The emergence of new energy vehicles and intelligent connected cars has brought one of the biggest changes to the automotive industry by accelerating the widespread application of automotive semiconductors. Looking at the market, currently, whether it is the indispensable IGBT power devices in new energy vehicles or the onboard sensors and T-boxes necessary for the development of autonomous driving, all rely on chip drives, thus driving the global automotive semiconductor market into a new round of explosive growth.

According to relevant statistics, the number of chips installed in an ordinary new car has increased from 550 in 2013 to 616 in 2016, with the value of onboard chips in each car soaring to $350. In the past three years, the global automotive chip market has been growing rapidly at a compound annual growth rate of 11%, and it is expected that the market size will reach $28.8 billion in 2017. Among them, in the field of new energy vehicles, the cost share of automotive electronic products has reached over 60%, and it is expected to continue to increase in the future.

Against this background, both traditional automotive semiconductor manufacturers and semiconductor companies from other fields are actively laying out onboard chips, either focusing on power devices needed for new energy vehicles to further enhance new energy vehicle technology, or innovating in key technologies such as onboard sensors and computational analysis to promote the ultimate realization of autonomous driving. However, overall, the focus on autonomous driving still dominates.

Driven by the “Three Transformations”, Infineon’s Automotive Chip Revenue Continues to Grow

With the increasing popularity of ADAS (Advanced Driver Assistance Systems) and new energy vehicles, as well as significant improvements in autonomous driving and vehicle networking technology levels, an increasing number of automotive functions, such as human-machine interaction systems and onboard sensors, are beginning to be integrated onto chips to provide better performance and superior control capabilities for vehicles. In this process, automotive semiconductors are gradually becoming an increasingly inseparable part of the automotive industry chain, profoundly influencing the future direction of the industry.

The continuous improvement of the automotive semiconductor market is directly benefiting onboard chip providers. According to Ralf Bornefeld, Vice President of Infineon’s Automotive Electronics Division and General Manager of the Sensor and Control Business Unit, under the backdrop of the automotive industry’s “electrification + intelligence + connectivity” development, the market share in the fiscal year 2016 achieved growth.

“In-depth analysis shows that our performance growth is mainly benefited from the development of new energy vehicles and ADAS and AD (autonomous driving),” Ralf Bornefeld told reporters from Gaishi Automobile, and then carefully analyzed the main profit growth points in various sub-sectors.

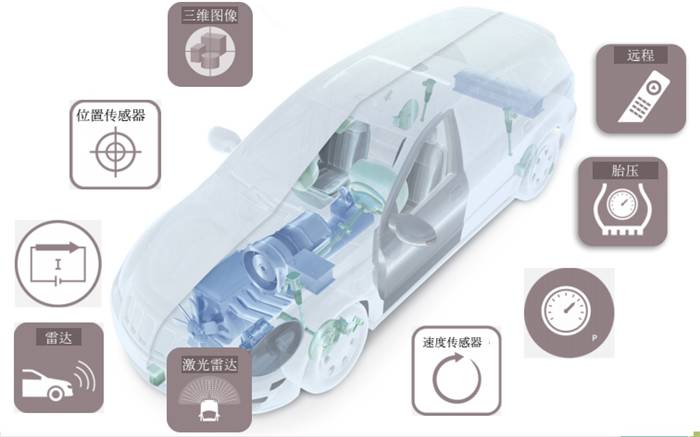

“Specifically, in 2016, our market share in the automotive sensor field was 12.5%, ranking second globally. The main growth points in this area are radar devices, especially 24GHz and 77GHz radar, as well as 3D graphic sensors. In the microcontroller field, the main growth sources are components related to ADAS, AD (autonomous driving), and powertrains. In terms of power devices, growth is driven by the continuous increase in the penetration rate of xEV (including pure electric and hybrid vehicles), which has a significant demand for power devices. Additionally, there is also substantial market growth in EPS (Electronic Power Steering) and automotive lighting fields.”

