Linking Elements mixlink.org Focus on innovation and entrepreneurship in the IoT era

Introduction: In the IoT era, will we see a repeat of the “no grass grows under the big tree” phenomenon of the internet era, or will it trend more towards industrial characteristics with large, medium, and small enterprises coexisting? This is a topic worth discussing, as it relates to the “survival” of IoT practitioners.

In the last month of 2017, the Xrea IoT platform from XCMG made significant strides. First, it was approved to list on the New Third Board in the first week, and then in the second week, it welcomed its first research visit after the 19th National Congress led by Xi Jinping. There is almost no online promotion for the Xrea IoT platform, but it is likely to enter the public eye on a large scale. Taking this opportunity, Linking Elements shares its latest exploration of IoT platforms.

(A chart reflecting the economic landscape of China)

(Xi Jinping’s research visit to XCMG)

The industrial IoT began to rise in the second half of 2015. That year, entrepreneurial companies related to industrial IoT platforms began to emerge (as analyzed in the article “After IoT + Industry, will IoT development platforms redefine power dynamics?”); GE Predix, established as an industry benchmark, began large-scale promotion.

At the same time, some IoT development platforms originally aimed at the consumer electronics sector, such as ZhiCloud and AbleCloud, also began to layout for industrial IoT. However, Linking Elements believes this is an inevitable trend, as IoT changes the existence form and method of objects themselves. Under this premise, the way objects are designed, produced, sold, and used will all change.

Whether aimed at consumer or industrial applications, both rely on manufacturing, so in principle, IoT platforms with development capabilities do not have a clear industrial or consumer attribute. Of course, at the application level, it is not just a simple division between consumer and industrial; each sub-industry, or even a specific product category, will have its own IoT platform, such as those dedicated to shared bicycles.

In the future, when data can truly be applied, there will also be many platforms aimed solely at big data applications, which will be extremely segmented (though they may be parasitic on some larger so-called enabling platforms).

Without further ado, let’s get to the point. After two years, IoT platforms have transitioned from the budding stage to a period of vigorous development (possibly a bubble period), as per the latest statistics from Linking Elements, among the thousands of companies in the Linking Elements database, 735 claim to have IoT platforms (details will be shared after further sorting by Linking Elements). Of course, this includes many application platforms, such as a company that developed a system for energy management in buildings, which connects cloud management and terminal, also referred to as an IoT platform, somewhat akin to the previous era’s information system integrators, but now the trend is towards “platforms”. A significant portion of these are indeed traditional information system integrators transitioning.

Today, we want to explore which IoT platforms with development capabilities have better opportunities in this round of competition.

48 IoT platforms with developer access

48 IoT platforms with developer access

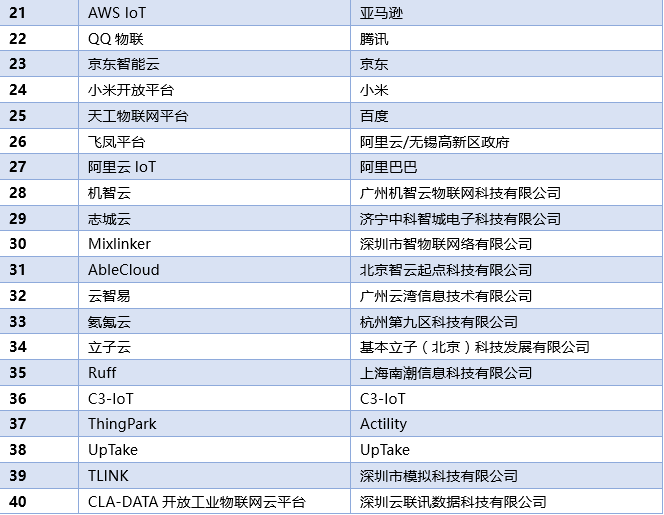

The above 48 IoT platforms (if any are missed, please reply in the comments) have all set up developer access, so we tentatively consider them as IoT platforms with development capabilities. Among these 48 platforms, 27 belong to the new explorations of giants, but these giants have different “backgrounds”.

