This article will sort out the basic definitions, hardware composition, application scenarios, industrial chain structure diagram, upstream and downstream industry analysis, key domestic enterprises, etc., for reference.

It refers to the cameras installed inside or outside the car, serving as core perception sensors, which achieve real-time acquisition of image information through lenses and image sensors to monitor the internal and external environment of the vehicle to assist the driver in safe driving.

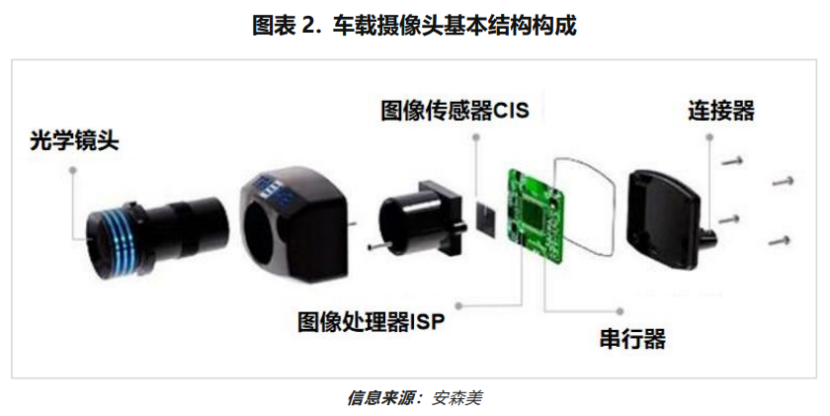

The automotive camera module mainly includes optical lenses, image sensor CIS, image signal processor ISP, serializer, and other components.

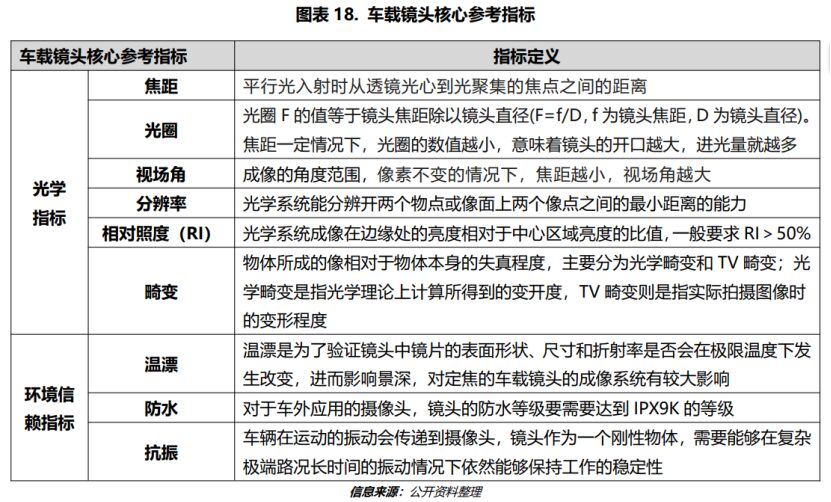

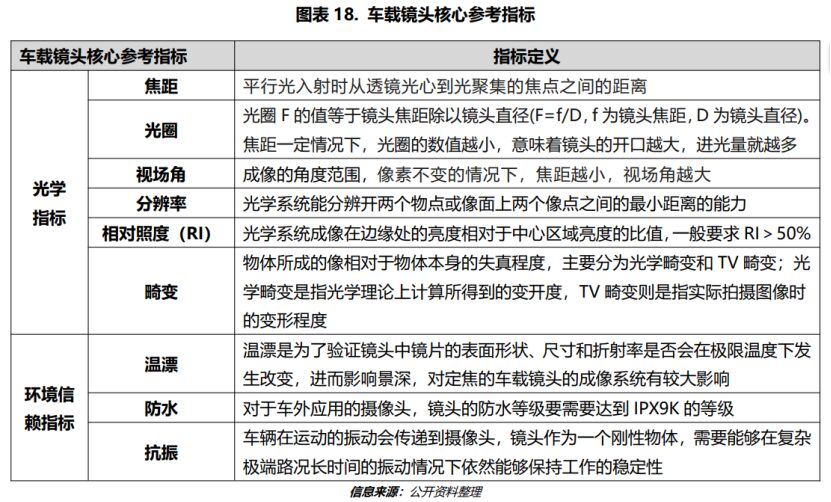

1) Lens:It consists of optical lenses, filters, protective films, etc. The lens is responsible for focusing light, projecting objects in the field of view onto the imaging medium surface, thereby generating optical images. Generally speaking, 70% of the optical parameters of the camera are determined by the lens. The lens is usually made up of multiple optical lenses, and the materials of the optical lenses mainly include plastic (P) and glass (G). Currently, automotive lenses mainly include two types: glass-plastic hybrid lenses and glass lenses. Among them, surround and cabin cameras mostly use glass-plastic hybrid lenses, while front view, side view, and CMS cameras mostly use all-glass lenses.

2) Image Sensor CIS:That is the imaging medium, which uses photoelectric conversion elements to convert the optical signals projected onto the CIS surface by the lens into electrical signals. Common image sensors are mainly divided into CCD and CMOS types. Overall, CCD sensors outperform CMOS sensors in terms of sensitivity and image quality. However, CMOS sensors outperform CCD sensors in terms of power consumption, size, and cost. Currently, automotive cameras generally use CMOS chips.

3) Image Signal Processor ISP:Processes the RAW format data output from the image sensor CIS, mainly including functions such as image scaling, auto exposure (AE), auto white balance (AWB), auto focus (AF), image denoising, etc., and finally converts it into RGB, YUV, and other format data. There are two forms of ISP inside the camera module: A- built-in within CMOS; B- independent chip configuration.

4) Serializer:Converts parallel signals into serial signals. Usually, the signals output after processing by the image sensor CMOS or image processor ISP are based on MIPI /CSI standards, with short transmission distances, so they need to be converted into serial signals suitable for long-distance transmission. Currently, the commonly used serializers are Maxim’s GMSL 2 standard and TI’s FPD-Link standard.

