Not long after Tesla popularized and then abandoned silicon carbide, gallium nitride and gallium oxide have emerged as potential contenders.

01

What are Third-Generation Semiconductor Materials?

Recently, Mazda announced a collaboration with Japanese semiconductor company Rohm to develop automotive components using next-generation semiconductor technology—gallium nitride (GaN) power semiconductors. Many people may have heard of “gallium nitride” in the context of the intensified semiconductor material controls during the US-China trade war or in the promotion of new consumer electronics, but it is still relatively rare in automotive applications.

To date, semiconductor materials have evolved through three generations of commercial technology: the first generation includes silicon and germanium; the second generation includes gallium arsenide and indium phosphide, primarily used for high-speed, high-frequency, high-power, and optoelectronic devices, making them excellent materials for high-performance microwave, millimeter-wave devices, and light-emitting devices; the third generation includes wide bandgap semiconductor materials such as silicon carbide, gallium nitride, and zinc oxide.

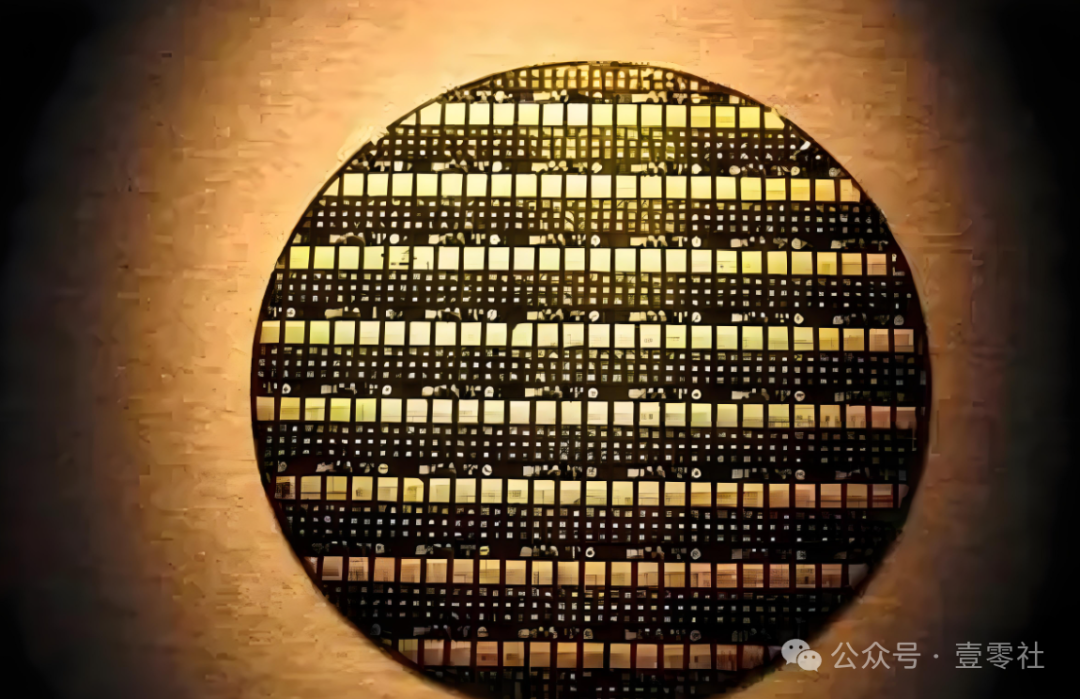

Semiconductor materials have undergone three generations of changes in commercial use

Semiconductor materials have undergone three generations of changes in commercial use

The ability of semiconductors to switch between insulators and conductors is due to electrons bound by atomic nuclei gaining sufficient energy to migrate from the valence band to the conduction band, becoming free electrons and thus conducting electricity.

The bandgap width refers to the minimum energy required to free a valence electron from its binding, so the narrower the bandgap, the easier it is for the semiconductor to become conductive under conditions of increased temperature or radiation. Conversely, a wider bandgap means that more energy input is required for the semiconductor to conduct electricity.

Traditional semiconductor materials typically have a bandgap width of less than 3 eV (electron volts) at room temperature; for example, germanium has a bandgap of 0.66 eV, and silicon has a bandgap of 1.12 eV. New wide bandgap materials have bandgaps exceeding 3 eV, with silicon carbide at 3.26 eV and gallium nitride at 3.4 eV.

