With a shortage of technology and high barriers to entry, how can the new generation survive in the machine vision sensor chip market dominated by giants?

Author | Yu Kuai

Editor | Zhang Dong

The global chip shortage has made “chips” and “chip shortages” well-known terms across the country.

Amid the vigorous wave of domestic substitution, in addition to the highly focused backend processor chips, frontend sensor chips, as the direct source of data, will also become a key player in the future.

The sensor chip field has long been a feast for foreign semiconductor giants, with China heavily reliant on imports, where the import ratio of mid-to-high-end products reaches 80%.

This makes the path of domestic substitution for sensor chips somewhat staggered, but also more determined.

In light of this, AI investment enthusiast and CEO of the visual sensor chip startup Ruisi Zhixin, Deng Jian, engaged in a dialogue to explore the current state of the market from his perspective.

When CIS Chips Become “Traditional”

“Ruisi Zhixin was established in 2019. Do you think the timing is too late?”

CEO Deng Jian believes it is not late at all; in fact, it is just the right time: because traditional image sensors have defects in machine vision.

Previously, the market mostly focused on backend processing chips, and AI was more about upgrading and empowering based on this; however, the development of frontend sensor chips has been slow, and it has now become a bottleneck for further upgrades in machine vision.

Specifically, the current market demand indicates that the three core elements of traditional CIS, namely frame rate, data volume, and dynamic range, can no longer meet the needs of computer vision.

First, the frame rate is limited.

Traditional CIS indiscriminately collects all objects within a scene and then processes the image in frames before outputting it to the backend.

During this process, from exposure to analog-to-digital conversion and data transmission, time is required; the longer the process takes, the lower the frame rate of the generated image.

The discontinuity between frames causes information loss, increasing the difficulty of machine judgment.

Second, the data volume is large but the effectiveness is low.

Typically, traditional CIS outputs frame images with a resolution of over a million pixels, resulting in a very large data volume. However, there is a lot of redundant information between frames, such as unchanged background images. This leads to a huge data volume but very low effectiveness.

Third, the dynamic range is insufficient, and the adaptability to the environment is weak.

The dynamic range of traditional CIS generally does not exceed 70dB, far less than that of the human eye. In cases of drastic changes in light and dark, traditional visual sensors often fail. Therefore, in applications of machine vision, environmental light often affects machine judgment.

Deng Jian stated that traditional image sensors were not originally designed for machine vision, and many of their characteristics are contrary to the needs of machine vision.

For example, in the application of vehicle recognition in smart cities, the purpose of installing surveillance cameras is to accurately capture and identify vehicle and driver information.

However, in scenarios where vehicles are moving at high speeds and the shooting environment is uncontrollable, traditional image sensors not only affect the instantaneous capture of images due to low frame rates and “overloaded” data volumes, leading to frequent blurriness, but also often result in overexposure or insufficient clarity due to dynamic range limitations.

In the past decade of photography, the goal of traditional CIS was to produce visually appealing, colorful, and static images. However, against the backdrop of the AI era, machine vision has high requirements for sensor frame rates, data volumes, dynamic ranges, and power consumption. Only by innovating frontend CIS can we better promote the development of backend AI.

Ruisi Zhixin recognized this and adopted “Hybrid Vision” technology to develop the bionic visual sensor chip ALPIX.

The goal of ALPIX is to innovate based on machine vision as the core, focusing on the visual sensor end.

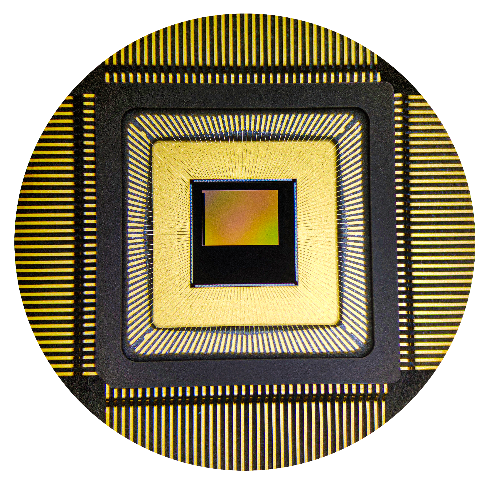

Ruisi Zhixin ALPIX Chip

Ruisi Zhixin ALPIX Chip

What Do Industry Giants See in It?