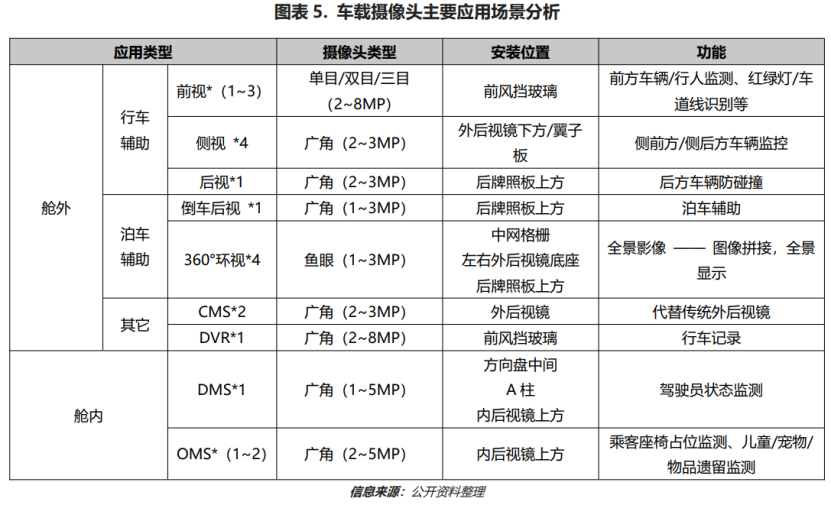

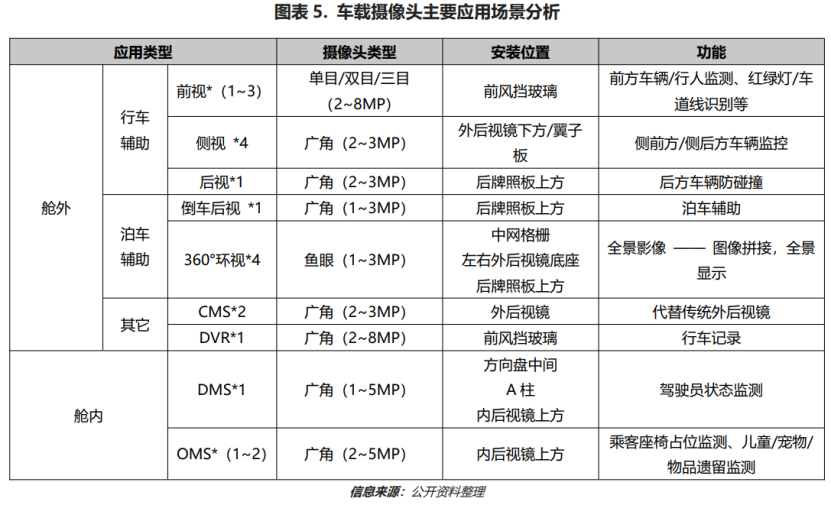

The application scenarios of automotive cameras can be divided into two categories: external applications and internal applications. External applications include parking assistance, driving assistance, CMS, DVR, etc.; internal applications include DMS, OMS, etc.

Industrial Structure Diagram

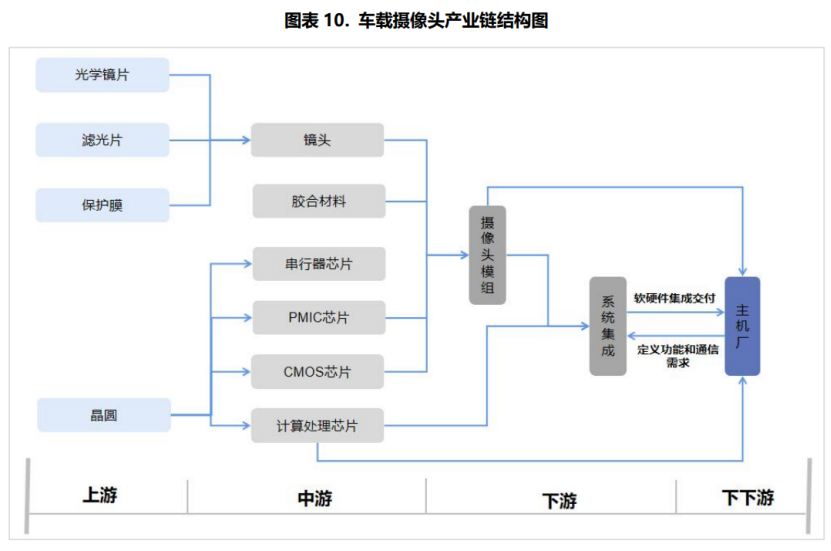

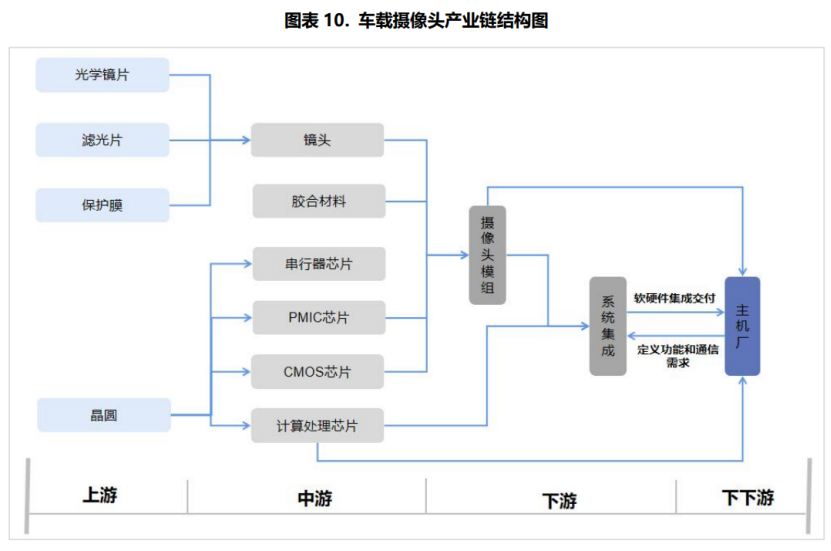

The entire industrial chain of automotive cameras can be divided into:

Upstream: Manufacturers of raw materials such as optical lenses, filters, protective films, and wafers.

Midstream: Manufacturers of lenses, adhesive materials, serializer chips, PMIC chips, CMOS chips, computing processing chips, etc.

Downstream: Camera module suppliers and system integrators.

Further downstream: OEMs.

Upstream Industry Analysis

The upstream companies of automotive lenses mainly include manufacturers of optical lenses, filters, and protective films, whose main business is raw material processing, and respectively produce lenses, filters, protective films, and other basic components; the upstream raw materials for CMOS chips, computing processing chips, PMIC chips, and serializer chips are silicon wafers.

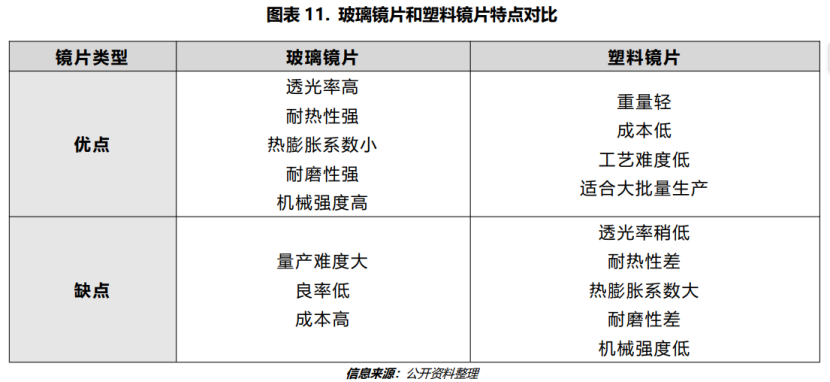

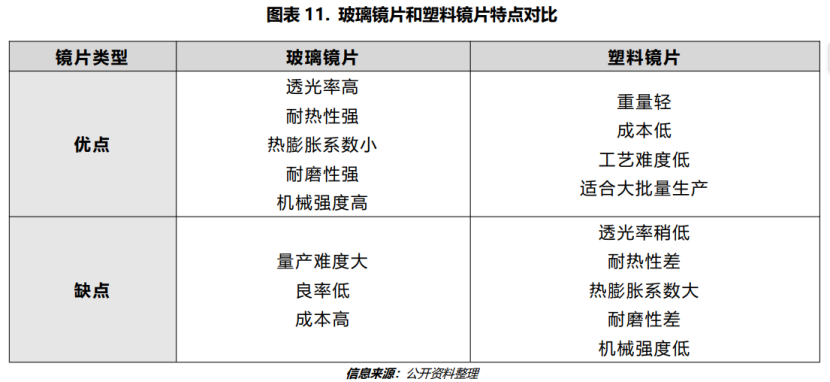

Optical lenses can be divided by material into: plastic lenses and glass lenses. Plastic lenses have a large expansion coefficient, poor wear resistance, and heat resistance. In harsh environments, lenses are prone to deformation, affecting imaging quality. The advantage is that the lenses are lightweight and cheap. Considering performance and cost, automotive lens manufacturers usually adopt a mixed form of plastic and glass lenses to make glass-plastic hybrid lenses. Glass lenses have the advantages of high light transmittance, heat resistance, and wear resistance, but the cost is higher, and mass production is difficult.

