Special Planning: Xiwen

Reporters: Ye Xi, Hong Ying, Chen Yuanhong

In recent years, domestic motion control (including CNC) technology has developed rapidly. Some traditional manufacturers of CNC equipment have begun to develop products with motion control features. Controllers are generally designed and developed independently byrobotmanufacturers. Currently, mainstream foreignrobot manufacturersdevelop their controllers based on general multi-axis motion controller platforms, and each brand of robot has its own matching control system. Therefore, the market share ofcontrollersis generally consistent with that of robots. A portion of the controllers for domestic industrial robots is developed independently by companies, while another part has formed specialized controller manufacturers.

The Current Market Situation of Domestic Controllers

Comparison of Three Core Components

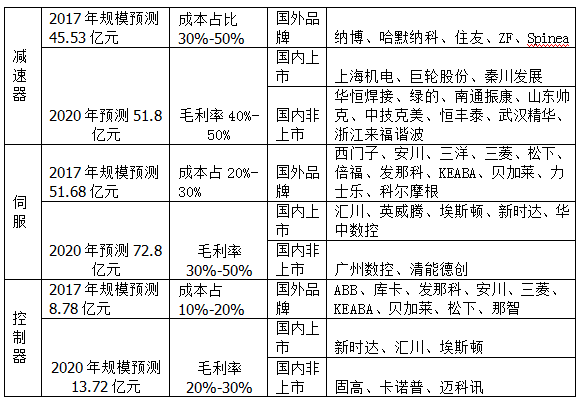

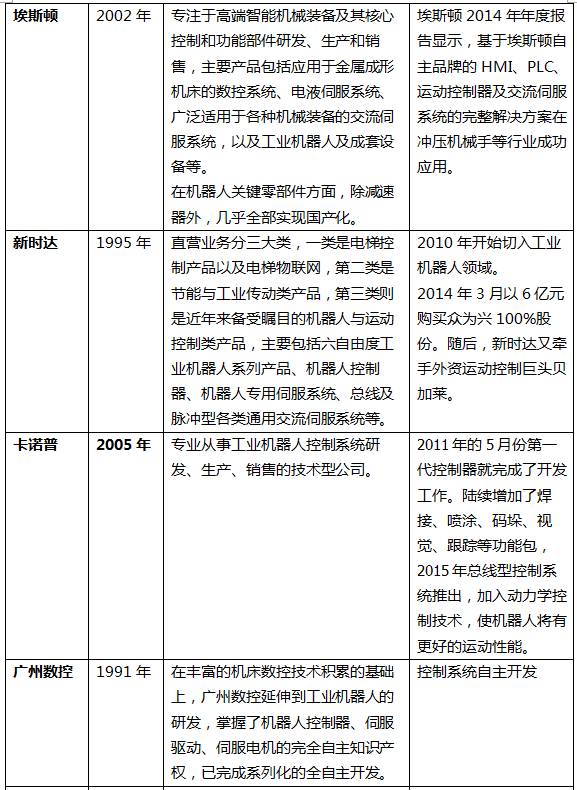

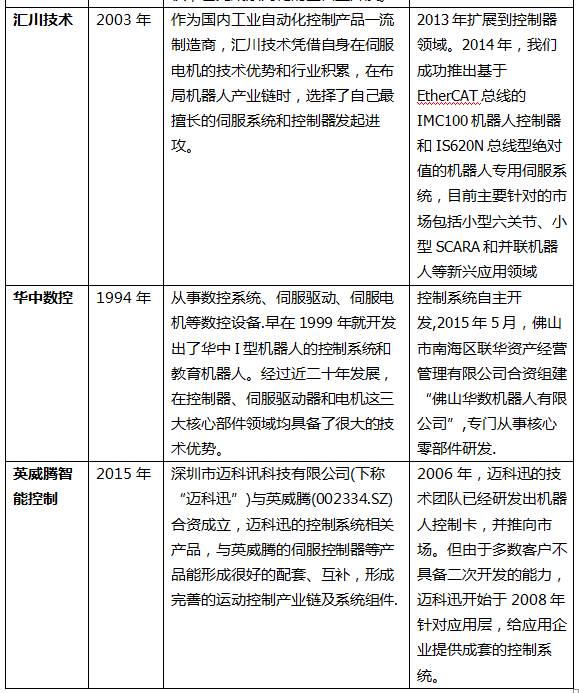

As the three core components of robots, reducers, controllers, and servo drives are key to the development and progress of the robot body. Compared to reducers, domestic controllers and servo systems have, to some extent, developed their own technological advantages and market foundations. (See the table below)

