After a two-year hiatus, the LoRa Alliance resumed its in-person LoRaWAN World Expo event on July 6-7, 2022, in Paris, France, welcoming over 1,000 attendees and exhibitors from around the globe. Market research firm Omdia also attended the event.

Achieving sustainable development goals through LoRaWAN networks was one of the key agenda items of this event

Sustainability was one of the important themes of this event, as it has become a strategic priority for many businesses, regardless of their size and industry focus. The Internet of Things (IoT), particularly applications supported by LoRaWAN (such as water and air quality monitoring), is recognized for its positive impact on sustainability due to the low power consumption and relatively minor environmental impact of LoRaWAN.During the two-day LoRaWAN World Expo, LoRaWAN members showcased several case studies demonstrating how LoRaWAN technology supports sustainability efforts.· Air quality monitoring provider Thingy IoT demonstrated how the LoRaWAN network supports its Thingy AQ sensors to track wildfire smoke and air quality.· CBRE showcased how it equips buildings with sensors to monitor space occupancy and effectively manage cleaning operations.· Libelium provided an interesting case study; it demonstrated how to use LoRaWAN technology to connect smart environmental sensors to monitor temperature, humidity, particulate matter, and gases on farms. Farmers analyze and use this data to reduce greenhouse gas emissions and optimize livestock production.The LoRaWAN standard and LoRa devices can serve a range of applications, making businesses more efficient and sustainable. The most commonly deployed projects with sustainable impacts focus on smart buildings, smart cities, and smart agriculture, including water and air quality monitoring, flood monitoring, and precision agriculture.

Partnerships are crucial for strengthening the LoRa ecosystem

A number of partnerships and new announcements were made at the expo. AWS announced a simplified and scalable asset tracking solution that leverages Semtech’s LoRa Cloud and AWS IoT Core for LoRaWAN. Additionally, Semtech announced collaborations with SAS and Microsoft aimed at establishing a center of excellence in Cary, North Carolina, to test IoT applications that can bring significant benefits to residents and other cities. These solutions are expected to integrate LoRaWAN wireless connectivity and focus on smart city use cases to address challenges related to natural disasters and sustainability.Omdia’s IoT technology and verticals, AI, and IoT senior research analyst Eleftheria Kouri believes that collaboration among different participants in the LoRa ecosystem is a key driving force for the technology’s expansion and further development. Partnerships should aim to minimize the complexity of application development to attract the developer community and simplify the scalability of LoRaWAN-based projects.