Optical lenses can also be divided by shape into: spherical lenses and aspherical lenses. Currently, the shapes of plastic lenses used in automotive lenses are basically all aspherical; for glass lenses, both spherical and aspherical types are applied. Spherical lenses: simple design but poor optical performance, with aberration problems, that is, the focal points of light rays entering from the center of the lens and those entering from the edge are inconsistent, leading to blurry images. Using multiple lenses in combination can reduce aberration. Aspherical lenses: high precision requirements and complex processes, but good imaging effects, and can eliminate aberration problems. By changing the curvature of the lens, the light rays converge at a fixed focal point. Aspherical plastic lenses are produced using injection molding technology, while aspherical glass lenses are produced using hot pressing technology. Currently, domestic companies capable of producing aspherical glass lenses for automotive cameras include Sunny Optical, Lianchuang Electronics, and Lante Optics.

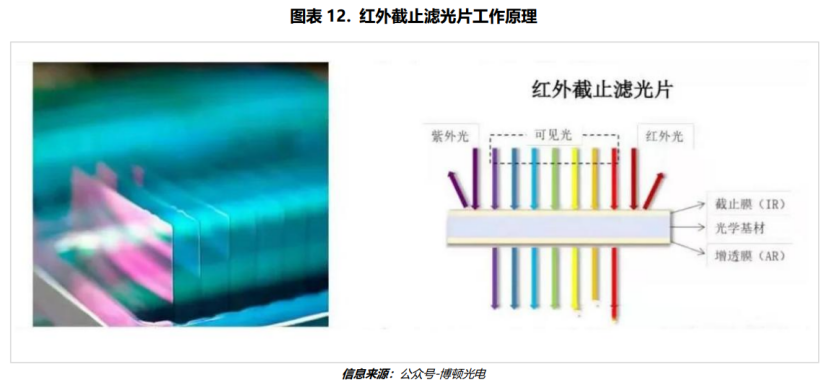

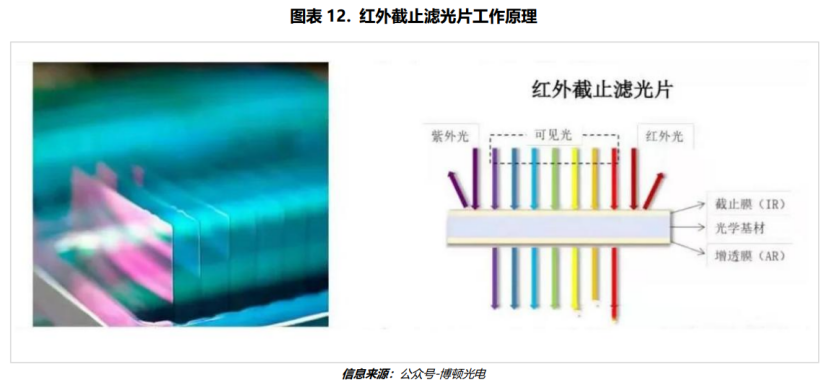

2) Infrared Cut-off Filters

Infrared cut-off filters (IRCF) utilize precision optical coating technology to alternately coat high and low refractive index optical films on optical substrates such as white glass, blue glass, or resin sheets, allowing light in the visible spectrum (400~700nm) to pass through while cutting off infrared light, thus eliminating the influence of infrared light on imaging and improving image color reproduction, making it closer to what the human eye sees.

The main materials for infrared filter substrates include three types: white glass, blue glass, and resin materials. Among them, filters with white glass and resin materials as substrates belong to reflective filters, which effectively reflect infrared rays and some other light by coating IR films on the substrate surface, but are prone to secondary imaging of reflected light, causing halo and ghosting phenomena. Therefore, infrared cut-off filters made of these two materials are generally applied in low-pixel cameras.

Filters with blue glass as substrates belong to absorptive filters. Blue glass itself is a special optical absorption material, and the copper ions in the glass absorb infrared rays, and there is no significant reflection, avoiding the occurrence of ghosting and light spots due to reflection and refraction of light in the lens assembly. Infrared cut-off filters based on blue glass substrates are generally used in high-pixel cameras.

The manufacturers of infrared filters are mainly concentrated in Japan, South Korea, and China. The manufacturers in Japan and South Korea include Asahi Glass, Daikin, Nippon Electric Wave, Tanaka Engineering, Otto-Len, etc.; the manufacturers in China include O-Film, Crystal Optoelectronics, Wufang Optoelectronics, and Jingji Optoelectronics.

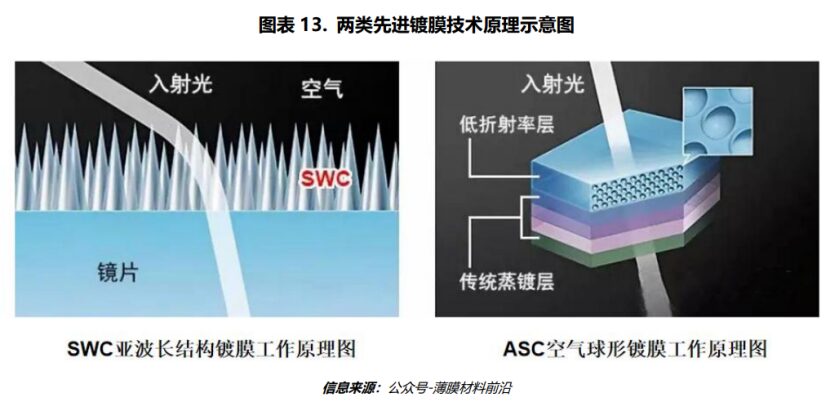

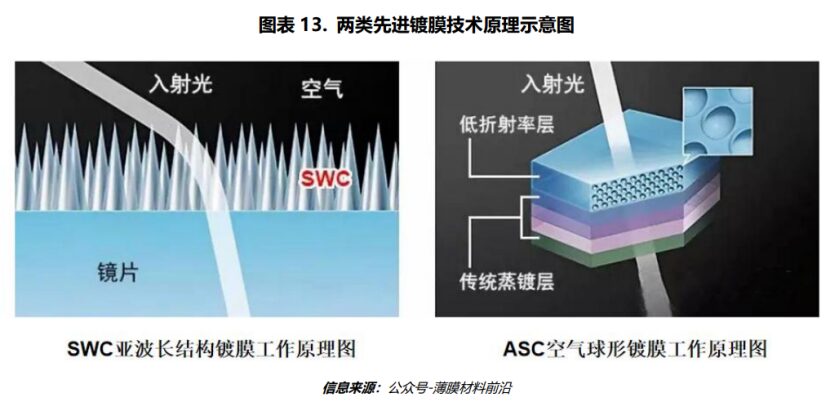

Automotive optical lenses typically consist of 4 to 7 lenses. When light enters the lens through multiple layers of lenses, multiple reflections and refractions occur, which not only lead to a loss of light but may also cause glare and ghosting. By coating protective films on the lenses, the light penetration on the lens surface can be increased, minimizing reflections and refractions to avoid glare and ghosting phenomena. Currently, advanced coating technologies include SWC sub-wavelength structure coating and ASC air-spherical coating.

