How can one not know?

The IoT platform industry chain  The IoT platform serves as a hub in the IoT industry chain, providing essential functions such as terminal management, connection management, application support, and business analysis from the bottom up.

The IoT platform serves as a hub in the IoT industry chain, providing essential functions such as terminal management, connection management, application support, and business analysis from the bottom up.

The development of communication technology has rapidly increased the number of connections, marking a turning point for the rapid development of the IoT.

The development of communication technology has rapidly increased the number of connections, marking a turning point for the rapid development of the IoT.

The growth of connection numbers is the foundation for the development of the IoT industry.

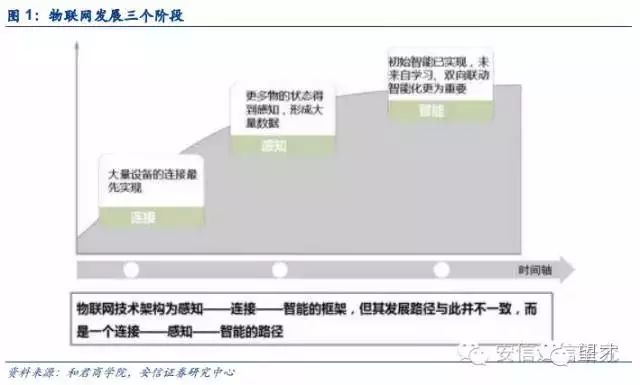

The development path of the IoT is connection — perception — intelligence. Currently, we are in the first stage of IoT development, which is characterized by a rapid increase in the number of IoT connections. By 2018, the number of global IoT connections is expected to exceed that of mobile phone connections.

First Stage of IoT Development: This stage involves the large-scale establishment of IoT connections, where an increasing number of devices are connected to the network through communication modules using mobile networks (LPWA, GSM, 3G, LTE, 5G, etc.), WiFi, Bluetooth, RFID, ZigBee, and other connection technologies. During this stage, the core focuses are on network infrastructure construction, connection management, and terminal intelligence. Ericsson predicts that by 2021, the number of global mobile connections will reach 27.5 billion, with IoT connections reaching 15.7 billion and mobile phone connections at 8.6 billion. Fields such as smart manufacturing, smart logistics, smart security, smart power, smart transportation, vehicle networking, smart homes, wearable devices, and smart healthcare will see exponential growth in connection numbers. The biggest investment opportunities in this stage mainly lie in network infrastructure construction, communication chips and modules, various sensors, connection management platforms, and measuring instruments.

Second Stage of IoT Development:In this stage, the status of a large number of connected devices is perceived, generating massive data and forming IoT big data. Sensors, meters, and other devices become further intelligent, and diverse data is perceived and collected, aggregated to cloud platforms for storage, classification, processing, and analysis. At this point, the IoT also becomes one of the largest businesses on cloud computing platforms. According to IDC’s predictions, by 2020, the total amount of global data will exceed 40ZB (equivalent to 40 trillion GB), which will be 22 times that of 2012, with a compound annual growth rate of 48%. In this stage, cloud computing will rapidly develop alongside the IoT. The main investment opportunities in this stage are in AEP platforms, cloud storage, cloud computing, and data analysis.

Third Stage of IoT Development:Initial artificial intelligence has been realized, and intelligent analysis of data generated by the IoT will demonstrate core value in IoT industry applications and services. Gartner predicts that by 2020, the value of IoT applications and services will reach $262 billion, with the market size exceeding four times that of the IoT infrastructure sector. In this stage, IoT data will achieve maximum value, as companies analyze sensor data and utilize the results to build solutions for commercial monetization. At the same time, operators will possess a large amount of user data, significantly improving their revenue through data monetization. The main investment opportunities in this stage will be in comprehensive IoT solution providers, artificial intelligence, and machine learning vendors.

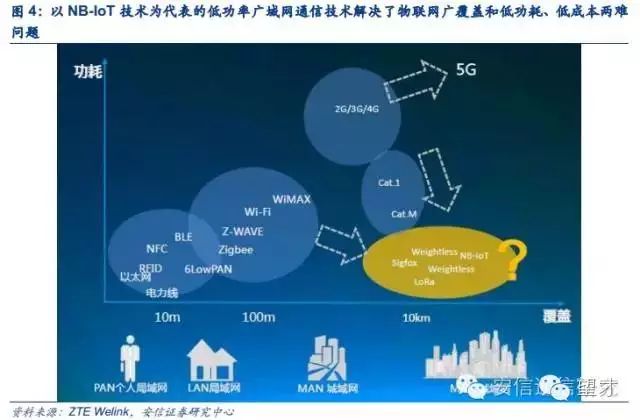

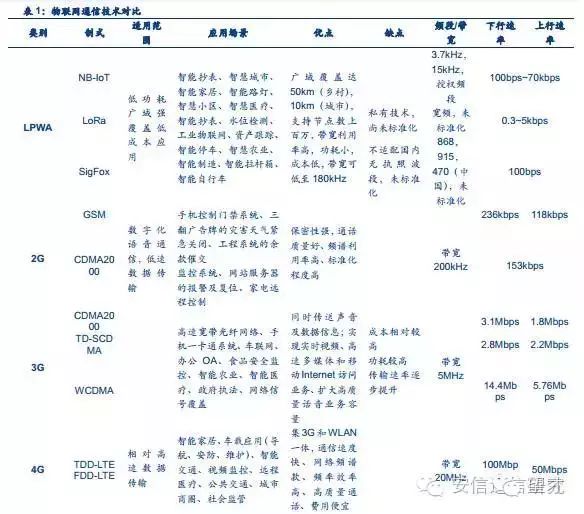

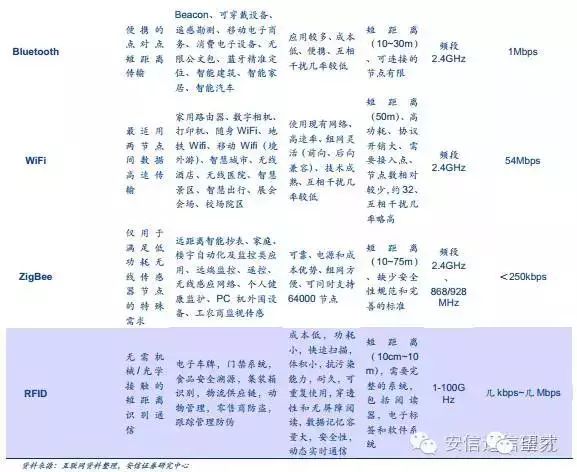

Before the emergence of LPWA communication technology, achieving wide coverage and low power/low cost in IoT connections was challenging, leading to slow growth in the number of IoT connections. The foundation of the Internet of Everything and connection establishment is to use communication technology to connect people to things and things to things. Currently, the communication technologies applied in the IoT include short-range wireless communication technologies such as WiFi, RFID, Bluetooth, ZigBee, and long-distance mobile cellular communication technologies such as GSM, 3G, 4G/LTE. Although short-range communication technologies have low deployment costs, low power consumption, and high transmission rates, their transmission distances can only meet local area network communication scenarios, typically used in smart homes, industrial data collection, and automated office scenarios. GSM/3G/4G cellular communication technologies were originally designed for person-to-person communication, and while they have wide coverage, they suffer from high power consumption and deployment costs. As a result, only 6% of the total connections globally are truly carried on mobile cellular networks, with most terminals still relying on short-range communication technologies like WiFi and Bluetooth. The main reason for the low proportion of operator network connections is that the carrying capacity of mobile networks (single sectors cannot support a large number of terminal connections, and considerations of power consumption and cost) is insufficient to support connections between things. To solve the dilemma of wide coverage and low cost, low power, communication technology specifically designed for IoT connections, LPWA (Low Power Wide Area) has emerged, which has also driven a rapid increase in the number of IoT connections.

