CPU

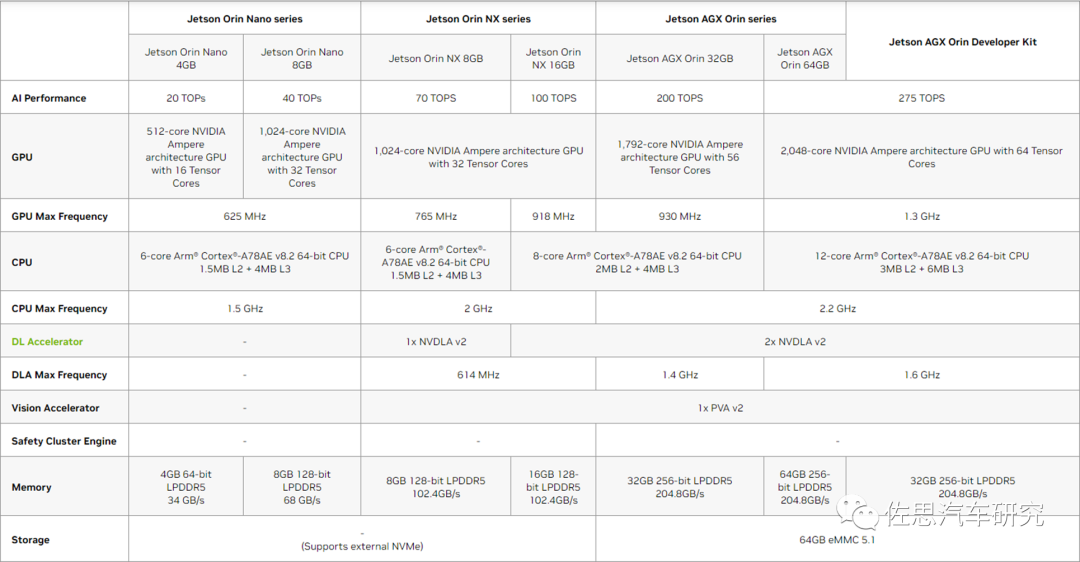

Basic parameters of the Nvidia Orin chip, Image source: NVIDA official website

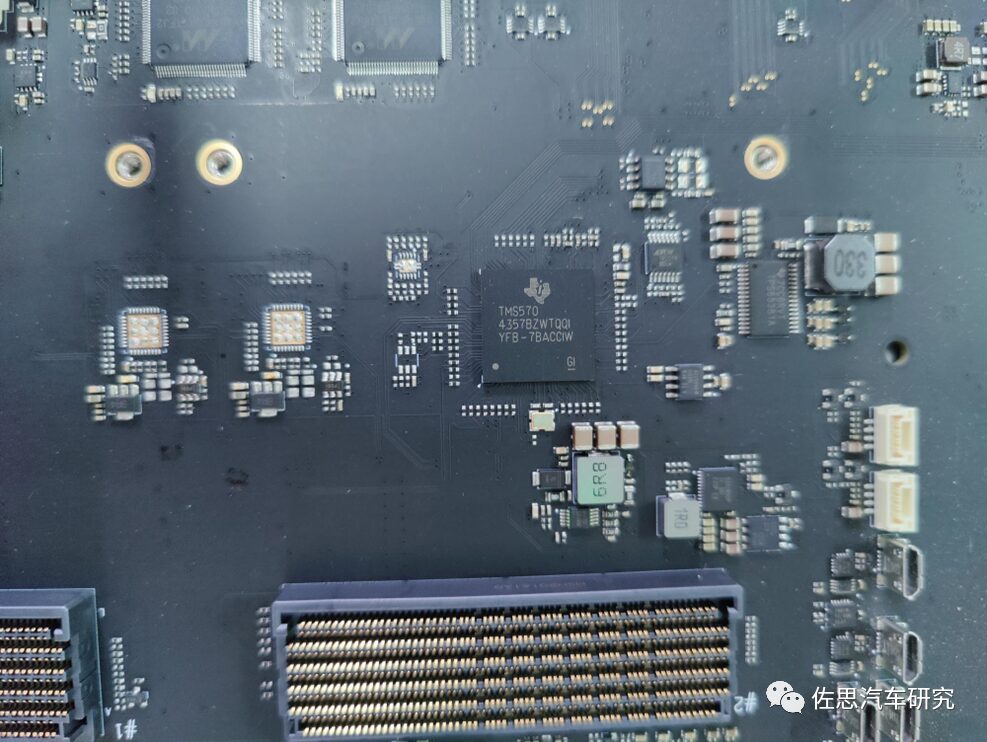

MCU in Domain Controllers

The DJI ADAS domain control prototype uses a Texas Instruments MCU, image source: Zuosi Automotive Research