Focusing on Three Major Areas to Promote the Realization of Autonomous Driving

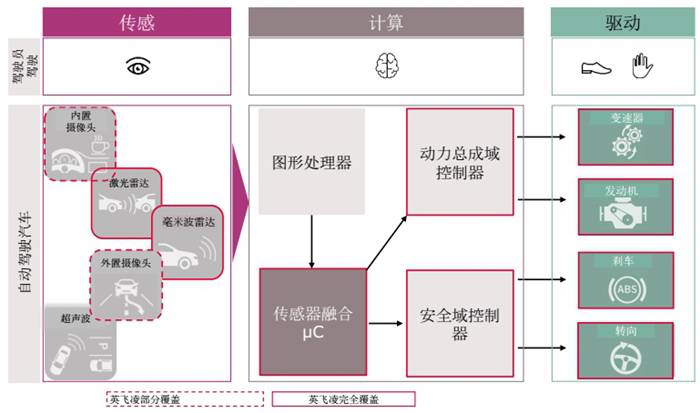

In the process of developing automotive semiconductor-related products, many semiconductor companies are currently adopting a “two-legged” approach, focusing simultaneously on the fields of new energy vehicles and autonomous driving, and Infineon is no exception. In the field of autonomous driving, Infineon mainly focuses on three major technologies: sensing, computing, and driving for chip development to support the mass production of autonomous vehicles.

“First, in terms of sensing, we have a wide range of sensor products, including LiDAR, millimeter-wave radar, 3D sensors, current sensors, position sensors, tire pressure sensors, and related sensor fusion solutions. Additionally, driving is also our strength, especially in areas such as transmission control, engine control, as well as braking and steering. We already have relevant power devices and a complete set of chip solutions available for our partners.”

Particularly, the 77GHz millimeter-wave radar is a significant consideration for many semiconductor companies in terms of cost reduction. However, Infineon applied it to a Porsche Cayenne back in 2009 and has since been installed in several models such as Golf, POLO, and Smart, achieving full coverage from high-end cars to mid-range and low-end cars. Infineon offers a comprehensive range of radar products, with detection ranges covering short, medium, and long distances, and has successfully initiated large-scale mass production.

“On the 77GHz millimeter-wave radar, we have two major technological innovations. First, we have adopted Ge-Si technology, which is already quite popular in high-frequency radar, but applying it to 77GHz millimeter-wave radar is currently done by only two companies globally, and we are one of them. Second, we use eWLB packaging technology, making it easy to integrate into systems during production, which can bring about a cost reduction of approximately 30%.” Ralf Bornefeld said, “It is particularly noteworthy that these two technologies are all developed and produced in-house without outsourcing to ensure high performance and quality of the products.”

Additionally, Infineon is currently developing the next generation of Ge-Si technology to apply it to some mid-to-high-end radar products to provide better performance for radar sensors. Meanwhile, regarding the CMOS technology adopted by other manufacturers, Ralf Bornefeld revealed that Infineon will also launch related products to meet customer demand for this technology. “After all, Ge-Si technology makes it difficult to integrate microprocessors and sensors onto one chip, while CMOS technology can easily achieve this. Given the cost-driven aspect, I believe that for a period of time, both CMOS and Ge-Si technologies will coexist.”

As for the 3D sensors, it is reported that Infineon’s current products are mainly used for in-car monitoring, such as driver monitoring, passenger monitoring, and gesture recognition applications to enhance driving safety and optimize operations. Among them, gesture recognition is already in use by partners, while the other two applications are still under discussion.

Regarding sensor fusion, Ralf Bornefeld believes that fusion is essential for promoting the mass production of autonomous vehicles. Earlier this year at the CES International Consumer Electronics Show in Las Vegas, Infineon showcased relevant products, demonstrating how to achieve autonomous driving using technologies like 77 GHz radar and LiDAR, automotive monitoring 3D cameras, and wireless software updates (SOTA).

“It is particularly worth mentioning that, since we have our own microprocessors and radar products, we can ensure good compatibility between them, making sensor fusion relatively simple under these conditions. At least when the sensor collects the information, the safety of the data and the functional safety of the system will be guaranteed to a certain extent. As for the algorithms, specialized companies like NVIDIA and Intel provide those.”