Compared to traditional semiconductor materials, the wider bandgap allows materials to operate at higher temperatures, under stronger voltages, and in radiation conditions, as well as at faster switching frequencies; additionally, wide bandgap semiconductor materials also feature lower conduction resistance, resulting in lower power loss. Therefore, the semiconductor industry has predicted that wide bandgap semiconductor materials will find extensive applications in high-power, high-frequency electronic components.

Gallium nitride, which began to emerge in the 1990s, is used for high-performance RF chips and is currently the best performer.

A technician from China Telecom’s Chongqing branch told reporters that most consumer-grade 4G and 5G smartphones currently use gallium arsenide for their RF chips. While it is technically possible to use other compound semiconductors or silicon-based materials for RF chips, the processes differ significantly, leading to much poorer chip performance. “Moreover, the replacement cycle often takes several years, which inevitably incurs high costs.” This highlights the importance of gallium as a metal.

So, what irreplaceable role does it play in automobiles?

02

Searching for the “Talent” Limit of Materials

In fact, gallium nitride is intended to replace the existing silicon carbide in new energy vehicles.

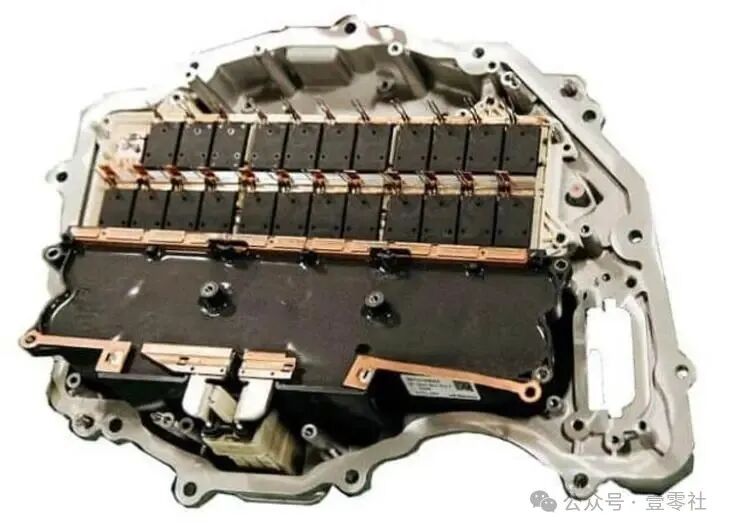

In 2018, Tesla released the high-range version of its “sales tool” Model 3, replacing the silicon-based IGBT power modules in the electric drive system inverter with 650V silicon carbide MOSFET modules produced by STMicroelectronics—this was the “secret recipe” the industry sought for “cost reduction without quality loss.”

Silicon carbide MOSFET module

Silicon carbide MOSFET module

In electric vehicles, the power battery operates on direct current, while the motor requires alternating current. The inverter’s job is to convert the direct current into alternating current to power the motor, and the conversion efficiency is key to determining the electric vehicle’s range.

Additionally, there are on-board chargers (OBC) and DC-DC converters, which can also utilize transistors made from silicon carbide.

The OBC is responsible for converting external AC power into DC to charge the power battery, while the DC-DC converter converts the high-voltage DC from the power battery into the low-voltage DC required by various electrical devices in the vehicle.

Each of these involves energy conversion, so how can we “consume more, digest well, and waste less”? To improve conversion efficiency, Tesla has elevated silicon carbide to a “sacred status”: silicon carbide power devices can achieve the same power conversion with only one-tenth the volume of traditional silicon-based devices.

Subsequently, the “800V fast charging platform” has become a trend for mid-to-high-end electric vehicles, with models from Porsche, NIO, and XPeng adopting silicon carbide devices, making new energy vehicles and charging piles the largest market for silicon carbide. Since 2022, American manufacturers like Wolfspeed and ON Semiconductor, Japanese manufacturers like Fuji Electric, Toshiba, Sumitomo, and Rohm, and European manufacturers like Infineon, Bosch, and STMicroelectronics have all announced large-scale silicon carbide expansion plans.

Similarly, gallium nitride, with its wider bandgap, can also optimize energy efficiency and reduce the size and weight of the entire power device.

