1. Layoff Incident: Dual Signals of Capacity Optimization and Strategic Contraction

1.1 Scale of Layoffs and Details Disclosed

In March 2025, a statement released by Texas Instruments (TI) sent ripples through the semiconductor industry, announcing a layoff plan at its Lehi, Utah plant. This decision was not without warning; looking back, TI has been gradually restructuring its workforce globally. As early as 2023, TI disbanded its MCU R&D team in China, transferring related operations to India while retaining only market and application functions. In 2024, the Beijing low-end power chip team was also reduced by 50 people to cope with fierce market competition.

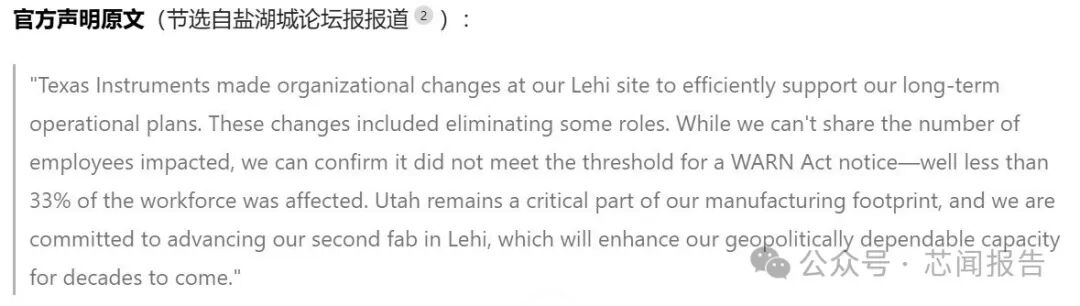

Although the exact number of layoffs at the Lehi plant has not been fully disclosed, estimates based on the U.S. Worker Adjustment and Retraining Notification Act (WARN Act) suggest that the layoffs are likely to be within the hundreds, as they do not meet the mandatory disclosure threshold of a 33% or more reduction in workforce or over 500 employees. According to 2023 data, the total number of employees at the Lehi plant was approximately 1,100, suggesting that around 300 employees may be affected. TI stated that the layoffs are intended to “efficiently support long-term operational plans,” but it is evident that this decision is driven by strategic choices under performance pressure.

1.2 The Contradiction of Layoffs and Capacity Expansion

At first glance, TI’s layoffs seem contradictory to its ongoing capacity expansion. In reality, these two aspects are closely related, underpinned by deeper strategic considerations. TI has secured $1.61 billion in funding through the CHIPS Act, planning to establish a second 300mm wafer fab in Utah by 2026. Once operational, this new facility will work in tandem with the existing plant, significantly increasing the production capacity of analog and embedded processing chips to meet the growing market demand for these essential chips.

The layoffs are a preparatory step for the new plant’s launch. Officially, the layoffs aim to “efficiently support long-term operational planning,” with the core logic being to reduce inefficient capacity at the existing plant, freeing up resources such as funds, equipment, and personnel to ensure the new plant’s smooth operation. In the semiconductor industry, capacity utilization directly impacts production costs and corporate profits. Maintaining high-cost, low-efficiency capacity in the face of insufficient market demand is clearly detrimental to long-term corporate development. Through these layoffs, TI can optimize its workforce allocation, concentrating resources on more promising and efficient production segments, thereby achieving a strategic transformation of “streamlining non-core businesses and focusing on high-end manufacturing.”

2. Performance Under Pressure: Weak End Demand and Structural Imbalance

2.1 Financial Data and Market Performance

From a financial perspective, TI’s performance in 2024 is not optimistic, with annual revenue reaching $15.641 billion, a 10.7% decline compared to the previous year, and net profit plummeting to $4.799 billion, a staggering 26% year-on-year drop. This data clearly illustrates the immense profit pressure the company faces in a weak market demand environment. The industrial and automotive sectors, as TI’s core business segments, contribute approximately 70% of revenue; however, demand in these two critical areas continues to falter. Particularly, the industrial automation and energy infrastructure markets remain entrenched in a downturn, showing no signs of a rebound. Amid a slowing global economy and geopolitical conflicts, investment and expansion in the industrial sector have noticeably slowed, with factory automation upgrade projects postponed and new energy infrastructure construction plans continually delayed, leading to persistently low procurement demand for related semiconductor chips.

