MCU, also known as a microcontroller unit, is a compact integrated circuit designed to govern a specific operation in an embedded system. In the next five years, automotive-grade MCU products will rapidly cover autonomous driving, and the import substitution of related domestic chips is also accelerating.

Industry Chain

The MCU industry chainUpstream consists of semiconductor materials and semiconductor equipment. Semiconductor materials mainly include silicon wafers, photoresists, photomasks, packaging materials, wet electronic chemicals, and sputtering targets, while semiconductor equipment mainly includes photolithography machines, etching machines, coating and developing equipment, and thin-film deposition equipment;Midstream consists of MCU manufacturers, which can be divided into IDM manufacturers and Fabless manufacturers.Downstream application fields include automotive electronics, consumer electronics, smart home appliances, industrial control, and computer networks.

Image Source: China Business Industry Research Institute

01Upstream Raw Materials and Equipment01Silicon Wafers

➤ Market Size

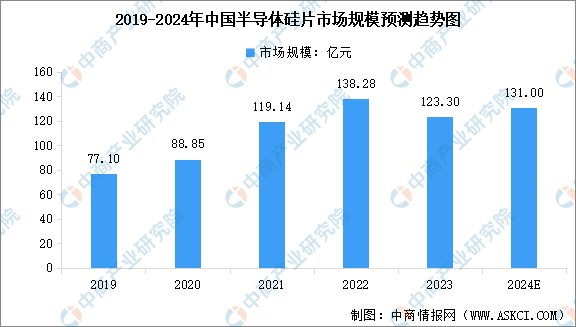

Although major semiconductor silicon wafer companies have initiated expansion plans, their expected production capacity will still be unable to fully meet the incremental demand from chip manufacturing companies in the long term. Coupled with considerations for medium- and long-term supply security, the domestic semiconductor silicon wafer industry will remain in a rapid development phase. According to the “2024-2029 Global and China Semiconductor Silicon Wafer Industry Development Trend Analysis and Investment Risk Forecast Report” released by the China Business Industry Research Institute, the market size of China’s semiconductor silicon wafers increased from 7.71 billion yuan in 2019 to 12.33 billion yuan in 2023, with an average annual compound growth rate of 12.45%. Analysts predict that the market size of China’s semiconductor silicon wafers will reach 13.1 billion yuan in 2024.

Data Source: Compiled by China Business Industry Research Institute

➤ Key Enterprise Analysis

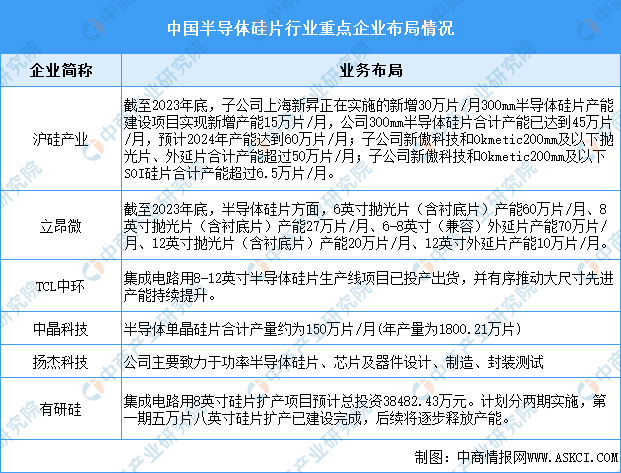

Compared to major international semiconductor silicon wafer suppliers, the market share of mainland China’s semiconductor silicon wafer manufacturers is relatively small, and there are still significant gaps in technology, process levels, and yield control compared to international advanced levels. Leading domestic semiconductor silicon wafer companies include Shanghai Silicon Industry, Lian Micro, TCL Zhonghuan, and Zhongjing Technology, with their production capacity and business layout shown in the following figure:

Data Source: Compiled by China Business Industry Research Institute

02Photoresists

➤ Market Size

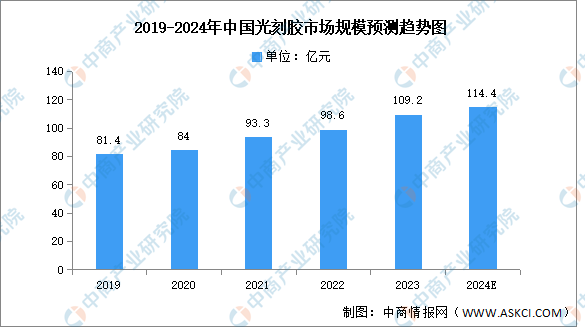

Currently, the global photoresist market has reached a scale of tens of billions of dollars, with vast market potential. China’s photoresist industry chain is gradually improving, and with the expansion of downstream demand, the market size of photoresists has significantly increased. According to the “2024-2029 Global and China Photoresist and Photoresist Auxiliary Materials Industry Development Status Research and Investment Prospects Analysis Report” released by the China Business Industry Research Institute, the market size of China’s photoresists was approximately 9.86 billion yuan in 2022, a year-on-year increase of 5.68%, and is expected to reach approximately 10.92 billion yuan in 2023. Analysts predict that the market size of China’s photoresists could reach 11.44 billion yuan in 2024.

Data Source: Compiled by China Business Industry Research Institute

➤ Key Enterprise Analysis

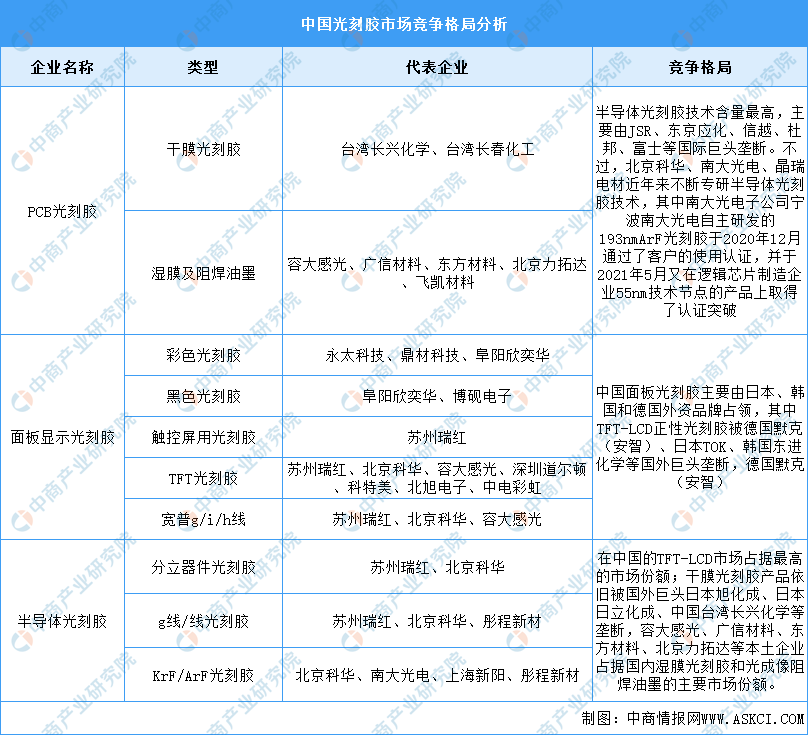

The application fields of photoresists mainly include the semiconductor industry, panel industry, and PCB industry. In the semiconductor photoresist market, due to the high technical content, the market is mainly dominated by international giants such as JSR, Tokyo Ohka, Shin-Etsu, DuPont, and Fujifilm. As shown in the figure below:

Data Source: Compiled by China Business Industry Research Institute

03Packaging Materials

➤ Packaging Substrates

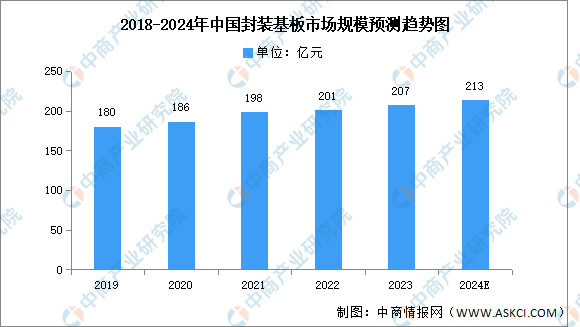

Packaging substrate products differ from traditional PCBs, with high processing difficulty and high investment barriers being the two core barriers. In recent years, with the advancement of domestic substitution, the Chinese packaging substrate industry has encountered opportunities. According to the “2024-2029 China Semiconductor Packaging Substrate Industry Market Analysis and Prospect Trend Research Report” released by the China Business Industry Research Institute, the market size of China’s packaging substrates was approximately 20.7 billion yuan in 2023, a year-on-year increase of 2.99%. Analysts predict that the market size of China’s packaging substrates will increase to 21.3 billion yuan in 2024.