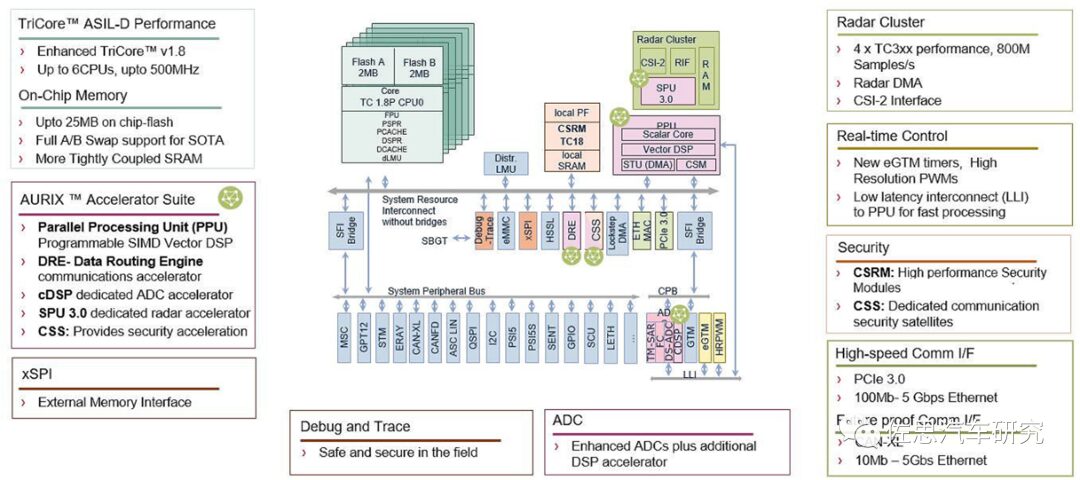

Infineon TC4xx architecture diagram, image source: Infineon official website

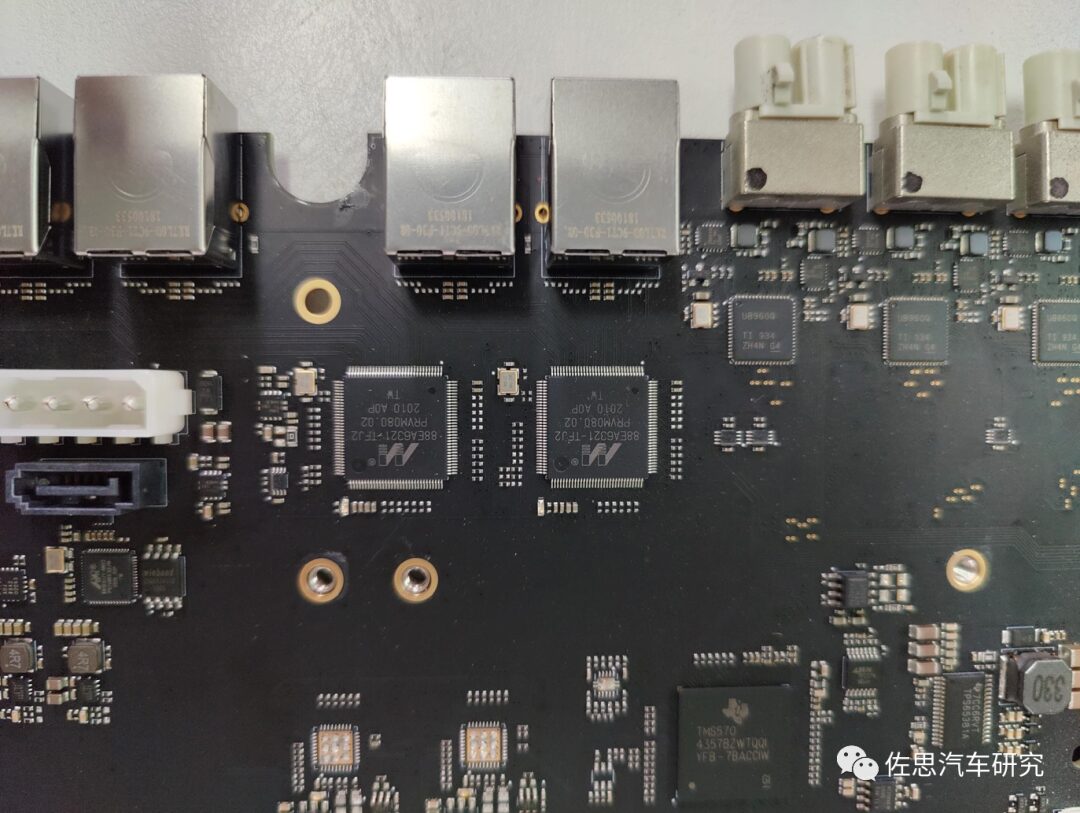

Interfaces

Part of the interfaces and Ethernet switch of the DJI ADAS domain control prototype, image source: Zuosi Automotive Research

Storage

Micron automotive-grade LPDDR5, image source: Micron official website

-

In terms of capacity, according to Micron’s data, the single vehicle DRAM capacity requirement for level 1/2 is about 8GB, while levels 3 and 5 increase to 16GB and 74GB, respectively.

-

