cover all performance requirements across various application fields, including security monitoring, machine vision, intelligent automotive electronics, and smartphones.

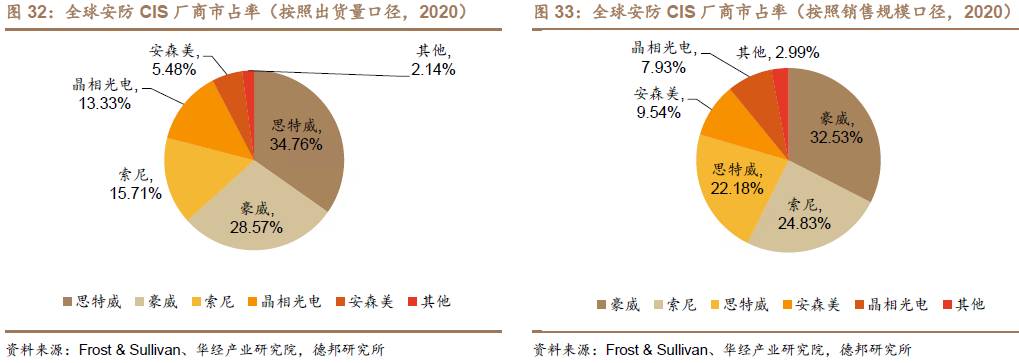

Global Leader in Security CIS, Technological Advantages Empower High-End Products, Solid Customer Base Stabilizes Business Foundation. The company continues to deepen its security CIS technology, rapidly gaining recognition from downstream customers due to its excellent night vision imaging performance. According to Frost & Sullivan data, in 2020, the company’s security CIS shipments reached 146 million units, ranking first globally. In terms of products, the company has launched a product matrix covering 1 to 13 million pixels based on industry-leading technologies such as SFCPixel, PixGain, near-infrared sensitivity NIR+, and ultra-low-light full-color night vision, with the revenue share of high-end products in the BSI-RS series continuously increasing, becoming a sustained growth driver for the company’s revenue. In terms of customers, the company’s main downstream customers in the security field include well-known domestic and international enterprises such as Dahua Technology, Hikvision, Qianfang Technology, and Ezviz Technology.

Rapid Development of Automotive CIS Business, Already Among the Global First Tier. In terms of technology, the company has established a product development process system that meets the highest functional safety level “ASIL D”, becoming one of the few domestic manufacturers capable of providing automotive-grade CIS solutions. In terms of products, since 2021, the company has invested heavily in R&D resources, developing various automotive CIS products such as 360-degree panoramic imaging, dash cameras, cabin monitoring, streaming media/electronic rearview mirrors, and ADAS/AD. According to TSR statistics, the company ranked fourth globally in automotive CIS shipments in 2021. In terms of customers, the company’s products have been adopted by leading domestic automakers such as BYD and Hikvision Automotive, and have established cooperative relationships with mainstream automakers such as GAC Toyota, Lantu, and others, with future plans to deepen cooperation with SAIC Group in supply chain and product development. In summary, with the continuous development of automotive intelligence and autonomous driving, the company’s automotive CIS business has a bright future.