BOE Knowledge Cool 👆Display Technology | Display News | PPT | Knowledge Management

Produced by DAS BG CTO Knowledge Management

Article No. 659

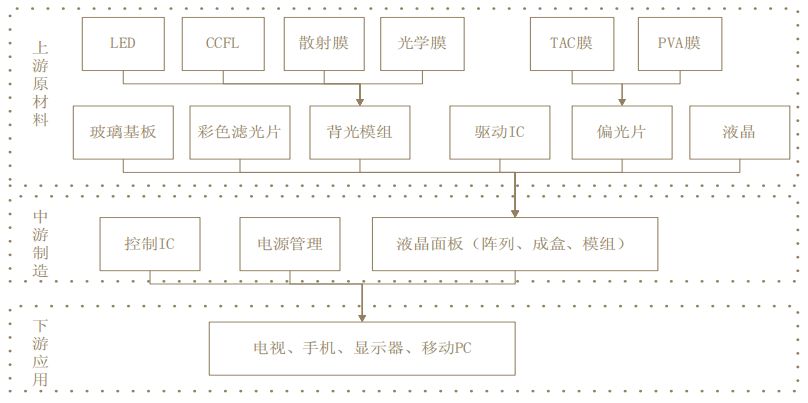

The panel industry primarily refers to the touch display panel industry used in electronic devices such as televisions, desktop computers, laptops, and mobile phones. In today’s information age, the role of information display technology in social activities and daily life is increasingly significant, with 80% of human information acquisition coming from visual sources. The interaction between various information system terminal devices and people is achieved through information display. The panel industry has become a leader in the optoelectronic industry, second only to the microelectronics industry in the information sector, making it one of the most important industries.

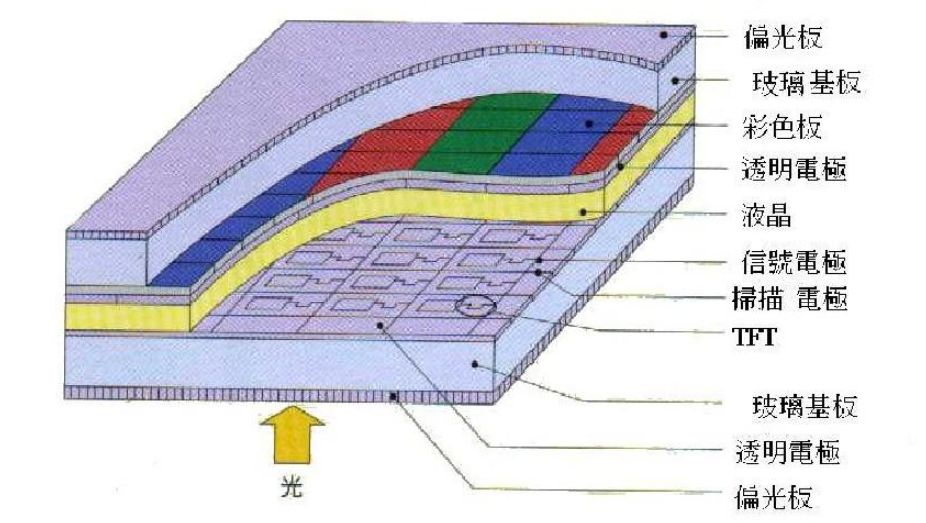

The main display panel products include liquid crystal panels (TFT), plasma panels (PDP), and organic light-emitting diode panels (OLED).

The production of LCD panels for televisions is one of the most critical links in the television industry and serves as the foundation of the entire industry.