Data Source: Prismark, compiled by China Business Industry Research Institute

Packaging substrates provide electrical connections, protection, support, heat dissipation, and assembly for chips, achieving multi-pin integration, reducing packaging product volume, improving electrical performance and heat dissipation, and enabling ultra-high density or multi-chip modularization. Key enterprises are shown in the figure below:

Data Source: Prismark, compiled by China Business Industry Research Institute

➤ Bonding Wires

Bonding wires are fine metal wires that achieve electrical connections between the input/output connection points of the chip’s internal circuits and the lead frame, with diameters ranging from tens of micrometers to several hundred micrometers. Depending on the material, they are divided into non-alloy wires and alloy wires, with non-alloy wires including gold, silver, copper, and aluminum wires; alloy wires include gold-plated silver wires and copper bonding wires.

The bonding wire market in China is mainly occupied by manufacturers from Germany, South Korea, and Japan, with domestic manufacturers offering relatively simple or low-end products. Key enterprises include Heraeus, Mingkaiyi, Nippon Steel, Tianzhong, Yinuo Electronics, and Wansheng Alloy.

Data Source: Compiled by China Business Industry Research Institute

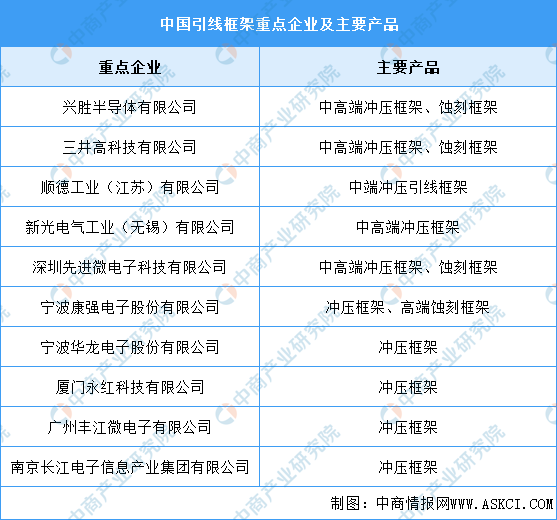

➤ Lead Frames

Currently, the major lead frame manufacturing enterprises are mainly concentrated in Asia, with some companies occupying significant shares of the global market. Apart from the Netherlands-based ASML in Europe, others are located in Asia. Some companies in mainland China have also achieved significant success in lead frame manufacturing, such as Ningbo Kangqiang Electronics Co., Ltd. and Ningbo Hualong Electronics Co., Ltd., as shown in the figure below:

Data Source: Compiled by China Business Industry Research Institute

04Photolithography Machines

➤ Market Size

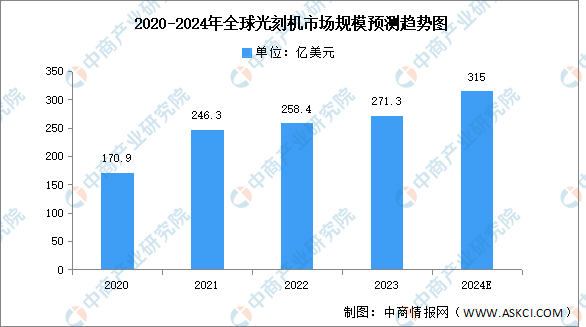

In recent years, amid relatively sluggish demand for consumer electronics, new demands such as electric vehicles, wind and solar storage, and artificial intelligence have become new growth drivers for the semiconductor industry, leading to steady growth in the global photolithography machine market. According to data released by SEMI, the global semiconductor equipment market size was $107.65 billion in 2022, with the photolithography machine market accounting for about 24%, reaching approximately $25.84 billion, and expected to be around $27.13 billion in 2023. Analysts predict that the global photolithography machine market size will increase to $31.5 billion in 2024.

