Source: Industrial Intelligence, Zhi Dongxi, Automation and Instrumentation, Global IoT Observation Compilation and Release

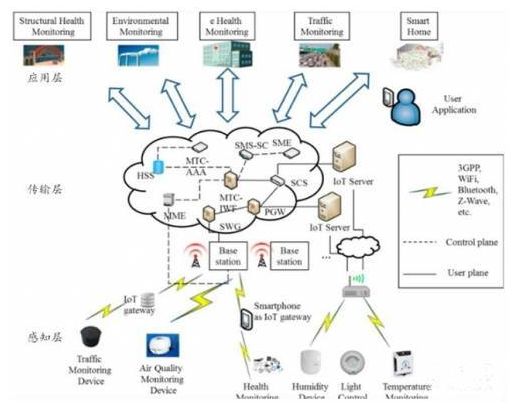

The architecture of the Internet of Things generally consists of the perception layer, transmission layer, and application layer. The perception layer mainly consists of sensors, microprocessors, and wireless communication transceivers. Sensors are at the lowest level of the IoT, serving as the entry point for data collection, the “heart” of the IoT, and are expected to experience significant development space.

Sensors, as cutting-edge technology in modern science, are regarded as one of the three pillars of modern information technology and are widely recognized as a high-tech industry with great development prospects both domestically and internationally. Experts in automation in China point out that sensor technology is directly related to the development of the automation industry in our country, stating that “strong sensor technology leads to a strong automation industry.” This highlights the importance of sensor technology to the automation industry and even to the overall industrial construction of the nation.

However, as sensors are entering a springtime of development, the Chinese public still seems to witness a feast dominated by foreign semiconductor giants. Industry insiders believe that although the Chinese sensor market is developing rapidly, there remains a significant gap between domestic sensor technology and the global standard.

This gap manifests itself in two ways: on one hand, there is a lag in the ability of sensors to perceive information, and on the other hand, there is a technological lag in the intelligence and networking capabilities of the sensors themselves. Due to the lack of sufficient large-scale applications, domestic sensors are not only low in technology but also high in price, making them difficult to compete in the market.

Development Status of Sensors in Various Countries

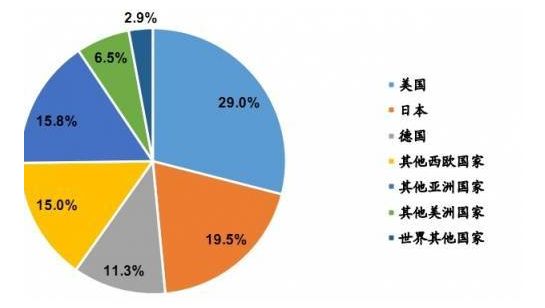

Currently, the global sensor market is primarily dominated by a few leading companies from the United States, Japan, and Germany. Together, the United States, Japan, Germany, and China account for 72% of the global sensor market share, with China accounting for about 11%. Compared to the more than 20,000 types of products produced globally, China can only produce about one-third of that, and the overall technical content is also relatively low, which is a state that urgently needs to change.

United States

The United States claimed as early as the 1980s that the world had entered the sensor era. In the early 1980s, the U.S. established a National Technology Group (BGT) to help the government organize and lead major companies and national enterprises in sensor technology development. Six of the 22 technologies crucial to the long-term safety and economic prosperity of the United States are directly related to sensor information processing technology. Among the key technologies that are critical to maintaining the quality advantage of U.S. weapon systems, eight involve passive sensors. In 2000, the U.S. Air Force identified 15 key technologies that would enhance the capabilities of the 21st-century Air Force, with sensor technology ranking second.

The U.S. development model follows a path of military first, then civilian, and from improvement to popularization. Its notable characteristics include:

1. A strong emphasis on the research of functional materials for sensors;

2. Significant investment in sensor technology development: For example, Honeywell’s solid-state sensor development center invests $50 million annually in equipment, currently possessing the most advanced complete sets of equipment and production lines, including computer-aided design, single crystal growth, processing, photomask generation, automated coating and lithography, plasma etching, sputtering, diffusion, epitaxy, vapor deposition, ion implantation, chemical vapor deposition, scanning electron microscopy, packaging, and dynamic testing. Most of the instruments and equipment are updated approximately every three years to ensure technological leadership.