Upstream of the industry chain lacks bargaining power

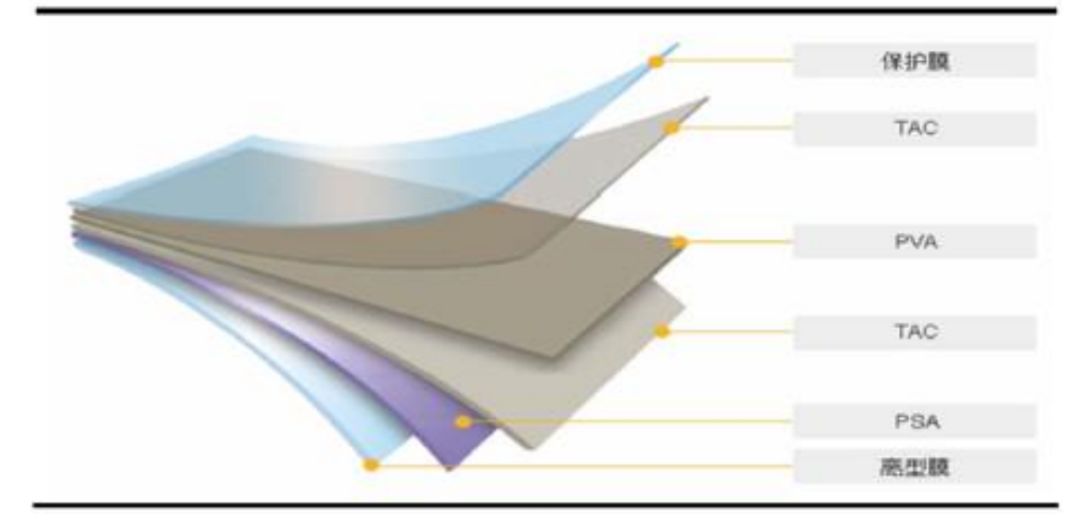

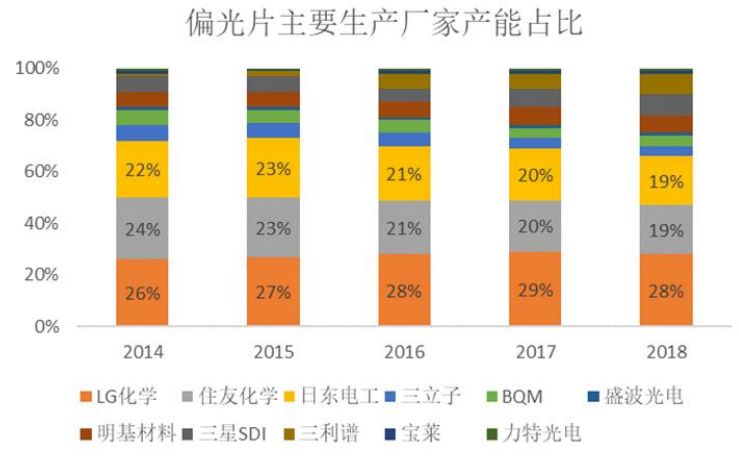

Looking at the current development status of the upstream and downstream of the display panel industry chain, most of the resources in the upstream are controlled by a few companies in Japan, South Korea, and Taiwan. For example, polarizers are a type of polymer material made from polyvinyl alcohol (PVA) film and triacetate cellulose (TAC) film through stretching, compounding, and coating processes, and are one of the key raw materials for liquid crystal display panels. It is worth noting that the core technologies for producing the key raw materials PVA and TAC films are strictly controlled by Japanese and American companies. Although mainland companies have the capability to produce PVA and TAC films, their permeability and thickness lag behind those of Japanese companies to some extent, and the quality shortfall of raw materials is one of the reasons for the low display quality of display panels.