The industry chain jointly promotes the rapid growth of connections led by LPWAN technology represented by NB-IoT.

The LPWA connection technology represented by NB-IoT has solved the barriers to the popularization of mobile IoT. After the large-scale deployment of LPWA, it will promote a rapid increase in the number of IoT connections. Compared to traditional short-range communication technologies and existing cellular communication technologies, LPWA represented by NB-IoT has four significant advantages, making it very suitable for IoT application scenarios that require long-distance data transmission, low communication data volume, and long battery life. Taking NB-IoT as an example, the four advantages are:

(1) Wide coverage: NB-IoT coverage is 20 dB better than traditional GSM networks. In terms of coverage area, a single base station can provide ten times the area coverage;

(2) Massive connections: Under a 200KHz frequency, a single base station can provide 100,000 connections using NB-IoT;

(3) Low power consumption: NB-IoT communication modules can operate independently on battery power for ten years without needing to recharge;

(4) Low cost: The cost of NB-IoT modules is less than $5. Moreover, NB-IoT is based on cellular networks and can be directly deployed on existing GSM, UMTS, or LTE networks, resulting in lower deployment costs for operators and enabling a smooth upgrade to 4.5G.

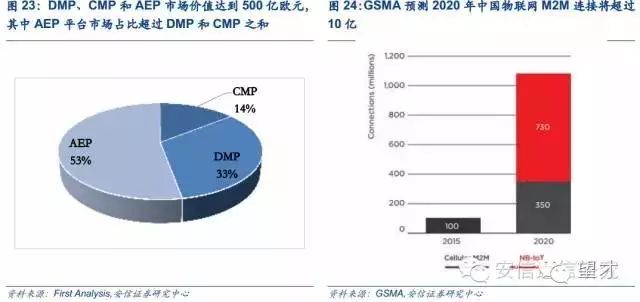

LPWA communication technology is particularly suitable for two types of IoT applications: one type is fixed-location, relatively dense scenarios, such as smart water meters inside buildings, warehouse management, or other device data collection systems. Although cellular networks are already applied in these fields, signal penetration has always been a shortcoming; the other type is long-distance applications that require battery power, such as smart parking, asset tracking, and geological hydrological monitoring. Cellular networks can be applied, but they cannot solve the high power consumption problem. In the future, the number of connections accessing the IoT through LPWA connection technology will exceed 50% of the total connections. GSMA predicts that by 2020, the number of machine-to-machine (M2M) connections in China will reach 1 billion, with LPWA technology represented by NB-IoT providing 730 million connections.

The IoT will become a fundamental business for operators. At the end of 2016, Huawei and the three major operators began large-scale deployment of NB-IoT IoT solutions. In the next two years, the growth rate of M2M connections in China will exceed 100%, marking the true onset of rapid development in the IoT industry. On June 30, 2016, Huawei released an end-to-end NB-IoT solution at the Shanghai IoT Summit, covering everything from NB-IoT communication chips and base station equipment to connection management platforms. The new products were officially launched in September 2016, with large-scale commercial use expected to start by the end of December. China Unicom plans to launch NB-IoT field-scale network tests in more than five cities this year, as well as over six business application demonstrations, including key areas like Shanghai Disneyland. China Unicom plans to advance the commercial deployment of NB-IoT in key cities by the end of 2016 and into early 2017, with a nationwide rollout expected to begin in 2018. China Mobile is also expected to start the commercialization process in 2017. China Telecom signed an innovation research cooperation agreement with Huawei in June 2016 for NB-IoT. Meanwhile, major global chip manufacturers, including Qualcomm, Intel, and Huawei, are also launching NB-IoT layout plans, with NB-IoT chips and modules expected to be released before 2017. Domestic operators plan to begin large-scale construction of low-power wide-area IoT in 2017, marking the true entry of the IoT industry into a period of rapid market development. It is expected that the number of mobile IoT connections in China will grow from 140 million at the end of 2016 to 300 million in 2017, a year-on-year increase of 114%, significantly higher than the 50% growth rate in 2016.

In the next three years, global M2M IoT connections will grow rapidly, with China maintaining its position as the global leader in IoT connections, greatly promoting the vigorous development of upper-layer applications in the domestic IoT. According to GSMA statistics, by the end of 2015, the number of IoT M2M connections in China had reached 74 million, accounting for 23.1% of the global IoT M2M connections, ranking first in the world, far exceeding the United States and European countries. With the largest population in the world, China also has a highly developed manufacturing, transportation, and logistics industry. As the demand for automation increases in China, the demand for smart manufacturing, smart logistics, smart retail, and smart communication will continue to grow, creating significant commercial value in the future.

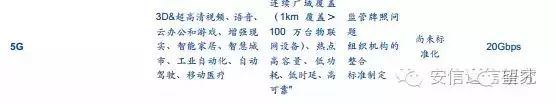

In the future, 5G will meet the diverse needs of advanced IoT applications, achieving ultimate connectivity.

In the future, LTE will evolve towards 5G in both high-speed and low-speed directions, coexisting with LPWA technology to meet the diverse needs of IoT applications and promote the vigorous development of upper-layer applications in the industry. In fact, there are also low-speed technologies in LTE networks, such as LTE Cat.M and LTE Cat.1, which will coexist with NB-IoT in the future, providing communication support for low-speed, low-cost IoT fields and meeting the needs of different niche markets. Compared to NB-IoT, LTE Cat.M is better compatible with GSM networks and is easier to replace GSM applications, having advantages in certain niche areas. Complex upper-layer applications such as autonomous driving, VR, and remote surgery require high transmission bandwidth, large data volumes, and ultra-low latency, posing new demands on network technology. Only with the large-scale deployment of 5G can these complex IoT application scenarios be realized. 5G offers higher performance than 4G, supporting user experience rates of 0.1 to 1 Gbps, a connection density of one million connections per square kilometer, millisecond-level end-to-end latency, traffic density of tens of Tbps per square kilometer, mobility over 500 km/h, and peak rates of tens of Gbps. In the future, LTE cellular technology will evolve towards 5G in both low-speed and high-speed directions, coexisting with LPWA technology to achieve continuous wide-area coverage, high-capacity hotspots, low-power large connections, and low-latency high reliability in IoT applications, ultimately realizing the Internet of Everything in the 5G era.

In the future, the IoT will give rise to diverse applications around governments, enterprises, and consumers, creating significant social value. The service targets of the IoT can be divided into three categories: government, enterprise, and consumer.