In terms of bandwidth, level 2 DRAM bandwidth is generally 25-50GB/s, while at level 3, bandwidth can reach 200GB/s, and after level 4, bandwidth will increase to 1TB/s.

-

In terms of products, level 2 primarily uses basic DDR2/DDR3, while currently level 2 is beginning to upgrade to level 3, and DRAM will gradually transition to DDR4/LPDDR4/LPDDR5/GDDR5.

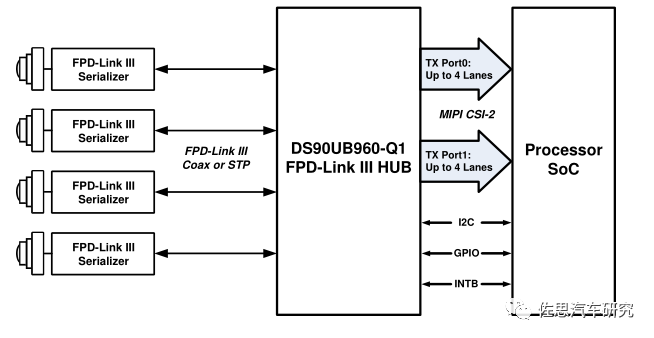

Deserialization

Typical application diagram of DS90UB960, image source: Texas Instruments

Table of Contents for the “2022 ADAS Domain Controller Key Component Trend Report”