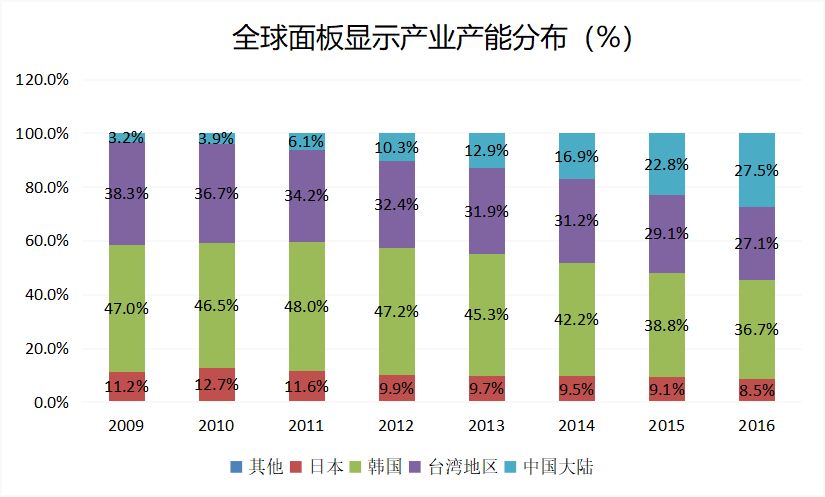

In the midstream of the industry chain, mainland TFT-LCD manufacturers are quite strong, with the world-leading display panel manufacturer BOE (000725) emerging. In recent years, multiple high-generation TFT-LCD lines have been put into production. According to DisplaySearch data, in a comparison of global panel display industry capacity shares in 2018, the capacities of Japan, South Korea, and Taiwan showed a gradual decline, while mainland China’s capacity increased from 3.2% in 2009 to 27.5% in 2016, accounting for more than a quarter of the global total, indicating a clear advantage for China in this field.

Data Source: BOE

Data Source: Display Search & BOE MRI

Representative companies in the upstream raw materials industry, both domestic and international

Image Source: Changhong

The rise of the domestic panel industry

In the early stages, China’s panel industry was constrained by technology, making the path forward quite challenging. Due to technological barriers, several introduced production lines were eliminated due to untimely technological updates, significantly reducing the competitiveness of domestic companies.

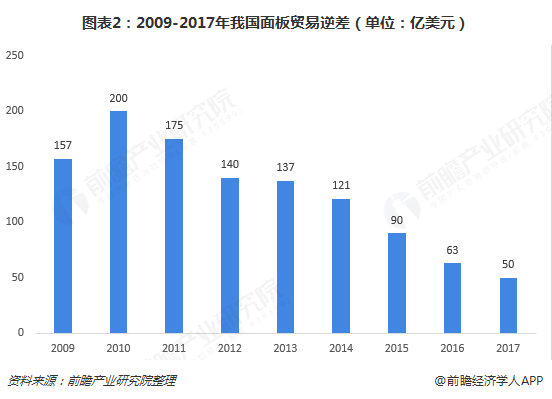

China’s LCD panel industry has long relied on imports, with a trade deficit reaching $20 billion in 2010. With the efforts of domestic panel manufacturers, the localization process of LCD panels has accelerated, and the trade deficit is decreasing year by year. By 2017, it had dropped to around $5 billion. In the future, with new production lines established by domestic panel manufacturers like BOE, the trade deficit is expected to shrink further. The integration capability of China’s panel industry chain continues to break through, with domestic products gradually replacing foreign products.

Concentrated in economically developed and technologically strong regions

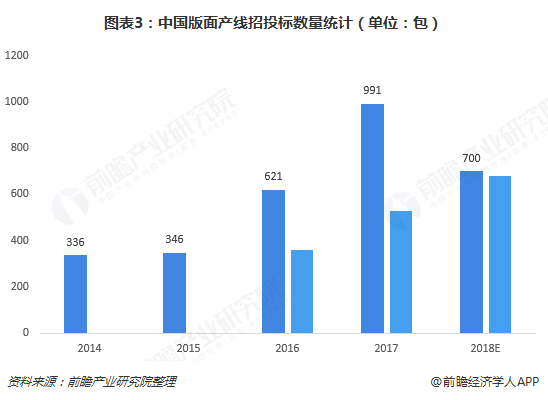

With the development of domestic panel technology and benefiting from a favorable investment environment, China has successfully achieved the transfer of global LCD panel production capacity. Although traditional panel powerhouses still have technological advantages, with strong support from the Chinese government and continuous breakthroughs in R&D by domestic companies, the integration capability of China’s panel industry chain will continue to improve, and production capacity will expand. In 2014, the number of equipment purchases for panel production lines in China was only 336 packages for TFT-LCD. It is expected that in 2018, the number of equipment purchases for domestic panel production lines will be approximately 700 packages for TFT-LCD and about 680 packages for the 6th generation AMOLED production lines.