Government IoT applications include public resource/energy management, smart transportation, safe cities, smart governance, and smart agriculture. Comparing the recent IoT application demands of governments in China, the US, and Europe, the primary goal is to address increasingly pressing issues of energy consumption, pollution, and urban safety. Therefore, future applications related to urban life, such as smart transportation, smart metering, and smart street lighting, will be the first to realize IoT applications. For example, Sweden’s smart transportation solution, which involves installing electronic license plates on vehicles and connecting them to a traffic big data platform, has achieved intelligent traffic management and congestion fee collection, reducing traffic congestion by 20-25%, decreasing waiting times by 30-50%, and reducing traffic emissions in central urban areas by 14%, with a total reduction of 2.5% in emissions across the Stockholm region and a 40% decrease in greenhouse gas emissions such as carbon dioxide.

Enterprise IoT applications include a comprehensive upgrade to Industry 4.0 (remote equipment management, data management, automation, etc.), smart logistics, and using machine learning and artificial intelligence to predict and solve business problems. An increasing number of enterprises are connecting their devices to the cloud for unified management, seeking to improve operational efficiency, reduce costs, and increase sales from production, logistics, sales, and after-sales data. In 2012, due to GE’s successful remote diagnostic detection, Spring Airlines saved over $210,000 in maintenance costs and avoided several unplanned engine disassemblies and groundings. Wind turbine manufacturer Vestas improved the layout of wind turbines by cross-analyzing weather data and customer turbine instrument data, thereby increasing the power output of wind turbines and extending their service life. In the future, the transition from equipment management and data analysis to machine cognitive learning will help solve problems. For example, AbleCloud achieved a 30% energy saving by training a water dispenser to automatically heat, maintain temperature, and power off after three months of machine learning, effectively meeting the drinking needs of office personnel.

In the consumer sector, vehicle networking, wearable devices, smart homes, and complex entertainment will become key application areas for the IoT. Currently, vehicle networking focuses on navigation, remote information collection, and in-vehicle system upgrades. In the future, with the popularization of in-vehicle entertainment systems, ADAS, and autonomous driving, integrated management of in-vehicle intelligent hardware is expected to be realized. In the smart community and smart home sectors, safe communities and safe homes are expected to achieve breakthroughs first: the original community video surveillance system will be expanded into an IoT platform, combined with community and home sensors, wearable devices, and community entrance management systems, providing infrastructure solutions for modern community management and intelligent big data applications. In the event of illegal intrusions, fires, gas leaks, or other anomalies, intelligent sensors will send alarm signals and transmit them to the community property management center, alarm center, and residents’ mobile phones through the home center, notifying security personnel to respond promptly. At the same time, residents can remotely monitor and visualize intercom through mobile devices such as smartphones and tablets.

The IoT platform serves as a crucial link, key to leveraging the IoT ecosystem.

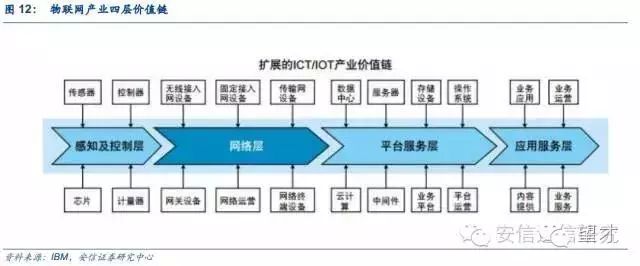

The technical system of the IoT mainly includes four levels: perception and control layer, network layer, platform service layer, and application service layer. The IoT platform is the hub of the IoT industry chain, connecting the dispersed IoT sensing layer below, aggregating sensing data, and providing a foundational platform for application developers and a unified data interface for the underlying network. Currently, IoT platforms can be deployed on private clouds of enterprises and public clouds of IoT vendors.

Perception and Control Layer:Information about the environment, assets, or operational status is obtained from sensors, meters, and other devices. After appropriate processing, the data is transmitted through sensor transmission gateways; at the same time, control instruction information is received through sensor reception gateways and transmitted locally to controllers to achieve control of assets, devices, and operations. In this layer, the management of perception and control devices, transmission and reception gateways, and local data and signal processing are important technical areas.

Communication Network Layer:Information, data, and instructions are transmitted between the perception control layer and the platform and application layers through public or private networks using wireless or wired communication methods. This layer mainly consists of various wide-area IP communication networks provided by operators, including ATM, xDSL, fiber optics, and mobile communication networks such as GPRS, 3G, 4G, and NB-IoT.

Platform Service Layer:The IoT platform is a key link in the IoT network architecture and industry chain, achieving integrated management of terminal devices and assets. It connects to the perception layer below and provides application development capabilities and unified interfaces to application service providers above. It also provides general service capabilities for various industries, such as data routing, data processing and mining, simulation and optimization, business process and application integration, communication management, application development, and device maintenance services.

Application Service Layer:Rich applications are the ultimate goal of the IoT. In the future, diverse IoT applications will emerge based on government, enterprise, and consumer groups, creating significant social value. According to business needs, relevant IoT applications will be established above the platform service layer, such as analysis and prediction of urban traffic conditions; monitoring and analysis of urban asset status; environmental monitoring, analysis, and early warning (e.g., wind, rainfall, landslides); health status monitoring and medical plan recommendations, etc.

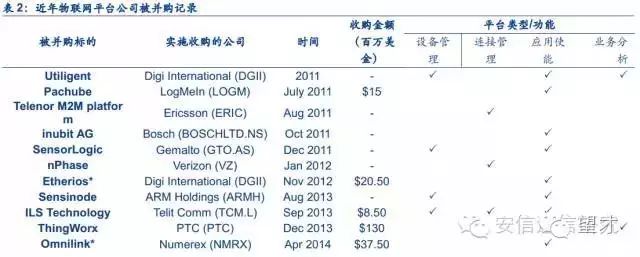

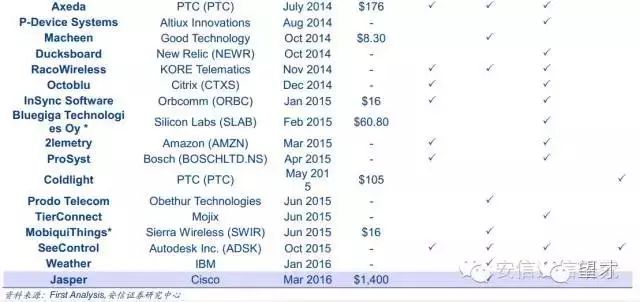

The IoT platform is the core of the overall IoT solution. An increasing number of cloud computing vendors and IoT solution providers are acquiring IoT platform vendors to form end-to-end IoT solutions. Due to the pivotal role of the IoT platform, it provides important functions such as device management, network connection management, application development, data services, intelligent analysis, and interconnection with third-party systems. At the same time, the IoT platform connects underlying devices, enterprise business needs, application developers, and other IT systems within the enterprise (CRM, ERP, etc.), making it the core of the entire IoT solution. Major comprehensive IoT solution providers are increasingly focusing on IoT platform business, with most acquiring IoT platform capabilities through external mergers and acquisitions. This is also the reason for the accelerated mergers and acquisitions in the IoT platform field in recent years, with representative companies including Cisco, Ericsson, PTC, Bosch, Sierra Wireless, and LogMeIn. Cloud computing vendors are choosing to establish strong IoT platform ecosystems through extensive cooperation, with representative companies such as IBM, AWS, and Microsoft collaborating with mainstream IoT platform providers.

