Source: Turen Guanchip, Author: Turen Guanchip

This morning, I came across an article by Lin from Sanwu Micro, titled “The Wi-Fi FEM Track Has No Way Out”. Mr. Zhong’s humorous writing made me laugh out loud, reminiscent of the cries of pigs in shared suffering.

In Mr. Zhong’s article, he wrote:

“As more and more competitors join, at the peak, there were over 30 companies, making me feel as if Wi-Fi FEM is the leader in the RF front end.”

“My misfortune lies in encountering a group of competitors with no price bottom line; their prices have dropped to a level I dare not look at, and I can vaguely feel the pain of cutting losses. Your misfortune is that I will continue to launch Wi-Fi FEMs with extreme performance and cost, and your losses will feel like being lost in a desert with no end in sight.”

“Can selling Wi-Fi FEMs at 50% of cost still win the love of investors?”

“From the definition of marketing, excessive competition refers to a state where the expected profits of any company participating in a market competition are less than zero. In other words, excessive competition is a market competition state where there are ‘no winners’, and any company involved in the competition cannot make a profit (including future profit hopes).”

The conclusion of the last paragraph inevitably reminds me of another industry in shared suffering, which is completely unrelated to semiconductors: the pig farming industry. Has the semiconductor industry now fallen to the same level as pig farming enterprises?

Historically, there was indeed a major European and American company that originated from pig farming, which is Micron, well-known in the storage field. Micron is located in Idaho, USA, an agricultural state famous for potatoes. The early investors of Micron indeed came from pig farming and potato selling. As a small memory manufacturer, Micron struggled for a long time on the brink of loss and bankruptcy, but fortunately, it eventually made it out; that is another story.

The current pig cycle has seen the longest and most difficult bottoming period in history. Due to an oversupply of pork, the capacity reduction has been tumultuous, and the entire industry has been in prolonged losses, leading to three listed companies facing bankruptcy or restructuring. Last year was the most challenging year for pig farming enterprises. According to data from the Ministry of Agriculture and Rural Affairs, in 2023, the average loss per pig raised in the industry was 76 yuan, marking the first official year of overall losses since 2014.

In a sense, doing semiconductors is just like pig farming; it is also driven by simple supply and demand relationships. Pig farming takes X years to sell, so when demand is high, everyone enters the pork industry and starts raising pigs. When the pigs are ready and enter the market, the supply exceeds demand. This is a classic capacity expansion and contraction model.

Like the pig farming industry, the semiconductor industry also experiences a necessary path of per capita losses and capacity reduction cycles, which I believe extends far beyond Mr. Zhong’s Wi-Fi FEM field. Recently, I saw the quarterly report from Kangxi Communication, where the gross profit margin has dropped to 11%. Two other domestic RF giants, Unisoc’s gross profit margin for 2023 is similar to ASR’s (Aojie announced a gross profit margin of 24%), compared to foreign giants, Qualcomm’s overall gross profit margin for the 2023 fiscal year is 56%, and MediaTek’s is 48%. The gross profit margin of domestic chips is even lower than that of the pig farming industry. Do domestic chip bosses want to be altruistic and not make money?

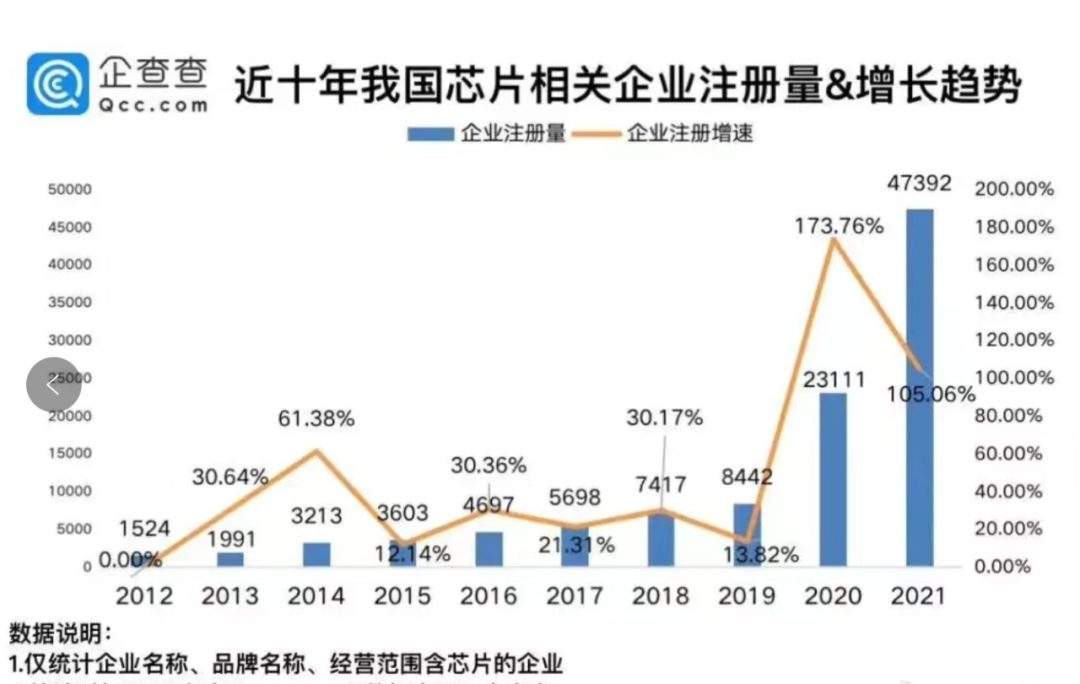

Take a look at the explosive registration data of chip companies below to get a sense of it.