However, this does not mean that Infineon does not conduct any research on algorithms. Ralf Bornefeld explained that for algorithms related to the hardware products that Infineon can provide, such as how the signals established by radar are transmitted to the microcontroller, how the microcontroller preprocesses the received signals, or performs preliminary functional safety and information security certifications, as well as how to help partners integrate Infineon’s electronic components into their systems… Infineon can provide all these algorithms. But for how to integrate and compute the collected environmental information after the sensor has fully gathered it, that is up to the vehicle manufacturers or Tier 1 suppliers to consider.

From ADAS to Autonomous Driving: Redundant Systems Are Key

As the year 2021, the year of mass production for autonomous driving, approaches, more and more companies are developing detailed timelines to promote the mass production of autonomous driving, and Infineon is no exception. It is understood that in the field of autonomous driving, in addition to products like the 77GHz millimeter-wave radar that are already being supplied in large quantities on the market, Infineon has many products still under development.

“By 2019, we will further improve the entire radar product line to support more autonomous vehicle needs from short-range, medium-range to long-range. Additionally, based on the 77GHz millimeter-wave radar, our low-cost LiDAR products will also be launched soon. Compared to existing LiDAR products, this new product will be smaller in size and will integrate more system application chips to achieve system integration. After all, the functionality of a single sensor is limited; only by fusing different types of sensors can we better meet the needs of future autonomous vehicles.”

Besides radar products, Ralf Bornefeld stated that Infineon will also have the next generation of microprocessors—AURIX 2G (second generation 32-bit microcontroller). It is reported that this product is a multi-core chip that is faster than the first generation AURIX and will greatly improve radar processing speed and work efficiency when combined with Infineon’s radar products. However, overall, for car manufacturers to leap from ADAS to autonomous driving, there is still a long way to go, and one of the key points is to have a redundant system. Why is that?

“The difference from ADAS to autonomous driving is actually from equipping a single sensor to having a redundant system. As the automation level of cars increases, the number of sensors onboard will also increase. Perhaps for L1 and L2, a single camera or radar can complete environmental perception to achieve partial ADAS functions. But by the time we reach L3, L4, or even L5, a single sensor will not be enough; multiple cameras and radars may be needed to both ensure the completeness of the collected environmental information and to create a redundant system that ensures at least one system is functioning normally under any circumstances.” Ralf Bornefeld stated.

“From this perspective, redundant systems are a framework that ensures autonomous vehicles can operate normally even in failure modes and are one of the key points in creating fully autonomous vehicles. Moreover, the higher the level of autonomous driving, the higher the redundancy of the system will be.”

-

2017 Automotive Companies Half-Year Report Card: Korean Brands Plummet, Japanese Brands Flourish

-

June Passenger Vehicle Sales Ranking: Great Wall Exits, SAIC Volkswagen Maintains First Place

-

June Automotive Sales Ranking Released: The New Buick Crowned Champion

-

The Most Comprehensive Animation of Automotive Components Working Principles: Understanding It Makes You an Automotive Expert

-

Overview of New Factories and Capacity Layout of Mainstream Automotive Companies in China and Abroad in Q2 2017

-

Analysis of the Automotive Transmission Industry Chain and Supplier List

-

Overview of New Factories Launched by Mainstream Automotive Parts Companies in Q2 2017

-

2017 Latest Global Top 100 Automotive Suppliers: 5 Chinese Companies Make the List

-

Analysis of Automotive Electronic Stability Control System Industry Chain and Supplier List

-

Distribution of Vehicle Manufacturing Bases in Various Provinces and Cities Across the Country

-

2017 Global Top 10 Automotive Brands by Brand Value: Toyota Tops BMW and Mercedes-Benz

-

List of the 35 Most Profitable Connector Manufacturers Worldwide

-

Directory of 850 New Energy Vehicle Industry Chain Companies (Complete Vehicle + Battery + Motor + Electric Control + BMS + Charging Piles, etc.)

-

Analysis of New Plant Layouts and Capacity Data of Six Luxury Brands in China

-

Analysis of Automotive Engine System Supply Chain and Supplier List

-

Distribution of New Energy/Emerging Intelligent Manufacturing Bases in Various Provinces and Cities in China

▼ Click here to see more exciting articles from Gaishi