Data Source: SEMI, compiled by China Business Industry Research Institute

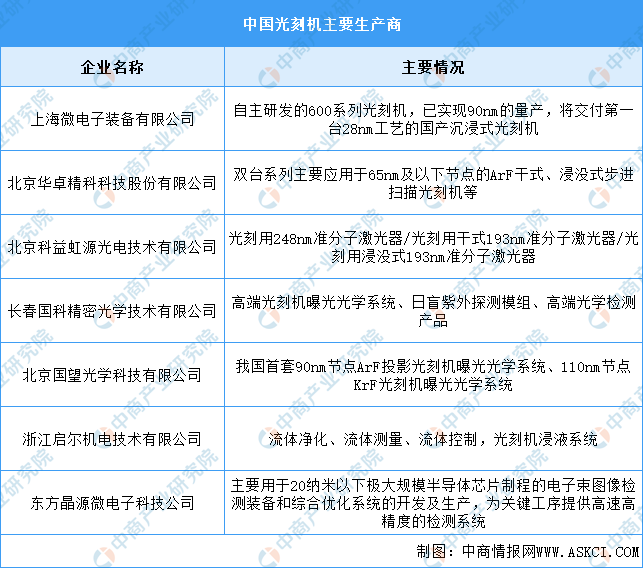

➤ Key Enterprise Analysis

Currently, there are few photolithography machine manufacturers in China, with major companies including Shanghai Micro Electronics Equipment Co., Ltd., Beijing Huazhuo Jingke Technology Co., Ltd., Beijing Keyi Hongyuan Optoelectronic Technology Co., Ltd., Changchun Guoke Precision Optical Technology Co., Ltd., Beijing Guowang Optical Technology Co., Ltd., Zhejiang Qier Electromechanical Technology Co., Ltd., and Dongfang Crystal Source Microelectronics Technology Company. Details are shown in the figure below:

Data Source: Compiled by China Business Industry Research Institute

05Etching Machines

➤ Market Size

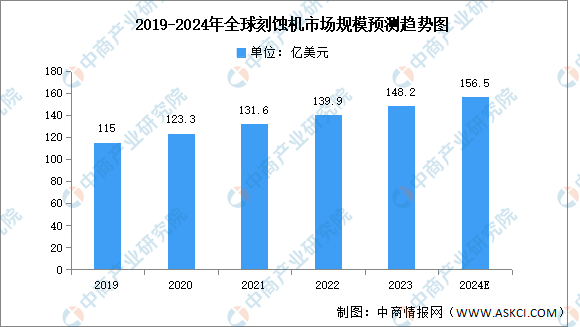

Etching machines are mainly used to manufacture semiconductor devices, photovoltaic cells, and other micro-mechanical components. In recent years, the global etching machine market size has shown a growth trend. According to the “2024-2029 Global and China Semiconductor Equipment Industry In-Depth Research Report” released by the China Business Industry Research Institute, the global etching machine market size increased from $11.5 billion in 2019 to $13.99 billion in 2022, with a compound annual growth rate of 6.8%, and is expected to reach approximately $14.82 billion in 2023. Analysts predict that the global etching machine market size will reach $15.65 billion in 2024.

Data Source: Gartner, compiled by China Business Industry Research Institute

➤ Key Enterprise Analysis

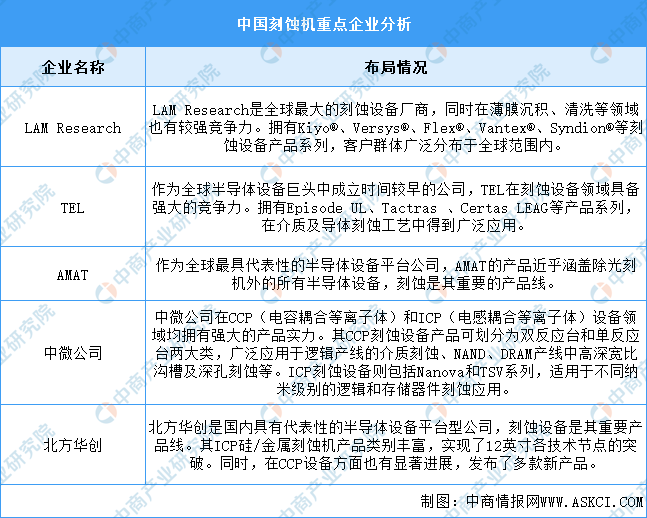

The competition landscape in the etching machine industry is highly concentrated and competitive. Globally, international giants such as LAM Research, AMAT, and TEL dominate the market, holding a significant share due to their advanced technology, extensive product lines, and broad customer base. Domestic companies like Zhongwei Company and Northern Huachuang are gradually emerging as leading enterprises in the domestic etching machine industry through independent research and innovation capabilities. Details are shown in the figure below:

Data Source: Compiled by China Business Industry Research Institute

02Midstream MCU Manufacturers01Market Size

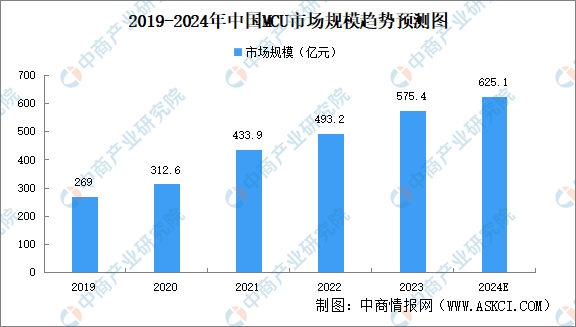

In the context of “domestic substitution” and “chip shortages”, domestic companies are accelerating the research, manufacturing, and application capabilities of MCU chips, gradually completing the localization of mid- to low-end MCUs and continuously penetrating into high-end fields, thereby enhancing the competitiveness of China’s MCU industry. According to the “2024-2029 China MCU Chip Market Status Research Analysis and Development Prospect Forecast Report” released by the China Business Industry Research Institute, the market size of China’s MCU reached 49.32 billion yuan in 2022, an increase of 13.67% compared to the previous year, and is expected to reach approximately 57.54 billion yuan in 2023. Analysts predict that the market size of China’s MCU will reach 62.51 billion yuan in 2024.

Data Source: Frost & Sullivan, compiled by China Business Industry Research Institute

02Market Structure

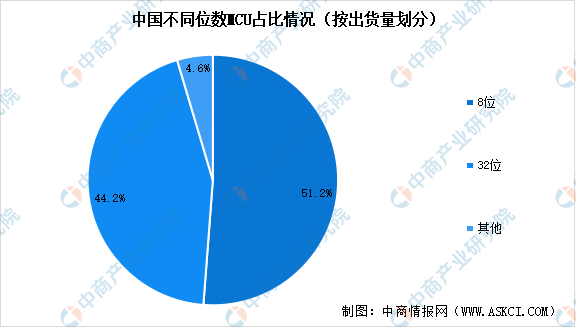

According to the classification by data processing bit, MCUs can be divided into 4-bit, 8-bit, 16-bit, 32-bit, and 64-bit. Among them, 8-bit MCUs are typically used for low-cost, low-power, and simple applications, such as some sensors and small household appliances, accounting for the largest share in the Chinese MCU market at 51.2%. The next is the 32-bit MCU, suitable for applications requiring complex data processing and high-performance computing, such as advanced automotive control systems, communication devices, and embedded computers, accounting for 44.2% of the Chinese MCU market.

Data Source: Frost & Sullivan, compiled by China Business Industry Research Institute

03Demand for Automotive-grade MCUs

With the development of new energy vehicles, especially smart cars, the number of MCUs installed in each vehicle has increased exponentially. Traditional fuel vehicles typically have around 70 MCUs per vehicle. Luxury fuel vehicles have even more, averaging 150 MCUs. However, smart cars, due to the high computing power requirements of smart cockpits and autonomous driving, have seen the number of MCUs installed in each vehicle surge to an average of 300, which is 4.3 times that of traditional fuel vehicles.

Data Source: Compiled by China Business Industry Research Institute

04Enterprise Layout

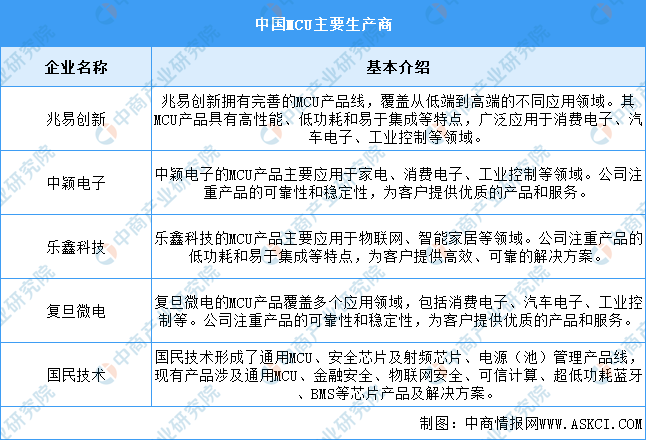

Key enterprises in the Chinese MCU market include Zhaoyi Innovation, Zhongying Electronics, Espressif Technology, Fudan Microelectronics, and Guomin Technology. These companies hold significant market shares and brand influence in the MCU field, serving as important forces driving the development of China’s MCU industry.