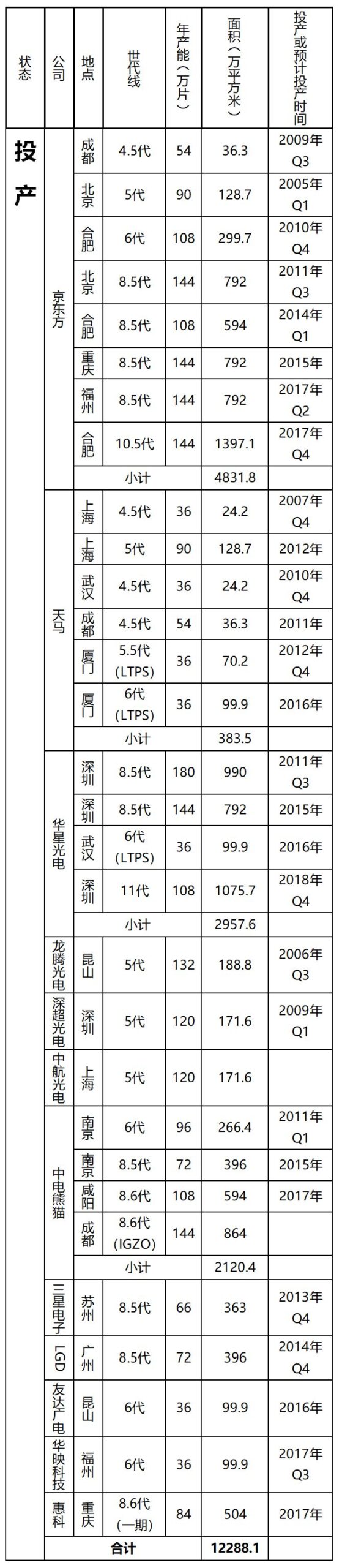

From the recent capacity planning of domestic panel manufacturers, BOE, China Electronics Panda, and Huike Electronics have all contributed to the transfer of panel capacity to China.Domestic panel manufacturers are continuously strengthening their capabilities, and China’s production capacity in the global panel market cannot be ignored.

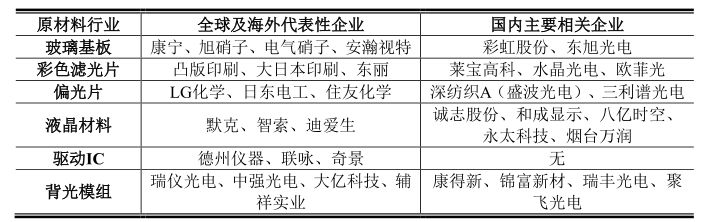

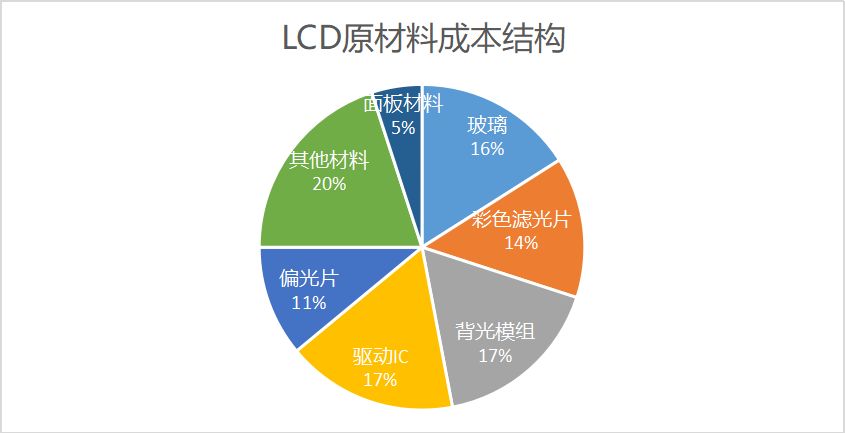

The six major raw materials required for producing LCD panels in the midstream of the industry chain are glass substrates, color filters, polarizers, liquid crystal materials, driver ICs, and backlight modules. Except for color filters, the other raw materials are heavily reliant on imports, resulting in low self-sufficiency rates. The previously mentioned polarizers account for 11% of the total raw material costs. Additionally, glass substrates, as one of the important raw materials for TFT-LCD production, have high requirements for chemical composition, performance, and production processes, and have long been monopolized by a few companies such as Corning in the United States and Nippon Electric Glass in Japan. Over time, the costs are expected to decrease.

Representative companies in the upstream raw materials industry, both domestic and international

Image Source: BOE Bond Prospectus

Representative companies in the upstream raw materials industry, both domestic and international

Image Source: Sanli Paper Prospectus

The core raw materials for producing polarizers, PVA film and TAC film, need to be imported, which restricts the production capacity of domestic manufacturers due to the supply cycle of raw materials and fluctuations in currency exchange rates.