Table 1: Comparison of Scale, Cost, and Brand Companies of the Three Core Components

Table 1: Comparison of Scale, Cost, and Brand Companies of the Three Core Components

Foreign Robot Companies Dominate Controller Market

The main task of industrial robot control systems is to control the robot’s motion position, posture, trajectory, operation sequence, and timing in the workspace. It also features easy programming, software menu operation, a friendly human-computer interaction interface, online operation prompts, and ease of use.

The degree of freedom of a robot depends on the number of movable joints; the more joints, the higher the degree of freedom and the better the displacement accuracy, but the number of servo motors required increases accordingly. In other words, the more precise an industrial robot is, the more servo motors it contains, typically controlled by a single control system, which also means higher performance requirements for the controller.

Like the body and software, controllers are generally designed and developed by robot manufacturers. Currently, the controllers of mainstream foreign robot manufacturers are developed based on a general multi-axis motion controller platform, with each brand of robot having its own matching control system. Therefore, the market share of controllers is basically consistent with that of robots, and domestic manufacturers’ controllers have not yet formed a competitive market advantage.

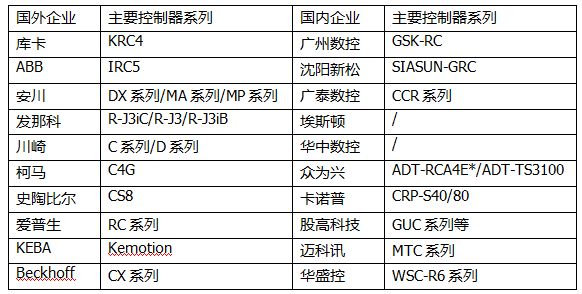

Table 2: Series of Self-Developed Controllers by Domestic and Foreign Robot Manufacturers

Table 2: Series of Self-Developed Controllers by Domestic and Foreign Robot Manufacturers

Domestic Controllers Gaining Ground

In recent years, domestic motion control (including CNC) technology has developed rapidly. Some traditional CNC equipment manufacturers have begun to develop products with motion control characteristics. To improve production efficiency and product quality, more and more machinery manufacturers are starting to use and gradually become familiar with general motion control systems, leading to the expansion of general motion control products into many previously underutilized fields.

At the same time, some CNC equipment manufacturers have developed dedicated motion control products for robots and promoted their industry applications, gradually moving towards maturity and industrialization. Companies such as Guangzhou CNC, Guantai CNC, and Estun are representatives of this trend; they not only developed dedicated control systems for robots but also entered the robot industry, becoming representatives among domestic robot manufacturers.