Data Source: Compiled by China Business Industry Research Institute

05Key Enterprise Analysis

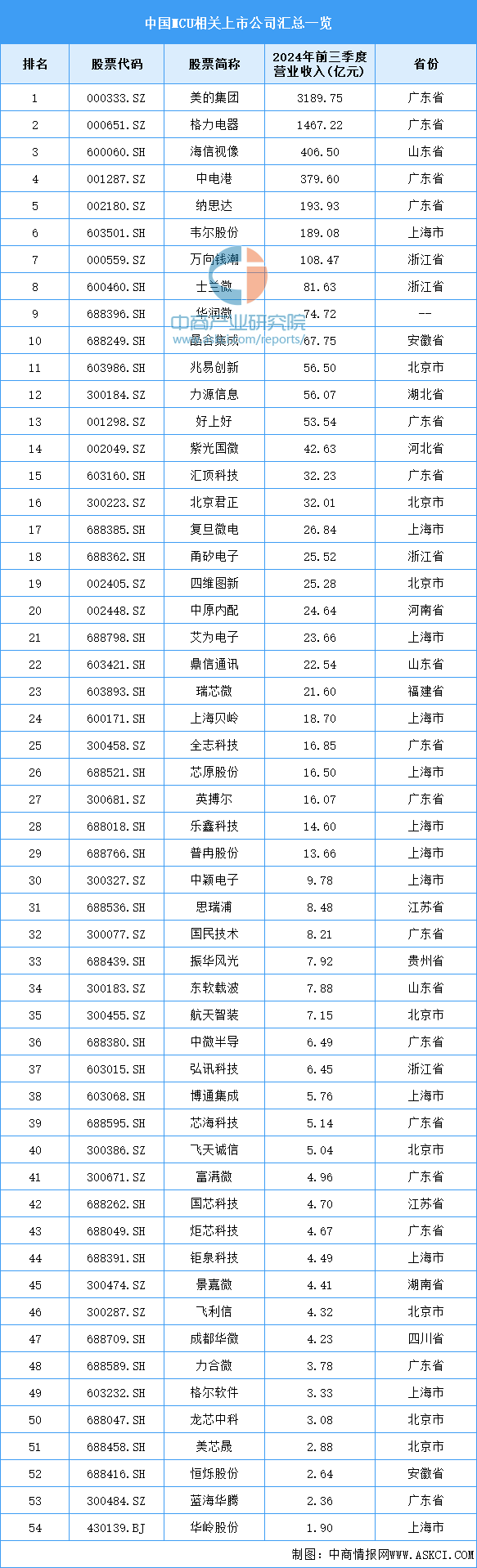

Currently, the listed companies related to MCUs in China are mainly distributed in Guangdong Province, with 15 companies. Shanghai and Beijing have 12 and 8 companies, ranking second and third, respectively.

Data Source: Compiled by China Business Industry Research Institute

03Downstream Applications01Automotive Electronics

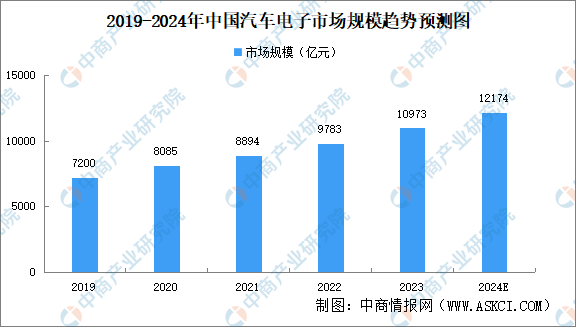

The growth rate of China’s automotive electronics market is faster than the global average. According to the “2024-2029 China Automotive Electronics Industry Development Status and Investment Strategy Research Report” released by the China Business Industry Research Institute, the market size of automotive electronics reached 978.3 billion yuan in 2022, and is expected to increase to 1,097.3 billion yuan in 2023. Analysts predict that the market size of China’s automotive electronics will exceed 1,200 billion yuan in 2024.

