Author: Wu Nü Wang (Peng Zhao)

IoT Think Tank Original

Please indicate the source and origin when reprinting

Introduction

There has always been a “gap” between the IIoT cloud platform and the industrial site. This year may be the year when this gap is continuously filled, reshaping the market landscape. Let’s start by addressing the “gap” issue with three questions.

This is my 111th article written in the [Wu Nü Heart Sutra] column.

The golden pig of 2019 is about to roll in, and today I prepare to have some fun before it arrives, using this article to “equip” my curiosity. Regarding the transition from the old year to the new, blessings, and visions, I have already explained clearly in the previous article, so I won’t ramble here and will directly enter the IoT field that concerns me the most – industry.

Because there has always been a “gap” between the IIoT cloud platform and the industrial site.

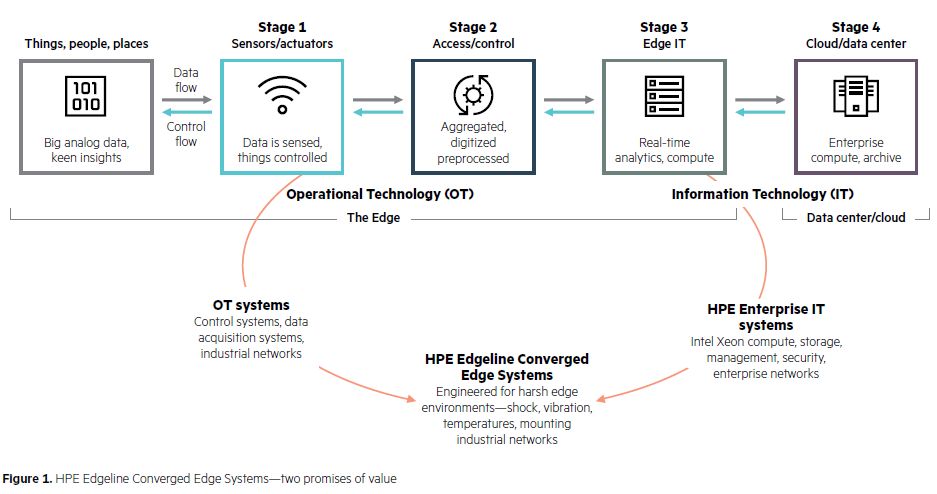

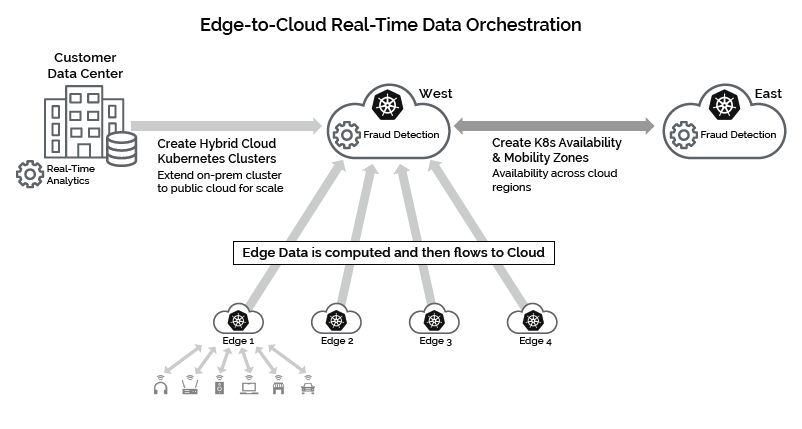

A large amount of industrial data should not be uploaded to the IIoT cloud platform but should be processed locally in real-time and exchanged at high frequency, with only the relevant decision-making data uploaded to the cloud. The trained algorithms and models should also be deployed as close to the site as possible and kept updated at all times. This requires that the “bridge” between the cloud and the site not only be responsible for communication but also possess computing and analysis capabilities.

The more complex the site, the larger the amount of data, and the higher the demand for computing.

I am curious about how this “gap” will be filled? Once curiosity is sparked, it spreads continuously, leading to three seemingly unrelated questions:

-

First, I wonder how Siemens implements AI in industrial settings?

-

Secondly, what is the shipment volume of edge intelligent servers?

-

Finally, what is the next step for the industrial IoT?

However, as my thoughts deepen, these three questions are actually deeply interconnected. Let’s slowly discuss the underlying logic.

How does AI land in industrial settings?

Why specifically focus on Siemens?