SWC (Sub-wavelength structure coating): A large number of wedge-shaped microscopic structures smaller than the wavelength of visible light are formed on the lens surface, which can continuously change the refractive index, thus eliminating the boundary where the refractive index suddenly changes, achieving a more ideal reflection suppression effect than vapor deposition coating.

ASC (Air-spherical coating): The coating layer can be divided into two parts – the lower layer is the traditional vapor deposition coating layer, and the upper layer is a low refractive index layer with low refractive index bubbles injected into the layer. In the low refractive index layer, tiny air bubbles smaller than the diameter of visible light are regularly laid out, which can effectively suppress light reflection.

The protective film manufacturers are mainly foreign, including 3M, LG, Nais, Zeiss, etc.; domestic manufacturers include Crystal Optoelectronics, Tianjin Haitai Environmental Protection, etc.

Midstream Industry Analysis

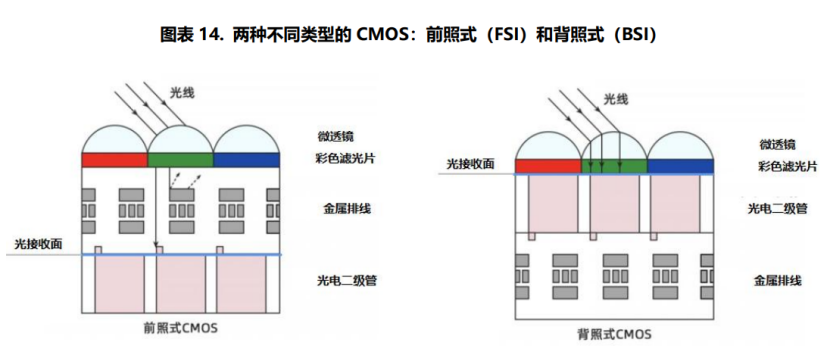

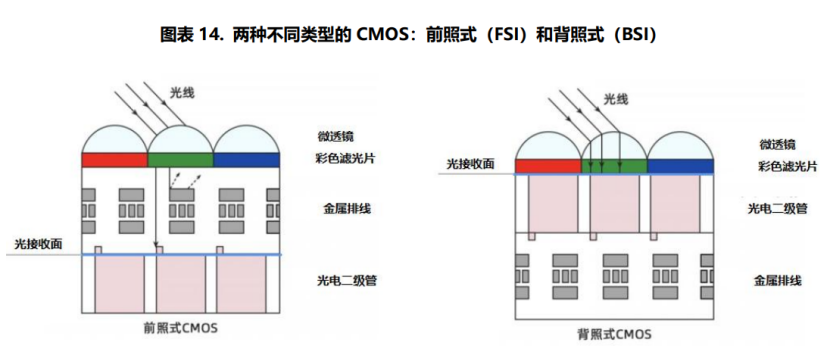

CMOS image sensors are the core components of cameras, responsible for converting the optical signals transmitted from the lens into electrical signals. Structurally, they generally include: microlenses, color filters (CF), metal interconnects, and photodiodes (PD). Depending on the different technical architectures, CMOS image sensors can be divided into three types: front-illuminated (FSI), back-illuminated (BSI), and stacked (Stack). The stacked structure is an improved solution based on the back-illuminated architecture, which separates the light-sensitive element layer as the upper layer, integrates the interconnection layer downward into another board, and then stacks the two together to form a stacked structure. Currently, automotive CMOS image sensors mostly adopt back-illuminated (BSI) technology architecture.

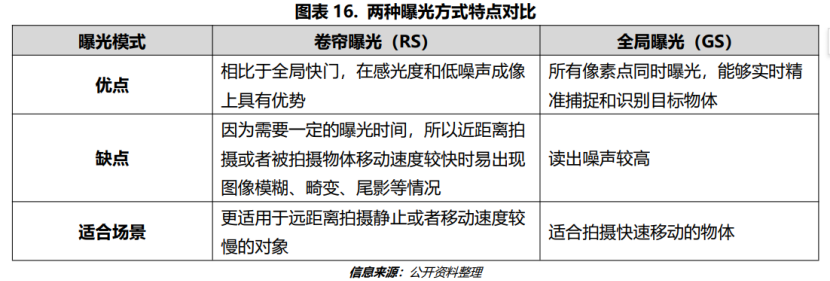

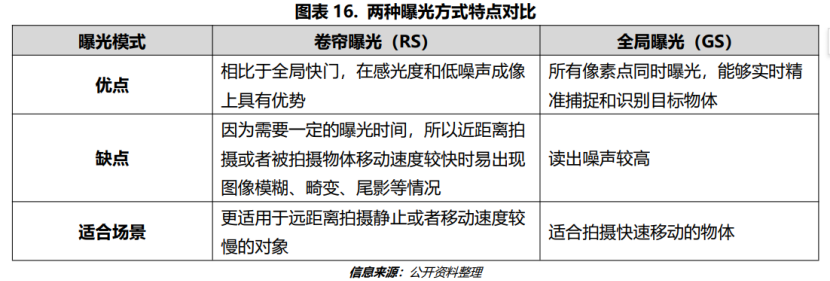

CMOS image sensors have two main shutter exposure modes: rolling shutter (Rolling Shutter) and global shutter (GlobalShutter).

In the automotive CMOS market, representative companies in Europe and America include ON Semiconductor, STMicroelectronics, etc.; representative companies in China include OmniVision, SmartSens, Gekewei, and BYD Semiconductor; representative companies in Japan and South Korea include Sony, Samsung, PixelPlus, and SK Hynix.

Optical lenses are usually composed of multiple lenses, and can be divided into three types based on lens material: plastic lenses, glass-plastic hybrid lenses, and glass lenses. Due to the high durability and stability requirements of automotive lenses, automotive lenses usually select glass-plastic hybrid lenses or glass lenses. Currently, front view, side view, rear view (driving) and CMS type lenses mostly use 6 to 7 glass lenses. Typically, 1 to 3 aspherical glass lenses are used, with the rest being spherical glass lenses. The specific quantity is determined by the application and requirements of the lens. Surround, reverse, and cabin cameras mostly use 5 to 6 glass-plastic hybrid lenses, that is, a combination of aspherical plastic lenses and spherical glass lenses. Typically, 3 to 4 aspherical plastic lenses are used, with the rest being spherical glass lenses, and the specific quantity is also determined by the application and requirements of the lens.

The major global automotive lens companies include Sunny Optical, OFILM, Lianchuang Electronics, Hongjing Optoelectronics, Teles Optics, Yutong Jiuzhou Optics, Phoenix Optics, Advanced Optoelectronics, Zhongshan United Optoelectronics, Asia Optical, Largan Precision, Yujing Optoelectronics, Largan Optics, Maxell, Fujifilm, and Seiko Instruments.