01

High-Performance Domain Controller Product Solutions

1.1 Huawei

1.1.1 Huawei Intelligent Driving Domain Controller Product Matrix

1.1.2 Huawei Intelligent Driving Domain Controller Product Features

1.1.3 Huawei Intelligent Driving Domain Controller Internal Architecture

1.1.4 Huawei MDC610 Domain Controller

1.1.5 Huawei MDC610 Logical Architecture

1.1.6 Huawei MDC610 Low Power State

1.1.7 Huawei MDC610 Appearance and Interfaces

1.1.8 Huawei MDC610 Interface Scheme – CAN/Ethernet/Video Interfaces

1.1.9 Huawei MDC610 Typical Deployment Scheme – Debugging/Mass Production Scheme

1.1.10 Huawei MDC610 Cooling Specifications – Liquid Cooling/Air Cooling

1.1.11 Huawei MDC610 Deployment Location

1.1.12 Huawei MDC610 Box Dimensions and Installation Space – Liquid Cooling/Air Cooling

1.1.13 Huawei MDC610 Thermal Management Deployment Requirements

1.1.14 Huawei MDC610 Compatible Sensors

1.1.15 Huawei MDC300/F Domain Controller

1.1.16 Huawei MDC300/F Appearance and Interfaces

1.1.17 Huawei MDC300/F Internal Structure

1.1.18 Huawei MDC300/F Technical Specifications – Interfaces/System/Computing Power and Power Supply

1.1.19 Huawei MDC300/F Hardware Design Block Diagram

1.2 Desay SV Automotive

1.2.1 Desay SV Intelligent Driving Domain Controller Product Planning

1.2.2 Desay SV Autonomous Driving Domain Controller IPU: Product Matrix and Comparison

1.2.3 Desay SV Autonomous Driving Domain Controller: Software and Hardware Architecture and Division of Logic

1.2.4 Desay SV Autonomous Driving Domain Controller IPU04: Internal Structure/Software Architecture

1.2.5 Desay SV Domain Fusion Central Computing Platform Aurora: Performance Features/Design Scheme

1.3 DJI Automotive

1.3.1 Domain Controller Appearance and Interfaces

1.3.2 Internal Structure of Domain Controller – Domain Controller Mainboard/SOM Slot/Chip Module

1.3.3 Domain Controller Mainboard Component Introduction

1.3.4 Domain Controller Ethernet Switch

1.3.5 Domain Controller Deserialization

1.3.6 Domain Controller Debugging PCB

1.3.7 Domain Controller System Block Diagram

1.3.8 Domain Controller Key Components – Summary/CPU/MCU/Deserialization

1.3.9 Control ECU Appearance and Interfaces

1.3.10 Control ECU Internal Structure

1.3.11 Control ECU System Block Diagram

1.3.12 Control ECU Key Components

1.4 Tesla

1.4.1 Tesla Autopilot Function Upgrade Path: HW1.0→HW3.0

1.4.2 Tesla Domain Controller HW: Development Path

1.4.3 Tesla Domain Controller HW2.5 VS HW3.0

1.4.4 Tesla Domain Controller HW3.0: Internal Structure

1.5 Haomo Zhixing

1.5.1 Haomo Zhixing Intelligent Driving Domain Controller: Product Development Planning

1.5.2 Haomo Zhixing Intelligent Driving Domain Controller: “Little Magic Box 3.0” (IDC 3.0)

1.6 Furukawa Tech

1.6.1 Furukawa Tech Intelligent Driving Domain Controller Layout

1.6.2 Furukawa Tech Third Generation Intelligent Driving Domain Controller ADC30 Architecture Diagram

1.6.3 Furukawa Tech Third Generation Intelligent Driving Domain Controller ADC30 Sensor Configuration and Function Support

1.6.4 Furukawa Tech Next Generation Autonomous Driving Domain Controller ADC-X

1.7 Domain Controller Technology Benchmarking

1.7.1 Domain Controller Product Technology Benchmarking (1)

1.7.2 Domain Controller Product Technology Benchmarking (2)

1.7.3 Domain Controller Product Technology Benchmarking (3)

02

Comparison of Key Components in High-End ADAS Domain Controllers

2.1 Chips

2.1.1 Chips: Nvidia

2.1.2 Chips: Horizon

2.1.3 Chips: Black Sesame

2.1.4 Chips: Qualcomm Snapdragon RIGE

2.1.5 ADAS Domain Controller Chip Manufacturers Software Stack Solutions

2.1.6 ADAS Domain Controller Chip Manufacturers Product Performance Parameter Comparison (1)

2.1.7 ADAS Domain Controller Chip Manufacturers Product Performance Parameter Comparison (2)

2.1.8 ADAS Domain Controller Chip Manufacturers Product Performance Parameter Comparison (3)

2.1.9 ADAS Domain Controller Chip Manufacturers Product Performance Parameter Comparison (4)

2.1.10 ADAS Domain Controller Chip Manufacturers Product Performance Parameter Comparison (5)

2.2 MCU

2.2.1 Main ADAS Domain Controller MCU Manufacturers

2.2.2 MCU: Infineon TC Series Comparison

2.2.3 MCU: Infineon TC2xx

2.2.4 MCU: Infineon TC3xx

2.2.5 MCU: Infineon TC4xx

2.2.6 Trend 1

2.2.7 Trend 2

2.2.8 Trend 3

2.3 Storage

2.3.1 Storage: Micron

2.3.2 Storage: Samsung

2.3.3 Storage: Hynix

2.3.4 Storage: Kioxia (formerly Toshiba Storage)

2.3.5 Storage: ISSI (a wholly-owned subsidiary of Beijing Junzheng)

2.3.6 Storage Trend 1

2.3.7 Storage Trend 2

2.3.8 Storage Trend 3

2.4 I/O Interfaces

2.4.1 LVDS/CAN/ETH

More Zuosi Reports

Zuoyan Jun: 18600021096 (same WeChat)