The LoRa ecosystem will continue to expand, while Sigfox struggles to keep pace

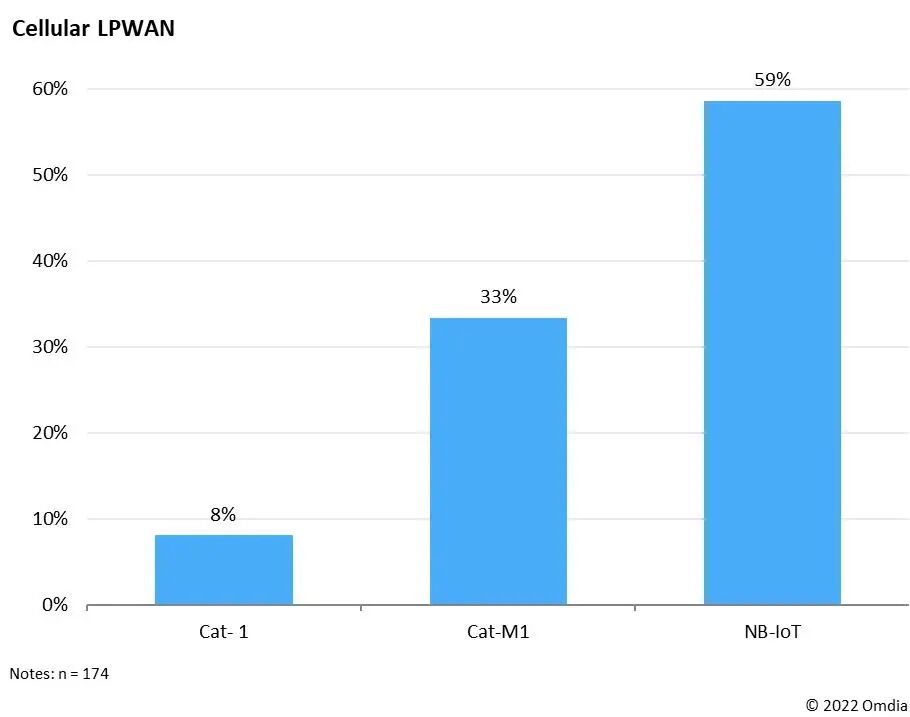

The LoRa Alliance mentioned that the number of projects supported by LoRaWAN has significantly increased and expanded over the past three years, which aligns with Omdia’s survey findings. According to Omdia’s 2022 IoT Enterprise Survey, LoRa technology shows the highest usage and future growth in enterprise adoption among all unlicensed spectrum network technology options. Meanwhile, compared to Sigfox, which was once considered a competing technology, LoRa currently appears to be in a stronger market position. Figure 1: What type of connectivity technology is your business using or planning to use for IoT solutions? — Cellular technology. Source: Omdia.

Figure 1: What type of connectivity technology is your business using or planning to use for IoT solutions? — Cellular technology. Source: Omdia.

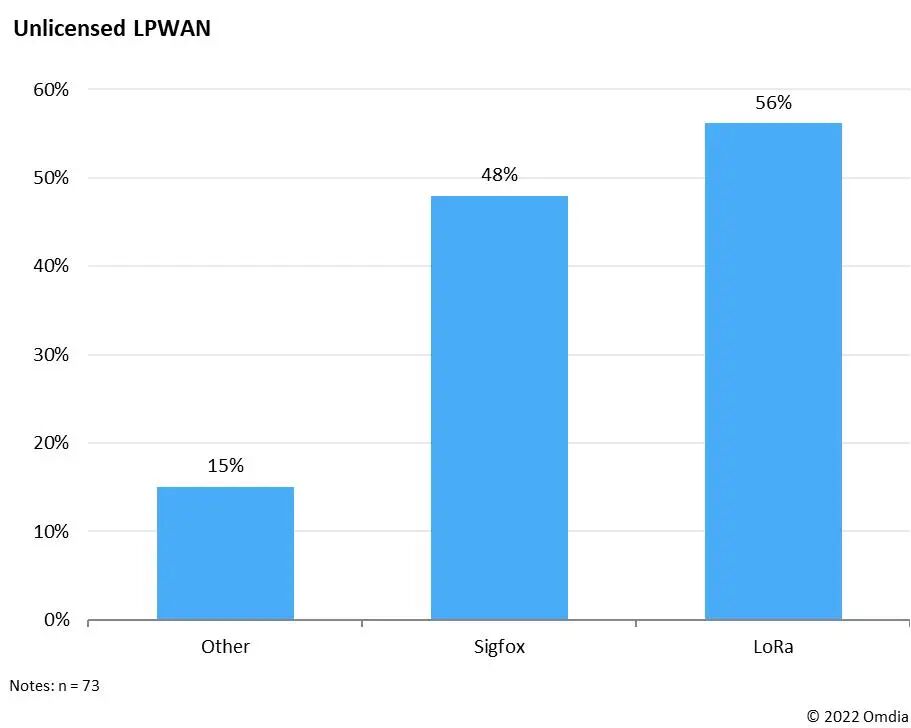

Figure 2: What type of connectivity technology is your business using or planning to use for IoT solutions? — Unlicensed spectrum. Source: Omdia.Omdia analysts state that for various reasons, LoRaWAN is the preferred network choice for many low-power IoT applications. For example, its open and affordable infrastructure makes it easier to implement. Furthermore, the LoRa ecosystem is richer and more mature than other LPWANs like Sigfox and NB-IoT, which not only reduces deployment costs but also protects businesses from vendor lock-in issues. The LoRaWAN ecosystem includes various sensor, chip, and device manufacturers, as well as base station and server providers (including but not limited to Semtech, Actility, Cisco, Kerlink, and Tektelic). According to Omdia’s latest forecast, shipments of integrated circuits (IC) for LoRa are expected to reach 353 million units by 2026. However, the recent acquisition of Sigfox by UnaBiz may challenge LoRa’s growth if the company decides to compete directly with LoRa and focus on markets outside of Asia (where UnaBiz already has a strong market position) in the US and EU.In the cellular LPWAN space, NB-IoT dominates. However, in terms of numbers, China has largely driven this trend. In this sense, LoRa has significant potential in many markets. Omdia expects demand for LoRaWAN to continue to grow in the coming years, as LoRaWAN-based applications can help businesses meet urgent environmental, social, and governance (ESG) goals.