This article will review the basic definition of automotive cameras, hardware composition, application scenarios, industrial chain structure diagram, upstream and downstream industry analysis, key domestic enterprises, etc., for reference.

Basic Definition

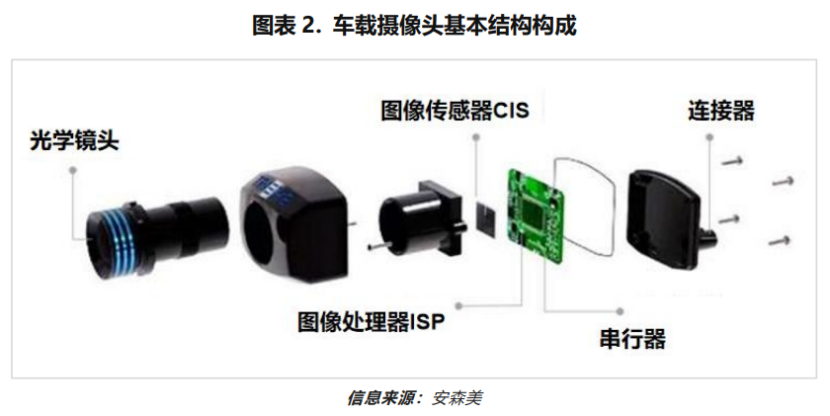