Zuosi 2023 Research Report Writing Plan

Panoramic View of the Intelligent Connected Vehicle Industry Chain (December 2022 Edition)

| Domestic Brand OEM Autonomous Driving | Automotive Vision (Domestic) | High-Precision Maps |

| Joint Venture Brand OEM Autonomous Driving | Automotive Vision (Foreign) | High-Precision Positioning |

| ADAS and Autonomous Driving Tier 1 – Domestic | Surround View Market Research (Local) | Automotive Gateway |

| ADAS and Autonomous Driving Tier 1 – Foreign | Surround View Market Research (Joint Venture) | Data Closed Loop Research |

| Autonomous Driving and Cabin Domain Controllers | Infrared Night Vision | Automotive Information Security Hardware |

| Multi-Domain Computing and Regional Controllers | Autonomous Driving Simulation (Foreign) | Automotive Information Security Software |

| Passenger Vehicle Chassis Domain Control | Autonomous Driving Simulation (Domestic) | OEM Digital Transformation |

| Domain Controller Ranking Analysis | LiDAR – Domestic | Wireless Communication Modules |

| E/E Architecture | LiDAR – Foreign | Automotive 5G Integration |

| L4 Autonomous Driving | Millimeter-Wave Radar | 800V High-Voltage Platform |

| L2/L2+ Autonomous Driving | Automotive Ultrasonic Radar | Fuel Cells |

| Passenger Vehicle Camera Quarterly Report | Radar Disassembly | Integrated Battery |

| ADAS Data Annual Report | LiDAR and Millimeter-Wave Radar Ranking | Integrated Die Casting |

| Joint Venture Brand Vehicle Networking | Dedicated Vehicle Autonomous Driving | Automotive Operating Systems |

| Domestic Brand Vehicle Networking | Mining Autonomous Driving | Steer-by-Wire Chassis |

| Autonomous Driving Heavy Trucks | Unmanned Shuttle Vehicles | Skateboard Chassis |

| Commercial Vehicle ADAS | Unmanned Delivery Vehicles | Electronic Control Suspension |

| Commercial Vehicle Intelligent Cockpit | Unmanned Retail Vehicle Research | Steering Systems |

| Commercial Vehicle Vehicle Networking | Agricultural Machinery Autonomous Driving | Line Control Braking Research |

| Commercial Vehicle Intelligent Chassis | Port Autonomous Driving | Charging and Swapping Infrastructure |

| Automotive Intelligent Cockpit | Modular Reports | Automotive Motor Controllers |

| Intelligent Cockpit Tier 1 | V2X and Vehicle-Road Coordination | Hybrid Power Reports |

| Multi-Screen and Linked Screens in Cockpits | Roadside Intelligent Perception | Automotive PCB Research |

| Intelligent Cockpit Design | Roadside Edge Computing | IGBT and SiC Research |

| Instrument and Central Control Display | Automotive eCall Systems | EV Thermal Management Systems |

| Intelligent Rearview Mirrors | Automotive EDR Research | Automotive Power Electronics |

| Dash Cameras | Personalization of Smart Vehicles | Electric Drive and Power Domain |

| Automotive Digital Keys | Multimodal Interaction in Vehicles | Automotive Wiring Harnesses |

| Automotive UWB Research | In-Vehicle Voice | Automotive Audio Systems |

| HUD Industry Research | TSP Manufacturers and Products | Automotive Seats |

| Human-Machine Interaction | Autonomous Driving Regulations | Automotive Lighting |

| In-Vehicle DMS | Autonomous Driving Standards and Certifications | Automotive Magnesium Alloy Die Casting |

| OTA Research | Intelligent Connected Testing Base | Denso’s New Four Modernizations |

| Automotive Cloud Service Research | PBV and Automotive Robots | New Forces in Car Manufacturing – NIO |

| Automotive Functional Safety | Flying Cars | New Forces in Car Manufacturing – XPeng |

| AUTOSAR Research | Integrated Driving Research | New Forces in Car Manufacturing – LI AUTO |

| Software-Defined Vehicles | Smart Parking Research | Autonomous Driving Chips |

| Software Suppliers | Automotive Car-Sharing | Chassis SOC |

| Passenger Vehicle T-Box | Shared Mobility and Autonomous Driving | Automotive VCU Research |

| Commercial Vehicle T-Box | Digital Transformation of Automakers | Automotive MCU Research |

| T-Box Ranking Analysis | Intelligent Surfaces | Sensor Chips |

| XPeng G9 Feature Disassembly | Model Supplier Research | In-Vehicle Storage Chips |

| LI AUTO L8/L9 Feature Disassembly | NIO ET5/ET7 Intelligent Function Disassembly | Automotive CIS Research |

| DJI Front Dual Camera and Tida Tong LiDAR Disassembly |

Autonomous Driving Fusion Algorithms |