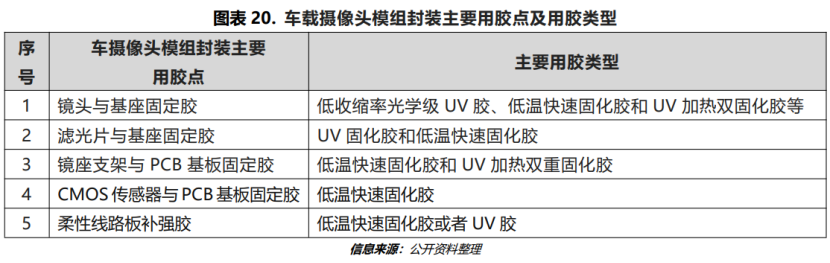

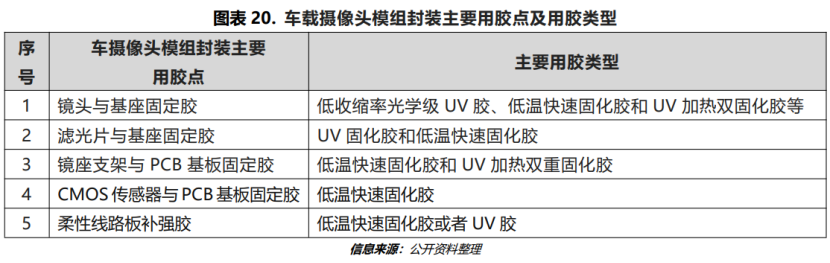

The adhesive materials used in the packaging of automotive camera modules are mainly UV adhesives (Ultraviolet Rays). These are adhesives that require curing through ultraviolet light and can be roughly divided into three types: thermosetting adhesives, dual curing adhesives, and fast curing adhesives.

The major global automotive lens companies include Sunny Optical, OFILM, Lianchuang Electronics, Hongjing Optoelectronics, Teles Optics, Yutong Jiuzhou Optics, Phoenix Optics, Advanced Optoelectronics, Zhongshan United Optoelectronics, Asia Optical, Largan Precision, Yujing Optoelectronics, Largan Optics, Maxell, Fujifilm, and Seiko Instruments.

The adhesive materials used in the packaging of automotive camera modules are mainly UV adhesives (Ultraviolet Rays). These are adhesives that require curing through ultraviolet light and can be roughly divided into three types: thermosetting adhesives, dual curing adhesives, and fast curing adhesives.

Currently, there are many UV adhesive manufacturers, and the market competition is fierce. The mainstream manufacturers are mainly distributed in Europe, America, and Japan, such as Henkel, Dow Corning, DuPont, BASF, 3M, etc.; Japanese manufacturers include Nitto, Nidec, and Epson; domestic UV adhesive manufacturers include Shanghai Yuntong Electronics Technology Co., Ltd. (AVENTK), Shanghai Hanshi Industrial Co., Ltd., and Shenzhen Tianxiang Technology Co., Ltd.

Downstream Industry Analysis

1) Automotive Camera Modules

Automotive camera modules are assembled from hardware components such as lenses, CMOS image sensors, PMIC chips, serializer chips, connectors, and casings.The work of automotive camera module manufacturers generally includes camera structure design, hardware design (schematic design, PCB design, structural block diagram design, etc.), ISP tuning, and module production (AA manufacturing process, reliability verification, etc.).

Among them, the structure design and hardware design determine the performance and functions of the automotive camera module products, and the ISP tuning determines the output quality of the images. By adjusting the ISP parameters, the output images can meet the differentiated needs of different applications and customers. The AA manufacturing process is the core to ensure the precise assembly of the lens and CMOS image sensor, which will affect the final test yield of the camera and is the most important step in the quality assurance of the entire module assembly process.

The domestic suppliers of automotive camera modules can be divided into three types: traditional Tier 1, camera module companies with optical backgrounds, and camera module manufacturers that have transitioned from the mobile phone field to the automotive field. Camera module manufacturers with optical backgrounds include Sunny Optical, OFILM, Yichuang Technology, and Huarui Technology; international Tier 1 include Magna, Continental, Bosch, ZF, Valeo, Denso, etc.; domestic Tier 1 include Desay SV, Jingwei Hengrun, Haon Automotive Electronics, Huayang General, Tongzhi Electronics, Hikvision Automotive, Zhihua Technology, Zongmu Technology, and Furuitai Technology, etc.; mobile camera module crossover companies include Q Technology, Sanyingxing, Xinyi International, and Helitai.

1) Automotive CMOS Chip Manufacturers

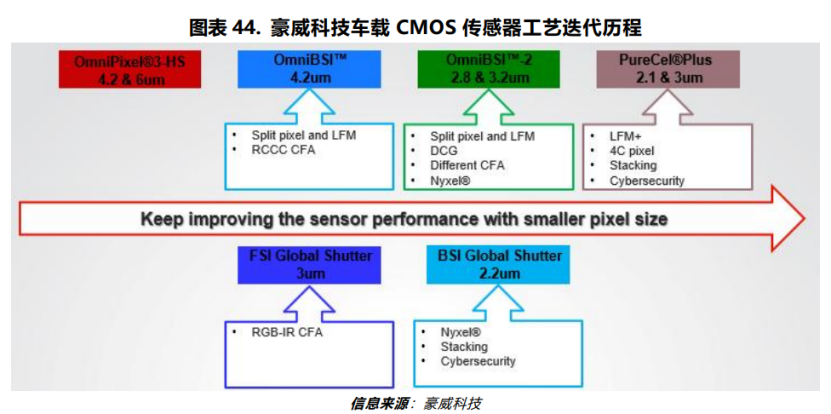

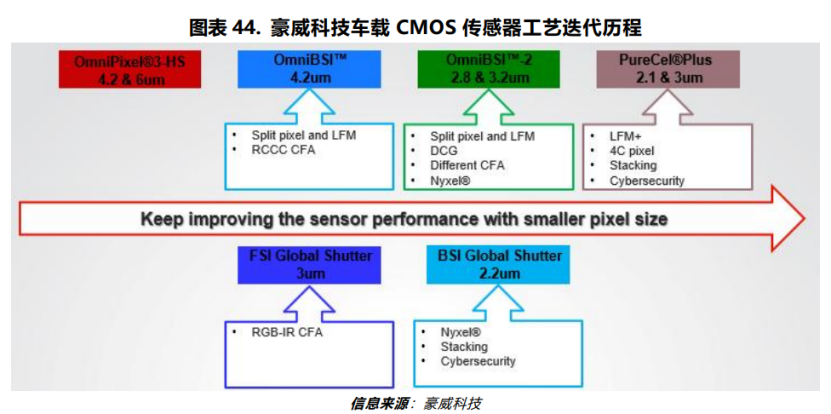

Headquartered in Shanghai, it is one of the leading semiconductor design companies in China. OmniVision Group is committed to providing sensor solutions, analog solutions, and display solutions, serving many fields such as mobile phones, security, automotive electronics, wearable devices, consumer electronics, industrial, and medical. In the field of automotive CMOS image sensors, OmniVision has continuously innovated and has iterated through four generations of processes, namely OmniPixel®3-HS, OmniBSI™, OmniBSI™-2, and PureCel®Plus, with pixel sizes evolving from the original 4.2μm to 2.1μm.

The domestic suppliers of automotive camera modules can be divided into three types: traditional Tier 1, camera module companies with optical backgrounds, and camera module manufacturers that have transitioned from the mobile phone field to the automotive field. Camera module manufacturers with optical backgrounds include Sunny Optical, OFILM, Yichuang Technology, and Huarui Technology; international Tier 1 include Magna, Continental, Bosch, ZF, Valeo, Denso, etc.; domestic Tier 1 include Desay SV, Jingwei Hengrun, Haon Automotive Electronics, Huayang General, Tongzhi Electronics, Hikvision Automotive, Zhihua Technology, Zongmu Technology, and Furuitai Technology, etc.; mobile camera module crossover companies include Q Technology, Sanyingxing, Xinyi International, and Helitai.