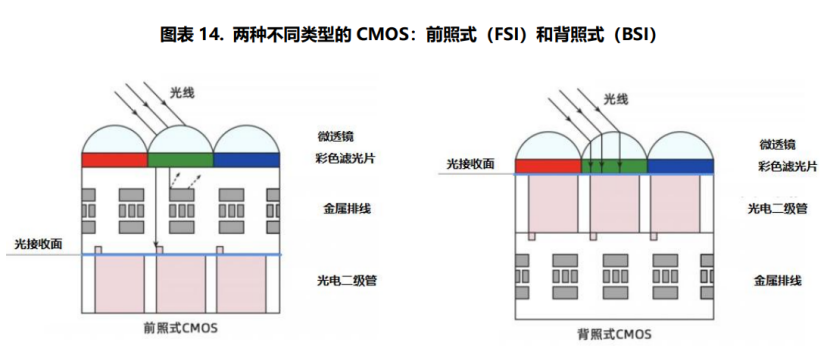

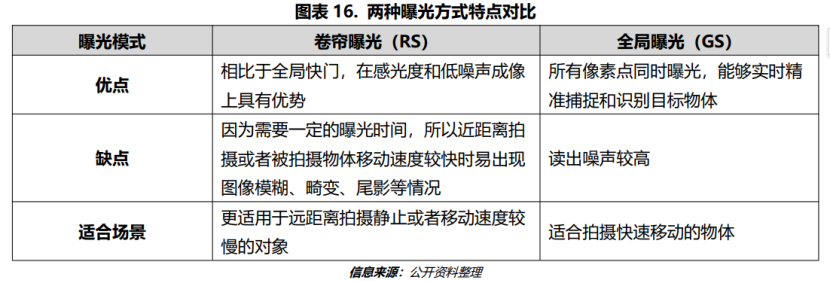

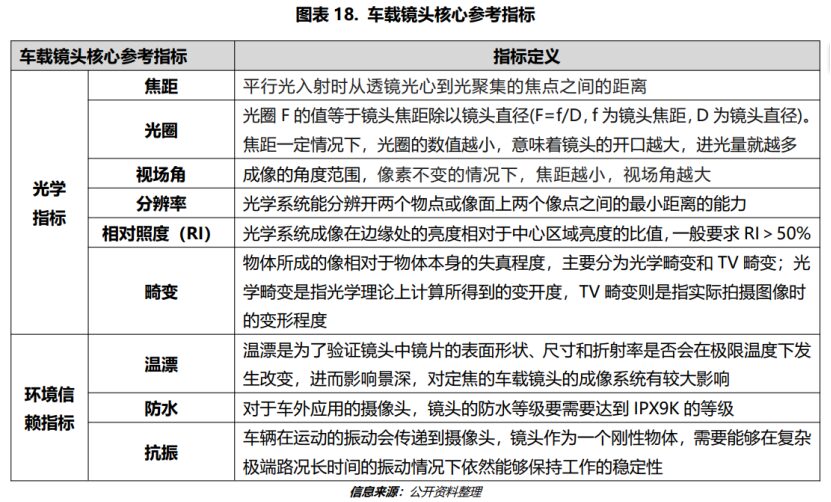

Hardware Composition

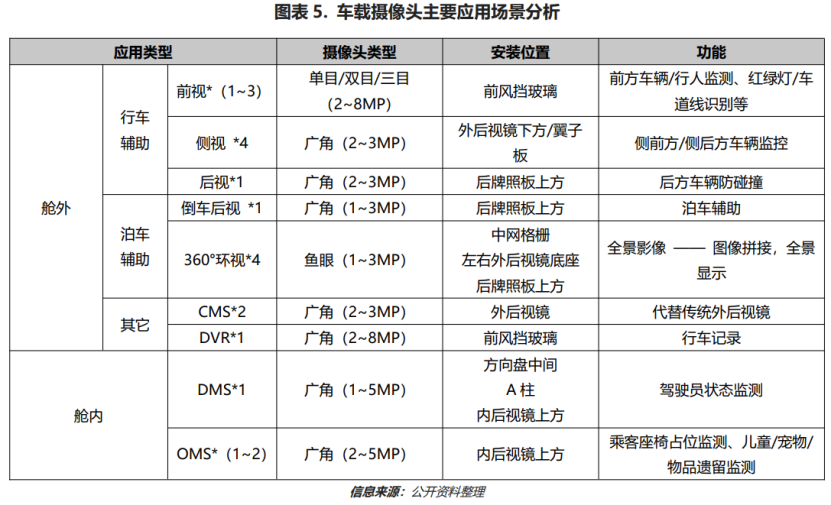

Application Scenarios

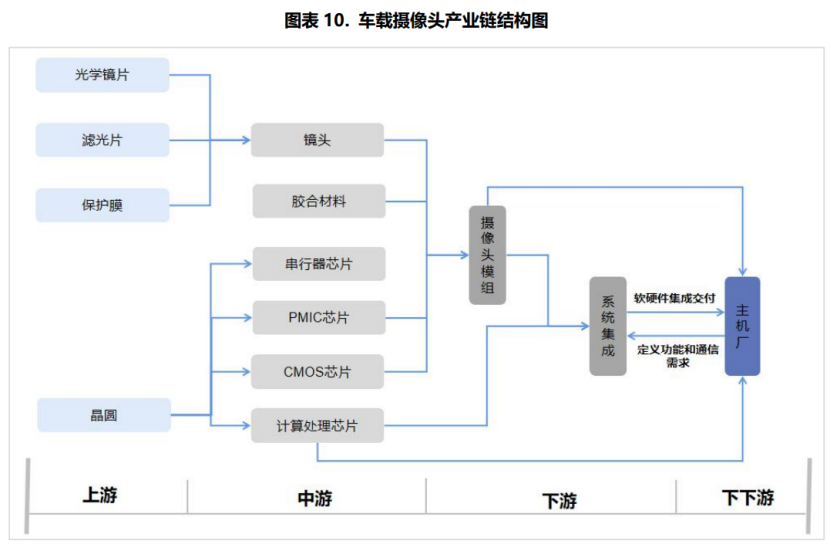

Industry Structure Diagram

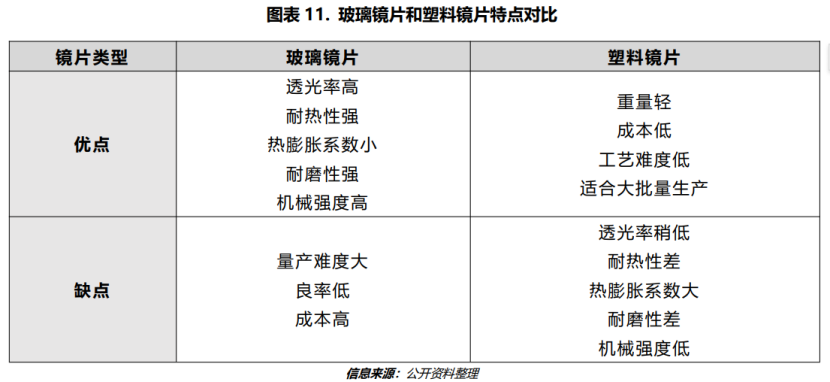