Data Source: Automotive Industry Association, compiled by China Business Industry Research Institute

02Consumer Electronics

➤ Mobile Phones

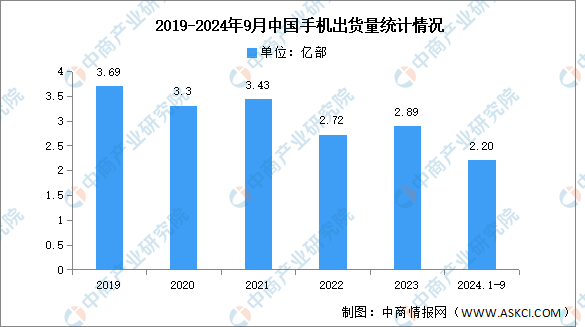

According to data from the China Academy of Information and Communications Technology, in September 2024, the domestic market shipped 25.371 million mobile phones, a year-on-year decrease of 23.8%. From January to September 2024, the domestic market shipped 220 million mobile phones, a year-on-year increase of 9.9%.

Data Source: China Academy of Information and Communications Technology, compiled by China Business Industry Research Institute

➤ TWS Earbuds

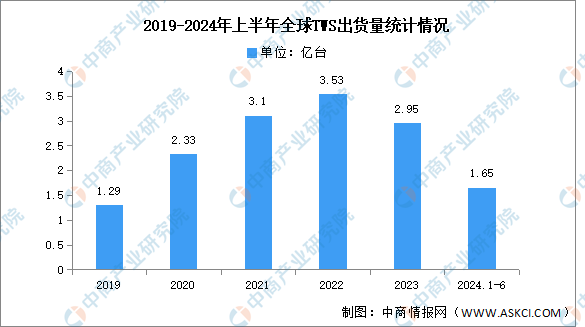

According to Canlays data, the global personal smart audio device market is showing signs of recovery, with global TWS earbud shipments reaching 165 million units in the first half of 2024. In the first quarter, shipments exceeded 90 million units, a year-on-year increase of 6%. In the second quarter, the market achieved double-digit growth, with a year-on-year increase of 12.6%, adding 7.5 million units compared to last year.

Data Source: Canlays, compiled by China Business Industry Research Institute

03Smart Home Appliances

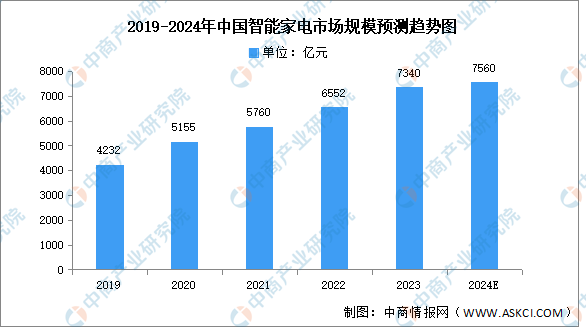

Smart home appliances, as part of smart homes, can interconnect with other appliances and facilities in the home to form a system that realizes smart home functions. With the improvement of consumer income levels in China, purchasing power is gradually increasing, and consumers’ brand awareness is becoming stronger, leading to higher demands for product quality and performance, thus accelerating the development of the smart home appliance market. According to the “2024-2029 China Smart Home Appliance Industry Outlook and Strategic Investment Opportunities Insight Report” released by the China Business Industry Research Institute, the market size of smart home appliances was approximately 655.2 billion yuan in 2022, a year-on-year increase of 13.75%, and is expected to reach approximately 734 billion yuan in 2023. Analysts predict that the market size of smart home appliances will exceed 750 billion yuan in 2024.

Data Source: Compiled by China Business Industry Research Institute

(Source: China Business Intelligence Network. This article is produced by the Qingdao West Coast International Investment Promotion Center, reprinted for sharing and learning purposes only, not for commercial use. If there is any infringement, please contact for deletion.)

Recommended Reading

“Chip” Quality Productivity! Qingdao New Core Technology Co., Ltd. First Shipment of 50,000 Units

Efficient Service New Model +1, Ebara Environmental Project “Completed and Put into Production, Finished and Ready to Use”

2024 Marine Cooperation Development Forum Opens in Qingdao West Coast New Area, Signing of the Fortune Marine Industry Innovation Center Project