Regionally, TI’s performance shows a clear divergence. In the Chinese market, benefiting from the booming electric vehicle market and sustained consumer demand for electronic products, revenue from automotive and consumer semiconductors has increased. The annual rise in electric vehicle sales has led to strong demand for automotive chips, and TI has successfully secured a foothold in this niche market due to its technological advantages in analog chips. However, the decline in traditional automotive markets in Europe and Japan cannot be fully offset by growth in China. These regions’ automotive industries face supply chain bottlenecks and high inflation, leading to declines in both production and sales, which directly results in a sharp drop in TI’s revenue in those areas. Although the U.S. market saw a slight year-on-year increase, significant revenue contractions in other regions have further exacerbated the company’s regional market risks, with global revenue divergence becoming increasingly pronounced.

2.2 Capacity Utilization and Cost Pressure

The weak end demand has directly led to a decline in TI’s factory capacity utilization. When market demand is insufficient, factories cannot operate at full capacity, leading to increased idle time for equipment and reduced production efficiency. The high depreciation costs of semiconductor manufacturing equipment mean that these fixed costs cannot be effectively distributed when capacity utilization declines, further squeezing the company’s profit margins. For example, in the fourth quarter of 2024, TI’s analog chip business revenue saw a slight year-on-year increase of 1.7%, while the embedded processing business declined by 18%. This structural contradiction in business growth highlights the company’s excessive reliance on the industrial and automotive markets. Any fluctuations in these two markets can severely impact the company’s overall performance, exposing the risks of a singular business structure.

3. Industry Challenges: Survival Wisdom in a Cyclical Low

3.1 Overall Dilemma of the Semiconductor Industry

TI’s predicament is not an isolated case but a microcosm of the entire semiconductor industry. In 2024, semiconductor giants such as Intel, Qualcomm, and ON Semiconductor also joined the layoff wave. Intel plans to lay off 15,000 employees, about 15% of its total workforce, in response to the decline in its PC business and setbacks in the AI chip market, attempting to cut costs and regain lost market share; Qualcomm is also actively adjusting its business layout, with rumors of negotiations to acquire parts of Intel’s business, reflecting the intensified market competition and increasing performance pressure.

Global power semiconductor manufacturers are mired in a dual quagmire of inventory buildup and demand slowdown. According to an analysis by Bank of America of about 80 semiconductor companies, semiconductor inventory (excluding memory) is expected to increase by 8 days quarter-on-quarter in the fourth quarter of 2024, reaching 116 days, far exceeding the five-year historical median. Among them, TI, Infineon, and six other semiconductor manufacturers have an average inventory days of 157 days, an increase of 8 days quarter-on-quarter, indicating a significant deviation in inventory levels. TrendForce predicts that in 2025, non-AI semiconductor demand will still be dragged down by macroeconomic conditions, with only mild inventory replenishment expected in the automotive and industrial sectors, making the industry’s overall recovery path still long.

3.2 The Backlash of Technological Blockades and Geopolitical Games

The U.S. technology blockade against China has also, to some extent, backfired on American semiconductor companies like TI. The adjustment of TI’s business in China is a direct result of this geopolitical game. The U.S. government has continuously implemented restrictive policies to curb the development of China’s semiconductor industry, from limiting chip exports to obstructing technological exchanges, attempting to sever the development path of China’s semiconductor industry. However, this move has sparked a determination for independent innovation among Chinese companies, with Huawei and others accelerating the domestic substitution process under immense pressure.

By 2024, China’s mature process capacity accounted for 28% of the global total, and this figure continues to grow steadily. With companies like SMIC and Hua Hong Semiconductor achieving technological breakthroughs and capacity expansions in the mature process field, China’s domestic chip supply capability has significantly improved, directly lowering chip prices globally, especially in North America. NVIDIA’s CEO Jensen Huang candidly stated, “Huawei’s full industry chain breakthrough has disrupted the U.S. efforts to restrict Chinese technology.” Huawei has not only achieved a lead in the 5G communication field but is also continuously iterating and upgrading its HiSilicon chips, achieving technological breakthroughs from AI chips to mobile phone chips, thereby breaking the technological monopoly of foreign companies. Chinese mature process chips, with their price advantages, are continuously expanding their global market share, significantly impacting the market shares of foreign semiconductor companies like TI and intensifying their competitive pressure and performance dilemmas.