Introduction to the Functional Classification of IoT Platforms

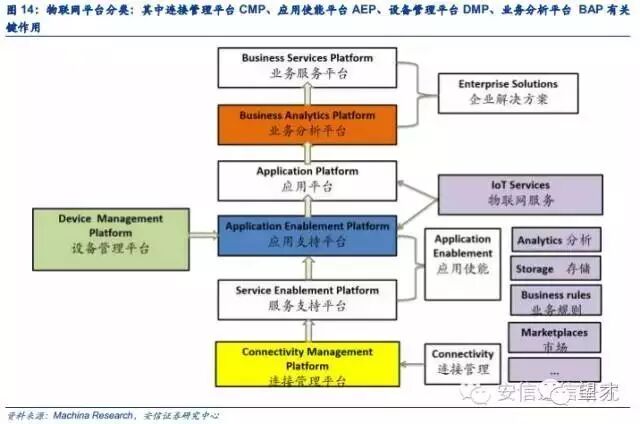

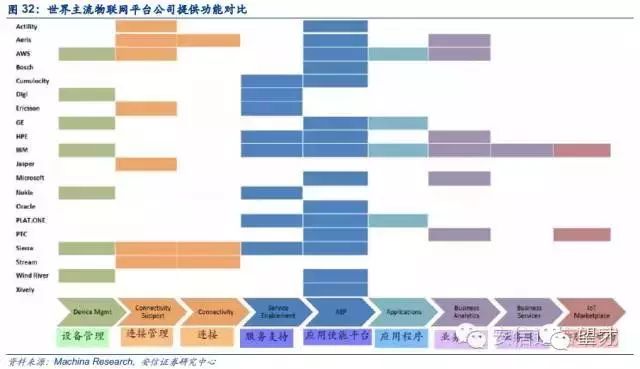

IoT platforms provide four main functions from the bottom layer to the top layer based on logical relationships: Device Management, Connectivity Management, Application Enablement, and Business Analytics. Therefore, IoT platforms can be divided into four major types: Device Management Platform (DMP), Connectivity Management Platform (CMP), Application Enablement Platform (AEP), and Business Analytics Platform (BAP). So far, no platform company has been able to provide end-to-end services from terminal management monitoring, connection management to application development and data analysis; each platform provider has its own focused area and unique advantages.

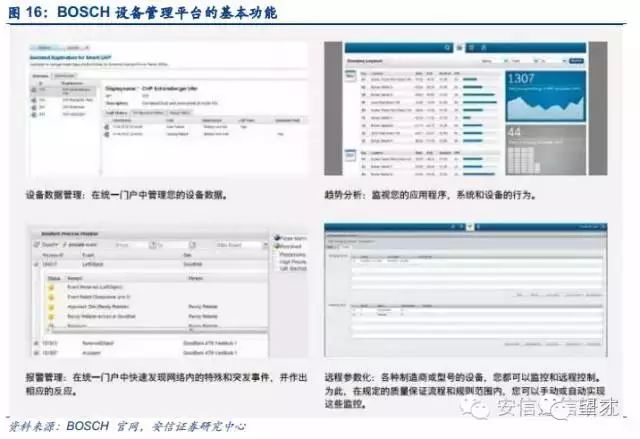

1) Device Management Platform (DMP): DMP platforms perform remote monitoring, configuration adjustments, software upgrades, system upgrades, fault diagnosis, and lifecycle management of IoT terminals. They can also provide real-time monitoring alerts for gateway and application status, supporting preemptive fault handling and improving customer service satisfaction. Open API interfaces help customers easily integrate systems and develop value-added features; all device data can be stored in the cloud.

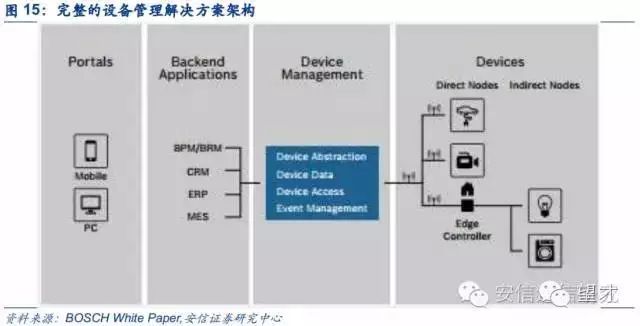

Generally, DMPs are integrated into a complete end-to-end M2M device management solution. Solution providers collaborate with partners to provide communication gateways, communication modules, sensors, device management cloud platforms (DMP), device connection software, and open interfaces for upper-layer application developers, offering end-to-end solutions. Vendors like Bosch, familiar with enterprise business processes, can also integrate enterprise business applications such as CRM, ERP, and MES into the DMP, forming a more complete device management solution. Most DMP platform providers are also communication module and device providers, such as DiGi, Sierra Wireless, and Bosch, which have their own connected devices, communication modules, gateways, and device management platforms, thus helping enterprises achieve a complete device management solution. DMPs are generally deployed within the entire device management solution, with overall pricing; there are also a few vendors that provide standalone cloud-based device management services, charging a certain operational management fee per device each month.

2) Connectivity Management Platform (CMP):CMP platforms are generally applied in operator networks to manage IoT connection configurations and faults, ensuring stable terminal network access, managing network resource usage, connection fee management, billing management, plan changes, and number/IP address/Mac resource management, better assisting mobile operators in managing IoT SIMs. M2M IoT applications have several characteristics for mobile operators: large M2M connection numbers, high SIM card usage, significant management workload, complex application scenarios, requiring flexible pricing plans, low ARPU values, and high cost management demands. Through CMP platforms, comprehensive communication connection status, service activation, and plan subscriptions of IoT terminals can be monitored; users can check the traffic usage and balance of their IoT terminals; and self-service fault diagnosis and repair can be performed. At the same time, IoT connection management platforms can push relevant alert information based on user configurations, allowing customers to flexibly control their terminal’s traffic usage and status changes.

The CMP connection management platform connects with mobile operator networks, helping operators manage M2M IoT. CMP platform suppliers participate in the revenue sharing of mobile IoT for operators. Using mobile networks (2G/3G/4G/NB-IoT) requires reasonable control of traffic, multi-user time-sharing billing, and dynamic real-time monitoring of usage status and costs. This makes CMP platforms collaborate with mobile operators, participating in the revenue sharing of mobile IoT, with a simple and clear business model. Considering that multinational enterprises prefer a single access point when connecting with CMP platforms, global CMP platforms are more competitive in serving large enterprises. Currently, there are three major camps of CMPs globally: Jasper platform, Ericsson DCP platform, and Vodafone GDSP platform. Jasper, as the leader in CMP, collaborates with over 100 operators and 3,500 enterprise customers globally, while Ericsson DCP and Vodafone GDSP platforms have fewer customers than Jasper. The CMP platforms of the three major domestic operators are: China Unicom collaborates with Jasper and Yitong Century, adopting a revenue-sharing model; China Mobile collaborates with Huawei in CMP, M2M modules, and terminal sales; China Telecom has just signed a memorandum of understanding with Ericsson DCP for collaboration in CMP and terminal sales.