3. Attention to process research: The principles of sensors are not difficult and are not kept secret; what is most confidential is the process. Many evaluations state that “sensors” are not just ordinary industrial products but rather masterpieces of craftsmanship. In terms of research and development, there are about 1,300 manufacturers producing and developing sensors in the U.S., along with over 100 research institutes and universities.

Germany

Germany prioritizes military sensors as a technology for development. The sensor industry in Germany fully leverages the inherent advantages of being an established industrial power, and through the integration of its brand reputation and advantages in technology research and quality management, the market competitiveness of its products is significantly enhanced.

On one hand, there is more attention to the cost savings of raw materials; on the other hand, there is a heavy investment in human capital to maintain technological leadership and thus a high market share!

Japan

Japan ranks sensor technology as one of its top ten technologies. Business people in Japan claim that “controlling sensor technology means controlling the new era.” Japan places significant importance on the development and utilization of sensor technology, listing it as one of the six core technologies for national development.

In the 1990s, the Japanese Ministry of Science and Technology established 70 key research projects, 18 of which were closely related to sensor technology.

Japan focuses on practicality and commercialization, moving from introduction and digestion to imitation and then to independent improvement and design innovation. The former requires more investment, while the latter is quicker and less expensive. In terms of research and development, Japan has about 800 manufacturers producing and developing sensors.

China

China began its foray into sensor manufacturing as early as the 1960s. In 1972, China established its first batch of piezoresistive sensor development and production units; in 1974, it successfully developed the first practical piezoresistive pressure sensor; in 1978, the first solid-state piezoresistive accelerometer was born; and in 1982, the earliest research on silicon micro-electromechanical systems (MEMS) processing technology and SOI (silicon on insulator) technology began. After entering the 1990s, various types of sensors such as absolute pressure sensors, micro-pressure sensors, ventilator pressure sensors, polysilicon pressure sensors, and low-cost TO-8 packaged pressure sensors were successively produced. Over the past 30 years of reform and opening up, China has made significant progress in sensor technology and its industry, mainly reflected in the establishment of national key laboratories for sensor technology, micron/nano national key laboratories, and national sensor technology engineering centers as research and development bases; research projects such as MEMS and MOEMS (micro-opto-electro-mechanical systems) have been included in the national high-tech development priorities; during the “Ninth Five-Year Plan” key national science and technology projects, sensor technology research achieved results of 51 varieties and 86 specifications of new products, initially establishing a sensitive element and sensor industry.

Currently, China’s sensor industry is at a critical stage of transitioning from traditional to new sensors, reflecting a general trend towards miniaturization, multifunctionality, digitalization, intelligence, systematization, and networking of new sensors.

Sensor technology has undergone years of development, and its technological evolution can be broadly divided into three generations:

The first generation consists of structural sensors that utilize changes in structural parameters to sense and convert signals.

The second generation, developed in the 1970s, comprises solid-state sensors that are made from solid components such as semiconductors, dielectrics, and magnetic materials, utilizing certain material properties. For example, thermocouple sensors, Hall sensors, and photodetectors are made using the thermoelectric effect, Hall effect, and photoconductive effect, respectively.

The third generation of sensors, which has just emerged, are intelligent sensors that combine microcomputer technology with detection technology, endowing sensors with a certain level of artificial intelligence.

Current Status of the Domestic Sensor Industry

Domestically, the sensor industry exhibits a lag in information perception on one hand and a technological lag in the intelligence and networking capabilities of sensors on the other. Due to the lack of sufficient large-scale applications, domestic sensors are not only low in technology but also high in price, making them difficult to compete in the market.

China began to emphasize sensor technology research around 1980. After years of effort, the development level in sensor research is relatively good. However, technological progress in productization has not been ideal; many sensor technologies have decent research levels in domestic laboratories but have not been fully utilized and have not translated into mature products entering the market.

Research in sensor technology requires a long-term investment; developing a sensor typically takes 6-8 years to mature, which is generally difficult for Chinese enterprises to bear. Chinese companies find it hard to endure failures, and the risk of failure in sensor research is quite high.

In contrast, Japanese companies support R&D that may not lead to products, but they can afford it; as long as 2-3 out of 10 projects can become products, that suffices. In comparison, many of our companies are preparing to take existing products from others. This mindset is problematic, including our constant desire to import ready-made products from abroad without nurturing our own talents.

Compared to larger instruments and equipment, the investment required for sensor productization is generally not very high, making it suitable for small enterprises to invest in. In this regard, China should have advantages. However, from another perspective, this also presents a shortcoming.