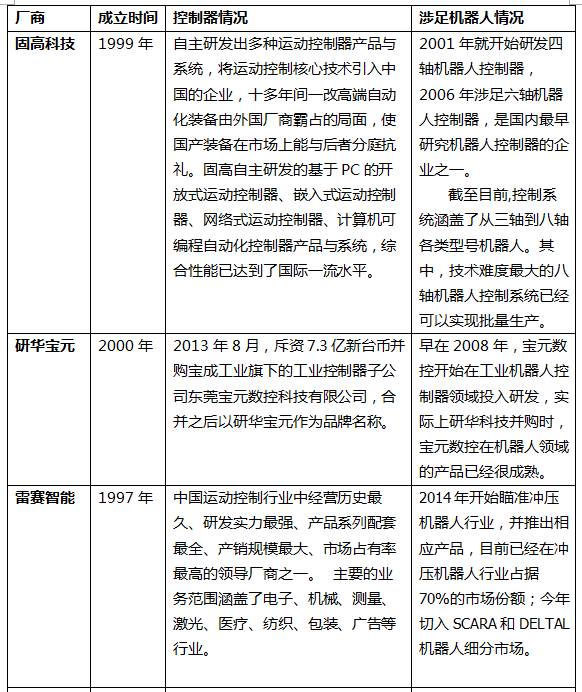

As the globalization of China’s manufacturing market has raised higher demands for technology and equipment, it has provided opportunities for the promotion and high-level application of motion control technology. Against this backdrop, a number of specialized motion control companies have gradually emerged, starting to provide dedicated controllers for robots. Companies like Googol Technology, Canopy, and Zhongwei Xing are representatives of this trend. Googol Technology is one of the earliest companies in China to achieve the industrialization of six-axis robot control systems, primarily providing control system platforms to robot integrators, while Canopy and Zhongwei Xing’s control systems have gained good application experience on their own robots. Meanwhile, many domestic robot companies have also gradually developed their own control systems.

After years of accumulation, the hardware platforms used by domestic robot controllers are not significantly different from foreign products; the gap mainly lies in control algorithms and the usability of secondary development platforms. With the accumulation of technology and application experience, domestic robot controller products have matured, becoming key components with the smallest gap compared to foreign products. In the coming years, China’s domestic robots are expected to develop rapidly, and the application market for domestic robot controllers is facing good development opportunities, especially for companies that have been deeply involved in motion control for many years.

Top Ten Domestic Controller Manufacturers

Company Interviews

For this controller special feature, we interviewed five specialized controller manufacturers, and their understanding of their products and the domestic market is largely similar. We can affirm that the gap between domestic industrial robot controllers and foreign brands will continue to exist for some time, but domestic products also have their unique advantages. We hope that domestic brands will continue to cultivate and innovate.

The following companies are listed in no particular order.

Chengdu Canopy Automation Control Technology Co., Ltd. General Manager Li Liangjun

Shenzhen Zhongwei Xing Technology Co., Ltd. Integrated R&D Center Manager Yang Jipeng

Shenzhen Invt Intelligent Control Co., Ltd. (Mikexun) General Manager Zhang Wei

Shenzhen Leadshine Intelligent Control Co., Ltd. Deputy General Manager of Industrial Robot Division Wu Han

Shenzhen Inovance Technology Co., Ltd. General Manager of Electromechanical Control Products Chen Peizheng

Li Liangjun from Canopy

Zhang Wei from Invt

Zhang Wei from Invt

Chen Peizheng from Inovance

Chen Peizheng from Inovance

Wu Han from Leadshine

Wu Han from Leadshine

Zhongwei Xing Yang Jipeng

Zhongwei Xing Yang Jipeng

1. What opportunities led your company to enter the robotics industry? What significant developments and breakthroughs have you experienced in control systems?

Li Liangjun from Canopy:Our core technical staff began engaging in industrial motion control over ten years ago, which is closely related to the control concepts of robots. This means we basically mastered the foundational technology of industrial robot control back then. Based on market visits in 2009-2010, we analyzed that industrial robots would be a core point for factory automation, thus we chose to focus on industrial robot controllers at the beginning of our startup in early 2011.

In May 2011, we completed the development of our first generation controller. After the success of the first generation controller, we gradually added functionality packages such as welding, spraying, palletizing, vision, and tracking based on customer applications, enriching our application technology to suit various scenarios. In 2015, we launched our bus-based control system, incorporating dynamic control technology to enhance the motion performance of robots.

Yang Jipeng from Zhongwei Xing:Zhongwei Xing has always been engaged in industrial automation solutions, and robotics is an inevitable trend in automation. We included it in our technical platform for development back in 2006. In the evolution of control systems, Zhongwei Xing has become a microcosm of China’s progress in recent years. From pulse-based robot motion control cards to EtherCAT bus-based control systems, and recently to integrated drive-control robot control systems, Zhongwei Xing has consistently met the needs of China’s robot development, especially for various robots suitable for the 3C manufacturing industry, such as SCARA and small six-axis robots. Our integrated ultra-compact robot control system is a classic representation of Zhongwei Xing’s years of accumulation in motion and servo technology.

