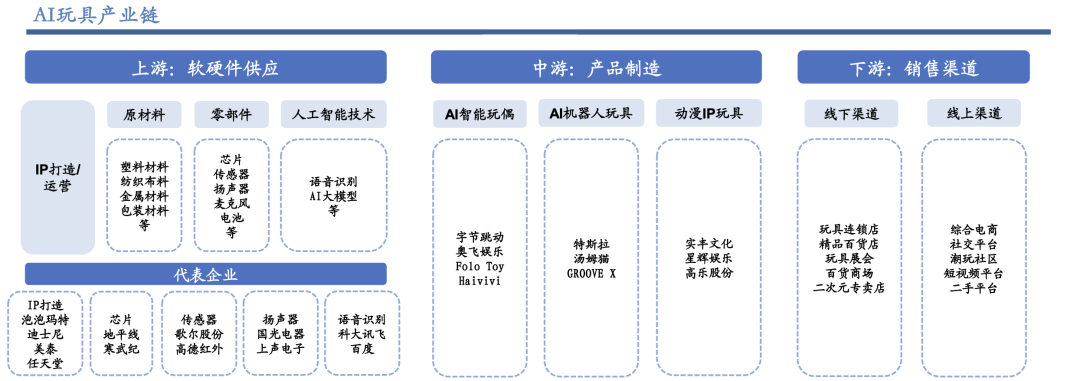

The tariff countermeasure has reached 125%, and we will no longer play digital games, so there is no point in discussing tariffs anymore. Today, let’s talk about AI toys. Currently, AI toys are somewhat of a pseudo-concept; to be precise, they are still in the explosive stage of AI + toys. Most toys are simply a basic toy shape combined with an AI large model core, and are labeled as AI toys. The user demographic mainly consists of infants and teenagers, with product functions primarily focusing on AI large model dialogues, priced around 300 yuan. Of course, there are also some high-end products abroad that can recognize emotions, priced at tens of thousands of yuan. Development Path The first stage, in fact, the explosion of AI + toys mentioned at the beginning is merely the nascent stage of AI toys. Why? The commercialization of a product must meet the criteria of low price and high demand, benefiting from the improvement of the Chinese industrial chain.Price wars have driven the cost down to the hundred yuan range, which is a result of competition among players. For example,the Guangdong Chenghai industrial cluster produces over 500,000 AI toys daily, with a quality rate of 98.7%. Currently, through modular production methods,AI core box (¥180) + doll shell (¥80) = finished product (¥399), allowing costs to be controlled at 399 yuan. This has led to the explosion of AI + toys, for instance,the GMV of AI toys on Douyin surged from 1% in 2023 to 18% in 2024. Innovation Period: As prices become more affordable, product sales explode. Following this explosion, with product upgrades, various gameplay and business models will emerge, such as hardware + content subscription, IP + model.FoloToy Cactus at 298 yuan unlocks 12 months of AI dialogue, supporting dialect interaction,while the Tom Cat AI robot at 1799 yuan offers lifetime large model computing power, capable of telling stories, checking the weather, and serving as a mental support. Platform Period: As technology develops to a certain stage, niche markets will gradually be divided. Leading companies will form their own AI toy platforms through the gradual establishment of closed-loop commercial scenarios, integrating“hardware + content + services” to create their own product barriers. Current Situation Currently, the domestic market is still in a phase of barbaric growth dominated by price wars, with products priced below 300 yuan accounting for 60% (FoloToy Cactus, Eye-catching Bag, etc.). The pain point is thatthere is severe homogenization, with 70% of products on the market merely upgrading their voice packages, with few breakthroughs in technology. However, under this barbaric growth,the online sales of AI toys in China have surged by 300% year-on-year, bringing about early prosperity. Not to exaggerate, Japan has a product calledLOVOT that is ahead of the curve, featuring a 360-degree panoramic camera, simulating life characteristics (body temperature, breathing fluctuations, blinking), capable of recognizing emotional information and interacting. It can be said to truly leverage the advantages of AI toys. Of course, the price is also quite attractive, at 30,000 yuan. LOVOT From this perspective, domestic AI toys still have significant development space.Upgrade Path Technologically, with the upgrade of electronic skin, bionic technology, and multi-modal interaction capabilities, products similar to LOVOT can gradually be domestically produced, significantly reducing the cost of AI toys. In fact, LOVOT’s profit margin currently exceeds 70%, but as AI toys become more intelligent, the target customer base will expand to include young adults and even the elderly, who have higher purchasing power. If the experience is good enough, they will be more willing to accept high-priced products. Algorithmically, current algorithms are more focused on emotional recognition, with facial expressions being recognizable over 80%, which will greatly enhance emotional experiences and significantly improve product experiences. In terms of IP, there are already many domestic products making strides, such as the Super Wings co-branded version from Alpha Group, which has a markup of over five times, and the Tom Cat combining large models to tell stories, check the weather, and serve as a mental support, priced close to 2000 yuan. Similar IPs like Disney can also command very high premiums. On the platform side, giants like Xiaomi and Tencent have their own large model databases, personalized content generation capabilities, and their own ecological series. For instance, Tencent has its own game IP. Imagine if Byte’s AI toy takes a photo, it could generate a video story or plot, or if an educational platform uploads a child’s test paper, it could generate a personalized animated course, etc. Of course, returning to the technology itself, comparing several capabilities, the first is multi-modal interaction, the second is emotional recognition algorithms, and the third is personalized content generation. Hardware-wise, it relies on computing power. Currently, edge computing chips struggle to support complex emotional models, possibly relying on cloud computing. Additionally, battery life is a challenge, especially for outdoor toys, due to the input and output of multi-modal content. Future Space Institutions predict that in the short term, the commercialization direction of AI toys, besides sales itself, will revolve around subscription services. By 2025, subscription service revenue is expected to exceed 50%. In 2023, the global toy market is valued at 773.1 billion yuan, with China accounting for 14%. Institutions predict that the penetration rate of AI toys will increase from 12% in 2023 to 19% in 2028, with an annual growth of 15%. In China, 2024 is expected to be the explosive year for AI toys, with the market size projected to reach 165.5 billion yuan by 2028. Key Focus Areas In the short term, focus on those that have successfully achieved profitability through subscription models, such asFoloToy, with a hardware profit margin of 28% and a subscription service gross margin of 82%. Tom Cat plans to launch an “AI Growth Package,” with an annual fee of ¥999 that includes exclusive course development. In the medium term, pay attention to the competition for data assets. For example, each LOVOT collects an average of 2300 interaction data points daily, which will be a core asset in the future. Additionally, toy manufacturers collaborating with educational institutions can generate children’s behavior reports valued at 150 yuan each. In the long term, focus on new species and new technologies, such as the bionic skin developed by the UK company SynTouch, which has reduced the cost of tactile sensors to ¥50 per square centimeter, and Arduino’s launch of AI toy development kits, with the number of developers increasing by 400% in six months.Appendix: AI Toy Industry Chain