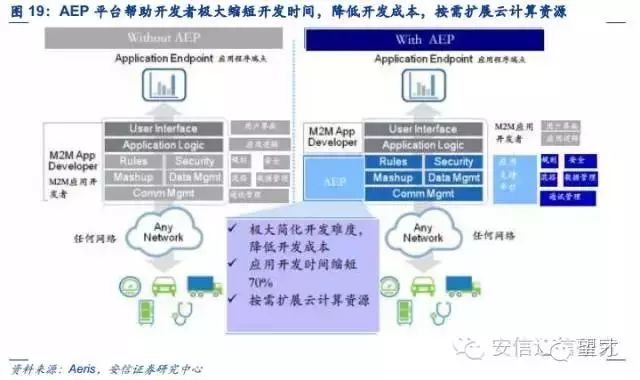

3) Application Enablement Platform (AEP):AEP platforms provide two main functions: application development and unified data storage, built on top of CMP platforms. Specifically, AEP platforms offer a complete set of application development tools (most provide graphical development tools, even requiring no coding from developers), middleware, data storage capabilities, business logic engines, and APIs for integrating with third-party systems. IoT application developers can quickly develop, deploy, and manage applications on AEP platforms without worrying about lower-level infrastructure expansion, data management and aggregation, communication protocols, and communication security issues, reducing development costs and significantly shortening development time. Currently, well-known AEP platforms are gradually enriching their functionalities, adding features such as terminal management, connection management, data analysis applications, and business support applications.

AEP platforms help enterprises significantly save time and costs in IoT application development, while allowing for large-scale expansion of upper-layer applications without worrying about lower-level resource expansion issues. Currently, AEP platforms mainly charge based on the number of activated devices after application development is completed. Establishing a complete IoT solution (from lower-level device management systems and networks to upper-layer applications) is a massive project for any enterprise, requiring collaboration from numerous professionals in different fields, resulting in long construction cycles and low ROI. AEP platforms help enterprises significantly save time and costs in IoT application development. According to Aeris, developers using AEP platforms can save 70% of their time, allowing applications to reach the market faster while saving costs associated with hiring lower-level infrastructure technical personnel. Another significant issue addressed by AEP platforms is the flexible expansion of upper-layer applications. Even as the scale of M2M management rapidly increases, using AEP platforms means not having to worry about lower-level resources keeping pace with the speed of connected device expansion.

4) Business Analytics Platform (BAP):The business analytics platform includes basic big data analysis services and machine learning capabilities. Big data services: the platform collects various related data, classifies, analyzes, and provides visualized data analysis results (charts, dashboards, data reports); through real-time dynamic analysis, it monitors device status and provides early warnings. The platform’s machine learning: by training historical data (structured and unstructured), it generates predictive models, or customers can develop models using tools provided by the platform, meeting predictive, cognitive, or complex analytical business logic needs. In the future, machine learning on IoT platforms will transition to artificial intelligence, such as IBM Watson, which has IBM’s unique DeepQA system, combining neural systems to simulate human brain thinking, gradually forming a powerful Q&A system that will help enterprises solve more business problems.

Currently, machine learning charges for both modeling and prediction. During the modeling phase: fees are charged based on the time spent on data analysis, model training, and evaluation, i.e., the number of computing hours required for these operations; once modeling is complete and calculations and predictions are made, fees are charged based on the volume of information from the data results or the memory capacity required for calculations.

The Chinese IoT platform is in its early development stage, with enormous market potential.

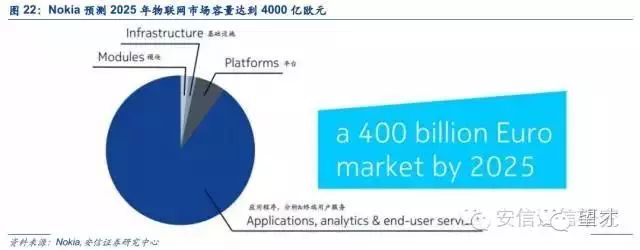

As a key link in the IoT industry chain, IoT platforms play an important role. In the future, the AEP market will exceed that of CMP and DMP. According to Nokia’s predictions, by 2025, the total value of the IoT industry will reach 400 billion euros, with the IoT platform market accounting for 12.5% of the entire IoT market, meaning the combined market of DMP, CMP, and AEP platforms will exceed 50 billion euros. According to First Analysis, by 2024, the AEP platform market share will reach 53% of the total market of the three types of platforms. If CMP platform providers need to collaborate with operators and cloud computing vendors to jointly provide connection services to gain more revenue share, such as Jasper collaborating with operators and cloud computing vendors like AWS and Microsoft globally, the key to AEP vendors’ success lies in providing an open platform and operating system, establishing a large application development community, making application development convenient while launching their own cross-industry general applications, and accumulating more customers and connections. As AEP platforms are closely integrated with upper-layer applications, in the future, as applications become more complex, the service fees charged by AEP platforms for each device will gradually increase, enhancing the overall value of the platform.

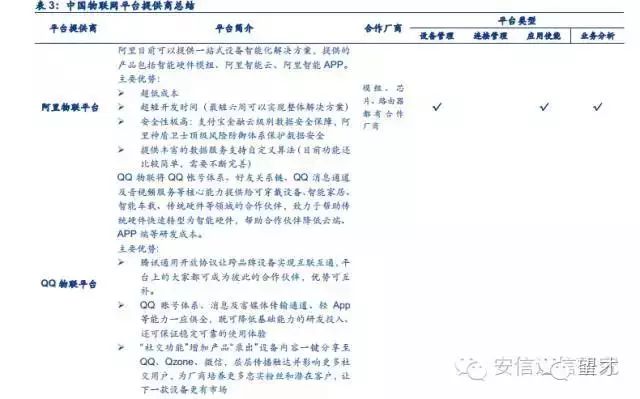

Chinese IoT platform providers can be roughly divided into operators, cloud computing vendors, internet giants, and startups. Currently, the IoT cloud platform functions they can provide are relatively simple, and the establishment of ecosystems still needs improvement, with a certain gap compared to foreign IoT vendors. As the operation of IoT platforms, ecosystem cultivation, and developer aggregation require a long time to accumulate, in the future, if traditional internet and IT companies want to enter the IoT platform field, acquiring excellent overseas and domestic startups or engaging in deep industry chain cooperation will be a good choice.

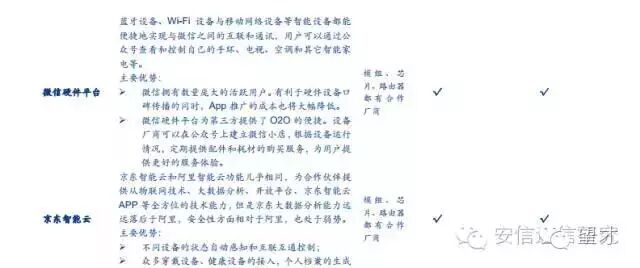

(1) BAT and JD are laying out IoT platforms based on their traditional advantages, including cloud, big data, and hardware management platforms, to build third-party ecosystems while leveraging their strengths. The IoT business strategies of several major internet companies are similar, with hardware networking as a foundational step, opening data and ecosystems, technology and interfaces, to build a collaborative ecosystem in the industry chain. Tencent has QQ IoT and WeChat smart hardware platforms, with a massive user base and social attributes being the core advantages of Tencent’s IoT platform. On the WeChat platform, device manufacturers can open WeChat public accounts, enabling device functionality plugins through the public account, connecting users with their smart devices, with each device also having a WeChat ID. At the same time, device manufacturers can establish WeChat stores on public accounts, regularly providing purchasing services for accessories and consumables based on device operation conditions. Alibaba has integrated smart cloud, Taobao crowdfunding, and Tmall electrical city for its IoT business, forming a smart life division, with Tmall electrical city and Taobao crowdfunding helping smart hardware developers solve market sales challenges. Baidu’s advantage lies in its long-term accumulation in artificial intelligence, voice recognition, and deep learning technologies. In the future, the massive data generated on its IoT platform can be processed using Baidu’s deep learning and artificial intelligence capabilities to develop powerful upper-layer applications, potentially surpassing Tencent and Alibaba in machine learning and big data processing.