Zhang Wei from Invt:Mikexun has been engaged in robot control for over eight years, launching related control products for industrial robots in 2008. Our technical team includes personnel from Taiwan and overseas, and for many years we have focused on joint robot controllers, including six-axis and SCARA robots.

Wu Han from Leadshine:Leadshine has been developing motion control since 1997, covering industries such as electronics, machinery, measurement, laser, medical, textiles, packaging, and advertising. However, we entered the robotics industry in 2014, targeting the stamping robot market and launching corresponding products, currently holding a 70% market share in this field. This year, we are entering the SCARA and DELTA robot segments to achieve results in these two areas.

Chen Peizheng from Inovance:Inovance entered the servo field of the robotics industry in 2008 and expanded into the controller field in 2013. After years of accumulation, Inovance’s servo systems hold a leading brand and market share in the robotics industry, especially in the rectangular coordinate and traditional four and six-axis robot markets, where we hold significant influence among domestic brands.

The controller is currently one of the key areas our company is promoting. Our approach focuses on dedicated robot controllers, leveraging our early experience in the PLC product market. The robot-specific control systems are designed to closely align with market demands, ensuring not only smooth and precise robot motion but also a tight integration with application ends. In 2014, we successfully launched the EtherCAT bus-based IMC100 robot controller and the IS620N bus-based absolute value robot-specific servo system, primarily targeting emerging application areas such as small six-axis, small SCARA, and parallel robots, and notably, we have achieved mass production in these fields.

2. What was your company’s sales figure in 2015? What proportion does the control system account for? What is your control system’s market position in the domestic industrial robot field?

Li Liangjun from Canopy:Our main business is robot control systems, and our products include six-axis and four-axis industrial robot control systems. In 2015, we sold 1,450 sets of industrial robot control systems, achieving sales of over 17 million. The majority of our control systems are six-axis, with four-axis accounting for about 20%.

Currently, our products are leading in the domestic industrial robot control system market, with a substantial customer base and a significant market share.

Zhang Wei from Invt:In 2015, we sold around 1,000 controller products, primarily in the mid to high-end multi-joint robot sector. In the second half of 2015, we joined the Invt Group, which brought new changes to both our product line and sales model. On one hand, we expanded our product line to include mainstream and niche control products, representing a comprehensive extension of product categories. On the other hand, we will quickly release sales volume and gradually broaden our sales reach to increase sales volume.

Currently, Mikexun has a team of over 30 people dedicated to specialized tasks, and after merging with Invt, we will provide a more comprehensive product and service based on system solutions.

Wu Han from Leadshine:In 2015, Leadshine’s total sales exceeded 400 million, with industrial robots being a newly emerging business segment with a relatively small proportion. Last year, we sold about 1,000 units in the robotics sector, primarily targeting stamping robots.

Chen Peizheng from Inovance:Inovance’s 2015 financial report shows that we achieved an operating income of 2.771 billion yuan and a net profit of 809 million yuan. Although the robotics business has a small share in the overall revenue, it is a high-growth area, so we will continue to increase our investment in robotics-related products.

3. The domestic industrial robot body market is developing rapidly, with several leading companies performing outstandingly. What is your view on the current development status of the domestic industrial robot body market? What predictions do you have for the future of industrial robots in China?

3. The domestic industrial robot body market is developing rapidly, with several leading companies performing outstandingly. What is your view on the current development status of the domestic industrial robot body market? What predictions do you have for the future of industrial robots in China?

Li Liangjun from Canopy:The number of companies involved in the domestic industrial robot body market is increasing, but very few truly possess independent design and development capabilities, with most still relying on imitation. I believe the future of industrial robots in China must have a good cost-performance ratio for general industrial applications, and improving the localization rate of the three core components is key. Once the localization rate increases and cost control is achieved, the market will open up.