This is why manufacturers currently focused on integrating gallium nitride into vehicles overlap significantly with the aforementioned silicon carbide manufacturers. It is reported that Mazda and Rohm plan to implement gallium nitride inverters by 2025 and conduct tests with prototype vehicles, aiming for practical application by 2027.

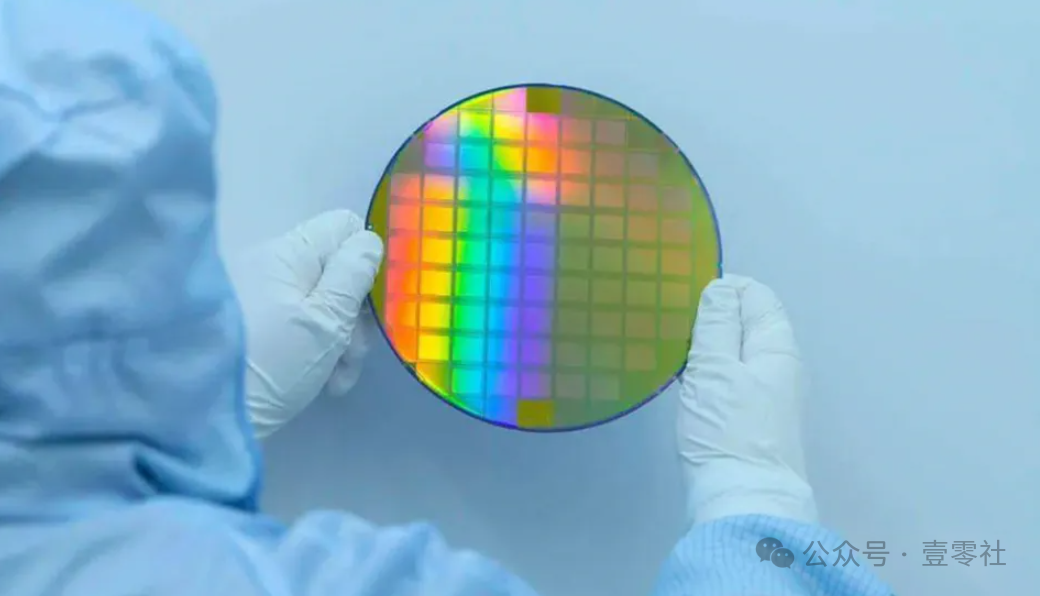

The fourth-generation semiconductor material, “gallium oxide,” is also attracting attention from automakers

The fourth-generation semiconductor material, “gallium oxide,” is also attracting attention from automakers

It is worth mentioning that fourth-generation semiconductor materials are also being preemptively invested in. The industry generally refers to semiconductor materials with a bandgap exceeding 3.4 eV as “ultra-wide bandgap semiconductors”; for example, gallium oxide has a bandgap of 4.8 eV, and diamond has a bandgap of 5.47 eV, indicating that its “talent” surpasses that of gallium nitride and silicon carbide, coupled with excellent high-temperature stability and cost advantages, which explains why BYD is quietly laying the groundwork.

Subscribe on WeChat

Subscribe on WeChat Welcome to subscribe to the 2025 “Computer News” through postal channelsPostal Issue Number: 77-19Price: 8 yuan, Annual Price: 400 yuanEditor|Zhang YiChief Editor|Li KunEditor-in-Chief|Wu Xin“Contact for tips:cpcfan1874 (WeChat)Yilong Society:Documenting fresh developments in technology and the internet, e-commerce life, cloud computing, ICT fields, consumer electronics, and business stories. Included weekly in the full-text collection of “China Knowledge Network”; ranked among the top 100 Chinese science and technology newspapers; member of the Weibo million-fan club in 2021; quality technology content creator on Douyin in 2022.”

Welcome to subscribe to the 2025 “Computer News” through postal channelsPostal Issue Number: 77-19Price: 8 yuan, Annual Price: 400 yuanEditor|Zhang YiChief Editor|Li KunEditor-in-Chief|Wu Xin“Contact for tips:cpcfan1874 (WeChat)Yilong Society:Documenting fresh developments in technology and the internet, e-commerce life, cloud computing, ICT fields, consumer electronics, and business stories. Included weekly in the full-text collection of “China Knowledge Network”; ranked among the top 100 Chinese science and technology newspapers; member of the Weibo million-fan club in 2021; quality technology content creator on Douyin in 2022.”