In the entire semiconductor industry chain, there is a significant gap in areas such as EDA, manufacturing, and key equipment like photolithography machines compared to the world’s advanced levels; in terms of design, the gap in mobile processors is relatively small compared to international standards, while desktop CPUs and GPUs show a clear gap, and some niche areas are also lagging behind. The packaging and testing sector is leading globally.

The design and manufacturing of storage chips are also relatively weak, but there are bright spots, and the development of analog chips domestically is relatively mature, with domestic replacement accelerating!

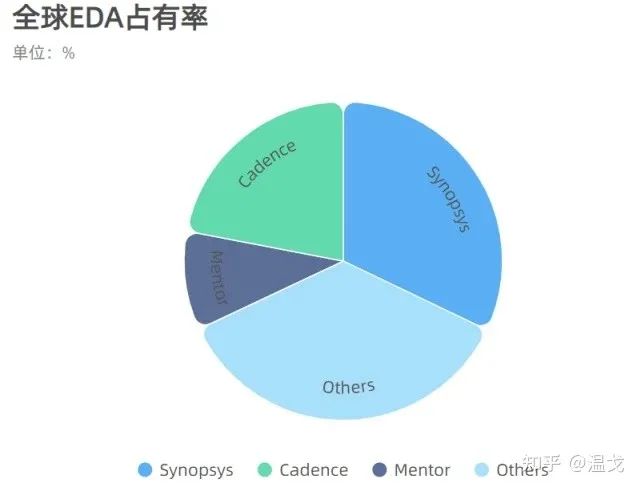

EDA (Electronic Design Automation)

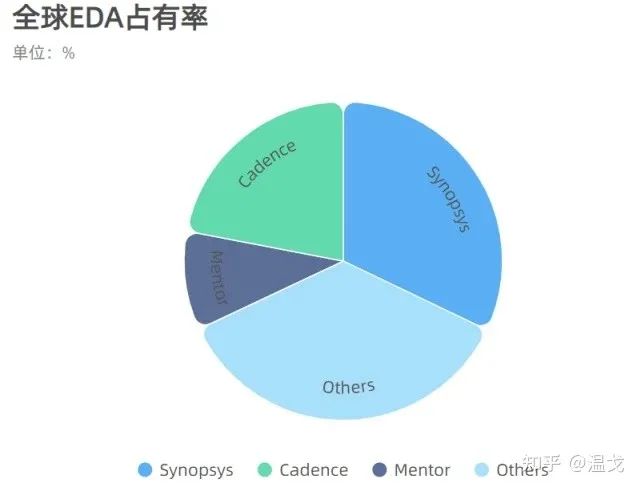

The three giants in the EDA field, Synopsys, Cadence, and Mentor Graphics (under Siemens), account for about 65% of the global market share, while their share in China exceeds 95%, indicating an absolute monopoly position.

Founded in 1986 and headquartered in Silicon Valley, USA, Synopsys is the world’s leading provider of EDA solutions. In 2018, Synopsys held about 32.1% market share in the EDA industry.

Synopsys’s EDA software covers the entire IC process and is highly powerful.

Source: Synopsys Official Website

Cadence was formed in 1988 by the merger of SDA and ECAD, headquartered in San Jose, California, USA. Cadence products cover the entire electronic design process, including system-level design, functional verification, IC synthesis and layout, IC physical verification, analog mixed-signal and RF IC design, full-custom IC design, PCCE design, and hardware simulation modeling. In 2018, Cadence held about 22% share in the global EDA market.

Mentor is a globally renowned EDA tool vendor, providing various design, simulation, and manufacturing tools needed for chip and system development, alongside Synopsys and Cadence, they are known as the top three global EDA companies. In 2015, its revenue was around $1.2 billion, with an operating profit of about 20.2%, and it currently employs 5,700 people worldwide.

In addition to EDA tools, Mentor also has many products that support automotive electronics manufacturers, including embedded software. Mentor’s strategy is to continuously strengthen independent research and development in its main business of EDA tools, investing 30% of annual sales revenue as R&D funding. In the EDA tools sector, hardware simulators maintain a super-fast growth rate of 24%.

In November 2016, Siemens acquired Mentor Graphics for $4.5 billion.