Yang Jipeng from Zhongwei Xing:Localization of industrial robots in China is an inevitable trend. China is a huge domestic market, and in recent years, there have been significant technological accumulations in industrial automation, especially in industrial robots, leading to many outstanding enterprises, including Zhongwei Xing. This phenomenon indicates that the demand in the Chinese market is becoming more segmented and upgraded, as Chinese manufacturing essentially outputs to the world. The big data behind Chinese manufacturing means we understand the manufacturing demands for the most popular products of this era, and leading demand trends is key to the development of robotics. For example, can a welding robot designed for 1400 be used for mobile phone assembly? Technically, yes, but if faster, more precise, and lighter robots are required, the welding robot will show its shortcomings. The significance of localization in Chinese robotics lies in producing robots that are faster, better, and more suitable for new process requirements. In the face of a surge of new demands, China’s robot development opportunities are equal to those abroad. I believe that the booming Chinese robot market will first stimulate diversified designs of the body and rapidly develop core components such as reducers, servo motors, drives, motion control, and visual recognition.

Zhang Wei from Invt:My view is that the existing industrial robot body market should not be overly optimistic. There are countless active robots, but the products that can be effectively applied are not satisfactory. Currently, China’s industrial robots face multiple pressures, including product performance, cost control, and application functionality. Faced with significant price reductions from foreign robots, domestic robot products can no longer compete solely on price. More critically, the technology of key components like reducers still struggles to match foreign products, and various challenges are testing domestic robot companies, forcing us to make multi-faceted efforts in terms of cost, performance, and functionality for control systems.

Wu Han from Leadshine:From our perspective, industrial robots represent a long-term development endeavor. Currently, many foundational technologies such as flexible grasping, adaptive vision, and force feedback have not been well realized, making widespread adoption challenging. However, from a long-term perspective, this market is immeasurable, which is why we are focused on entering the robotics field. Additionally, the current domestic industrial robot body market has not formed a distinct market structure, and which unexpected body companies will emerge as leaders remains to be seen. However, it is essential to note that the future of domestic industrial robots is full of hope.

Chen Peizheng from Inovance:From an application perspective, domestic and foreign robots are currently on the same starting line in fields such as 3C, bathroom polishing, spraying, and loading/unloading, so everyone has the opportunity to compete in these areas. Therefore, I believe that establishing brands and building confidence for domestic robots should pinpoint their positioning, which is not only the responsibility of body manufacturers but also the obligation of core component manufacturers.

From a market structure perspective, the current domestic industrial robot body market has yet to show a clear picture. In three to five years, many companies will struggle and exit the market, and at that time, domestic robots may have a new world.

From a product technology perspective, a significant gap for domestic industrial robots currently is a profound understanding of dynamics or the ability to design a robot from a structural perspective. We notice that very few manufacturers are continuously launching updated and improved robot products on the market, indicating that the path to product refinement still requires time.

4. What are the most prominent advantages of your company’s control system? What areas do you think need further improvement and enhancement?

Li Liangjun from Canopy:The advantage of our control system lies in its reliability and comprehensive functionality. We have fully considered reliability from the design stage, conducting related reliability designs and tests on platforms, hardware, and software, and we have a significant advantage compared to similar products in the market. In terms of functionality, our early entry into the robotics field and large customer base have allowed us to accumulate a wealth of features and process packages, all of which have practical applications. This widens the range of customer satisfaction.

As for areas for improvement, we mainly need to further enhance the motion performance of robot control and refine processes to align the application functions and characteristics of domestic industrial robots with imported robots.

Yang Jipeng from Zhongwei Xing:Zhongwei Xing is a company focused on motion control solutions. Since 2000, we have been engaged in the research and development of foundational technologies related to automation. In recent years, our R&D achievements have mainly been reflected in CNC motion control technology and servo drive technology. In recent years, we have integrated these two technology systems to develop an integrated drive-control system specifically for robots. The standout advantage of Zhongwei Xing’s robot control system is that we develop robots based on CNC technology, enabling them to not only meet traditional applications but also to be as simple and user-friendly as CNC machines. One demonstration is having a robotic arm draw the twelve zodiac animals, where we only spent five minutes to generate complex trajectory data and run it smoothly. This is one of the advantages based on CNC technology.