Ruisi Zhixin was established in July 2019 and is a chip R&D and overall solution provider focused on the next generation of computer vision sensors.

Ruisi Zhixin has independently developed the bionic visual sensor chip ALPIX, entering the market from the development status of new sensors and the machine vision industry.

In the industry, bionic visual sensors similar to ALPIX are also known as Event-based cameras.

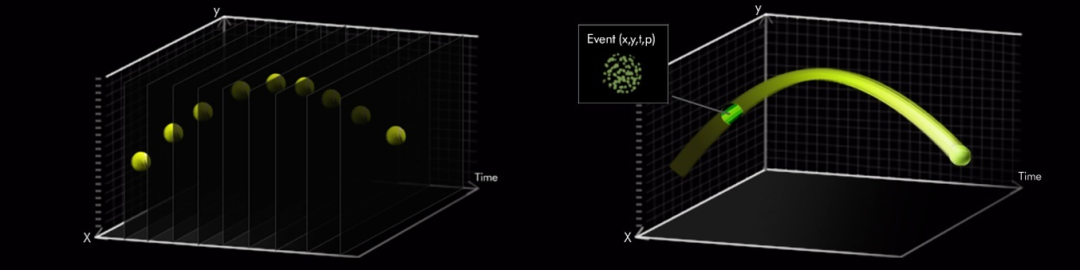

Unlike traditional image sensors that output image information based on shutter exposure in frames, bionic visual sensor chips mimic the working principle of the human eye’s retina, with each pixel working independently, outputting changing pulse signals by perceiving changes in external light intensity, and not outputting anything when there is no change in light intensity. This output of changing signals is also known as event signals.

Working Principle Comparison of Traditional CIS and Event-based Cameras

Working Principle Comparison of Traditional CIS and Event-based Cameras

Compared to traditional CIS, bionic visual sensors have characteristics such as high speed (>5000 frames/s), low power consumption (tens of mW), low data volume, and high dynamic range (>120dB), effectively addressing some of the current pain points faced by computer vision.

These features have attracted significant investment from giants as soon as bionic visual sensors hit the market, with companies like Samsung, Sony, Huawei, and Bosch all engaging in related chip and application development, while the French startup Prophesee also received investments from Intel and Bosch at its inception.

However, in practical use, many scenarios require both event stream signals for rapid predictions and traditional images for detailed judgments.

Ruisi Zhixin realized that integrating bionic visual sensor chip technology with high-end image sensor technology might be a breakthrough.

Based on this idea, they created the “Hybrid Vision” technology by integrating bionic visual sensor chip technology with high-end image sensor technology, allowing for the output of both event stream signals and high-quality image signals.

Illustration of Traditional Images and Event Stream Signals

Illustration of Traditional Images and Event Stream Signals

This dual-functionality possesses the low power consumption, high speed, high data efficiency, and high dynamic range characteristics of bionic visual sensors. Compared to similar competing products, ALPIX effectively improves the chip’s signal-to-noise ratio, addresses noise issues and low-light performance, and meets customer performance requirements.

It can also output traditional image signals, fully compatible with existing machine vision algorithms, making it easier for customers to develop related algorithms and applications, while effectively reducing the cost of visual system solutions.

Additionally, due to the different underlying chip structures, ALPIX has a smaller pixel area under the same process conditions, meaning lower prices, making it more suitable for consumer electronics.

“There is a significant market demand for this integrated visual sensor, but so far, there has been no productized solution. Existing bionic visual sensors, although some can output image information, do not meet the quality standards to compete with traditional CIS, making many applications unfeasible,” Deng Jian stated.

The improvements mentioned above are currently needed in fields such as security monitoring, consumer electronics, mobile phones, robotics, and autonomous driving.