Data Source: Industry Information Network

Image Source: Sanli Paper Prospectus, Tianfeng Securities Research Institute

From the capacity share of the main polarizer manufacturers shown in the above chart, it is found that domestic companies such as Sanli Paper and Shengbo Optoelectronics have a relatively small share in capacity. According to IHS data, in 2016, Sanli Paper’s polarizer capacity accounted for 6% of the global total. Meanwhile, LG Chem, Sumitomo Chemical, and Nitto Denko accounted for 28%, 21%, and 21% of the global market, respectively.

Imbalance in supply and demand for display panels

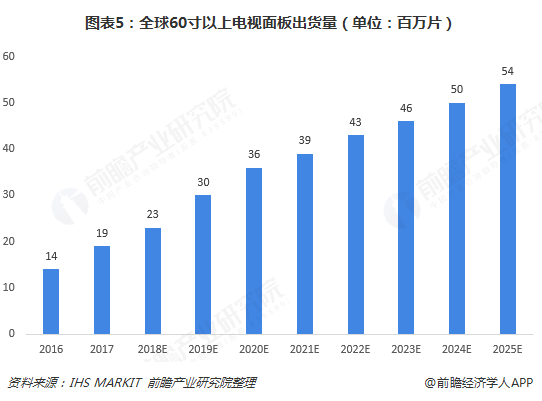

2017 marked the beginning of the era of ultra-large displays, with major panel manufacturers investing more resources to produce panels larger than 60 inches. However, the significant increase in production capacity for ultra-large panels will not be realized until 2019 and beyond when production lines for ultra-large panels come online.

According to IHS Markit data, the specifications of panels are accelerating towards ultra-large sizes and ultra-high definitions. It is expected that by 2019, global shipments of television panels larger than 60 inches will reach 30 million units, and by 2025, this number will reach 54 million units. From 2016 to 2025, the total share in terms of shipment area is expected to triple, increasing from 12% to 33%.

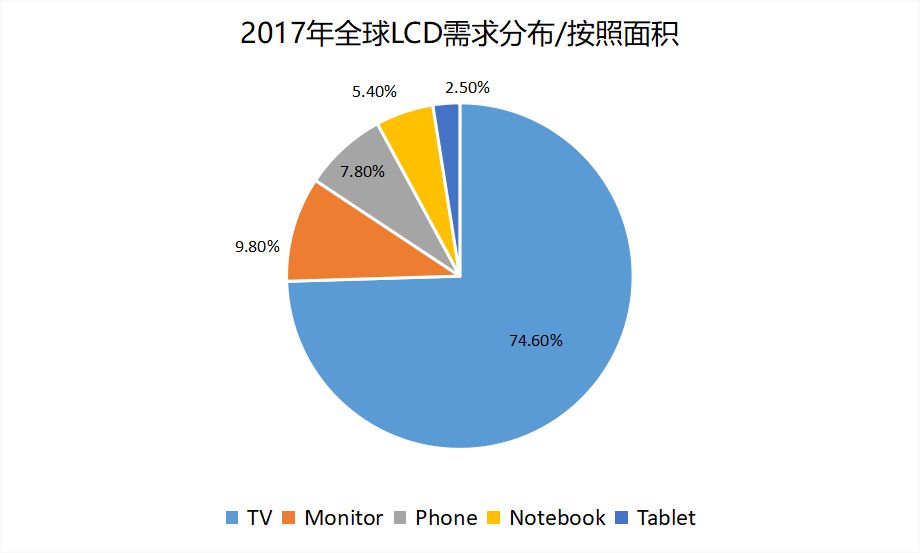

As TFT-LCD panels replace CRTs to become the mainstream display panels, the trends of larger screens and thinner designs have become mainstream in consumer electronics (televisions, laptops, and smartphones). In televisions and smartphones, there is a growing pursuit of “narrow bezels” for full-screen displays to enhance screen area. Currently, the demand for TFT-LCD primarily comes from four major consumer electronic products: televisions, monitors, smartphones, and laptops, with televisions and monitors corresponding to large-size panels, while smartphones and laptops correspond to medium and small-size panels.