Among domestic EDA companies, Huada Jiutian is currently the largest and most technically capable EDA leading enterprise in China. It can provide full-process solutions for analog/digital mixed IC design, digital SoC IC design and optimization solutions, wafer manufacturing-specific EDA tools, and full-process solutions for flat panel display (FPD) design. However, it is clearly unable to compete with the three giants in terms of performance and support for advanced processes.

The remaining EDA companies, such as Xinhua Zhang, Xinha Technology, Guangli Micro, Gai Lun Electronics, Ruobei, and Xinyuanjing, only provide support or optimization in certain areas, making their competitiveness relatively weak.

The development of EDA companies is interdependent with chip design companies, continuously fixing EDA bugs and improving performance amid rapid technological iterations, thus forming a virtuous cycle. It is relatively difficult to change the domestic EDA situation in the short term through large amounts of capital and talent investment.

In light of the domestic shortage of EDA talent and the scattered product situation of EDA companies, increasing training for EDA talent in the future, as well as strengthening cooperation among EDA enterprises or integrating domestic EDA companies, may be a future development path. To have international competitiveness, it is essential to first solidly tackle comprehensive solution processes and gradually narrow the gap with international standards. EDA is likely to be a bottleneck in the future, so we must not be complacent.

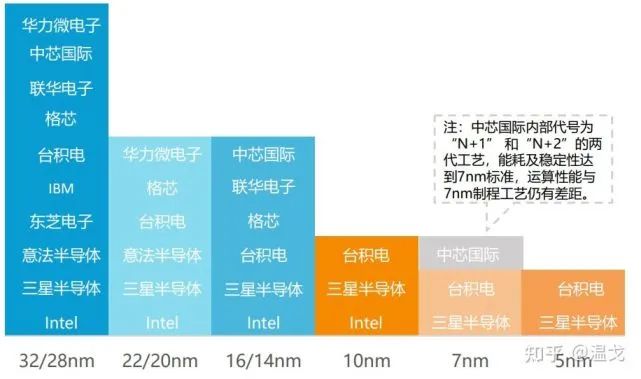

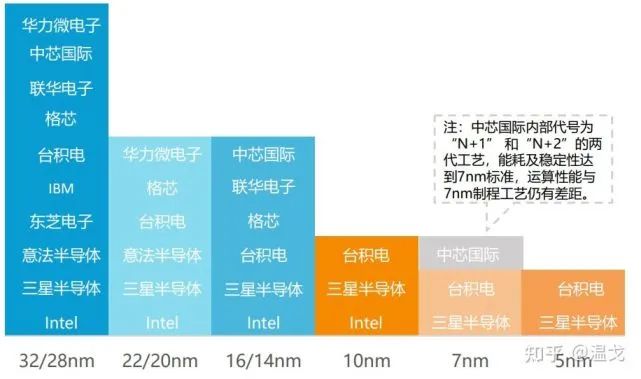

In terms of chip manufacturing, the most advanced technology in China is SMIC‘s 14nm process, while Samsung and TSMC have already achieved mass production at 5nm, indicating a gap of about three generations.

Source: Guoyuan Securities, Yiou整理

In terms of key manufacturing process equipment, photolithography machines, there is a significant gap compared to international advanced levels. The most advanced photolithography machine in China is the DUV (ArF 193nm light source) photolithography machine capable of manufacturing 90nm processes from Shanghai Micro Electronics Equipment (SMEE).

High-end photolithography technology is monopolized by the Dutch company ASML, whose most advanced photolithography machine uses an extreme ultraviolet light source (EUV) with a wavelength of 13.5nm, capable of meeting the chip manufacturing requirements of 5nm and 3nm processes.

IC Design Logic Computing Chips

In mobile processor design, the most advanced in China is the HiSilicon Kirin 9000 series, which reached world-leading levels before Huawei was sanctioned by the US. It can compete with mainstream Apple A-series, Qualcomm Snapdragon, and Samsung Exynos processors.

Unisoc is also a noteworthy mobile SoC design company, with its Tiger T processor mainly used in budget smartphones.

In the desktop CPU sector, the commercial market is basically shared by Intel and AMD, with the most well-known domestic product being Longxin, mainly used in defense, military, aerospace, and other fields.