LOVOT From this perspective, domestic AI toys still have significant development space.Upgrade Path Technologically, with the upgrade of electronic skin, bionic technology, and multi-modal interaction capabilities, products similar to LOVOT can gradually be domestically produced, significantly reducing the cost of AI toys. In fact, LOVOT’s profit margin currently exceeds 70%, but as AI toys become more intelligent, the target customer base will expand to include young adults and even the elderly, who have higher purchasing power. If the experience is good enough, they will be more willing to accept high-priced products. Algorithmically, current algorithms are more focused on emotional recognition, with facial expressions being recognizable over 80%, which will greatly enhance emotional experiences and significantly improve product experiences. In terms of IP, there are already many domestic products making strides, such as the Super Wings co-branded version from Alpha Group, which has a markup of over five times, and the Tom Cat combining large models to tell stories, check the weather, and serve as a mental support, priced close to 2000 yuan. Similar IPs like Disney can also command very high premiums. On the platform side, giants like Xiaomi and Tencent have their own large model databases, personalized content generation capabilities, and their own ecological series. For instance, Tencent has its own game IP. Imagine if Byte’s AI toy takes a photo, it could generate a video story or plot, or if an educational platform uploads a child’s test paper, it could generate a personalized animated course, etc. Of course, returning to the technology itself, comparing several capabilities, the first is multi-modal interaction, the second is emotional recognition algorithms, and the third is personalized content generation. Hardware-wise, it relies on computing power. Currently, edge computing chips struggle to support complex emotional models, possibly relying on cloud computing. Additionally, battery life is a challenge, especially for outdoor toys, due to the input and output of multi-modal content. Future Space Institutions predict that in the short term, the commercialization direction of AI toys, besides sales itself, will revolve around subscription services. By 2025, subscription service revenue is expected to exceed 50%. In 2023, the global toy market is valued at 773.1 billion yuan, with China accounting for 14%. Institutions predict that the penetration rate of AI toys will increase from 12% in 2023 to 19% in 2028, with an annual growth of 15%. In China, 2024 is expected to be the explosive year for AI toys, with the market size projected to reach 165.5 billion yuan by 2028. Key Focus Areas In the short term, focus on those that have successfully achieved profitability through subscription models, such asFoloToy, with a hardware profit margin of 28% and a subscription service gross margin of 82%. Tom Cat plans to launch an “AI Growth Package,” with an annual fee of ¥999 that includes exclusive course development. In the medium term, pay attention to the competition for data assets. For example, each LOVOT collects an average of 2300 interaction data points daily, which will be a core asset in the future. Additionally, toy manufacturers collaborating with educational institutions can generate children’s behavior reports valued at 150 yuan each. In the long term, focus on new species and new technologies, such as the bionic skin developed by the UK company SynTouch, which has reduced the cost of tactile sensors to ¥50 per square centimeter, and Arduino’s launch of AI toy development kits, with the number of developers increasing by 400% in six months.Appendix: AI Toy Industry Chain

This article is compiled based on publicly available information and does not constitute investment advice.

Investment Research Uncle focuses on uncovering real and reliable first-hand information in the industry,

Following is effortless; missing out on news you want to see would be a pity!

Recent Popular Articles

Tariff Countermeasures, Don’t Rush to Cut Losses!

Laser Radar Expected to Explode

April Securities Firms’ Gold Stock Summary