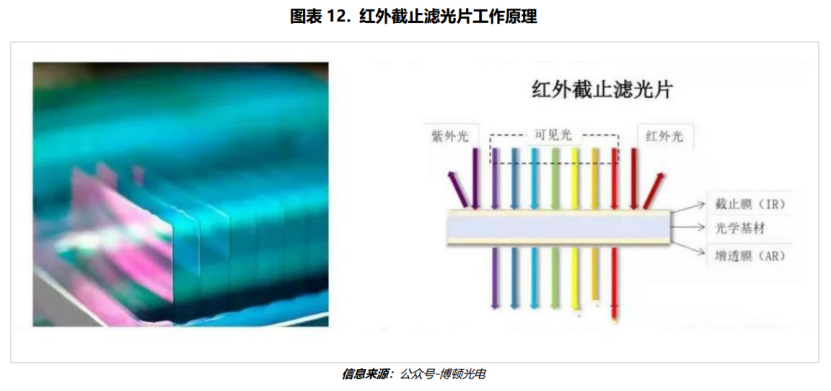

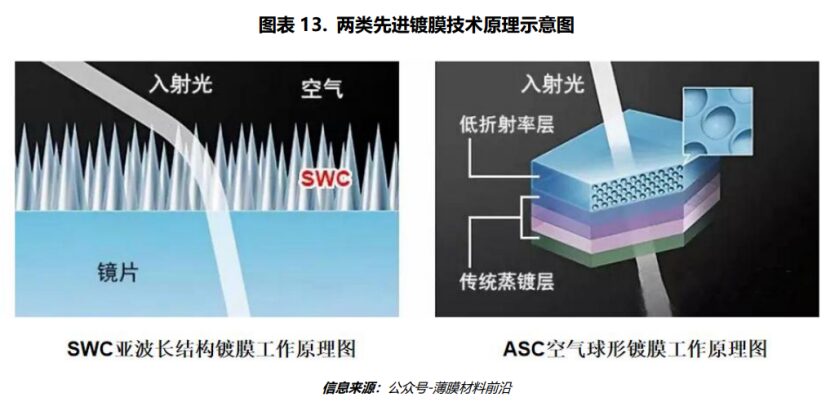

Upstream Industry Analysis

Midstream Industry Analysis

Downstream Industry Analysis

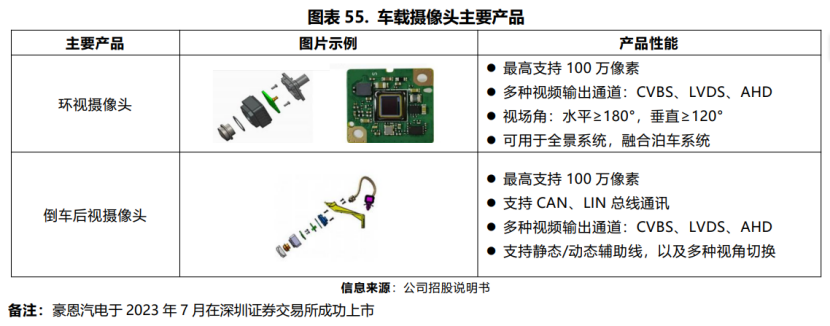

Key Domestic Enterprises

-

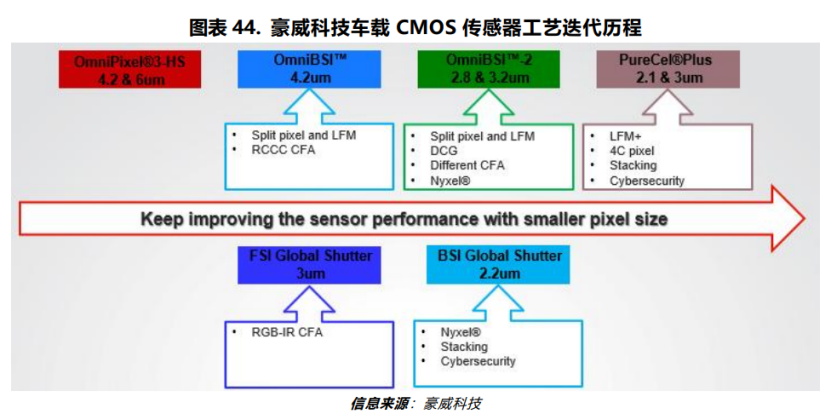

OmniVision

-

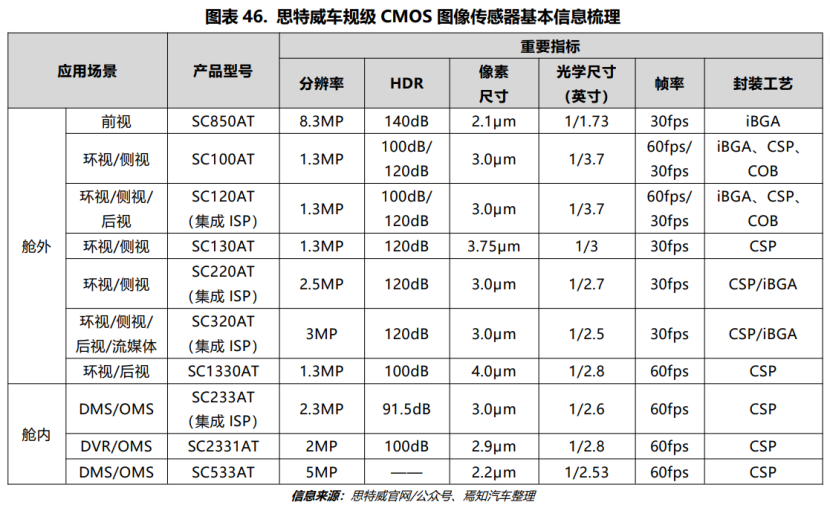