In the GPU industry, China has very little development experience, and there are few application cases based on domestic GPUs. However, in recent years, some startup companies in the GPU sector have emerged, such as Muxi, Birun, Tianshu, Jingjiawei, and Moer Thread.

With the steady increase in demand for AI computing chips and the ongoing boom in the personal consumption market, this environment will attract financially strong companies with a demand for GPU products to invest in this market.

We are also pleased to see that technical teams from chip companies around the world have returned to mainland China to establish new companies to develop domestic GPUs and GPGPUs, and their rich product development experience will accelerate the development of these products. Through frequent financing of new companies like Muxi Integrated Circuits and Moer Thread, it is evident that the primary market continues to provide funding and attention to the GPU industry. With various favorable conditions combined, China’s GPU technology development has entered the fast lane.

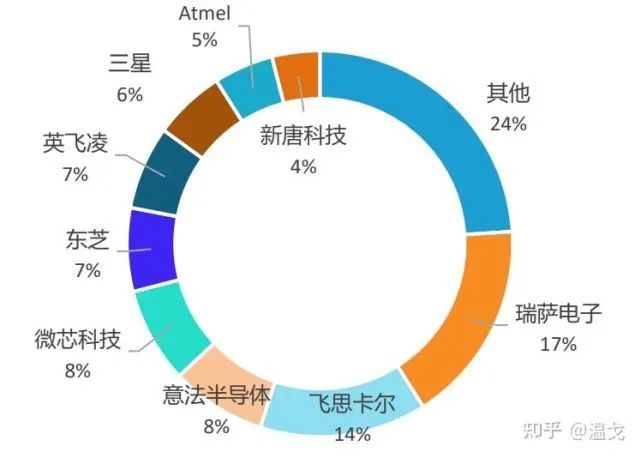

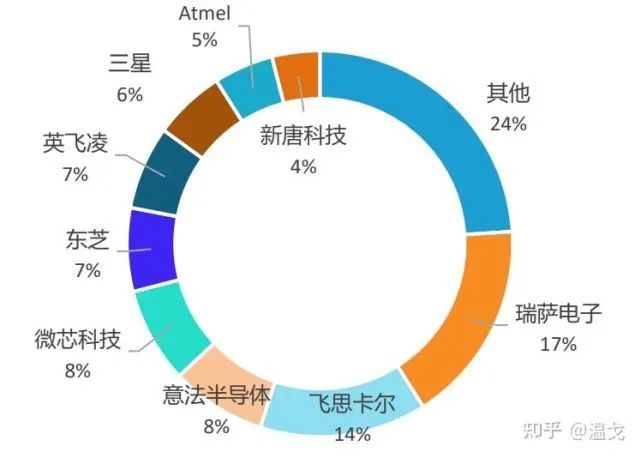

In the MCU, MPU, and DSP fields, the major market share is still divided by foreign companies. Currently, domestic MCU companies that are performing well include GigaDevice, Zhongying Electronics, and Shanghai Belling. The design barriers in this part of the chip are relatively low, and domestic replacement manufacturers can start from this aspect.

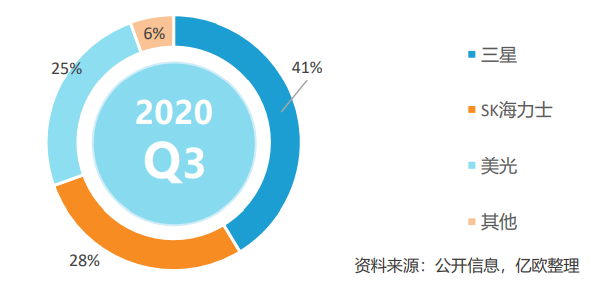

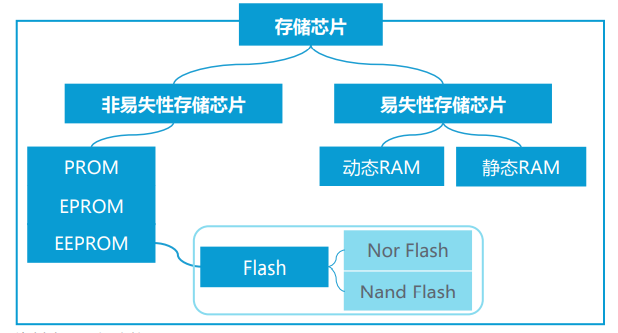

Storage chips are also one of the weak links in China. Apart from having a few companies in the Flash memory chip market with about 5% market share, other common storage chips are basically monopolized by established companies like Samsung, Toshiba, and Micron.