1) Automotive CMOS Chip Manufacturers

Headquartered in Shanghai, it is one of the leading semiconductor design companies in China. OmniVision Group is committed to providing sensor solutions, analog solutions, and display solutions, serving many fields such as mobile phones, security, automotive electronics, wearable devices, consumer electronics, industrial, and medical. In the field of automotive CMOS image sensors, OmniVision has continuously innovated and has iterated through four generations of processes, namely OmniPixel®3-HS, OmniBSI™, OmniBSI™-2, and PureCel®Plus, with pixel sizes evolving from the original 4.2μm to 2.1μm.

OmniVision provides corresponding CMOS image sensor solutions for external (parking assistance, driving assistance, CMS) and internal (DMS, OMS) applications, with a product line covering specifications such as 1.3MP/1.7MP/2MP/3MP/8MP.

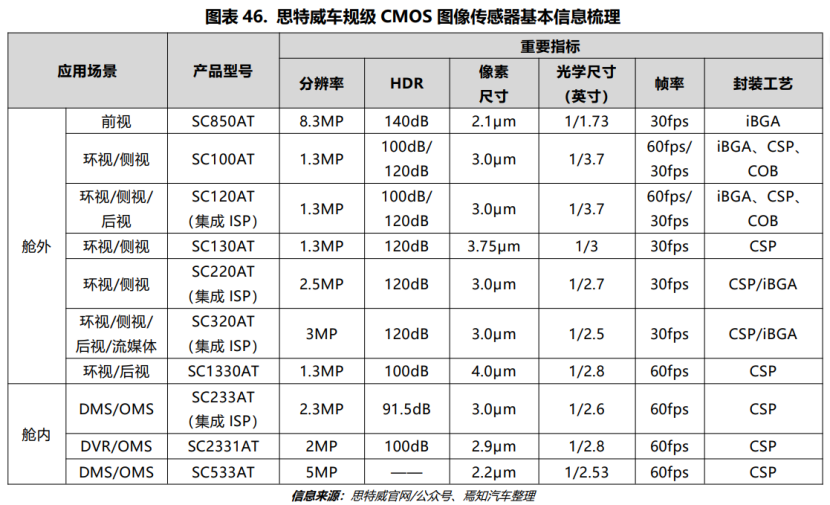

Founded in 2017, headquartered in Shanghai, it is a technology company engaged in the research, design, and sales of CMOS image sensor chips. The company’s products cover various application fields such as security monitoring, machine vision, smart automotive electronics, and smartphones. In 2019, SmartSens began strategic deployment in the front-mounted automotive market and acquired Shenzhen Allchip in June 2020, further strengthening its automotive product line. In 2021, SmartSens established the automotive chip department, focusing on the research and development of automotive-grade CMOS image sensor technology.

Currently, SmartSens has released 11 automotive-grade image sensor products, covering three major series: imaging, ADAS perception, and internal applications, with resolutions ranging from 1MP to 8MP, basically achieving full scene coverage for automotive applications.

2) Automotive Lens Manufacturers

Founded in 1984, it mainly engages in the design, research and development, production and sales of optical and optical-related products. The main products include: optical components (such as automotive lenses, automotive LIDAR optical components, virtual reality spatial positioning lenses, smartphone lenses, digital camera glass spherical lenses, and other optical components), optoelectronic products (such as automotive modules, VR folding optical path modules, VR visual modules, smartphone camera modules, and other optoelectronic modules), and optical instruments (such as intelligent detection equipment and microscopes).

Sunny Optical has a rich product line layout in the field of automotive lenses, including front view, side view, rear view, surround view, internal view, and CMS electronic rearview series automotive lenses. To maintain its leading position in the industry, Sunny Optical adheres to two main strategic directions: continuous R&D innovation in the high-end ADAS lens field to ensure technological leadership. For example, Sunny has completed the development of 8MP all-glass aspherical lens and 17MP front-view automotive lens; in addition, self-developed clear water film defogging and automatic cleaning functions; in the mid-to-low-end lens field, achieve cost-effective solutions through technological innovation. For example, Sunny Optical has overcome the technical difficulties of temperature stability of plastic lenses, completing the development of 2MP front-view and 5MP cabin glass-plastic hybrid lenses.

Founded in 2006, it focuses on developing optical lenses and imaging modules, touch display devices, and other new optical and optoelectronic industries, with products widely used in smart terminals, smart cars, smart homes, smart cities, and other fields. In the field of automotive cameras, Lianchuang Electronics has formed a full-stack solution for automotive camera products, including reversing camera systems, 360 surround systems, advanced ADAS systems, internal monitoring systems, electronic rearview mirrors, etc. The company extends upstream to self-produce molded glass to achieve cost reduction and efficiency improvement, ensuring product yield and supply stability; and extends downstream to jointly develop automotive camera modules with customers, successfully entering the supply chain systems of many Tier 1 and automotive companies, including Valeo, Magna, Aptiv, and automotive companies such as Tesla, NIO, BYD, and Geely.

Established in 2021. In 2015, OFILM began to enter the smart automotive field by acquiring Huadong Automotive Electronics and Nanjing Tianqing, successfully becoming a Tier 1 supplier to domestic OEMs; in 2018, the company acquired Fujifilm’s Tianjin lens factory, further strengthening its layout in automotive lenses. Currently, OFILM relies on its technological advantages in the optical and optoelectronic fields, deeply laying out smart driving, body electronics, and smart cockpits, and extending from optical lenses and cameras to millimeter-wave radar, LIDAR, head-up displays (HUD), and other products.