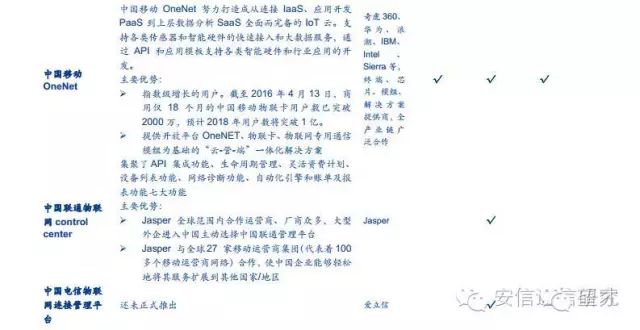

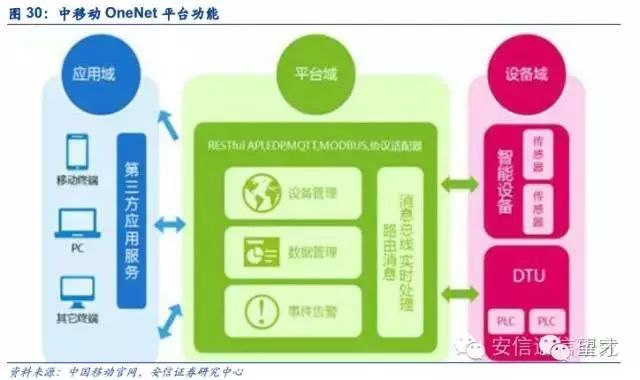

(2) The three major Chinese operators attach great importance to the development of IoT connection management platforms (CMP), collaborating with leading domestic and foreign platform companies to provide one-stop global IoT connection services for enterprise customers. In July 2015, Jasper and China Unicom launched the ControlCenter IoT management platform, which integrates seven major functions: API integration, lifecycle management, flexible pricing plans, device list functions, network diagnostics, automation engines, and billing and reporting functions. In November 2014, China Mobile officially launched the OneNet IoT open platform, providing a complete solution from lower-level IaaS connections to upper-layer applications, establishing partnerships with numerous industry vendors. On July 15, 2016, China Telecom signed a memorandum of understanding with Ericsson for cooperation in IoT connection management, jointly building global IoT connections to provide one-stop global IoT connection services for enterprise customers. As of May 2016, China Mobile’s IoT connections exceeded 60 million, with a target of reaching 100 million by the end of 2016; China Unicom’s IoT connections reached 13 million, with a target of achieving 30 million IoT connections in 2016. China Telecom has not disclosed its IoT connection numbers, with a target of netting 12 million new IoT users in 2016 and achieving sales of 10 million IoT terminals.

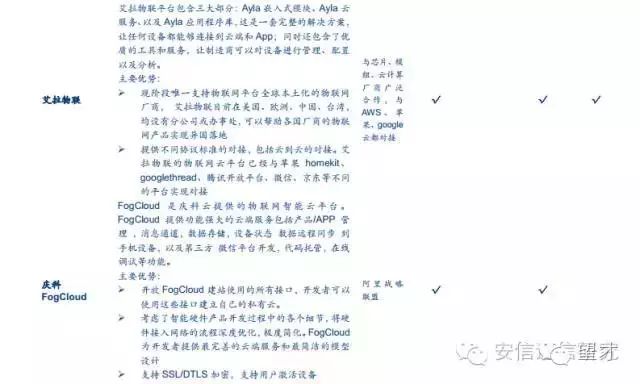

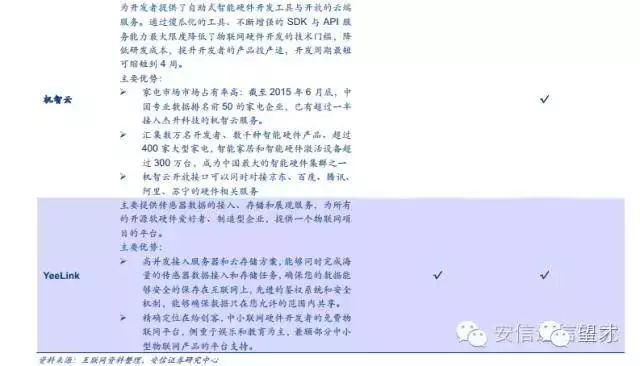

(3) IoT platform startups are continuously breaking financing records and are expected to emerge as unicorn companies. On June 29, 2016, Ayla Networks announced it secured $39 million in Series C financing; on August 31, 2015, Jiesheng Technology (Gizwits) received 200 million RMB in Series B financing. IoT platform startups are constantly refreshing financing records, driven by major IT giants and investment institutions seeing opportunities in the rapid development of IoT. The better IoT platform companies in China focus on device management platforms and application enablement platforms, aiming to solve the difficulties of smart hardware application software development, high R&D costs, long development times, and long sales cycles, helping other smart hardware manufacturers improve their survival capabilities. Domestic companies like Gizwits, Shanghai Qingke, and Ayla Networks (China branch) are among the top startups, with a growing scale of developers and partners on their platforms. In the future, as they delve deeper into traditional industries, integrate upstream and downstream resources in the industry chain, and continuously accumulate in the IoT field, they are expected to emerge as a unicorn platform company.

The Chinese IoT AEP platform is in its infancy, with enormous market potential.

As a foundational platform for IoT application development, AEP platforms in China are still in their infancy, with the future market expected to reach hundreds of billions. According to GSMA predictions, by 2020, the number of M2M connections in China (i.e., devices connected through cellular networks, satellite networks, and other LPWA technologies) will reach 1 billion. Assuming an average charge of 5 RMB per connection per month, the value of China’s AEP platform in 2020 will be at least 60 billion RMB. If we include other non-M2M IoT connections (which are three times the number of M2M connections), the total value of the AEP management platform will exceed hundreds of billions. Compared to foreign vendors, China’s IoT application development platforms started later and are still in the early stages of development. In the future, from the perspective of listed companies, acquiring domestic and foreign IoT AEP platform companies or deeply collaborating with excellent domestic and foreign IoT AEP platform companies will be the fastest and most realistic development path. Currently, some of the better IoT AEP platform companies in China include Gizwits, Shanghai Qingke, China Mobile’s OneNet, and Ayla Networks’ China branch.