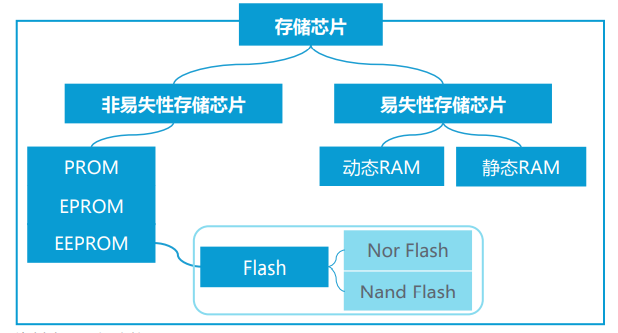

Storage chips are also divided into different types, detailed classification can be seen in the image below:

NOR Flash was developed by Intel in 1988 and is one of the two main types of non-volatile memory on the market today.

GigaDevice has entered the world forefront in this field, with a global market share of third place. This company covers the fields of “storage, control, and sensing”, and its main products include NOR Flash, SLC NAND Flash, MCU, and biometric chips.

Wuhan Xinxin provides high-performance NOR Flash technology services from 90nm to 45nm, and is a globally leading NOR Flash manufacturer. Wuhan Xinxin was the first manufacturer to mass-produce 45nm NOR Flash, with a single chip capacity of 8Gb.

By the end of 2018, Wuhan Xinxin had shipped a cumulative total of 780,000 NOR Flash wafers, covering NOR Flash markets from consumer products to IoT, wearable devices, automotive, and industrial control.

SMIC also has related businesses.

In 1989, Toshiba introduced the NAND Flash structure.

Yangtze Memory Technologies is the leader in the domestic NAND Flash sector, focusing on the integrated design and manufacturing of 3D NAND flash memory.

Unisoc Group invested in Nanjing in 2017 to build a factory for the production of 3D NAND Flash and DRAM storage chips. Once this factory is completed, its monthly production capacity will reach the scale of 100,000 pieces. The chip shortage that began in the second half of 2020 led to price increases, and due to strong demand, NAND Flash prices remain high. In the second half of this year, with both domestic and international production capacity increasing, there will be some changes.

Dongxin Semiconductor is developing small and medium-capacity NAND, NOR, and DRAM chip businesses by introducing existing mature NAND Flash technology and R&D teams from South Korea, covering design, production, and sales. Dongxin Semiconductor completed the domestic first 38nm process 2G capacity SPI NAND chip trial production in 2017, marking a breakthrough. The company received undisclosed A-round financing in 2018 and is currently undergoing IPO processes on the Science and Technology Innovation Board.

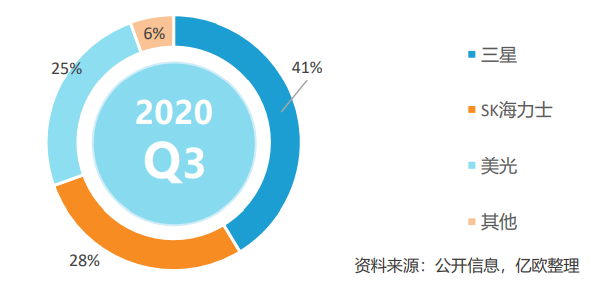

DRAM (Dynamic RAM) is the largest member of the RAM family, and when people refer to RAM, they usually mean DRAM. It is mainly used as memory for computers or mobile phones, such as DDR, LPDDR, etc.

Changxin Memory, located in Hefei, is an IDM company that focuses on the DRAM field, integrating design, research and development, production, and sales. It has built its first 12-inch wafer factory and has begun production of DDR4 chips, while also striving to promote the mass production of DDR5 chips.