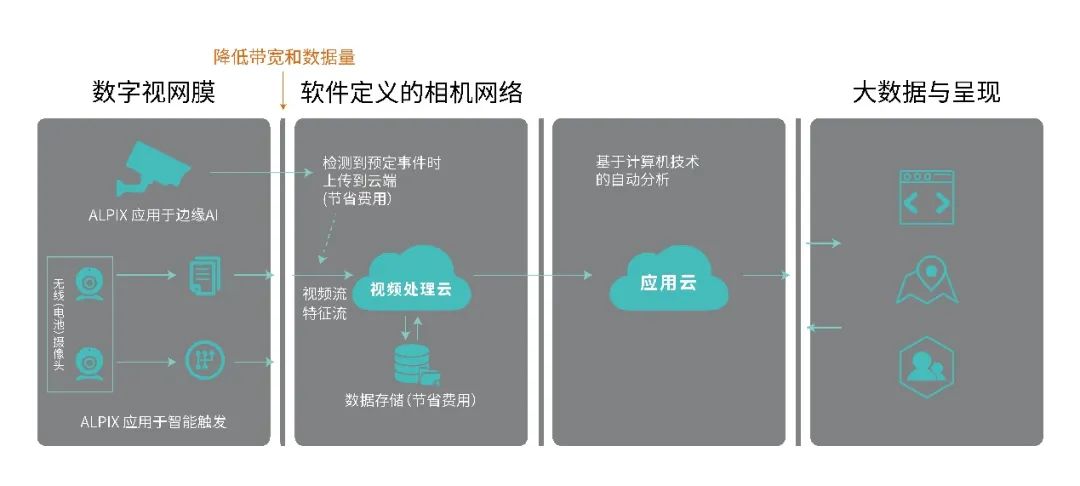

For example, in security, current security systems primarily transmit massive amounts of front-end image data to backend servers or the cloud for storage or computation.

The large data volume leads to high transmission, storage, and computation costs, making data traceability difficult.

Deng Jian stated that based on ALPIX, a smart trigger function can be set at the terminal, waking up the entire monitoring system based on specific events, and using edge AI to extract feature data and label it based on event information, efficiently transmitting the data to the cloud for storage and computation, significantly reducing the costs of transmission, storage, computation, and retrieval for the entire system.

Moreover, due to ALPIX’s high dynamic range, it can continuously monitor changes in people and objects in extreme lighting conditions, addressing the adaptability issues of traditional CIS.

Application Illustration of ALPIX in Security

Application Illustration of ALPIX in Security

In the smart home sector, ALPIX’s features can also meet user demands for privacy protection, low power consumption, and low system costs.

For instance, ALPIX can choose to output only event stream signals for machines to “see,” which can be used for specific event detection and alarm functions in private areas of applications like caregiving and infant care; it can also be used in smart locks and doorbells to determine if someone is visiting based on event stream signals before transmitting image signals to the user; or it can be used in air conditioners and televisions for smart wake-up, smart airflow adjustment, or gesture control.

Application of ALPIX in Smart Home

Application of ALPIX in Smart Home

In the autonomous driving field, compared to traditional sensors, the ALPIX sensor significantly reduces the time required from perception to braking, shortening the reaction time during vehicle braking and reducing braking distance, thereby enhancing driving safety; in terms of dynamic range, ALPIX has optimized pixel design, ensuring that the sensor does not fail due to changes in lighting conditions when a vehicle exits a tunnel or drives at night.

As the direct source of information for machine vision systems, image sensors have a “shared fate” relationship with machine vision. They determine the effectiveness and quality of data collection, indirectly determining the capabilities of the entire system.

“If the data source is poor, no matter how powerful the backend algorithm is, it is difficult to compensate for the interpretation of information at the source,” Deng Jian added.

Many well-known companies have already entered the field of bionic visual sensor chips, such as Sony (acquiring Swiss Insightness), Samsung (investing in Swiss Inivation), and the French company Prophesee.

Many Chinese giants have clearly realized this as well, and when Ruisi Zhixin emerged with its unique technological strength, it attracted the attention of industry giants along the supply chain.

Market potential, technological scarcity, and productization capability are the core factors considered by most investors.