One characteristic of the sensor industry is that while the technology content of sensors is high, the price of individual sensors is generally low. This characteristic leads to the result that, despite the high technological added value of sensors, it is difficult to form a considerable output value by relying solely on sensors.

Generally speaking, sensors are somewhat like the “drug carriers” in traditional Chinese medicine; their functions are important, but to form a scale, they still need to rely on the entire formulation. Many foreign sensor companies quickly develop related measuring instruments once they achieve breakthroughs in certain sensors.

Additionally, under China’s patent protection mechanism, the key technologies painstakingly developed in sensors often take on a “know-how” nature, making them difficult to clarify after being copied, and companies cannot afford lawsuits. Although there are MEMS sensor companies in China, most are engaged in contract manufacturing, and if mishandled, the processing companies may take the technology for themselves, indicating significant issues in the current corporate innovation system.

Gaps Between China’s Sensor Development and Foreign Countries

Domestic sensor manufacturers occupy the mid-to-low-end market. The development trend of domestic sensor manufacturers can be categorized into three situations:

1. Products from private or joint ventures occupy the mid-to-low-end market, where traditional technologies and equipment can meet the manufacturing requirements of the vast majority of products, and the market development state is good. Except for a few manufacturers that have secured significant market shares by packaging chips produced abroad, other high-end products are monopolized by foreign manufacturers.

2. With the rise of emerging industries like the Internet of Things, the sensor industry has become an important field of competition for high-tech development in various countries. In recent years, China’s sensor industry has grown rapidly, and application models have matured. However, due to the low level of the industry and poor technological innovation capabilities, the domestic sensor industry presents a market structure of low-end surplus and high-to-mid-end monopolized by foreign countries. The lag in sensor technology development has hindered the smooth advancement of domestic strategic emerging industries.

Currently, China has formed a relatively complete sensor industry chain from materials, devices, systems to networks. Significant progress has been made in areas such as network interfaces, sensor and network communication integration, and IoT architecture. However, the industry level is low, the scale of enterprises is small, and the ability for technological innovation is poor; many enterprises merely import foreign components for processing, resulting in severe homogenization. Additionally, outdated production equipment and unstable processes lead to scattered product indicators and poor stability. Imitated products also lack agility. In relatively advanced R&D areas, there is a neglect of fundamental industrial development, and commercialization development is severely lagging.

Currently, there are about 6,000 types of sensor products in China, while abroad there are over 20,000, far from meeting domestic market demand. The import ratio of mid-to-high-end sensors reaches 80%, and the import ratio of sensor chips even reaches 90%, indicating a significant localization gap. High-tech products such as digitalization, intelligence, and miniaturization are severely lacking. High-end products required for major national equipment are mainly dependent on imports. Moreover, for sensors and intelligent instruments related to national security and major projects, foreign countries often impose restrictions on China. Foreign products occupy the vast majority of the domestic high-end market and will continue to dominate the high-end market for a long time to come; this trend is unlikely to change fundamentally in the short term.

3. State-owned enterprises are experiencing steady growth, overall lagging behind the latest technological developments abroad, with a general trend of widening the gap except for a few manufacturers. This is due to the rapid development of sensor technology, the fast update of processes and manufacturing equipment, and many new devices that domestic manufacturers are unable to produce. Additionally, the price of new equipment ranges from hundreds of thousands to millions of dollars, making it difficult for most manufacturers to purchase new equipment based on their own accumulation, which prevents them from keeping up with the rapid technological advancements of foreign enterprises.

Main Reasons for the Gap in Sensor Development in China

1. Core manufacturing technologies are significantly lagging behind foreign countries, resulting in subpar domestic products.

New technologies, products, processes, and materials for sensors continuously emerge abroad, with digitalization, intelligence, and miniaturization becoming trends; most products have become a reality and are continually improved and upgraded. While China’s sensor research and development fields are generally on par with foreign countries, there is a significant lag in certain core manufacturing process technologies, resulting in large differences in depth and breadth, mainly reflected in:

1. Incomplete product varieties and specifications, with a lack of new products.

Currently, China has around 3,000 types of sensor products, while abroad there are over 20,000, with a product variety satisfaction rate of only 60%-70%, far from meeting domestic sensor market demand. From the perspective of industry product structure, the proportion of old products exceeds 60%, with insufficient new products, and high-tech products are even scarcer. Overall, the product variety is mismatched, series are incomplete, low-end products are numerous, high-end products are few, and there is a lack of market competitiveness.