For example, IBM, Microsoft, and Siemens are traditional software or industry information solution providers; GE, XCMG, and Envision Energy come from traditional manufacturing; China Mobile and Nokia are telecom operators and equipment manufacturers; Advantech and ABB are traditional industrial automation manufacturers; Amazon, Alibaba, and Baidu are internet companies. In the case of startups, most founding teams also have IT or internet backgrounds.

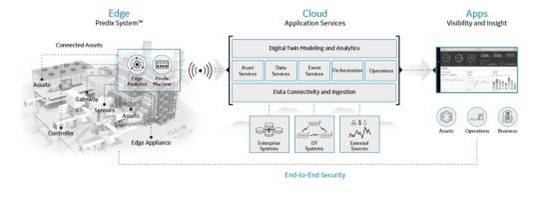

GE Predix

Siemens Mindsphere

Xrea platform architecture diagram

Envision Energy EnOS™

ZhiCloud GDMS

If from a technical perspective, traditional industry information solution providers and industrial automation manufacturers seem to have an advantage, as they should understand both IT and industry, being neutral and resourceful. For example, Siemens occupies nearly half of the market in industrial PLCs, and it can connect various protocols almost effortlessly. In contrast, another company attempting the same task would inevitably expend significantly more time and effort.

Then there are traditional industrial enterprises, which should be said to be similar to pure IT/internet background companies, both being “specialized” types. Industrial backgrounds may have a slight disadvantage in understanding IT, while IT/internet background companies may lack understanding of industrial processes.

These differences are clearly reflected at the platform level. For instance, IoT platforms launched by internet companies are often reluctant to do “dirty work”, preferring to focus on data reception, leaving the lower-level data collection, node layout, and device connectivity to others. This may be the biggest disadvantage for internet companies engaging in IoT.

On the other hand, traditional industrial companies excel at identifying which data is useful within a device, which devices should be interconnected, and how to collect data more efficiently. What they may struggle with are concepts like AI, fog computing, and other IT technologies that can be quite confusing.

However, after two years of development, these issues seem to be gradually resolved through “talent restructuring”. For example, in late November, Linking Elements visited XCMG in Xuzhou. Before the visit, there were no expectations; while XCMG is strong, IoT relies on talent, and such talent is primarily located in major cities. Upon visiting, it was found that their team is almost a gathering place for ICT giants. When the data from clients flashed on the screen, it was instantly impressive. From this perspective, talent should be one of the competitive points for current IoT platform companies. Of course, there are many factors that attract talent.

However, compared to IT/internet companies, traditional industrial enterprises may have a significant disadvantage due to strong mutual exclusion among peers.

How to say, history often repeats itself. This situation has been experienced in cloud computing; it also occurred during the consumer-led IoT phase from 2013 to 2015.

Finally, regarding startups, the advantage of startups lies in their “clean teams” that are not easily labeled; “clean products” that are not influenced by any “background”; and their neutrality. However, these can also be disadvantages. Take cloud computing as an example. Back in 2010-2012, many cloud computing startups emerged. Today, only a few giants remain active in the cloud computing industry, with startups like UCloud, Qiniu Cloud, and QingCloud being the only ones left. Most other startups have shifted to private cloud solutions or cloud operations. Will IoT platform companies follow the same path?

In summary, “IoT platforms based on CPS theory are the core of the development in the IoT 2.0 era”; once this becomes a unified understanding among IoT practitioners, the development of the IoT industry will begin to get on track, and the real competition among enterprises will officially commence.

Previous reviews: IoT platform series

As the IoT era begins, who will become the BAT in the IoT field?

Where are the giants in the IoT era: 3 types of platforms, 5 paths [Part 1]

Where are the giants in the IoT era: 3 types of platforms, 5 paths [Part 2]

74 IoT platform map

As IoT enters the 2.0 era, who are the true IoT companies?