Everything is cyclical; in any industry, the changes in capital expenditure (capex) largely bring about cyclical fluctuations. If you don’t invest three years ago, you won’t see new capacity coming online this year. This year, if you invest, the new capacity will only be released three years later. Whether in cyclical industries or semiconductor pig farming, the principle is the same: capex is a leading indicator of industry prosperity reversal.

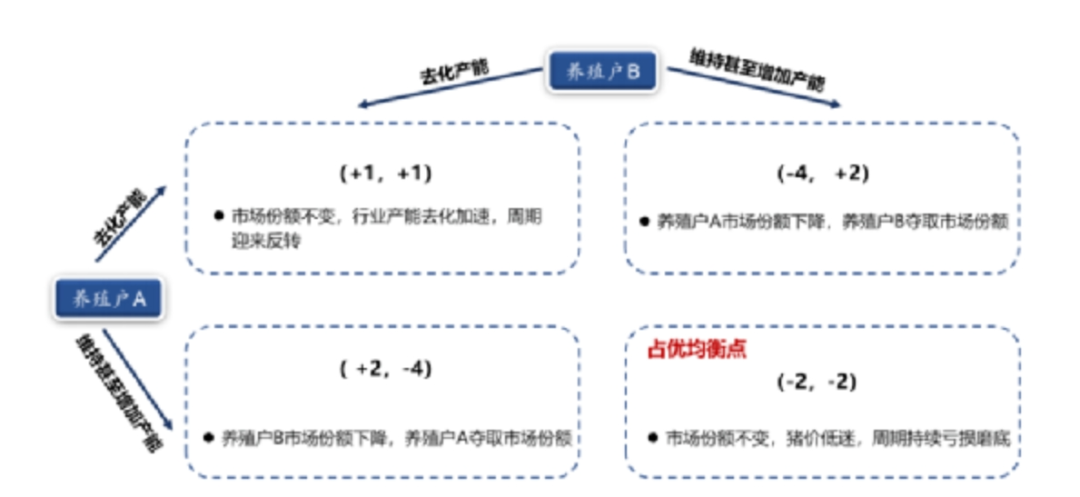

The semiconductor industry and the pig farming industry have very similar cyclical patterns:

1. Producers lack information and do not know whether others will expand or contract capacity;

2. Capacity release takes a long time. Pork takes 200 days, coal takes 5 years, chip wafer fabs take 4 years, and chip inventory clearance takes 100 days.

3. Industry corrections have a lag effect, and the market adjusts passively and slowly.

If a sector’s capex is significantly increasing in the short term, the entire industry is likely to be in trouble later. If a sector’s capex has been in a contraction state for a long time, then at some point in the future, the entire industry may likely reverse. I just saw that in Q1 of this year, the production of mature process chips in China increased by 40%, which made me start to worry about the future of foundries.

Most market players are operating within this model, and only a few leading players can break out of this internal competition model to achieve long-term monopolistic high profits. The reasons are nothing more than: administrative monopoly (tobacco), technological monopoly (TSMC, ASML), channel monopoly (Procter & Gamble), and user habit monopoly (WeChat, Douyin, Apple). There is no way around it; only monopoly can lead to easy wins. All other market competitors face a constant state of having no way out, merely fluctuating with market cycles.

In the chip design industry, to put it bluntly, we are still just small fish in a vast industrial chain. Whoever can carve out a small territory and build a high dam to keep competitors at bay is already doing well. If we encounter a drought year, everyone’s life will not be good, just like the pig farmers.

The industry downturn cycle is a disaster for small companies, but it is also an opportunity for them. Chaos is a ladder; large companies often cannot respond well to changes due to institutional rigidity, which can also lead them to overlook many small companies and opportunities. Classic examples include Nokia and Kodak, which had money and resources but ultimately missed industry opportunities. Other cases include instances in the panel and storage industries where companies have leveraged against the trend to create miracles.

Small companies that seize opportunities and go all in can often rise in the market against the trend. Companies with technology, customers, cost control capabilities, cash flow, and profits may run faster in this competitive landscape where the strong get stronger and the weak exit faster.

In Mr. Zhong’s article, there is a viewpoint I do not quite agree with:

“Rationally speaking, the market size of the Wi-Fi FEM track is only one-tenth of that of mobile phone PAs, and it is divided into three branches: one leads to routers, one to smartphones, and the other to Xiaomi SU7. The three paths of Wi-Fi FEM are all connected, yet none lead anywhere; the Wi-Fi FEM track has no way out.”

I do not know much about the Wi-Fi FEM track. What Mr. Zhong sees are these three paths, which are merely the three paths everyone sees. A phrase I have been quoting in previous articles is:

Schopenhauer said: “Talented people hit targets that others cannot hit, while geniuses hit targets that others cannot see.”

If everyone sees this target and wants to hit it, even outsiders think this industry is great, then competition may have already become fierce. There must be some targets in the industry that are still invisible to everyone; this is the true industry dividend, the place where there is no internal competition. Investors invest in your company not because they hope you will merely compete in the paths everyone is taking, but because they hope you will discover new tracks and lead the way on these new paths. Perhaps there are ten paths for Wi-Fi FEM in the future, just waiting for you to discover.

The MCU track we are in can be likened to a fishing pond, a place abundant with fish. There are hundreds of visible fishing ponds, and many players are crowded into certain specific ponds. They feel this industry is highly competitive because the products in their hands are highly homogeneous, while they cannot see many other invisible fishing ponds. This is also the most attractive aspect of this track. In the downturn of the industry cycle, it is actually a good time for us to sow seeds, hoping that more like-minded partners will join us in sowing, patiently waiting for the flowers to bloom and bear fruit, as the cycle slowly passes. Perhaps a beautiful garden will emerge.

Live Broadcast: Key Technologies of Precision Testing such as ADC and PLL Revealed!