Not only because it is a giant in industrial automation, but also because this German company’s approach has always been steady, differing from the recent “big and small” industrial 4.0 trends, focusing more on creating actual value.

Using a comparative method to be pragmatic, MindSphere, which is also an industrial IoT IIoT platform, is gradually establishing its position in the market, while its former partner GE Predix has not been so smooth. Although Siemens’ MindSphere was launched later than GE Predix, it was not affected by Predix’s “hasty” approach, and business progress has been orderly.

From Siemens’ latest financial report, it confirms that MindSphere has not been hampered. In the first quarter of fiscal year 2019 (October 1, 2018 – September 30, 2019), Siemens’ digital factory business revenue grew across the board.

During a time when major industry players like Apple, Nvidia, and Ford are blaming poor performance on the Chinese market, Siemens calmly states that they still maintain double-digit growth in the Chinese market.

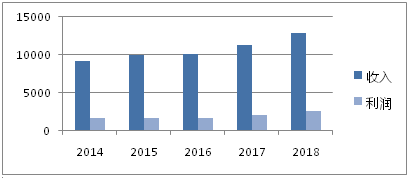

Analysis of Siemens’ digital factory business total revenue and profit from fiscal years 2014-2018 (in million euros)

Returning to the topic of how AI lands in industrial settings.

I believe I am not the only one particularly curious about this question. Because the carrier for AI to take root is an important missing link in the IIoT landscape.

As mentioned at the beginning, the “gap” between the IIoT cloud platform and industrial settings is currently generally filled by small controllers and industrial gateways. From the current state of computing capabilities, these devices have extremely limited computing and storage capabilities. If we compare them to smartphones, controllers and gateways are in the “feature phone” stage and have not yet reached the enlightenment of “smartphones”.

Edge Intelligence Servers (EIS) or products of similar “size” are the most likely hardware carriers to bring AI capabilities to the front line.

There is reason to believe:

As the neural center closest to the site, the importance of EIS servers will be greater than that of controllers, gateways, and various actuators.

Integrated hardware and software solutions are Siemens’ specialty. In the current situation where the profitability model of the IIoT cloud platform is not yet clear, the Germans will certainly not be easily brainwashed by the “free model” but will calmly explore methods for “making money steadily.” Since the launch of MindSphere, the main products on the edge side have been MindConnect IoT2040 (priced at about 2000 RMB) and MindConnect Nano (priced at about 8000 RMB), which clearly have significant expansion potential.

Therefore, I am very curious about how Siemens handles the carrier issue of edge intelligence.

Artificial intelligence, unmanned devices, and edge computing have always been listed as innovative research directions in Siemens’ financial reports. From a series of recent actions, it appears that Siemens’ R&D investments are already showing results.

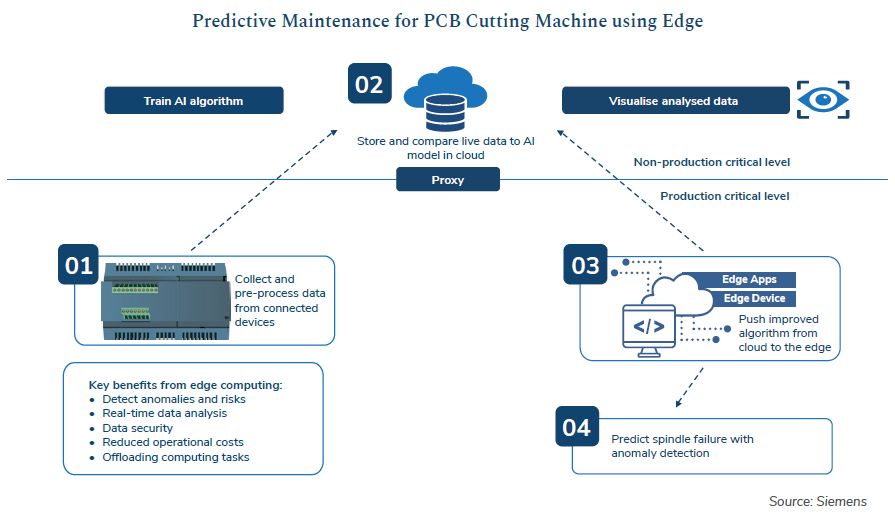

For example, in the Amberg electronic manufacturing plant (EWA), a milling machine is occasionally jammed by fine dust, causing unexpected machine downtime without a predictable rhythm. Siemens used its industrial edge platform to analyze the operating parameters of the machine, achieving predictive maintenance for this device. According to estimates, it can save 200,000 euros in losses each year.