Data Source: Qunzhi Consulting, IHS, Guoxin Securities Economic Research Institute Forecast

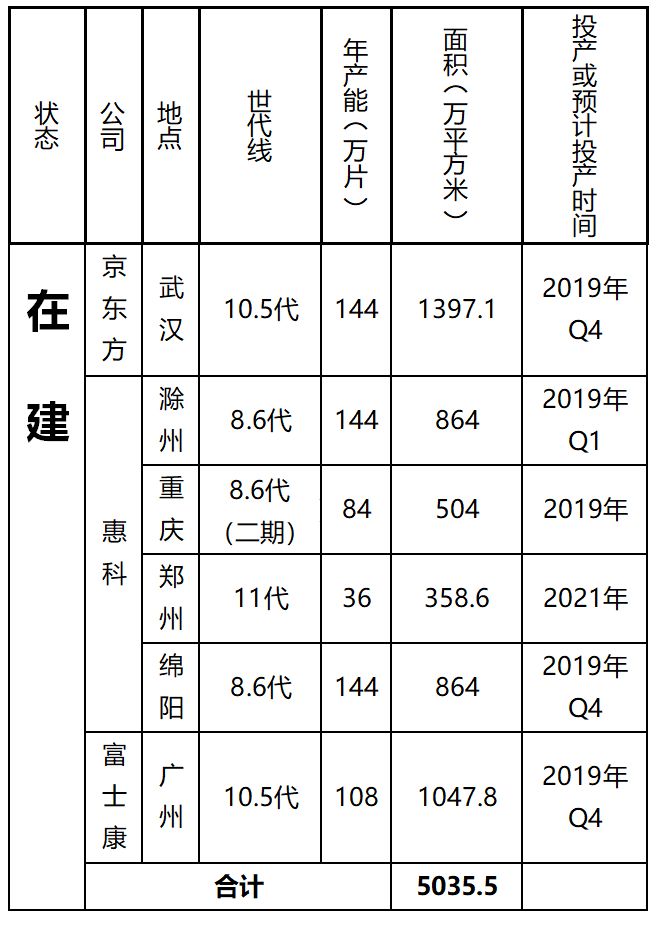

The supply-demand relationship for TFT-LCD panels remains in a state of oversupply. The following table shows the current and under-construction LCD panel generation lines in mainland China as of the first quarter of 2019. Based on the currently operational data, the supply scale of the LCD panel market in mainland China is approximately 12,288.1 million square meters per year. Additionally, there are 5,035.4 million square meters per year of LCD capacity under construction.

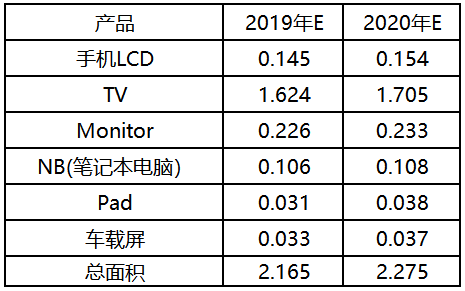

The following data is based on estimates from the Guoxin Securities Economic Research Institute, predicting that the total demand area for LCDs will grow at rates of 4.24% and 5.08% for 19/20 years.

The expected global LCD demand area for 2019-2020 is shown in the following table:

Unit: 100 million square meters/year

Data Source: Guoxin Securities Economic Research Institute

Capacity consumption is expected to be one of the important factors affecting the future panel industry. Upgrading technology and product iteration are effective methods for reducing capacity in the display panel industry. With the advantages of labor cost, capital, and policy support, China’s display panel industry is expected to gradually stabilize in the future.

Source: Guoan Long Nest

| BOE Knowledge Cool · The only knowledge public account of BOE |

Exciting material downloads

Follow BOE Knowledge Cool, and reply in the public account dialog box with keywords such as OLED, 8D, 8K, workplace skills,team leader, knowledge management to obtain relatedhighly valuable thematic articles.

Recommended reading:

-

What happens when a laptop meets a foldable screen?

-

[Useful] How far does the industrialization of graphene touch screens have to go to replace ITO?

-

What is the commonly used PWM frequency in OLED?

BOE Knowledge Cool

The only technical public platform of BOE