4. Strategic Response: Layoffs and Innovation Coexist

4.1 Cost Control and Resource Focus

In the face of industry challenges, TI is actively taking countermeasures, focusing on cost control and resource allocation. In its capital expenditure plan, the company plans to invest $5 billion in capacity expansion in 2025, which is nearly 70% of its total capital expenditure over the past six years. TI has clearly shifted its strategic focus towards domestic high-end manufacturing, planning to complete the layout of new global factories by 2026, with the new plants becoming key supports for enhancing capacity and technological competitiveness. The second 300mm wafer fab in Utah is an important part of this strategic layout, and with funding support from the CHIPS Act, the new plant will significantly increase the production capacity of analog and embedded processing chips, giving the company a competitive edge in high-end manufacturing.

In terms of product innovation, TI released the world’s smallest MCU (only 1.38mm²) in March 2025, specifically designed for high-growth areas such as medical wearables, offering an extremely high cost-performance ratio at just $0.16 per unit. Its compact size is 38% smaller than similar devices, allowing designers to optimize circuit space in medical wearables and personal electronic products without compromising performance. This MCU integrates 16KB of memory, a three-channel 12-bit ADC, six general-purpose I/O pins, and is compatible with standard communication interfaces such as UART, SPI, and I2C, providing engineers with great convenience in embedded system design and demonstrating TI’s determination to precisely target niche markets and capture emerging market shares.

4.2 Technological Breakthroughs and Capacity Upgrades

Technological breakthroughs and capacity upgrades are another key strategy for TI to tackle challenges. In critical technology areas, TI has increased its investment and R&D in Gallium Nitride (GaN) technology. In October 2024, the company announced that it would quadruple the in-house manufacturing capacity of GaN semiconductors at two factories and successfully launched pilot projects applying GaN manufacturing processes on 12-inch wafers. GaN, as a new semiconductor material, offers advantages such as high energy efficiency, fast switching speeds, and compact power solutions, providing higher power density. By expanding GaN capacity, TI can meet market demand for high-efficiency, high-power-density chips, further solidifying its position in the power semiconductor field. GaN-based chips are already widely used in power converters for laptops and smartphones, as well as in motor drives for HVAC systems and home appliances, with broader application prospects as the technology matures.

In the layout of edge AI and connectivity technologies, TI has also made significant progress. In November 2024, the company launched the TMS320F28P55x series C2000 MCU, a real-time microcontroller integrated with a Neural Processing Unit (NPU), achieving up to 99% fault detection accuracy. By integrating the NPU to run Convolutional Neural Network (CNN) models, it can reduce latency by 5 to 10 times compared to traditional software methods, greatly enhancing the intelligent decision-making capabilities of edge devices, meeting the stringent requirements for real-time data processing and fault detection in smart IoT, industrial control, and automotive electronics. The concurrently launched F29H85x series MCU, based on a 64-bit architecture C29 core, supports international safety standards, including ISO 26262 and IEC 61508, providing safer and more reliable guarantees for automotive and industrial applications, with real-time signal processing performance doubling compared to the C28 core, further enhancing system operational efficiency.

In low-power Bluetooth connectivity technology, TI launched the new wireless microcontroller SimpleLink low-power Bluetooth CC2340 in July 2024. This product continues the advantages of TI’s BLE series modules, offering high-quality, low-power Bluetooth connectivity at only half the price of competing devices. The CC2340 series is built on TI’s decades of expertise in wireless connectivity, featuring excellent RF performance, standby current, and connection range, with an output power of up to +8dBm, outperforming major competitors’ BLE MCUs. Its integrated RF balun allows for fewer external components, simplifying design and effectively reducing costs, providing a superior, cost-effective solution for wireless connectivity in IoT devices and helping the company expand its market share in the IoT sector.

5. Future Outlook: Long-Termism at the Bottom of the Cycle

TI’s strategy of simultaneous layoffs and expansion essentially aims to exchange short-term pain for long-term competitiveness. Despite challenges such as employee placement and market confidence, the company remains firmly committed to the industrial, automotive, and AI edge computing sectors. As global semiconductor inventory gradually gets digested and demand recovers, TI’s capacity optimization and technological innovation may allow it to seize opportunities in the industry’s rebound. As CEO Haviv Ilan stated, “We are actively participating in the competition in the Chinese market through strict cost control and continuous innovation.”

TI’s layoffs are not an isolated event but a reflection of the deep adjustments within the semiconductor industry. In the context of intertwined technological iterations and geopolitical changes, companies must navigate cycles with flexible strategies and innovative capabilities to break through in fierce competition.

end

Stay tuned for more information