Recently, Ruisi Zhixin announced the completion of nearly 100 million yuan in Pre-A round financing. Among the investors are Hikvision, Yaotu Capital, Zhuiyuan Venture Capital, iFlytek Venture Capital, Sunny Optical Technology, Allwinner Technology, Tongchuang Weiye, and existing shareholders Lenovo Venture Capital and Zhongke Chuangxing continuing to invest.

Born in a Land of Giant Monopoly

Ruisi Zhixin has chosen a territory that is both a treasure trove of potential trillion-dollar markets and a battleground for major international automotive and mobile phone manufacturers. This landscape is fraught with challenges.

For a long time, the CMOS market has been dominated by Japanese and Korean manufacturers like Sony and Samsung. According to IHS Market data, currently, Sony holds a 50.1% market share in the global CMOS image sensor market, while Samsung holds 20.5%, with the two leading manufacturers accounting for over 70% of the market share. The two giants have established a stronghold in the sensor field.

At the same time, Samsung and Sony actively integrate new sensing technologies through mergers and acquisitions, quickly entering new sensor fields.

“In recent years, they have acquired all the technologies and companies they could,” Deng Jian said.

The scarcity of technology and high barriers to entry have left few companies willing to delve deep and achieve results.

How can the young Ruisi Zhixin compete?

Technology is one of Ruisi Zhixin’s decisive weapons.

It is reported that they have applied for over 10 core patents (EU and PCT patents), comprehensively protecting the company’s core technology from the bottom-up, including principles and data formats.

“In the field of visual sensor AI chips, we should be the only company in China with a complete set of core technology independent patents.”

Although Ruisi Zhixin is less than two years old, its team members are not “young” in terms of qualifications; they are strong:

They include researchers from renowned institutions such as Cambridge, ETH Zurich, and the University of Manchester, as well as technical and experienced personnel from world-renowned companies like CSEM, NXP, ARM, ON Semiconductor, Freescale, Magic Leap, and Intel.

It is worth noting that the main research institutions for this technology internationally include ETH and MIT, and Ruisi’s technological roots are in Switzerland, where they have accumulated significant experience in this field.

“The design chain for sensor chips is long, emphasizing time accumulation; the team has at least 7 years of experience in event cameras.”

In contrast, companies like Samsung and Sony, which focus on acquisitions, have accumulated less experience.

Furthermore, compared to competing products, Ruisi Zhixin’s technology features are unique.

Deng Jian stated, “The Hybrid Vision technology allows its ALPIX chip to output both event stream signals and traditional image signals, making it more suitable for various types of visual perception needs. Additionally, it reduces the difficulty of user development and lowers the overall cost of the visual system. Currently, this is a feature that competitors do not possess.”

Thirdly, the market is large enough. The field of machine vision is vast, covering consumer electronics, monitoring, autonomous driving, industrial applications, and more.

According to a report by Yole Development, the global CIS market size was approximately $19.3 billion in 2019 and is expected to reach $23 billion by 2021.

However, such a vast market still lacks truly intelligent solutions from the information collection end, and bionic visual sensor chips represent a transformative technology with significant future market potential.

The market is large enough to accommodate many players, presenting opportunities for both Samsung and Sony, as well as for Ruisi Zhixin.

Currently, Ruisi has two chips that are being iterated and optimized, soon to enter mass production.

Given the current chip shortage, how can a startup secure production capacity?

Deng Jian explained that while sensor production capacity is indeed very limited, it is also a highly promising market, and major foundries are willing to allocate some production capacity to promising startups with new sensor technologies.

Promoting Future Developments

Machine vision is ubiquitous. Statistics show that 80% of the world’s data consists of unstructured data such as video images, and this volume will continue to grow. Experts predict that the global machine vision technology market will reach $24.8 billion by 2023.

“Products are not designed; they are used,” Deng Jian emphasized. A new technology cannot change life; only new products can change life.

In a market dominated by giants, Ruisi respects its predecessors while not abandoning its own beliefs. They focus on solidifying technology and continuously feedback and optimize in practical applications, striving to turn technology into an excellent product, a product that can change lives.

In the future, fields such as robotics, smartphones, autonomous driving, drones, and security have potential market sizes in the trillion-dollar range.

This vast market will require more Ruisi Zhixin in the future machine perception era.

Recommended Reading