StarChip

-

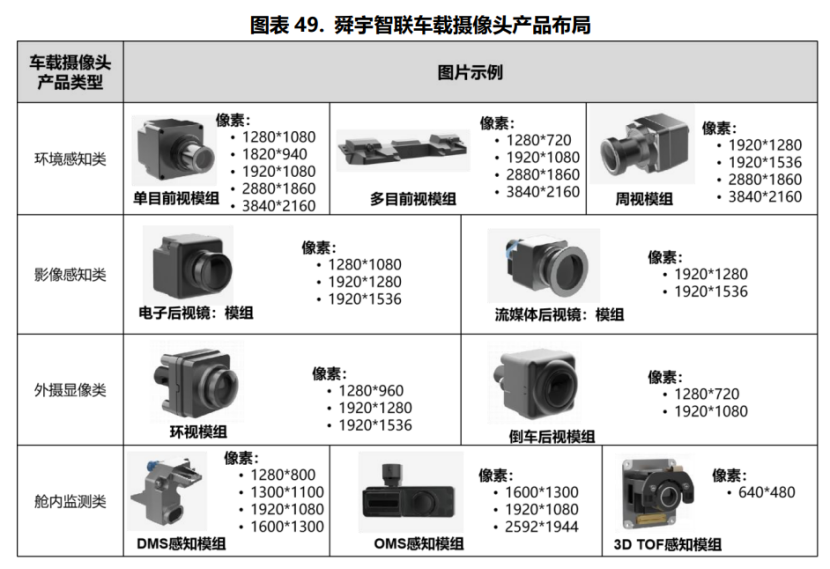

Sunny Optical

-

Lianchuang Electronics

-

OFILM

-

Sunny Intelligent

-

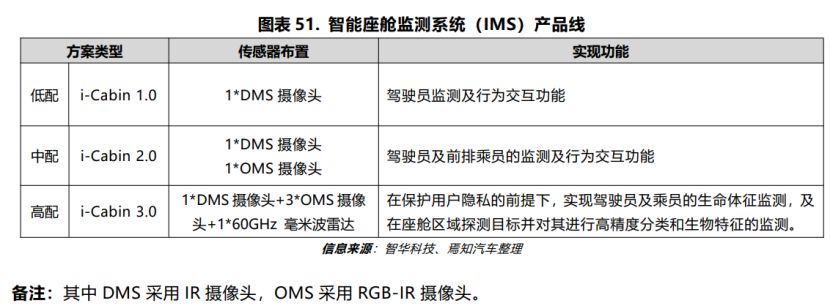

ZhiHua Technology

-

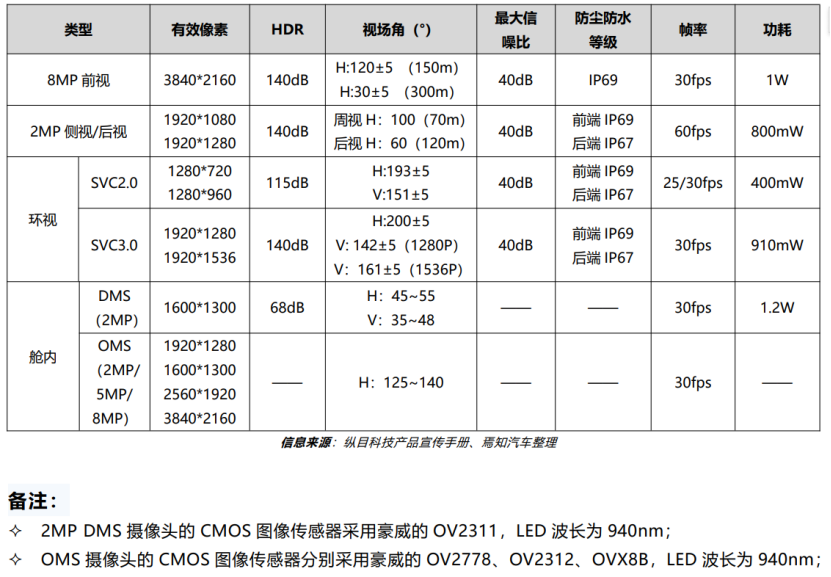

Zongmu Technology

-

Jingwei Hengrun

-

Haon Automotive Electronics