On the surface, the hardware carrier of this industrial edge platform is the embedded industrial computer SIMATIC IPC227E. Upon a second glance, aside from the more comprehensive software features and management interface, it doesn’t seem to have much innovation.

However, one cannot judge the true strength of the industrial edge platform solely by its appearance; its value lies precisely in the invisible parts. It is a complete solution deployed on the edge using cloud-native thinking, capable of global unified scheduling and management, coordination between cloud platforms and edges, and software functionality updates and distribution at any time.

After all, the core of edge intelligence is not the various hardware devices we see, but the overall solution that fully integrates and schedules various computing resources to maximize production efficiency.

This system can be seen as Siemens’ further attempt towards IT thinking, which will inevitably trigger a new round of imitation.

What is the shipment volume of EIS servers?

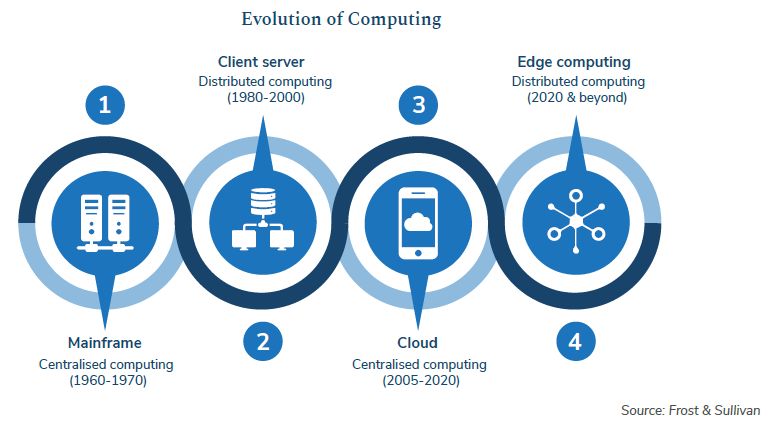

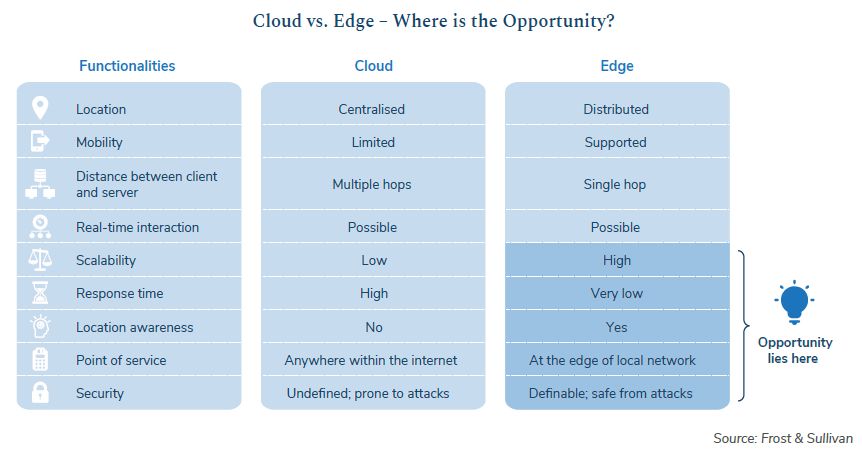

In the white paper on edge computing completed by Siemens in collaboration with Frost & Sullivan, the important position of the edge is highlighted. Edge intelligence will become a new revenue growth point following cloud computing. This has become a consensus within the industry over the past year or two.

The cloud computing field has been monopolized by major giants such as Amazon, Microsoft, Google, and Alibaba, while the competition for edge intelligent devices has just begun. Visionaries like Siemens certainly know that opportunities must not be missed!

Industrial scenarios differ greatly from commercial scenarios; IT is merely a tool for achieving intelligence, while Know-How remains within the industry itself. Engineers in each vertical industry have accumulated valuable experience over decades. Compared to flashy algorithms and innovative technologies, the industry is more concerned with basic configurations like stability, safety, and reliability, while it must also create real value for users.

Quick response to reduce latency, alleviate cloud pressure, save bandwidth costs, and ensure on-site safety are qualities that are extremely important in industrial settings. In the context of a continuously declining market, how to quickly improve production and sales is the most critical assessment indicator for enterprises.