3) Automotive Camera Module Manufacturers

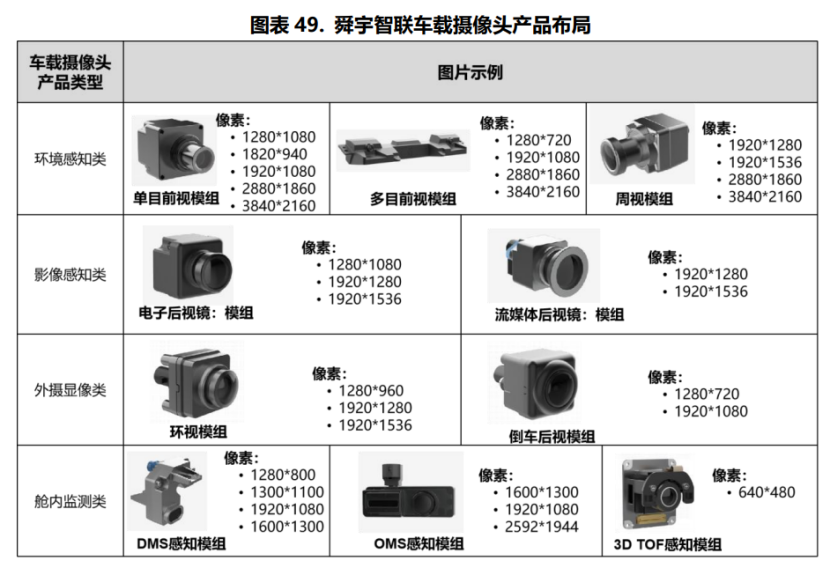

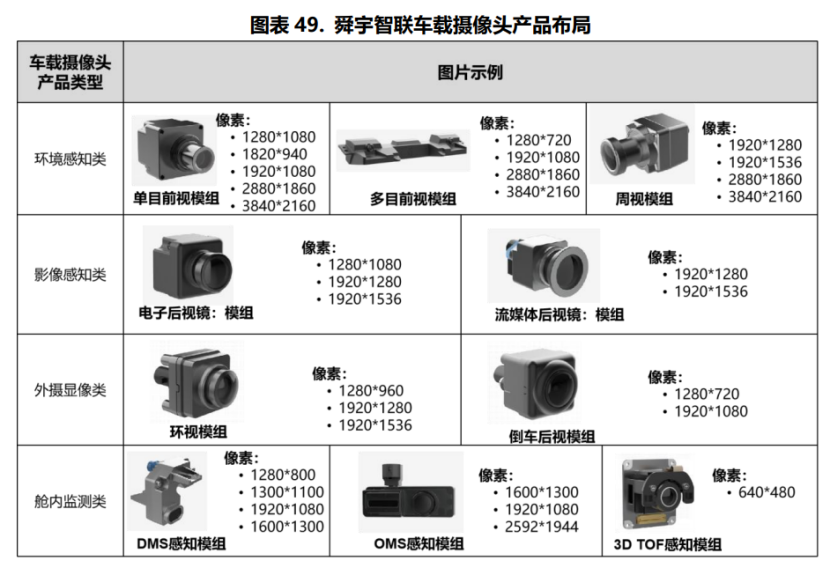

Founded in 2015, it is a subsidiary of Sunny Group, focusing on the research, manufacturing, sales, and technical services of automotive camera modules. Sunny Intelligence’s automotive camera module products are divided into four categories: environmental perception, imaging perception, external imaging, and internal monitoring. The resolution of automotive camera modules ranges from 1MP to 8MP, with field of view angles ranging from 15° to 120°.

Sunny Intelligence collaborates with Tier 1 and automotive companies to manufacture and provide automotive module products and solutions. Currently, it has cooperated with more than 10 Tier 1 companies and more than 20 OEMs in China. At the same time, it collaborates with chip platform companies and perception algorithm solution providers to accelerate the landing of new camera module products. Cooperative customers include automotive companies such as NIO, Li Auto, XPeng, IM, Zeekr, Geely, Great Wall, BYD, Toyota, Hyundai, Subaru, and Tier 1 companies such as Denso, ZF, and Haomo, as well as ecosystem partners such as Mobileye, NVIDIA, Qualcomm, Ambarella, TI, Samsung, OmniVision, Horizon Robotics, and others.

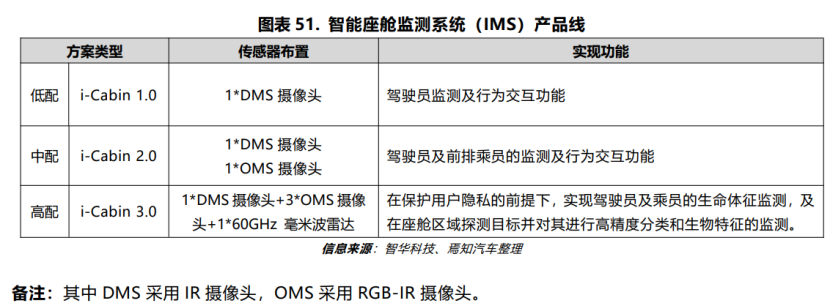

Founded in 2012, it is positioned as a supplier of customized systems for progressive smart driving. Currently, the company has the capability of intelligent driving fusion perception and control algorithms, customized intelligent driving system and intelligent sensor design and development, and automotive-grade manufacturing and large-scale production capability. The company focuses on three application scenarios: intelligent driving, intelligent parking, and intelligent cockpit. ZhiHua Technology focuses on improving the mass production capability of automotive-grade visual products, and its production base has passed IATF16949 quality management system certification and related environmental and information security certifications. According to relevant data, ZhiHua Technology’s intelligent camera sensors have cumulatively shipped over 10 million units, and intelligent driving system-level products have exceeded 2 million sets, cumulatively serving over 3 million intelligent vehicles in pre-installed mass production.

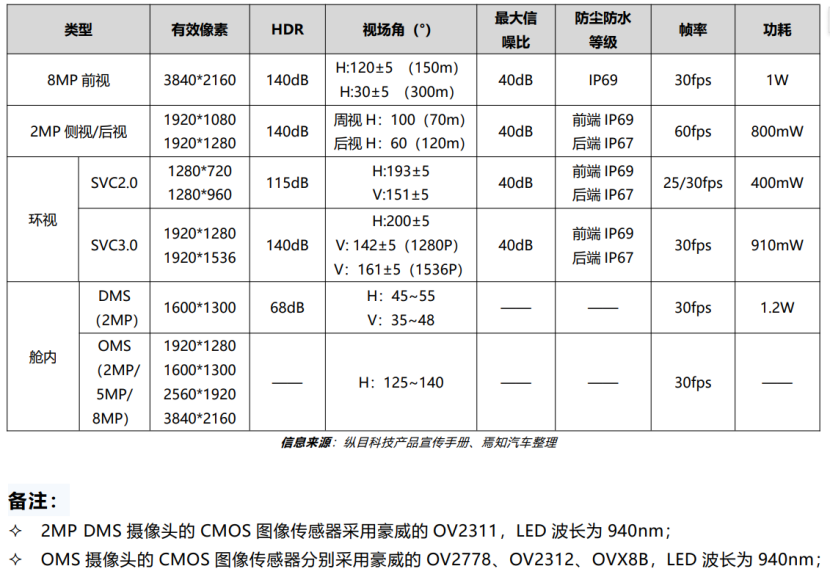

ZhiHua Technology’s automotive camera products cover three application scenarios: intelligent driving, parking, and internal applications.

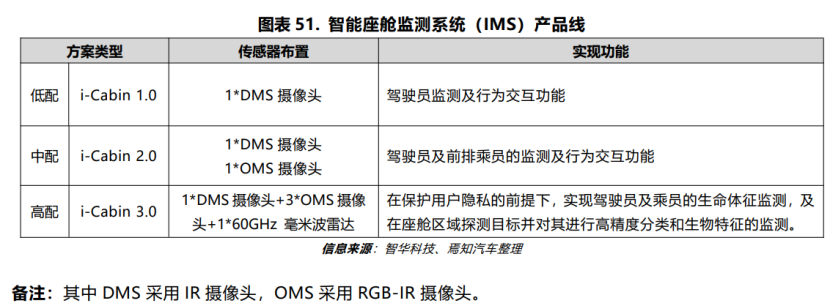

For internal application scenarios, ZhiHua Technology’s intelligent cockpit monitoring system (IMS) product line includes three configurations: low, medium, and high, to meet the differentiated needs of different OEM customers:

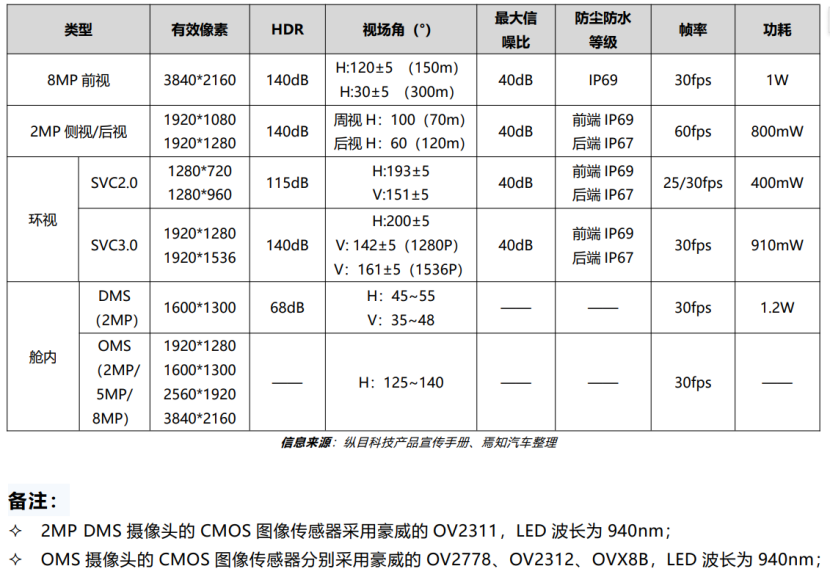

Founded in 2013, headquartered in Shanghai Zhangjiang International Innovation Center, it mainly engages in the research, production, and sales of automotive intelligent driving systems. Zongmu Technology not only has the capability to supply hardware products such as ADS/ADAS (domain) controllers, cameras, millimeter-wave radar, and ultrasonic radar, but can also provide solutions related to intelligent driving. Zongmu Technology’s automotive camera product matrix is rich, covering multiple application scenarios such as ADAS front view/rear view/surround view, 360 surround view, internal DMS/OMS, etc. In the field of automotive cameras, Zongmu Technology’s surround cameras have been mass-produced in models of many mainstream automotive companies such as Changan Automobile, FAW Group, Seres, Lantu Automotive, Jiangqi Group, SAIC Group, WM Motor, and Li Auto; internal DMS cameras and OMS cameras have already obtained fixed contracts from Huaren Yuntong Automotive.

Founded in 2003, headquartered in Beijing, with production factories established in Tianjin and Nantong. It focuses on providing automotive electronics products, automotive electronic R&D services, and high-level intelligent driving system development and operation services for customers in the automotive and unmanned transport fields. Among them, the automotive electronics product business can be divided into: intelligent driving electronic products, intelligent cockpit electronic products, intelligent connected electronic products, body and comfort domain electronic products, chassis control electronic products, and new energy and power system electronic products.

For intelligent driving electronic products, the technology solutions chosen by Jingwei Hengrun’s ADAS system mainly include three types: 1) VO (VisionOnly single front view all-in-one pure vision solution); 2) 1V1R (single front view all-in-one + 1 front millimeter-wave radar); 3) 1VnR (single front view all-in-one + n millimeter-wave radars). In the passenger car ADAS market, Jingwei Hengrun mainly promotes the VO technology route; in the commercial vehicle ADAS market, Jingwei Hengrun mainly promotes the 1V1R technology route.

The automotive camera products of Jingwei Hengrun cover both external and internal scenarios. The external scenarios are mainly intelligent driving applications, including front view, side view, rear view, and surround view cameras. The internal scenarios are mainly intelligent cockpit applications, including DMS and OMS cameras. Currently, the company has formed a complete camera product solution from the design end, production end, to the application end.

Founded in 2003, headquartered in Beijing, with production factories established in Tianjin and Nantong. It focuses on providing automotive electronics products, automotive electronic R&D services, and high-level intelligent driving system development and operation services for customers in the automotive and unmanned transport fields. Among them, the automotive electronics product business can be divided into: intelligent driving electronic products, intelligent cockpit electronic products, intelligent connected electronic products, body and comfort domain electronic products, chassis control electronic products, and new energy and power system electronic products.

For intelligent driving electronic products, the technology solutions chosen by Jingwei Hengrun’s ADAS system mainly include three types: 1) VO (VisionOnly single front view all-in-one pure vision solution); 2) 1V1R (single front view all-in-one + 1 front millimeter-wave radar); 3) 1VnR (single front view all-in-one + n millimeter-wave radars). In the passenger car ADAS market, Jingwei Hengrun mainly promotes the VO technology route; in the commercial vehicle ADAS market, Jingwei Hengrun mainly promotes the 1V1R technology route.

The automotive camera products of Jingwei Hengrun cover both external and internal scenarios. The external scenarios are mainly intelligent driving applications, including front view, side view, rear view, and surround view cameras. The internal scenarios are mainly intelligent cockpit applications, including DMS and OMS cameras. Currently, the company has formed a complete camera product solution from the design end, production end, to the application end.

-

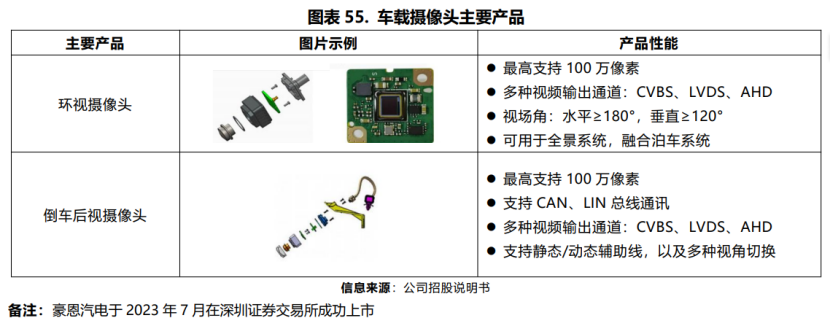

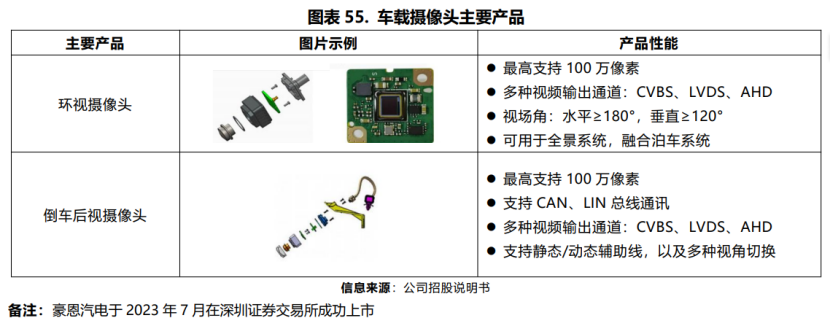

Haon Automotive Electronics

It is a company focusing on the research, design, manufacturing, and sales of automotive intelligent driving perception systems. The company’s main business includes reversing radar, cameras, 360° panoramic systems, automatic parking systems, blind spot monitoring systems, dash cams, driving computers, HUD head-up displays, and other automotive electronic products and system solutions. Currently, Haon Automotive Electronics has become a global supplier in the field of automotive intelligent driving perception systems, with major customers including Nissan, Volkswagen, PSA Global, Geely, Ford, Suzuki, Hyundai Kia, BYD, Xiaopeng Motors, Li Auto, and other domestic and foreign automotive companies.

In the field of automotive cameras, Haon Automotive Electronics’ main products include surround cameras, rearview cameras, DMS/OMS cameras, etc. Currently, the resolution of Haon Automotive Electronics’ automotive cameras can cover from 300,000 to 8 million pixels, with a maximum frame rate of up to 60fps.

Disclaimer: The content of this article comes from the Automotive Industry Research Center, and is for reference only. If there are copyright issues with the text, videos, images, etc. used in this article, please contact the editor at 18079052114 (same WeChat), and we will delete it immediately!