2. Poor technological innovation, with few products having independent intellectual property rights.

Domestic companies’ capabilities for independent development and technological innovation are weak. Due to various influencing factors, domestic companies still produce low-tech products manually or products that have been discontinued abroad. Many new companies are merely sales agents for foreign products, and although many universities and research institutes have decent capabilities for tracking high technology and developing high-value-added products, most results are in the form of samples, far from industrialization, with few independent developments and few research achievements with independent intellectual property rights.

2. Outdated process equipment leads to poor product quality.

After years of development, although a batch of processes and products has been developed, the stability and reliability issues of batch production processes have not been fundamentally resolved, limiting their application fields and industry development. Some high-performance products rely not on process guarantees but on selective grading. From a technical perspective, due to the relative backwardness of domestic sensor production processes and equipment, micro-mechanical processing technology and packaging technology are not advanced enough, and there is still a lot of manual operation, leading to major performance indicators being 1-2 orders of magnitude worse than those abroad and a lifespan that is 2-3 levels lower. Therefore, in major projects in fields such as chemicals, power plants, metallurgy, petroleum, environmental protection, and machinery, many high-performance sensors still rely on imports.

3. A shortage of talent resources leads to insufficient industry development.

One characteristic of sensors and their industry is that they are technology-intensive, which naturally requires a talent-intensive approach. Currently, in China, there is a relative lack of high-level research teams and young and middle-aged technical experts, technical managers, and academic leaders who can meet the demands of today’s sensor technology development, resulting in a slow pace of technological updates in the industry and insufficient momentum for industrial development.

4. Insufficient overall planning and inadequate investment efforts.

The existing problems include repeated and scattered efforts, insufficient overall planning, low intensity of research investment, outdated research equipment, and disconnection between research and production, which affect the transformation of research results, resulting in low comprehensive strength of China’s sensor products. Additionally, due to insufficient government attention, the understanding of the importance of sensor technology in the development of information technology has lagged behind that of computer technology and communication technology, leading to too small a scale and intensity of resource investment for development needs, which slows the pace of sensor technology development and constrains the rapid advancement of information technology.

Future Important Application Directions for Sensors

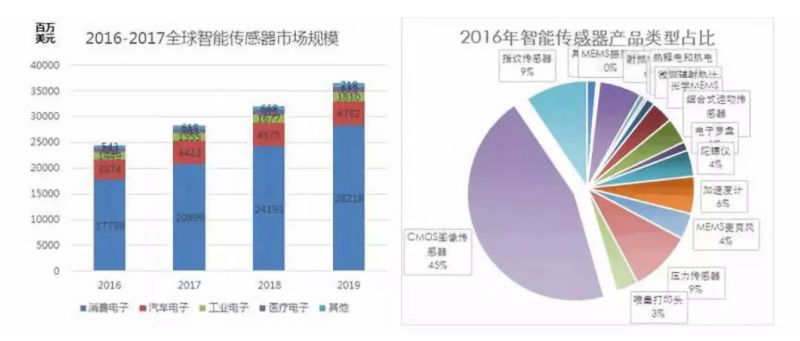

From the perspective of application fields, the largest markets for sensors are in industrial, automotive electronics, communication electronics, and consumer electronics. The proportion of sensors in domestic industrial and automotive electronics products is about 42%, with the fastest growth occurring in the automotive electronics and communication electronics application markets.

Smart cars and autonomous driving are significant drivers for the development of MEMS sensors. In the era of smart cars, a large number of MEMS motion sensors will be used to achieve active safety technologies: voice will become an important interaction method between humans and smart cars, and MEMS microphones will welcome new development opportunities. The rise of autonomous driving technology further pushes MEMS sensors into the automotive sector. The automotive industry occupies more than 30% of the entire MEMS market share, and in 2015, global automotive MEMS industry revenue reached $3.73 billion. According to forecasts, in the next six years, the global automotive MEMS market is expected to grow steadily at a compound annual growth rate of 4.2%.

Furthermore, MEMS sensors are also the “heart” of smart factories, making them a powerful tool for industrial robots to become “omnipotent.” They ensure the continuous operation of product production processes and keep workers away from production lines and equipment, ensuring personal safety and health. It is predicted that in the next six years, MEMS in the industrial market is expected to grow rapidly at a compound annual growth rate of 7.3%.