Industrial edge platforms are more practical than IIoT cloud platforms because they are closer to the front line.

However, not only Siemens is launching EIS servers and similar products. HPE and Dell have also taken steps in this direction.

For computer server manufacturers like Dell and HPE, edge intelligence may represent an opportunity for rebound and rise. As more and more business workloads shift to the public cloud, spending on internal data centers has decreased.

Many established IT companies are closely monitoring the rise of edge intelligence.

I am very curious about the shipment volume of EIS servers from these companies.

HPE was one of the first companies to launch EIS servers and has invested $4 billion in smart edge technology. They have established laboratories in multiple locations to study the combined applications of 5G and edge intelligence, and have partnered with platforms such as SAP HANA, PTC ThingWorx, GE Digital, Microsoft Azure, and Spark Cognition to explore landing in more industrial scenarios.

The Edgeline compact EIS server series launched by HPE indeed meets specific market needs, designed for harsh environments, capable of withstanding significant impacts and vibrations, with a wider temperature range, suitable for space-constrained edge environments. The EL300 in this series is priced at about $2,500, and the Edgeline OT Link software platform was launched in early 2019.

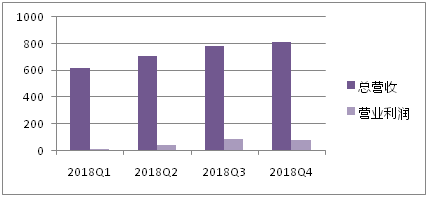

Since the first quarter of fiscal year 2018, HPE has separately reported the revenue of its smart edge business, including Edgeline, and has maintained a year-on-year growth rate of over 10%.

Analysis of HPE’s smart edge business total revenue and profit for each quarter of fiscal year 2018 (in million dollars)

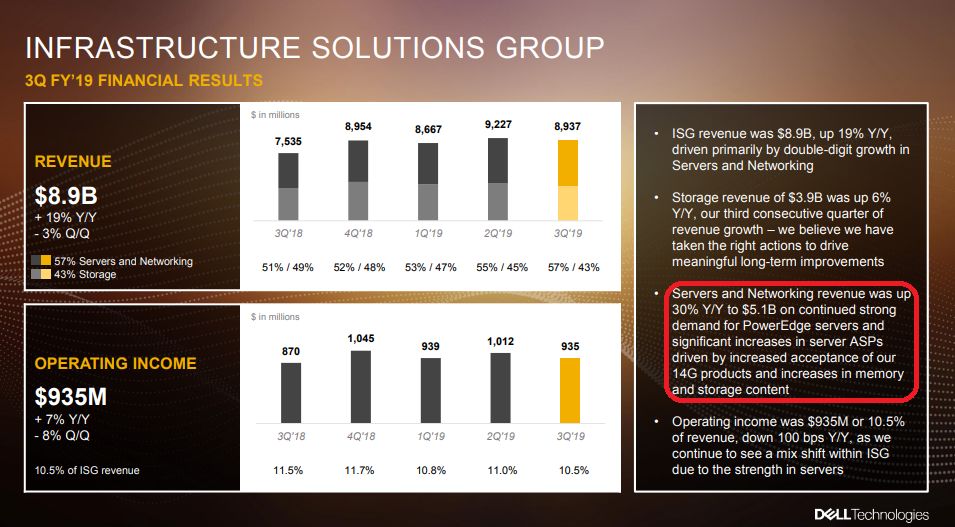

Dell has been deeply involved in the open-source edge computing platform EdgeX Foundry and is continuously updating new servers for edge computing. Currently, the PowerEdge server has been updated to the 14th generation. Revenue from PowerEdge is included in its ISG infrastructure solutions business, and according to Dell’s official statement, its sales revenue has maintained double-digit growth for six consecutive quarters.

In the fourth quarter of 2018, Cisco launched its first server built specifically for artificial intelligence, the UCS C480ML, and is reportedly building dedicated servers for the edge.

It is evident that to seize the opportunities in edge intelligence, OT and IT enterprises will have a direct encounter in the EIS server field.

Industrial enterprises are generally conservative and will not hastily try something new before the solution has been verified by the market. Therefore, for EIS servers and similar products, both product and sales are equally important.

Siemens, well aware of this, has explored a complete methodology in the sales of integrated hardware and software systems. They use consulting projects as an entry point, packaging EIS servers, edge hardware, and the MindSphere cloud platform according to the characteristics of various industries into a digital factory solution that spans the entire implementation cycle.