ISSI was acquired by Beijing Junzheng after delisting from NASDAQ. The company’s business involves the design of DRAM, Flash, and LED driver chips, which are applied in communication devices, automotive, and industrial control fields. In 2021, ISSI’s performance fluctuated due to the dual pressure of industry giants and poor internal management.

According to research data from Yiou, the domestic market share remains very low, and a significant amount of demand has to be imported.

In recent years, domestic analog chips have developed vibrantly. This includes 5G IoT, WI-FI chips, Bluetooth chips, RF chips, signal chain chips, isolation interface chips, power management chips, sensors, etc.

From the development trend, analog chips have a relatively lower threshold compared to CPUs and GPUs, with a faster domestic replacement process, and are also favored by capital.

Packaging and Testing Field

In the ATE sector, over 80% of the domestic market share is divided between Teradyne and Advantest. These two companies have a very broad product line covering the testing of digital chips, analog chips, SoC chips, and discrete devices. Due to the slow update of ATE equipment, these two companies with profound technical accumulation can fully enjoy the profits brought by the large market.

Source: CCID Consulting, GF Securities

The main testing equipment manufacturers currently in China include Huafeng Measurement and Control, Changchuan Technology, and Wuhan Jinghong. Among them, in the field of analog testing machines, domestic companies including Huafeng Measurement and Control and Changchuan Technology have occupied a considerable share of the domestic market, while Wuhan Jinghong has obtained orders from Yangtze Memory Technologies in the storage testing machine field, and companies like Huafeng Measurement and Control are actively laying out in the SoC testing machine field.

Packaging and testing are relatively simple in the entire chip industry chain, note that it is only relatively simple, and it is currently a priority development direction in China, where domestic companies are leading in the packaging and testing field. The major packaging and testing manufacturers in mainland China include:

Longji Technology is the third-largest packaging and testing company globally, with the largest market share in China. Longji Technology acquired Xingke Jintong, becoming the third-largest packaging and testing company with a 13% global market share.

It has production bases in Jiangyin, Chuzhou, Suqian, and Longji Advanced. It also has subsidiaries Xingke Jintong and Longji Korea.

Jingfang is a packaging and testing vendor for companies like OmniVision, Sony, Geke Microelectronics, Hynix, and Goodix, and is currently developing well and deserves attention.

Huatian Technology ranks second in both packaging capacity and sales revenue among listed companies in the same industry in China.

There is a significant talent gap in the domestic semiconductor industry, and the competition among companies for talent is becoming increasingly intense. Graduates with an EE background are particularly sought after by various companies. The position of IC design, which once had a high threshold, has lowered its requirements in the face of a hot market, as hiring is genuinely difficult.

In this context, graduates from physics, materials, communication, chemistry, and mechanical engineering disciplines are transitioning into the semiconductor industry, and many process positions are also switching to design roles. The knowledge involved in IC design is complex and extensive, making training programs a stepping stone for transitioning careers. Lu Sang, the founder of LuKe Verification, revealed that nearly 200 students registered for the spring verification class in 2021, indicating the hot market.

In the past few decades, the global semiconductor industry has followed a division of labor model, but after the US imposed sanctions on Chinese companies, having a complete semiconductor industry chain has become crucial for a country! South Korea plans to invest $450 billion in semiconductors over the next decade, and 17 EU countries have also signed a declaration to jointly develop semiconductors. It can be said that in the turbulent international semiconductor industry situation, solidifying one’s own industrial chain and avoiding being choked is the urgent task. The development of the semiconductor industry is not achieved overnight but requires steady progress. Our success in the packaging and testing field may provide valuable insights for other segments.

Source: Guokexun Technology

In the past few decades, the global semiconductor industry has followed a division of labor model, but after the US imposed sanctions on Chinese companies, having a complete semiconductor industry chain has become crucial for a country! South Korea plans to invest $450 billion in semiconductors over the next decade, and 17 EU countries have also signed a declaration to jointly develop semiconductors. It can be said that in the turbulent international semiconductor industry situation, solidifying one’s own industrial chain and avoiding being choked is the urgent task. The development of the semiconductor industry is not achieved overnight but requires steady progress. Our success in the packaging and testing field may provide valuable insights for other segments.

Source: Guokexun Technology

Daylily Defense Research Institute

Long press the QR code to follow Daylily Defense