Not only does Zhongwei Xing have unique advantages in motion control algorithms, but we also perfectly integrate servo operation support. Firstly, we know that bus systems are the mainstream robot control solutions abroad, and most use a 100Mbit Ethernet. The advantage of integrated drive-control technology is that it converts serial communication into parallel communication, achieving a communication speed 25 times that of bus systems. Faster communication and lower synchronization jitter are the two fundamental indicators of servo and motion performance. Zhongwei Xing believes that the performance of robot systems must have hard indicators in software.

Regarding the work we are currently doing, we recognize that we are still limited to standard robots such as SCARA and small six-axis robots. We have already observed the branches derived from these areas and will launch corresponding solutions at the appropriate time.

Zhang Wei from Invt:In terms of motion controllers and driving products, we have developed the MTC standard series of motion control cards and IMC high-performance motion controllers with the power of global Chinese professionals. Our engineers can provide complete system solutions based on the needs of customer machines and develop customized motion control systems as needed. Currently, our controllers are basically mature in applications for four and six-axis joint robot products, receiving positive feedback from customers. This is the result of our persistence over the years.

Compared to international brand products, the basic performance of domestic controllers is not significantly different; they can compete in terms of speed, accuracy, and stability. However, since the development of domestic controllers has started relatively late, the technology at the application level lags behind, especially in terms of software functionality, which is difficult to catch up with in a short time. Focusing on the development and improvement of application-level technology will be the key for domestic controllers to catch up, and this technological accumulation is an endless endeavor that requires significant investment. However, we cannot be discouraged; prioritizing applications is the direction of future intelligent control at Invt.

Wu Han from Leadshine:Currently, Leadshine is building a complete intelligent robot control system centered around control software, which includes control, drive, perception, networking, safety, and key process components. For example, the controller we developed for stamping robots not only ensures stable efficiency but also focuses on vibration suppression, reliability, and ease of use. In the future, we need to introduce bus control solutions to further enhance system speed and precision.

In comparison, foreign robot controllers generally have good generalization performance, especially with excellent underlying performance, suitable for applications across various industries, but they lack ease of use and openness for secondary programming. This is precisely the advantage of domestic controllers; our focus on user-friendly design and development is a competitive strength. Although we started later, we maintain a cautious yet rapid approach, ensuring that when we enter a particular niche, we have a clear understanding, and once we enter, we strive for a leadership position. This is also the reason why we have gradually expanded from stamping robots to SCARA and other multi-joint robot fields over the past three years.

Chen Peizheng from Inovance:I believe Inovance’s controllers have three main advantages. Firstly, the core technology of our controllers is independently developed, allowing us to master core algorithms that give Inovance products both good logical functionality and excellent motion control capabilities. Secondly, based on our proprietary industrial automation control technology, we have not only matured the controllers for standard robot models but can also quickly provide personalized solutions and customized products for customers. Lastly, we offer customers core components, including servo systems and controllers, and in conjunction with machine vision, we also need to enhance usability in our development work, which is one of our major strengths. These combined functionalities enable us to make robots smarter.

As for areas for improvement, domestic controllers indeed need to refine details. We believe that with our unique openness and customization advantages, along with more attentive future services, domestic controllers can gain more confidence.

5. Based on your understanding, what do you estimate is the current localization rate of control systems for domestic industrial robots? What is the price of your control system, and what is its profit margin?

5. Based on your understanding, what do you estimate is the current localization rate of control systems for domestic industrial robots? What is the price of your control system, and what is its profit margin?

Li Liangjun from Canopy:The current localization rate of control systems for domestic industrial robots is estimated to exceed 50%. Our product prices range from 10,800 to 16,000 yuan, with a gross profit margin of around 80%. However, due to significant development investments and relatively high software costs, the actual net profit is not high.

Zhang Wei from Invt:Currently, there is not much difference in sales among companies producing industrial robot controllers, as the overall market has not yet taken off. At this stage, our investment and output ratio cannot be measured by profit margins, as the development of this market still relies on the volume of domestic robots. We believe that a controller company needs to sell over 5,000 units to achieve scale and efficiency, so collective efforts are still needed at this stage.