In contrast, IT companies often take a product-oriented approach, with each business constructed according to the product system, lacking a deep understanding of various vertical industries and the awareness and capability to package products into solutions for different industries and implement them on a project basis.

This shift in thinking is more challenging than product development, which also determines the complementarity and irreplaceability of the two.

What is the next step for IIoT?

The combination of IIoT cloud platforms and edge intelligence is becoming a set of combination punches for industrial IoT enterprises.

Therefore, I am very curious about how the industrial IoT, equipped with both cloud and edge, will take the next step, how fast it will move, and how far it can go?

By understanding a company’s development direction through internal R&D or external investments, we can see that the first few companies to enter the EIS server field, whether Siemens, HPE, Dell, or Cisco, are all adept at investing and acquiring. In 2018, their investment preferences became increasingly similar.

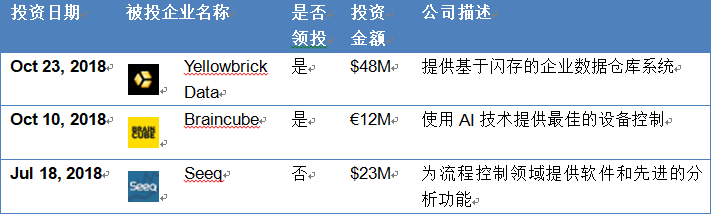

Siemens’ investments in startups are conducted through its independent business unit next47, based on the overall development of Siemens. Investments related to digital factories in 2018 included Yellowbrick Data, Braincube, and Seeq.

To accelerate the landing of MindSphere, Siemens completed the acquisition of the low-code application development platform Mendix in the first quarter of fiscal year 2019.

Overseas, Siemens has not labeled MindSphere as “industrial” but has allowed it to flourish in fields such as smart cities, intelligent transportation, and smart buildings.

After acquiring Aruba Networks, HPE completed the acquisition of Cape Networks in 2018. Cape Networks is a company that provides sensor-based network assurance solutions. This acquisition enhances HPE’s capabilities in AI-driven networks on the edge, proactively notifying IT personnel of issues before they impact customers or business.

Dell participated in the B round of venture capital for Foghorn, which was founded in 2014 and has focused on edge analytics and edge intelligence, becoming one of the fastest-growing startups in the edge computing field. Foghorn embraced cloud-native concepts early on and built microservices based on containers.

Cisco is steadily advancing the “pipeline” strategy and has just announced the acquisition of Singularity Networks, which collects and analyzes network data to help service providers, network companies, and enterprises improve network performance, manage costs, and reduce downtime.

Companies that have not yet launched EIS servers do not mean they won’t enter the market this year. On the contrary, the edge intelligence market is likely to undergo significant changes in the next year or two, even reshaping the landscape.

Looking at the entire industrial IoT landscape, in the map composed of cloud-pipe-edge, each company has its strengths. OT companies like Siemens excel in edge hardware devices, IT companies like HPE specialize in server R&D and deployment, Cisco excels in network communication, and an increasing number of cloud computing giants are leveraging their advantages to move towards edge intelligence.

Finally, I am curious about who will be the next to launch EIS servers?

Key Takeaways:

-

Edge intelligent servers EIS or products of similar “size” are most likely to bring AI capabilities to the front line. As the neural center closest to the site, the importance of EIS servers will surpass that of controllers, gateways, and various actuators.

-

The core of edge intelligence is not the various hardware products we see, but the overall solution that fully integrates and schedules various computing resources to maximize production efficiency.

-

Companies that have already launched EIS servers are maintaining double-digit growth in related businesses, and companies that have not yet launched EIS servers do not mean they will not enter the market.

Popular Articles (Click on the title to read directly):

-

[Wu Nü Heart Sutra | Written on the 6th Birthday of the IoT Think Tank] IoT is a career worth your lifelong investment

-

[Wu Nü Heart Sutra | The Birth History of the “Internet of Things” Unicorn]

-

[Wu Nü Heart Sutra | Brewing a $100 Billion Scale Second Vision Fund, is Son Masayoshi going to be the Godfather of the Intelligent Era?

-

[Wu Nü Heart Sutra | GE’s Bumpy Road in Industrial Internet, will Foxconn try to go all the way?

-

[Wu Nü Heart Sutra | A Comprehensive Look at Industrial Big Data, More and More Companies are Turning Data Value into Cash]