Gizwits is currently one of the largest smart hardware clusters in China, gathering over 30,000 developers and over 30,000 smart hardware projects in development, with a decade of technological accumulation. Established over 10 years ago, Gizwits provides PaaS and SaaS cloud services for smart hardware developers, including basic access services (intelligent development tools and M2M access, data storage and analysis, third-party data integration, OTA firmware upgrades, and hardware socialization), post-access services (providing smart device access systems GDCS, smart device management systems GDMS, and IoT time-sharing leasing platforms that can connect with mainstream ERP and CRM systems), and developer services (providing self-service development tools and technical support for smart hardware). Gizwits has numerous partners across the entire industry chain and has proactively connected with over 70 mainstream chip and module manufacturers. In the future, it aims to establish joint laboratories with domestic and foreign research institutions to study artificial intelligence, machine learning, and other technologies, laying a technical foundation for in-depth analysis of upper-layer applications.

Shanghai Qingke collaborates with Alibaba to become a one-stop smart hardware solution provider, leading in the layout of industrial IoT and operating systems. Shanghai Qingke (MXCHIP) provides a comprehensive IoT solution that integrates device-side, mobile-side, and cloud-side services. Core technologies, products, and services include the IoT operating system MiCO, wireless modules based on MiCO, mobile application (App) development, and cloud services across four areas. In July 2014, Shanghai Qingke, in collaboration with Alibaba Smart Cloud, launched MiCO IoTOS, the first truly IoT operating system in China, designed for smart hardware, running on microcontrollers, and serving as a highly portable operating system and middleware development platform. It reduces smart hardware development costs and improves development efficiency, having been widely applied in smart home appliances, lighting, healthcare, security, entertainment, and other IoT application markets. Low power consumption, low cost, and security are the greatest advantages of the MiCO operating system, with over a million smart products successfully running on it. In April 2016, at the Alibaba Cloud Summit, a one-stop industrial IoT solution based on MiCO was launched, achieving intelligent remote control through precise data collection and analysis, while valuable on-site experience and fault sample data will help industrial equipment manufacturers upgrade their products more effectively.

Ayla Networks has a clear global advantage and has achieved rapid breakthroughs in China in a short time. Founded in 2010 and headquartered in Silicon Valley, California, Ayla Networks is a leading global IoT cloud platform (B2B/PaaS) service provider. It entered the Chinese IoT market in 2012 and has a branch in Shenzhen, being the only foreign company with an ICP license. The Ayla agile IoT platform mainly consists of three components: Ayla embedded modules, Ayla cloud services, and Ayla application library. This is a complete solution that allows almost any device to connect to the cloud and App; it also includes high-quality tools and services that enable manufacturers to manage, configure, and analyze devices. On the device side, Ayla collaborates with chip manufacturers like Qualcomm and Broadcom to embed connection control software in chips; on the cloud side, it connects with mobile applications, allowing consumers to control devices directly through the App, forming a closed-loop IoT. At the same time, the Ayla platform integrates with various platforms such as Apple HomeKit, Google Thread, Tencent Open Platform, WeChat, and JD, helping enterprises achieve user sharing with third-party platforms. With significant global advantages, Ayla Networks has its own clouds in China, Europe, and the United States, providing global cloud services and assisting Chinese appliance manufacturers in providing IoT services overseas. For example, in May 2015, Ayla Networks signed a cooperation agreement with TCL Air Conditioning to first collaborate in the US market, allowing consumer users to use the Ayla IoT platform to view and manage TCL smart air conditioners. At the same time, TCL can use the Ayla platform for data collection (user behavior analysis) and other intelligent analysis functions.

China Mobile’s OneNet strives to build a comprehensive IoT cloud from connection IaaS, application development PaaS to upper-layer data analysis SaaS. The OneNet platform supports the rapid access of various sensors and smart hardware through adapting to various networks and protocols, while also supporting the development of various smart hardware and industry applications through APIs and application templates, reducing the development and deployment costs of various IoT applications, and meeting platform-level service needs for device connections, protocol adaptation, data storage, data security, and big data analysis in the IoT field. OneNet aims to save 70% of development time and costs for small and micro enterprises. As of May 2016, OneNET had over 19,000 registered users, with over 2.3 million connected devices and more than 2,400 cooperating enterprises, including Qihoo 360, Huawei, Inspur, IBM, Intel, Sierra, Sinotrans, Jicheng Electronics, and Sanchuan Water Meter.

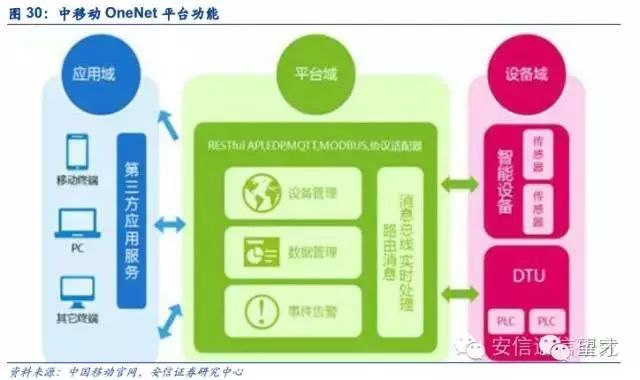

Yitong Century: Perfecting the IoT platform layout, becoming an expert in end-to-end IoT solutions in the future.

Yitong Century has accurately positioned itself in the IoT AEP platform layout, continuously improving the IoT platform architecture and providing more complete IoT solutions. In May 2016, Tianhe Hongcheng established a joint venture subsidiary “Beijing Particle” to layout the IoT application enablement platform (AEP), continuously improving the layout of large IoT application management platforms. Among A-share companies, following the CMP platform, it has perfectly positioned itself in the AEP platform layout, continuously enhancing its leading advantage in China. In the future, the AEP platform will become the foundational platform for IoT application development for enterprises in various industries, allowing the company to charge service fees based on connected devices; gradually extracting common needs from customer cases to develop cross-industry applications, profiting from general applications, and accumulating more cross-industry customers. More importantly, the AEP platform is a key link in the overall IoT solution, enabling Yitong Century to integrate upstream and downstream in the industry chain, utilizing its existing IoT platform to provide customers with complete IoT solutions from communication modules, device management, application development to system integration, thereby creating greater value.

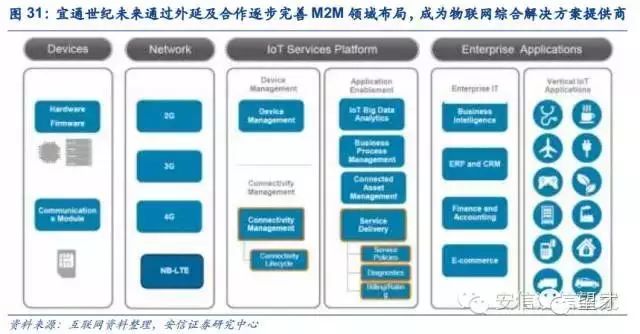

Over 70% of the value in the IoT industry chain comes from providing IoT applications and end-to-end solutions, and IoT solution providers will gain the most benefits in the industry chain. Yitong Century will gradually transform into an end-to-end IoT solution provider. Since the end of 2015, Tianhe Hongcheng has begun providing end-to-end IoT solutions to customers, targeting the actual business characteristics of customers, providing IoT industry system integration solutions that include IoT basic communication management, IoT application development, asset and hardware device management, and data management across the perception layer, network layer, infrastructure layer, platform layer, and application layer.