Wu Han from Leadshine:I personally believe that among domestic industrial robots, the usage rate of domestic controllers is close to 70%. In the domestic industrial robot body market, the localization rate of controllers is relatively high compared to reducers and servo drives. However, since the entire domestic industrial robot market is still small, the controller market is evidently not large, and domestic controllers will inevitably develop alongside the growth of the domestic industrial robot market, which we look forward to.

6. Compared to reducers, international well-known robot body manufacturers generally develop control systems independently. What are the main reasons for this? Domestic robot body manufacturers such as Siasun, Estun, and New Times have their own control systems; what are their considerations? How large do you think the market for domestic industrial robot control systems is?

Li Liangjun from Canopy:Foreign robot manufacturers are often large multinational companies; they develop control systems independently for two reasons: first, they have the capabilities to do so, and second, they can achieve optimal control effects tailored to their robots’ characteristics. I believe domestic robot manufacturers create their systems mainly for brand considerations and to develop application functions based on their familiar industries without being constrained by others.

I estimate that in the Chinese robot market, domestic industrial robots will account for over 50% within the next five years, with domestic manufacturers’ use of control system brands exceeding 60%. This 60% represents the market for our domestic industrial robot controllers.

Yang Jipeng from Zhongwei Xing:It must be acknowledged that the foundation for China’s robot design and manufacturing is still relatively weak. Therefore, when facing various technical accumulation directions, companies with financial strength generally prioritize developing the “control brain.” Currently, I believe there are two main development routes for domestic robots. The first is a comprehensive approach, which is more common among listed companies, aiming to benchmark against foreign companies that have already captured market scale, such as Fanuc and ABB. This choice is understandable, but it is difficult to catch up with a 20-30 year lead in just five years. The second route is to focus on expertise and accumulate innovation in core technologies, which will help enhance the overall industry chain’s height and maturity and expand market scale. I believe this will be the trend for the rise of Chinese robotics. Although Zhongwei Xing is working on the “brain” part, it is merely a component of the entire robot. It is essential to popularize the basic value that any component manufacturer can become the pinnacle of the entire industry chain, depending on whether they specialize in their field. I often introduce Zhongwei Xing as “a professional, lightweight technology company from Shenzhen, whose culture emphasizes accumulation over management, enabling us to have an independent technological property advantage in core technologies.” Zhongwei Xing’s attitude towards cooperation in the robotics field is, “You need it, and I specialize in it.”

7. What are your company’s goals for 2016 and future development plans?

Li Liangjun from Canopy:In 2016, our sales target for control systems is no less than 2,500 sets, with a market share of no less than 30% in domestic robot control.

Zhang Wei from Invt:In the next three years, our goal is to achieve annual sales of 5,000 units and further solidify and promote our brand and reputation.

Wu Han from Leadshine:Currently, Leadshine’s industrial robot division has about 20 people, mainly comprising technical and development personnel. In 2016, our goal is to double our sales and achieve breakthroughs in new fields. In product development and planning, Leadshine has clear and long-term plans: continuously enhancing motion control performance, accumulating industry application experience, and transitioning from traditional control to bus-based control, steadily advancing towards the high-end market.

Chen Peizheng from Inovance:Currently, Inovance has a team of several dozen focusing on the controller field. Undoubtedly, robotics is a significant direction for Inovance’s overall layout. In the future, we will invest efforts in continuously optimizing core components and researching process technologies, providing customers with comprehensive solutions based on industrial robots. We hope to combine Inovance’s strengths with body manufacturers for open cooperation, genuinely promoting robot products recognized by the market.

From national government policy support to local industrial park investments and the involvement of capital and listed companies, China’s robot industry has shown signs of overheating in a short time. To some extent, the development of domestic industrial robot bodies reflects a pressing growth potential, especially in terms of technological breakthroughs and expectations for core components. However, haste makes waste, and the gap between domestic and foreign products mainly lies in the accumulation of time, which is difficult to eliminate in the short term. Therefore, domestic robot controller manufacturers should carefully consider how to leverage their local advantages and occupy positions in emerging niche fields.