Currently, Tianhe Hongcheng collaborates with IoT chip, communication module, and sensor device suppliers, communication operators, cloud service providers, platform service providers, and application developers in the IoT industry chain to build IoT systems at various levels for enterprises, providing demand research, solution design, installation, software development, personnel training, platform debugging, and subsequent technical services and operation and maintenance services, ultimately realizing the implementation of IoT industry system integration solutions and the overall operation of customer IoT businesses.

Currently, Tianhe Hongcheng has collaborated with chip and communication module manufacturers to develop IoT chips or communication modules with built-in platform software. Tianhe Hongcheng has signed cooperation agreements with companies such as Procter & Gamble Guangzhou, Guizhou Gas Group, Shanghai Yibest Information Technology, Guangdong Kanglin Pharmaceutical, Hangzhou Qundui Technology, and Beijing Yaxin Data to provide IoT industry system integration solutions for them.

Introduction to Major Global IoT Platform Providers

Currently, major global IoT platform providers have different focuses and advantages. By organizing the leading IoT platform suppliers, we summarize the following development rules:

1) Establishing alliances between platforms and collaborating with integrators and upstream and downstream manufacturers is essential to provide complete IoT solutions, requiring continuous cultivation of the IoT ecosystem. End-to-end IoT solutions are a massive and complex project, and platforms are divided into four major types. Almost no vendor can independently provide a complete solution from lower-level connections to upper-level application analysis, so extensive cooperation with other manufacturers in the industry chain is necessary to cultivate the IoT ecosystem.

2) Open platforms attract more developers, continuously enhancing platform compatibility and the ability to connect with third-party systems and applications. AEP, DMP, and BAP platforms need to interface with numerous third-party systems and applications, offering free open platform interfaces to community developers, enhancing platform connectivity and compatibility, thereby continuously improving the platform’s scalability and attracting more customers.

3) Artificial intelligence and machine learning capabilities will become the core competitiveness of business analytics platforms in the future. The ultimate goal of IoT is to optimize operations and processes, enhance efficiency, save costs, and increase revenue through data analysis behind machines, thereby improving profitability. Therefore, after the infrastructure is completed, intelligent analysis and machine learning capabilities will become the core competitiveness of business analytics platforms.

Introduction to DMP Leaders

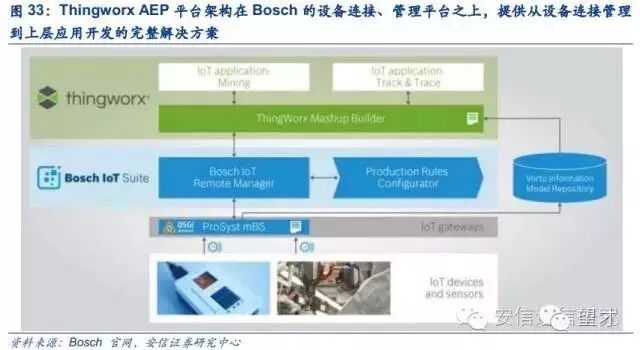

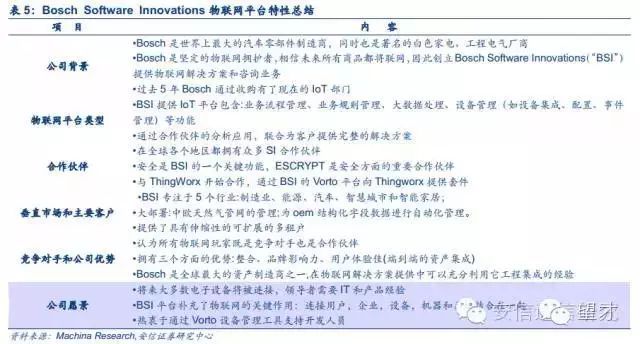

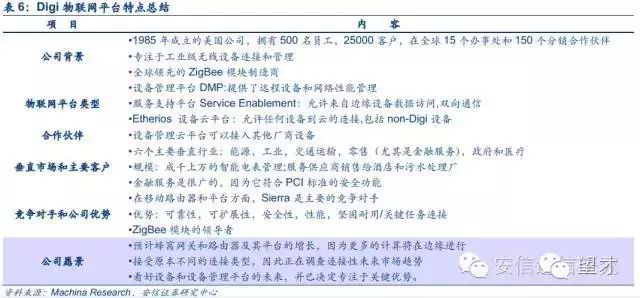

Digi and Nokia started early in the Device Management Platform (DMP) and have formed powerful device management cloud platforms. Bosch later caught up, starting in 2011 through external acquisitions to develop its current IoT systems and platforms. Due to its rich integration experience in industrial systems and numerous global integration partners, it has become a leader in device management IoT solutions. All three companies provide IoT connected devices, sensor products, and management cloud platform services, offering complete end-to-end solutions. Digi’s cloud platform focuses on industrial 4.0 device management, with better compatibility with other manufacturers. Nokia’s platform has a large user base and comprehensive functionalities, providing customized applications for vertical industries such as vehicle networking, healthcare, and smart cities. Bosch currently has a strong alliance with Thingworx, where Thingworx’s AEP platform can be directly built on Bosch’s device management and connection platforms, providing a complete solution from device management to application development.

Bosch Software Innovations (BSI) is currently the leader in device management platforms, providing not only basic functions for device connectivity but also various value-added services, such as security and integration with existing business systems (ERP, CRM, MES, etc.). In early 2016, PTC and Bosch announced a technology alliance to integrate the ThingWorx AEP platform with Bosch’s IoT suite, jointly providing IoT solutions to customers while enabling them to develop IoT applications in complex IT environments at low costs.

Digi, as an expert in industrial M2M solutions, combines industrial devices, modules, and cloud services to provide end-to-end solutions. Digi’s competitive advantage lies in providing complete solutions for industrial 4.0 IoT device management, offering both embedded and non-embedded products such as enterprise cellular routers, gateways, wireless communication adapters (ZigBee, Wi-Fi, proprietary RF), serial servers, smart control console servers, USB products, remote display products, cameras, sensors, and the globally best-selling serial card series, along with a device management cloud platform.

Digi Device Management Platform Introduction: Digi formed the current Etherios device cloud platform by merging Etherios with its original iDigi device cloud. The functionalities provided by Etherios device cloud include: 1) Device configuration: configuring devices through a browser, software upgrades, remote status monitoring; 2) Device status alerts: setting alert conditions, automatic alarms, and automatic firmware reboot settings; 3) Integrating data into third-party systems, such as Salesforce: through the platform’s open API, device data can be pushed into any third-party application or build a custom M2M application. For example, using Salesforce.com, the Salesforce AppExchange application seamlessly connects devices to the core business processes of the Salesforce platform, transforming raw data into actionable business information. 4) Security services: providing data security value-added services.

Source: Anxin Communication Research; the views in this article are for sharing and communication only and do not represent the position of this public account. Please indicate the source when reprinting. If there are any copyright issues, please inform us, and we will handle them promptly.

Automotive Technology New Media

WeChat Matrix: Automotive Insights; New Energy Vehicle Industry Development Alliance; CST Autonomous Driving; CST Automotive Lightweight; HR Cloud; Automotive Financial Ecosystem Research Institute

| Information | Knowledge | Experience |

Long press the QR code to follow